SISTEMA MULTILATERAL X SISTEMAS REGIONAIS X Desalinhamentos cambiais DESAFIOS PARA O BRASIL Centro do Comércio Global e do Investimento – CCGI EESP/FGV Profa. Vera Thorstensen O Multissistema do Comércio Global 2 Regras Multilaterais OMC (DSB), FMI, BM, OCDE, UNCTAD, FAO, OMPI Regras Preferenciais Acordos Regionais, Bilaterais e Não Recíprocos Regras Nacionais UE, EUA, China, Índia, África do Sul… Brasil Sistema dos Estados x Sistema das Transnacionais 3 Regras Multilaterais Influência das Transnacionais OMC (DSB), FMI, BM, OCDE, UNCTAD, FAO, OMPI • Multilateral Regras Preferenciais Acordos Regionais, Bilaterais e Não Recíprocos Regras Nacionais UE, EUA, China, Índia, África do Sul… • Plurilateral • Preferencial • Regulação nacional Brasil Sistema dos Estados x Sistema das Transnacionais 4 Lógica dos Estados • Comércio de bens • Tarifas, quotas • AD, CVM, salvaguardas • Regras de origem Lógica das Transnacionais • “Trade in tasks” (cadeias de valor) • Sem Tarifas, AD, CVM, Salv., ou RO preferenciais • Investimento, concorrência, Propriedade Intelectual • Subsídios • Harmonização de padrões (TBT/SPS/privados) • SOLUÇÃO CONTROVÉRSIAS • ARBITRAGEM DESAFIOS 5 ACORDOS PREFERENCIAIS A Evolução dos APCs no mundo Fonte: OMC APCs firmados e em negociação pelos países da Am. Latina 7 Chile Austrália Canadá Chile China Cingapura Colômbia Coréia do Sul EFTA EUA Índia Japão México Nova Zelândia Peru Turquia UE Aliança Pacífico TPP Firmado Em negociação Colômbia Equador México Peru Bolívia Venezuela - * - Fontes: Sítios virtuais dos ministérios e secretarias de comércio exterior dos países selecionados / elaboração CCGI / *ratificação pendente APCs do Mercosul Acordo Data de Assinatura Data de Entrada em Vigor Mercosul – Índia 25.01.2004 01.06.2009 Mercosul – Israel 18.12.2007 39.04.2010 Mercosul – SACU* 03.04.2009 - Mercosul – Egito 02.08.2010 - Mercosul – Palestina 20.12.2011 - *União Aduaneira do Sul da África (África do Sul, Botsuana, Lesoto, Namíbia e Suazilândia) Fonte: Mercosul Volume de Comércio: Brasil e parceiros dos APCs Exportações Importações País US$ FOB Participação no total (%) US$ FOB Participação no total (%) Egito 2.711.858.469 1,12 251.416.679 0,11 Índia 5.576.930.397 2,30 5.042.842.814 2,26 Israel 376.063.459 0,16 1.143.543.923 0,51 Palestina 22.479.493 0,01 87.644 - 1.792.960.861 0,74 852.462.301 0,38 SACU Fonte: Secex, 2012 APCs em negociação Acordo Marrocos Status Acordo-Quadro prevendo a negociação de uma zona de livre comércio assinado em 2004 Conselho de Cooperação do Acordo-Quadro prevendo a negociação de uma zona de livre comércio assinado em 2005, Golfo – CCG* última reunião de negociação em 2012 SACU e Índia Negociação de um APC baseado nos acordos já existentes Sistema de Integração Centro- Projeto lançado em 2004, realização de reuniões exploratórias até 2010 Americana – SICA** Paquistão Acordo-Quadro prevendo a negociação de uma zona de livre comércio assinado em 2006 Jordânia Acordo-Quadro prevendo a negociação de uma zona de livre comércio assinado em 2008 Turquia Acordo-Quadro prevendo a negociação de uma zona de livre comércio assinado em 2010 União Européia Relançamento das negociações em 2010, consulta pública pela Secex em 2012 para atualização do posicionamento do setor privado brasileiro (Circular Secex n.44/12)*** Canadá Abertura de consultas pela Secex, em 2012, sobre eventual lançamento de negociações (Circular Secex n.45/12). *Omã, Emirados Árabes Unidos, Arábia Saudita, Qatar, Bahrein e Kuwait **Belize, Costa Rica, El Salvador, Guatemala, Honduras, Nicarágua e Panamá. *** As negociações para a negociação de um APC com a União Européia foram lançadas em 1994 e interrompidas em 2004. Fonte: Ministério das Relações Exteriores Volume de Comércio: Brasil e parceiros dos APCs em negociação País Marrocos Conselho de Cooperação do Golfo – CCG Sistema de Integração CentroAmericana - SICA Paquistão Jordânia Turquia UE Canadá Fonte: Secex, 2012 Exportação Vol. (US$) Part. (%) Importação Vol. (USS) Part. (%) 872.306.154 0,36 1.281.171.583 0,57 7.630.448.591 3,15 5.247.439.709 2,35 1.450.388.863 0,60 562.072.694 0,25 192.875.684 0,08 92.331.983 0,04 215.640.783 0,09 1.933.138 --- 1.207.133.102 0,50 964.114.176 0,43 48.859.641.610 20,14 47.661.649.903 21,36 3.079.926.642 1,27 3.072.137.103 1,38 Modelagem EUA UE China AS Simulações de APCs para o Brasil: Impacto no PIB setorial em % EUA Agronegócio Carnes bovinas, eqüinas e ovinas Outros produtos de carne Óleos e gorduras vegetais Laticínios Arroz processado Açúcar Outros produtos alimentícios Bebidas e tabaco Agricultura Arroz com casca Trigo Grãos de cereais Vegetais, frutas e castanhas Sementes oleaginosas Cana-de-açúcar Fibras vegetais Outras culturas agrícolas Gado, ovelhas e cavalos Outros produtos animais Leite não pasteurizado Lã e matérias primas Número de setores sensíveis UE-27 China América do Sul + + + ++ + - ++++ ++++ --+ ++++ ++++ - -+++ + + + + + + + + + - + + + + +++ + + + ++ 6 + -+++ +++ --++++ ---++++ ++++ +++ 8 ++ ++++ + ++ ++++ + --+ ++ 7 + + + + + 10 (+) ou (-) (ganhos e perdas abaixo de 1%) (++) ou (--) (ganhos e perdas entre 1% e 2%) (+++) ou (---) (ganhos e perdas entre 2% e 3%) (++++) ou (----) (ganhos e perdas acima de 3%) Fonte: CMEA/ FGV Simulações de APCs para o Brasil: Impacto no PIB setorial em % EUA Indústria Brasileira Extrativa Silvicultura Pesca Carvão Petróleo Gás Outros minerais Manufatura Têxteis Vestuário Couro Produtos de madeira Papel Derivados de petróleo/carvão Químico, borracha/plástico Outros produtos minerais Metais ferrosos Metais (outros) Produtos/metal (outros) Veículos motor/peças Equipamentos/transporte/outros Equipamentos eletrônicos Outros/Máquina Outros manufaturados Número de setores sensíveis UE-27 China América do Sul + + + + - --+ ------ + +++ - - + + +++ + + -++ + --11 ------------------------------------21 --------++ ++ ++ ++ -----++++ ----------15 + + + + --+ +++ -+ 15 (+) ou (-) (ganhos e perdas abaixo de 1%) (++) ou (--) (ganhos e perdas entre 1% e 2%) (+++) ou (---) (ganhos e perdas entre 2% e 3%) (++++) ou (----) (ganhos e perdas acima de 3%) Fonte: CMEA/FGV Modelagem Brasil – EUA, UE, Can, Mex, Chin, Ind, AS Tipos: c/ e s/ Argentina c/ e s/ Vem Variações: - sem e com câmbio - sem e com BNT 16 EXCHANGE RATES AND TRADE OBSERVATORY ON EXCHANGE RATES SÃO PAULO SCHOOL OF ECONOMICS FGV-SP 2013 Prof. Vera Thorstensen, Prof. Emerson Marçal, Prof. Lucas Ferraz Big Mac Index – 1/2013 e 7/2013 17 IMF Estimates of Exchange Rate Misalignments (6/2012) Pilot External Sector Report 18 IMF Estimates of Exchange Rate Misalignments (6/2013) Pilot External Sector Report 19 Misalignment from FEER – Cline and Williamson 20 Exchange rate misalignments 2010 - 2012 (Shin, Johansen, Engle-Granger) 21 FGV 22 Exchange Rate Misalignments FGV 2012 Petersen x IMF x FGV (REER) 23 Brazil: real exchange rate, fundamentals and exchange rate misalignments (annually) 24 Real Effecitive Exchange Rate Fundamentals 100 80 60 1970 30 1975 1980 1985 1990 1995 2000 2005 2010 1985 1990 1995 2000 2005 2010 Exchange Rate Misalignment 20 10 0 -10 -20 1970 1975 1980 Sources: Misalignment estimates – Observatory on Exchange Rate - EESP/FGV (2013) BRASIL Taxa de câmbio Real, Fundamentos e Desalinhamento cambial (trimestral - 6/13) 25 175 Fundamentos Taxa de Câmbio Real 150 125 100 75 1980 40 1985 1990 1995 2000 2005 2010 1990 1995 2000 2005 2010 Desalinhamento Cambial 20 0 -20 1980 1985 BRASIL: Desalinhamento cambial Diversas metodologias 26 60 Modelo I Modelo III Média dos Modelos 50 Modelo II Modelo IV Modelo V 40 30 20 10 0 -10 -20 -30 1980 1985 1990 1995 2000 2005 2010 US: real exchange rate, fundamentals and exchange rate misalignments (annually) 27 Real Effective Exchange Rate Estimated Fundamentals 140 120 100 1970 1975 1980 1985 1990 1995 2000 2005 2010 1985 1990 1995 2000 2005 2010 Estimated Exchange Rate Misaligment 0.2 0.1 0.0 -0.1 1970 1975 1980 Sources: Misalignment estimates – Observatory on Exchange Rate - EESP/FGV (2012) China: real exchange rate, fundamentals and exchange rate misalignments (annually) 28 200 China Real Effective Exchange Rate China Fundamentals 150 100 1985 1990 1995 2000 2005 2010 Exchange Rate Misalignment 50 0 -50 1985 1990 1995 2000 2005 2010 Sources: Misalignment estimates – Observatory on Exchange Rate - EESP/FGV (2013) European Area: Exchange Rate Misalignments (2009 – 2011) 29 FGV “Tariffication” of exchange rate misalignments 30 To exam the impact of exchange rate misalignments on trade, one possibility is to transform a misaligment into a tariff and then to adjust the import tariff of each country, through a “tariffication” exercise. An overvalued exchange rate has the effect of reducing or nullifying the import tariffs of the overvalued country, creating an incentive to imports from third countries. An undervalued exchange rate, on the other hand, will give an incentive to exports from the undervalued country. A country’s undervalued currency will have the effect of increasing its import tariffs, sometimes above the bound levels at the WTO. The equation used to “tarifficate” the effects of exchange rate misalignments is presented in the next slide Tariffication of Exchange Rates 31 Simulations regarding the effects of exchange rate misalignments on selected Tariff Profiles 32 Using the “tariffication methodology”, one can represent the effects of exchange rate misalignments on a country Tariff Profile. The Tariff Profile is comprised of bound tariffs and applied tariffs Bound tariffs are the tariffs negotiated at the WTO as the maximum permitted level of an import tariff. Applied tariffs are the import tariffs actually applied by a country and notified to the WTO After applying the “tariffication methodology” the results are adjusted bound and applied tariffs that represent the actual level of protection of a given country. In the following slides we present the simulations for Brazil, US and EU Tariff Profiles, considering the effects of the exchange rate misalignments of selected countries. Impacts of Exchange Rates on China Tariff Profile China devaluation in 2012 (17%) 33 Impacts of Exchange Rates on China Tariff Profile (2012) 34 Ch-Brazil (37%), Ch-Germany (13%), Ch-US (12%) Bilateral Misalignments Impacts of Exchange Rates on US Tariff Profile US devaluation in 2012 (5%) 35 Impacts of Exchange Rates on US Tariff Profile (2012) US-Brazil (25%), US-Spain (9,5%), US-China (12%) Bilateral Misalignments 36 Impacts of Exchange Rates on Brazil Tariff Profile Brazil Overvaluation in 2012 (20%) 37 Impacts of Exchange Rates on Brazil Tariff Profile Brazil-China (37%), Brazil-US (25%), Brazil-Germany (24%) Bilateral Misalignments in 2012 38 Impacts of Exchange Rates on EU Tariff Profile Brazil (40%), US (7%), China (14%) Misalignments in 2011 and Brazil (15%) in 06/2012 39 Conclusions 40 - Countries with overvalued exchange rates (Brazil) have their negotiated tariffs reduced or nullified. - Countries with undervalued exchange rates (USA, China) grant subsidies to their exports and their applied tariffs surpass the bound levels agreed at the WTO. - Substantial and persistent exchange rate misalignments significantly affect or nullify most WTO rules: tariffs, antidumping, countervailing measures, safeguards, rules of origin, regional agreements, DSB retaliations… - Problem: the WTO does not have adequate rules to address the exchange rate issue Solutions 41 IMF - manipulation (Article IV) WTO - frustation (Article XV) Rules relating between exchange rates and trade 42 General Agreement on Tariffs and Trade (GATT) Article II:6 (a) The specific duties and charges included in the Schedules relating to contracting parties members of the International Monetary Fund, and margins of preference in specific duties and charges maintained by such contracting parties, are expressed in the appropriate currency at the par value accepted or provisionally recognized by the Fund at the date of this Agreement. Accordingly, in case this par value is reduced consistently with the Articles of Agreement of the International Monetary Fund by more than twenty per centum, such specific duties and charges and margins of preference may be adjusted to take account of such reduction; provided that the CONTRACTING PARTIES (i.e., the contracting parties acting jointly as provided for in Article XXV) concur that such adjustments will not impair the value of the concessions provided for in the appropriate Schedule or elsewhere in this Agreement, due account being taken of all factors which may influence the need for, or urgency of, such adjustments. WTO Rules relating trade and exchange rates 43 General Agreement on Tariffs and Trade (GATT) Article XV:4 Contracting parties shall not, by exchange action, frustrate* the intent of the provisions of this Agreement, nor, by trade action, the intent of the provisions of the Articles of Agreement of the International Monetary Fund. * Ad Article XV -Paragraph 4 The word “frustrate” is intended to indicate, for example, that infringements of the letter of any Article of this Agreement by exchange action shall not be regarded as a violation of that Article if, in practice, there is no appreciable departure from the intent of the Article. Thus, a contracting party which, as part of its exchange control operated in accordance with the Articles of Agreement of the International Monetary Fund, requires payment to be received for its exports in its own currency or in the currency of one or more members of the International Monetary Fund will not thereby be deemed to contravene Article XI or Article XIII. Another example would be that of a contracting party which specifies on an import license the country from which the goods may be imported, for the purpose not of introducing any additional element of discrimination in its import licensing system but of enforcing permissible exchange controls. WTO Rules relating trade and exchange rates 44 GATT Article XV.1: The CONTRACTING PARTIES shall seek co-operation with the International Monetary Fund to the end that the CONTRACTING PARTIES and the Fund may pursue a coordinated policy with regard to exchange questions within the jurisdiction of the Fund and questions of quantitative restrictions and other trade measures within the jurisdiction of the CONTRACTING PARTIES. WTO Rules relating trade and exchange rates 45 GATT Article XV.9: Nothing in this Agreement shall preclude: (a) the use by a contracting party of exchange controls or exchange restrictions in accordance with the Articles of Agreement of the International Monetary Fund or with that contracting party's special exchange agreement with the CONTRACTING PARTIES, IMF Rules relating exchange rates and trade 46 IMF’s Articles of Agreement Article IV: Obligations Regarding Exchange Arrangements Section 1. General obligations of members Recognizing that the essential purpose of the international monetary system is to provide a framework that facilitates the exchange of goods, services, and capital among countries, and that sustains sound economic growth, and that a principal objective is the continuing development of the orderly underlying conditions that are necessary for financial and economic stability, each member undertakes to collaborate with the Fund and other members to assure orderly exchange arrangements and to promote a stable system of exchange rates. In particular, each member shall: (i) endeavor to direct its economic and financial policies toward the objective of fostering orderly economic growth with reasonable price stability, with due regard to its circumstances; (ii) seek to promote stability by fostering orderly underlying economic and financial conditions and a monetary system that does not tend to produce erratic disruptions; (iii) avoid manipulating exchange rates or the international monetary system in order to prevent effective balance of payments adjustment or to gain an unfair competitive advantage over other members; and (iv) follow exchange policies compatible with the undertakings under this Section IMF Rules relating exchange rates and trade 47 Principles for Guidance Article IV Section I (2007) Manipulation (i) protracted large-scale intervention in one direction in the exchange market; (ii) official or quasi-official borrowing that either is unsustainable or brings unduly high liquidity risks, or excessive and prolonged official or quasi-official accumulation of foreign assets, for balance of payments purposes; (iii) (a) the introduction, substantial intensification, or prolonged maintenance, for balance of payments purposes, of restrictions on, or incentives for, current transactions or payments, or (b) the introduction or substantial modification for balance of payments purposes of restrictions on, or incentives for, the inflow or outflow of capital; (iv) the pursuit, for balance of payments purposes, of monetary and other financial policies that provide abnormal encouragement or discouragement to capital flows; (v) fundamental exchange rate misalignment; (vi) large and prolonged current account deficits or surpluses; and (vii) large external sector vulnerabilities, including liquidity risks, arising from private capital flows. IMF Rules relating exchange rates and trade 48 IMF’s Articles of Agreement Article IV: Obligations Regarding Exchange Arrangements Section 3. Surveillance over exchange arrangements (a) The Fund shall oversee the international monetary system in order to ensure its effective operation, and shall oversee the compliance of each member with its obligations under Section 1 of this Article. (b) In order to fulfill its functions under (a) above, the Fund shall exercise firm surveillance over the exchange rate policies of members, and shall adopt specific principles for the guidance of all members with respect to those policies. Each member shall provide the Fund with the information necessary for such surveillance, and, when requested by the Fund, shall consult with it on the member’s exchange rate policies. The principles adopted by the Fund shall be consistent with cooperative arrangements by which members maintain the value of their currencies in relation to the value of the currency or currencies of other members, as well as with other exchange arrangements of a member’s choice consistent with the purposes of the Fund and Section 1 of this Article. These principles shall respect the domestic social and political policies of members, and in applying these principles the Fund shall pay due regard to the circumstances of members. GATT 49 Guideliness to Art II.6(a) (Approved by CP) 15 February 1980 (L/4938) Assume a World with different exchange rate arrangements . Allow undervalued countries to renegotiate especific tariffs . CP ask IMF to calculate size of depretiation . Undervaluation was more than 20% . Basket of currencies of 85% of imports . Period of analysis for size of depreciation: rate of 6 months preciding the request x 6 months preceding last bound (weighted avarage) A NEW PROPOSAL 50 - Create a world currency - Negotiate a fluctuation band - Solve the conflict bilaterally Exchange Rate Misalignment Bands 51 4 Normalized PPP - Trade weight world basket 3 2 1 0 -1 -2 -3 United States Brazil Australia Austria Belgium Canada China France Germany India Italy Japan South Korea Mexico Netherlands Spain Sweden Switzerland United Kingdom Malaysia +- 2 S.D. +- 1 S.D. Jul-12 Apr-11 Jan-10 Oct-08 Jul-07 Apr-06 Jan-05 Oct-03 Jul-02 Apr-01 Jan-00 Oct-98 Jul-97 Apr-96 Jan-95 Oct-93 Jul-92 Apr-91 Jan-90 Oct-88 Jul-87 Apr-86 Jan-85 Oct-83 Jul-82 Apr-81 Jan-80 Oct-78 Jul-77 Apr-76 Jan-75 Oct-73 Jul-72 Apr-71 Jan-70 Oct-68 Jul-67 Apr-66 Jan-65 Oct-63 Jul-62 Apr-61 Jan-60 -4 Brazilian Bilateral Real Exchange Rate Misalignment 80% 60% % relative to equilibrium 52 Brazil – Bilateral Misalignments 40% 20% 0% -20% -40% -60% -80% 2000 2002 2004 2006 2008 2010 Argentina Australia Austria Belgium Brazil Canada China Colombia Denmark Finland France Germany Greece Hong Kong Ireland Italy Japan Korea Mexico Netherlands New Zealand Norway Portugal Singapore Spain Sweden Switzerland United Kingdom United States Uruguai South Africa Indonesia Turquia 2012 US – Bilateral Misalignments 53 United States Bilateral Exchange Rate Misalignment 55% % relative to equilibrium 45% 35% 25% 15% 5% -5% -15% -25% -35% -45% -55% 2000 2002 2004 2006 2008 2010 Argentina Australia Austria Belgium Brazil Canada Colombia Denmark Finland France Germany Greece Hong Kong Ireland Italy Japan Korea Mexico Netherlands New Zealand Norway Portugal Singapore Spain Sweden Switzerland United Kingdom United States Uruguai South Africa Indonesia Turquia 2012 IMF Art. IV Selected Developed Economies 54 IMF Art. IV Selected Emerging Economies 55 IMF Art. IV Selected Poor Economies 56 Conclusions 57 Substantial and persistent exchange rate misalignments affect the effectiveness of trade instruments negotiated at the WTO. Therefore, they must be object of WTO regulation Juridical concept of time x economic concept of time (time of violation x time for long run equilibrium) In summary: The WTO must address the effects of exchange rate misalignments or misaligned exchange rates will turn the WTO into a juridical and economic fiction !!! NOVA QUESTÃO 58 QUEM JULGA AS VIOLAÇÕES DE CAMBIO ? 59 Câmbio e comércio – um antigo desafio I am gratified to announce that the Conference at Bretton Woods has completed successfully the task before it. It was, as we knew when we began, a difficult task, involving complicated technical problems. We came here to work out methods which would do away with the economic evils – the competitive currency devaluation and destructive impediments to trade – which preceded the present war. We have succeeded in that effort. Henry Morgenthau, Jr., United States Secretary of the Treasury President of the Bretton Woods Conference. 60 Bretton Woods e a questão cambial O FMI foi criado para garantir a estabilidade financeira global e evitar o “caos” das desvalorizações competitivas da década de 1930 Duas preocupações: Balança de pagamentos (restrições temporárias de capital e comércio) + câmbio fixo (padrão dólar-ouro – paridades cambiais) Os membros deveriam manter taxas de câmbio em uma banda de 1% do valor definido no Fundo (Artigo IV original do Acordo do FMI) 61 Bretton Woods e a questão cambial Com o fim da regime de paridades fixas (Nixon Shock), na década de 1970, o Artigo IV foi modificado para sua atual versão Não haveria mais um critério objetivo para definir as obrigações dos membros do Fundo em relação a suas taxas de câmbio Os membros poderiam definir se manteriam câmbios flutuantes ou em paridade com outras moedas, desde que não as atrelassem ao ouro Thou shall not manipulate 62 O parâmetro objetivo deu lugar a uma obrigação subjetiva. Os membros do Fundo não deveriam manipular suas taxas de câmbio para evitar o ajuste efetivo da balança de pagamentos nem para conseguir vantagens competitivas desleais sobre seus pares Article IV: Obligations Regarding Exchange Arrangements Section 1. General obligations of members Recognizing that the essential purpose of the international monetary system is to provide a framework that facilitates the exchange of goods, services, and capital among countries (…) each member shall: (…) (iii) avoid manipulating exchange rates or the international monetary system in order to prevent effective balance of payments adjustment or to gain an unfair competitive advantage over other members; (…) A revolução silenciosa do FMI 63 A obrigação do artigo IV deveria ser fiscalizada por meio do novo mecanismo de supervisão criado pelo Fundo FMI rapidamente evolui, tornando-se essencialmente um garantidor de liquidez para países enfrentando dificuldades com suas balanças de pagamento Inclui em suas considerações diversos fatores macroeconômicos, tolerando e mesmo estimulando desvalorizações cambiais FMI é uma organização politizada – dificuldade em identificar “dolo” e manipuladores O GATT e a questão cambial 64 Contrário ao que se argumenta, o sistema multilateral de comércio, desde o GATT preocupa-se com a questão cambial e seus impactos no comércio Artigo XV como maior expoente mas não o único (Artigo II:6, Ad Note ao GATT VI, Currency dumping) Em especial, o Artigo XV:4 estabelece que: Contracting parties shall not, by exchange action, frustrate the intent of the provisions of this Agreement, nor, by trade action, the intent of the provisions of the Articles of Agreement of the International Monetary Fund 65 O artigo XV e a relação OMCxFMI Qual a relação entre o Artigo IV do FMI e o Artigo XV do GATT? Qual a diferença entre manipular o câmbio para conseguir vantagens competitivas desleais e por ação cambial frustrar os objetivos do comércio? Qual o papel do FMI em uma eventual disputa na OMC envolvendo o Artigo XV do GATT? A resposta a essas questões passa pela análise de três termos – exchange arrangements; exchange action; exchange restrictions or controls 66 O artigo XV e a relação OMCxFMI A ligação entre o Art. XV do GATT e o Art. IV do FMI é estabelecida já em seus títulos, ambos trazendo o termo “exchange arrangements” Termo genérico (stricto sensu x lato sensu) O Artigo XV estabelece diversas obrigações aos membros e à própria organização sobre a questão cambial Obrigação de cooperação 67 Seu §1º traz uma obrigação abrangente de cooperação em “exchange questions” 1. The CONTRACTING PARTIES shall seek co-operation with the International Monetary Fund to the end that the CONTRACTING PARTIES and the Fund may pursue a co-ordinated policy with regard to exchange questions within the jurisdiction of the Fund and questions of quantitative restrictions and other trade measures within the jurisdiction of the CONTRACTING PARTIES. Exchange questions X exchange arrangements? Definição dos campos de atuação: FMI - exchange questions WTO quantitative restrictions and other trade measures Ambos os casos quando estiverem sob sua jurisdição Obrigação de consulta 68 A 1ª frase de seu §2º traz uma obrigação específica de consulta 2. In all cases in which the CONTRACTING PARTIES are called upon to consider or deal with problems concerning monetary reserves, balances of payments or foreign exchange arrangements, they shall consult fully with the International Monetary Fund. Haveria alguma questão envolvendo o Art. XV que não diga respeito a reservas monetárias, balança de pagamentos ou arranjos cambiais? Caso exista, não seria obrigatório consultar (Caso Argentina - Textiles and Apparel, DS56) Natureza da consulta: Caso India – Quantitative Restrictions (DS90) - a consulta com base na primeira parte do parágrafo 2 do Art. XV é uma consulta a expert como qualquer outra (Art. 13 do DSU – direito do painel de consultar experts) Obrigação de aceitar (1) 69 A 1ª parte da 2ª frase do §2º traz a obrigação de aceitar dados estatísticos In such consultations, the CONTRACTING PARTIES shall accept all findings of statistical and other facts presented by the Fund relating to foreign exchange, monetary reserves and balances of payments A 2ª parte da 2ª frase do §2º traz a obrigação de aceitar decisões do FMI relacionadas a sua jurisdição and shall accept the determination of the Fund as to whether action by a contracting party in exchange matters is in accordance with the Articles of Agreement of the International Monetary Fund Obrigação de aceitar (2) 70 Ou seja, a prerrogativa do FMI é de dizer se a ação de uma parte “in exchange matters” está de acordo com o seu próprio arcabouço jurídico Justificativa: Personalidade jurídica e ordenamentos jurídicos distintos - teoria dos (multi)sistemas autônomos de regulação + impedir que decisões da OMC contradigam decisões do FMI (coerência sistêmica) Finalmente, a 3ª frase do §2º traz obrigação de aceitar análises específicas Obrigação de aceitar (3) 71 The CONTRACTING PARTIES in reaching their final decision in cases involving the criteria set forth in paragraph 2 (a) of Article XII or in paragraph 9 of Article XVIII, shall accept the determination of the Fund as to what constitutes a serious decline in the contracting party's monetary reserves, a very low level of its monetary reserves or a reasonable rate of increase in its monetary reserves, and as to the financial aspects of other matters covered in consultation in such cases. §2(a) do Art. XII do GATT – restrições para proteger balança de pagamentos – conceitos de “serious decline in monetary reserves” e “reasonable rate of increase” §9 do Art. XVIII – proteção da posição externa de países em desenvolvimento- conceito de “inadequate monetary reserves” Reforçam a interpretação da coerência sistêmica e dados Demais § do Art. XV do GATT 72 §5º - Obrigação de reportar ao fundo quando “exchange restrictions on payments and transfers” forem consideradas contrárias às regras da OMC §6º - Obrigação dos membros de requererem acessão ao FMI ou firmar acordo cambial específico com a OMC §7º - reafirmação do dever de não frustrar o comércio por ações cambiais no caso de acordos cambiais específicos Exceção do Art. XV:9 (1) 73 9. Nothing in this Agreement shall preclude: (a) the use by a contracting party of exchange controls or exchange restrictions in accordance with the Articles of Agreement of the International Monetary Fund or with that contracting party's special exchange agreement with the CONTRACTING PARTIES, Qual o significado dessa exceção? Apenas ações cambiais que violem o ordenamento jurídico do FMI violarão o Art XV do GATT? Enquanto exceção, o §9º deve ser interpretado restritivamente. Importante diferença entre exchange action e exchange controls e restrictions Exceção do Art. XV:9 (2) 74 O FMI trata especificamente de exchange controls referenciando a controle de capital: Art. VI.1: Requer que membros imponham controles de capital para evitar uso dos recursos do Fundo Art. VI. 3: Membros podem controlar capital mas não restringir “payments for current transactions”. Art. VIII. 2 (a) : Obrigação dos membros de não restringir “payments and transfers for current international transactions” No entanto, há diversas exceções no Acordo do FMI que permitem controles e restrições. Ex: Art VI section 3 control of capital transfers, Art VII section 3(b) and section 4 on control and restriction of exchange operations due to scarcity of currency; Art VIII section 2(b) on exchange control cooperation; Art XIV section 2 on exchange restrictions. São esses controles a que o Art XV:9 faz referência Exceção do Art. XV:9 (3) 75 Há outros artigos do GATT com exceções e deferências similares (inclusive “multiple exchange rates”) Article VII:c on multiple currencies conversion; Ad Note to GATT Article VIII regarding exchange fees for balance of payment reasons; Article XIV:1,3 and 5(a) on exceptions to the Rule of Non-discrimination; Ad Note to Section B of GATT Article XVI on multiple exchange rates AD NOTE do Art. XV:4 – afirma que “exchange control or restrictions” que sejam implementadas de acordo com o FMI não violam o GATT Nesses casos, como determina o Art. XV:2, é o FMI quem diz se a parte respeitou o acordo do FMI e por isso não estaria violando o GATT. Exceção do Art. XV:9 (4) 76 Controles e restrições cambiais seriam espécies das quais ação cambial seria o gênero Caso Rep. Dominicana - Import and Sale of Cigarettes (DS302) – consulta ao FMI se a medida da Rep. Dominicana estava de acordo com o ordenamento jurídico do FMI. Resposta: (I)t does not constitute a multiple currency practice or an exchange restriction notwithstanding its label (…) the issue of its consistency or inconsistency with the Funds Articles for purpose of paragraph 8 of the Co-operation Agreement does not arise. O que mais seriam exchange actions? Manipulação cambial? Provavelmente frustra o comércio, mas nem toda frustração advém de uma manipulação Exchange rate intervention? Discussão corrente no FMI – acumulação de reservas? Mas também QE? O que é exchange action? 77 Exchange action X exchange rate action Ação cambial – controle sobre acesso e conversibilidade de moedas Ação na taxa de câmbio – intervenção direta ou indireta para afetar a taxa de câmbio Tanto o GATT, quanto o acordo do FMI parecem, em momentos distintos, referir-se a ambos os sentidos. Ação cambial – Art. XV:1,2,4 e 9 GATT e Art. VI FMI Ação na taxa de câmbio – Art. XV:4,6 e 7 GATT e Art. IV FMI O GATS, por sua vez, trata especificamente de ação cambial (Art. XI – specific commitments, Annex on Financial Services – “prudential carve out”) Conclusão 78 OMC determina se uma medida cambial frustra seus objetivos Deve consultar com o FMI, aceitar statistical findings e, no que couber, se a medida respeita as obrigações do FMI Outras exchange actions que não exchange restrictions or control ou multiple currency practices, não precisam ser analisadas pelo FMI quanto à sua regularidade com o fundo. Dito de outro modo, mesmo que feitas respeitando as obrigações do FMI, nada impede que violem o GATT. Pergunta: Quais seriam essas outras exchange actions?

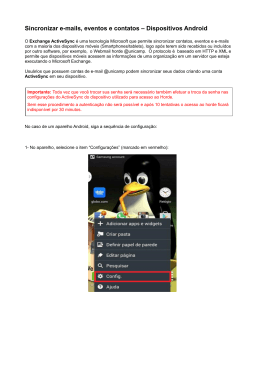

Baixar