GETULIO VARGAS FOUNDATION

SÃO PAULO SCHOOL OF ECONOMICS

DYNAMIC HEDGING IN MARKOV REGIMES

Wagner Oliveira Monteiro

Advisor: Rodrigo De Losso da Silveira Bueno, Phd

São Paulo

2008

Livros Grátis

http://www.livrosgratis.com.br

Milhares de livros grátis para download.

GETULIO VARGAS FOUNDATION

SÃO PAULO SCHOOL OF ECONOMICS

DYNAMIC HEDGING IN MARKOV REGIMES

Wagner Oliveira Monteiro

Advisor: Rodrigo De Losso da Silveira Bueno, Phd

Dissertation presented to the São

Paulo School of Economics, Getulio

Vargas Foundation as one of the

requirements for completion of the

Masters in Economics

São Paulo

2008

Oh friends, no more of these tones!

Let us sing more cheerful songs,

More joyful. Joy! Joy!

Daughter of Elysium!

We come …re-touched,

Heavenly one, to your shrine.

Your magic again binds

What custom has divided.

All men become brothers,

Under the sway of your gentle wing.

Whoever has created,

An abiding friendship,

Whoever has won a loving wife,

Yes, whoever calls even one soul theirs,

Join in our song of praise;

But any that cannot must leave tearfully

Away from our circle.

All creatures drink of joy

At the breasts of nature;

All good, all evil,

Follow her roses’trail.

Kisses gave she us, and wine,

A friend, proven unto death;

Pleasure was to the worm granted,

And the cherub stands before God.

Glad, as his suns ‡y

Through the Heavens’glorious plan,

Run, brothers, your race,

Joyful, as a hero to victory.

Be embraced, you millions!

This kiss for the whole world!

Brothers, beyond the star-canopy

Must a loving Father dwell.

Do you bow down, you millions?

Do you sense the Creator, world?

Seek Him beyond the star-canopy!

Beyond the stars must He dwell.

Be embraced, you millions!

This kiss for the whole world!

Brothers, beyond the star-canopy

Must a loving Father dwell.

Be embraced, This kiss for the whole world!

Joy, beautiful spark of God,

Daughter of Elysium,

Joy, beautiful spark of God

Ludwig van Beethoven, Symphony No. 9, Fourth Movement

1

Acknowledgements

It was a very hard task to …nish this dissertation, so I need to thank many people that

helped me during this journey.

First of all, my parents that always supported me and my brother during our studies.

My friends of the Master course. They are many: Ulisses, Luiz Henrique, Fernando Terra,

Lucas "Físico", Vitor, Daniel, Juliana, Adriana Dupita, Adriana Sbicca, Renata, Danilo,

Bruno, Lucas, Felipe, Marina, Thiago and Felipe Garcia.

My friends that have the same advisor: Ricardo Buscarolli and Juliana Inhasz. They

could bear the eccentricities1 from our advisor like me.

My dear friends outside the Master course: Antonio Noguero (Tonhão) and Robson

Santos Sousa (Robinho).

All the professors that I had during my studies at School of Economics.

My old professor and friend Emerson Fernandes Marçal that accepted to participave in

my committes.

I thank FAPESP and EESP-FGV for the …nancial support.

And I need to thank very much my advisor that helped me a lot during all the time and

did not give up on me.

1

strange or unusual, sometimes in an amusing way

2

Abstract

This dissertation proposes a bivariate markov switching dynamic conditional correlation

model for estimating the optimal hedge ratio between spot and futures contracts. It considers

the cointegration between series and allows to capture the leverage e¤ect in return equation.

The model is applied using daily data of future and spot prices of Bovespa Index and R$/US$

exchange rate. The results in terms of variance reduction and utility show that the bivariate

markov switching model outperforms the strategies based ordinary least squares and error

correction models.

Key-words: Dynamic Conditional Correlation, Hedge, Markov Regime Switching.

JEL Codes: D81, CX53

3

Contents

1 Introduction

6

2 A Bivariate Markov Switching Dynamic Conditional Correlation

2.1 Model . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.2 Estimation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.3 Optimal Hedge Ratio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8

10

12

3 Measuring Hedging Perfomance

3.1 Utility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.2 Variance Reduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13

14

4 Data Description

4.1 Ibovespa . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.2 Exchange rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

14

17

5 Estimation Results

5.1 Ibovespa . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.1.1 Ordinary Least Squares . . . . . . . . . . . . . . .

5.1.2 Error Correction Model . . . . . . . . . . . . . . . .

5.1.3 Markov Switching Dynamic Conditional Correlation

5.1.4 Variance Reduction . . . . . . . . . . . . . . . . . .

5.1.5 Utility . . . . . . . . . . . . . . . . . . . . . . . . .

5.2 Exchange Rate . . . . . . . . . . . . . . . . . . . . . . . .

5.2.1 Ordinary Least Squares . . . . . . . . . . . . . . .

5.2.2 Error Correction Model . . . . . . . . . . . . . . . .

5.2.3 Markov Switching Dynamic Correlation Model . . .

5.2.4 Variance Reduction . . . . . . . . . . . . . . . . . .

5.2.5 Utility . . . . . . . . . . . . . . . . . . . . . . . . .

19

19

19

20

21

24

25

26

26

27

28

30

32

. . . .

. . . .

. . . .

Model

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

. . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6 Comments and Conclusions

32

7 Bibliography

34

4

List of Figures

1

2

3

4

5

6

7

8

9

10

11

12

13

14

Future Ibovespa. From BMF. .

Spot Ibovespa. From BMF. . .

R$/US$ Future. From: BMF. .

R$/US$ Spot. From: BACEN. .

Estimated Variance . . . . . . .

Correlation . . . . . . . . . . .

Filtered Probabilities . . . . . .

Optimal Hedge Ratio . . . . . .

Expected Optimal Hedge Ratio

Variance Estimated . . . . . . .

Correlation . . . . . . . . . . .

Filtered Probabilities . . . . . .

Optimal Hedge Ratio . . . . . .

Expected Optimal Hedge Ratio

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

15

17

18

22

23

24

24

25

29

30

31

31

31

1

Introduction

Agents participants of future markets need to buy a optimal number of futures contracts

to minimize the variance of their portfolios returns. The prime articles about this subject

were Johnson (1960) and Stein (1961). But only in Ederington (1979) and Figlewski (1984)

one can …nd the …rst derivation of the optimal hedge that equals the ratio of covariance

between the spot price variation (St ) and the future price variation (Ft ) by the variance of

the future price. Since these works, many studies estimated the optimal hedge ratio using

di¤erent econometric techniques

Di¤erent kinds of estimation methods are used: ordinary least squares [Junkus and Lee

(1985)], cointegration [Lien e Luo (1993), Ghosh (1993), Wahab e Lashgari (1993)] and

multivariate generalized autoregressive conditional heteroscedasticity models as Kroner and

Sultan (1993), Park and Switzer (1995), Gagnon and Lypny (1995, 1997), Brooks, Henry

and Persand (2002) and Bystrom (2003). Other possible models are fractional and threshold

cointegration as in Lien and Tse (1999), random coe¢ cient as in Bera, Garcia and Roh

(1997) and stochastic volatility as in Lien and Wilson (2000).

Theses models can not capture all the most important stylized facts found in …nancial series. The ordinary least square does not consider the heterocedasticity and the cointegrated

relationship between spot and future prices. The error correction model permits to capture

the long run relationship between both series and can have a structure for heteroscedastic errors but this kind of model has not been used to estimate the optimal hedge ratio

yet. Multivariate generalized autoregressive conditional heteroscedasticity models as BabaEngle-Kraft-Kroner, here after, BEKK [Engle and Kroner (1995)] and Dynamic Conditional

Correlation (DCC) [Engle (2002)] consider the heteroscedastic behaviour of errors but they

have mispeci…cation problems because they do not consider the cointegrated relationship.

Another problem with theses models is the structurals breaks that can be present in …nancial

series. These kind of fact can create an estimation where the conclusion is that there are

high persistence in the series but there are not.

6

The aim of this work is to evaluate if a model with a bivariate markov switching regime

with two states in the conditional correlation equation of the series can improve the estimation of optimal hedge. For this task we use a bivariate markov switching regime dynamic

correlation as in Pelletier (2006) to estimate the optimal hedge for Ibovespa Index and

R$/US$ exchange rate. This model was previously used only by Billio and Caporin (2005)

in a contagion analysis. In our model we permit the presence of an error correction term

and asymmetry in variance equation The di¤erence between the future price and spot price

called basis is used as error correction term. According to Fama and French (1987) the basis

has a predictive power for the spot returns.

There are some articles that had applied markov switching regime models to calculate

the optimal hedge ratio. Alizadeh and Nomikos (2004).using an ordinary least squares estimation with markov regime switching. Lee and Yoder (2007) proposed a bivariate markov

regime switching BEKK model Lee, Yoder, Mittelhammer and McCluskey (2006) used an

autoregressive random coe¢ cient markov switching regime model. Finally, Lee and Yoder

(2007) calculate the optimal hedging with a time varying correlation garch regime switching

model. The model proposed in my work is similar to the Lee and Yoder (2007) article but

the structure considers the cointegrated relationship between data, the leverage e¤ect for

univariate variance and permits the unconditional correlation to change in the states.

The model is compared with other optimal hedge ratio estimation from ordinary least

squares and vector error correction model using the criteria of reduction variance and maximun utility. The results indicate that the model proposed outperforms the other models

in-sample.

The text is divided as follow: in section two the model is presented and I explain the measured hedging performance, in section three I discuss the data characteristics and afterwards

I present the results of estimation. Then I conclude and make some comments.

7

2

A Bivariate Markov Switching Dynamic Conditional

Correlation

In this section I present the model to estimate the optimal hedge ratio. My intention is to

elaborate a model that can capture the stylized facts of the series. Since Mandelbrot (1956)

we know that …nancial series usually present facts as clustering, conditional heteroscedastic

and assimetry. If a model is not able to capture them, then there will be a mispeci…cation

problem. In the case of spot and futures prices the series have a cointegration relationship

as shown by Lien and Luo (1993), Kroner and Sultan (1993), Park and Switzer (1995), Lien

(1996), Chow (1998) Sarno and Valente (2000), Brooks, Henry and Persand (2002), Yang

and Allen (2004), Mili and Abid (2004), Sarno and Valente (2005). In those circustances

it is necessary to build a model to embody these characteristics if we want to avoid the

mispeci…caation problem The model presented can capture them all.

2.1

Model

The model is a bivariate markov switching regime dynamic conditional correlation. First

of all, let st and ft be the log of the spot and future prices respectively, St and Ft , and

the di¤erence operator, that is

where the spot price in t

xt 1 . So

xt = xt

st represents the spot price variation

1 is subtracted from the spot price in t and

future variation where the future price in t

be

ft represent the

1 is subtracted from the future price in t.

st = c s +

s (ft 1

st 1 ) + "s;t

(1)

ft = cf +

f (ft 1

st 1 ) + "f;t

(2)

t

=

"s;t

"f;t

i:i:d (0; Ht )

(3)

Equations 1 and 2 represente the return build on a constant given by cs and cf , an

error correction term represented by the di¤erence between future and spot prices in the last

8

period, also know as, the basis of Fama and French (1987) and an error term that has zero

average and a variance-covariance matrix given by Ht as in equation 4.

(4)

Ht = Dt Rt Dt

Dt = diag(

s;t ;

(5)

f;t )

2

s;t

=$+

2

s s;t 1

+ 's "2s;t

1

+

2

s "s;t 1 I

("s;t

2

f;t

=$+

f

2

f;t 1

+ 'f "2f;t

1

+

2

f "f;t 1 I

("f;t

1

1

< 0)

(6)

< 0)

(7)

Where I ("t ) is an indicator function that assumes the value 1 for negative values of "t

1

and 0 otherwise. The equations 6 and 7 are the univariate variance of each series, their

structures are given by the last variance and the square of last error observed plus the last

term used to verify if there is a di¤erence between the variance caused by negative and

positive impacts. This part of model follows Glosten, Jagannathan and Runkle (1993) here

after GJR.

~ ij

Rtij = Q

t

Qij

t = 1

j

j

j

Qj +

1

~ ij

Qij

Q

t

t

0

j t 1 t 1

~ ij

Q

t = diag

+

1

i

j Qt 1

(8)

; where

i; j = 1:::2 and

q

q

ij

ij

q11;t

; q22;t

t 1

= Dt

1

t

(9)

(10)

The evolution of Ht is given by a dynamic correlation model. In this case Ht equals

Dt Rt Dt as in equation 4 where Dt represents a diagonal matrix with the standard deviation

of each series as in equation 5 and Rt is the correlation matrix that depends on an equation of

correlation given by Qt as in equation 9. This model has the same structure of Engle’s (2002)

DCC model for conditional correlation where the correlations is given by a constant term,

the standardized matrix of residuals and the variance-covariance observed in last period.

To avoid problems caused by structural breaks as the persistence in the results I use a

model that permits the possibility of two di¤erent states in economy for dynamic conditional

9

correlation. This structure is identi…ed by upperscript j and i in equations 8, 9 and 10, where

the upperscript j and i refers to the state in t, t

1, respectively. Note that in equation 9

the unconditional correlation has the subscript j indicating that the model permits that its

value change in each state.

Pr (st = 1) =

2

1 P22;t

and Pr (st = 2) =

P11;t P22;t

2

1 P11;t

P22;t P11;t

(11)

The ergodic probabilities are given by equations in 11 and indicates the unconditional

probabilities of each state. The parameters P11 and P22 are the probabilities of the transition

matrix. For details about the asymptotic properties of model DCC see Engle(2002) and

Engle and Sheppard (2002) and for the possibility of a markov switching regime dynamic

conditional correlation consult Pelletier (2006).

2.2

Estimation

The process the estimation of the model is relatively simple. This kind of model is

estimate using a two-step Quasi Maximum Likelihood method following Engle (2002) and

a modi…ed Hamilton …lter as in Kim(1994). Supose that the full log-lilkelihood can be

represented by

T

T

1X

1X

LogL (Y ) =

log L (Yt ) =

T t=1

T t=1

1

log jHt j + "0t Ht 1 "t

2

(12)

but we know from equation 4 that Ht = Dt Rt Dt and is possible to prove that Dt Rt Dt =

jDt j jRt j jDt j ;then we conclued that

LogL (Y ) =

T

1 X

2 log jDt j + log jRt j + "0t Dt 1 Rt 1 Dt 1 "t

2T t=1

10

(13)

and replacing "0t Dt

1

for

t

we have that

T

1 X

2 log jDt j + log jRt j +

2T t=1

LogL (Y jD) =

t Rt

1

(14)

t

So it is possible to break the estimate of the model into two stages. In the …rst step I

estimate the univariate variance of the each series. With the results from this …rst estimation, it is possible to estimate the correlation structure of the series. In the case of regime

switching, Pelletier (2006) demonstrated the possibility of using a modi…ed Hamilton …lter

according to Kim (1994), because the value of correlation given by Qt is not observed, as

follow:

1. given the …ltered probabilities as inputs, determine the joint probabilities:

Pr st = j; st

1

= i j It

1

= Pr (st = j; st

1

= i) Pr st

1

= i j It

1

i; j = 1:::2 (15)

2. evaluate the regime dependent likelihood:

Qij

t = 1

j

j

0

j t 1 t 1

Qj +

q

~ ij

Q

t = diag

1

~ ij

Rtij = Q

t

LogLt Yt j Dt ; st = j; st

1

= i; I t

1

ij

q11;t

;

+

q

i

j Qt 1

ij

q22;t

~ ij

Qij

Q

t

t

=

(16)

i; j = 1:::S

(17)

1

(18)

1

log Rtij +

2T

1

Rtij

1

t

t

(19)

1

(20)

3. evaluate the likelihood of observation t:

LogLt Yt j Dt ; I

t 1

=

S X

S

X

j=1 i=1

LogLt Yt j Dt ; st = j; st

Pr st = j; st

1

= i j It

1

= i; I t

1

LogL (Yt ; :::; Y1 ) = LogL (Yt 1 ; :::; Y1 ) + LogLt Yt j Dt ; I t

11

(21)

1

(22)

4. update the joint probabilties:

Pr st = j; st

1

= i j It

1

=

LogLt (Yt j Dt ; st = j; st 1 = i; I t 1 ) Pr (st = j; st

LogLt (Yt j Dt ; I t 1 )

1

= i j I t 1)

(23)

5. compute the …ltered probabilities:

Pr st = j j I

t

=

2

X

Pr st = j; st

1

i=1

= i j It

j = 1:::2

(24)

6. update the correlation matrix using the following approximation:

Qjt =

2

P

Pr (st = j; st

i=1

1

= i j I t)

Qij

t

Pr (st = j j I t )

(25)

7. iterate 1 to 6 until the end of sample.

The bivariate markov switching regime model will be estimated using GAUSS 6.0 software, applyed the Constrained Optimization code2 . To compare the proposed model I estimate the ordinary least squares and vector error correction model too.

2.3

Optimal Hedge Ratio

To obtain the variance-covariance matrix for each instant of time, given that I have two

di¤erent possible states of economy I use the conditional expectation as in Pelletier (2006)

given by equation 26:

E [Ht ] = Dt E [Rt ] Dt

(26)

where Dt is the standard deviations of univariate variance estimation as in equation 5 and

Rt is the conditional expectational correlation matrix given by equation 8. To calculate the

expected value of Rt is used the expression given by equation 27:

2

I thank Monica Billio and Massimiliano Caporin for the estimation model code.

12

E [Rt ] = R1;t+1

Pr st = 1 j I t + R2;t+1

Pr st = 2 j I t

(27)

So for each point in time there will be two di¤erent correlations and, consequently, two

di¤erents hedge ratios. I will use an optimal hedge ratio calculated from two distincts correlations weighted by their respectives …ltered probabilities given by equations in 11 estimated

endogeously in the model.

3

Measuring Hedging Perfomance

In this section I present the two di¤erent measurements used in this dissertation to

evaluate the optimal hedge ratio.

3.1

Utility

This measurement supposes that the agent’s utility function is quadratic as in equation

28. According to the literature, the parameter

assumes values between 1 and 4. It rep-

resents the risk aversion of the agent. This utility function is used by Kroner and Sultan

(1993), Gagnon et al. (1998) and Lafuente Novales (2003) to evaluate di¤erent kinds of

hedge strategies.

2

t

Et U (rt ) = Et (rp;t )

Where rp;t =

st

t

ft is the return of the agent’s portfolio, the parameter

optimal hedge ratio given by each model and

V ar ( st

t

(rp;t )

2

t

(28)

is the

(rp;t ) is the variance of portfolio given by

ft ). The value of Et (rp;t ) is considered zero as in other articles. So the value

of the utility will be negative because the values of

and

2

t

(rp;t ) are positive. The strategy

with high utility is the best choice for the agent that are willing to minimize the variance of

their portfolio.

13

3.2

Variance Reduction

The purpose of the variance reduction is to compare the portfolio variance reduction

using the strategy of the estimated model over the strategy where the agent does not buy

any future contract. First of all it is calculated the agent’s portfolio variance using 29.

V ar (rp;t ) = V ar ( st

The parameter

t

ft )

(29)

is the optimal hedge ratio given by each model. Equation 30 shows the

variance reduction compared to an unhedge strategy, in other words, a strategy where

is

zero .

1

V ar (rp;t )h

V ar (rp;t )u

(30)

In 30 the subscript h and u refers to hedge and unhedge, respectively. The higher the

value of 30, the better the model is. The model which has the highest value for the statistic

outperforms all the other ones.

4

Data Description

I used the Bovespa Index spot and future and R$/US$ exchange rate spot and future to

estimate the models. The future data sample consists of settlement price from 03=01=2000

to 15=02=2006. To build the series, it is used the most liquid contract near the due date.

4.1

Ibovespa

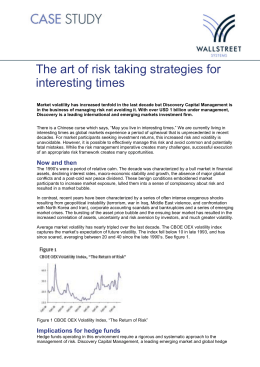

In …gures 1 and 2 we can see the behavior of log level and return for each series. The

stylized facts as clustering and variant variance can be veri…ed. And it is possible to see

in this sample that the data appear to have a positive trend in log level. As expected, the

future and spot series are very similar. So we can expect that conditional correlation be time

varying but in a determined level be close to one.

14

10.8

10.4

10.0

9.6

.12

9.2

.08

8.8

.04

.00

-.04

-.08

250

500

750

Return

1000

1250

1500

Log Level

Figure 1: Future Ibovespa. From BMF.

10.8

10.4

10.0

9.6

.08

9.2

.04

8.8

.00

-.04

-.08

-.12

250

500

750

Return

1000

1250

1500

Log Level

Figure 2: Spot Ibovespa. From BMF.

15

Table 1 has the summary statistics of the series. It is possible to verify that the return of

each series has a negative skewness or a negative asymmetry, this fact indicates that using

a GJR model for univariate variance is a good choice and that the series has excess kurtosis

in …rst di¤erence or return. The value of kurtosis is very low for a …nancial data, near 3.

This fact can be explain by a sample characteristic.

Table 1 - Summary

Log Level

Spot

Futures

Mean

9:742229 9:752695

Median

9:704321 9:718663

Maximum 10:55800 10:55579

Minimum 9:032409 9:035630

Std. Dev. 0:346388 0:344983

Skewness 0:229525 0:220043

Kurtosis 2:190144 2:190886

Statistics

Return

Spot

Futures

0:000579

0:000555

0:000939

0:000984

0:073353

0:091306

0:096342

0:074941

0:018929

0:020011

0:243482

0:029039

4:022739

3:612698

In table 2 I present the result of Unit Root Test3 for future and spot series. All tests say

that the serie has a unit root in level and is stationary in the …rst di¤erence. Only by KPSS

test we have that the series have a unit root in …rst di¤erence in a level of 1%. This fact can

occur because in some point of …gure 2 and 1 it is possible to see high positive and negative

values for return that can cause this kind of problem.

Table 2 - Unit

ADF

Future Log Level

0:038

Future Return

38:925

Spot Log Level

0:207

Spot Return

37:923

1%

3:434

5%

2:863

10%

2:567

Root Test

PP

ERS

0:189

17:832

39:009 0:059

0:302

21:040

37:929 0:082

3:434

1:99

2:863

3:26

2:567

4:48

KPSS

2:772

0:390

2:778

0:407

0:739

0:463

0:347

In table 3 I present the Johansen Cointegration test applied with no trend and an irrestrit

constant4 . The result of the test is that the series are cointegrated in level. This indicate

3

I applied the Augmented Dickey-Fuller (ADF), Phillips-Perron (PP), Kwiatkowski, et. al. (KPSS),

Elliot, Richardson and Stock (ERS) Point Optimal test.

4

But for all possibles combinations I found out at least one cointegration relations

16

that the model needs to consider this relationship when modelling the joint behavior of the

series.

Table 3 - Johansen Cointegration Test

No CE

Trace Statistic Critical Value Max-Eingen Statistic Critical Value

None

140:157

15:494

140:142

14:264

At most one

0:015

3:841

0:015

3:841

4.2

Exchange rate

In …gures 3 and 4 I show the behavior of the log level and return of exchange rate data.

Again it is possible to see that the stylized facts are present in these series. But di¤erent

from index data this one does not have a trend. So, it is interesting to use our model in

these two di¤erent data.

8.4

8.2

8.0

7.8

.08

7.6

.04

7.4

.00

-.04

-.08

-.12

250

500

750

Log Level

1000

1250

1500

Return

Figure 3: R$/US$ Future. From: BMF.

In Table 4 I present the summary statistics of the spot and future exchange rate in log

level and in return. Again it is possible to say that the series have negative skewness but the

excess of kurtosis in …rst di¤erence is much higher for currency data compared with index

data. So exchange rate series present the common …nancial series stylized facts.

17

8.4

8.2

8.0

7.8

.05

7.6

7.4

.00

-.05

-.10

250

500

750

Log Level

1000

1250

1500

Return

Figure 4: R$/US$ Spot. From: BACEN.

Mean

Median

Maximum

Minimum

Std. Dev.

Skewness

Kurtosis

Table 4 - Summary Statistics

Log Level

Return

Spot

Futures

Spot

Futures

7:837422

7:841825 9:46e 05 8:25e 05

7:849246

7:856752

0:000180

0:000346

8:282685

8:284450

0:047583

0:061572

7:451822

7:452724

0:093604

0:105023

0:201346

0:200539

0:009513

0:010949

0:176943

0:208389

0:509710

0:120257

2:282702

2:257729

12:40289

11:99867

In Table 5 it is presented the result of Unit Root Test for future and spot exchange rate

in log level and …rst di¤erence. All tests say that the series has a unit root in level and is

stationary in the …rst di¤erence but this is not true for KPSS test in a level of 1%. Again

this fact can occur because in some points of …gures 2 and 1 it is possible to see high positive

and negative values for return.

18

Table 5 - Unit Root Test

ADF

PP

ERS

Future Log Level

1:4241

1:397 36:034

Future Return

41:689

41:677 0:057

Spot Log Level

1:408

1:449 47:095

Spot Return

28:651

32:243 0:074

1%

3:434

3:434

1:99

5%

2:863

2:863

3:26

10%

2:567

2:567

4:48

KPSS

1:995

0:562

1:977

0:598

0:739

0:463

0:347

In Table 6 I present the Johansen Cointegration test applied with a costant and without

trend 5 . The result of this test is that the series are cointegrated in level. So it is possible

to say again that the model needs to consider this relationship when modelling the joint

behavior of series.

Table 6 - Johansen Cointegration Test

No CE

Trace Statistic Critical Value Max-Eingen Statistic Critical Value

None

300:143

15:494

298:078

14:264

At most one

2:065

3:841

2:065

3:841

5

Estimation Results

In this section I present the results from the estimated models: ordinary least square,

vector error correction model and bivariate markov switching regime model for each data

series.

5.1

5.1.1

Ibovespa

Ordinary Least Squares

In equation 31 I show the result of the Ordinary Least Squares model. It is possible to

note that all estimated parameters are signi…cant at 5%. Using this model I conclude that

the optimal hedge is 0:88. This will be the value used to evaluate the optimal hedge ratio

strategy calculated from ordinary least squares model. For this model the R2 statistic is 0:89.

5

But for all possibles combinations I found out at least one cointegration relations

19

st = 0:00008 + 0:885

(0:0001)

(31)

ft

(0:008)

Only for the good of science or perhaps curiosity I estimate an ordinary least squares

model with an extra variable: the basis. The result is shown in equation 32 In this case

I can infer that the constant parameter and the new parameter included have statistical

signi…cance. So I veri…ed that the value of the basis in t

1 has statistical signi…cance to

explain the exchange rate spot return in t.The R2 statistic is of 0:90.

st = 0:002 + 0:90

(0:0002)

ft

(0:007)

0:206

(0:015)

(ft

1

(32)

st 1 )

I use the optimal hedge ratio from 31 because in 32 the parameter of future variable

return is not any more equal the ratio between covariance of spot and future return and the

variance of future return.

5.1.2

Error Correction Model

The Error Correction Model results can be observed in equations 33, 34 and 35. The

adjustment parameter is not signi…cant in the equation of spot returns given by equation 33

but it is in the equation of future returns given by equation 34, so I can infer that it is the

future price that adjusts the long-run relationship. The spot prices appear not to have an

autoregressive component and the value of future price in t

1 can not help explaining the

value of spot price in t given that these two parameters are not signi…cant. For future prices

it happened the opposite, the last value of spot prices and the autorregressive compenent

are signi…cant to explain the value of future price in t. This fact indicates that future prices

adjust itself after a shock to keep the long-run relationship.

st = 0:0005 + 0:046

(0:0004)

(0:083)

st

1

0:008

(0:078)

20

ft

1

+ 0:046

(0:055)

zt

1

(33)

ft = 0:0005 + 0:227

(0:00051)

st

(0:088)

where zt

1

=

ft

1

0:188

1

ft

(0:083)

0:995 st

1

(0:002)

1

0:156 zt

(0:058)

(34)

1

(35)

0:058

The parameter value in the cointegrated vector given by equation 35 estimated is significant at 5% and is nearly 1. A probable indication that the basis can be used as an error

correction term. To calculate the optimal hedge ratio for this model it is necessary to calculate the ratio between the covariance of residuals from equations of spot and future returns

given by equations 33 and 34 and the variance of residuals from equation of future return

given by equation 34. The value that I have found out was 1:0166.

5.1.3

Markov Switching Dynamic Conditional Correlation Model

In equations 36 and 37 I can verify the results for equation return of each index series.

The parameter that represents the error correction term is signi…cant only in future return

equation, as seen in the results of error correction model.

st = 0:0001 + 0:040

(0:046)

(0:046)

(ft

1

st 1 )

(36)

ft = 0:002

0:166

(ft

1

st 1 )

(37)

(0:0006)

(0:046)

The results of the variance equation for each serie are in equations 38 and 39. We can

note that the model captures a leverage e¤ect, or in other words, the model capture of

di¤erent ways negative impacts ("bad news") and positive impacts in variance equation as

in the literature.

2

s;t

= 0:00001 + 0:928

(0:000003)

(0:017)

2

s;t 1

0:008 "2s;t

(0:01)

21

1

+ 0:087 I ("s;t 1 )

(0:016)

"2s;t

1

(38)

2

f;t

2

f;t 1

= 0:000009 + 0:943

(0:000002)

(0:013)

0:011 "2f;t

(0:009)

1

+ 0:085

"2f;t

I ("f;t 1 )

(0:016)

(39)

1

In …gure 5, I plot the estimate variance for both sample series.

.0016

.0016

.0014

.0012

.0012

.0010

.0008

.0008

.0006

.0004

.0004

.0002

.0000

.0000

250

500

750

1000

1250

1500

250

500

Future

750

1000

1250

1500

Spot

Figure 5: Estimated Variance

In the second stage, I estimate the conditional correlation between series using the residuals from the univariate variance estimations. The results are shown in equations 40 and

41. According to the estimates, there are two di¤erent states for series correlation. In state

one, the unconditional correlation is equal 0:980 and in state two, the value is 0:605. I can

infer that both estimated parameters are signi…cant at 5%. So in state one there is a high

positive correlation between series and the state two has a low correlation between series.

The parameter estimated are not signi…cant and in state one the vale of parameter

Q1t = 1

Q2t = 1

0

(0:021)

0:014

(0:051)

0:019

(0:063)

0:331

(0:468)

0:980 + 0

(0:021)

(0:001)

0:605 +

(0:051)

0

(0:034)

0

t 1 t 1

+ 0:019

0

t 1 t 1

+ 0:331

(0:063)

(0:468)

Q1t

Q2t

is zero.

(40)

1

1

(41)

In …gure 6 is shown the behavior of estimated correlation. I can infer that in state one

there is a high correlation and state two the correlation is lower than state one again. In

22

state one the range of correlation is equal 0:007 but in a high level correlation and in state

two the correlation range is high but in a lower level compared with state one.

.981

.80

.980

.76

.979

.72

.978

.977

.68

.976

.64

.975

.60

.974

.973

.56

250

500

750

1000

1250

1500

250

State 1

500

750

1000

1250

1500

State 2

Figure 6: Correlation

In Table 7 are the transitions probabilities of the model. Using this information we can

conclude that state one has a duration of

of

1

1 0:4879

1

1 0:9498

= 19: 92 days and state two has a duration

= 1: 952 7 days. The ergodic probabilities are given by

for state one and

1 0:9498

2 0:9498 0:4879

1 0:4879

2 0:9498 0:4879

= 0:910 72

= 0:089 28 for state two. So we can conclude that for this

sample, the probability of conditional correlation between series is bigger for state one than

state two.

Table 7 - Probabilities Transition

State One State Two

State One

0:9498

0:050 2

State Two

0:512 1

0:4879

In …gure 7 I show the …ltered probabilities of each state. They indicate that in each state

the probability of been in state one is bigger than state two for each t.

I plote in …gure 8 the optimal hedge ratio estimate in each state. Both series are very

similar. In the state one the correlation between spot and future Ibovespa index is close to

one so the optimal hedge ratio is close to one too for each t: In the state two the value of

optimal hedge ratio is less than that of state one because the conditional correlation between

the series presents this behavior too. Another observation is that both graphs are similar

23

1.0

1.0

0.8

0.8

0.6

0.6

0.4

0.4

0.2

0.2

0.0

0.0

250

500

750

1000

1250

1500

250

500

State 1

750

1000

1250

1500

1000

1250

1500

State 2

Figure 7: Filtered Probabilities

1.1

1.1

1.0

1.0

0.9

0.9

0.8

0.8

0.7

0.7

0.6

0.6

0.5

0.5

250

500

750

1000

1250

1500

250

500

State 1

750

State 2

Figure 8: Optimal Hedge Ratio

but in di¤erents levels.

In …gure 9 are the expected optimal hedge ratio calculated using the hedge ratio in each

state and their respectives …ltered probabilities. The serie ‡oats between 0:9 and 0:8. In

some points there is a trend to achieve values close of 0:6.

5.1.4

Variance Reduction

In Table 8 are the results of model’s evaluation using the variance reduction criterion.

Second this judge the best strategy in-the-sample is given by switching regime model reducing

the variance in 89:86% followed by ordinary least squares model that can reduce the variance

24

1.1

1.0

0.9

0.8

0.7

0.6

0.5

250

500

750

1000

1250

1500

Figure 9: Expected Optimal Hedge Ratio

in 89:44%, the values are very close.

Table 8 -Variance Reduction

Variance

Reduction

Unhedge 0:0003510351797

Naive

0:0000423391708

87:94%

OLS

0:0000370814818

89:44%

ECM

0:0000435916178

87:58%

MSDCC 0:0000355961241

89:86%

The values for variance reduction is very high, almost 90% so I can conclude that some

kind of strategy buying future contracts of Ibovespa index can reduced signi…cantly the

variance of agent’s portfolio.

5.1.5

Utility

In Table 9 are presented the values of utility obtained by equation 28 using the results of

each model or strategy. For all value of coe¢ cient risk aversion the switching regime model is

the better choice compared with ordinary least squares and vector error correction models.

The curios fact is that the naive strategy is a better choice than vector error correction

model.

25

Risk Aversion

Unhedge

Naive

OLS

ECM

MSDCC

5.2

5.2.1

Table 9 - Measure Utility

Utility

1

2

3

0:000351

0:000702

0:001053

0:000042

0:000085

0:000127

0:000037

0:000074

0:000111

0:000044

0:000087

0:000131

0:000036

0:000071

0:000107

4

0:001404

0:000169

0:000148

0:000174

0:000142

Exchange Rate

Ordinary Least Squares

In equation 42 I can evaluate the result of the ordinary least squares model. It is possible

to note that only the parameter of future return is signi…cants at 5%. Using this model

I conclude that the optimal hedge is 0:535 for exchange rate, a less value when compared

with index optimal hedge ratio from ordinary least squares. This will be the value used

to evaluate the optimal hedge ratio calculated from ordinary least squares model. For this

model we have a R2 statistic of 0:38. The values of the optimal hedge ratio parameter and

R2 statistic is less than compared with the values for index results.

st = 0:00005 + 0:535

(0:0001)

(0:017)

(42)

ft

As before I estimate an ordinary least squares model with a one more variable in the

model: the basis. The result is presented in equation 43 In this case the constant parameter

and the new parameter include have statistician signi…cant. So it is possible to say that the

basis in t

1 has statistician signi…cant to explain the return of spot exchange rate in t. The

R2 statistic is of 0:63.

st =

0:002 + 0:583

(0:0001)

(0:013)

ft + 0:634

(0:019)

(ft

1

st 1 )

(43)

Note how the value of R2 increased with an addiotinal explicative variable when compared

with the same situation in index results. I use the optimal hedge ratio from 42 because in

26

43 the parameter of future return explicative variable in equation 43 is not any more equal

the ratio between covariance of spot and future return and the variance of future return as

in equation 42.

5.2.2

Error Correction Model

For Error Correction Model the results to exchange rate can be observed in equations 44,

45 and 46. It can be noted that the parameter of adjustment is signi…cant in both equations

and assumes a positive value to spot equation and a negative value to future equation. So I

can infer that both prices adjust the long-run relationship and that spot exchange rate needs

to increase and future exchange rate needs to decrease to do it. The spot prices appear not

to have an autoregressive component and the value of return future price in t

1 can help

predicting the value of spot price in t. For future prices, the last value of spot prices and an

autoregressive component are signi…cant to explain the value of future price in t.

st = 0:00006

(0:0002)

0:001

(0:031)

ft = 0:0008 + 0:117

(0:00028)

(0:040)

where zt

1

=

ft

st

1

st

1

1

+0:222

(0:078)

0:093

(0:042)

0:996 st

(0:001)

1

ft

1

ft

1

+ 0:369

(0:037)

zt

0:094 zt

(0:048)

0:033

1

1

(44)

(45)

(46)

A last comment is about the cointegration vector. The parameter value estimated is

signi…cant at 5% and is nearly 1. A probable indication that the basis can be used as a

proxy of an error correction term. To calculate the optimal hedge ratio for this model is

necessary to calculate the ratio between the covariance of residuals from equations 44 and

45 and the variance of residuals from equation 45. The value found out were 1:0069. A value

higher than that one predicted by the ordinary least squares model.

27

5.2.3

Markov Switching Dynamic Correlation Model

In equations 47 and 48 it is possible to verify the results for equation return of future and

spot exchange rate. The parameter value of basis is signi…cant in both equations as in error

correction model. It is observed that the signs of the parameter’s error correction term is

the same that those found out in equations 44 and 45, indicating that to repair the long-run

relationship it is necessary that spot exchange rate increase and that future exchange rate

decrease. So both data need adjustment to repair the long-run relationship.

st =

0:002 + 0:521

(0:0001)

ft = 0:0008

(0:0002)

(0:024)

0:172

(0:035)

(ft

(ft

1

1

st 1 )

(47)

st 1 )

(48)

The results of the univariate variance to spot and future exchange rate are in equations

49 and 50, respectively. Note that the model captures a leverage e¤ect, or in other words,

the model captures of di¤erent ways negative impacts and positive impacts as in literature

for both variance equations. Anotther interesting fact to note is that sign of the leverage

e¤ect parameter is negative, the opposite of index results indicating that negative impacts

reduce the variance.

2

s;t

2

f;t

= 0:00001 + 0:808

(0:000003)

(0:018)

= 0:00001 + 0:877

(0:000003)

(0:012)

2

s;t 1

+ 0:245 "2s;t

1

2

f;t 1

+ 0:137 "2f;t

1

(0:026)

(0:015)

0:132 I ("s;t 1 )

(0:025)

0:044

(0:015)

I ("f;t 1 )

"2s;t

"2f;t

1

1

(49)

(50)

In …gure 10 I plot the variances estimatives of both series. According to them I can infer

that the variance of spot exchange rate and the variance of future exchange rate are very

similar and that they are clearly variant in time.

In the second stage, I estimate the conditional correlation between series using the residuals from the univariate models. The results are in equations 51 and 52. According to the

28

.0020

.0020

.0016

.0016

.0012

.0012

.0008

.0008

.0004

.0004

.0000

.0000

250

500

750

1000

1250

1500

250

500

Future

750

1000

1250

1500

Spot

Figure 10: Variance Estimated

estimates there are two di¤erents states for correlation between spot and future exchange

rate. In state one the unconditional correlation is equal 0:899 and in state two this value is

0:560. The estimatives parameters

and

estimated are not signi…cant and in state two,

given by equation 52, the value of parameter

Q1t = 1

Q2t = 1

0:005

(0:029)

0

(0:034)

0:681

(0:111)

0:597

(0:214)

is zero.

0:899 +0:005

(0:029)

(0:039)

0:560 +

(0:075)

0

(0:034)

0

t 1 t 1

+ 0:681

0

t 1 t 1

+ 0:597

(0:111)

(0:214)

Q1t

Q2t

1

1

(51)

(52)

In …gure 11 I plote the behavior of estimated correlation between series. For state one

the estimated correlation between spot and future exchange rate ‡oats around a level of 0:8

and for state two the correlation ‡oats around a level of 0:6, as expected, a positive and high

value, very close to one. This can indicate that both series are almost always very close and

in some moments their keep a high correlation but in a lower level.

In table 10 are the transitions probabilities of the model. Using this information I can

conclude that in average the state one has a duration of

has a duration of

1

1 0:804

1

1 0:8420

= 6: 329 1 days and state two

= 5: 102 days. The ergodic probabilities are given by

0:553 67 for state one and

1 0:842

2 0:8420 0:804

1 0:804

2 0:8420 0:804

=

= 0:446 33 for state two. So we can conclude that

29

1.0

1.0

0.8

0.8

0.6

0.6

0.4

0.4

0.2

0.2

0.0

0.0

250

500

750

1000

1250

1500

250

State 1

500

750

1000

1250

1500

State 2

Figure 11: Correlation

for this sample the probability that conditional correlation between series is bigger for state

one than state two but not much and it is more probable that the spot and future exchange

rate have a higher correlation close to 0:8 as in …gure 11.

Table 10 - Transition Probabilities

State One State Two

State One 0:8420

0:158

0:804

State Two 0:196

In …gure 7 it is observed the …ltered probabilities for each state. Their indicate that the

probability of been in state one is almost the same of been in state two for each t in average,

this behaviour is expected because the ergodic probabilities obtained by model.

I plote the optimal hedge ratio estimated in each state in …gure 13. Both series are very

similar. and they ‡oat almost around the same level, di¤erently of the optimal hedge ratios

results obtained by Ibovespa Index and reported in …gure 8.

In …gure 14 are ploted the expected optimal hedge ratio for each t. I can infer that the

behavior of graph is very similar compared to …gure 13.

5.2.4

Variance Reduction

Table 11 present the results of model’s evaluation using the variance reduction criterion

to exchange rate. I can infer that using some kind of strategy, then the agents can reduce the

30

1.0

1.0

0.8

0.8

0.6

0.6

0.4

0.4

0.2

0.2

0.0

0.0

250

500

750

1000

1250

1500

250

500

State 1

750

1000

1250

1500

1000

1250

1500

State 2

Figure 12: Filtered Probabilities

1.4

1.4

1.2

1.2

1.0

1.0

0.8

0.8

0.6

0.6

0.4

0.4

0.2

0.2

0.0

0.0

250

500

750

1000

1250

1500

250

500

State 1

750

State 2

Figure 13: Optimal Hedge Ratio

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

250

500

750

1000

1250

1500

Figure 14: Expected Optimal Hedge Ratio

31

variance of his portfolio as the results obtained by Ibovespa index and that the best strategy

in-the-sample is given by the switching regime model. A curios fact is that the variance

reduction obtained by vector error correction model (8:82%) is very small when compared

with variance reduction obtained by ordinary least squares (38:15%) and switching regime

model (39:73%) and a naive strategy is a better choice to an optimal hedge ratio than vector

error correction term.

Table 11 - Variance Reduction

Variance

Variance

Unhedge 0:0000904814249

Naive

0:0000817149847

9:69%

OLS

0:0000559637992

38:15%

VECM 0:0000824974200

8:82%

MSDCC 0:0000545306447

39:73%

5.2.5

Utility

In table 12 are present the values of utility. For all values of coe¢ cient risk aversion the

switching regime model is the better choice for exchange rate data. The same result obtained

by index data. The vector error correction model is a worse choice when compared with a

naive strategy, the same result found out in table 9 for Ibovespa Index.

Table 12

Utility

Risk Aversion

Unhedge

Naive

OLS

VECM

MSDCC

6

1

0:000090

0:000082

0:000056

0:000082

0:000055

2

0:000181

0:000163

0:000112

0:000165

0:000109

3

0:000271

0:000245

0:000168

0:000247

0:000164

4

0:000362

0:000327

0:000224

0:000330

0:000218

Comments and Conclusions

The results achieved in this dissertation need some further explanation and comments.

For both series some estimated parameters of the conditional correlation equation are

zero or not signi…cant but the unconditional correlation and the transition probabilities are

32

signi…cant. So this econometric model says that the probabilities and the unconditional

correlation are more important to determine the correlation in each point of time and that

there is a switching regime in the correlation data. The fact that the equation parameters

are not signi…cant can be a little strange but it is supported by the high correlation behavior

that can be assumed from the log level graphs.

The future and spot prices are very narrowly related, so the correlation or covariance

between them is high during all the time and sometimes it can change to a lower level.

Then for the estimated structure, unconditional correlation and probabilities are important.

The correlation is always ‡uctuating around these two levels of the estimated unconditional

correlation.

The …ltered probabilities indicate that the correlation between the series does not stay

in each state for a long time, as we can see in the pictures of the …ltered probabilities. These

results, perhaps, can not have an economic interpretation but Lee, Yoder, Mittelhammer

and McCluskey (2006) found very similar …ltered probabilities to those I found in my work

and Lee and Yoder (2007) presented, similarly to my work, not only the …ltered probabilities

but also some parameter that are not signi…cant and some equal zero.

Concluding, in this work I estimated the optimal hedge ratio using a bivariate markov

switching regime dynamic conditional correlation that incorporate a leverage e¤ect in univariate variance and an error correction term. The model was applied in two di¤erent data

series. The results from the variance reduction and utility indicate that this model is a better choice when compared to ordinary least squares and vector error correction model. An

extension of this dissertation is to estimate a model with a markov switching structure for

univariate variances and apply the White test to determine the statistic signi…cance between

models.

33

7

Bibliography

ALIZADEH, A. & NOMIKOS, K. A Markov Regime Switching Approach for Hedge

Stock Indices, The Journal of Future Markets, vol.24, p.p. 649-674, 2004.

ANDERSON, R. W. & DANTHINE, J. The Time Pattern of Hedge and the Volatility

of Futures Prices, Review of Economic Studies, p.p. 249-266, 1983.

BAILLIE, R. T. & MYERS, R. J. Bivariate GARCH Estimation of the Optimal Commodity Futures Hedge, Journal of Applied Econometrics, vol. 6 p.p. 109-124, 1991.

BAUWENS, L., LAURENT, S. & ROMBOUTS, J. V. K. Multivariate GARCH Models:

A survey, Journal of Applied Econometrics, vol. 21, p.p. 79-109, 2006.

BENNINGA, S. , ELDOR, R. & ZILCHA, I. The optimal hedge ratio in unbiased futures

markets. Journal of futures markets, vol. 4, p.p. 155-159, 1984.

BERA, A. K., GARCIA, P., & ROH, J. S., Estimation of Time-Varying Hedge Ratios

for Corn and Soybean: BGARCH and Random Coe¢ cient Approaches, The Indian Journal

of Statistics, vol. 59, p.p. 346-368, 1997.

BILLIO, M. & CAPORIN, M. Multivariate Markov Switching Dynamic Conditional Correlation GARCH Representations for Contagion Analysis, Statistical Methods & Applications, vol. 14, p.p. 145-161,2005.

BROOKS, C., HENRY, O. T. & PERSAND, G. The E¤ect of Asymmetries on Optimal

Hedge Ratios. Journal of Business, vol. 75, p.p 333-352, 2002.

BYSTRÖM, H. N. E., The Hedge Performance of Electricity Futures on the Nordic Power

Exchange. Applied Economics, vol. 35, p.p.1-11,2003

CECCHETTI, S. G., CUMBY R. E. & FIGLEWSKI, S. Estimation of Optimal Futures

Hedge. Review of Economics and Statistics, vol. 70, p.p 623-630, 1988.

COTTER, J. & HANLY, J. Reevaluating Hedge Performance. The Journal of Futures

Markets, vol. 26, p.p. 677-602, 2006.

CHOW, Y.F., Regime Switching and Cointegration Tests of the E¢ ciency of Futures

Markets. The Journal of Futures Markets, vol. 18, p.p. 871-901, 1998.

EDERINGTON, L. H. The hedge performance of the new futures markets. Journal of

Finance, vol. 34, p.p. 157-170, 1979.

ENGLE, R. F., Dynamic Conditional Correlation – A Simple Class of Multivariate

GARCH Models. Journal of Business and Economic Statistics, vol. 20, p.p. 339-350,

2002.

ENGLE, R. F. & GRANGER, C. W. J. Co-integration and Error Correction representation, estimation and testing. Econometrica, vol. 55, p.p. 251-276, 1987.

FAMA, E. F. and FRENCH, K. , Commodity Futures Prices: Some Evidence on Forecast

Power, Premiums and the Theory of Storage, The Journal of Business, vol. 60, p.p. 55 - 73.

FIGLEWSKI, S. Hedge Performance and Basis Risk in Stock Index Futures. Journal of

Finance, vol. 60, p.p. 55-73, 1984.

FONG, W. M. & SEE, K. H. A Markov Switching Model of the Conditional Volatility of

crude oil prices. Energy Economics, vol. 35, p.p. 71-96.

34

GAGNON, l. & LYPNY, G. Hedge short-term interest risk under time-varying distributions. Journal of Future Markets, vol. 15, p.p. 767-783, 1995.

GLOSTEN, L., JAGANNATHAN, R., RUNKLE, D., “On the Relation Between Expected Value and the Volatility of the Nominal Excess Returns on Stocks”. Journal of

Finance, vol. 48, p.p. 1779-1801, 1993.

GAGNON, L., LYPNY, G. J., and MCCURDY, T. H. Hedge Foreign Currency Portfolios,

Journal of Empirical Finance, vol. 5, p.p.197-220, 1998.

HAMILTON, J. D., A New Approach to the Economic Analysis of Nonstationary Time

Series and the Business Cycle, Econometrica, vol. 57(2), p.p. 357-384, 1989.

HAMILTON, J. D., & SUSMEL, R., Autoregressive Conditional Heteroscedasticity and

Changes in Regime, Journal of Econometrics vol. 64, 307-333, 1994

HEANEY, J. & POITRAS, G. Estimation of the Optimal Hedge Ratio, Expected Utility,

and Ordinary Least Squares Regression. The Journal of Futures Markets, vol. 11, p.p. 603612, 1991.

HILL, J. & SCHNEEWEIS, T. A note on the hedge e¤ectiveness of foreign currency

futures. Journal of Futures Markets, vol. 1, p.p 659-664, 1981.

JOHNSON, L. The Theory of Hedge and Speculation in Commodity Futures. Review of

Economic Studies, vol. 27 p.p. 139-151, 1987.

KAVUSSANOS, M. & NOMIKOS, N. Hedge in the freight futures markets. Journal of

Derivatives, vol. 8, p.p. 41-58, 2000.

KIM, C-J. Dynamic linear models with Markov-switching. Journal of Econometrics, vol.

60, p.p. 1-22, 1994.

KRONER, K. & SULTAN, J. Time-varying Distributions and Dynamic Hedge with Foreign Currency Futures. Journal of Financial and Quantitative Analysis, vol. 28, p.p. 535551, 1993.

KUWORNU, J. K. M.; KUIPER, W. E.; PENNINGS, J. M. E. & MEULENBERG M.

T. G. Time-varying Hedge Ratios: A Principal-agent Approach. Journal of Agricultural

Economics, vol. 56, p.p. 417-432, 2005.

LAMOUREUX, C. G., & LASTRAPES, W. D. Persistence in Variance, Structural

Change, and the GARCH Model. Journal of Business & Economic Statistics, vol. 8, p.p

255-234, 1990.

LEE, H. T. & YODER, J. A Bivariate Markov Regime Switching Garch Approach to

Estimate Time Varying Minimum Variance Hedge Ratios. Applied Economics, 2007.

LEE,H. T., YODER, J., MITTELHAMMER, R. C. & MCCLUSKEY J. J. A random

coe¢ cient autoregressive Markov regime switching model for dynamics futures hedging The

Journal of Futures Markets. vol. 26, p.p. 103, 2006.

LEE, H. T. & Yoder, J. Optimal hedging with a regime-switching time-varying correlation

GARCH model. The Journal of Futures Markets, vol. 27, p.p. 495, 2007.

LI, W K , LING, S. & MCALEER, M., Recent Theoretical Results of Time Series Models

with GARCH Errors, Journal of Economic Survey, vol. 16,p.p. 245-69, 2002.

LIEN, D. The E¤ect of the Cointegration Relationship on Futures Hedge: A Note. Journal of Futures Markets, vol. 16, p.p. 773-780, 1996.

LIEN, D. Estimation Bias of Futures Hedge Performance: A Note. Journal of Futures

Markets, vol. 26, p.p. 835-841, 2006.

LIEN, D. & LUO, X. Estimating Multiperiod Hedge Ratios in Cointegrated Markets.

The Journal of Futures Markets, vol. 13, p.p. 908-920, 1993.

35

LIEN, D. & TSE, Y. K., Fractional Cointegration and Futures Hedge, Journal of Futures

Markets, vol. 19, p.p. 457-474, 1999.

LIEN, D. & TSE, Y. K., Some Recent Developments in Futures Hedge, Journal of Economic Surveys, vol. 16, p.p. 357-396, 2002.

MARTINEZ, S. W. & ZERING, K. D. Optimal Dynamic Hedge Decisions for Grain

Producers. American Agricultural Economics Association, p.p. 879-888, 1992.

MECNEW, K. P. & FACKLER, P. L. Nonconstant Optimal Hedge Ratio Estimation and

Nested Hypotheses Tests. The Journal of Futures Markets, vol. 14, p.p. 619-635, 1994.

MILI, M. & ABID, F. Optimal Hedge Ratios Estimates: Static vs Dynamic Hedge.

Finance India, vol. 18, p.p. 655-670, 2004.

MYERS, R. J. Estimating Time-Varying Optimal Hedge Ratios on Futures Markets,

Journal of Futures Markets, vol. 11, p.p. 39-53, 1991.

MYERS, R. J. & HANSON, S. D. Optimal Dynamic Hedge in Unbiased Futures Markets,

American Agricultural Economics Association,vol. 78, p.p. 13-20, 1996.

PARK, T. H. & SWITZER, L. N. Bivariate GARCH Estimation of the Optimal Hedge

Ratios for Stock Index Futures: A Note. The Journal of Futures Markets, vol. 15, p.p.

61-67, 1995.

PELLETIER, D. Regime Switching for Dynamic Correlations. Journal of Econometrics,

vol. 131, p.p 445-473, 2006.

RYDEN T., TERASVIRTA, T. & ASBRINK, S. Stylized Facts of Daily Return Series

and the Hidden Markov Model. Journal of Applied Econometrics, vol. 13, p.p. 217-244.

1998.

TONG, W. H. S., An Examination of Dynamic Hedge. Journal of International Money

and Finance, vol. 15, p.p. 19-35, 1996.

SARNO, L. & VALENTE, G. Modelling and Forecasting Stock Returns: Exploiting the

Futures Market, Regime Shifts and International Spillovers, Journal of Applied Econometrics, vol. 20, p.p. 345-376, 2005.

SARNO, L. & VALENTE, G. The Cost of Carry Model and Regime Shifts in Stock Index

Futures Markets: An Empirical Investigation, The Journal of Future Markets, vol. 20, p.p

603-624, 2000.

STEIN, J. The Simultaneous Determination of Spot and Futures Prices. American Economic Review, vol. 51, p.p. 1012-1025, 1961.

YANG, W. & ALLEN, D. E., Multivariate GARCH Hedge Ratios and Hedge E¤ectiveness

in Australian Futures Markets. Accounting and Finance, vol. 45, p.p. 301-321, 2004.

YEH, S. C. & GANNON, G. L. Comparing Trading Performance of the Constant and

Dynamic Hedge Models: A Note. Review of Quantitative Finance and Accounting, vol. 14,

p.p. 155-160, 2000.

36

Livros Grátis

( http://www.livrosgratis.com.br )

Milhares de Livros para Download:

Baixar livros de Administração

Baixar livros de Agronomia

Baixar livros de Arquitetura

Baixar livros de Artes

Baixar livros de Astronomia

Baixar livros de Biologia Geral

Baixar livros de Ciência da Computação

Baixar livros de Ciência da Informação

Baixar livros de Ciência Política

Baixar livros de Ciências da Saúde

Baixar livros de Comunicação

Baixar livros do Conselho Nacional de Educação - CNE

Baixar livros de Defesa civil

Baixar livros de Direito

Baixar livros de Direitos humanos

Baixar livros de Economia

Baixar livros de Economia Doméstica

Baixar livros de Educação

Baixar livros de Educação - Trânsito

Baixar livros de Educação Física

Baixar livros de Engenharia Aeroespacial

Baixar livros de Farmácia

Baixar livros de Filosofia

Baixar livros de Física

Baixar livros de Geociências

Baixar livros de Geografia

Baixar livros de História

Baixar livros de Línguas

Baixar livros de Literatura

Baixar livros de Literatura de Cordel

Baixar livros de Literatura Infantil

Baixar livros de Matemática

Baixar livros de Medicina

Baixar livros de Medicina Veterinária

Baixar livros de Meio Ambiente

Baixar livros de Meteorologia

Baixar Monografias e TCC

Baixar livros Multidisciplinar

Baixar livros de Música

Baixar livros de Psicologia

Baixar livros de Química

Baixar livros de Saúde Coletiva

Baixar livros de Serviço Social

Baixar livros de Sociologia

Baixar livros de Teologia

Baixar livros de Trabalho

Baixar livros de Turismo

Baixar