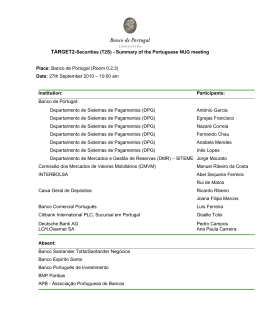

TARGET2-Securities (T2S) – SUMMARY OF THE PORTUGUESE NUG MEETING Place: Banco de Portugal (Room 0.2.3) Date: 9th November 2012 - 10h30 Institutions: Members: Banco de Portugal: Departamento de Sistemas de Pagamentos (DPG) Jorge Egrejas Francisco Pedro Marques Fernando Chau Nazaré Correia Anabela Mendes Ana Gomes Lara Fernandes João Sarilho Fabio Michelli Duarte Martins Departamento de Mercados e Gestão de Reservas (DMR) – SITEME Comissão dos Mercados de Valores Mobiliários (CMVM) Anabela Cardoso INTERBOLSA Marta Calado Paula Pereira Rui Matos CGD Ricardo Ribeiro Banco Comercial Português Luís Castanho Ferreira Banco Santander Totta Rita Roque Banco Português de Investimento Carlos Ferreira Machado Banco Espírito Santo Bruno Pinho Deutsche Bank AG Pedro Campos Citibank International PLC, Sucursal em Portugal Giselle Toloi LCH.Clearnet SA Ana Paula Carreira SIBS FPS Luís Sequeira Miguel Maurício Absent: BNP Paribas APB - Associação Portuguesa de Bancos 1. Current update of the T2S Programme by Banco de Portugal (cash issues): presentation - Banco de Portugal The meeting is part of the Portuguese market preparation in the development of the T2S Programme. In April and June of this year, 23 European CSD, representing almost all euro area market, signed with the Eurosystem the T2S Framework Agreement. This is a major achievement of the Programme since the last NUG-PT meeting. Hence, the T2S Programme focus moved from specification and bargaining issues to implementation phase, towards the go-live date set for 2015. BdP emphasized the import of preparation work aimed at operationalizing connection to the future T2S platform and the setting up of the appropriate “migration wave” for the national market. a. VAT regime on T2S services; BdP informed the NUG-PT on the démarches undertaken in March 2011 (and a further note in March 2012) to Tax authorities to consider T2S services in Portugal as “out of scope” of VAT Directive (nº 1 of artº 13). The Ministry of Finance has not responded to this proposal yet; according to information from Eurosystem, Tax authorities in several European countries have replied, accepting that interpretation on demand from their National Central Bank. b. Synchronization Points 2 and 3 and preparation to connect to T2S; Major developments of T2S technical working groups were presented: the Project Managers Group (PMG), the Operations Managers Group (OMG) and the Change Review Group (CRG). The work on Migration and Testing in T2S (under the responsibility of two sub-groups of PMG) was updated and users testing are planned to begin: 3º Quarter of 2014 for the 1st wave of migration participants; and 2nd Quarter of 2015 for those in the 2nd wave of migration. The tests will be coordinated with TARGET2 as well as with CSD. Some issues related to the organization of tests and their duration are being finalized and could be object, for some specific issues, of market consultation with users. i. Directly connected participants, cash and securities; The concepts of directly and indirectly connected participants to the T2S platform were presented, for cash as well for securities. Physical connection to T2S can be through Value Added Network (VAN), with 2 selected providers for these services (SWIFT and SIA/Colt), or via Dedicated Link (DL), through the future CoreNet3 of Eurosystem. ii. Connection between TARGET2 - T2S; TARGET2 is planning to provide 2 options for RTGS account cash management to be implemented in release 7.0. In the first one, called Standard Offer, users messages are compatible with ISO 20022 messages, so that they can instruct cash transfer from their RTGS accounts to DCA accounts (associated with RTGS accounts) via XML messages. In the second option, called Optional Offer, banks will be able to send MTxxx messages to TARGET2, which will convert them to ISO 20022 format and resend them to T2S – in this option, users can initiate cash transfer from their RTGS account to their DCA account and vice-versa. iii. Autocolateralization from Central Bank. This new T2S service/functionality aims at reducing trade failures due to participants lack of cash. Main concepts and parameters of autocollateralization of Central Bank or Payment Bank were provided, as well as autocolaterlization on flow e on stock. Two examples were presented for autocolateralization: Central bank on flow and payment bank on flow and on stock. In the former case, credit should be reimbursed by 15H30 (Portuguese time); if not, this credit will be, exceptionally, converted into intraday credit and transferred to TARGET2 (in the respective RTGS account). 2. Current update of the T2S Programme Interbolsa: presentation – Interbolsa a. Information on Migration Plan to T2S - Interbolsa Interbolsa will present shortly the adaptation plan to T2S in the T2S Portuguese Market Forum. Two scenarios of possible migration date of Interbolsa were presented; in any scenario, Interbolsa would migrate in the same wave as ESES markets of Euroclear. Concerning the connection to T2S platform, Interbolsa mentioned that it will use SWIFT services (that is, aVAN). b. Implications from tax changes Participants considered important that tax changes on financial transactions (Financial Transactions Tax) should reduce their negative impacts, namely through; i) preserving a “level playing field” in european markets; ii) allowing time for the necessary adaptation in institutions’ information systems; iii) easy to interpret (specially, on the tax incidence – whether it is the financial intermediary or the final client that bears the tax burden). Participants mentioned that there were not known research on the impact of financial transaction tax on markets. c. Synchronization Points 2 and 3; adaptation calendar It is expected that the SP3 will be postponed to the 1º Quarter of 2013 as a result of the need to; i) analyze the Change Requests considered as “showstoppers”; ii) the final decision on migration were not adopted. It is necessary to research the impact of an eventual delay of SP3 in T2S Plan. d. Information on Gap Analysis of T2S Standards for Corporate Actions on Flow Interbolsa presented the results of the recent Gap Analysis of Corporate Actions SubGroup (CASG). The results from this evaluation on the Portuguese market are positive. 3. Activities of CSD Steering Group (CSG): presentation – Interbolsa With the signing of the T2S Framework Agreement, the T2S governance changed as agreed in the T2S FA. The Chair of CSG became to be elected from CSD. The current Chair is Jésus Benito from Iberclear. CSG will meet again in 12 and 13 November to find a consensos on the composition of migration waves as well as testing issues in T2S. 4. Activities of Project Managers Group (PMG): presentation - Banco de Portugal e Interbolsa The activities of this group were mentioned above. 5. Other business The Chair thanked the participation and contribution of members, especially from Interbolsa. The NUG-PT was informed that na informal group was set up between BdP and Interbolsa for the operational issues associated with the implementation of T2S in the Portuguese market.

Baixar