Notes on the 2nd Supplementary Budget and other recent developments Notes on the 2nd Supplementary Budget and other recent developments On August 28th, the 2nd Supplementary Budget was presented, ensuring compliance with the 4% of GDP deficit target for 2014, down from 4.9% in 2013 (under ESA1995) The effects of negative Constitutional Court decisions and other identified pressures are compensated by an upward revision of tax revenue, a better Social Security balance and overall expenditure control In 2014, GDP is expected to expand by 1%, while the unemployment rate should drop to 14.2% from 16.2% in 2013, according to the revised macroeconomic scenario GDP posted a positive growth rate yoy for the 3rd consecutive quarter in 2014 Q2, with capital expenditure (GFCF) showing signs of further improvement, while unemployment declined to 13.9% in the same period, on the back of strong job creation According to the budgetary outturn until August, the Budget execution is on track, as the deficit declined €0.8 bn over the same period last year IGCP has issued a syndicated 15-year bond, the first since 2008, at a reoffer yield of 3.92% Economic recovery in 2014 more reliant on domestic demand A gradual acceleration of economic activity is projected for the medium-term. In the 2nd Supplementary Budget, GDP growth is estimated to stand at 1.0% (vs 0.8% in the initial Budget (Oct 2013) and 1.2% in the Fiscal Strategy Document (Apr 2014)). Moreover, growth composition changed substantially: exports growth is now expected to slow down due to less robust external demand, but this is compensated by the recovery in domestic demand. Private consumption has stabilized on the back of improved labor market conditions. In 2014Q2, unemployment rate dropped to 13.9%, after peaking at 17.5% in 2013Q1. Investment is showing evidence of bouncing back, with acquisition on equipment and machinery leading the uptrend. Despite the less favorable evolution of net external demand, the current and capital account is expected to remain in surplus, standing at 1.3% of GDP over 2014 (from 1.9% in 2013). Growth composition is now different than forecasted in April: i) exports growth is now expected to slow down namely due to less robust external demand … ii) … but this is compensated by stronger private consumption growth, on the back of better labor market conditions Forecasts for the unemployment rate decreased 3.5pp vis-à-vis the initial Budget (Oct13) and 1.2pp compared to the Fiscal Strategy Document (Apr-14) Source: Ministry of Finance, 2nd Supplementary Budget September 29, 2014 1 Notes on the 2nd Supplementary Budget and other recent developments In 2014 Q2 economic recovery gathered traction as GDP grew 0.3% qoq (under the new ESA 2010 rules), mainly reflecting an increase in exports. The recent rebound in exports has partially compensated the adverse GDP performance in 2014Q1 (-0.5%), which was negatively affected by some one-off factors, namely the temporary shutdown of the car factory Autoeuropa and the main oil refinery in Portugal for maintenance reasons. In yoy terms, GDP grew 0.9% in 2014Q2, the third positive yoy growth rate in a row, for the first time since 2010. Domestic demand gave a positive contribution (1.8pp), driven mainly by private consumption (1.1pp). GDP posted a positive growth rate yoy for the 3rd quarter in a row Investment is also showing encouraging signs of improvement, as expenditure in other machinery and equipment was positive for the 4th consecutive quarter and the negative contribution from construction is declining. Gross Fixed Capital Formation (contributions to yoy growth, %) 12 8 4 2,3 0,4 1,3 0 2,3 -4 -3,5 -8 -7,2 -12 -6,0 -7,3 -10,4 -12,7 -16 -13,1 -13,2 -15,2 -15,8 -17,7 -20 -19,3 -24 2010.III Investment is showing signs of improvement, with GFCF growing 2.3% yoy, on the back of investment in machinery and transport equipment 2011.I 2011.III 2012.I 2012.III 2013.I Other machinery and equipment Construction Gross fixed capital formation 2013.III 2014.I Transport equipment Others Source: Statistics Portugal (GDP under new ESA 2010 rules) High-frequency indicators are showing mixed signs, although the overall trend is positive: The activity coincident indicator (BdP), which traditionally shows a close relationship with GDP, has turned negative since July (-0.6% in August) after peaking at +0.9% in the turn of the year. However, the private consumption coincident indicator is still running at a positive pace (1.2% in August), close to the peak of 1.6% observed in April and May. Confidence indicators (BdP) also seem to have reached a plateau since Q2, after recovering steadily over the past couple of years from the trough reached in late 2012. Industrial production is showing signs of a positive performance and retail sales keep a steady improvement, with the yoy growth rate (12m MA) turning positive since April, for the first time since late 2010. Industrial production Retail sales While the activity coincident indicator has recently turned negative … … hard data present evidence of a positive performance of the industrial sector and an acceleration of private consumption 6 10 4 5 2 0 0 -2 -5 -4 -10 -6 yoy (%) -15 -8 12m MA yoy (%) yoy (%) 12m MA yoy (%) -10 -20 May-07 May-08 May-09 May-10 May-11 May-12 May-13 May-14 -12 Aug-07 Aug-08 Aug-09 Aug-10 Aug-11 Aug-12 Aug-13 Source: Statistics Portugal September 29, 2014 2 Notes on the 2nd Supplementary Budget and other recent developments The contribution of net external demand to real GDP growth has turned negative over the 1st half of 2014, as imports growth has accelerated (+4.8% yoy in Q2) and exports performance softened (2.4% yoy in Q2). This translated into a deterioration of the balance of goods and services, from about €1.6 billion in Jan-Jul 2013 to €0.7 billion in Jan-Jul 2014, according to BdP figures. Over the same period, the current account turned negative, from €0.5 bn to -€1.0 bn. The current account turned negative in the first 7 months of 2014 Again, this is mainly explained by a stronger imports growth (+4.9% yoy in Jan-Jul). Exports are still posting a positive performance, but at a slower pace (+2.0% yoy), with the main contribution coming from the services sector (+4.9%), as tourism is growing around 10%. Exports of goods have shown a less robust performance, especially in March through May, but figures from June and July have improved. Exports (yoy% 3m MA) Imports (yoy% 3m MA) 30% 30% 20% 20% 10% 10% 0% 0% -10% -10% Goods -20% Goods and services -30% Goods -20% Services Exports growth rate has declined and is now relying more on the services sector Services Goods and services -30% Source: Banco de Portugal (Balance of Payments statistics; in nominal terms) On the other hand, FDI is showing encouraging signs, with net FDI increasing more than €6.8 bn in Jan-Jul over the same period last year. Gross FDI has been highly concentrated in the financial and insurance sector and mainly directed from EU countries and Brazil. The unemployment rate declined 1.2pp in Q2 to 13.9%, after peaking at 17.5% in early 2013. Importantly, the decline of unemployment over Q2 was exclusively based on job creation (+2.0% qoq increase in employed population), as the labor force increased over the same period (+0.5% qoq). In yoy terms, employment growth rate continued to accelerate, standing at +2.0%, after 1.7% in Q1. This is the3rd consecutive yoy increase, confirming the reversion of a cycle of about 5 years of successive declines in employment. Unemployment rate (% labor force) 20 3 17,5 18 15,1 13,9 16 14 Employment variation 1,7 0,7 2 1 2,0 Unemployment rate has declined 3.6pp over the past year, resulting from strong job creation 0 12 -1 10 -2 8 6 -3 4 -4 2 -5 0 -6 2008Q2 1Q11 3Q11 1Q12 3Q12 1Q13 3Q13 1Q14 qoq (%) yoy (%) 2009Q4 2011Q2 -5,0 2012Q4 2014Q2 Source: Statistics Portugal September 29, 2014 3 Notes on the 2nd Supplementary Budget and other recent developments It is also worth noticing that employment creation is coming from full-time, permanent jobs, and mainly employing high-skilled labor force: Employment for people with higher education is growing by 16.8% yoy, vis-à-vis basic education (-5.8%) and secondary and post-secondary nontertiary education (+8.2%); permanent contracts have grown 4.9% yoy, while temporary jobs and other contractual arrangements increased 2.4% and 3.5%, respectively, and self-employed declined; full-time workers are growing 4.1% yoy, whereas the number of part-time workers decreased 9.8%. Job creation is concentrated in full-time, permanent jobs, and is mainly employing highskilled labor force Inflation has remained in negative territory for the 7th consecutive month in August. Harmonized yoy inflation (HICP) stood at -0.1% (preliminary estimate), up from -0.7% July, while CPI yoy inflation stood at -0.4% (-0.9% in July), and is expected to be 0% over 2014 on average. The trend has followed closely the general downward trajectory observed in the euro area, although the inflation differential between Portugal and the euro area remained negative (between 0.5pp and 1.0pp) since early 2013, reflecting unit labor costs trends and some recovery of price competitiveness. At this stage, however, there is no evidence that consumers and businesses are putting off their spending on account of the consumer prices downtrend. Inflation Rate (yoy, %) 5,0 4,0 Inflation has shown a steady downward trajectory in the past 3 years, following the general euro area trend and domestic competitiveness gains 3,0 2,0 1,0 0,0 -1,0 Euro area (18 countries) Portugal -2,0 -3,0 Jul-07 Jul-08 Jul-09 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 Source: Eurostat September 29, 2014 4 Notes on the 2nd Supplementary Budget and other recent developments 2014 Fiscal targets still on track, despite negative CC decisions Budget execution for the end of 2014 is on track, given the budgetary outturn in the year to August. In the first eight months of the year, the General Government (GG) deficit, on a cash basis, reached €4.7 bn, about €0.8 bn lower than in 2013. General Government (GG) balance (EUR million, yoy change) 2.000 6.000 636 0 121 5.000 -48 -846 -273 -2.258 -1.442 -2.000 -1.009 -2.548 4.000 -1.738 -4.043 -4.000 -4.192 -6.000 -8.000 3.000 -4.686 -5.455 -5.435 -5.823 515 -7.530 769 729 595 1.607 291 225 The budget execution is on track, with the deficit declining €769 mln until August (target decline for the year of €1.6 bn) 2.000 1.000 -9.137 -10.000 0 -149 -12.000 Jan Feb Mar Apr May Jun YoY Change (right scale) -389 Jul -1.000 Aug Sep 2014 Oct Nov Dec 2013 Source: Ministry of Finance Over this period, overall expenditure increased 1.7% yoy (primary expenditure +0.8%), on the back of higher compensation of employees (+6.9%). This performance is explained by the reversion of wage cuts since June (as determined by the Constitutional Court ruling on May 30th) and by the payment of holiday bonuses in June/July (while in 2013 it was paid in November). On the other hand, overall revenue increased 3.9% yoy, on the back of a very strong fiscal revenue performance (+7.1%). On August 28th, the Government submitted the 2nd Supplementary Budget to Parliament, restating its commitment to achieve the 4% of GDP deficit target for 2014, while the primary balance is expected to be in surplus (+0.3% of GDP) for the first time since 1997. The structural deficit is expected to decline from 2.6% of potential GDP in 2013, to 2.1% in 2014, thus complying with a structural adjustment of 0.5pp. Overall balance Overall balance excluding one-offs Structural overall balance OVERALL BALANCE 2009 2010 -10,2 -9,8 -10,2 -9,1 -8,9 -8,6 2011 -4,3 -7,3 -6,2 2012 -6,4 -5,8 -3,5 2013 -4,9 -5,3 -2,6 2014 -4,0 -4,0 -2,1 Primary balance Primary balance excluding one-offs Structural primary balance PRIMARY BALANCE 2009 2010 2011 -7,3 -7,0 -0,3 -7,3 -6,3 -3,3 -6,1 -5,8 -2,1 2012 -2,1 -1,5 0,8 2013 -0,6 -1,0 1,7 2014 0,3 0,3 2,3 The 2nd Supplementary Budget maintains the 4% target for the overall deficit with no need for additional fiscal consolidation measures Source: Ministry of Finance September 29, 2014 5 Notes on the 2nd Supplementary Budget and other recent developments Taking into account the Constitutional Court’s rulings on public servants’ wage cuts, as well as the ongoing budget execution and the latest data on economic activity, the executive concluded that the identified pressures are offset by the upward revision of fiscal revenue, larger Social Security surplus and overall expenditure control. Therefore, the Government ensured that the target of 4% for the 2014 deficit can still be met with no need for additional fiscal consolidation measures (apart from the reinstatement of the wage cuts that were in place between 2011 and th 2013 and which were deemed constitutional on August 14 ). Negative impact of Constitutional Court’s rulings in 2014 budget execution was compensated by a stronger fiscal revenue and better Social Security balance On the revenue side, the main revision occurred in the VAT revenue and, to less extent, in the Personal Income Tax, based on the improvement in labor market conditions, the economic activity recovery and the crackdown on tax evasion and underground economy. On the expenditure side, the main changes reflect the revisions in compensation of employees, which increased mostly due to the impact of the CC ruling of May 30th, and the increased funds for severance payments arising from the extension of the voluntary separation scheme. On the other hand, the lower level of unemployment (vis-à-vis the initial projection) compensated part of this increase. IGCP expects to have pre-financed about 2/3 of 2015 borrowing needs by year-end On September 3rd, IGCP held a syndicated deal of PGBs maturing in February 2030, raising €3.5 bn out of a final order book that exceeded €8 bn. This was the first 15-year syndicated transaction since 2008 and the first EURdenominated syndication since exiting the official EU-IMF program in May 2014. The deal was priced at a coupon of 3.875% and a spread of 235 basis points over mid-swaps, for a reoffer yield of 3.923%. The transaction enjoyed particularly strong take-up from international real money investors, with prominent presence of US, UK, and Scandinavia. IGCP placed the first 15year syndicated bond since 2008, with a YTM below 4% €3.5 bn syndication of PGB 3.875% 15 February 2030 5,9 3,9 5,7 0,3 North America 7,2 32,2 1,4 0,3 Asset Managers 13,0 UK Inssurance/Pension Funds Scandinavia 8,4 Banks/Private Banks GER./AUS./SWI. Other Europe 13,2 Hedge Funds Portugal 13,0 Central Banks Spain Other 29,1 66,4 Others Source: IGCP This issuance adds to €11.7bn of MLT financing previously executed in the current year, which broadly cover the initially projected financing needs for the year. September 29, 2014 6 Notes on the 2nd Supplementary Budget and other recent developments On the other hand, the adoption of a resolution measure to BES impacted negatively to the State’s borrowing needs, as the subsequent capitalization of Novo Banco by the Resolution Fund was partly financed by a State loan amounting to €3.9 bn. However, the net impact on borrowing needs was only €2.4 bn, since IGCP’s projected financing needs (based on the initial Budget) already included €1.5 bn destined to the capitalization of the Resolution Fund. Moreover, this increase in the State’s financing needs was compensated by the reimbursement of CoCo loans by BCP ahead of schedule (€1.85 bn) and an increase of the estimate of retail issuance to €3.5bn (€3bn already executed by August), implying no significant change in IGCP’s estimated year-end deposits. The increase in financing needs stemming from BES resolution plan was compensated by the anticipation of the reimbursement of CoCos by BCP and an increase of the estimate of retail issuance for 2014 State’s net financing needs during the year are now projected to stand at €16.1 bn. Gross borrowing requirements stand at €29.6bn, given MLT debt redemptions of €13.5 bn (which already include buybacks on the PGB maturing in 2015). Taking into account: the stock of deposits at end-2013 (€15.3 bn); MLT debt market issuance already executed (€15.2 bn); EU-IMF loans already disbursed (€4.8 bn); and retail issuances already executed by end-Aug (€3.0 bn); the financing needs in 2014 are fully covered and some pre-financing for 2015 has already occured. State Treasury borrowing needs and sources (€ billion) State borrowing requirements Net financing needs Overall deficit * Private sector banks' recapitalizations Other net acquisitions of financial assets ** Privatizations (-) MLT Redemptions Tbonds (PGB + MTN) IMF State financing sources Use of deposits Financing in the year Executed EU-IMF Tbonds (PGB + MTN) Tbills (net) Retail debt (net) Other flows (net) To be executed EU-IMF Tbonds Tbills (net) Retail debt (net) Other flows (net) Additional financing needs Total additional financing needs 2015-18 State Treasury cash position at year-end of which: deposits for bank recap 2013 E 24,3 11,1 7,7 1,1 3,8 -1,5 13,1 13,1 2014 P 29,6 16,1 7,4 2015 P 15,6 7,1 4,3 2016 P 11,6 -0,9 2,7 2017 P 16,7 1,8 1,3 2018 P 16,6 1,4 0,0 8,8 -0,1 13,5 13,5 2,7 -3,6 0,5 1,4 24,3 -0,4 24,6 29,6 5,7 23,9 8,6 8,0 0,5 15,6 7,1 8,5 12,5 9,9 2,6 11,6 0,0 11,6 14,9 11,3 3,6 16,7 0,0 16,7 15,2 11,0 4,2 16,6 0,0 16,6 10,0 12,0 1,3 1,1 0,3 4,8 15,2 16,6 53,3 2,5 2,5 3,0 0,4 1,5 -1,5 0,5 - - 8,5 11,6 16,7 15,3 6,4 9,6 2,5 2,5 2,5 2,5 2,5 2,5 2,5 * State sub-sector cash deficit in 2012-14. Projection for GG deficit in 2015-18 (Fiscal Strategy Document, Apr 2014). ** Includes refinancing of other public entities (namely SOEs and regions), as well as ESM participation, capitalization of the resolution fund, and redemption of CoCos. Financing needs in 2014 are already covered and 2/3 of 2015 are expected to be financed by end2014 Source: IGCP Given additional retail issuance (€0.5bn), a final EFSM disbursement (€0.4mln) to be received later this year, and additional MLT financing, IGCP plans to reduce the stock of Tbills and have, by year-end, around €10 bn (from which €2.5 bn are still earmarked for bank recap needs) to preemptively cover part of 2015’s borrowing needs(circa €16 bn). September 29, 2014 7 Notes on the 2nd Supplementary Budget and other recent developments Links related to the 2nd Supplementary Budget (only in PT): Report Ministry of Finance statement Further information on the Portuguese economy can be obtained from: Ministry of Finance www.portugal.gov.pt/en/the-ministries/ministry-of-finance Banco de Portugal www.bportugal.pt Statistics Portugal www.ine.pt Public Finance Council www.cfp.pt UTAO (only in PT) Website Portugal Economy Probe www.peprobe.comi Disclaimer: The information and opinions contained in this document have been compiled or arrived at from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. All opinions and estimates contained in this document are published for the assistance of recipients, but is not to be relied upon as authoritative or taken in substitution for the exercise of judgment by a recipient and, therefore, does not form the basis of any contract or commitment whatsoever. IGCP does not accept any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents. Tel: +351 217923300 Fax: +351 217993795 E-mail: [email protected] September 29, 2014 Web site: www.igcp.pt Reuters pages: IGCP01 Bloomberg pages: IGCP 8

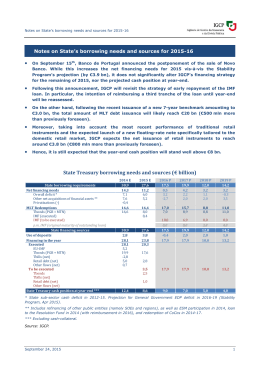

Baixar