SECOND SUPPLEMENT (dated 23 January 2013) to the BASE PROSPECTUS (dated 4 October 2012) As supplemented by the first supplement to the Base Prospectus dated 2 November 2012 BANIF – BANCO INTERNACIONAL DO FUNCHAL, S.A. (incorporated with limited liability in Portugal) BANIF FINANCE, LTD. (incorporated with limited liability in the Cayman Islands) EUR 2,500,000,000 Euro Medium Term Note Programme This supplement dated 23 January 2013 (the “Second Supplement”) to the Base Prospectus dated 4 October 2012, as supplemented by the first supplement to the Base Prospectus dated 2 November 2012 (the “Base Prospectus”), constitutes a supplement to the Base Prospectus, in the meaning of article 16 of Directive 2003/71/EC, as amended, prepared in connection with the Euro Medium Term Note 1 Programme (the “Programme”) established by Banif – Banco Internacional do Funchal, S.A. and Banif Finance, Ltd. (the “Issuers”, fully identified in the Base Prospectus). Terms defined in the Base Prospectus have the same meaning when used in this Second Supplement. Banif – Banco Internacional do Funchal, S.A., with head office at Rua de João Tavira, no. 30, 9004-509 Funchal, Portugal, the members of its Board of Directors, the members of its Audit Board and its Statutory Auditor, and Banif Finance, Ltd., with head office at the offices of Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands, and the members of its Board of Directors (see Boards and Officers of Banif), have taken all reasonable care to ensure that the information contained in the Base Prospectus, as supplemented by this Second Supplement, is, to the best of their knowledge, in accordance with the facts and contains no omission likely to affect its import and accepts responsibility accordingly. This Second Supplement is supplemental to, and should be read in conjunction with, the Base Prospectus. To the extent that there is any inconsistency between any statement in this Second Supplement and any other statement in or incorporated by reference in the Base Prospectus, the statements in this Second Supplement will prevail. Save as disclosed in this Second Supplement, no other significant new factor, material mistake or inaccuracy relating to information included in the Base Prospectus has arisen or been noted, as the case may be, since the last date on which the Base Prospectus has been supplemented. Investors in an existing offer of Notes who have already agreed to purchase or subscribe for Notes before this Second Supplement is published have the right, exercisable until 25 January 2013, which is two working days after the publication of this Second Supplement, to withdraw their acceptances. This Second Supplement is available for viewing in the following websites: Website of the issuer: www.banif.pt; Website of the Luxembourg Stock Exchange: www.bourse.lu. 2 I. GENERAL AMENDMENTS 1. This Second Supplement dated 23 January 2013 shall be referred to together with the Base Prospectus. II. COVER PAGE 2. The cover page, third paragraph shall be amended and replaced by the following: “Banif has been assigned a long-term debt rating of B2 with a under review outlook from Moody’s Investors Service España S.A. (“Moody’s”) and BB with a negative outlook from Fitch Ratings España S.A.U. (“Fitch”). Notes issued under the Programme have been rated (P)B2 (senior unsecured notes) and P(Not Prime) (short-term notes) by Moody’s and BB (long-term senior notes) and B (short-term senior notes) by Fitch, respectively. Each of Moody’s and Fitch is established in the European Economic Area (“EEA”) and registered under Regulation (EC) No 1060/2009, as amended (the “CRA Regulation”) and are, as of the date of this Base Prospectus, included in the list of credit rating agencies published by the European Securities and Markets Authority on its website (http://www.esma.europa.eu/page/List-registered-and-certified-CRAs) in accordance with the CRA Regulation. In general, European regulated investors are restricted from using a rating for regulatory purposes if such rating is not issued by a credit rating agency established in the EEA and registered under the CRA Regulation unless (1) the rating is provided by a credit rating agency not established in the EEA but is endorsed by a credit rating agency established in the EEA and registered under the CRA Regulation or (2) the rating is provided by a credit rating agency not established in the EEA which is certified under the CRA Regulation. According to Moody’s rating system, obligations rated B are considered speculative and are subject to high credit risk and the modifier 1 indicates that the obligation ranks in the higher end of its generic rating category. According to Fitch’s rating system, “BB” ratings indicate an elevated vulnerability to default risk, particularly in the event of adverse changes in business or economic conditions over time, but business or financial flexibility exists which supports the servicing of financial commitments and “B” ratings indicate that material default risk is present, but a limited margin of safety remains and that financial commitments are currently being met yet capacity for continued payment is vulnerable to deterioration in the business and economic environment.” III. SUMMARY 3. On page 7 and following of the Base Prospectus, the text pertaining to the elements “B.5 The Group”, “B.13 Recent Events”, “B.15 The Issuer’s Principal Activities”, “B.16 Controlling Persons” and “B.17 Ratings assigned to the Issuers or their Debt Securities” of “Section B – Issuers and Guarantor” of the chapter “SUMMARY” shall be amended and replaced by the following: (i) On page 9 of the Base Prospectus, the column under the heading “B.5 The Group” shall be amended and replaced by the following: 3 “Banif together with its consolidated subsidiaries (the “Banif Financial Group”), was established in Madeira in January 1988, by incorporating the assets and liabilities of Caixa Económica do Funchal, which was founded in 1987. Currently, the main business activities of Banif Financial Group are carried out through more than 40 companies operating in sectors including banking, insurance, leasing and consumer credit, brokerage, asset management, real estate, venture capital and trade finance. The main shareholder of Banif is the undivided estate of the late Horácio da Silva Roque (the “Herança Indivisa de Horácio da Silva Roque”), which holds, directly and indirectly, approximately a 59.686 per cent. of the voting rights of Banif as of 31 December 2012. Banif Finance is controlled by Numberone SGPS, Lda., a subsidiary of Banif. Numberone, SGPS, Lda. and Banif together own 100 per cent. of the voting shares of Banif Finance.” (ii) On page 11 of the Base Prospectus, the column under the heading “B.13 Recent Events” shall be amended and replaced by the following: “On 31 December 2012, Banif informed that, after appraisal by the Bank of Portugal and following the agreement in principle from the Portuguese State regarding its participation in the Banif Financial Group’s recapitalisation plan (developed in accordance with Law no. 63-A/2008, of 24 November, as amended from time to time), it would submit the recapitalisation plan for approval at the General Meeting of Shareholders. Such meeting was held on the 16 January 2013 and the following resolutions were passed: (i) approval of the recapitalisation plan, which includes accessing the public investment under the terms of the Law no. 63-A/2008, of 24 November, as amended from time to time, and, within such framework, approved Banif’s recapitalisation plan, upon related commitments and obligations, including the necessary share capital increase foreseen in the first and second stages of the recapitalisation plan approved (both making part of the recapitalisation plan); (ii) approval of a modification to article 5 of Banif’s bylaws and the insertion of a new paragraph in the following terms: “article 1A. After the injection of the public funds corresponding to the first phase of the recapitalisation process, approved by the General Meeting held on 16 January 2013, the Board of Directors must deliberate a share capital increase in the amount of €450.000.000, by way of cash contributions until 30 June 2013 through one or more issues”; (iii) approval of the suppression of the pre-emption rights of the shareholders on the subscription of the share capital increase, in the amount of €700 million, to be subscribed by the Portuguese State, through the issuance of 70.000.000.000 new shares designated as special according to article 4º of the Law no. 63-A/2008, of 24 November, as amended from time to time, at an issuance price of €0.01/share. It was also deliberated to approve the suppression of the preemption rights of the shareholders as regards share capital increases to be resolved by the Board of Directors, with the favourable opinion of the Audit Committee, by way of cash contributions, in the amount of €450 million, through a public offer to occur until 30 June 2013; (iv) approval of the issue of contingently convertible subordinated bonds, eligible as core tier 1, in the amount of €400 million and the share capital increase in the amount of €700 million, through the issuance of 70.000.000.000 new shares designated as special according to article 4º of the Law no. 63-A/2008, of 24 November, as amended from time to time, of which 44.511.019.900 shares with voting rights and 25.488.980.100 shares with restricted voting rights according to the limitations foreseen 4 in paragraph 8 of article 4 of the same Law, at an issuance price of €0.01/share. Both situations comprise the form of public investment to be subscribed by the Portuguese State within the framework of the recapitalisation plan. It was also approved the share capital increase up to the amount of €450 million, under the terms and conditions established in the recapitalisation plan, granting, in any case, an authorisation to the Board of Directors to establish the terms of the issues. On 17 December 2012, the merger of Banif SGPS, S.A. into Banif has been definitively registered at the Commercial Registry Office (“Conservatória do Registo Comercial”). Under legal terms, with the definitive register of the merger, Banif SGPS, S.A. as incorporated company was extinct and the shareholders of Banif SGPS, S.A. became the shareholders of Banif. All actions and operations performed by the participating companies will be considered, from an accounting and tax perspective, as performed on behalf of Banif from the 1 July 2012. On 4 December 2012, Moody’s has downgraded deposits and senior debt ratings of Banif from “B1” to “B2”, maintaining the outlook on review. Rentipar Financeira, Banif Financial Group’s controlling entity, in 3 December 2012, has informed that the results of the On-site Inspections Programme on exposures to construction and real estate sectors in Portugal and Spain, as of 30 June 2012, was concluded on 29 November 2012. The assessment concluded that the need to reinforce impairment levels amounted to Euro 86 million. As of 30 September 2012, part of this charges were already covered, reducing the amount of impairment reinforcement to Euro 59 million, which will be accounted up to 31 December 2012.” (iii) On page 11 of the Base Prospectus, the column under the heading “B.15 The Issuer’s Principal Activities” shall be amended and replaced by the following: “Banif is a well-established bank in the Portuguese financial sector, with a nationwide network of branches, organised in accordance with the concept of modern points of sale, and e-banking system which is increasingly being taken up by customers and potential customers. The Bank offers a comprehensive range of products and services, for both personal and corporate clients, and constantly adjusts those products and services to meet market needs. The Bank is currently the market leader in Madeira and is well established with Portuguese residents in Venezuela and South Africa, providing a personalised service and a full range of products. Banif operates in mainland Portugal, in the Madeira Autonomous Region and the Azores Autonomous Region. Following the merger of Banif SGPS, S.A. into Banif, Banif has become the controlling entity of the Banif Financial Group, whose main business activities are carried out through more than 40 companies operating in various sectors including banking, insurance, leasing and consumer credit, brokerage, asset management, real estate, venture capital and trade finance. Banif Finance’s sole business activity is to participate in capital markets transactions, through the issuance of securities, to provide funding to the Banif Financial Group.” 5 (iv) On page 11 of the Base Prospectus, the column under the heading “B.16 Controlling Persons” shall be amended and replaced by the following: “Following the merger of Banif SGPS, S.A. into Banif, the main shareholder of Banif is the undivided estate of the late Horácio da Silva Roque (the “Herança Indivisa de Horácio da Silva Roque”), which holds, directly and indirectly, approximately a 59.686 per cent. of the voting rights of Banif as of 31 December 2012. Banif Finance is controlled by Numberone, SGPS, Lda., a subsidiary of Banif. Numberone, SGPS, Lda. and Banif together own 100 per cent. of the voting shares of Banif Finance.” (v) On page 12 of the Base Prospectus, the column under the heading “B.17. Ratings assigned to the Issuers or their Debt Securities” shall be amended and replaced by the following: “As at the date of this Supplement, Banif has a long-term debt rating of B2 with an under review outlook from Moody’s Investors Service España S.A. (“Moody’s”) and BB with a negative outlook from Fitch Ratings España S.A.U. (“Fitch”). Notes issued under the Programme have been rated (P)B2 (senior unsecured notes) and (P)Not Prime (short-term notes) by Moody’s and BB (long-term senior notes) and B (short-term senior unsecured notes) by Fitch, respectively. Each of Moody’s and Fitch is established in the European Economic Area (“EEA”) and registered under Regulation (EC) No 1060/2009, as amended (the “CRA Regulation”).” IV. RISK FACTORS 4. On page 24 of the Base Prospectus, the paragraph under the heading “Risk of a Banif rating downgrade” shall be amended and replaced by the following: “Credit ratings affect the cost and other terms upon which Banif may obtain funding. Ratings are based on a number of factors, including the relevant Issuer’s financial strength and the conditions affecting the industry generally. As at the date of this Base Prospectus, Banif has a long-term debt rating of B2 with an under review outlook from Moody’s and BB with a negative outlook from Fitch. Each of Moody’s and Fitch is established in the EEA and registered under the CRA Regulation. In light of the difficulties in the Portuguese economy, there can be no assurance that the rating agencies will maintain Banif’s current ratings. The recent downgrades of the Portuguese sovereign rating could in turn negatively affect the perception that these agencies have of Banif’s rating. Banif’s failure to maintain its current ratings or a further downgrade of its rating could increase its cost of funding and may result in the funding markets continuing to be inaccessible to Banif, which could in turn have a material adverse effect on its financial condition and results of operations.” V. DESCRIPTION OF THE ISSUERS AND THE GUARANTOR 5. On page 85 of the Base Prospectus, the following paragraphs shall be added after the seventh paragraph under the heading “Banif – Banco Internacional do Funchal, S.A.” 6 “On 4 September 2012, the Board of Directors of Banif SGPS, S.A. has submitted to the Commercial Registry Office (“Conservatória do Registo Comercial”) the registration of the merger project of Banif SGPS, S.A. into Banif, previously approved by the Bank of Portugal. The merger transaction results in the transfer of the assets of Banif SGPS, S.A. into Banif and in the attribution, to the shareholders of Banif SGPS, S.A. of new shares representing the share capital of Banif. This transaction results in the integration of the Banif Financial Group’s top holding into its main banking institution and represents a further step in the internal reorganisation process that is being carried by the Banif Financial Group, in order to create the appropriate framework for the recapitalisation process submitted to the national authorities. The merger of Banif Comercial SGPS, S.A. and Banif Investimentos, S.A. into Banif SGPS, S.A. has also been concluded. The merger of Banif SGPS, S.A. into Banif has been definitively registered on 17 December 2012. Under legal terms, with the definitive register of such merger, Banif SGPS, S.A. as incorporated company has been extinct and the shareholders of Banif SGPS, S.A. became the shareholders of Banif. Shares of Banif SGPS, SA were attributed in a 1:1 proportion, on 21 December 2012, the same as the shares started trading. All action and operations performed by the participating companies will be considered, from an accounting and tax perspective, as performed on behalf of Banif from 1 July 2012. 6. On page 86 of the Base Prospectus, the organisational structure of the Banif Financial Group as at 31 August 2012 under the heading “Banif – Banco Internacional do Funchal, S.A.” shall be amended and replaced with the organisational structure of Banif Financial Group as at 31 December 2012 as set below: 7 BANIF FINANCIAL GROUP ( 31 DECEMBER 2012) Banif - Banco Internacional do Funchal, SA Share capital: 570.000.000 Eur 85,92% 47,69% Banif Mais - SGPS, SA Rentipar Seguros , SGPS, SA 7,92% Share capital: € 135.570.000,00 Share capital: 20.369.095 Eur 84% Banif Imobiliária, SA 0,99% 99,01% Share capital: 200.000.000 Eur 16% Banco Banif Mais, SA 51,69% Share capital: 101.000.000 Eur Banco Caboverdiano de Negócios 100% 100% Banif - Banco de Investimento, SA Companhia de Seguros Açoreana, SA Share capital: € 107.500.000,00 Share capital: 900.000.000$00 100% Share capital: 85.000.000 Euros Banif (Cayman),Ltd c) 100% Share capital: USD 42.000.000 Banif Financial Services Inc. Share capital: USD 371.000 100% SIP - Sociedade Imobiliária Piedade, SA 100% Share capital: 50.000 Eur Banif Plus Bank ZRT Share capital: HUF 3.000.000.000 Banif Bank 78% (Malta) Share capital: 32.500.000,00€ Giga - Grupo Integrado de Gestão de Acidentes, SA 60% 100% Share capital: € 700.000,00 Banif Gestão de Activos 85% Share capital: 2.000.000 € Banif International Holdings, Ltd 100% Banif Finance (USA) Corp. Share capital: USD 6.280.105.09 Share capital: USD 17.657.498 90% Banif Açores, Inc 100% San José a) Share capital: USD 1.000.000 Banif Açores, Inc 100% Fall River Share capital: USD 100.000 10% TCC 99,9% Investments Luxembourg Banif Holding (Malta), Ltd Share capital: 10.002.000,00€ 25,85% Centaurus Realty Group Invest. Imobiliários, SA Share capital: 125.000,00 Eur Margem 100% Mediaçao de Seguros, Lda Share capital: 6.234,97 Eur MCO2 - Soc. Gestora de 0,1% CRIA - Centro de Reabilitação 100% Share capital: 450.000 € Integrada de Acidentes, SA 70% Share capital: € 320.000,00 11,75% Banif Forfaiting 25% Fundos de Inv. Mobiliário 100% 50% Banif Ecoprogresso Trading, SA 100% 100% 100% Banca Pueyo, SA 56,49% Banif (Espanha) 29,19% Açor Pensões Share capital: 4.800.000 € 10,81 % Share capital: 1.850.000 € 99% Banif Finance, Ltd Inmobiliaria Vegas Altas 33,33% (Espanha) Share capital: 60.330,42€ SGPS, Lda 1% 33,32% 100% 100% Share capital: 750.000 € Banif International e) Bank, Ltd Banif Banco de 75% Gamma - Soc. 100% Investimento (Brasil), SA 100% Share capital: 250.000 € Banif Gestão de Ativos (Brasil) S. A. Banif International Asset Management Share capital: R $ 10.787.073,00 Share capital: USD 50.000 100% 25% Share capital: R $ 90.785.158,21 Titularização de Créditos 99,7% Banif Brasil (Holdings), SA Share capital: R$ 1.000,00 Banif Multi Fund Banif Securities Inc Share capital: USD 8.532.707 Share capital: 25.000.100 € Banif Capital - Soc. de Capital de Risco Share capital: b) 100% Banif (Brasil), Ltda Share capital: R $ 150.000 Share capital: 5.000 Eur d) Share capital: USD 50.000 59,20% Investaçor, SGPS Share capital: 10.000.000 Eur a) b) c) d) e) Paid-up share capital of USD 100 % of controlling capital is 100%. Share capital is comprised of 100.000 ordinary shares with nominal value of USD 1 and non-voting preference shares: 50.000 shares of USD 0,01 and 68.517 shares of EUR 0,01. % of controlling capital is 100%. Share capital is comprised of 26.000.000 ordinary shares with nominal value of USD 1 and 16.000.000 non-voting preference shares USD 0,01. Paid-up share capital of USD 100. % of controlling capital is 100%. Share capital is comprised of 25.000 ordinary shares with nominal value of EUR 1 and 10.000 non-voting preference shares of EUR 0,01. Company Share capital: USD 2.108.000 Share capital: 250.020 € Share capital: R$ 33.365.081,00 Numberone Banif Securities Holdings, Ltd Share capital: USD 250.000 100% Banif Rent, SA Share capital: 300.000 € 90% Banif-Banco Internacional do Funchal (Brasil), SA 10% Share capital: R $ 200.357.555,09 8 7. On page 87 of the Base Prospectus, the third paragraph under the heading “History and Ownership” shall be amended and replaced by the following: “Following the merger of Banif SGPS, S.A. into Banif, Banif has its shares listed on the regulated market Euronext Lisbon, managed by Euronext Lisbon – Sociedade Gestora de Mercados Regulamentados, S.A. (“Euronext Lisbon”).” 8. On page 90 of the Base Prospectus, the heading “Boards and Officers of Banif” shall be amended and replaced by the following: (a) Management Team All members of the Management Team of Banif have their business address at the registered office of Banif. (i) Board of Directors Chairman Luis Filipe Marques Amado Vice-Chairman Jorge Humberto Correia Tomé Maria Teresa Henriques da Silva Moura Roque dal Fabbro Paula Cristina Moura Roque Directors Fernando José Inverno da Piedade José António Vinhas Mouquinho Carlos Eduardo Pais e Jorge Diogo António Rodrigues da Silveira Gonçalo Vaz Gago da Câmara de Medeiros Botelho João José Gonçalves de Sousa João Paulo Pereira Marques de Almeida Manuel Carlos de Carvalho Fernandes Nuno José Roquette Teixeira Vítor Manuel Farinha Nunes (ii) Executive Committee Chairman Jorge Humberto Correia Tomé 9 Members José António Vinhas Mouquinho Carlos Eduardo Pais e Jorge Gonçalo Vaz Gago da Câmara de Medeiros Botelho João José Gonçalves de Sousa João Paulo Pereira Marques de Almeida Nuno José Roquette Teixeira Vítor Manuel Farinha Nunes (b) Audit Board Chairman Fernando Mário Teixeira de Almeida Effective Full Members António Ernesto Neto da Silva Fernando Thomaz de Mello Paes de Vasconcellos Alternate Full Member (c) José Pedro Lopes Trindade Official Auditors Ernst & Young Associados – S.R.O.C., S.A., represented by Ana Rosa Ribeiro Salcedas Montes Pinto (ROC nr. 1230) Below is a list of the offices held in other companies by members of the Board of Directors and of the Executive Committee of Banif (to whom the Board of Directors have delegated the day-to-day management responsibilities) as above mentioned which are significant with respect to Banif: Board of Directors Luís Filipe Marques Amado (i) Chairman of the Board of Directors Banif – Banco Internacional do Funchal, S.A. Banif – Banco de Investimento, S.A. Jorge Humberto Correia Tomé (i) Vice-Chairman of the Board of Directors and Chief Executive Officer Banif – Banco Internacional do Funchal, S.A. 10 Banif – Banco de Investimento, S.A. (ii) Member of the Board of Directors and Chief Executive Officer Banco Banif Mais, S.A. (iii) Member of the Board of Directors Banif – Banco de Investimento (Brasil), S.A. Banif Imobiliária, S.A. Banif – Banco Internacional do Funchal (Brasil), S.A. (iv) Chairman and Chief Executive Officer Banif Finance Ltd. (v) Member of the Superior Corporate Board Banif – Banco Internacional do Funchal, S.A. Maria Teresa Henriques da Silva Moura Roque Dal Fabbro (i) Vice-Chairman of the Board of Directors Banif – Banco Internacional do Funchal, S.A. Rentipar Financeira, SGPS, S.A. Fundação Horácio Roque – Instituição Particular de Solidariedade Social (ii) Member of the Board of Directors Rentipar Investimentos, SGPS, S.A. Renticapital - Investimentos Financeiros, S.A. Rentimundi - Investimentos Imobiliários, S.A. Rentipar Indústria, SGPS, S.A. Rentiglobo, SGPS, S.A. (iii) Chairman of the General Assembly Rentimédis - Mediação Seguros, S.A. Génius - Mediação Seguros S.A. 11 Mundiglobo - Habitação e Investimentos, S.A. MS Mundi – Serviços Técnicos de Gestão e Consultoria, S.A. Banif Gestão de Activos – Sociedade Gestora de Fundos de Investimento Mobiliário, S.A. Banif Capital - Sociedade de Capital de Risco, S.A. Paula Cristina Moura Roque (i) Vice-Chairman of the Board of Directors Banif – Banco Internacional do Funchal, S.A. (ii) Member of the Board of Directors Rentipar Financeira, SGPS, S.A. Rentipar Indústria, SGPS, S.A. Rentipar Investimentos, SGPS, S.A. Fernando José Inverno da Piedade (i) Member of the Board of Directors Banif – Banco Internacional do Funchal, S.A. (ii) Chaiman of the Board of Directors Rentipar Financeira, SGPS, S.A. Rentipar Indústria, SGPS, S.A. Rentipar Investimentos, SGPS, S.A. Rentiglobo – SGPS, S.A. Renticapital - Investimentos Financeiros, S.A. Rentimundi- Investimentos Imobiliários, S.A. Rentimedis - Mediação de Seguros, S.A. Génius – Mediação de Seguros, S.A. MS - Mundi - Serviços Técnicos de Gestão e Consultoria, S.A. Rentipar Seguros, SGPS, S.A. 12 Companhia de Seguros Açoreana, S.A. (iii) Chairman of the General Assembly Banif Imobiliária, S.A. José António Vinhas Mouquinho (i) Member of the Board of Directors Banif Imobiliária, S.A. Rentipar Seguros SGPS, S.A. Banif International Holdings, Ltd (ii) Secretary of the General Assembly Banif Rent – Aluguer, Gestão e Comércio de Veículos Automóveis, S.A. Carlos Eduardo Pais e Jorge (i) Member of the Board of Directors Banif Rent – Aluguer, Gestão e Comércio de Veículos Automóveis, S.A. Banif – Banco de Investimento (Brasil), S.A. Banif – Banco Internacional do Funchal (Brasil), S.A. Banif Securities, Inc. Banif Multifund, Ltd. Banif International Asset Management, Ltd. Banif Securities Holdings, Ltd. Banif Ecoprogresso Trading, S.A. Diogo António Rodrigues da Silveira (i) Member of the Board of Directors Banif Imobiliária, S.A. (ii) Chairman of the Board of Directors Companhia de Seguros Açoreana, S.A. 13 Gonçalo Vaz Gago da Câmara de Medeiros Botelho (i) Member of the Board of Directors Banif – Banco Internacional do Funchal, S.A. Banif – Banco de Investimento, S.A. Banif (Açores) – Sociedade Gestora de Participações Sociais, S.A. João José Gonçalves de Sousa None. João Paulo Pereira Marques de Almeida (i) Member of the Board of Directors Banif – Banco Internacional do Funchal, S.A. Banif – Banco de Investimento, S.A. Banif Finance, Ltd. Manuel Carlos de Carvalho Fernandes None. Nuno José Roquette Teixeira (i) Member of the Board of Directors Banif – Banco de Investimento, S.A. Companhia de Seguros Açoreana, S.A. Banieuropa Holding, S.L. (em processo de dissolução) Banif – Banco Internacional do Funchal (Brasil), S.A. Banif International Bank, Ltd. Banif – Banco Internacional do Funchal (Cayman), Ltd. Banif Finance, Ltd. Banif Securities, Inc. (ii) Chairman of the Board of Directors 14 Gamma – Sociedade de Titularização de Créditos, S.A. (iii) Member of the Remuneration Committee Banif Imobiliária, S.A. Banif Capital – Sociedade de Capital de Risco, S.A. Banif – Gestão de Activos – Sociedade Gestora de Fundos de Investimento Mobiliário, S.A. Vítor Manuel Farinha Nunes (i) Chairman of the Board of Directors Banif Rent – Aluguer, Gestão e Comércio de Veículos Automóveis, S.A. (ii) Member of the Board of Directors Banif – Banco Internacional do Funchal, S.A. Banif Mais SGPS, S.A. Banco Banif Mais, S.A. Banif – Banco de Investimento, S.A. Tecnicrédito ALD, Aluguer de Automóveis, S.A. Banif Plus Bank Company, Ltd. TCC Investments Luxembourg, SARL (iii) Manager Margem – Mediação de Seguros, Lda. Audit Board Fernando Mário Teixeira de Almeida (i) Chairman of the Audit Board Banif – Banco de Investimento, S.A. António Ernesto Neto da Silva None. Thomaz de Mello Paes de Vasconcellos 15 (i) Member of the Audit Board Companhia de Seguros Açoreana, S.A. José Pedro Lopes Trindade None. 9. On page 94 of the Base Prospectus, the heading “Conflicts of Interest” shall be read as referring to the above Directors and members of the audit board. “To the best of its knowledge, there are no potential conflicts of interest between the private interests or other duties of the above Directors and any of their duties to Banif, and there are no potential conflicts of interest between the private interests or other duties of the members of the Audit Board and any of their duties to Banif.” 10. On page 114 of the Base Prospectus, the heading “Capital and Shares” shall be amended and replaced by the following: “Shareholder Structure of Banif, S.A. (as at 31 December 2012 ) % Share Capital No. of Shares Rentipar Financeira, SGPS, S.A. .................................. 53.871% 307,063,133 Auto Industrial SGPS, S.A. .......................................... 13.3996% 76,377,857 As at the date of this Base Prospectus, the share capital of Banif is EUR 570.0 million, comprised of 570,000,000 ordinary shares with no nominal value and is fully paid up.” 11. On page 114 of the Base Prospectus, the text under the heading “Corporate Governance” shall be amended and replaced by the following: “Following the merger of Banif SGPS, S.A. into Banif, Banif has become a company with its shares admitted to trading in a regulated market and therefore has now the requirement to comply with the Corporate Governance Rules as set forth in Regulation 1/2010 of the CMVM and article 245-A of the Portuguese Securities Code.” 12. On page 120 of the Base Prospectus, the last paragraph shall be amended and replaced by the following: “In January 2003, ratings were assigned to Banif – Banco International do Funchal, S.A. by Moody’s (Baa1/P-2) and by Fitch (BBB+/F2). These ratings were confirmed in December 2005 with a Stable outlook. As a result of the negative events affecting the financial markets globally, as well as the Euro zone and sovereign debt crisis, each of Moody’s and Fitch have downgraded Banif’s credit ratings consecutively since 2009. As at the date of this Supplement, Banif has a long 16 term and short term debt rating of B2/Not Prime, with an under review outlook from Moody’s, and a long term and short term debt rating of BB/B, with a negative outlook from Fitch.” 13. On page 128 of the Base Prospectus, the following paragraphs shall be added after the last paragraph under the heading “Recent Developments”: “Rentipar Financeira, Banif Financial Group’s controlling entity, in 3 December 2012, has informed that the results of the On-site Inspections Programme on exposures to construction and real estate sectors in Portugal and Spain, as of 30 June 2012, was concluded on 29 November 2012. The assessment concluded that the need to reinforce impairment levels amounted to Euro 86 million. As of 30 September 2012, part of this charges were already covered, reducing the amount of impairment reinforcement to Euro 59 million, which will be accounted up to 31 December 2012. On 5 December 2012, resulting of the impact of the deterioration of the credit risk given the downward revision of the prospects for the Portuguese economy growth in 2013, Moody’s has revised Banif’s deposits and senior debt ratings from “B1” to “B2”, maintaining the outlook on review. On 17 December 2012, the definitive registration of the merger of Banif SGPS, S.A. into Banif has occurred. Under legal terms, with the definitive register of the merger Banif SGPS, S.A., as incorporated company is extinct and the shareholders of Banif SGPS, S.A. become the shareholders of Banif. The shares of Banif SA were automatically attributed to the shareholders of Banif SGPS, S.A.. Shares of Banif were attributed in a 1:1 proportion, the same day in which the shares started trading, in 21 December 2012. All actions and operations performed by the participating companies will be considered, from an accounting and tax perspective, as performed on behalf of Banif from the 1st of July 2012 (inclusive). On 31 December 2012, Banif informed that, after appraisal by the Bank of Portugal and following the agreement in principle from the Portuguese State regarding its participation in the Banif Financial Group’s recapitalisation plan (developed in accordance with Law no. 63-A/2008, of 24 November, as amended from time to time), it would submit the recapitalisation plan for approval at the General Meeting of Shareholders. The recapitalisation plan will be implemented in 2 stages and comprehends the following types of investment: (a) An initial public investment of 1,100 million euros, following the approval of the recapitalisation plan, comprising: (i) The issuance of contingent convertible bonds eligible as Core Tier 1 capital in the total amount of 400 million euros, pursuant to law nº 63-A/2008, November 24th and other applicable laws; (ii) Share capital increase of Banif, in cash with suppression of pre-emption rights, reserved for the subscription of the Portuguese State, totaling 700 million euros, through the 17 issuance of 70.000.000.000 of new shares, of which 44.511.019.900 shares with full voting rights at an issuance price of 0,01/share. (b) At a second stage, an additional share capital increase of Banif (to be made by the end of June 2013), in the amount of 450 million euros, with subscription through a public offer on conditions yet to be defined. In the context and for the purposes of this second stage, the current reference shareholders have presented an underwriting commitment to subscribe shares in the amount of 100 million euros. The proceeds from the capital increase referred in (b) will be used for anticipated reimbursement of contingent convertible instruments. This process will allow Banif to reach the target established by the Bank of Portugal, through Aviso no. 3/2011, of a Core Tier 1 ratio above 10% and, simultaneously, to establish a prudential capital buffer. The recapitalisation process is based on interim support of the State for a maximum of 5 years and involves an aggressive process of restructuring of the business model and enhancement of its core segments of activity. The Board of Directors has performed a thorough review of the business plan of the Banif Financial Group, fully focused on value creation, will adjust the business model and organizational structure to current market reality, ensuring a return to sustainable profitability levels and strengthened solvency and liquidity levels. According to the applicable legal framework, the recapitalisation of Banif is also subject to decision, from the European Commission (EC), of its compliance with State-aid rules, as well as the EC’s formal approval of a restructuring plan for Banif to be submitted during the following months. On 16 January 2013 the General Meeting of Shareholders was held and the following resolutions were passed: (i) approval of the recapitalisation plan, which includes accessing the public investment under the terms of the Law no. 63-A/2008, of 24 November and, within such framework, approved Banif’s recapitalisation plan, upon related commitments and obligations, including the necessary share capital increase foreseen in the first and second stages of the recapitalisation plan approved (both making part of the recapitalisation plan); (ii) approval of a modification to article 5 of Banif’s bylaws and the insertion of a new paragraph in the following terms: “article 1A. After the injection of the public funds corresponding to the first phase of the recapitalisation process, approved by the General Meeting held on 16 January 2013, the Board of Directors must deliberate a share capital increase in the amount of €450.000.000, by way of cash contributions until 30 June 2013 through one or more issues”; (iii) approval of the suppression of the pre-emption rights of the shareholders on the subscription of the share capital increase, in the amount of €700 million, to be subscribed by the Portuguese State, through the issuance of 70.000.000.000 new shares designated as special according to article 4º of the Law no. 63-A/2008, of 24 November, at an issuance price of €0.01/share. It was also deliberated to approve the 18 suppression of the pre-emption rights of the shareholders as regards share capital increases to be resolved by the Board of Directors, with the favourable opinion of the Audit Committee, by way of cash contributions, in the amount of €450 million, through a public offer to occur until 30 June 2013; (iv) approval of the issue of contingently convertible subordinated bonds, eligible as core tier 1, in the amount of €400 million and the share capital increase in the amount of €700 million, through the issuance of 70.000.000.000 new shares designated as special according to article 4º of the Law no. 63-A/2008, of 24 November, of which 44.511.019.900 shares with voting rights and 25.488.980.100 shares with restricted voting rights according to the limitations foreseen in paragraph 8 of article 4 of the same Law, at an issuance price of €0.01/share. Both situations comprise the form of public investment to be subscribed by the Portuguese State within the framework of the recapitalisation plan. It was also approved the share capital increase up to the amount of €450 million, under the terms and conditions established in the recapitalisation plan, granting, in any case, an authorisation to the Board of Directors to establish the terms of the issues.” VI. TAXATION 14. On page 135 of the Base Prospectus, the first four paragraphs of subtitle “Resident holders” of the section “Portuguese Taxation” of the chapter “TAXATION” shall be amended and replaced by the following wording: “If the payment of interest or other investment income is made available to Portuguese resident individuals, withholding tax applies at a rate of 28 per cent., which is the final tax on that income unless the individual elects to include such income in his taxable income, subject to tax at progressive rates of up to 48 per cent.. In the latter circumstance an additional income tax will be due on the part of the taxable income exceeding € 80,000 as follows: (i) 2.5 per cent on the part of the taxable income exceeding € 80,000 up to € 250,000 and (ii) 5 per cent on the remaining part (if any) of the taxable income exceeding € 250,000. Also if the option of income aggregation is made an additional surcharge at the rate of 3,5 per cent. will also be due over the amount that exceeds the annual amount of the monthly minimum guaranteed wage. In this case, the tax withheld is deemed a payment on account of the final tax due. Investment income paid or made available to accounts opened in the name of one or more account holders acting on behalf of one or more unidentified third parties is subject to a final withholding tax rate of 35 per cent., unless the relevant beneficial owner(s) of the income is/are identified and as a consequence the tax rates applicable to such beneficial owner(s) will apply. Capital gains obtained by Portuguese resident individuals on the transfer of Notes are taxed at a special tax rate of 28 per cent. levied on the positive difference between the capital gains and capital losses of each year unless the individual elects to include such income in his taxable income, subject to tax at progressive rates of up to 48 per cent.. In the latter circumstance an additional income tax will be due on the part of the taxable income exceeding € 80,000 as follows: (i) 2.5 per cent on the part of the taxable income exceeding € 80,000 up to € 250,000 and (ii) 5 per cent on the remaining part (if any) of the taxable income exceeding € 250,000. Also if the option of income aggregation is made an additional surcharge at the rate of 3,5 per cent. will also be due 19 over the amount that exceeds the annual amount of the monthly minimum guaranteed wage Accrued interest qualifies as interest, rather than as capital gains, for tax purposes.” 15. On page 135 of the Base Prospectus, the second sentence of the fifth paragraph of subtitle “Resident holders” of the section “Portuguese Taxation” of the chapter “TAXATION” shall be amended and replaced by the following wording: “A State Surcharge (“derrama estadual”) rate will be 3 per cent. due on the part of the taxable profits exceeding EUR 1.500.000 up to EUR 7.500.000 and 5 per cent. on the part of the taxable profits exceeding EUR 7.500.000.” 16. On page 136 of the Base Prospectus, the first three paragraphs of subtitle “Non-resident holders” of the section “Portuguese Taxation” of the chapter “TAXATION” shall be amended and replaced by the following wording: “Interest and other types of investment income obtained by non-resident legal persons without a Portuguese permanent establishment to which the income is attributable is subject to withholding tax at a rate of 25 per cent. which is the final tax on that income. However, if the interest and other types of investment income are obtained by non-resident individuals without a Portuguese permanent establishment to which the income is attributable said income is subject to withholding tax at a rate of 28 per cent., which is the final tax on that income. Investment income paid or made available to accounts opened in the name of one or more account holders acting on behalf of one or more unidentified third parties is subject to a final withholding tax rate of 35 per cent., unless the relevant beneficial owner(s) of the income is/are identified and as a consequence the tax rates applicable to such beneficial owner(s) will apply. A withholding tax rate of 35 per cent. applies in case of investment income payments to individuals or companies domiciled in a country, territory or region subject to a clearly more favourable tax regime included in the “low tax jurisdictions” list approved by Ministerial Order (Portaria) no. 150/2004 of 13 February 2004, amended by Ministerial Order (Portaria) no. 292/2011, of 8 November 2011 (lista dos países, territórios e regiões de tributação privilegiada, claramente mais favorável).” 17. On page 136 of the Base Prospectus, the second sentence of the fifth paragraph of subtitle “Nonresident holders” of the section “Portuguese Taxation” of the chapter “TAXATION” shall be amended and replaced by the following wording: “Capital gains obtained by individuals that are not entitled to said exemption will be subject to taxation at a 28 per cent. flat rate.” 18. On page 139 of the Base Prospectus, the last paragraph under item 2. (Internationally Cleared Notes – held through an entity managing an international clearing system) under the subtitle “Special debt securities tax regime” of the section “Portuguese Taxation” of the chapter “TAXATION” shall be amended and replaced as follows: 20 “The absence of evidence of non-residence in respect of any non-resident beneficial owner who benefits from the abovementioned tax exemption regime shall result in the loss of the tax exemption and consequent submission to the above applicable Portuguese general tax provisions.” 21

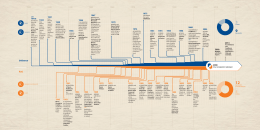

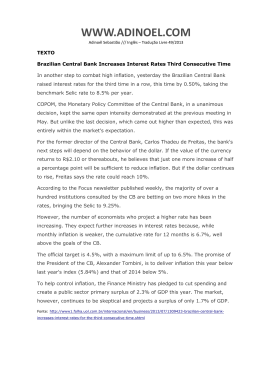

Download