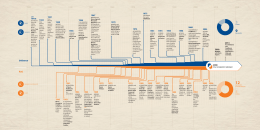

Reuniao General da Rede Sindical de Cooperacao para o Desenvolvimento Sao Paulo, 18-20 de Marco, 2014 “Políticas de Desenvolvimento Globais e Regionais: Prioridades, Desafíos e Oportunidades” Políticas de desarrollo globales y regionales: prioridades, desafíos y oportunidades Politiques de développement globales et régionales: priorités, défis et opportunités Global and regional development policies: priorities, challenges and opportunities Boris E. Utria Coordenador -Geral de Operações Banco Mundial Brasil O Grupo Banco Mundial International Bank for Reconstruction and Development - IBRD, 187 members Start of operations: 1946 World Bank International Development Association IDA, 170 members Founding: 1960 International Financial Corporation – IFC Foundation: 1956, 182 members World Bank Group Multilateral Investment Guarantee Agency – MIGA Foundation: 1988, 175 members International Center for the Settlement of Investment Disputes ICSID, 144 members Foundation: 1966 A ESTRATEGIA DO GRUPO BANCO MUNDIAL O Crecimento Economico tem Contribuido para a Reducao da Pobreza e a Compartilhacao da prosperidade, Mas ainda nao e Suficiente… A metade da populacao do mundo vive na Probreza: 1.2 Bilhoes de Pessoas com < US$1.25/dia, 2.7 bilhoes com $1.25-$4/day Extreme Poverty (<$1.25/day) and GDP per capita Poverty ($1.25-$4/day) and GDP per capita Source: POVCALNET and World Development Indicators for the World Bank Atlas method Low income = $1,025 or less; lower-middle income = $1,026 - $4,035; upper-middle income = $4,036 - $12,475; and high income.= $12,476 or more purchasing power parity 4 O Crecimento Deve Ser acompanhado de Inclusao e Sustentavilidade Crecimento Economico que gere bons empregos sustenta o desenvolvimento — Uma grande geracao de empregos requer a mobilizacao do setor privado e o desenvolvimento de politicas e instituicoes publicas efetivas. Inclusao Social significa empoderar todas as pessoas (mulheres, juventude, minorias, etc. que sao geralmente excluidas) para participar e se beneficiar dos processos de desenvolvimento — a inclusao é essencial para garantir que o desenvolvimeto geral seja traducido em ganhos espeficios e significativos para os pobres (40% e extremos) Sustentabilidade garante que o progreso de hoje nao seja revertido amanha —sustentabilidade permea a agenda de politica, desde a “economia verde” ate o fortalecimento do consensus social Esta agenda requer accao ao niveis Nacionais, Regionais e Global 5 ESTRATEGIA DO GRUPO BANCO MUNDIAL Duas Metas Ambiciosas Guiam ao GBM Acabar a Pobreza Extrema Reducir a percentual de pessoas vivendo com menos de US$1.25/dia para 3% ate 2030 Promover a Prosperidade Compartilhada Promover aumento da renda para o 40% da pupolacao de menores ingresos em cada pais Para lograr as metas de forma sustentavel é necessario: Asegurar o futuro a lungo-prazo do planeta e de seus recursos naturais, asegurar a inclusao social, e limitar o custo economico das generacoes futuras. As metas do GBM estao alinhadas com a agenda de desenvolvimento post-2015 que esta sendo elaborada pela comunidade internacional 6 BANCO MUNDIAL NA REGIAO ALC IFC LAC Pillars LCR Strategy LAC Challenges WBG Priorities A ESTRATEGIA PARA ALC É CONSISTENTE COM AS METAS DO GRUPO BANCO MUNDIAL Create opportunities for growth and employment Target the poor and the vulnerable Strengthen governance Promote global collective action Managing and preparing for crisis Boost sustained growth and productivity Address poverty and inequality Strengthen governance and institutions Engage in Global Issues Minimize vulnerability Growth and Jobs Gini , Poverty & Gender Governance & Institutions Global Involvement Guarding Against Disasters • Generate high sustained, more diversified growth • Address structural gaps • Minimize vulnerability to risk • Improve competitiveness • Help decrease overall level of poverty • Tackle persistent inequality • Enable poor to participate in economy • Strengthen economic role of women • Help youth at risk •Expand access to finance • State and citizen relationship (“identity agenda”) • Provide opportunities for all, access to infrastructure services, targeted safety nets, increased citizen security •Increase transparency and reduce red tape • Climate Change, Epidemics, Finance, Migration South-South/NorthSouth Cooperation • LAC in the world and the world in LAC • Help countries with risk mitigation instruments •Improve fiscal, monetary, financial system resiliency Innovation/ Competitiveness Integration Climate Change Inclusive Growth Integration 8 IFC LAC Pillars LCR Strategy LAC Challenges WBG Priorities A ESTRATEGIA PARA ALC É CONSISTENTE COM AS METAS DO GRUPO BANCO MUNDIAL Create opportunities for growth and employment Target the poor and the vulnerable Strengthen governance Promote global collective action Managing and preparing for crisis Boost sustained growth and productivity Address poverty and inequality Strengthen governance and institutions Engage in Global Issues Minimize vulnerability Growth and Jobs Gini , Poverty & Gender Governance & Institutions Global Involvement Guarding Against Disasters • Generate high sustained, more diversified growth • Address structural gaps • Minimize vulnerability to risk • Improve competitiveness • Help decrease overall level of poverty • Tackle persistent inequality • Enable poor to participate in economy • Strengthen economic role of women • Help youth at risk •Expand access to finance • State and citizen relationship (“identity agenda”) • Provide opportunities for all, access to infrastructure services, targeted safety nets, increased citizen security •Increase transparency and reduce red tape • Climate Change, Epidemics, Finance, Migration South-South/NorthSouth Cooperation • LAC in the world and the world in LAC • Help countries with risk mitigation instruments •Improve fiscal, monetary, financial system resiliency Innovation/ Competitiveness Integration Climate Change Inclusive Growth Integration 9 PRESTAR UMA AMPLA GAMA DE SERVICOS AOS NOSSOS DIVERSOS CLIENTES Regional Activities Fragile Country • Human • Post-disaster Opportunity Index & poverty monitoring • Risk response and monitoring • Regional studies • Global goods: • SEPA • Count the Poor • LCR Gender work • Food prices working group • Studies on Crime and Violence • South-South learning for CCT & assistance system administration •Peer-to-peer learning reconstruction (e.g. Housing & Infrastructure programs) • Vulnerability reduction and resilience •Access to basic services •Business climate improvement , private sector and financial sector development for inclusive growth • Global knowledge and TA for development of sector strategy and policy •Gender mainstreaming in projects Lower Income & Lower MIC Small Upper MIC • Support to strengthening of governance and institutions • Improving service delivery • Safeguarding the vulnerable (e.g. CCTs, improving nutrition) • Disaster risk management Menu of services: • Financing • Innovative financial products e.g. Green Bonds, CAT/DDOs • Support to country specific and regional themes. • TA, fee-based services e.g. Panama Areas Revertidas •Regional efforts in Central America (e.g. on citizen security ; economic integration) •Improve financial oversight & financial sector development for inclusive growth •Business climate and productivity improvement Regional themes: • Financial sector in OECS countries • Growth initiatives in Caribbean • Regional integration • Boys at risk •Thematic clusters grouping financial and knowledge services Large Upper MIC • Package of services on development issues • Poverty & inequality • Natural resource mgmt. & commodity prices • Disaster risk management •Economic participation of women •Energy efficiency & climate change • Sub-national , sectoral, or programmatic lending and knowledge services • Fee-based services • South-South/North-South knowledge sharing e.g. Brazil-Africa • Global engagement (COP 16, G20) •Capital markets & financial sector development for inclusive growth ……By encouraging innovation, risk taking, knowledge generation and sharing 10 … CONTRIBUIR A ENTREGA DE SOLUCOES E RESULTADOS DE DESENVOLVIMENTO Fragile (Haiti) • 1 m. displaced people moved from camps to improved housing. Camp occupancy down to 35% of initially displaced people • 5.5 m. cubic meters of debris removed from Port au Prince • Schools have reopened, 900,000 children attending school without need to pay tuition • Hot meals for 2 m. school children daily • GDP grew 5.1% in 2010/11 • Increased energy supply capacity in Portau-Prince by about 35%. Small Upper MIC The Bahamas Dominican Republic Mexico Guatemala El Salvador St. Kitts & Nevis Dominica St. Lucia St. Vincent & The GrenadinesGrenada Barbados Trinidad & Tobago Venezuela Guyana Costa Rica Panama Suriname Colombia Ecuador Lower Income and Lower MIC • Bolivia: Electricity to 130,000 people in rural areas. 9,200 solar home systems installed in poorest rural areas benefitting 45,000 people • Ecuador: 417,000 more people with potable water and sanitation systems • El Salvador: 100,000 families benefitting from CCTs. Reduction in untargeted public subsidies by $134.3 million • Guatemala: 95% enrollment rate and 74% gross completion rate in primary schools • Central America: 1.3% reduction in cost of remittances resulted in US$580m in savings for families receiving remittances Haiti Belize Jamaica Honduras Nicaragua Antigua & Barbuda • OECS: A harmonized aviation regulatory framework for all OECS countries • Costa Rica: 10% greater primary forest coverage from Ecomarkets program • Panama: improved health and nutrition services to 400,000 families in rural areas. 60,000 workers trained in National Training Plan • Uruguay: Decline in gross public debt from 73% to 60% Large Upper MIC Peru Brazil Bolivia Paraguay Chile Fragile Lower Income & Lower Income MIC Small Upper MIC Argentina Uruguay • Brazil: 650,000 families receiving electricity from Rural Poverty Program. An annual $77million saved in Minas Gerais since 2005 due to modernization program • Argentina: 90% of national and provincial paved roads in good condition. Access to health care for 1m. children and uninsured pregnant women, immunization rates up to 94%. • Peru: nearly 500,000 people have gained access to electricity • Mexico: Provided green mortgage for 800,000 new houses to reduce 1.2 m. tons of CO2 emissions/year by 2012 Large Upper MIC 11 BANCO MUNDIAL NO BRASIL O Brasil está entre os três Maiores Clientes do Banco Mundial Brasil: US$55 bilhões (FY2014) 100 80 60 AID Bird 40 20 0 Bangladesh Colômbia Paquistão Argentina Turquia Indonésia China México Brasil Índia Estratégia de Parceria com o Brasil 2012-2015 Country Partnership Strategy - CPS Identifica as prioridades de parceria a serem desenvolvidas através de empréstimos, assistência técnica e outros instrumentos Acordada com o Governo Federal, com consultas: Congresso, governos estaduais Setor privado Comunidade acadêmica Sociedade civil ONGs, sindicatos, movimentos sociais Aprovada pela Diretoria Executiva do Banco Brasil - Banco Mundial: Objetivos Estratégicos (2012-15) Acabar a Pobreza Extrema Reducir a percentual de pessoas vivendo com menos de US$1.25/dia para 3% ate 2030 Promover a Prosperidade Compartilhada Promover aumento da renda para o 40% da pupolacao de menores ingresos em cada pais 1. Aumentar volume e produtividade de investimentos públicos e privados; 2. Melhorar serviços públicos para famílias de baixa renda (i.e.,saúde, educação, moradia); 3. Promover desenvolvimento regional por meio de políticas e investimentos estratégicos; e, 4. Melhorar a gestão sustentável de recursos naturais e a resiliência climática. Brasil - Banco Mundial: Objetivos Estratégicos (2012-15) Acabar a Pobreza Extrema Reducir a percentual de pessoas vivendo com menos de US$1.25/dia para 3% ate 2030 Promover a Prosperidade Compartilhada Promover aumento da renda para o 40% da pupolacao de menores ingresos em cada pais 1. 2. 3. 4. 5. 6. GERACAO DE BONS EMPREGOS; INCLUSAO SOCIAL, COM ATENCAO AS MULHERES; ESTABILIDADE ECONOMICA; SUSTENTABILIDADE; EFICIENCIA DO SETOR PUBLICO; e, BOA GOVERNANCA. Mas o Banco Mundial é muito pequeno em relação ao Brasil… Os empréstimos do Banco Mundial equivalem a 4% do investimento público total anual A EPP se apoia em quatro princípios para maximizar o impacto do GBM no Brasil: 1. Foco na inovação (novos desafios e avancos de conhecimento) 2. Alavancagem (Conhecimento & Financeiro) 3. Flexibilidade (as necessidades do Brasil mudam) 4. Seletividade (i.e., foco no Nordeste, Areas Metropolitanas, etc.) Outros Aspectos Importantes do EPP Foco nos Estados: poucos empréstimos ao Governo Federal (focados em inovação) Operações Multi-Setoriais: ajudando o Brasil a enfrentar desafios complexos Gênero: intervenções para reduzir desigualdade de gênero em todos os setores Cooperação Sul-Sul: grande interesse do resto do mundo nos avanços do Brasil Foco em Resultados: seremos cobrados pela matriz de indicadores EPP (2012-15): Emfase no Nordeste e Norte Finaciamentos por Regiao – Milhoes US$ 432.0 3,082.9 5,717.7 600.0 Federal: 1,318.7 920.0 Brasil: Portfalio Activo por Setores (US$ 12.07 Billion) Urban Development, 388.0 Water, 659.6 Agriculture and Rural Development, 1,008.4 Competitives Industries, 350.0 Economic Policy, 950.0 Education, 294.0 Energy and Mining, 544.6 Transport, 4,040.0 environment, 84.3 Financial and Private Sector Development (I), 941.0 Health, Nutrition and Population, 749.7 Public Sector Governance, 1,360.9 Social Protection, 200.0 Poverty Reduction, 500.0 Brasil: Portfalio Activo por Tipo de Mutuario (US$ 12.07 Billion) Municipal 4% Federal 11% Estadual 85% Brasil: 4,000.0 3,500.0 Emprestimos BIRD 3,000.0 (FY07-14) Milhoes US$ 2,500.0 Federal 2,000.0 Municipal 1,500.0 State 1,000.0 500.0 0.0 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 4,000.0 3,500.0 3,000.0 Federal 2,500.0 Other 2,000.0 North 1,500.0 Northeast 1,000.0 500.0 0.0 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 Obrigado pelo convite e atencao !! Boris E. Utria Coordenador -Geral de Operações Banco Mundial Brasil

Baixar