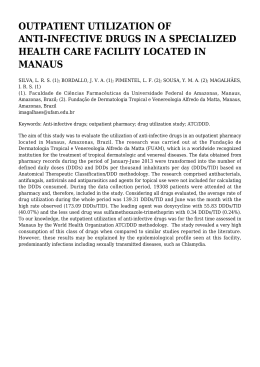

Manaus Free Trade Zone Meeting with Taipei Delegation Brasília, October 25th, 2013 MANAUS FREE TRADE ZONE (ZFM) MANAGEMENT MODEL PRESIDENCY OF THE REPUBLIC Ministry of Development, Industry and Foreign Trade SUFRAMA SUFRAMA Operating Area FOREIGN GOODS CONTROL SYSTEM For Consumables: Import Duty (II) Suspension, Excise Tax (IPI) Exemption, PIS/COFINS Rates reduced to zero For Products: II and IPI Exemption and PIS/COFINS Rates reduced to zero WESTERN AMAZON 1 GUYANA VENEZUELA st Bonfim SURINAM RORAIMA COLOMBIA Boa Vista ECUADOR Tabatinga AMAPÁ Manaus DOMESTIC GOODS CONTROL SYSTEM Itacoatiara EXPORTS (ALICEWEB) FULL EXEMPTION PERU Cruzeiro do Sul* AMAZONAS 4 BrasiléiaEpitaciolândia WESTERN AMAZON 3 th IPI Exemption, PIS/COFINS Rates reduced to zero rd 2nd Porto Velho ACRE Macapá-Santana RONDÔNIA Ji-Paraná Rio Branco Guajará-Mirim Vilhena BRAZIL SUFRAMA Headquarters Free Trade Areas (9) Regional Coordination Boards (5) (*) BOLIVIA INDUSTRIAL INDICATORS SYSTEM 88% Reduction in II, IPI Exemption , Differential PIS/COFINS Rates – 0.65% PIS and 3.0% COFINS Main Tax Incentives – MANAUS INDUSTRIAL SECTOR (PIM) FEDERAL TAXES IMPORT DUTY (II) - 88% reduction for the consumables to be used in industrialization processes, or proportional to the domestic added value, when dealing with information technology goods SUFRAMA EXCISE TAX (IPI) – Exempt SOCIAL INTEGRATION PROGRAM (PIS) and CONTRIBUTION FOR SOCIAL SECURITY FINANCING (COFINS) – Zero rated for incoming materials and inter-industry internal sales and 3.65% for sales of finished goods to the rest of the country. SUDAM INCOME TAX (IR) - 75% reduction in taxes on income and nonrefundable additional fees, exclusively for reinvestment. Common to all the Legal Amazon Region STATE TAXES SEFAZ/AM STATE VALUE ADDED TAX (ICMS) Credit Incentives of between 55% and 100%. In all cases, the companies are obliged to contribute to funds, which finance higher education, tourism, R&D, and small and micro-companies TABLE COMPARING THE MAIN TAX INCENTIVES Inside the ZFM v Outside the ZFM TAX Inside the ZFM Outside the ZFM Exempt for goods entering the ZFM for internal consumption or industrialization purposes. IMPORT DUTY (II) 88% reduction for outgoing industrialized products Information Technology goods: Tax Rate Reduction Coefficient (CRA) Full payment of the tax rate with differentiated rates for the import of information technology goods Automobiles, tractors and other land vehicles: CRA + 5% Exempt for goods entering the ZFM for internal consumption or industrialization purposes. Exempt for goods produced in the ZFM, whether for internal consumption or for sale anywhere in Brazil. Full payment, with the exemption of information EXCISE TAX (IPI) technology goods where Equivalent to Brazilian exports abroad when sending domestically produced goods for consumption there is a reduction of up to or industrialization in the ZFM 90% Exemption for products produced with regionally produced agricultural raw materials and vegetable extracts, excluding animal production, for establishments located in the Western Amazon (AMOC) 75% Reduction (up to 2018) Full payment Scaled reduction on income and non-refundable extras of 12.5% (up to 2013) INCOME TAX - IR Reinvestment deposits None PIS/Cofins Credit discounts: 12 years PIS/Cofins STATE VALUE ADDED TAX Additional Freight Charge for the Renewal of the Merchant Navy (AFRMM) Exemption 3.65% Reduction of between 55% and 100% Information Technology Goods: 100% 9.25% 17% Retail and 12% COUNTERPARTS REQUIRED OF COMPANIES IN EXCHANGE FOR THE INCENTIVES GRANTED Compliance with the Basic Production Process (BPP); Creating Jobs in the Region; Granting social benefits to the workforce; Incorporating state-of-the art product and production process technologies; Increasing productivity and competitiveness levels; Reinvesting profits in the region; Investing in the training and qualification of human resources for scientific and technological development; and Approval of the industrial project within the annual consumables importation limits; Main Industries - Participation Chemicals 12.47% Metallurgy 4.22% Information Technology Goods 14.84% Thermoplastics 4.81% Two Wheels 18.47% Consumer Electronics 33.12% Others 12.06% Source: Manaus Industrial Sector (PIM) indicator report updated in August 2013 Data for June 2013 CHANGE IN PIM TURNOVER in billions 70 73,519 69,036 60 61,585 54,352 50 45,663 40 10 50,364 49,685 37,553 31,972 22,750 26,545 10,622 35,090 30,163 14,190 43,871 41,237 41,404 30 20 49,441 25,697 25,878 21,268 18,914 9,105 2002 2003 2004 2005 2006 2007 Reals 2008 2009 2010 2011 Dollars Source: COISE/CGPRO/SAP – SUFRAMA – INDICATORS SYSTEM – page 10 January to July 2013 partial data 2012 2013 AMAZONAS BRAZIL The Manaus Industrial Sector has created an economic alternative that has enabled 98% of the native canopy cover to be preserved. SOME OF THE MORE THAN 600 COMPANIES IN THE MANAUS INDUSTRIAL SECTOR – PIM Foreign Companies RESEARCH INSTITUTES SIDIA Amazônia SOME OF THE MORE THAN 600 COMPANIES IN THE MANAUS INDUSTRIAL SECTOR – PIM Domestic Companies PORT AND AIRPORT INFRASTRUCTURE PUBLICLY OWNED PORT: - PORT OF MANAUS Largest floating port in the world Total area: 94,923 m² PRIVATELY OWNED PORTS: - SUPERTERMINALS Storage Area: 8,000 m² - CHIBATÃO Storage Area: 17,600 m² - AURORA EADI Storage Area: 9,000 m² EDUARDO GOMES INTERNATIONAL AIRPORT: - CARGO TERMINAL Total area: 49,000 m² Third largest airport in Brazil in terms of cargo SUPERTERMINALS DISTRIBUTION FROM THE PIM SOUTH BOUND ATLANTIC OCEAN AP Ports -MANAUS - FORTALEZA -SUAPE -SALVADOR -SEPETIBA -SANTOS -RIO GRANDE -MONTEVIDEO -BUENOS AIRES BELÉM PEC MAO PA AM FOR SUA PORTO VELHO SSA RO NORTH BOUND BRAZIL Ports Road and river transport most used Routes to the South and Southeast of Brazil: Rio de Janeiro São Paulo •Manaus – Porto Velho – Cuiabá – Campo Grande – São Paulo: average of 7 - 10 days (Road and river) SEP SSZ •Manaus – Belém – Goiânia – Porto Alegre: average of 10 - 12 days (Road and river) •Manaus – Belém: 4-5 days (via Amazonas River) Road and river •Manaus – Porto Velho: 3 days(via Madeira River) •Manaus – Boa Vista: 12-14 hours (highway) or 1 hour (air) -BUENOS AIRES -MONTEVIDEO -SANTOS -SEPETIBA -SALVADOR -SUAPE -CEARÁ -MANAUS Belo Horizonte Porto Alegre RIG MVD BUE Highway NORTH BOUND SOUTH BOUND FIAM 2013 INVITATION Images from the VI FIAM Thank you very much!

Baixar