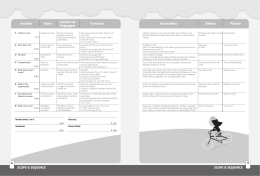

SAMPLE IMPORT TAX Datas related to the import of merchandise Currency rate 1,000 FRET value EUR FOB value EUR CFR value EUR Cost Percentage II IPI1 ICMS2 ICMS / FECP PIS3 COFINS4 Armaz. AFRMM5 DAS Siscomex Lib. BL Honorarios LI Total FRET FOB CFR BC1 BC2 35% 0% 14% 0% 1,65% 8,60% 0,00% 0,00% (To inform the value) 500,00 (To inform the value) 5000,00 (To inform the value) 5500,00 (To inform the value) Value R$ 1925,00 (To fulfill) 0,00 (To fulfill) 1333,45 (To fulfill) 0,00 (To fulfill) 123,34 (To fulfill) 642,84 (To fulfill) 0,00 (To fulfill) 0,00 (To fulfill) 0,00 (To fulfill) 0,00 (To fulfill) 0,00 (To fulfill) 0,00 (To fulfill) 0,00 (To fulfill) 4024,69 R$ 500,00 5000,00 5500,00 7474,90 9524,62 Aliq. ICMS total = 14,00% BC1= the base calculation for the expenses PIS/COFINS BC2= the base calculation for ICMS To determinate the amount of taxes in relation with the combined nomenclature (Customs Tariff Numbers) and for further information you can consult the websites: http://www.tributado.net/ http://www.receita.fazenda.gov.br/simulador/ IPI (Imposto sobre Productos Industrializados) : Tax on Industrialized Products ICMS (Imposto sobre Circulação de Mercadorias e Serviços) : Tax on Circulation of Goods and Services 3 PIS (Progama de Intregação Social): Social Integration Program 4 COFINS (Contribução para o Financiamento da Seguridad Social): Taxation for financing the health care 5 AFRMM : Taxation for the renovation of the merchant navy 1 2

Baixar