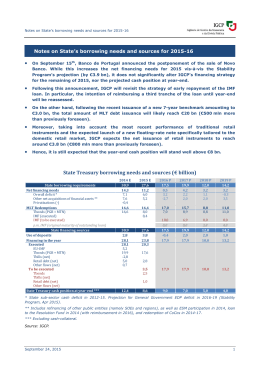

Critical Analysis of Bus Financing in Bus Rapid Transit Projects! Dr. Abel López Dodero! www.worldbank.org! Content! ! Public transport in Mexico! ! Progress in public transport in Mexico! ! Common practices in bus improvements! ! Bus financing! ! Risks in bus financing ! ! The concept of “Project Finance”! Public Transport Provision in Mexico! ! Prevails man-and-his bus model. Problems in areas off:! ! Human resources! ! Financial management! ! Operation and maintenance! ! Service provision without regulation (frequency, service hours)! ! Prevails informality in all areas associated with the operation and management! ! Verbal agreements between the driver and concession holder! ! Income management and taxes! ! Route schedule and alignment ! ! Transit units/buses in poor conditions ! Se realizan en transporte público Problems with service provision! Compe33on in the market and oversupply of service Problems with service provision! Low level of comfort and safety Externalities! Contribu3on to air pollu3on Improvements in public transport! 2003! 2005! 2008! 2009! 2011! 2012! 2014! 26 km! 1 system! 46 km! 2 systems! 55 km! 2 systems! 92 km! 3 systems! 128 km! 5 systems! 156 km! 6 systems! 215 km! 8 systems! 237,000 Pax/day! 497,000! Pax/day! 552,000! Pax/day! 964,000! Pax/day! 1,304,000! Pax/day! 1,354,000! Pax/day! 1,754,000! Pax/day! 2.5% of all total trips made by public transport! Common practices in bus improvements! 8! Elements of bus improvements and ! their impact on the Tariff! Infrastructure costs and its associated financial costs are covered by the government! (Federal Government + Municipality) ! No impact on Tariff! Bus financing is critical for the financial viability of the Tariff! Federal Government Support (PROTRAM)! Up to 50% for technical ! studies! Credit ! Guarantees ! ! Up to 50% for the cost of the infrastructure! Bus financing! 1. Commercial Bank financing 2. Armadoras / Ensambladoras financing 3. Project finance Commercial Bank financing! ! Local banks with a clear idea of who operators are and of their business ! ! Local banks evaluate cash flows and cascade of payments! ! Assets of the companies / or the buses as collateral. ! ! Buses as collateral do not have an impact on risk reduction ! ! Partial guarantee ! ! Characteristics:! ü Interest rate: 10% - 15% ! ü Include the cost of a partial guarantee! ü 6 years maturity term ! ü 6 months grace period! Disadvantages! ü Expensive! ü Only available when the operator can proved credit history and has assets that can be used as collateral. ! ü Assets cannot be used for any other financial operation! Armadoras financing! ! Bus assemblers give financial options for the operators! ! Evaluate cash flows and cascade of payments! ! Buses as collateral. There is a secondary market. ! ! Partial guarantee ! Characteristics! Disadvantages! ü Interest rate: 6% -‐ 10% ü Maturity and grace period can be nego9ated Very attractive credit conditions but these conditions are offset by having a high initial cost of transit units! ! Cheap financing for costly buses! How to deal with the cost of financing?! Understand the risks associated with transport projects ! Regulatory Risks Risks with cash flows Mismatch between infrastructure and transit units Trust and Fare Collection System Legal Framework Demand Forecast Commercial Risks Tariff Policy Management of the company Corporate Risks To ensure "project finance" all associated risks with public transport provision need to be covered Project Finance! Government Actions! Concession Right! Regulator – Public Entity! Concessionaire Actions ! Fare collection and Trust! Legal Framework! Guarantee! Smart cards / no cash ! Tariff ! Policy! Project ! Finance! Transparency and good practices! Government Actions! Project Finance: Social Policy vs Bancability! Concession Right! Concessionaire Actions ! Regulator – Public Entity! Transparency and good practices! Fare collection and Trust! Legal Framework! Government! Par3al Guarantees • Government covers the cost of the guarantee • Government secures any issue with the system through federal transfers Project ! Finance! Guarantee! Smart cards / no cash ! Tariff ! Policy! Socially VERY REASONABLE! Political Decision! For Banks VERY UNRESANOBLE! How can we promote "Project Finance" and achieve social goals? Conclusions! ! Project finance for buses offers an important opportunity to lower the total financial cost of BRT systems and helps to lower Tariffs! ! Project finance requires a rethinking of BRT design and structuring and a different role for governments to make financial institutions comfortable! ! A key issue is Tariff Policy ! !What is eminently sensible from a public policy perspective poses a risk that Bankers are not comfortable taking ! ! Creating project finance for buses will require government create more transparency and assurance in Tariff adjustment and perhaps complement a project finance approach with guarantees that cover for Political Risk! Se realizan en transporte público Thanks ! ! Abel López Dodero Departamento de Desarrollo Sostenible Región de América Latina y el Caribe! [email protected] | Tel: (52-55) 5480-4247 | Fax: (52-55) 5480-4222 | @abeldodero! With the support of Shomik Mehndiratta, Alejandro Hoyos, Antonio Huerta y the National Bank for Public Works in Mexico (BANOBRAS)!

Baixar