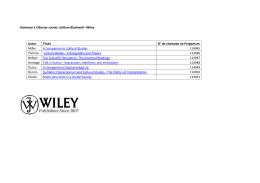

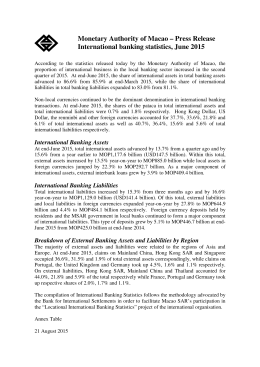

CÂMARA CURRICULAR DO CoPGr FORMULÁRIO PARA APRESENTAÇÃO DE DISCIPLINAS SIGLA DA DISCIPLINA: EAC NOME DA DISCIPLINA: Banking and Investment Banking PROGRAMA/ÁREA: Controladoria e Contabilidade Nº DA ÁREA: 12136 VALIDADE INICIAL (Ano/Semestre): 2015/01 Nº DE CRÉDITOS: 04 Aulas Teóricas: 5 Aulas Práticas 0 , Seminários e Outros: 15 Horas de Estudo: 60 DURAÇÃO EM SEMANAS: 3 DOCENTE(S) RESPONSÁVEL(EIS): 1. Lucas Ayres Barreira de Campos Barros X Docente Usp, n.º 3079831 Docente externo. Data de obtenção do título: Instituição: 2. James F. Cotter Docente Usp, n.º X Docente externo. Data de obtenção do título: 1993 Instituição: Wake Forest University 3. Docente Usp, n.º Docente externo. Data de obtenção do título: Instituição: CUSTOS REAIS DA DISCIPLINA: R$ (Apresentar, se pertinente, orçamento previsto para o exercício, em folha anexa) PROGRAMA OBJETIVOS: The course will examine the regulatory and institutional structure of the market for corporate control by examining merger and acquisition (M&A) transactions, the motivation for private equity and strategic transactions, and how to finance these transactions. The pedagogical method will be to offer students and opportunity to analyze a real world situation through the use of business school cases followed by a discussion of the theory and practice of each topic covered. Students will be expected to prepare for each class by analyzing each case and supporting documentation for each topic. In this course, students will be put in the position of an investment banker serving the capital raising, and mergers and acquisitions (M&A) activities of 1) publicly traded corporations, 2) private equity firms and 3) privately held firms. Most of the time, students will be providing advice and guidance to the Board of Directors (BOD), Chief Executive Officer (CEO) or Chief Financial Officer (CFO) of the firm in each situation. In this class, students will be offering advice that is consistent with maximizing the value of the firm to the owners of the firm, the shareholders of the company. In the initial stages of the course, we will be asking students to complete some fairly simple skill building exercises designed to insure that they have the skill set to complete more advanced projects. In progressively more complex and realistic situations, we will ask students to pitch ideas to a client and provide concrete solutions for a company that is chosen for them to evaluate and pitch financial solutions and restructuring. In so doing, students might be faced with questions that should be considered by the management of a firm: 1. 2. 3. 4. 5. 6. 7. 8. 9. What is the goal of a corporation? What is the value of a financial asset? What is a bank? How are banks regulated? Why are banks regulated? How would we analyze a bank’s financial performance? How should firms be designed and managed to maximize its value to shareholders? How should firms optimally distribute cash to shareholders? How can an investment banker identify, make recommendations and execute distribution strategies? 10. How do we value assets and acquisitions? 11. What issues are critical for expanding the existing operations of the firm through investments made relative to expanding into new lines of business or acquisitions? 12. What are the sources of value created in an acquisition, disposition, or merger of a company with another one? 13. When can a firm reasonably expect to benefit from synergies by acquiring the assets of another company? 14. When should firms make acquisitions or sell parts of their businesses? 15. What is the optimal method of payment for a transaction? 16. What additional value can be captured by the firm through a strategic acquisition relative to that of a purely financial buyer? 17. What role do financial buyers play in the M&A process? 18. How should the board of directors be structured and what is the value of independence at the board level? We will also discuss current topics in finance including where theory meets practice, agency issues and governance. This is a participatory class which utilizes traditional cases, “real time” cases, discussion, and debate to hone the financial skill of students and improve their ability to articulate and defend their position. JUSTIFICATIVA: Banking and Investment Banking have dramatically grown in importance and scale over the past fifty years. By offering a case-based short course covering the most important Investment Banking topics, this course aims to fill a gap in the FEA-USP curricula. The invited lecturer, Professor James Cotter, is a leading expert in the field, featuring relevant academic contributions, combined with extensive knowledge of the investment banking and mergers and acquisitions practice in the USA. This course has an interdisciplinary flavor and should be of interest to graduate students in the fields of finance, accounting, economics, and management. In addition to its academic contribution, this course offers an invaluable opportunity for students to interact with international faculty and to improve their English speaking, listening, reading, and writing abilities. CONTEÚDO (EMENTA): The topics of this course focus on the investment banking and facilitating the merger and acquisition process. As such, we will cover the following decision topics: BANKING 1. Banking and the Financial Services Industry. • Credit Crisis of 2007-2009. Impact on Banks and the Banking Environment. How Do Banks Differ? Trends in the Structure of U.S. Banks. Organizational Structure and Financial Services Business Models. 2. Government Policies and Regulation. • Historical Bank Regulation. Products and Services. Goals and Functions of Depository Institution Regulation. Ensure Safety and Soundness and Provide an Efficient and Competitive System. Supervision and Examination. New Charters. Federal Deposit Insurance. Product Restrictions: The Federal Reserve System. Monetary Policy. The Federal Reserve's Crisis Management Tools. The Role of Depository Institutions in the Economy. 3. Analyzing Bank Performance. • Commercial Bank Financial Statements. The Balance Sheet. The Income Statement. The relationship between the Balance Sheet and Income Statement. The Return on Equity Model. Profitability Analysis. Expense Ratio and Asset Utilization. Managing Risk and Returns. Credit Risk. Liquidity Risk. Market Risk. Operational Risk. Legal and Reputation Risk. Capital or Solvency Risk. Evaluating Bank Performance: INVESTMENT BANKING Part I: The Mergers and Acquisitions Environment • Introduction to Mergers and Acquisitions • The Corporate Takeover Market: Common Takeover Tactics, Takeover Defenses, and Corporate Governance Part II: The Mergers and Acquisitions Process: • Planning: Developing Business and Acquisition Plans—Phases 1 and 2 of the Acquisition Process Part III: Merger and Acquisition Valuation and Modeling • A Primer on Merger and Acquisition Cash Flow Valuation • Applying Financial Modeling Techniques to Value and Structure Mergers and Acquisitions Part IV: Deal Structuring and Financing Strategies • Financing Transactions: Leveraged Buyout Structures and Valuation BIBLIOGRAFIA: Bank Management, 7th Edition Timothy W. Koch, University of South Carolina and S. Scott MacDonald, Southern Methodist University ISBN-10: 0324655789 ISBN-13: 9780324655780 Mergers, Acquisitions, and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases, and Solutions, 5th edition, by Donald M. DePamphilis, Academic Press, 2013 (ISBN: 978-0-12-374878-2). CRITÉRIOS DE AVALIAÇÃO: 1. Daily Quizzes 2. Case Write-ups 3. Final Exam Proportion of Grade 0.1% 54.9% 45% Case Write Ups: During the course, there will be two, two-person group case write ups that students will have to complete. Case write-up should be no more than 5 pages. The first section of the memo (half a page at the most) should summarize the business of the firms involved and the relevant historical financial performance of the firms involved. Students should include information about what the firm does and how they have done the analysis and recommendations. The remainder of the paper should be divided into sections, each with a heading and supporting arguments for the issues put forward in the executive summary. When appropriate, the exhibits should provide a detailed analysis of the situation. Each member of the group should participate in and understand each answer. Final Exam: Students will be asked to complete a computer based final exam that asks to evaluate a business situation and make recommendations to the management team and board of directors. The background information will be given to the students, however, they will need to complete an analysis of the company and financial performance to draw conclusions. OBSERVAÇÕES: The course will be taught exclusively in English.

Baixar