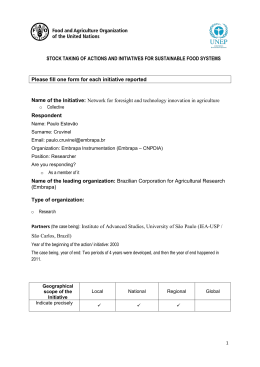

Funding, Financing and Investment - Engines of Startup Growth? Antonio José Junqueira Botelho PhD Professor Titular / Coordenador do Programa de Pós-Graduação em Ciência Política e Relações Internacionais / Coordenador do Laboratório de Estudos em Ciência, Tecnologia, Inovação & Sociedade LECTIS, Instituto Universitário de Pesquisas do Rio de Janeiro - Iuperj / UCAM Presidente do Conselho Diretor, Gávea Angels 3ª Conferência Consórcio Internacional de Estudos sobre Inovação e Empreendedorismo:Políticas e Recursos de Apoio ao Empreendedorismo Mesa 3: Startups: Funding and Financing /Investimento e Financiamento de Startups Rio de Janeiro, 21 de novembro de 2013 Agenda 1. Funding, Financing and Investment 2. Startup Growth 3. Context 4. Funding & Financing in Brazil 5. Engines of Startup Growth? 1. Funding, Financing and Investment Agenda 1. Funding, Financing and Investment 2. Startup Growth 3. Context 4. Funding & Financing in Brazil 1.0 0.5 Existing Technology Market Discontinuity 0.0 Creative Destruction MRI Cellphone Digital Cameras DVD Leverage base Automobiles Evolutionary Electronics businesses Cameras 0 ] Existing IBM PC 0.5 New 1 Market 5 Gomper’s Entrepreneurial Financing 4 Factors for assessing startup financing Uncertainty is the measure of of the array of potetial outcomes for a company or a project Asymmetric information – moral hazard / adverse selection Nature of firm assets – tangible / intangible Market conditions – different supply and cost of capital-public vs private / nature of product market shifts Sanlman’s 4 Critical Success Factors • People – key players / experienceopporunity / s & w / add-remove • Opportunity – nature / competitive advantage / barriers to entry / exploitation timing / milestones • Deal – right structure / incentives and contingencies • Context – most dificult / government polocies+> market size & industrial structure • 3 Questions: What can go right? What can go wrong? What actions can be taken to increase the probability that things go right and to minimize the chances that things will go wrong? => FIT 1. Startup Growth Startup Life Cycle Source: Chandra, A. (2007) Competência Tecnológica Differents Forms of Startup Growth Capital Proof of Concept Financing Financing: Innovation Capital Investing: Angel Capital Seed Capital Startup Capital Development / Growth Capital Mezzanine Capital Competência em Negócios Clássico Transição Descoberta e Invenção Mercantil Venture Capital Pre-Venture Capital Funding: R&D Capital / Concept Capital 1. Context Globalization of competition at startup level … • Makes angel capital more important, as time-to-market is now critical • Pushes VC to internationalize launch market and production • Beyond Guerrilla /Bootstrap/Royalty Financing • Brings discipline and structure to startup • Takes startup from proof of concept to optimized business model faster • Crossing the chasm (Geoffrey Moore) 12 Funding and Financing Mechanisms - Brazil Nível de risco p/investidor Alto Baixo Founders, friends and family Capital semente SENAI Inovação Startup Brasil, Rio Faperj e Rio PM Fundos Semente Capital de risco Empresas não financeiras Tecnova Fundos VC Fundos incubadoras INOVAR Inova Empresa Desenvolvimento e financiamento de empresas Inicial Mercado de capitais Bancos Emergente Crescimento Estágio Consolidada 13 Angels: Majority of US Startup Funding • • • • • US $22.5 billion ~66,200 deals 42% seed/startup 57% early/expansion stage 318,500 individuals Venture Capital 2011 • • • • • US $28.4 billion ~3,750 deals 3% seed/startup/ 29% early stage 68% later/expansion capital 462 firms active Funding by Source and Stage- 2010 16,000 US$ Millions Angel Investors 2011 8,000 4,000 Venture Capital Angels 5,321 12,000 8,583 1,700 9,976 6,371 6,231 3,491 0 Seed Early Expansion Investment Stage Later Angels Invest in the Majority of Startup & Early Stage Deals Number of Deals in 2009: Angel Investment and Venture Capital 30,000 25,000 889 309 20,000 Venture Capital Angel Investment 15,000 10,000 20,029 24,035 11,445 5,000 0 1,604 Startup/Seed Early Stage Expansion/Later Source: Jeffrey E. Sohl, Center for Venture Research and 2010 NVCA Yearbook ACA Members and Innovative Startups • Fund about 800 new companies every year (mostly USA, Canada) • More than 5,000 companies in portfolio • Typically on Board of Directors (or observers) • See 75,000+ companies every year – lead deal flow in their communities • Exits by acquisition and IPO – more members are partnering with strategic corporations for early exits Gávea Angels • • • • • • Founded November 2002 Associates: 30 => 36 Angels who made at least 1 investment: 12 => 22 Angels with > 1 investment: 6 => 12 Gávea Angels Forum: to date 25 => 2013: 5 Deals closed: 10 (2010:1 /2011:2 /2012:3 => 2013: 6 1 syndicated investment (RJ/SP) 1 Series A, 1 Series B 1 Seed follow-on in negotiation • • • • Average deal size (with follow-on): US$ 300K Negotiations: 2012= 8 / 2013 = 12 Investment proposals reviewed: 2012: 600 III International Angel Investor Workshop, 8-9 November 2012: 100 participants (LA/Europe/US) Other Angel Groups in Brazil • Gávea Angels Estimated number of active angels:500 São Paulo Angels (July 2008):CLOSED? • Floripa Angels (2009): ~10; absent • Bahia Angels (2009) inactive • C2i Anjos (Curitiba PR) (2011): 20+ • Vitória Anjos (ES) (2012): 10+ • HBS Angels (Sao Paulo) (2013) : 30+ Other angels – Boutiques: Gávea Angels Estimated number of potential angels: 10,000 • • Emidee (2005): one man angel fund Ipanema Ventures (RJ) (2011): dormant • Jacard (SP and SC) (2010) • Bossa Nova Angels (SP) (2010) Other angel organizations: • • Inovar Seed Funds: 200+ ; passive Anjos do Brasil, loose network individual angels + “financial investor “super-angels”, passive, risk averse Latin America Pais Número de redes Inversionistas (año 1a red) ángeles en las redes Inversiones Valor (US$ milliones) Argentina 3(2006) 150 25 3.5 Bolivia 1(2008) nd 1 nd Brasil 4 (2002) 88 9 1.1 Chile 7(2004) 127 30 9 2(2010) +3 93 6 0.5 México 3(2009) 100 8 8.2 Panamá 1(2009) 26 3 nd Perú 2(2009) 24 6 nd Dominicana 1(2008) 57 (20) 0.270 nd Venezuela 2(2000) 20 22 nd Uruguay 1(2006) 26 5 nd Colombia 1. Engines of Startup Growth? Innovation clusters • Global distribution of VC (2012): top 5 regions represent 52% of $42.3 billion in global VC investments: SV, New England, S. Calif, Ny Metro UK…. followed by Beijing , Germany, Israel…NO LA country or region • How to? – Entrepreneurial communities, Brad Feld’s network bottom-up model – Beijing innovation cluster state leverage, large market autarkic model – Israel military-entrepreneurial model: competences spillover and skillful incentives – Ontario’s Waterloo state-private model: future tech to create newq market • Silicon Valley model it IS NOT ABOUT funding and financing, is it about investment ($ 11 billion VC in 2012) ? – Bilions $ spent in attemps to replicate – top down strategy a failure • Kendal Square densesr concetration of startups in the worls : 450+ next to $ 8.7 billion VC investments – 52% (1995-2005) of founders with at least one foreign-born founder 21 MUITO OBRIGADO Antonio José J. Botelho Professor Titular, Iuperj/ UCAM [email protected] (21) 2216 7421 / 9347 0472

Baixar