DIÁRIO OFICIAL DA INDÚSTRIA E COMÉRCIO

Porto Alegre, sexta-feira, 27 de fevereiro de 2015

5(/$7Ï5,2'$$'0,1,675$d26UV$FLRQLVWDV$,QYHVWSUHY6HJXURVH3UHYLGrQFLD6$HPFXPSULPHQWRjVGLVSRVLo}HVOHJDLVHHVWDWXWiULDVFRORFDPjGLVSRVLomRGH96DVSDUDDSUHFLDomRDV'HPRQVWUDo}HV)LQDQFHLUDV3DUHFHUGRV$XGLWRUHV,QGHSHQGHQWHVHR3DUHFHU$WXDULDOUHODWLYRVDRH[HUFtFLRGH'(6(03(1+2(&21Ð0,&2±),1$1&(,52$HPSUHVDDSUHVHQWRXQRH[HUFtFLRGH

XPOXFUROtTXLGRGH5VHLVFHQWRVHQRYHQWDHFLQFRPLOHPFRQWUDSDUWLGDDXPSUHMXt]RGH5RLWRPLOK}HVHTXDWURFHQWRVHTXDUHQWDHGRLVPLOQRH[HUFtFLRGH$PHOKRUDQRUHVXOWDGRGHYHVHDXPLQFUHPHQWRGHUHFHLWDRULXQGRGDRSHUDomRGR&RQVyUFLR'SYDWFRPLQtFLRHPMDQHLURGHDVVRFLDGDDDGRomRGHXPDSROtWLFDGHUHGXomRGHFXVWRVPDLVDJUHVVLYD2OXFUROtTXLGRIRLXWLOL]DGR

SDUDDEVRUomRGRVSUHMXt]RVDFXPXODGRVQmRRFRUUHQGRGLVWULEXLomRGHGLYLGHQGRVQHVWHH[HUFtFLR3DUDD,QYHVWSUHYWHYHFRPRREMHWLYRPDQWHURIRFRQDFRPHUFLDOL]DomRGRVSODQRVSUHYLGHQFLiULRVQDV

PRGDOLGDGHVGHSHF~OLRHUHQGD1RHQWDQWRLQWHQVL¿FDUiRVLQYHVWLPHQWRVQRGHVHQYROYLPHQWRGRVUHFXUVRVKXPDQRVDSULPRUDQGRDVIHUUDPHQWDVGHFRPHUFLDOL]DomRHUHODFLRQDPHQWRFRPRFDQDOFRUUHWRU$

DGPLQLVWUDomRGD&RPSDQKLDYLVDQGRXPDPHOKRULDQRVVHXVVLVWHPDVGHLQIRUPDomRLQYHVWLXHPXPQRYRVRIWZDUHSDUDDJHVWmRGHVHJXURVHSUHYLGrQFLDTXHGHYHUiHQWUDUHPSURGXomRDWpDEULOGH

)$725(/(9$17($6XSHULQWHQGrQFLDGH6HJXURV3ULYDGRVQDGDWDGHGH$JRVWRGHSRUPHLRGD3RUWDULD686(3QGHFUHWRXD,QWHUYHQomR([WUDMXGLFLDO2UHJLPHGHLQWHUYHQomRYLJRURX

SHORSUD]ROHJDOGHPHVHVVHQGRHQFHUUDGDSHOD686(3QRGLDGHIHYHUHLURGH1RGLDGHIHYHUHLURGHRVDGPLQLVWUDGRUHVHOHLWRVHKRPRORJDGRVSHOD686(3IRUDPUHFRQGX]LGRVDRV

VHXVUHVSHFWLYRVFDUJRV2FRQWUROHDFLRQiULRGDFRPSDQKLDpGHWLGRSHOR%DQFR5XUDO6$±(0/,48,'$d2(;75$-8',&,$/$VVLPR/LTXLGDQWHGR%DQFR5XUDO6$(/(IRLDXWRUL]DGRSHOR%DQFR

&HQWUDOGR%UDVLODDOLHQDUDSDUWLFLSDomRDFLRQiULDGHWLGDQDFRPSDQKLDDWUDYpVGHXPOHLOmRS~EOLFRDVHUGHVLJQDGR'(&/$5$d2'(&$3$&,'$'(),1$1&(,5$(PDWHQomRj&LUFXODU686(3Q

GHGHMDQHLURGHHDOWHUDo}HVSRVWHULRUHVGHFODUDPRVTXHDHPSUHVDSRVVXLFDSDFLGDGH¿QDQFHLUDFRPSDWtYHOFRPDVVXDVRSHUDo}HV&216,'(5$d®(6),1$,65HD¿UPDPRVQRVVDFUHQoD

QRFRPSRUWDPHQWRpWLFRUHVSHLWDQGRDV/HLVH'LUHWUL]HVTXHQRUWHLDPQRVVDDWLYLGDGHTXHVmRRVEDOL]DGRUHVGHQRVVDDWXDomRQDGLUHomRGD(PSUHVD3RUWR$OHJUHGHIHYHUHLURGH$'LUHWRULD

,19(6735(96(*8526

(35(9,'Ç1&,$6$

CNPJ 17.479.056/0001-73 - NIRE 4330005359-8

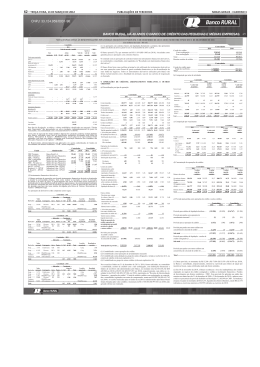

%DODQoRV3DWULPRQLDLVGHGH]HPEURGHHGHGH]HPEUR(PPLOKDUHVGHUHDLV

$7,92

&,5&8/$17(

',6321Ë9(/

&DL[DH%DQFRV

$3/,&$d®(6

&5e',726'$623(5$d®(6

&206(*8526(5(66(*8526

3UrPLRVD5HFHEHU

&5e',726'$623(5$d®(6&20

35(9,'Ç1&,$&203/(0(17$5

9DORUHVD5HFHEHU

2XWURV&UpGLWRV2SHUDFLRQDLV

$7,92'(5(66(*852(5(752&(662

3529,6®(67e&1,&$6

7Ë78/26(&5e',726$5(&(%(5

7tWXORVH&UpGLWRVD5HFHEHU

&UpGLWRV7ULEXWiULRVH3UHYLGHQFLiULRV

'HSyVLWRV-XGLFLDLVH)LVFDLV

2XWURV&UpGLWRV

2875269$/25(6(%(16

%HQVD9HQGD

2XWURV9DORUHV

'(63(6$6$17(&,3$'$6

55

12/2014 12/2013

65.470 51.206

$7,9212&,5&8/$17(

5($/,=È9(/$/21*235$=2

$3/,&$d®(6

7Ë78/26(&5e',726$5(&(%(5

'HSyVLWRV-XGLFLDLVH)LVFDLV

,19(67,0(1726

3DUWLFLSDo}HV6RFLHWiULDV

,PyYHLV'HVWLQDGRVD5HQGD

2XWURVLQYHVWLPHQWRV

,02%,/,=$'2

%HQV0yYHLV

2XWUDV,PRELOL]Do}HV

,17$1*Ë9(/

2XWURV,QWDQJtYHLV

24.313

11.979

727$/'2$7,92

89.783

63.185

3$66,92

&,5&8/$17(

&217$6$3$*$5

2EULJDo}HVDSDJDU

Impostos e encargos sociais a recolher

(QFDUJRVWUDEDOKLVWDV

(PSUpVWLPRVH¿QDQFLDPHQWRV

,PSRVWRVHFRQWULEXLo}HV

2XWUDVFRQWDVDSDJDU

'e%,726'(23(5$d®(6&20

6(*8526(5(66(*8526

2SHUDo}HVFRPUHVVHJXUDGRUDV

&RUUHWRUHVGHVHJXURVHUHVVHJXURV

2XWURVGpELWRVRSHUDFLRQDLV

'e%,726'(23(5$d®(6&20

35(9,'Ç1&,$&203/(0(17$5

'pELWRVGHUHVVHJXURV

2XWURVGpELWRVRSHUDFLRQDLV

'(3Ï6,726'(7(5&(,526

3529,6®(67e&1,&$6±6(*8526

3(662$6

9,'$,1',9,'8$/

9,'$&20&2%(5785$325

62%5(9,9Ç1&,$

3529,6®(67e&1,&$6±

35(9,'Ç1&,$&203/(0(17$5

3/$126%/248($'26

3/$12612%/248($'26

3*%/35*3

3$66,9212&,5&8/$17(

&217$6$3$*$5

7ULEXWRVGLIHULGRV

(PSUpVWLPRVH¿QDQFLDPHQWRV

35297e&±35(9,'&203/(0(17$5

3/$126%/248($'26

3/$12612%/248($'26

287526'e%,726

3URYLV}HVMXGLFLDLV

3$75,0Ð1,2/Ë48,'2

&DSLWDOVRFLDO

$XPHQWRGHFDSLWDOHPDSURYDomR

5HVHUYDVGHFDSLWDO

Reservas de lucros

$MXVWHGHDYDOLDomRSDWULPRQLDO

/XFURVRXSUHMXt]RVDFXPXODGRV

727$/'23$66,92(3$75,0/Ë48,'2

12/2014 12/2013

59.075

30.989

136

2

13.577

17.131

89.783

15.757

16.440

63.185

'HPRQVWUDo}HVGDV0XWDo}HVGR3DWULP{QLR/LTXLGR([HUFtFLRV¿QGRVHPGHGH]HPEURGHHGHGH]HPEURGH

(PPLOKDUHVGHUHDLV

$XP 5HV 5HVHUYDV 5HVHUYDV $MXVWHFRP /XFURVRX

Capital

de

de

de

de 7tWH9DORUHV 3UHMXt]RV

Social Cap. Capital

5HDYDO

/XFURV 0RELOLiULRV

$FXPXO

Total

6$/'26$17(5,25(6(0

15.200

4

1.170

19

- 16.392

$-867(6'((;(5&Ë&,26$17(5,25(6

1

1

$80(1725('8d2'(&$3,7$/

7Ë78/26(9$/2(602%,/,È5,26

(11)

(11)

5(68/7$'2/,48,'2'23(5,2'2

3523267$3$%625d235(-8,=26

7UDQVIHUrQFLDVSDUD5HVHUYDV

5HVHUYDOHJDO

5HVHUYDV(VWDWXWiULDV

6$/'26),1$,6(0

6$/'26$17(5,25(6(0

$80(1725('8d2'(&$3,7$/

7Ë78/26(9$/2(602%,/,È5,26

5(68/7$'2/,48,'2'23(5,2'2

6$/'26),1$,6(0

1RWDV([SOLFDWLYDVDV'HPRQVWUDo}HV)LQDQFHLUDV([HUFtFLR¿QGRHPGHGH]HPEURGH(PPLOKDUHVGHUHDLV

1. Contexto operacional: A Investprev Seguros e Previdência S.A. (doravante “Companhia”), controlada pelo Banco Rural S.A., é uma

VRFLHGDGHGHFDSLWDOIHFKDGRFRP¿QVOXFUDWLYRVFRPDXWRQRPLDDGPLQLVWUDWLYDH¿QDQFHLUDHWHPFRPRREMHWLYRVRFLDORSHUDUHPDWLYLGDGHVGHSUHYLGrQFLDFRPSOHPHQWDUUHQGDHSHF~OLREHPFRPRGHVHJXURVGRUDPRYLGDHPJHUDOQRWHUULWyULRQDFLRQDO$&RPSDQKLD

HVWiORFDOL]DGDQD$Y&DUORV*RPHV±DQGDU6DOD3RUWR$OHJUH±5LR*UDQGHGR6XO%UDVLO(PGHGH]HPEURGH

D&RPSDQKLDPDQWpPDPHVPDHVWUXWXUDGRFRQWUROHDFLRQiULRRXVHMDGR%DQFR5XUDO6$2EMHWLYDQGRDODYDQFDUVXDVRSHUDções no mercado, a Investprev criou planos de seguro de vida e acidentes pessoais nas modalidades de contratação individual e coletiva.

6mRSODQRVGHVHJXURVFRPFREHUWXUDVGHPRUWHHLQYDOLGH]YROWDGDVWDQWRSDUDSHVVRDVItVLFDVTXDQWRMXUtGLFDV2XWURSRQWRLPSRUWDQWH

DVHUUHVVDOWDGRpTXHD&RPSDQKLDYHPLPSOHPHQWDQGRXPDSROtWLFDGHRWLPL]DomRGHFXVWRVFRPYLVWDVDPHOKRUDUDUHQWDELOLGDGH$

&RPSDQKLDHVWiH[SRVWDDULVFRVTXHVmRSURYHQLHQWHVGHVXDVRSHUDo}HVHTXHSRGHPDIHWDUVHXVREMHWLYRVHVWUDWpJLFRVH¿QDQFHLURV

(VVDVGHPRQVWUDo}HV¿QDQFHLUDVIRUDPDSURYDGDVSHOR&RQVHOKRGD'LUHWRULDHPGHIHYHUHLURGH2. Elaboração e apresentaomRGDVGHPRQVWUDo}HV¿QDQFHLUDVD'HFODUDomRGHFRQIRUPLGDGH(PGHMDQHLURGHD686(3HPLWLXD&LUFXODUQ

TXHGLVS}HVREUHDVDOWHUDo}HVGDVQRUPDVFRQWiEHLVDVHUHPREVHUYDGDVSHODVHQWLGDGHVDEHUWDVGHSUHYLGrQFLDFRPSOHPHQWDUVRFLHGDGHVGHFDSLWDOL]DomRVRFLHGDGHVVHJXUDGRUDVHUHVVHJXUDGRUDVORFDLVSURGX]LQGRHIHLWRVUHODWLYDPHQWHDSURFHGLPHQWRVFRQWiEHLVD

SDUWLUGHGHMDQHLURGH(VVDFLUFXODUKRPRORJDRVSURQXQFLDPHQWRVWpFQLFRVHPLWLGRVSHOR&RPLWrGH3URQXQFLDPHQWRV&RQWiEHLV

&3&HUHYRJDD&LUFXODU686(3Q'HVWDIRUPDDVGHPRQVWUDo}HV¿QDQFHLUDVIRUDPHODERUDGDVFRQIRUPHRVGLVSRVLWLYRV

GD&LUFXODU686(3QRVSURQXQFLDPHQWRVWpFQLFRVDVRULHQWDo}HVHDVLQWHUSUHWDo}HVHPLWLGDVSHOR&RPLWrGH3URQXQFLDPHQWRV &RQWiEHLV &3& H QRUPDV GR &RQVHOKR 1DFLRQDO GH 6HJXURV 3ULYDGRV &163 GRUDYDQWH ³SUiWLFDV FRQWiEHLV DGRWDGDV QR

%UDVLODSOLFiYHLVjVLQVWLWXLo}HVDXWRUL]DGDVDIXQFLRQDUSHOD686(3´$&RPSDQKLDHIHWXRXDVHJUHJDomRGHLWHQVSDWULPRQLDLVHQWUH

DWLYRHSDVVLYRFLUFXODQWHTXDQGRHVWHVDWHQGHPjVVHJXLQWHVSUHPLVVDV(VSHUDVHTXHVHMDUHDOL]DGRRXSUHWHQGHVHTXHVHMDYHQGLGRRXFRQVXPLGRQRGHFXUVRQRUPDOGRFLFORRSHUDFLRQDOGD&RPSDQKLDPHVHV(VWiPDQWLGRHVVHQFLDOPHQWHFRPRSURSyVLWRGH

VHUQHJRFLDGRH(VSHUDVHTXHVHMDUHDOL]DGRDWpGR]HPHVHVDSyVDGDWDGREDODQoR7RGRVRVLWHQVTXHQmRDWHQGHPDRH[SRVWR

DFLPDIRUDPFODVVL¿FDGRVFRPR³QmRFLUFXODQWHV´E%DVHSDUDPHQVXUDomR$VGHPRQVWUDo}HV¿QDQFHLUDVIRUDPHODERUDGDVGHDFRUGRFRPRFXVWRKLVWyULFRFRPH[FHomRDRVVHJXLQWHVLWHQVQREDODQoRSDWULPRQLDO,QVWUXPHQWRV¿QDQFHLURVPHQVXUDGRVSHORYDORU

MXVWRSRUPHLRGRUHVXOWDGR3URYLV}HVWpFQLFDVPHQVXUDGDVGHDFRUGRFRPDVGHWHUPLQDo}HVGD686(3F&RPSDUDELOLGDGHAs

GHPRQVWUDo}HV¿QDQFHLUDVHVWmRVHQGRDSUHVHQWDGDVFRPLQIRUPDo}HVFRPSDUDWLYDVGHSHUtRGRVDQWHULRUHVFRQIRUPHGLVSRVLo}HVGR

&3& 5 H LQVWUXo}HV GR yUJmR UHJXODGRU 3DUD R EDODQoR SDWULPRQLDO H GHPDLV SHoDV D &RPSDQKLD XWLOL]RXVH GDV LQIRUPDo}HV

FRQVWDQWHVQRSHUtRGR¿QGRLPHGLDWDPHQWHSUHFHGHQWHGHGH]HPEURGHG&RQWLQXLGDGHA Companhia possui recursos para

dar continuidade em suas operações no futuro e, portanto, a mensuração e a apresentação dos componentes do patrimônio levam em

FRQWDHVVDFLUFXQVWkQFLD$GLFLRQDOPHQWHD$GPLQLVWUDomRQmRWHPRFRQKHFLPHQWRGHQHQKXPDLQFHUWH]DPDWHULDOTXHSRVVDJHUDUG~YLGDV VLJQL¿FDWLYDV VREUH D FDSDFLGDGH GH FRQWLQXDU RSHUDQGR 3RUWDQWR DV GHPRQVWUDo}HV ¿QDQFHLUDV IRUDP SUHSDUDGDV FRP EDVH

QHVVHSULQFtSLRH0RHGDIXQFLRQDOHGHDSUHVHQWDomR$VGHPRQVWUDo}HV¿QDQFHLUDVIRUDPHODERUDGDVHPUHDLV5TXHpDPRHGD

IXQFLRQDOGD&RPSDQKLDHHVWmRVHQGRDSUHVHQWDGDVHPPLOKDUHVGHUHDLVH[FHWRTXDQGRLQGLFDGRGHRXWUDIRUPD$&RPSDQKLDQmR

SRVVXLDWLYRVHSDVVLYRVPRQHWiULRVGHQRPLQDGRVHPPRHGDHVWUDQJHLUDQDGDWDGRIHFKDPHQWRGREDODQoRI8VRGHHVWLPDWLYDVH

MXOJDPHQWRV$SUHSDUDomRGHGHPRQVWUDo}HV¿QDQFHLUDVGHDFRUGRFRPDVQRUPDVKRPRORJDGDVSHOD686(3H[LJHTXHD$GPLQLVWUDomRUHJLVWUHGHWHUPLQDGRVYDORUHVGHDWLYRVSDVVLYRVUHFHLWDVHGHVSHVDVFRPEDVHHPHVWLPDWLYDDVTXDLVVmRHVWDEHOHFLGDVDSDUWLU

GHMXOJDPHQWRVHSUHPLVVDVTXDQWRDHYHQWRVIXWXURV2VYDORUHVUHDLVGHOLTXLGDomRGDVRSHUDo}HVSRGHPGLYHUJLUGHVVDVHVWLPDWLYDV

HPIXQomRGDVXEMHWLYLGDGHLQHUHQWHDRSURFHVVRGHVXDGHWHUPLQDomRSRUpPGHYHVHUPHGLGRHPEDVHVFRQ¿iYHLVSDUDTXHDVGHPRQVWUDo}HVFRQWiEHLVQmRVHMDPSUHMXGLFDGDV4XDQGRHQWUHWDQWRQmRSXGHUVHUIHLWDXPDHVWLPDWLYDUD]RiYHORLWHPQmRGHYHVHUUHFRQKHFLGRQDGHPRQVWUDomRFRQWiELO(VWLPDWLYDVHSUHPLVVDVVmRUHYLVWDVSHULRGLFDPHQWH5HYLV}HVFRPUHODomRDHVWLPDWLYDVFRQWiEHLVVmR

UHFRQKHFLGDVQRSHUtRGRHPTXHDVHVWLPDWLYDVVmRUHYLVDGDVHHPTXDLVTXHUSHUtRGRVIXWXURVDIHWDGRV5HVXPRGDVSULQFLSDLV

práticas contábeis: $VSULQFLSDLVSUiWLFDVFRQWiEHLVXWLOL]DGDVQDSUHSDUDomRGDVGHPRQVWUDo}HV¿QDQFHLUDVHVWmRGHPRQVWUDGDVDVHJXLU(VVDVSROtWLFDVIRUDPDSOLFDGDVFRQVLVWHQWHPHQWHSDUDWRGRVRVSHUtRGRVFRPSDUDWLYRVDSUHVHQWDGRVD&ODVVL¿FDomRGRVFRQWUDWRVGHVHJXURVHGHLQYHVWLPHQWR$VSULQFLSDLVGH¿QLo}HVGDVFDUDFWHUtVWLFDVGHXPFRQWUDWRGHVHJXURHVWmRGHVFULWDVQRSURQXQFLDPHQWRWpFQLFR&3&±&RQWUDWRVGHVHJXURVHPLWLGRSHOR&RPLWrGH3URQXQFLDPHQWRV&RQWiEHLV$OpPGLVVRD6XSHULQWHQGrQFLD

GH6HJXURV3ULYDGRV±686(3HVWDEHOHFHXFULWpULRVSDUDLGHQWL¿FDomRGHXPFRQWUDWRGHVHJXUR$GH¿QLomRGHXPFRQWUDWRGHVHJXURp

TXDQGRD&RPSDQKLDDFHLWDXPULVFRGHXPDFRQWHFLPHQWRIXWXURHLQFHUWRHPWURFDGDLQGHQL]DomRDRVHJXUDGREHQH¿FLiULRFDVRHVWH

ULVFRRFRUUD2VFRQWUDWRVGHUHVVHJXURWDPEpPVmRWUDWDGRVGDPHVPDIRUPDFRPRFRQWUDWRVGHVHJXURVSRUWUDQVIHULUHPULVFRGHVHJXURVLJQL¿FDWLYR1HVVHFRQWH[WRD$GPLQLVWUDomRSURFHGHXjVGHYLGDVDQiOLVHVGRVFRQWUDWRVHPLWLGRVFRPEDVHQDVQRUPDVVXSUDFLWDGDVHQmRLGHQWL¿FRXFRQWUDWRVFODVVL¿FDGRVFRPRFRQWUDWRVGHLQYHVWLPHQWRVE&DL[DHHTXLYDOHQWHVGHFDL[DIncluem caixa, saldos

SRVLWLYRVHPFRQWDPRYLPHQWRDSOLFDo}HV¿QDQFHLUDVUHVJDWiYHLVFXMRYHQFLPHQWRGDVRSHUDo}HVVHMDLJXDORXLQIHULRUDGLDVHQWUHD

GDWDGHDTXLVLomRHYHQFLPHQWRHFRPULVFRLQVLJQL¿FDQWHGHPXGDQoDGHVHXYDORUGHPHUFDGRHTXHQmRDIHWHPDYLQFXODomRFRPDWLYRV

garantidores. F,QVWUXPHQWRV)LQDQFHLURV$WLYRV¿QDQFHLURV$&RPSDQKLDFODVVL¿FDVHXVDWLYRV¿QDQFHLURVQDVVHJXLQWHVFDWHJRULDV

9DORUMXVWRSRUPHLRGRUHVXOWDGR0DQWLGRVDWpRYHQFLPHQWR'LVSRQtYHLVSDUDYHQGDH(PSUpVWLPRVHUHFHEtYHLV$FODVVL¿FDomR

GHQWUHDVFDWHJRULDVpGH¿QLGDSHOD$GPLQLVWUDomRQRPRPHQWRLQLFLDOHGHSHQGHGDHVWUDWpJLDSHODTXDORDWLYRIRLDGTXLULGR$WLYRV¿QDQFHLURVGHVLJQDGRVDYDORUMXVWRSRUPHLRGRUHVXOWDGR8PDWLYR¿QDQFHLURpFODVVL¿FDGRSHORYDORUMXVWRSRUPHLRGRUHVXOWDGRFDVR

VHMDFODVVL¿FDGRFRPRPDQWLGRSDUDQHJRFLDomRHVHMDGHVLJQDGRFRPRWDOQRPRPHQWRGRUHFRQKHFLPHQWRLQLFLDO$&RPSDQKLDJHUHQFLD

WDLVLQYHVWLPHQWRVHWRPDGHFLV}HVGHFRPSUDHYHQGDEDVHDGDVHPVHXVYDORUHVMXVWRVGHDFRUGRFRPDJHVWmRGHULVFRVHHVWUDWpJLD

GHLQYHVWLPHQWRV(VVHVDWLYRVVmRPHGLGRVSHORYDORUMXVWRHPXGDQoDVQRYDORUMXVWRGHVVHVDWLYRVVmRUHFRQKHFLGDVQRUHVXOWDGRGR

H[HUFtFLR$WLYRV¿QDQFHLURVPDQWLGRVDWpRYHQFLPHQWR6mRFODVVL¿FDGRVQHVVDFDWHJRULDFDVRD$GPLQLVWUDomRWHQKDLQWHQomRHD

FDSDFLGDGH GH PDQWHU HVVHV DWLYRV ¿QDQFHLURV DWp R YHQFLPHQWR 2V LQYHVWLPHQWRV PDQWLGRV DWp R YHQFLPHQWR VmR UHJLVWUDGRV SHOR

FXVWRDPRUWL]DGRGHGX]LGRVGHTXDOTXHUSHUGDSRUUHGXomRDRYDORUUHFXSHUiYHO(PSUpVWLPRVHUHFHEtYHLV - Compreende, principalPHQWHRVUHFHEtYHLVRULJLQDGRVGHFRQWUDWRVGHVHJXURVWDLVFRPRRVVDOGRVGHSUrPLRVDUHFHEHUGHVHJXUDGRVHYDORUHVDUHFHEHUH

GLUHLWRVMXQWRDRVUHVVHJXUDGRUHV$SyVRUHFRQKHFLPHQWRLQLFLDOVmRPHQVXUDGRVSHORFXVWRDPRUWL]DGRSHORPpWRGRGDWD[DHIHWLYDGH

MXURV2VMXURVDDWXDOL]DomRPRQHWiULDPHQRVSHUGDVGRYDORUUHFXSHUiYHOTXDQGRDSOLFiYHOVmRUHFRQKHFLGRVQRUHVXOWDGRTXDQGR

LQFRUULGRVQDOLQKDGHUHFHLWDVRXGHVSHVDV¿QDQFHLUDV'HWHUPLQDomRGRYDORUMXVWR2VYDORUHVMXVWRVGRVLQYHVWLPHQWRVFRPFRWDomR

S~EOLFDVmRUHJLVWUDGRVFRPEDVHQRVSUHoRVGLYXOJDGRV3DUDRVDWLYRV¿QDQFHLURVVHPPHUFDGRDWLYRRXFRWDomRS~EOLFDD&RPSDQKLD

HVWDEHOHFHRYDORUMXVWRDWUDYpVGHWpFQLFDVGHDYDOLDomRTXHLQFOXHPRXVRGHRSHUDo}HVUHFHQWHVFRQWUDWDGDVFRPWHUFHLURVDUHIHUrQFLDDRXWURVLQVWUXPHQWRVTXHVmRVXEVWDQFLDOPHQWHVLPLODUHVDDQiOLVHGHÀX[RVGHFDL[DGHVFRQWDGRVHRVPRGHORVGHSUHFL¿FDomRGH

RSo}HVTXHID]HPRPDLRUXVRSRVVtYHOGHLQIRUPDo}HVJHUDGDVSHORPHUFDGRHFRQWDPRPtQLPRSRVVtYHOFRPLQIRUPDo}HVJHUDGDV

SHODDGPLQLVWUDomRGDSUySULD&RPSDQKLD5HGXomRDRYDORUUHFXSHUiYHODWLYRV¿QDQFHLURV8PDWLYRWHPSHUGDQRVHXYDORUUHFXSHUiYHOVHXPDHYLGrQFLDREMHWLYDLQGLFDTXHXPHYHQWRGHSHUGDRFRUUHXDSyVRUHFRQKHFLPHQWRLQLFLDOGRDWLYR¿QDQFHLUR$HYLGrQFLD

REMHWLYDGHTXHRVDWLYRV¿QDQFHLURVLQFOXLQGRWtWXORVSDWULPRQLDLVSHUGHUDPYDORUSRGHLQFOXLURQmRSDJDPHQWRRXDWUDVRQRSDJDPHQWRSRUSDUWHGRGHYHGRULQGLFDo}HVGHTXHRGHYHGRURXHPLVVRUHQWUDUiHPSURFHVVRGHIDOrQFLDRXRGHVDSDUHFLPHQWRGHXPPHUFDGR

DWLYRSDUDRWtWXOR$OpPGLVVRSDUDXPLQVWUXPHQWRSDWULPRQLDOXPGHFOtQLRVLJQL¿FDWLYRRXSURORQJDGRHPVHXYDORUMXVWRDEDL[RGRVHX

FXVWRpHYLGrQFLDREMHWLYDGHSHUGDSRUUHGXomRDRYDORUUHFXSHUiYHO$VSHUGDVVmRUHFRQKHFLGDVQRUHVXOWDGRHUHÀHWLGDVHPFRQWD

UHGXWRUDGRDWLYRFRUUHVSRQGHQWH4XDQGRXPHYHQWRVXEVHTXHQWHLQGLFDUHYHUVmRGDSHUGDGHYDORUDGLPLQXLomRQDSHUGDGHYDORUp

UHYHUWLGDHUHJLVWUDGDQRUHVXOWDGR3HUGDVGHYDORUUHGXomRDRYDORUUHFXSHUiYHOQRVDWLYRV¿QDQFHLURVGLVSRQtYHLVSDUDYHQGDVmRUHFRQKHFLGDVSHODUHFODVVL¿FDomRGDSHUGDFXPXODWLYDTXHIRLUHFRQKHFLGDHPRXWURVUHVXOWDGRVDEUDQJHQWHVQRSDWULP{QLROtTXLGRSDUDR

UHVXOWDGR$ SHUGD FXPXODWLYD TXH p UHFODVVL¿FDGD GH RXWURV UHVXOWDGRV DEUDQJHQWHV SDUD R UHVXOWDGR p D GLIHUHQoD HQWUH R FXVWR GH

DTXLVLomROtTXLGRGHTXDOTXHUUHHPEROVRHDPRUWL]DomRGHSULQFLSDOHRYDORUMXVWRDWXDOGHFUHVFLGRGHTXDOTXHUUHGXomRSRUSHUGDGH

'HPRQVWUDo}HVGR5HVXOWDGR

([HUFtFLRV¿QGRVHPGHGH]HPEURGHHGHGH]HPEURGH

(PPLOKDUHVGHUHDLVH[FHWRROXFUROtTXLGRSRUDomR

12/2014 12/2013

Prêmios Emitidos

&RQWULEXLo}HVSDUD&REHUWXUDGH5LVFRV 9DULDo}HVGDV3URY7pFQLFDVGH3UrPLRV 3UrPLRV*DQKRV

5HFHLWD&RP(PLVVmRGH$SyOLFHV

6LQLVWURV2FRUULGRV

&XVWRVGH$TXLVLomR

2XWUDV5HFHLWDVH'HVS2SHUDFLRQDLV 5HVXOWDGRFRP2SHUDo}HVGH5HVVHJXUR 'HVSHVDFRP5HVVHJXUR

5HQGDVGH&RQWULEXLo}HVH3UrPLRV

&RQVWGD3URYGH%HQHID&RQFHGHU

5HFHLWDVGH&RQWULEH3UrPLRVGH9JEO

9DULDomRGH2XWUDV3URY7pFQLFDV

%HQH¿FLRV5HWLGRV

&XVWRVGH$TXLVLomR

2XWUDV5HFHLWDVH'HVS2SHUDFLRQDLV

'HVSHVDV$GPLQLVWUDWLYDV

'HVSHVDVFRP7ULEXWRV

5HVXOWDGR)LQDQFHLUR

5HVXOWDGR3DWULPRQLDO

5HVXOWDGR2SHUDFLRQDO

*DQKRVRX3HUGDVFRP$WLYRV1mR&RUUHQWHV 5HVXOWDGRDQWHVGRV,PSH3DUWLFLSDo}HV ,PSRVWRGH5HQGD

&RQWULEXLomR6RFLDO

3DUWLFLSDo}HVVREUHR/XFUR

/XFUR/tTXLGR3UHMXt]R

4XDQWLGDGHGH$o}HV

/XFUR/tTXLGR3UHMXt]RSRU$omR

'HPRQVWUDo}HVGR5HVXOWDGR$EUDQJHQWH

([HUFtFLRV¿QGRVHPGHGH]HPEURGHHGHGH]HPEURGH

(PPLOKDUHVGHUHDLV

12/2014 12/2013

/XFUROtTXLGRGRH[HUFtFLR

2XWURVUHVXOWDGRVDEUDQJHQWHV

(IHLWRVWULEXWVREUHRVUHVXOWDEUDQJHQWHV

(1)

(3)

9DULDomROtTXLGDQRYDORUMXVWRGHDWLYRV

¿QDQFHLURVGLVSRQtYHLVSDUDYHQGD

5HVXOWDEUDQJHQWHGRH[HUFtFLROtTGRVLPS 5HVXOWDGRDEUDQJHQWHGRH[HUFtFLRDWULEXtYHODRV

Acionistas da empresa controladora

'HPRQVWUDomRGH)OX[RGH&DL[D,QGLUHWR

([HUFtFLRV¿QGRVHPGHGH]HPEURGHH

(PPLOKDUHVGHUHDLV

$7,9,'$'(623(5$&,21$,6

12/2014 12/2013

/XFUR3UHMXt]ROtTXLGRGRSHUtRGR

$MXVWHVSDUD

'HSUHFLDomRHDPRUWL]Do}HV

3HUGD*DQKRQDDOLHQDomRGHLPRELOLHLQWDQJtYHO 2XWURV$MXVWHV

9DULDomRQDVFRQWDVSDWULPRQLDLV

$WLYRV¿QDQFHLURV

&UpGLWRVGDVRSHUDo}HVGHVHJXURVHUHVVHJXURV

$WLYRVGHUHVVHJXUR

&UpGLWRV¿VFDLVH3UHYLGHQFLiULRV

'HSyVLWRVMXGLFLDLVH¿VFDLV

'HVSHVDVDQWHFLSDGDV

2XWURVDWLYRV

,PSRVWRVHFRQWULEXLo}HV

2XWUDVFRQWDVDSDJDU

'pELWRVGHRSHUDo}HVFRPVHJXURVHUHVVHJXURV

'pELWRVGDVRSHUFRPSUHYLGrQFLDFRPSOHPHQWDU

'pELWRVGDVRSHUDo}HVFRPFDSLWDOL]DomR

'HSyVLWRVGHWHUFHLURV

3URYLV}HVWpFQLFDV6HJXURVHUHVVHJXURV

3URYLV}HVWpFQLFDV3UHYLGrQFLDFRPSOHPHQWDU 3URYLV}HVMXGLFLDLV

2XWURVSDVVLYRV

&DL[D*HUDGR&RQVXPLGRSHODV2SHUDo}HV

-XURVSDJRV

&DL[D/tTXLGR*HUDGR&RQVXPLGRQDV

$WLYLGDGHV2SHUDFLRQDLV

$7,9,'$'(6'(,19(67,0(172

5HFHELPHQWRSHOD9HQGD

,PRELOL]DGR

3DJDPHQWRSHOD&RPSUD

,QYHVWLPHQWRV

,PRELOL]DGR

&DL[D/tTXLGR*HUDGR&RQVXPLGRQDV

$WLYLGDGHVGH,QYHVWLPHQWR

$7,9,'$'(6'(),1$1&,$0(172

Aumento de Capital

6.000

3DJDPHQWRGH(PSUpVWLPRVH[FHWRMXURV

&DL[D/tTXLGR*HUDGR&RQVXPLGRQDV

$WLYLGDGHVGH)LQDQFLDPHQWR

$XPUHGOtTGHFDL[DHHTXLYDOHQWHVGHFDL[D

&DL[DHHTXLYGHFDL[DQRLQtFLRGRH[HUFtFLR

&DL[DHHTXLYDOHQWHGHFDL[DQR¿QDOGRH[HUFtFLR YDORUUHFXSHUiYHOSUHYLDPHQWHUHFRQKHFLGDQRUHVXOWDGR7RGDYLDTXDOTXHUUHFXSHUDomRVXEVHTXHQWHQRYDORUMXVWRGHXPDWLYR¿QDQFHLUR

GLVSRQtYHO SDUD YHQGD SDUD R TXDO WHQKD VLGR UHJLVWUDGD SHUGD GR YDORU UHFXSHUiYHO p UHFRQKHFLGD HP RXWURV UHVXOWDGRV DEUDQJHQWHV

3DVVLYRV ¿QDQFHLURV &RPSUHHQGH VXEVWDQFLDOPHQWH IRUQHFHGRUHV FRQWDV D SDJDU H DV FRQWDV TXH FRPS}HP R JUXSR ³GpELWRV FRP

RSHUDo}HVGHVHJXURV´TXHVmRUHFRQKHFLGRVLQLFLDOPHQWHDRYDORUMXVWR$SyVUHFRQKHFLPHQWRLQLFLDOVmRPHQVXUDGRVSHORFXVWRDPRUWL]DGRSHORPpWRGRGDWD[DHIHWLYDGHMXURV2VMXURVDDWXDOL]DomRPRQHWiULDHDYDULDomRFDPELDOTXDQGRDSOLFiYHLVVmRUHFRQKHFLGRV

QRUHVXOWDGRTXDQGRLQFRUULGRVG3UrPLRVGHVHJXURV2VSUrPLRVDUHFHEHUHDVUHVSHFWLYDVGHVSHVDVGHFRPHUFLDOL]DomRVmRUHJLVWUDGRVSHORVHXYDORUIXWXURGHGX]LGRGRVMXURVDDSURSULDUTXHVmRUHFRQKHFLGRVSHORUHJLPHGHFRPSHWrQFLDFRPRUHFHLWDV¿QDQFHLUDV

$SURYLVmRSDUDULVFRVGHFUpGLWRVpFDOFXODGDSDUDFREULUDVSHUGDVHVSHUDGDVQDUHDOL]DomRGRVFUpGLWRVFRPSUrPLRVGHVHJXURVHD

PHVPDpFRQVWLWXtGDHPVXDWRWDOLGDGHTXDQGRRSHUtRGRGHLQDGLPSOrQFLDIRUVXSHULRUDVHVVHQWDGLDVGDGDWDGRYHQFLPHQWRGR

crédito. H&XVWRGHDTXLVLomRGLIHULGR'$&2VFXVWRVGHDTXLVLomRGLIHULGRVVmRFRPLVV}HVGHFRUUHWDJHPGHDJHQFLDPHQWRHRXWURV

FXVWRVGHDQJDULDomRGLIHULGDHVmRDPRUWL]DGDVGHDFRUGRFRPRSUD]RGHYLJrQFLDGDVDSyOLFHVHRXFRQWUDWRVI,QYHVWLPHQWRVPropriedades para investimento são inicialmente mensuradas ao custo, incluindo custos da transação. Propriedades para investimento são

EDL[DGDVTXDQGRYHQGLGDVRXTXDQGRDSURSULHGDGHGHLQYHVWLPHQWRGHL[DGHVHUSHUPDQHQWHPHQWHXWLOL]DGDHQmRVHHVSHUDQHQKXP

EHQHItFLRHFRQ{PLFRIXWXURGDVXDYHQGD(YHQWXDLVJDQKRVRXSHUGDVQDEDL[DRXDOLHQDomRGHSURSULHGDGHGHLQYHVWLPHQWRVmRUHFRQKHFLGRVQDGHPRQVWUDomRGRUHVXOWDGRQRDQRGDUHIHULGDEDL[DRXDOLHQDomR7UDQVIHUrQFLDVVmRUHDOL]DGDVSDUDDFRQWDGHSURSULHGDGHGH

LQYHVWLPHQWRRXGHVWDFRQWDDSHQDVTXDQGRKRXYHUXPDPXGDQoDQRVHXXVRHYLGHQFLDGDSHORWpUPLQRGDRFXSDomRSHORSURSULHWiULR

LQtFLRGHDUUHQGDPHQWRPHUFDQWLOSDUDRXWUDSDUWHRXFRQFOXVmRGDFRQVWUXomRRXLQFRUSRUDomR3DUDXPDWUDQVIHUrQFLDGHSURSULHGDGHGH

LQYHVWLPHQWRSDUDSURSULHGDGHGHXVRSUySULRRFXVWRSUHVXPLGRSDUD¿QVGHFRQWDELOL]DomRVXEVHTXHQWHFRUUHVSRQGHDRYDORUMXVWRQD

GDWDGDPXGDQoDQRVHXXVR6HRLPyYHOGHXVRSUySULRVHWRUQDUXPDSURSULHGDGHGHLQYHVWLPHQWRD&RPSDQKLDFRQWDELOL]DDUHIHULGD

SURSULHGDGHGHDFRUGRFRPDSROtWLFDGHVFULWDQRLWHPGHLPRELOL]DGRDWpDGDWDGDPXGDQoDQRVHXXVR4XDQGRD&RPSDQKLDFRQFOXL

SHORVSUySULRVPHLRVDFRQVWUXomRRXLQFRUSRUDomRGHXPDSURSULHGDGHGHLQYHVWLPHQWRTXDOTXHUGLIHUHQoDHQWUHRYDORUMXVWRGDSURSULHGDGHQDTXHODGDWDHRVHXYDORUFRQWiELODQWHULRUpUHFRQKHFLGDQDGHPRQVWUDomRGRUHVXOWDGRJ,PRELOL]DGR2DWLYRLPRELOL]DGRGHXVR

SUySULRXWLOL]DGRQDFRQGXomRGRVQHJyFLRVGD&RPSDQKLDFRPSUHHQGHLPyYHLVGHXVRSUySULRHTXLSDPHQWRVPyYHLVPiTXLQDVXWHQVtOLRVHYHtFXORV2LPRELOL]DGRGHXVRSUySULRpGHPRQVWUDGRDRFXVWRKLVWyULFR2FXVWRGRDWLYRLPRELOL]DGRpUHGX]LGRSRUGHSUHFLDomR

DFXPXODGDGRDWLYRH[FHWRSDUDWHUUHQRVFXMRDWLYRQmRpGHSUHFLDGRDWpDGDWDGHGHGH]HPEURGH2FXVWRKLVWyULFRGRDWLYR

LPRELOL]DGRFRPSUHHQGHJDVWRVTXHVmRGLUHWDPHQWHDWULEXtYHLVSDUDDTXLVLomRGRVLWHQVFDSLWDOL]iYHLVHSDUDTXHRDWLYRHVWHMDHPFRQGLo}HVGHXVR*DVWRVVXEVHTXHQWHVVmRFDSLWDOL]DGRVDRYDORUFRQWiELOGRDWLYRLPRELOL]DGRRXUHFRQKHFLGRVFRPRXPFRPSRQHQWHVHSDUDGRGRDWLYRLPRELOL]DGRVRPHQWHTXDQGRpSURYiYHOTXHEHQHItFLRVIXWXURVHFRQ{PLFRVDVVRFLDGRVFRPRLWHPGRDWLYRLUmRÀXLUSDUDD

&RPSDQKLDHRFXVWRGRDWLYRSRVVDVHUDYDOLDGRFRPFRQ¿DELOLGDGH4XDQGRRFRUUHDVXEVWLWXLomRGHXPGHWHUPLQDGRFRPSRQHQWHRX

³SDUWH´GHXPFRPSRQHQWHRLWHPVXEVWLWXtGRpEDL[DGRDSURSULDGDPHQWH7RGRVRVRXWURVJDVWRVGHUHSDURRXPDQXWHQomRVmRUHJLVWUDGRVQRUHVXOWDGRGRSHUtRGRFRQIRUPHLQFRUULGRV$GHSUHFLDomRGHLWHQVGRDWLYRLPRELOL]DGRpFDOFXODGDSHORRPpWRGRSURUDWDGLHH

FRQIRUPHRSHUtRGRGHYLGD~WLOHVWLPDGDGRVDWLYRVRVWHUUHQRVQmRVmRGHSUHFLDGRV2YDORUFRQWiELOGHXPLWHPGRDWLYRLPRELOL]DGRp

EDL[DGRLPHGLDWDPHQWHVHRYDORUUHFXSHUiYHOGRDWLYRIRULQIHULRUDRYDORUFRQWiELOGRDWLYR$VWD[DVDQXDLVGHGHSUHFLDomRXWLOL]DGDVSHOD

&RPSDQKLDVmRSDUDPyYHLVPiTXLQDVXWHQVtOLRVHTXLSDPHQWRVGHFRPXQLFDomRHVHJXUDQoDHGHSDUDYHtFXORVHVLVWHPDGH

processamento de dados. K,QWDQJtYHO$WLYRVLQWDQJtYHLVFRPYLGDGH¿QLGDVmRDPRUWL]DGRVDRORQJRGDYLGD~WLOHFRQ{PLFDHDYDOLDGRV

HPUHODomRjSHUGDSRUUHGXomRDRYDORUUHFXSHUiYHOVHPSUHTXHKRXYHULQGLFDomRGHSHUGDGHYDORUHFRQ{PLFRGRDWLYR2SHUtRGRHR

PpWRGRGHDPRUWL]DomRSDUDRVDWLYRVLQWDQJtYHLVFRPYLGDGH¿QLGDVmRUHYLVDGRVQRPtQLPRDR¿QDOGHFDGDH[HUFtFLRVRFLDO0XGDQoDV

QDYLGD~WLOHVWLPDGDRXQRFRQVXPRHVSHUDGRGRVEHQHItFLRVHFRQ{PLFRVIXWXURVGHVVHVDWLYRVVmRFRQWDELOL]DGRVSRUPHLRGHPXGDQoDV

QRSHUtRGRRXPpWRGRGHDPRUWL]DomRFRQIRUPHRFDVRVHQGRWUDWDGDVFRPRPXGDQoDVGHHVWLPDWLYDVFRQWiEHLV$DPRUWL]DomRGHDWLYRV

LQWDQJtYHLVFRPYLGDGH¿QLGDpUHFRQKHFLGDQDGHPRQVWUDomRGRUHVXOWDGRQDFDWHJRULDGHGHVSHVDFRQVLVWHQWHFRPDXWLOL]DomRGRDWLYR

LQWDQJtYHOL5HGXomRDRYDORUUHFXSHUiYHOGRVDWLYRVQmR¿QDQFHLURV$DGPLQLVWUDomRUHYLVDDQXDOPHQWHRYDORUFRQWiELOOtTXLGRGRV

DWLYRVFRPRREMHWLYRGHDYDOLDUHYHQWRVRXPXGDQoDVQDVFLUFXQVWkQFLDVHFRQ{PLFDVRSHUDFLRQDLVRXWHFQROyJLFDVTXHSRVVDPLQGLFDU

GHWHULRUDomRRXSHUGDGHVHXYDORUUHFXSHUiYHO4XDQGRWDLVHYLGrQFLDVVmRLGHQWL¿FDGDVHRYDORUFRQWiELOOtTXLGRH[FHGHRYDORUUHFXSHUiYHOpFRQVWLWXtGDSURYLVmRSDUDGHWHULRUDomRDMXVWDQGRRYDORUFRQWiELOOtTXLGRDRYDORUUHFXSHUiYHO3HODVDQiOLVHVHMXOJDPHQWRHIHWXDGRVDFRQFOXVmRGD$GPLQLVWUDomRpGHTXHQmRpQHFHVViULDDFRQVWLWXLomRGHXPDSURYLVmRSDUDUHGXomRDRYDORUUHFXSHUiYHOGHVHXV

DWLYRVQmR¿QDQFHLURVM&RQWUDWRVGHDUUHQGDPHQWRPHUFDQWLO2VFRQWUDWRVGHDUUHQGDPHQWRPHUFDQWLOOHDVLQJVmRFODVVL¿FDGRVHP

GRLVJUDQGHVJUXSRVRSHUDFLRQDLVH¿QDQFHLURV2IDWRUGHWHUPLQDQWHSDUDHVVDFODVVL¿FDomRFRQIRUPH&3&±2SHUDomRGHDUUHQGDPHQWRPHUFDQWLOpDWUDQVIHUrQFLDGRVULVFRVHEHQHItFLRVLQHUHQWHVjSURSULHGDGHGREHPArrendamentos operacionais - A Companhia

possui contratos de arrendamento de aluguel da sala para a sede administrativa da Companhia. A Companhia, como arrendatário, determiQRXFRPEDVHQDDYDOLDomRGRVWHUPRVHFRQGLo}HVGRVFRQWUDWRV¿UPDGRVTXHQmRUHWpPWRGRVRVULVFRVHEHQHItFLRVDVVRFLDGRVDR

FRQWUDWRSRUWDQWRFRQWDELOL]DDVRSHUDo}HVFRPRDUUHQGDPHQWRRSHUDFLRQDO2VSDJDPHQWRVIHLWRVSHOD&RPSDQKLDUHIHUHQWHDRVDUUHQGDPHQWRVRSHUDFLRQDLVVmRUHFRQKHFLGRVFRPRGHVSHVDSHORPpWRGROLQHDUSHORSHUtRGRGHYLJrQFLDGRFRQWUDWR$UUHQGDPHQWRV¿QDQceiros'XUDQWHRSHUtRGRGHGLYXOJDomRQmRH[LVWLDPFRQWUDWRVGHDUUHQGDPHQWRPHUFDQWLO¿QDQFHLURYLJHQWHVQD&RPSDQKLDN3URYLV}HV7pFQLFDV$VSURYLV}HVWpFQLFDVVmRFRQVWLWXtGDVHFDOFXODGDVHPFRQVRQkQFLDFRPDVGHWHUPLQDo}HVHRVFULWpULRVHVWDEHOHFLGRV

SHOR&163HSHOD686(3HHVWmRDVVLPUHVXPLGDVSeguros$SURYLVmRGHSUrPLRVQmRJDQKRV331*pFRQVWLWXtGDSHODSDUFHODGR

SUrPLRUHWLGRFRUUHVSRQGHQWHDRSHUtRGRGHULVFRDGHFRUUHUFDOFXODGDSHORPpWRGR³SURUDWDGLH´HDWXDOL]DGDPRQHWDULDPHQWHTXDQGR

DSOLFiYHO$&RPSDQKLDFRQVWLWXLSURYLVmRUHODWLYDDULVFRVYLJHQWHVHQmRHPLWLGRV591(FXMRYDORUIRLGHWHUPLQDGRFRPEDVHHPFiOFXORVDWXDULDLVTXHOHYDUDPHPFRQWDDH[SHULrQFLDKLVWyULFDPHWRGRORJLDSUHYLVWDQD&LUFXODU686(3QHPHWRGRORJLDSUHYLVWDHP

QRWDWpFQLFDDWXDULDOSDUDSUrPLRVSURYLV}HVWpFQLFDVFRPLVV}HVVREUHSUrPLRVHPLWLGRVHGHVSHVDVGHFRPHUFLDOL]DomRGLIHULGDV$SURYLVmRGHVLQLVWURVDOLTXLGDU36/pFRQVWLWXtGDSRUHVWLPDWLYDGHSDJDPHQWRVSURYiYHLVOtTXLGRVGHUHFXSHUDo}HVGHWHUPLQDGDFRPEDVH

QRVDYLVRVGHVLQLVWURVUHFHELGRVDWpDGDWDGREDODQoRHDWXDOL]DGDPRQHWDULDPHQWHQRVWHUPRVGDOHJLVODomR$SURYLVmRGHVLQLVWURV

RFRUULGRVPDVQmRDYLVDGRV,%15pUHDOL]DGDFRPEDVHHPFiOFXORVDWXDULDLVTXHFRQVLGHUDPDH[SHULrQFLDKLVWyULFDHDPHWRGRORJLD

SUHYLVWDHP1RWD7pFQLFD$WXDULDO17$EHPFRPRDPHWRGRORJLDSUHYLVWDQD&LUFXODU686(3QPrevidência - As provisões

PDWHPiWLFDVUHSUHVHQWDPRVYDORUHVGDVREULJDo}HVDVVXPLGDVVREDIRUPDGHSODQRVGHUHQGDSHQVmRHSHF~OLRHVmRFDOFXODGDVVHJXQGRRUHJLPH¿QDQFHLURSUHYLVWRFRQWUDWXDOPHQWHSRUHVREUHVSRQVDELOLGDGHGHDWXiULROHJDOPHQWHKDELOLWDGRUHJLVWUDGRQR,QVWLWXWR

%UDVLOHLURGH$WXiULD,%$$VSURYLV}HVPDWHPiWLFDVUHSUHVHQWDPRYDORUSUHVHQWHGRVEHQHItFLRVIXWXURVHVWLPDGRVFRPEDVHHPPpWRGRVHSUHVVXSRVWRVDWXDULDLV$SURYLVmRPDWHPiWLFDGHEHQHItFLRVDFRQFHGHU30%D&UHIHUHVHDRVSDUWLFLSDQWHVFXMDSHUFHSomRGRV

EHQHItFLRVDLQGDQmRIRLLQLFLDGDHDSURYLVmRPDWHPiWLFDGHEHQHItFLRVFRQFHGLGRV30%&UHIHUHVHjTXHOHVMiHPJR]RGHEHQHItFLRV

2VHQFDUJRV¿QDQFHLURVFUHGLWDGRVjVSURYLV}HVWpFQLFDVVmRFODVVL¿FDGRVFRPR³GHVSHVDV¿QDQFHLUDV´$VSURYLV}HVTXHHVWmRYLQFXODGDVDRVVHJXURVGHYLGDFRPFREHUWXUDGHVREUHYLYrQFLD9*%/HDRVSODQRVGHSUHYLGrQFLDGDPRGDOLGDGH³JHUDGRUGHEHQHItFLRVOLYUHV´

3*%/UHSUHVHQWDPRPRQWDQWHGDVFRQWULEXLo}HVHIHWXDGDVSHORVSDUWLFLSDQWHVOtTXLGDVGHFDUUHJDPHQWRVHGHRXWURVHQFDUJRVFRQWUDWXDLVDFUHVFLGDVGRVUHQGLPHQWRV¿QDQFHLURVJHUDGRVSHODDSOLFDomRGRVUHFXUVRVHPIXQGRVGHLQYHVWLPHQWRVHVSHFLDOPHQWHFRQVWLWXtGRV

(FIE’s). O7HVWHGHDGHTXDomRGRVSDVVLYRV±7$3³/$7±/LDELOLW\$GHTXDF\7HVW´3DUDHVVHWHVWHIRLDGRWDGDXPDPHWRGRORJLDTXH

FRQVLGHUDDVREULJDo}HVGHFRUUHQWHVGRVFRQWUDWRVGHSUHYLGrQFLDFRPSOHPHQWDUDEHUWDHVHJXURVHPFXPSULPHQWRDRGLVSRVWRQD&LUFXODU686(3QGHGHGH]HPEURGH2FiOFXORGR7$3IRLUHDOL]DGRFRPSUXGrQFLDHREMHWLYLGDGHDSDUWLUGDXWLOL]DomRGHPpWRGRVHVWDWtVWLFRVHDWXDULDLVUHOHYDQWHVDSOLFiYHLVHDGHTXDGRVEDVHDGRHPGDGRVDWXDOL]DGRVGD&RPSDQKLD3DUDDVSURYLV}HVFRQVWLWXtGDVQRVSODQRVGHULVFRHGHVHJXURVVHJPHQWRGHSHVVRDVRVÀX[RVGHVFRQWDGRVDSUHVHQWDUDPVXSHUiYLWWHQGRHPYLVWDTXHHVWHV

SODQRVSRVVXHPSUHPLVVDVFRQVHUYDGRUDVHPVXDVEDVHVWpFQLFDV3DUDDVSURYLV}HVFRQVWLWXtGDVQRVSODQRVGHDFXPXODomR)*%3*%/

H9*%/RVÀX[RVGHVFRQWDGRVWDPEpPDSUHVHQWDUDPVX¿FLrQFLD2FiOFXORIRLHODERUDGRSRUDWXiULRH[WHUQRHGRSRQWRGHYLVWDJOREDO

SRUVHJPHQWRDVSURYLV}HVVHPRVWUDUDPDGHTXDGDVHPWRGDVDVVHJPHQWDo}HVQmRWHQGRVLGRGHWHFWDGDTXDOTXHUQHFHVVLGDGHGH

FRQVWLWXLo}HVGHSURYLV}HVDGLFLRQDLVQDGDWDEDVHGDVGHPRQVWUDo}HV¿QDQFHLUDVP$WLYRVHSDVVLYRVFRQWLQJHQWHVHREULJDo}HV

OHJDLV¿VFDLVHSUHYLGHQFLiULDV2UHFRQKHFLPHQWRDPHQVXUDomRHDGLYXOJDomRGRVDWLYRVHSDVVLYRVFRQWLQJHQWHVHREULJDo}HVOHJDLVVmRHIHWXDGRVGHDFRUGRFRPRVFULWpULRVHVWDEHOHFLGRVQRSURQXQFLDPHQWRWpFQLFR&3&QGR&RPLWrGH3URQXQFLDPHQWRV&RQWiEHLVFRQVLGHUDGDVDVRULHQWDo}HVSUHYLVWDVQD&LUFXODU686(3QVHQGRFODVVL¿FDGRVQDVVHJXLQWHVFDWHJRULDVContingências

ativas1mRVmRUHFRQKHFLGDVQDVGHPRQVWUDo}HV¿QDQFHLUDVH[FHWRTXDQWRGDH[LVWrQFLDGHHYLGrQFLDVTXHSURSLFLHPDJDUDQWLDGHVXD

UHDOL]DomRVREUHDVTXDLVQmRFDEHPPDLVUHFXUVRVContingências passivas6mRUHFRQKHFLGDVQDVGHPRQVWUDo}HV¿QDQFHLUDVTXDQGR

EDVHDGRQDRSLQLmRGHDVVHVVRUHVMXUtGLFRVHGD$GPLQLVWUDomRIRUFRQVLGHUDGRRULVFRGHSHUGDGHXPDDomRMXGLFLDORXDGPLQLVWUDWLYD

FRPXPDSURYiYHOVDtGDGHUHFXUVRVSDUDDOLTXLGDomRGDVREULJDo}HVHTXDQGRRVPRQWDQWHVHQYROYLGRVIRUHPPHQVXUiYHLVFRPVX¿FLHQWHVHJXUDQoD2EULJDo}HVOHJDLV±¿VFDLVHSUHYLGHQFLiULDV5HIHUHPVHDGHPDQGDVMXGLFLDLVSRUPHLRGDVTXDLVHVWmRVHQGRFRQWHVWDGDVDOHJDOLGDGHHDFRQVWLWXFLRQDOLGDGHGHWULEXWRVHFRQWULEXLo}HV2PRQWDQWHGLVFXWLGRpTXDQWL¿FDGRUHJLVWUDGRHDWXDOL]DGRPHQVDOmente. Q2XWURVDWLYRVHSDVVLYRV8PDWLYRpUHFRQKHFLGRQREDODQoRTXDQGRIRUSURYiYHOTXHVHXVEHQHItFLRVHFRQ{PLFRVIXWXURV

VHUmRJHUDGRVHPIDYRUGD&RPSDQKLDHVHXFXVWRRXYDORUSXGHUVHUPHQVXUDGRFRPVHJXUDQoD2VDWLYRVHSDVVLYRVVmRFODVVL¿FDGRV

FRPRFLUFXODQWHVTXDQGRVXDUHDOL]DomRRXOLTXLGDomRpSURYiYHOTXHRFRUUDQRVSUy[LPRVGR]HPHVHV&DVRFRQWUiULRVmRGHPRQVWUDGRV

FRPRQmRFLUFXODQWHV8PSDVVLYRpUHFRQKHFLGRQREDODQoRTXDQGRD&RPSDQKLDSRVVXLXPDREULJDomROHJDOFRQVWLWXtGDFRPRUHVXOWDGR

GHXPHYHQWRSDVVDGRVHQGRSURYiYHOTXHXPUHFXUVRHFRQ{PLFRVHMDUHTXHULGRSDUDOLTXLGiOR$VSURYLV}HVVmRUHJLVWUDGDVWHQGRFRPR

EDVHDVPHOKRUHVHVWLPDWLYDVHRULVFRHQYROYLGRR$SXUDomRGRUHVXOWDGR$VUHFHLWDVFRPVHJXURVHSUHYLGrQFLDFXMRIDWRJHUDGRUpD

YLJrQFLDGRULVFRVmRUHFRQKHFLGDVSHORUHJLPHGHFRPSHWrQFLD3DUDRVSURGXWRVGHDFXPXODomRRUHFRQKHFLPHQWRGDUHFHLWDpRUHFHELPHQWRGDVFRQWULEXLo}HV$VUHFHLWDVHRVRXWURVFXVWRVUHODFLRQDGRVjVDSyOLFHVFRPIDWXUDPHQWRPHQVDOFXMDHPLVVmRGDIDWXUDRFRUUH

QRPrVVXEVHTXHQWHDRSHUtRGRGHFREHUWXUDVmRUHFRQKHFLGRVSRUHVWLPDWLYDFDOFXODGDVFRPEDVHQRKLVWyULFRGDHPLVVmR2VYDORUHV

HVWLPDGRV VmR DMXVWDGRV H UHYHUWLGRV TXDQGR GD HPLVVmR GD IDWXUD$V GHPDLV UHFHLWDV H GHVSHVDV VmR UHFRQKHFLGDV SHOR UHJLPH GH

competência. S,PSRVWRGHUHQGDHFRQWULEXLomRVRFLDO$SURYLVmRSDUDLPSRVWRGHUHQGDpFRQVWLWXtGDjDOtTXRWDGHGROXFURWULEXWiYHODFUHVFLGDGRDGLFLRQDOGHVREUHROXFURUHDODQXDOH[FHGHQWHDRVOLPLWHV¿VFDLVHVWDEHOHFLGRV$SURYLVmRSDUDFRQWULEXLomR

VRFLDOpFRQVWLWXtGDjDOtTXRWDGHVREUHROXFUROtTXLGRDMXVWDGRSHORVLWHQVGH¿QLGRVHPOHJLVODomRHVSHFt¿FD4. Gerenciamento de

Continua

56

Porto Alegre, sexta-feira, 27 de fevereiro de 2015

Continuação

riscos: A Seguradora, de forma geral, está exposta aos seguintes

ULVFRV SURYHQLHQWHV GH VXDV RSHUDo}HV H TXH SRGHP DIHWDU FRP

PDLRURXPHQRUJUDXRVVHXVREMHWLYRVHVWUDWpJLFRVH¿QDQFHLURV

5LVFRGHVHJXUR5LVFRGHFUpGLWR5LVFR¿QDQFHLURR5LVFRGH

PHUFDGRR5LVFRGHOLTXLGH]5LVFRRSHUDFLRQDO$¿QDOLGDGHGHVWDQRWDH[SOLFDWLYDpDSUHVHQWDULQIRUPDo}HVJHUDLVVREUHHVWDVH[SRVLo}HVEHPFRPRRVFULWpULRVDGRWDGRVSHOD6HJXUDGRUDQDJHVtão e redução de cada um dos riscos acima mencionados. A

Seguradora dispõe de uma estrutura de gerenciamento de riscos

TXHpFRPSRVWDSRUSULQFtSLRVSROtWLFDVUHVSRQVDELOLGDGHVSURFHdimentos e ações internas. A administração considera essa estrutuUDFRPSDWtYHOFRPDQDWXUH]DHFRPSOH[LGDGHGRVSURGXWRVVHUYLços, processos e sistemas da Seguradora. A estrutura interna de

gerenciamento de riscos da Seguradora é composta pelas seguinWHViUHDV'HSDUWDPHQWRGHFRQWUROHVLQWHUQRV'HSDUWDPHQWRGH

DQiOLVHGHVXEVFULomRGHULVFR'HSDUWDPHQWRDWXDULDO$XGLWRULD

interna. D5LVFRGHVHJXUR$6HJXUDGRUDGH¿QHULVFRGHVHJXUR

FRPRRULVFRWUDQVIHULGRSRUTXDOTXHUFRQWUDWRRQGHKDMDDSRVVLELOLGDGHIXWXUDGHTXHRHYHQWRGHVLQLVWURRFRUUDHRQGHKDMDLQFHUWH]D VREUH R YDORU GH LQGHQL]DomR UHVXOWDQWH GR HYHQWR GH VLQLVWUR

(VVH ULVFR p LQÀXHQFLDGR SHORV VHJXLQWHV IDWRUHV )UHTXrQFLD H

VHYHULGDGHGRVVLQLVWURV+LVWyULFRGRVVLQLVWURVGHORQJRSUD]RH

&DUDFWHUtVWLFDVHSHU¿OGRULVFR1HVWHVHQWLGRD6HJXUDGRUDHQWHQGHTXHRSULQFLSDOULVFRWUDQVIHULGRSDUDVLpRULVFRGHTXHRV

sinistros avisados e os pagamentos de indenizações resultantes

GHVVHVHYHQWRVH[FHGDPRYDORUFRQWiELOGRVSDVVLYRVGHFRQWUDWRV

de seguros. A gestão de riscos é realizada através de regras de

VXEVFULomRULJRURVDPHQWHVHJXLGDVSHODViUHDVGHVXEVFULomRWpFnica e operacional. Cada produto ou cotação deve seguir os preceiWRVHVWDEHOHFLGRVQRPDQXDOGHVXEVFULomRQRWDVWpFQLFDVFRQGLo}HVJHUDLVHFRQWUDWRGHUHVVHJXURVHPSUHREVHUYDQGRRVOLPLWHV

HDOoDGDVSUpGH¿QLGDV(PDGLomRjVIHUUDPHQWDVDFLPDUHODFLRQDGDVTXHVmRDVGLUHWUL]HVVHJXLGDVSHODHTXLSHGHHVSHFLDOLVWDHP

análise de riscos, a Seguradora realiza operações com resseguradoras como parte do seu programa de redução de riscos. A concentração de riscos da Seguradora está no seguro de pessoas em todo

RWHUULWyULRQDFLRQDO$QiOLVHGHVHQVLELOLGDGH2VSURGXWRVGHVHJXURVDSUHVHQWDPFRPRSULQFLSDOULVFRGHQHJyFLRRYDORUGDVSHUGDV

ou sinistros ocorridos superarem o valor das provisões técnicas e

SUrPLRVUHFHELGRV+iWDPEpPLQFHUWH]DVLQHUHQWHVDRSURFHVVRGH

HVWLPDWLYDGDVSURYLV}HVWpFQLFDVTXDQGRHVWDVVmRREWLGDVDWUDYpVGHPHWRGRORJLDVHVWDWtVWLFRDWXDULDLV8PH[HPSORGLVVRpTXH

R DWXDO PRQWDQWH GH VLQLVWURV HVWLPDGRV VHUi FRQ¿UPDGR DSHQDV

TXDQGRWRGRVHOHVIRUHPHIHWLYDPHQWHOLTXLGDGRVSHOD6HJXUDGRUD

2 WHVWH GH VHQVLELOLGDGH YLVD GHPRQVWUDU RV HIHLWRV TXDQWLWDWLYRV

VREUHRPRQWDQWHHVWLPDGRGHVLQLVWURVGHFODUDGRVQRSDVVLYRGD

6HJXUDGRUDEHPFRPRQRSDWULP{QLROtTXLGRDMXVWDGR3/$TXDQdo alterada alguma das variáveis aplicadas à metodologia de cálcuORGDSURYLVmRFRQVWLWXtGDQXPDGHWHUPLQDGDGDWDEDVH$DQiOLVH

GHVHQVLELOLGDGHSUHYLVWDQRLQFLVR;,GR$UWLJRGR$QH[RGD

&LUFXODU686(3GHWHUPLQDTXHVHIDoDXPUHFiOFXORGDV

operações considerando outros cenários com alterações nas variáYHLVGHGHVSHVDVDGPLQLVWUDWLYDVHtQGLFHGHVLQLVWUDOLGDGH2TXDGUR DEDL[R GHPRQVWUD DV YDULDELOLGDGHV RFRUULGDV FRQVLGHUDQGR D

DOWHUDomRGHSUHPLVVDVHPPLOKDUHV

%DODQoR FRP'$ FRP'6

'HVSHVDV$GPLQLVWUDWLYDV 'HVSHVDVFRP6LQLVWURV 5HVXOWDGR

3/

E5LVFRGHFUpGLWRRisco de crédito é o risco de perda de valor

GHDWLYRV¿QDQFHLURVHDWLYRVGHUHVVHJXURFRPRFRQVHTXrQFLDGH

uma contraparte no contrato não honrar a totalidade ou parte de

VXDVREULJDo}HVSDUDFRPD&RPSDQKLD3DUDJHVWmRGHVHXVLQYHVWLPHQWRV D &RPSDQKLD FODVVL¿FD FRPR EDL[R ULVFR GH FUpGLWR

RV WtWXORV HPLWLGRV RX JDUDQWLGRV SHOR7HVRXUR 1DFLRQDO ULVFR VREHUDQR 2V WtWXORV GH 5HQGD )L[D GHYHUmR VHU FODVVL¿FDGRV FRPR

EDL[RRXPpGLRDOWRULVFRGHFUpGLWREDVHDGRVHPDQiOLVHVUDWLQJV

HIHWXDGDVSRUDJrQFLDVFODVVL¿FDGRUDVGHULVFRHPIXQFLRQDPHQWR

QRSDtV$WDEHODDVHJXLUDSUHVHQWDDGLVWULEXLomRGDFRPSRVLomR

GRULVFRGDFDUWHLUDGHLQYHVWLPHQWRV

6WDQGDUG3RRU¶V±(VFDOD1DFLRQDO

&RPSRVLomRGDFDUWHLUDSRUFODVVHHSRUFDWHJRULDFRQWiELO EU$$$ EU$ EU$ 6HP5DWLQJ 6DOGRFRQWiELO

$WLYRFLUFXODQWH

7tWXORVSDUDYHQGD

7tWXORVGHUHQGD¿[D

/HWUDV¿QDQFHLUDVGRWHVRXUR±/)7

&HUWL¿FDGRGHGHSyVLWREDQFiULR&'%

'HErQWXUHV

4XRWDVGHIXQGRVGHLQYHVWLPHQWRV±H[FOXVLYR

4XRWDVGHIXQGRVGHLQYHVWLPHQWRV±QmRH[FOXVLYR

4XRWDVGHIXQGRVGHLQYHVWLPHQWRV'39$7

7tWXORVGHUHQGDYDULiYHO

$o}HV

7tWXORVPDQWLGRVDWpRYHQFLPHQWR

5HFLERGH'HSyVLWR%DQFiULR±5'%

([SRVLomRPi[LPDDRULVFRGHFUpGLWR

20.756

743

58

52.390

73.947

2)XQGRGH,QYHVWLPHQWR5XUDO3UHYQmRSRVVXLDYDOLDo}HVGHUDWLQJGLYXOJDGDV(VWHIXQGRSRVVXLFRPRDGPLQLVWUDGRUHJHVWRUR

%1<0HOORQ$5;,QYHVWLPHQWRV/WGDFXMDFODVVL¿FDomRGHUDWLQJDWXDOUHDOL]DGDSHOD)LWFKpGHEU0$SHVDUGDLQH[LVWrQFLDGHFODVVL¿FDomRGHUDWLQJHVWHIXQGRHVWiDORFDGRHPWtWXORVS~EOLFRVIHGHUDLVFXMRUDWLQJpFRQVLGHUDGRVREHUDQRF5LVFR¿QDQFHLUR

$6HJXUDGRUDHVWiH[SRVWDDXPDVpULHGHULVFRV¿QDQFHLURVWUDQVIHULGRVSHORVGLYHUVRVDWLYRVHSDVVLYRVLQHUHQWHVDRVHXQHJyFLR2V

SULQFLSDLVULVFRVDVVRFLDGRVDRVLQVWUXPHQWRV¿QDQFHLURVVmR5LVFRGHPHUFDGRH5LVFRGHOLTXLGH]F5LVFRGHPHUFDGR5LVFR

GHPHUFDGRpDTXHOHDVVRFLDGRjSRVVLELOLGDGHGHRFRUUrQFLDGHSHUGDVGHYLGRjVRVFLODo}HVQRVSUHoRVGHPHUFDGRGRVDWLYRV3DUD

DYDOLDomRGRULVFRGHPHUFDGRGHVHXSRUWIyOLRGHLQYHVWLPHQWRVD6HJXUDGRUDXWLOL]DRPRGHOR³9DOXHDW5LVN9#5´VHQGRTXHVXD

SDUDPHWUL]DomRpDVHJXLQWH6HPFRUUHODo}HV9RODWLOLGDGHSDUDPpWULFD1tYHOGHFRQ¿DQoDGHH3HUtRGRGHUHYHUVmRGH

XPGLDF5LVFRGHOLTXLGH]2ULVFRGHOLTXLGH]pRULVFRGHQmRWHUDFHVVRDUHFXUVRV¿QDQFHLURVSDUDLQYHVWLUQDRSHUDomRRXKRQUDU

VHXVFRPSURPLVVRV(OHpOLPLWDGRSHODUHFRQFLOLDomRGRÀX[RGHFDL[DFRQVLGHUDQGRWDPEpPRVSDVVLYRVDSDJDUGD6HJXUDGRUD3DUD

WDQWRVmRHPSUHJDGRVPpWRGRVDWXDULDLVSDUDHVWLPDURVSDVVLYRVRULXQGRVGHFRQWUDWRVGHVHJXUR'HQWURGHVVHFRQWH[WRD6HJXUDGRUDSRVVXLXPDSROtWLFDFULWHULRVDGHFRPHUFLDOL]DomRYLVDQGRPLWLJDURVULVFRVLQHUHQWHVjVXEVFULomRHQWUHHOHVRULVFRGHQmRUHFHELPHQWRGRSUrPLRLQDGLPSOrQFLD1RkPELWRGRVDWLYRV¿QDQFHLURVD6HJXUDGRUDLQYHVWHUHFXUVRVHPDWLYRV¿QDQFHLURVFXMRVHPLVVRUHV

VmRDPSODPHQWHFRQKHFLGRVHFRQ¿iYHLV7DLVDWLYRVSRVVXHPOLTXLGH]GLiULDHSRGHQGRVHUWUDQVIRUPDGRVHPFDL[DUDSLGDPHQWH$

FRPELQDomRGDVFDUDFWHUtVWLFDVGHVXEVFULomRHGRVDWLYRV¿QDQFHLURVPHQFLRQDGDVDFLPDWHQGHDUHGX]LURULVFRGHOLTXLGH]G5LVFR

operacional: 5LVFRVRSHUDFLRQDLVVmRRVULVFRVGHSUHMXt]RVGLUHWRVRXLQGLUHWRVGHFRUUHQWHVGHXPDYDULHGDGHGHFDXVDVDVVRFLDGDV

D SURFHVVRV SHVVRDO WHFQRORJLD H LQIUDHVWUXWXUD H GH IDWRUHV H[WHUQRV 1D &RPSDQKLD D JHVWmR GRV ULVFRV RSHUDFLRQDLV HQYROYH R

PDSHDPHQWRGHSURFHGLPHQWRVHODERUDomRGHPDQXDLVRSHUDFLRQDLVLGHQWL¿FDomRHLPSOHPHQWDomRGHSRQWRVGHFRQWUROHYLVDQGRD

mitigação de riscos inerentes às atividades operacionais. Gestão de capital - A Companhia executa suas atividades de gestão de risco de

FDSLWDOFRPRREMHWLYRSULPiULRGHDWHQGHUDRVUHTXHULPHQWRVGHFDSLWDOPtQLPRVHJXQGRFULWpULRVGHH[LJLELOLGDGHGHFDSLWDOHPLWLGRVSHOD

686(3PDVWDPEpPSDUDPDQWHURUHWRUQRVREUHRFDSLWDOSDUDRVDFLRQLVWDV2SHUDFLRQDO$(TXLSH2SHUDFLRQDOWHPFRPRSULQFLSDO

DWLYLGDGHIXQo}HVGHDUWLFXODomRHSRVVXLRREMHWLYRGHDODYDQFDUDSURGXWLYLGDGHGRVFOLHQWHVLQWHUQRVHH[WHUQRVFRPRFRPSURPLVVR

GHJHUDUUHVXOWDGRVSRUPHLRGHVXSRUWHjRSHUDomRHVROXo}HVTXHDJUHJDPYDORUjHPSUHVD3DUDWDQWRD6HJXUDGRUDHVWiUHDOL]DQGR

XPDLPSOHPHQWDomRGLiULDQDGRFXPHQWDomRGHSURFHVVRVHWUHLQDPHQWRYLVDQGRPXOWLSOLFDUFRQKHFLPHQWRHQWUHRVFRODERUDGRUHV$V

PHOKRUHVSUiWLFDVYLVDPUHFRQKHFLPHQWRSHODVGHPDLViUHDVFRPRXPDHTXLSHGHGLFDGDQDEXVFDHPLQRYDo}HVH[FHOrQFLDQDJHVWmR

GHSURFHVVRVH¿FiFLDQDJHVWmRGHLQFLGHQWHHIDFLOLWDGRUDSDUDRVQRYRVSURGXWRV7HFQRORJLDGD,QIRUPDomR9LVDQGRPLWLJDURVULVFRV

LQHUHQWHV D 7HFQRORJLD GD ,QIRUPDomR D 6HJXUDGRUD HODERURX XPD SROtWLFD SDUD XWLOL]DomR GH UHFXUVRV FRPSXWDFLRQDLV TXH WUDWD GD

FRQ¿GHQFLDOLGDGHGDLQIRUPDomRGLUHLWRVGHYHUHVHUHVSRQVDELOLGDGHVGRVXVXiULRVOLFHQFLDPHQWRGHVRIWZDUHSROtWLFDGHVHQKDVDOpP

GDGLVSRQLELOLGDGHGHVHXVUHFXUVRV3DUDLVWRGHXFLrQFLDDWRGRVRVVHXVFRODERUDGRUHVUHFROKHQGRDDVVLQDWXUDHPXPIRUPXOiULR

HVSHFt¿FRSDUDHVWH¿P$DGPLQLVWUDomRGD&RPSDQKLDYLVDQGRXPDPHOKRULDQRVVHXVVLVWHPDVGHLQIRUPDomRLQYHVWLXHPXPQRYR

VRIWZDUHSDUDDJHVWmRGHVHJXURVHSUHYLGrQFLDTXHGHYHUiHQWUDUHPSURGXomRDWpDEULOGH$OpPGLVWRWHPLQYHVWLGRPDFLoDPHQWH

HPXPSURMHWRSDUDUHYLVDUVHXVVLVWHPDVSDUDHOLPLQDUWRGRVRVJDSVHWUD]HUPDLRUDXWRPDWLFLGDGHDJLOLGDGHHFRQWUROHjVVXDVDWLYLGDGHVSRVVLELOLWDQGRDVVLPDODYDQFDUVXDVSRWHQFLDOLGDGHV

$SOLFDo}HV¿QDQFHLUDVD$SOLFDo}HV¿QDQFHLUDVSRUYHQFLPHQWR'HPRQVWUDPRVDEDL[RDFRPSRVLomRGRVDOGRGDVDSOLFDo}HV

¿QDQFHLUDVHPGHGH]HPEURGHHGHGH]HPEURGH

12/2014

12/2013

6HP $Wp $FLPDGH

9DORU

6DOGR

6DOGR

'HVFULomR

YHQFLPHQWR

GLDV GLDV

WRWDO FRQWiELO $SOLFDGR FRQWiELO

7tWXORVSDUDYHQGD

/HWUDV)LQDQFHLUDVGR7HVRXUR±/)7

&HUWL¿FDGRGH'HSyVLWR%DQFiULR±&'%SyV¿[DGR

'HErQWXUHV

4XRWDVGHIXQGRVGHLQYHVWLPHQWR±H[FOXVLYR

4XRWDVGHIXQGRVGHLQYHVWLPHQWR±QmRH[FOXVLYR

4XRWDVGHIXQGRVGHLQYHVWLPHQWR±'39$7

$o}HVGHFRPSDQKLDVDEHUWDV

7tWXORGH&DSLWDOL]DomR

7tWXORVPDQWLGRVDWpRYHQFLPHQWR

5HFLERGH'HSyVLWR%DQFiULR±5'%SyV¿[DGR

7RWDOSRUYHQFLPHQWR

'HPRQVWUDPRVDEDL[RDFRPSRVLomRGDVTXRWDVGHIXQGRVGHLQYHVWLPHQWRVH[FOXVLYRV

12/2014

12/2013

Saldo

Saldo

&RQWiELO $SOLFDGR Contábil

4XRWDVGHIXQGRVGHUHQGD¿[D

/HWUDV)LQDQFHLUDVGR7HVRXUR±/)7 2XWUDVFRQWDVDSDJDUOtTXLGDV

7RWDOGDFDUWHLUD

&LUFXODQWH

$DORFDomRGHUHFXUVRVGRSRUWIyOLRGD,QYHVWSUHYHVWiGLYLGLGDHP

UHQGD ¿[D UHSUHVHQWDGD SRU WtWXORV S~EOLFRV /)7 H IXQGR GH LQYHVWLPHQWRV UHQGD ¿[D WtWXORV S~EOLFRV LQGH[DGRV D 6(/,& WtWXORV

SULYDGRV&'%SyVHR)XQGR5XUDO3UHYLQGH[DGRVD&',&(7,3

GHErQWXUHVLQGH[DGDVDR,*3',DFUHVFLGRGHXPVSUHDGHUHQGD

YDULiYHOUHSUHVHQWDGDSHODVDo}HVGD9DOH6$2YDORUGHPHUFDGR

GDV TXRWDV GH IXQGRV GH LQYHVWLPHQWR IRL DSXUDGR FRP EDVH QRV

YDORUHVGHTXRWDVGLYXOJDGRVSHORVDGPLQLVWUDGRUHVGRVIXQGRVQRV

TXDLVD&RPSDQKLDDSOLFDVHXVUHFXUVRV2VWtWXORVS~EOLFRVIHGHUDLV IRUDP FRQWDELOL]DGRV SHOR FXVWR GH DTXLVLomR DFUHVFLGRV GRV

UHQGLPHQWRVDXIHULGRVHDMXVWDGRVDRYDORUGHPHUFDGRFRPEDVH

QDV WDEHODV GH UHIHUrQFLD GR PHUFDGR VHFXQGiULR GD$VVRFLDomR

1DFLRQDOGDV,QVWLWXLo}HV)LQDQFHLUDVGR0HUFDGR)LQDQFHLUR$1%,0$2VFHUWL¿FDGRVHUHFLERVGHGHSyVLWREDQFiULRHDVGHErQWXUHVIRUDPFRQWDELOL]DGRVSHORFXVWRGHDTXLVLomRDFUHVFLGRGRV

UHQGLPHQWRV DXIHULGRV DWp D GDWD GR EDODQoR 2V WtWXORV S~EOLFRV

HVWmRFXVWRGLDGRVQR6LVWHPD(VSHFLDOGH/LTXLGDomRH&XVWyGLD

6(/,&HRVWtWXORVSULYDGRVQD&(7,36$±%DOFmR2UJDQL]DGRGH

$WLYRVH'HULYDWLYRV$VTXRWDVGHIXQGRVGHLQYHVWLPHQWRHVSHFLDOPHQWHFRQVWLWXtGRVFRPRUHFXUVRVJDUDQWLGRUHVGHSODQRVGHEHQHItFLRVVmRDGPLQLVWUDGRVSHOD%1<0HOORQ$5;,QYHVWLPHQWRV/WGD

E'HWHUPLQDomRGRYDORUMXVWRGDVDSOLFDo}HV¿QDQFHLUDV2

YDORUMXVWRGRVDWLYRV¿QDQFHLURVpRPRQWDQWHSHORTXDOXPDWLYR

SRGHVHUWURFDGRRXXPSDVVLYROLTXLGDGRHQWUHSDUWHVFRQKHFLGDV

HHPSHQKDGDVQDUHDOL]DomRGHXPDWUDQVDomRMXVWDGHPHUFDGR

QD GDWD GR EDODQoR 2 YDORU MXVWR GDV DSOLFDo}HV HP IXQGRV GH

LQYHVWLPHQWRIRLREWLGRDSDUWLUGRVYDORUHVGDVTXRWDVGLYXOJDGDV

SHODV LQVWLWXLo}HV ¿QDQFHLUDV DGPLQLVWUDGRUDV GHVVHV IXQGRV 2V

WtWXORV GH UHQGD ¿[D S~EOLFRV WLYHUDP VHXV YDORUHV MXVWRV REWLGRV

DSDUWLUGDVWDEHODVGHUHIHUrQFLDGLYXOJDGDVSHOD$VVRFLDomR1DFLRQDOGDV,QVWLWXLo}HVGR0HUFDGR)LQDQFHLUR$1%,0$(PUD]mR

GRVDWLYRV¿QDQFHLURVGD&RPSDQKLDHQFRQWUDUHPVHLQWHJUDOPHQWH

DORFDGRVQRSDGUmR&',6(/,&RVYDORUHVFRQWiEHLVMiHVWmRUHJLVWUDGRVjPHUFDGRRXVHMDSHORYDORUMXVWRGRVDWLYRV+LHUDUTXLDGR

YDORUMXVWR$WDEHODDEDL[RDSUHVHQWDRVLQVWUXPHQWRV¿QDQFHLURV

UHJLVWUDGRV SHOR YDORU MXVWR XWLOL]DQGR R PpWRGR GH DYDOLDomR SRU

QtYHLV2VGLIHUHQWHVQtYHLVIRUDPGH¿QLGRVFRQIRUPHVHJXH1tYHO

±RVSUHoRVFRWDGRVQmRDMXVWDGRVHPPHUFDGRVDWLYRVSDUDDWLYRVRXSDVVLYRVLGrQWLFRV1tYHO±RXWURVGDGRVTXHQmRVHMDP

RV SUHoRV FRWDGRV HP PHUFDGRV DWLYRV LQFOXtGRV QR 1tYHO TXH

VmRREVHUYiYHLVSDUDRDWLYRRXSDVVLYRVHMDGLUHWDPHQWHRXVHMD

FRPRRVSUHoRVRXLQGLUHWDPHQWHLVWRpGHULYDGRGRVSUHoRV

1tYHO±RVGDGRVSDUDRDWLYRRXSDVVLYRQmRVHEDVHLDPHPGDGRVREVHUYiYHLVGHPHUFDGRGDGRVQmRREVHUYiYHLV

12/2014

12/2013

Saldo

Saldo

'HVFULomR

1tYHO FRQWiELO 1tYHO FRQWiELO

7tWXORVSDUDYHQGD

7tWXORVS~EOLFRVIHGHUDLV

Letras Financeiras do

7HVRXUR±/)7

7tWXORVSULYDGRV

&HUWL¿FDGRGH'HSyVLWR

%DQFiULR±&'%

'HErQWXUHV

4XRWDVGHIXQGRGH

LQYHVWLPHQWR±H[FOXVLYR

4XRWDVGHIXQGRVGH

LQYHVWLPHQWR±QmRH[FOXVLYR 4XRWDVGHIXQGRVGH

LQYHVWLPHQWR±'39$7

$o}HVGHFRPSDQKLDVDEHUWDV

7tWXORVPDQWLGRVDWpRYHQFLPHQWR

7tWXORVSULYDGRV

5HFLERGH'HSyVLWR

%DQFiULR±5'%SyV¿[DGR 7RWDOSRUQtYHO

$ &RPSDQKLD SRVVXL RSHUDo}HV FRP DSOLFDo}HV ¿QDQFHLUDV FXMD

FODVVL¿FDomRVHHQTXDGUDVRPHQWHQRQtYHOHPGHGH]HPEUR

GHF$WLYRVRIHUHFLGRVHPJDUDQWLDGDVSURYLV}HVWpFQLcas - 2VDWLYRVJDUDQWLGRUHVGDVSURYLV}HVWpFQLFDVHVWmRFRPSRVWRVFRQIRUPHWDEHOD

12/2014

12/2013

Valor Garantia

Valor

OtTXLGR GDV5HV OtTXLGR

FRQWiELO 7pFQLFDV contábil

/)7/HWUDV)LQDQFHLUDVGR7HVRXUR &HUWL¿FDGRGH'HSyVLWR%DQFiULR

'HErQWXUHV

$o}HVGH&RPSDQKLDV$EHUWDV

4XRWDVGH)XQGRVGH,QYHVWLPHQWRV Total

41.824

41.824 47.396

3URYLV}HV7pFQLFDV7RWDLV6HJXURV 3URYLV}HV7pFQLFDV7RWDLV

3UHYLG&RPSOHP

3URYLV}HVDVHUHPFREHUWDV

6X¿FLrQFLD

4.290

G,QVWUXPHQWRV¿QDQFHLURVGHULYDWLYRV(PGHGH]HPEURGH

HGHGH]HPEURGHQmRKDYLDFRQWUDWRVHQYROYHQGR

RSHUDo}HV GH ³VZDS´ RSo}HV RX RXWURV LQVWUXPHQWRV ¿QDQFHLURV

derivativos na Companhia. 6. Prêmios a receber: 2V SUrPLRV D

UHFHEHUFRQWHPSODPRVSUrPLRVGHHPLVVmRGLUHWDGHDFRUGRFRP

DV YLJrQFLDV FRQWUDWXDLV GDV DSyOLFHV$ &RPSDQKLD DYDOLD SHULRGLFDPHQWHRVYDORUHVUHJLVWUDGRVQDUXEULFD³±5HGXomRDR

YDORUUHFXSHUiYHO´HPDQWpPDWXDOL]DGDDSURYLVmRFRQVWLWXtGDHP

VXD WRWDOLGDGH TXDQGR R SHUtRGR GH LQDGLPSOrQFLD IRU VXSHULRU D

VHVVHQWDGLDVGDGDWDGRYHQFLPHQWRGRFUpGLWR2YDORUSURYLVLRQDGRHPGHGH]HPEURGHpGH5HHPGH

GH]HPEUR GH p GH 5 2 TXDGUR DEDL[R GHPRQVWUD D

PRYLPHQWDomRGRVDOGRGHSUrPLRVDUHFHEHUHQWUHGHGH]HPEUR

GHHGHGH]HPEURGH

3UrPLRVSHQGHQWHVHPGHGH]HPEURGH

496

3UrPLRVHPLWLGRVOtTXLGRV

&REUDGRV&DQFHODGRV

5HGXomRDR9DORU5HFXSHUiYHO

3UrPLRVSHQGHQWHVHPGHGH]HPEURGH

259

DIÁRIO OFICIAL DA INDÚSTRIA E COMÉRCIO

$FRPSRVLomRGRVSUrPLRVDUHFHEHUSRUGHFXUVRGHSUD]RHVWiGHPRQVWUDGDQRTXDGURDEDL[R

Prêmios a Receber

12/2014

12/2013

12/2014

12/2013

12/2014

12/2013

3UrPLRV9HQFLGRV

3UrPLRV9LQFHQGRV

5HGXomRDR9DORU5HFXSHUiYHO

'HDGLDV

'HDGLDV

'HDGLDV

'HDGLDV

'HDGLDV

6XSHULRUDGLDV

Total

991

1.314

14

6

746

824

9DORUHVDUHFHEHU±3UHYLGrQFLD&RPSOHPHQWDU2VYDORUHVDUHFHEHUUHJLVWUDGRVQHVVDUXEULFDVmRGHFRUUHQWHVGDVFRQWULEXLo}HV

DUHFHEHUGHSDUWLFLSDQWHVGHDFRUGRFRPDVFRQGLo}HVSDUWLFXODUHVGHFDGDSODQRHYDORUHVDUHFHEHUGHyUJmRVDYHUEDGRUHVFXMRYDORU

HPGHGH]HPEURGHpGH55HP

&RQWULEXLo}HVSHQGHQWHVHPGHGH]HPEURGH

&RQWULEXLo}HVHPLWLGDVOtTXLGDV

&REUDGRV&DQFHODGRV

3''

&RQWULEXLo}HVSHQGHQWHVHPGHGH]HPEURGH

$FRPSRVLomRGDVFRQWULEXLo}HVDUHFHEHUSRUGHFXUVRGHSUD]RHVWiGHPRQVWUDGDQRTXDGURDEDL[R

&RQWULEXLo}HVD5HFHEHU

12/2014

12/2013

12/2014

12/2013

12/2014

12/2013

&RQWULEXLo}HV9HQFLGDV &RQWULEXLo}HV9LQFHQGDV

5HGXomRDR9DORU5HFXSHUiYHO

'HDGLDV

'HDGLDV

'HDGLDV

'HDGLDV

'HDGLDV

6XSHULRUDGLDV

Total

2.410

2.251

1.816

1.295

7tWXORVHFUpGLWRVDUHFHEHU$FRPSRVLomRGRVWtWXORVHFUpGLWRVDUHFHEHUHPGHGH]HPEURGHHGHGH]HPEURGH

HVWiGHPRQVWUDGDQRTXDGURDEDL[R

12/2014

12/2013

9DORUHVDUHFHEHUGHVRFLHGDGHVOLJDGDV

9DORUHVDUHFHEHUGHRXWUDVLQVWLWXLo}HV

'HSyVLWRVMXGLFLDLVH¿VFDLV

'LUHLWRVGHUHVXOWDGRQDYHQGDGHLPyYHLV

&UpGLWRVWULEXWiULRVHSUHYLGHQFLiULRV

$GLDQWDPHQWRVREUHIROKDGHVDOiULR

$GLDQWDPHQWRDGPLQLVWUDWLYR

6DOGRVEDQFiULRVEORTXHDGRV

2XWURV

Total

6.003

5.186

&LUFXODQWH

1mR&LUFXODQWH

,QYHVWLPHQWRV2VLQYHVWLPHQWRVHVWmRFRPSRVWRVFRPRVHJXH

12/2014

12/2013

7D[D$QXDOGH'HSUHF &XVWRGHDTXLVLomR 'HSUHFLDomR

Saldo Contábil

Saldo Contábil

'HVFULomR

3DUWLFLSDo}HV6RFLHWiULDV

,QFHQWLYRV)LVFDLV

,PyYHLV

7HUUHQRV

(GL¿FDo}HV

7RWDO

,PRELOL]DGR2LPRELOL]DGRHVWiFRPSRVWRFRPRVHJXH

12/2014

12/2013

7D[D$QXDOGH'HSUHF &XVWRGHDTXLVLomR 'HSUHFLDomR 7RWDOGR,PRELOL]DGR 7RWDOGR,PRELOL]DGR

'HVFULomR

(TXLSDPHQWRV(TXLS,QIRUPiWLFD

0yYHLV0iTH8WHQVtOLRV

%HQIHLWRULDV,PyYHLV7HUFHLURV

9HtFXORV

7RWDO

$VEHQIHLWRULDVHPLPyYHLVGHWHUFHLURVVmRDPRUWL]DGDVHPFRQIRUPLGDGHFRPRFRQWUDWRGHDOXJXHORXVHMDFDOFXODGDSHORSHUtRGR

GDGDWDGHDTXLVLomRGDEHQIHLWRULDDWpR¿QDOGRFRQWUDWR$WD[DDSOLFDGDpYDULiYHOGHDFRUGRFRPRSHUtRGRGHYLJrQFLDGRFRQWUDWR

GHDOXJXHOHPFDGD¿OLDO5HVVHJXUR'H¿QLPRVDSROtWLFDGHUHVVHJXURWRPDQGRFRPRSUHPLVVDQRVVDFDSDFLGDGHGHUHWHQomR

SRUULVFRVHJXUDGRHODERUDGDDWUDYpVGHHVWXGRVDWXDULDLV'HVVDGH¿QLomRFRQVWDPRVULVFRVDUHVVHJXUDUOLVWDGRV5HVVHJXUDGRUHV

HJUDXGHFRQFHQWUDomR2VFRQWUDWRVGHUHVVHJXURDXWRPiWLFRVVmR¿UPDGRVHUHQRYDGRVFRPSHULRGLFLGDGHDQXDODOpPGRVWHUPRV

facultativos, consideram condições proporcionais, de forma a reduzir a exposição a riscos isolados. A seguradora atua nos segmentos

de seguro de pessoas e de previdência privada, garantindo através de seus contratos a entrega de um capital ou renda, ao segurado

ou a terceiro, no caso de realização dos riscos segurados relativos à vida humana. 'HSyVLWRVGHWHUFHLURVAs contas registradas

HPGHSyVLWRVGHWHUFHLURVVmRFRPSRVWDVSRUYDORUHVUHFHELGRVHIHWLYDPHQWHHDLQGDQmREDL[DGRVFRQ¿JXUDQGRXPDFRQWDWUDQVLWyULD

RQGHVmRUHJLVWUDGDVDVRSHUDo}HVGHFREUDQoDGHSUrPLRVHEHQHItFLRVGD&RPSDQKLD2VDOGRWRWDOUHJLVWUDGRQHVVHJUXSRHPGH

GH]HPEURGHpGH55HPGHGH]HPEURGH

$FLRQLVWD&RQWD'HSyVLWR Prêmios e Emol. Recebidos 9DORUHVD5HFODV3UHYLG&RPSOHP 2XWURV'HSyVLWRV

12/2014

12/2013

12/2014

12/2013

12/2014

12/2013 12/2014 12/2013

'HDGLDV

'HDGLDV

'HDGLDV

'HDGLDV

'HDGLDV

6XSHULRUDGLDV

Saldo

370

22

'HWDOKDPHQWRHPRYLPHQWDomRGDVSURYLV}HVWpFQLFDV6HJXHDPRYLPHQWDomRGDVSURYLV}HVWpFQLFDVUHIHUHQWHDRDQRGH

0RYLPHQWDomRGDVSURYLV}HVWpFQLFDVEUXWDVGHUHVVHJXUR3UHYLGrQFLD9*%/H9LGD,QGLYLGXDO

3URYLVmR

6DOGRHP 5HYHUVmR &RQVWLWXLomR 3DJDPHQWR~QLFR 6DOGRHP

30%$&

30%&

331*

331*591(

395

,%15

3'$

36/

7RWDO

0RYLPHQWDomRGDVSURYLV}HVWpFQLFDVOtTXLGDVGHUHVVHJXUR3UHYLGrQFLD9*%/H9LGD,QGLYLGXDO

3URYLVmR

6DOGRHP 5HYHUVmR &RQVWLWXLomR 3DJDPHQWR~QLFR 6DOGRHP

30%$&

30%&

331*

331*591(

395

,%15

3'$

36/

7RWDO

0RYLPHQWDomRGDV3URYLV}HV7pFQLFDV6HJXURV%UXWDGH5HVVHJXUR

3URYLVmR

6DOGRHP 5HYHUVmR &RQVWLWXLomR 3DJDPHQWR~QLFR 6DOGRHP

331*

331*591(

36/

,%15

3'5

7RWDO

0RYLPHQWDomRGDV3URYLV}HV7pFQLFDV6HJXURV/tTXLGDGH5HVVHJXUR

3URYLVmR

6DOGRHP 5HYHUVmR &RQVWLWXLomR 3DJDPHQWR~QLFR 6DOGRHP

331*

331*591(

36/

,%15

3'5

7RWDO

'HVHQYROYLPHQWRGHVLQLVWURV2TXDGURGHGHVHQYROYLPHQWRGHVLQLVWURVWHPRREMHWLYRGHDSUHVHQWDURJUDXGHLQFHUWH]DH[LVWHQWH

QDHVWLPDWLYDGRPRQWDQWHGHVLQLVWURVRFRUULGRVQDGDWDGHSXEOLFDomRGREDODQoR3DUWLQGRGRSHUtRGRHPTXHRVLQLVWURRFRUUHXHR

PRQWDQWHHVWLPDGRQHVWHPHVPRSHUtRGRQDSULPHLUDOLQKDGRTXDGURDEDL[RpDSUHVHQWDGRFRPRHVWHPRQWDQWHYDULDQRGHFRUUHUGRV

SHUtRGRVFRQIRUPHVmRREWLGDVLQIRUPDo}HVPDLVSUHFLVDVVREUHDIUHTXrQFLDHVHYHULGDGHGRVVLQLVWURVjPHGLGDTXHRVVLQLVWURVVmR

avisados para a Companhia.

(PPLOKDUHV

7$%(/$'('(6(192/9,0(172'(6,1,67526

0RQWDQWHHVWLPDGRSDUDRVVLQLVWURV MXQ GH] MXQ GH] MXQGH] MXQ GH] MXQ GH] MXQGH]727$/

1R¿QDOGRVHPHVWUHGRDYLVR

8PVHPHVWUHDSyVRDYLVR

'RLVVHPHVWUHVDSyVRDYLVR

7UrVVHPHVWUHVDSyVRDYLVR

4XDWURVHPHVWUHVDSyVRDYLVR

&LQFRVHPHVWUHVDSyVRDYLVR

6HLVVHPHVWUHVDSyVRDYLVR

6HWHVHPHVWUHVDSyVRDYLVR

2LWRVHPHVWUHVDSyVRDYLVR

1RYHVHPHVWUHVDSyVRDYLVR

'H]VHPHVWUHVDSyVRDYLVR

2Q]HVHPHVWUHVDSyVRDYLVR

(VWLPDWLYDFRUUHQWH

3DJDPHQWRVDFXPXODGRVDWpDGDWDEDVH

3DVVLYRUHFRQKHFLGRQREDODQoR

3DVVLYRVFRQWLQJHQWHVD2EULJDo}HVOHJDLV$&RPSDQKLDGHVLVWLXGDVDo}HVMXGLFLDLVUHIHUHQWHVDH[HFXo}HV¿VFDLVUHODWLYDV

DGLYHUVRVWULEXWRVHLQFOXLXRVGpELWRVQRSDUFHODPHQWRGD/HL1mRFRQVWDYDORUHVQHVVDUXEULFDQRH[HUFtFLRGHHQR

H[HUFtFLRGHE3URYLV}HVUHODFLRQDGDVDEHQHItFLRVHVLQLVWURVMXGLFLDLVFtYHLVHWUDEDOKLVWDV%HQHItFLRV6LQLVWURV2V

SURFHVVRVUHODFLRQDGRVDEHQHItFLRVVLQLVWURVHVWmRUHJLVWUDGRVQRJUXSR³3URYLV}HVWpFQLFDV´QDVUXEULFDV³3URYLVmRGH6LQLVWURVD/LTXLGDU´H³3URYLVmRGH6LQLVWURVD/LTXLGDU-XGLFLDLV´UHVSHFWLYDPHQWH5HIHUHPVHjHVWLPDWLYDGHSHUGDVSURYiYHLVHPDo}HVUHIHUHQWHV

DEHQHItFLRVVLQLVWURVGHFRUUHQWHVGRFXUVRQRUPDOGDVRSHUDo}HVFXMDVREULJDo}HVHYDORUHVYrPVHQGRGLVFXWLGRVMXGLFLDOPHQWHSHOD

&RPSDQKLD$$GPLQLVWUDomRFRQVWLWXLDVSURYLV}HVGHDFRUGRFRPRVFULWpULRVHVWDEHOHFLGRVQRSURQXQFLDPHQWRWpFQLFR&3&QGR&RPLWrGH3URQXQFLDPHQWRV&RQWiEHLVFRPEDVHQDRSLQLmRGHVHXVFRQVXOWRUHVMXUtGLFRVQDMXULVSUXGrQFLDQRKLVWyULFRSURFHVVXDOJHUDGR

HPGHPDQGDVDQWHULRUHVQDDQiOLVHGDVGHPDQGDVMXGLFLDLVSHQGHQWHVQDH[SHULrQFLDDQWHULRUUHIHUHQWHjVTXDQWLDVUHLYLQGLFDGDVEHP

FRPRQDLPSRUWkQFLDVHJXUDGDHUHJXODo}HVWpFQLFDV2VDOGRUHJLVWUDGRGHEHQHItFLRVHPGHGH]HPEURGHpGH55

HPGHGH]HPEURGH-iRVDOGRUHJLVWUDGRGHVLQLVWURHPGHGH]HPEURGHpGH55HPGHGH]HPEUR

GH&tYHLV$&RPSDQKLDpSDUWHHPRXWURVSURFHVVRVMXGLFLDLVHPUD]mRGRFXUVRQRUPDOGHVXDVRSHUDo}HV$$GPLQLVWUDomR

DFRPSDQKDRDQGDPHQWRGHVVHVSURFHVVRVHFRPEDVHQDRSLQLmRGHVHXVDVVHVVRUHVOHJDLVSDUDWRGRVDTXHOHVSURFHVVRVFXMRGHVIHFKRGHVIDYRUiYHOpDYDOLDGRFRPRSURYiYHOpFRQVWLWXtGDSURYLVmRSDUDSHUGDHYHQWXDO2VDOGRUHJLVWUDGRHPGHGH]HPEURGHp

GH55HPGHGH]HPEURGH7UDEDOKLVWDV2VSDVVLYRVFRQWLQJHQWHVGHFRUUHQWHVGHOLWtJLRVWUDEDOKLVWDVVmRDSXUDGRV

FRPEDVHQDPpGLDSRQGHUDGDGDVSHUGDVRFRUULGDVQRV~OWLPRVGR]HPHVHVDSOLFDGDVREUHDVFDXVDVHPDEHUWRHTXDQGRDSOLFiYHO

VmRFRPSOHPHQWDGDVSRUSURYLVmRSDUDFDXVDVHVSHFt¿FDV2VDOGRUHJLVWUDGRHPGHGH]HPEURGHpGH55HPGH

GH]HPEURGHF&RPSRVLomRHPRYLPHQWDomRGRVSDVVLYRVFRQWLQJHQWHVHREULJDo}HVOHJDLV$SURYLVmRGDVDo}HVMXGLFLDLV

Continua

DIÁRIO OFICIAL DA INDÚSTRIA E COMÉRCIO

Continuação

HPDQGDPHQWRHPGHGH]HPEURGHHGHGH]HPEURGHVHJXQGRDYDOLDomRGRVDVVHVVRUHVMXUtGLFRVGD&RPSDQKLDp

GHPRQVWUDGDQRTXDGURDEDL[R

12/2014

12/2013

9DORU

9DORU 4XDQWLGDGH

9DORU

9DORU 4XDQWLGDGH

3UREDELOLGDGHGHSHUGD

UHFODPDGR SURYLVLRQDGR

GHDo}HV

UHFODPDGR SURYLVLRQDGR

GHDo}HV

Sinistro

3URYiYHO

3RVVtYHO

Remota

Total

752

155

23

658

45

20

%HQHItFLRV

3URYiYHO

3RVVtYHO

Remota

Total

8.388

3.738

578

7.971

3.105

540

&tYHLV

3URYiYHO

3RVVtYHO

Remota

Total

81.673

100

87

76.729

25

43

7UDEDOKLVWD

3URYiYHO

3RVVtYHO

Remota

Total

2.280

596

22

2.602

451

17

)LVFDLV

$&RPSDQKLDQmRSRVVXLDo}HV¿VFDLVQRVH[HUFtFLRVGH

H2TXDGURDEDL[RGHPRQVWUDDPRYLPHQWDomRGRVDOGRGH

SURYLV}HVMXGLFLDLVHQWUHGHGH]HPEURGHHGHGH]HPEURGHDEUDQJHQGRDVSURYLV}HVFtYHLVWUDEDOKLVWDVH¿VFDLV

6DOGRLQLFLDOHPGHGH]HPEURGH

%DL[D5HYHUVmR

,QFOXV}HV

$WXDOL]Do}HV

6DOGR¿QDOHPGHGH]HPEURGH

2TXDGURDEDL[RGHPRQVWUDDGLVFULPLQDomRGDVSURYLV}HVMXGLFLDLV

GHVLQLVWURVEHQHItFLRVHQWUHGHGH]HPEURGHHGHGH]HPEURGH

HPPLOKDUHV

12/2014 12/2013

6DOGRLQLFLDOGRSHUtRGR

7RWDOSDJRQRSHUtRGR

7RWDOSURYLVLRQDGRGHDo}HVSDJDV

1RYDVFRQVWLWXLo}HVQRSHUtRGREDVH

1RYDVFRQVWLWXLo}HVH[HUFtFLRVDQWHULRUHV

%DL[DSURYLVmRSRUr[LWR

$OWHUDomRGHHVWLPDWLYDV

$WXDOL]DomRPRQHWiULD

6DOGR¿QDOGRSHUtRGR

%HQHItFLRV D HPSUHJDGRV $V REULJDo}HV GH EHQHItFLRV GH

curto prazo para empregados são reconhecidas pelo valor espeUDGRDVHUSDJRHODQoDGDVFRPRGHVSHVDjPHGLGDTXHRVHUYLoR UHVSHFWLYR p SUHVWDGR$ &RPSDQKLD DOpP GRV EHQHItFLRV DRV

HPSUHJDGRV H[LJLGRV SHOR DFRUGR FROHWLYR FRPR WLFNHW UHIHLomR H

DOLPHQWDomRDX[tOLRFUHFKHEDEiYDOHWUDQVSRUWHHSODQRGHDVVLVWrQFLD PpGLFD WDPEpP RIHUHFH DX[tOLR HGXFDomR H DVVLVWrQFLD

RGRQWROyJLFD 3DWULP{QLR OtTXLGR D &DSLWDO VRFLDO 2 FDSLWDO VRFLDO HP GH GH]HPEUR GH p GH 5 H HVWi

UHSUHVHQWDGRSRUDo}HVRUGLQiULDVQRPLQDWLYDVVHPYDORU

QRPLQDO WRGDV SHUWHQFHQWHV D DFLRQLVWDV GRPLFLOLDGRV QR SDtV E

'LYLGHQGRV2VDFLRQLVWDVWrPGLUHLWRDXPGLYLGHQGRREULJDWyULR

QmRLQIHULRUDGROXFUROtTXLGRGRH[HUFtFLRDMXVWDGRGHDFRUGR

FRPDOHLVRFLHWiULDHRHVWDWXWR1RH[HUFtFLRGHROXFURGR

H[HUFtFLRIRLWRWDOPHQWHDEVRUYLGRSHORV3UHMXt]RV$FXPXODGRVF

5HVHUYDOHJDO&RQVWLWXtGDDR¿QDOGRH[HUFtFLRQDIRUPDSUHYLVWDQDOHJLVODomRVRFLHWiULDEUDVLOHLUDSRGHQGRVHUXWLOL]DGDSDUDD

FRPSHQVDomR GH SUHMXt]RV RX SDUD DXPHQWR GH FDSLWDO VRFLDO G

5HVHUYD HVWDWXWiULD Conforme previsto no artigo 30, parágrafo

1o, do Estatuto Social a parcela remanescente dos lucros anuais,

QmR GHVWLQDGD j FRQVWLWXLomR GD UHVHUYD OHJDO H D GLVWULEXLomR GH

dividendos, é transferida à conta de reserva estatutária. H/XFUR

SUHMXt]RSRUDomR$WDEHODDVHJXLUHVWDEHOHFHRFiOFXORGROXFUR

OtTXLGRSUHMXt]RSRUDomRSDUDRVH[HUFtFLRV¿QGRVHPH

HPPLOKDUHVH[FHWRROXFUROtTXLGRSUHMXt]RSRUDomR

12/2014 12/2013

/XFUR/tTXLGR3UHMXt]RGRSHUtRGR

4XDQWLGDGHGHDo}HV

3UHMXt]ROXFURSRUDomR±EiVLFRHGLOXtGRHP5

I 3DWULP{QLR OtTXLGR DMXVWDGR 3/$ PDUJHP GH VROYrQFLD H

H[LJrQFLDGHFDSLWDO(PGHGH]HPEURGHRFiOFXORGR

FDSLWDO PtQLPR UHTXHULGR p FDOFXODGR FRQIRUPH UHTXHULPHQWRV GD

5HVROXomR&163GHGHGH]HPEURGH

3$75,0Ð1,2/Ë48,'2$-867$'2

12/2014 12/2013

3DWULP{QLR/tTXLGR

'HVSHVDV$QWHFLSDGDV

&UpGLWRV7ULEXWiULRV

$WLYRV,QWDQJtYHLV

3DUWLFHP6RF)LQDQF

$WLYR'LIHULGR

3DWULP{QLR/tTXLGR$MXVWDGR

0$5*(0'(62/9Ç1&,$

3UrPLRV5HWLGRV~OWLPRVPHVHV

6LQLVWURV5HWLGRV~OWLPRVPHVHV

0DUJHPGH6ROYrQFLDD

&$3,7$/%$6(&%E

&$3,7$/'(5,6&2

&DSLWDOGHVXEVFULomR&5VXEV

&DSLWDOGHFUpGLWR&5FUHG

&DSLWDORSHUDFLRQDO&URSHU

&RUUHODomR

&DSLWDOGHULVFR&5F

&$3,7$/0Ë1,025(48(5,'2

3DWULPRQLR/tTXLGR$MXVWDGR

([LJrQFLDGH&DSLWDO(&PDLRUHQWUHDERXF

- 15.000

([LJrQFLDGH&DSLWDO(&PDLRUHQWUHERXF 15.000

6X¿FLrQFLD,QVX¿FLrQFLDGH&DSLWDO5

6X¿FLrQFLD,QVX¿FLrQFLDGH&DSLWDOGD(& $WLYRV/tTXLGRV/LYUHV

GR&05

/LTXLGH]HPUHODomRDR&05

17. Transações com partes relacionadas: A Investprev realiza

RSHUDo}HVFRPHPSUHVDVLQWHJUDQWHVGRJUXSR¿QDQFHLURDVTXDLV

HVWmRGHPRQVWUDGDVFRQIRUPHTXDGURDEDL[R

12/2014

12/2013

$WLYR 5HFHLWD

$WLYR 5HFHLWD

3DVVLYR 'HVSHVD3DVVLYR 'HVSHVD

%DQFR5XUDO6$

'LVSRQtYHO

7tWXORVH&UpGLWRVD5HFHEHU

2EULJDo}HVD3DJDU

2XWUDV5HFHLWDV2SHUDFLRQDLV

103

,QYHVWSUHY6HJXUDGRUD6$

7tWXORVH&UpGLWRVD5HFHEHU

2EULJDo}HVD3DJDU

2XWUDV5HFHLWDV2SHUDFLRQDLV

2.130

563UHYLGrQFLD

7tWXORVH&UpGLWRVD5HFHEHU

2EULJDo}HVD3DJDU

5HIHUHVHjVFRQWDVFRUUHQWHVEDQFiULDVTXHD&RPSDQKLDSRVVXLQR%DQFR5XUDO6$5HVVDUFLPHQWRGHGHVSHVDVSDUDD56

Previdência, em função da transferência da carteira (ocorrida em

DEULOGHLRemuneração do pessoal chave da Administração

$ &RPSDQKLD QmR SRVVXL EHQHItFLRV GH FXUWR H ORQJR SUD]R GH

UHVFLVmRGHFRQWUDWRGHWUDEDOKRRXUHPXQHUDomRSDUDVHXSHVVRDO

chave da Administração. ii. 2XWUDVLQIRUPDo}HV - Conforme legislação em vigor, sociedades seguradoras, entidade de previdência e

sociedades de capitalização não podem conceder empréstimos ou

DGLDQWDPHQWRV SDUD D 'LUHWRUHV H PHPEURV GRV FRQVHOKRV FRQVXOWLYRV RX DGPLQLVWUDWLYR ¿VFDLV H VHPHOKDQWHV EHP FRPR VHXV

F{QMXJHVHUHVSHFWLYRVSDUHQWHVDWpRJUDXE3HVVRDVItVLFDV

RX MXUtGLFDV TXH SDUWLFLSHP GH VHX FDSLWDO FRP PDLV GH F

3HVVRDVMXUtGLFDVGHFXMRFDSLWDOSDUWLFLSHPFRPPDLVGHGD

SUySULD&RPSDQKLDTXDLVTXHUGLUHWRUHVRXDGPLQLVWUDGRUHVGDSUySULD&RPSDQKLDEHPFRPRVHXVF{QMXJHVHUHVSHFWLYRVSDUHQWHV

DWpRJUDX'HVVDIRUPDQmRIRUDPHIHWXDGRVSHOD&RPSDQKLD

HPSUpVWLPRVRXDGLDQWDPHQWRVDTXDOTXHUVXEVLGLiULDPHPEURVGR

&RQVHOKRGH$GPLQLVWUDomRRXGD'LUHWRULDHVHXVIDPLOLDUHV

'HWDOKDPHQWRGHFRQWDVGRUHVXOWDGRD5DPRVGHDWXDomRHtQGLFHVGHVLQLVWUDOLGDGHHFRPHUFLDOL]DomR

ËQGLFHGH

ËQGLFHGH

3UrPLRVJDQKRV Sinistros retidos

Sinistralidade

comissionamento

Ramos

12/2014 12/2013 12/2014 12/2013

12/2014

12/2013

12/2014

12/2013

±3UHVWDPLVWD

±$3,QGLYLGXDO

±$3&ROHWLYR

±9LGDLQGLYLGXDO

±9LGDHPJUXSR

2XWURV

±'39$7

Pecúlio

Total

38.699

11.909 E6LQLVWURV

,QGHQL]Do}HVDYLVDGDV

'HVSHVDVFRPVLQLVWURV

9DULDomRGDVSURYLV}HVGHVLQLVWURV

RFRUULGRVPDVQmRDYLVDGRV

'HVSHVDVFRPEHQHItFLRV

Provisão de eventos ocorridos mas

QmRDYLVDGRV3HQVmRSHF~OLRLQYDOLGH]

Total

F&XVWRGHDTXLVLomR

3UHYLGrQFLD

'HVSHVDVGHFRUUHWDJHPDJHQFLDPHQWR

'HVSHVDVGHFXVWHDPHQWRGHYHQGDV

2XWUDVGHVSHVDVGHFRPHUFLDOL]DomR

Total

12/2014 12/2013 6HJXURV

12/2014 12/2013

&RPLVV}HV9*%/

Total

12/2014 12/2013

G'HVSHVDVDGPLQLVWUDWLYDV

'HVSHVDVFRP3HVVRDO3UySULR

'HVSHVDVFRP6HUYLoRVGH7HUFHLURV

'HVSHVDVFRP/RFDOL]DomRH)XQFLRQDPHQWR

'HVSHVDVFRP3XEOLFLGDGHH3URSDJDQGDV

'HVSHVDVFRP3XEOLFDo}HV

12/2014 12/2013

'HVSHVDVFRP'RQDWLYRVH&RQWULEXLo}HV

2XWUDV

(1.306)

- 'HVSHVDV$GPLQLVWUDWLYDVGR&RQYrQLR'SYDW

Total

Porto Alegre, sexta-feira, 27 de fevereiro de 2015

H'HVSHVDVFRPWULEXWRV

'HVSHVDVFRP,PSRVWRV)HGHUDLV

'HVSHVDVFRP,PSRVWRV(VWDGXDLV

'HVSHVDVFRP,PSRVWRV0XQLFLSDLV

'HVSHVDVFRP&2),16

'HVSHVDVFRP3,63$6(3

'HVSHVDVFRP&RQWULEXLomR6LQGLFDO

'HVSHVDVFRP7D[DGH)LVFDOL]DomR686(3

12/2014 12/2013

I5HVXOWDGR)LQDQFHLUR

5HFHLWDV)LQDQFHLUDV

5HFHLWDGH$SOLFDo}HVQR0HUFDGR$EHUWR

5HFHLWDFRP7tWXORVGH5HQGD)L[D3ULYDGRV

5HFHLWDFRP7tWXORVGH5HQGD)L[D3~EOLFRV

5HFHLWDFRP7tWXORVGH5HQGD9DULiYHO

5HFHLWDFRP2SHUDo}HVGH6HJXURV

5HFHLWDFRP&UpGLWRV7ULEXWiULRV

5HFHLWDV)LQDQFHLUDV±&RQVyUFLR'SYDW

5HFHLWDVFRP'HSyVLWRV-XGLFLDLVH)LVFDLV

5HFHLWDVFRP)XQGRVGH,QYHVWLPHQWR

Receitas Financeiras – Previdência Complementar

Receitas Financeiras Eventuais

2

2

7RWDO5HFHLWDV)LQDQFHLUDV

8.396

3.974

'HVSHVDV)LQDQFHLUDV

'HVSHVDVF7tWXORVGH5HQGD9DULiYHO

'HVSHVDV)LQDQFF5HQGD)L[D

'HVSHVDV)LQDQF3URY6LQ/LTXLGDU

'HVSHVDV)LQDQF5HVVHJXUR&HGLGR

'HVSHVDV)LQDQF3URY7pF9LGD&REHUW6REUHY

'HVSHVDV)LQDQF3URY7pF3UHY

&RPSOHP3ODQRV%ORT

'HVSHVDV)LQDQF3URY7pF3UHY

&RPSO3ODQR1mR%ORT

57

(QFDUJRVVREUH7ULEXWRV

2XWUDV'HVSHVDV)LQDQFHLUDV

'HVSHVDV)LQDQFHLUDV6HJXURV

'HVSHVDV)LQDQFHLUDV±&RQVyUFLR'SYDW

(11)

7RWDO'HVSHVDV)LQDQFHLUDV

7RWDO5HVXOWDGR)LQDQFHLUR

J*DQKRVRXSHUGDVFRPDWLYRVQmRFRUUHQWHV

Ganhos ou perdas com ativos não correntes

12/2014 12/2013

5HVXOWDGRQDDOLHQDomRGHEHQVGRDWLYRSHUPDQHQWH Resultado de outras operações

Ganho com ativos não correntes

K ,PSRVWR GH UHQGD H FRQWULEXLomR VRFLDO 2 LPSRVWR GH UHQGD

H D FRQWULEXLomR VRFLDO FDOFXODGRV FRP EDVH QDV DOtTXRWDV R¿FLDLV

estão reconciliados para os valores reconhecidos nas demonstrações

GRUHVXOWDGRFRPRVHJXH

12/2014

12/2013

'HVFULomR

,53- &6// ,53- &6//

Resultado antes do imposto de

UHQGDFRQWULEXLomRVRFLDOH

SDUWLFLSDomRQRVUHVXOWDGRV

'HVSHVDVQmRGHGXWtYHLV

5HFHLWDVQmRWULEXWiYHLV

%DVHGHFiOFXORDQWHVGDV

FRPSHQVDo}HV

&RPSHQVDo}HV

,PSRVWRGHUHQGD

,PSRVWRGHUHQGD±DOtTXRWD

DGLFLRQDO

&RQWULEXLomRVRFLDO

'HGXomRGRVLQFHQWLYRV¿VFDLV Total

271

129

3RUWR$OHJUHGHIHYHUHLURGH

'LUHWRULD([HFXWLYD

*HUDOGR+HQULTXHGH&DVWUR

'LUHWRU3UHVLGHQWH

Contadora Responsável

/XFLDQD0DULD2XULTXH3HL[RWR

&5&56±2

)OiYLR7DERDGD

'LUHWRU9LFH3UHVLGHQWH

/XFLDQR*UDQHWR9LHLUD

'LUHWRU

Atuário Responsável

&DUORV+HQULTXH5DGDQRYLWVFN

0,%$±

3DUHFHUGRV$XGLWRUHV$WXDULDLV,QGHSHQGHQWHV

$RV$GPLQLVWUDGRUHVH$FLRQLVWDVGD,QYHVWSUHY6HJXURVH3UHYLGrQFLD6$

([DPLQDPRV DV SURYLV}HV WpFQLFDV UHJLVWUDGDV QDV GHPRQVWUDo}HV ¿QDQFHLUDV H RV GHPRQVWUDWLYRV GR FDSLWDO PtQLPR GD VROYrQFLD H

GRVOLPLWHVGHUHWHQomRGD,QYHVWSUHY6HJXURVH3UHYLGrQFLD6$³&RPSDQKLD´HPHODERUDGRVVREDUHVSRQVDELOLGDGHGH

VXD$GPLQLVWUDomRHPFRQIRUPLGDGHFRPRVSULQFtSLRVDWXDULDLVGLYXOJDGRVSHOR,QVWLWXWR%UDVLOHLURGH$WXiULD±,%$HFRPDVQRUPDVGD

6XSHULQWHQGrQFLDGH6HJXURV3ULYDGRV±686(3

5HVSRQVDELOLGDGHGD$GPLQLVWUDomRA Administração da Companhia é responsável pelas provisões técnicas registradas nas demonstrao}HV¿QDQFHLUDVHSHORVGHPRQVWUDWLYRVGHFDSLWDOPtQLPRGDVROYrQFLDHGRVOLPLWHVGHUHWHQomRHODERUDGRVGHDFRUGRFRPRVSULQFtSLRV

DWXDULDLVGLYXOJDGRVSHOR,QVWLWXWR%UDVLOHLURGH$WXiULD±,%$HFRPDVQRUPDVGD6XSHULQWHQGrQFLDGH6HJXURV3ULYDGRV±686(3HSHORV

FRQWUROHVLQWHUQRVTXHHODGHWHUPLQRXVHUHPQHFHVViULRVSDUDSHUPLWLUDVXDHODERUDomROLYUHGHGLVWRUomRUHOHYDQWHLQGHSHQGHQWHPHQWH

se causada por fraude ou erro.

5HVSRQVDELOLGDGH GD $XGLWRULD ,QGHSHQGHQWH 1RVVD UHVSRQVDELOLGDGH p D GH H[SUHVVDU XPD RSLQLmR VREUH DV SURYLV}HV WpFQLFDV

UHJLVWUDGDVQDVGHPRQVWUDo}HV¿QDQFHLUDVHRVGHPRQVWUDWLYRVGRFDSLWDOPtQLPRGDVROYrQFLDHGRVOLPLWHVGHUHWHQomRFRPEDVHHP

QRVVDDXGLWRULDDWXDULDOFRQGX]LGDGHDFRUGRFRPRVSULQFtSLRVDWXDULDLVHPLWLGRVSHOR,QVWLWXWR%UDVLOHLURGH$WXiULD±,%$(VWHVSULQFtSLRV

DWXDULDLVUHTXHUHPTXHDDXGLWRULDDWXDULDOVHMDSODQHMDGDHH[HFXWDGDFRPRREMHWLYRGHREWHUVHJXUDQoDUD]RiYHOGHTXHDVSURYLV}HV

WpFQLFDVUHJLVWUDGDVQDVGHPRQVWUDo}HV¿QDQFHLUDVHRVGHPRQVWUDWLYRVGRFDSLWDOPtQLPRGDVROYrQFLDHGRVOLPLWHVGHUHWHQomRHVWmR

livres de distorção relevante.

8PDDXGLWRULDDWXDULDOHQYROYHDH[HFXomRGHSURFHGLPHQWRVVHOHFLRQDGRVSDUDREWHQomRGHHYLGrQFLDDUHVSHLWRGRVYDORUHVGDVSURYLV}HVWpFQLFDVUHJLVWUDGDVQDVGHPRQVWUDo}HV¿QDQFHLUDVHGRVGHPRQVWUDWLYRVGRFDSLWDOPtQLPRGDVROYrQFLDHGRVOLPLWHVGHUHWHQomR

2VSURFHGLPHQWRVVHOHFLRQDGRVGHSHQGHPGRMXOJDPHQWRGRDWXiULRLQFOXLQGRDDYDOLDomRGRVULVFRVGHGLVWRUomRUHOHYDQWHLQGHSHQGHQWHPHQWHVHFDXVDGDSRUIUDXGHRXHUUR1HVVDVDYDOLDo}HVGHULVFRRDWXiULRFRQVLGHUDRVFRQWUROHVLQWHUQRVUHOHYDQWHVSDUDRFiOFXORH

HODERUDomRGDVSURYLV}HVWpFQLFDVUHJLVWUDGDVQDVGHPRQVWUDo}HV¿QDQFHLUDVHGRVGHPRQVWUDWLYRVGRFDSLWDOPtQLPRGDVROYrQFLDHGRV

OLPLWHVGHUHWHQomRGD&RPSDQKLDSDUDSODQHMDUSURFHGLPHQWRVGHDXGLWRULDDWXDULDOTXHVmRDSURSULDGRVQDVFLUFXQVWkQFLDVPDVQmRSDUD

¿QVGHH[SUHVVDUXPDRSLQLmRVREUHDHIHWLYLGDGHGHVVHVFRQWUROHVLQWHUQRVGD&RPSDQKLD

$FUHGLWDPRVTXHDHYLGrQFLDGHDXGLWRULDREWLGDpVX¿FLHQWHHDSURSULDGDSDUDIXQGDPHQWDUQRVVDRSLQLmRGHDXGLWRULDDWXDULDO

%DVHSDUD2SLQLmR$&RPSDQKLDPHQFLRQRXQD1RWDQDFHUFDGRVLQYHVWLPHQWRVTXHHVWiID]HQGRSDUDPHOKRULDGRVVHXVVLVWHPDV

GHLQIRUPDomRHPSURGXomRDSDUWLUGHDEULO$VEDVHVGHGDGRVXWLOL]DGDVSDUDWHVWDUDFRQVLVWrQFLDGDVSURYLV}HVGHVLQLVWURVD

OLTXLGDU36/HGHVLQLVWURVRFRUULGRVHQmRDYLVDGRV,%15DVVLPFRPRGDVSURYLV}HVGHEHQHItFLRVDFRQFHGHU30%$&HGHUHVJDWHVH

RXWURVYDORUHVDUHJXODUL]DU395UHODFLRQDGDVjVRSHUDo}HVGHSUHYLGrQFLDWUDGLFLRQDOQmRGHPDQGDUDPDTXDOL¿FDomRQHFHVViULDHP

UHODomRDGHWHUPLQDGRVSHUtRGRVPDLVSUHWpULWRVFXMDPHOKRULDMiVHSRGHREVHUYDU

2SLQLmR(PQRVVDRSLQLmRDVSURYLV}HVWpFQLFDVUHJLVWUDGDVQDVGHPRQVWUDo}HV¿QDQFHLUDVFRPH[FHomRGRPHQFLRQDGRQRSDUiJUDIR

DQWHULRUHRVGHPRQVWUDWLYRVGRFDSLWDOPtQLPRGDVROYrQFLDHGRVOLPLWHVGHUHWHQomRGD&RPSDQKLDHPGHGH]HPEURGHIRUDP

HODERUDGRVHPWRGRVRVDVSHFWRVUHOHYDQWHVGHDFRUGRFRPDVQRUPDVHRULHQWDo}HVHPLWLGDVSHORVyUJmRVUHJXODGRUHVHSHOR,QVWLWXWR

%UDVLOHLURGH$WXiULD±,%$3RUWR$OHJUHGHIHYHUHLURGH

(GHU*HUVRQ$JXLDUGH2OLYHLUD$WXiULR0,%$

$78È5,$%5$6,/$VVHVVRULD&RQVXOWRULDH$XGLWRULD66/WGD&,%$

&13-5XD*HQHUDO&kPDUDQ&RQM±32$56

5HODWyULRGRV$XGLWRUHV,QGHSHQGHQWHVVREUHDV'HPRQVWUDo}HV)LQDQFHLUDV

$RV'LUHWRUHVH$FLRQLVWDVGD

GDV GHPRQVWUDo}HV ¿QDQFHLUDV GD &RPSDQKLD SDUD SODQHMDU RV

,QYHVW3UHY6HJXURVH3UHYLGrQFLD6$

SURFHGLPHQWRVGHDXGLWRULDTXHVmRDSURSULDGRVQDVFLUFXQVWkQFLDV

([DPLQDPRV DV GHPRQVWUDo}HV ¿QDQFHLUDV GD ,QYHVW3UHY PDVQmRSDUD¿QVGHH[SUHVVDUXPDRSLQLmRVREUHDH¿FiFLDGHVVHV

6HJXURV H 3UHYLGrQFLD 6$ ³&RPSDQKLD´ TXH FRPSUHHQGHP R FRQWUROHV LQWHUQRV GD &RPSDQKLD 8PD DXGLWRULD LQFOXL WDPEpP

EDODQoRSDWULPRQLDOHPGHGH]HPEURGHHDVUHVSHFWLYDV D DYDOLDomR GD DGHTXDomR GDV SUiWLFDV FRQWiEHLV XWLOL]DGDV H D

GHPRQVWUDo}HV GR UHVXOWDGR GDV PXWDo}HV GR SDWULP{QLR OtTXLGR UD]RDELOLGDGH GDV HVWLPDWLYDV FRQWiEHLV IHLWDV SHOD $GPLQLVWUDomR

H GRV ÀX[RV GH FDL[D SDUD R VHPHVWUH ¿QGR QDTXHOD GDWD DVVLP EHP FRPR D DYDOLDomR GD DSUHVHQWDomR GDV GHPRQVWUDo}HV

FRPR R UHVXPR GDV SULQFLSDLV SUiWLFDV FRQWiEHLV H GHPDLV QRWDV ¿QDQFHLUDVWRPDGDVHPFRQMXQWR

explicativas.

$FUHGLWDPRV TXH D HYLGrQFLD GH DXGLWRULD REWLGD p VX¿FLHQWH H

5HVSRQVDELOLGDGHGD$GPLQLVWUDomRVREUHDV'HPRQVWUDo}HV apropriada para fundamentar nossa opinião.

)LQDQFHLUDV A administração da Companhia é responsável pela 2SLQLmR VHP UHVVDOYD Em nossa opinião, as demonstrações

HODERUDomR H DGHTXDGD DSUHVHQWDomR GHVVDV GHPRQVWUDo}HV ¿QDQFHLUDVDQWHULRUPHQWHUHIHULGDVDSUHVHQWDPDGHTXDGDPHQWHHP

¿QDQFHLUDVGHDFRUGRFRPDVSUiWLFDVFRQWiEHLVDGRWDGDVQR%UDVLO WRGRV RV DVSHFWRV UHOHYDQWHV D SRVLomR SDWULPRQLDO H ¿QDQFHLUD GD

aplicáveis às entidades supervisionadas pela Superintendência ,QYHVW3UHY6HJXURVH3UHYLGrQFLD6$HPGHGH]HPEURGH

GH 6HJXURV 3ULYDGRV ± 686(3 H SHORV FRQWUROHV LQWHUQRV TXH RGHVHPSHQKRGHVXDVRSHUDo}HVHRVVHXVÀX[RVGHFDL[DSDUDR

HOD GHWHUPLQRX FRPR QHFHVViULRV SDUD SHUPLWLU D HODERUDomR H[HUFtFLR ¿QGR QDTXHOD GDWD GH DFRUGR FRP DV SUiWLFDV FRQWiEHLV

GH GHPRQVWUDo}HV ¿QDQFHLUDV OLYUHV GH GLVWRUomR UHOHYDQWH adotadas no Brasil aplicáveis às entidades supervisionadas pela

independentemente se causada por fraude ou erro.

6XSHULQWHQGrQFLDGH6HJXURV3ULYDGRV±686(3

5HVSRQVDELOLGDGH GRV $XGLWRUHV ,QGHSHQGHQWHV 1RVVD ÇQIDVH2FRQWUROHDFLRQiULRGDFRPSDQKLDpGHWLGRSHOR%DQFR5XUDO

UHVSRQVDELOLGDGH p D GH H[SUHVVDU XPD RSLQLmR VREUH HVVDV 6$ ± (0 /,48,'$d2 (;75$-8',&,$/$VVLP R /LTXLGDQWH GR

GHPRQVWUDo}HV ¿QDQFHLUDV FRP EDVH HP QRVVD DXGLWRULD Banco Rural S.A. – E.L.E, foi autorizado pelo Banco Central do Brasil

FRQGX]LGD GH DFRUGR FRP DV QRUPDV EUDVLOHLUDV H LQWHUQDFLRQDLV a alienar a participação acionária detida na companhia, através de um

GH DXGLWRULD (VVDV QRUPDV UHTXHUHP R FXPSULPHQWR GH OHLOmRS~EOLFRDVHUGHVLJQDGR

H[LJrQFLDVpWLFDVSHORVDXGLWRUHVHTXHDDXGLWRULDVHMDSODQHMDGD 2XWURV DVVXQWRV 2V YDORUHV FRUUHVSRQGHQWHV DR H[HUFtFLR ¿QGRV

HH[HFXWDGDFRPRREMHWLYRGHREWHUVHJXUDQoDUD]RiYHOGHTXHDV HPGHGH]HPEURGHDSUHVHQWDGRVSDUD¿QVGHFRPSDUDomR

GHPRQVWUDo}HV¿QDQFHLUDVHVWmROLYUHVGHGLVWRUomRUHOHYDQWH8PD IRUDP SRU QyV DXGLWDGRV FRQIRUPH UHODWyULR GH DXGLWRULD HPLWLGR

auditoria envolve a execução de procedimentos selecionados para HP GH IHYHUHLUR GH FRQWHQGR rQIDVH TXDQWR D ,QWHUYHQomR

REWHQomR GH HYLGrQFLD D UHVSHLWR GRV YDORUHV H GDV GLYXOJDo}HV ([WUDMXGLFLDO GHFUHWDGDSHOD6XSHULQWHQGrQFLDGH6HJXURV3ULYDGRV

DSUHVHQWDGRV QDV GHPRQVWUDo}HV ¿QDQFHLUDV 2V SURFHGLPHQWRV SRUPHLRGD3RUWDULD686(3QQRSHUtRGRGHGHDJRVWRGH

VHOHFLRQDGRV GHSHQGHP GR MXOJDPHQWR GR DXGLWRU LQFOXLQGR D iGHIHYHUHLURGH

avaliação dos riscos de distorção relevante nas demonstrações

3RUWR$OHJUH56GHIHYHUHLURGH

¿QDQFHLUDV LQGHSHQGHQWHPHQWH VH FDXVDGD SRU IUDXGH RX HUUR

1HVVD DYDOLDomR GH ULVFRV R DXGLWRU FRQVLGHUD RV FRQWUROHV -RVp$OELQR)LORPHQD

LQWHUQRV UHOHYDQWHV SDUD D HODERUDomR H DGHTXDGD DSUHVHQWDomR &5&56&90

&RQWDGRU&5&56

1444832

Baixar