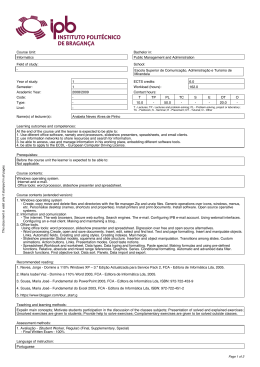

Description of Individual Course Unit Financial Management II Course Title: Hotel management Area of Study: Business Sciences Course Code: ECTS Credits: 5 Degree Degree Level: Bachelors Year: 1st 2nd Type of Course: Compulsory Student Workload: Theory (T) Theoretical Application (TA) Laboratory Work (LW) Fieldwork (F) Seminar (S) Prerequisites: Specify: Objectives No Bachelors Masters 3rd Elective 45 Semester: 1st 2nd Work Experience (WE) Tutorial (T) Independent Study (IS) Assessment (A) Other (O) TOTAL Yes 45 45 4 139 GENERAL AIMS The financial decisions taken by companies are of vital importance to them, since they affect not only their financial structure, but also their consistent profitability and competitive capacity, and even sometimes, to stay on the market. Thus, the function has financial implications and is closely linked with other business functions. SPECIFIC AIMS Once the students of the course of Hotel Management must be prepared to respond to certain questions relating to the financial area of hotels, they must be able to: • to Make a proper management of financial needs and resources linked to the area of operation of the company; • Select the most convenient sources of financing in the short term; • Select the best sources of financing in the medium and long terms; • Assess the profitability of different investment options, and their risk; • Select the investments to implement and manage them. Contents 1. Financial Management of Short Term 1.1. Key parts accounting: 1.1.1. Functional Review 1.1.2. Demonstration of Fixed Results 1.2. Balance and the company's financial situation 1.2.1. Management depth 1.2.2. Financial Balance 1.2.3. Liquidity indicators 1.3. Treasury Management 1.4. Management Needs in Management depth 1.4.1. Realizable Management 1.4.2. Stocks Management 1.4.3. Short-term debts Management 2. Short Term Financing and Financial Planning 2.1. Short term financing 2.1.1. Sources of financing 2.2. Short-term financial planning 2.2.1. Introduction 2.2.2. Budgetary Management 3. Medium and Long-term Financing 3.1. Permanent capital Structure 3.2. Capital structure Theories 3.3. Company's financial policy 3.4. Sources of financing in the medium and long term 4. Decisions on investment 4.1. Definition of investment 4.2. Type of investments 4.3. Projects assessment 4.3.1. Social-economic Assessment 4.3.2. Financial evaluation 4.4. Investments evaluating Criteria: 4.4.1. Accounting Policies 4.4.2. Policies based on cash flow 4.4.3. Investments selection Teaching Methods The classes will teach the kind of theoretical and practical, which held the exhibition of materials for teaching and the presentation of clear examples of them. Those will be combined with practical exercises solved by the students. Assessment Students may choose one of two types of evaluation: continuous or periodic. Continuous assessment requires that they meet, as mandatory requirement, a minimum of 75% of attendance at classes. Such an assessment is made of two tests, which have a weighting of 95%, besides participation in class, with a weighting of 5%. It should be noted that the students can not have less than eight note values, rounded to the unit in each of the tests. The regular assessment is the realization of a test, with weighting of 95%, and a job, which has a weighting of 5%. The students must choose at the beginning of the period, for one of these two types of evaluation; failing to do so, the teacher feels that they are subject to periodic evaluation. Bibliography Borges, António, Rodrigues, Azevedo e Morgado, José, 2004, “Contabilidade e Finanças para a Gestão”, 2ª Edição, Áreas Editora Brealey, Richard A e Myers, Stewart C. 1998, “Princípios de Finanças Empresariais”; Editora McGraw-Hill, Lisboa Carrilho, José e Outros, 2005, “Elementos de Análise Financeira – Casos Práticos”, Editora Publisher Team, Lisboa Menezes, H. Caldeira, 1996, “Princípios de Gestão Financeira”, 6ª Edição, Editorial Presença, Lisboa Nabais, Carlos e Nabais, Francisco, 2005, “Prática Financeira II – Gestão Financeira”, Editora Lidel, Lisboa Neves, João Carvalho, 2002, “Análise Financeira – Vol. I – Técnicas Fundamentais”, Texto Editora Owen, Gareth, 1998, “Accounting for Hospitality, Tourism & Leisure”, Second Edition, Financial Times, Prentice Hall, Pearson Education

Baixar