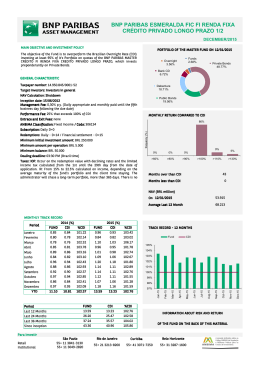

The art of risk taking strategies for interesting times Market volatility has increased tenfold in the last decade but Discovery Capital Management is in the business of managing risk not avoiding it. With over USD 1 billion under management, Discovery is a leading international and emerging markets investment firm. There is a Chinese curse which says, “May you live in interesting times.” We are currently living in interesting times as global markets experience a period of upheaval that is unprecedented in recent decades. For market participants seeking investment returns, this increased risk and volatility is unavoidable. However, it is possible to effectively manage this risk and avoid common and potentially fatal mistakes. While the risk management imperative creates many challenges, successful execution of an appropriate risk framework creates many opportunities. Now and then The 1990’s were a period of relative calm. The decade was characterized by a bull market in financial assets, declining interest rates, macro-economic stability and growth, the absence of major global con#icts and a post-cold war peace dividend. These benign conditions emboldened market participants to increase market exposure, lulled them into a sense of complacency about risk and resulted in a market bubble. In contrast, recent years have been characterized by a series of often intense exogenous shocks resulting from geopolitical instability (terrorism, war in Iraq, Middle East violence, and confrontation with North Korea and Iran), corporate accounting scandals and bankruptcies and a series of emerging market crises. The bursting of the asset price bubble and the ensuing bear market has resulted in the increased correlation of assets, uncertainty and risk aversion by investors, and much greater volatility. Average market volatility has nearly tripled over the last decade. The CBOE OEX volatility index captures the market’s expectation of future volatility. The index fell below 10 in late 1993, and has since soared, averaging between 20 and 40 since the late 1990’s. See figure 1. Figure 1 CBOE OEX Volatility Index, “The Return of Risk” Implications for hedge funds Hedge funds operating in this environment require a rigorous and systematic approach to the management of risk. Discovery Capital Management, a leading emerging market and global hedge fund manager, owes much of its success to disciplined risk management. The firm’s #agship Discovery Global Opportunity Fund has generated annual returns of 17% in a period when the S&P 500 returned -12% per annum and many of the countries in its investment universe went through significant crises. See figure 2. Figure 2 Discovery Global Opportunity Fund Returns (Aug 1999–Mar 2003) Rogerio Chequer, who is responsible for fixed income and foreign exchange at the firm and jointly manages Discovery’s multi-strategy product, observes, “We are in the business of managing risk, not avoiding it.” Chequer adds, “we have outperformed the S&P 500 by over 110% (Discovery up 75%, S&P down 36%), but the months that I am most proud of are those in which global markets were rocked by volatility.” In global markets’ five worst months during the life of Discovery, the S&P fell on average 9% in each of those months. In contrast, the Discovery fund averaged positive 1%, and made money in 4 of the 5 months. David Chon, who jointly manages the multi-strategy product with Chequer and is in charge of Equity at the firm, likens the risk process responsible for these results to guarding Michael Jordan, the NBA’s all-time leading scorer. Chon argues, “It is unreasonable to go out with the expectation of stopping Jordan. He will score his 30 points a game, you just need to make sure he doesn’t bury you with 50 or 60 points.” Discovery’s risk framework is a holistic one, where risk management is an integral part of the investment process. The main objective of our risk framework is to protect partners’ capital when we are wrong. Everyone in the firm is involved in its planning and execution. In order to identify a risk system that allowed us to fully incorporate our investment and risk management philosophy and process, we embarked on a global search. After reviewing nearly 60 vendors, Discovery selected Wall Street Systems TremaSuite™. The main reason for this decision was the architecture of Finance KIT, which matched perfectly with our investment and risk management objectives. TremaSuite™ is providing full front, middle and back office functionality in one solution. Its ability to perform real-time profit and loss, straight-through processing (STP) capabilities, various risk and return attribution analysis, and other customized reporting and study engines, are all important tools we depend on to make the right investment and risk taking decisions. TremaSuite™ is helping us to communicate clear risk parameters throughout our front, middle and back office. We are very excited about the positive impact TremaSuite™ is already making to our investment and risk control process. Another important part of our risk strategy is to avoid common but often costly risk-related mistakes, what we call the “7 Deadly Sins of Risk.” Sin #1: Hubris and #2: Envy of precision The heroes of Greek tragedies possess overbearing self-confidence, which ultimately leads to their ruin. In a world of uncertainty, investors crave and derive comfort from precision. This precision, provided by financial models and statistical analysis, often gives its followers a false sense of security. The partners and Nobel Laureates of Long Term Capital Management’s almost religious belief in the infallibility of their very sophisticated financial models brought about the downfall of their firm, when market movements overwhelmed their largely model-generated portfolio. Risk models depend on the quality of inputs and the validity of the underlying assumptions; and consequently have rather important limitations. We believe in the fallibility of our models and in our investment decisions. Stop-losses protect our partners’ capital when we are wrong. We utilize stop-losses at security level, paired-trade level, investment theme/strategy level, and aggregate them on a portfolio level. Sin # 3: Complacency and ignorance of risk Complacency is the opposite of the sin of precision. Often there is a tendency to attempt to ignore or minimize risks that can’t be quantified, at often large consequences. Such was the case of the British ocean liner Titanic. After estimating the probability at one-in-a-million of the supposedly unsinkable vessel sinking, Lloyd’s of London insured the ship for an annual premium estimated in the tens of thousands. In 1912, Lloyd’s paid claims totaling $5,000,000 after the ship struck an iceberg on its maiden voyage and sank. David Chon, left Rogerio Chequer The lesson of the Titanic is not whether Lloyd’s was paid enough for the risk it took. It is about the viability of an investment strategy being short low probability, high-payout instruments. Many financial assets have fat-tailed distributions and are subject to significant price jumps at the extremes. Assets with low perceived risk of loss and low expected return, such as levered carry trades or writing out-of-the money options, are subject to substantial tail event losses. Hedge funds do not have either the balancesheet strength or the diversification ability that protects property and casualty insurance companies against tail risk. At Discovery, we are not writers of uncovered options. Rather, we are buyers of option volatility and employ other portfolio insurance strategies. By staying long Gamma, low probability, high return payouts are in our favor. Sin #4: Greed and #5: Gluttony Greed, the search for too much yield, and gluttony, too much leverage, share common attributes of overindulgence. When global interest rates fall to low nominal levels (as exist today), investors tend to ignore the concept of risk-adjusted return and look for just plain return, often disregarding incremental risks (duration, credit, market and currency) needed to obtain their historical target yield. Our investment approach involves managing defined units of risk, not defined units of return. It is the philosophy that Discovery’s Equity Head David Chon calls, “taking what the market gives you.” We do this by focusing on risk-adjusted return profiles of potential investments and by maintaining appropriate portfolio guidelines for net exposure (longs minus shorts), gross exposure (by employing only modest leverage) and using more liquid instruments to express our views. Sin #6: Emotion and #7: Fear and paralysis One of our Malaysian investors’ investment philosophy is to “buy at the sounds of cannons and sell at the sounds of trumpets.” Although it sounds straightforward, it is difficult to execute. Often investors react with fear to price movements and do just the opposite. Or the volatility paralyses them and they do nothing. Our strategy is to act proactively in anticipation of market moves, pre-define a game plan and to rehearse its execution ahead of the roar of cannons. When emotions run high and many market participants are panicking, our scripted plan allows us to focus on execution and to buy assets at liquidation prices. Controlling our risk without emotion and with tranquility also permits us to let our profits run in winning positions. Conclusions Risk management should work like a German engineered automobile, combining performance and safety. The Mer-cedes Benz CL55 AMG (similar to the one that sits in our parking lot) features an AMG-built intercooler supercharged 5,439-cc SOHC 24-valve V-8 with 493 horse power. It can go from 0-60 in 4.6 seconds. It is fast. But it stops quickly and cleanly and corners extremely well. It also features an active safety system, rollover sensor, electronic stability program and eight air bags. Just in case. It is both faster and safer than most cars. It is what hedge funds should aspire to be and investors demand. Funds like ours must generate strong investment performance, but they must also protect their partner’s capital on the downside. They must be able to ride fast and furious, change directions rapidly in response to market changes, and protect their occupants from volatilities of the marketplace. As the fine print in the Mercedes ad reads, “no system no matter how sophisticated can repeal the laws of physics or overcome careless driving actions.” So please always wear your seatbelt. And manage your portfolio carefully. The author of this article is Harry Krensky, Principal of Discovery Capital Management.

Baixar