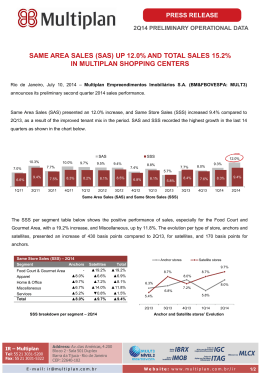

2Q15 Results LOJAS RENNER S.A. EARNINGS RESULTS FOR THE SECOND QUARTER (2Q15) LOJAS RENNER S.A. The Company was incorporated in 1965 and has been listed since 1967. A pure widely held capital company since 2005 with a 100% free float, Lojas Renner was deemed the first Brazilian corporation. Renner’s equities are traded under the LREN3 symbol on the BM&FBOVESPA’s Novo Mercado, the highest level of Corporate Governance. Closing share price as of June 30, 2015: R$ 113.00 July 30, 2015 – LOJAS RENNER S.A. (BM&FBOVESPA: LREN3), the largest fashion retailer in Brazil, announces its results for the second quarter (2Q15) and the first half (1H15) 2015. HIGHLIGHTS FOR 2Q15 Net Revenue from Merchandise Sales with a growth of 21.9% Same Store Sales of +14.5% Gross Margin from the Retailing Operation of 55.3% (+1.1p.p.) Operating Expenses represented 34.0% of Net Revenue (-0.1p.p) Adjusted EBITDA from the Retailing of R$ 272.2 million (+39.1%) EBITDA Margin from the Retailing Operation of 20.1% (+2.5p.p.) Total Adjusted EBITDA of R$ 326.2 million (+31.5%) Net Income of R$ 158.2 million (+33.5%) Market capitalization as of June 30, 2015: R$ 14.4 billion CONFERENCE CALL ON RESULTS* Friday, July 31, 2015 Time: 1:00 p.m. (Brazil) / 12 noon (US-ET) Access in Portuguese: +55 11 3127-4971 / +55 11 3728-5971 Access in English: +1 516-300-1066 Password: Lojas Renner Replay: +55 11 3127-4999 Password - Portuguese: 15329904 Password - English: 69052193 Access to the Webcast: http://webcast.neo1.net/Cover.aspx?PlatformId=HgKo mXAkKGMJvRexWeO4mA%3D%3D * The conference call will be conducted in Portuguese only with simultaneous translation into English. CONTACTS Laurence Gomes – CFO and IRO [email protected] Paula Picinini Tel. +55 51 2121 7044 [email protected] Diva Freire Tel. +55 51 2121 7045 [email protected] Felipe Fernandez Tel. +55 51 2121 7006 [email protected] Felipe Gaspar Tel. +55 51 2121 7183 [email protected] Carla Sffair Tel. +55 51 2121 7006 [email protected] LEGAL NOTICE This release contains forward-looking statements relating to the prospects of the business, estimates for operating and financial results, and those related to growth prospects of Lojas Renner S.A. and are merely projections and, as such, are based exclusively on the expectations of the Company’s management concerning the future of the business. Such forward-looking statements depend substantially on changes in market conditions, the performance of the Brazilian economy, the sector and the international markets, and are therefore subject to change without prior notice. www.lojasrenner.com.br/ri MANAGEMENT COMMENTS Renner’s second quarter sales continued to maintain growth rates in spite of the current macro-economic climate and greater sales promotions in the Brazilian retail sector as a whole. In addition, positive customer reaction to the seasonal collections, good sales performance ahead of Mother’s Day and Valentine’s Day and prudent inventory management helped Net Revenue from Merchandise Sales to grow by 21%. As a result, Renner again exceeded the IBGE’s Monthly Survey of Trade index. Similarly, Renner’s Same Store Sales posted an evolution of 14.5%. Gross Profit from the Retailing Operation was R$ 749.2 million, a yearon-year growth of 24.5%. Gross Margin from the Retailing Operation reported an expansion of 1.1.p.p. to 55.3%, once again benefiting from the Company’s good inventory management and commercial strategy. Operating Expenses (Selling, General and Administrative) were 34.0% of Net Revenue from Merchandise Sales against 34.1% for 2Q14, due principally to strong sales growth and rigid control over expenses. Adjusted EBITDA from the Retailing Operation reported expansion of 39.1%, reaching R$ 272.2 million and equivalent to an EBITDA Margin from the Retailing Operation of 20.1% against 17.6% in 2Q14. The Company’s Results from Financial Products was R$ 54.0 million, a growth of 3.0% in the period. Growth rates were influenced by increased funding costs and provisions due to higher sales volume in 2Q15. Losses from Renner Card business, Net of Recoveries was 4.3% of the total portfolio. Total Adjusted EBITDA was R$ 326.2 million, growth of 31.5% in relation to 2Q14. The Total Adjusted EBITDA Margin for the quarter was 24.1% compared with 22.3% in 2Q14. In the light of the foregoing, the Company reported a Net Income of R$ 158.2 million, a growth of 33.5%. Net Margin was 11.7%, a 1.0p.p. improvement in relation to the preceding period. During 2Q15, the Company opened 18 stores of which 10 under the Renner banner, 5 Camicado and 3 Youcom. Investments in the quarter totaled R$ 146.6 million. Página 2 de 10 LOJAS RENNER S.A. EARNINGS RESULTS FOR THE SECOND QUARTER (2Q15) CONSOLIDATED INFORMATION (R$ MM) 2Q15 2Q14 Var. % 1H15 1H14 Var. 1,354.2 1,111.2 21.9% 2,365.1 1,925.7 22.8% Growth in Same Store Sales (%) 14.5% 10.0% 4.5p.p. 15.4% 8.0% 7.4p.p. Gross Profit from Merchandise Sales 749.2 602.0 24.5% 1,299.6 1,024.3 26.9% Gross Margin from Retailing Operation (%) 55.3% 54.2% 1.1p.p. 54.9% 53.2% 1.7p.p. Operating Expenses (SG&A) (460.7) (378.5) 21.7% (868.3) (716.3) 21.2% SG&A as a % of Net Revenue from Merchandise Sales (%) 34.0% 34.1% -0.1p.p. 36.7% 37.2% -0.5p.p. Ajusted EBITDA from Retailing Operation 272.2 195.7 39.1% 402.9 269.4 49.6% Ajusted EBITDA Margin from Retailing Operation (%) 20.1% 17.6% 2.5p.p. 17.0% 14.0% 3.0p.p. Net Revenue from Merchandise Sales Financial Products Result 54.0 52.4 3.0% 122.1 113.8 7.3% Ajusted Total EBITDA (Retail + Financial Products) 326.2 248.1 31.5% 525.0 383.2 37.0% Ajusted Total EBITDA Margin (%) 24.1% 22.3% 1.8p.p. 22.2% 19.9% 2.3p.p. Net Income 158.2 118.5 33.5% 231.4 169.4 36.6% Net Margin (%) 11.7% 10.7% 1.0p.p. 9.8% 8.8% 1.0p.p. 5.9% 5.4% 0.5p.p. 9.3% 8.2% 1.1p.p. ROIC (%) Businesses Breakdown - 2Q15 Stores in Operation 259 63 28 472.8 28.9 3.8 1,280.4 65.5 8.3 % of Growth 21.7% 17.9% 124.2% Gross Margin (%) 55.8% 45.9% 59.6% Selling Area (thousand m²) Net Revenue (R$ MM) Net Revenue from Merchandise Sales was R$ 1,354.2 million in 2Q15, year-on-year growth of 21.9%, reflecting the favorable customer response to the seasonal collections together with the satisfactory sales performance leading up to Mother’s Day and the Brazilian version of Valentine’s Day. Net revenues were also driven by a well-honed strategy of product allocation to the stores and good execution at the store level. As a result, Renner once more exceeded Federal Government Statistics Office (IBGE)’s Monthly Survey of Trade index up to the end of May (-1.9%). In 1H15, Net Revenue from Merchandise Sales was R$ 2,365.1 million, representing growth of 22.8% against 1H14. Same Store Sales in 2Q15 posted growth of 14.5% against 10.0% in 2Q14, and in 1H15 of 15.4% against 8.0% in the same period for 2014. Gross Profit from Merchandise Sales was R$ 749.2 million, 24.5% higher than recorded for the same period in 2014. Gross Margin from the Retailing Operation reached 55.3%, an increase of 1.1p.p. in relation to 2Q14, benefiting from well implemented inventory management and product distribution to the stores combined with the Company’s commercial strategy. Improved margins at Camicado and Youcom also contributed to this trend. In 1H15, the Company registered Gross Profit from Merchandise Sales of R$ 1,299.6 million and a Gross Margin from the Retailing Operation of 54.9%. Operational Expenses (R$ MM) 2Q15 2Q14 (460.7) 34.0% Selling Expenses General and Administrative Expenses Operational Expenses (SG&A) % Over Net Revenue from Merchandise Sales Other Operating Expenses Management Remuneration Var. % 1H15 1H14 Var. % (378.5) 21.7% (868.3) (716.3) 21.2% 34.1% -0.1p.p. 36.7% 37.2% -0.5p.p. (344.0) (286.2) 20.2% (651.3) (542.4) 20.1% (116.7) (92.3) 26.4% (217.0) (173.9) 24.8% (16.4) (27.8) -41.0% (28.4) (38.6) -26.5% (2.7) (4.0) -33.5% (5.0) (6.1) -17.9% Tax Expenses (10.2) (8.2) 24.4% (19.6) (14.8) 32.2% Employee Profit Sharing (16.5) (17.4) -5.0% (23.3) (21.8) 7.2% Recovery of Tax Credits 10.7 2.2 378.7% 20.9 3.0 609.2% 2.3 (0.4) -656.7% (1.4) 1.1 -232.1% (477.1) (406.3) 17.4% (896.7) (754.9) 18.8% Other Operating Expenses Total Operational Expenses www.lojasrenner.com.br/ri Página 3 de 10 In the context of Operating Expenses, Selling Expenses in 2Q15 were R$ 344.0 million, representing 25.4% of Net Revenue from Merchandise Sales, a dilution of 0.4p.p. in relation to 2Q14, notwithstanding higher electric energy expenses. General and Administrative Expenses in turn reached R$ 116.7 million in the quarter, this representing 8.6% of Net Revenue from LOJAS RENNER S.A. EARNINGS RESULTS FOR THE SECOND QUARTER (2Q15) Merchandise Sales against 8.3% for the same period in 2014. This item was largely impacted by higher logistics expenses in the light of the new Santa Catarina Distribution Center. In 1H15, Selling Expenses were R$ 651.3 million, representing 27.5% of Net Revenue from Merchandise Sales while General and Administrative Expenses reached R$ 217.0 million, 9.2% of Net Revenue from Merchandise Sales. Other Operating Expenses totaled R$ 16.4 million in 2Q15 against R$ 27.8 million in 2Q14, positively impacted by the recovery of tax credits. In the first half, Other Operating Expenses amounted to R$ 28.4 million in contrast to R$ 38.6 million. A combination of higher sales, enhanced gross margins and stability in expenses in relation to revenues all served to boost year-on-year Adjusted EBITDA from the Retailing Operation by 39.1% to R$ 272.2 million in 2Q14. Adjusted EBITDA Margin from the Retailing Operation was 20.1% against 17.6% in 2Q14. In 1H15, Adjusted EBITDA from the Retailing Operation was R$ 402.9 million and Adjusted EBITDA Margin from the Retailing Operation was 17.0% against 14.0% in 1H14. FINANCIAL PRODUCTS RESULTS The Company reported a 2Q15 Result from Financial Revenues, Net of Funding and Taxes 168.5 140.5 20.0% 320.1 260.5 22.9% Products of R$ 54.0 91.7 86.4 6.2% 173.2 158.5 9.3% Renner Card (Private Label) million, 3.0% higher 48.2 30.0 60.8% 91.8 54.3 68.9% than the R$ 52.4 Co-branded Card Meu Cartão million reported in 28.6 24.1 18.7% 55.1 47.7 15.4% Quick Withdrawal and Insurances 2Q14. In the first half, Credit Losses, Net of Recoveries (74.1) (54.0) 37.1% (119.8) (83.2) 44.0% this result reached (45.1) (37.9) 18.9% (69.9) (53.0) 31.9% R$ 122.1 million, Renner Card (Private Label) representing 23.3% of (18.7) (11.6) 61.0% (32.5) (19.9) 63.1% Co-branded Card Meu Cartão the Company’s Total (10.3) (4.5) 129.2% (17.4) (10.3) 69.0% Quick Withdrawal EBITDA. The more Operating Expenses (Cards and Other Products) (40.4) (34.0) 18.8% (78.1) (63.5) 22.9% modest growth compared with the Financial Products Result 54.0 52.4 3.0% 122.1 113.8 7.3% retailing business is % of Company's Total Adjusted EBITDA 16.6% 21.1% -4.5p.p. 23.3% 29.7% -6.4p.p. largely a reflection of higher funding costs. Results from this segment were also affected by higher provisioning expenses in tandem with the growing sales volume in the period. In line with the current macroeconomic scenario, Renner reported a slightly higher level of delinquency although controlled and within company forecasts, thus also contributing to this result. Financial Products Result Breakdown (R$ MM) 2Q15 2Q14 Var. % 1H15 1H14 Var. % Revenue, Net of Funding and Taxes reached R$ 168.5 million in 2Q15, a 20.0% increase over the same period in 2014, principally reflecting growth in Meu Cartão revenues. Conversely, revenues from the Private Label card were influenced by the higher cost of funding and by the reduction in the average term for receivables. In 1H15, Revenue, Net of Funding and Taxes was R$ 320.1 million, a growth of 22.9% against 1H14. Credit Losses, Net of Recoveries totaled R$ 74.1 million, a growth of 37.1% in relation to 2Q14, given the greater necessity for provision in the Private Label business, reflecting in large part increased sales in the period, and the stage of maturation reached by the Co-branded card. Delinquency with the Saque Rápido facility proved slightly above company forecasts, although in line with the current macroeconomic context. In the first half, Credit Losses, Net of Recoveries were R$ 119.8 million, 44.0% greater than 1H14. At the end of June, the total number of Renner Cards issued amounted to 25.2 million, accounting for 50.0% of merchandise sales during the course of 2Q15 compared with 51.0% in 2Q14. Out of this participation, 39.8% were originated from sales under the interest free 0+5 installment credit plan and 10.2% under the interest bearing 0+8 installment credit plan. The average Renner Card Sales Ticket was R$ 189.45 in 2Q15, 5.0% higher than the R$ 180.39 registered in 2Q14. In turn, the Company’s average ticket was R$ 139.81, 6.8% higher than the R$ 130.95 in 2Q14, reflecting greater store traffic and an increase in the number of new customers who characteristically do not immediately make use of the Card. Losses from Renner Card, Net of Recoveries were 4.3% of the total portfolio in 2Q15, versus 4.1% in 2Q14, to a large degree due to greater provisioning in line with a 21.9% growth in sales during the period. In the first half, Losses from Renner Card, Net of Recoveries reached 6.6% of the total portfolio against 5.7% in 1H14. At month-end June 2015, Renner had issued 1.7 million Meu Cartão purchase-enabled credit cards, a growth of 57.3% in the portfolio, sales with this product reporting R$ 389.6 million for the quarter. Quarterly revenue was R$ 48.2 million, 60.8% greater than recorded in the same period in the preceding year. In 1H15, revenue amounted to www.lojasrenner.com.br/ri Página 4 de 10 LOJAS RENNER S.A. EARNINGS RESULTS FOR THE SECOND QUARTER (2Q15) R$ 91.8 million. Losses on the total Co-branded portfolio, net of recoveries were 4.8% of the portfolio value - in line with the 4.7% in the same period in 2014. In 1H15, Net Losses on the total Co-branded portfolio were 8.3% against 8.0% in 1H14. The Saque Rápido (quick withdrawal facility) portfolio totaled R$ 196.8 million at the end of June 2015 (R$ 131.1 million when adjusted to present value), versus R$ 160.9 million for 2Q14. Losses from the Saque Rápido facility, Net of Recoveries were 5.2% on the total portfolio against 2.8% for the same period in 2014. This reflects increased provisioning due to higher delinquency rates, albeit slightly above the Company’s forecasted limits for the product given the characteristics of this facility, however in line with current macroeconomic circumstances. Operating Expenses on Financial Products, posted growth of 18.8% in relation to 2Q14, reaching R$ 40.4 million. In 1H15, these same expenses were R$ 78.1 million, a growth of 22.9% against 1H14. On June 30, 2015, Accounts Receivable totaled R$ 1,746.1 million, 23.5% more than the position in June 2014. This increase is in line with sales growth in the period and breaks down into R$ 944.2 million for the Renner Card (Private Label), R$ 371.0 million for Meu Cartão (Co-Branded) and R$ 165.1 million for Saque Rápido. Third Party Card Companies and Other Accounts Receivable totaled R$ 265.7 million. Accounts Receivable (R$ MM) Jun.15 Renner Card (Private Label) - Total Portfolio (Adjusted to Present Value) Dec.14 Jun.14 1.057,4 1.205,3 929,2 944,2 1.088,2 826,5 On Due Receivable 865,7 1.094,0 754,3 Overdue Receivable 217,0 144,4 195,4 Present Value Adjustment (25,2) (33,1) (20,5) Allowance for Losses to the Realizable Value (67,6) (58,9) (59,5) Others (45,6) (58,2) (43,2) Meu Cartão (Co-Branded) - Total Portfolio 389,6 338,0 247,7 Meu Cartão (Co-Branded) - Net Portfolio 371,0 326,1 236,2 On Due Receivable 296,9 281,0 193,6 Overdue Receivable 92,7 57,0 54,1 (18,6) (11,9) (11,5) Quick Withdrawal - Total Portfolio 196,8 168,9 160,9 Quick Withdrawal - Net Portfolio 165,1 141,7 137,5 Fees and Transactions Receivable 196,8 168,9 160,9 Allowance for Losses to the Realizable Value (31,7) (27,2) (23,4) 259,8 347,6 212,2 5,9 4,9 1,9 1.746,1 1.908,5 1.414,4 Renner Card (Private Label) - Net Portfolio Allowance for Losses to the Realizable Value Total Third-Party Credit Card Companies Other Accounts Receivable Total Credit Portfolio, Net www.lojasrenner.com.br/ri Página 5 de 10 LOJAS RENNER S.A. EARNINGS RESULTS FOR THE SECOND QUARTER (2Q15) TOTAL ADJUSTED EBITDA: RETAIL + FINANCIAL PRODUCTS EBITDA Reconciliation 2Q15 2Q14 1H15 1H14 158.2 118.5 231.4 169.4 ( + )Income and Social Contribution Taxes 69.9 49.6 99.3 67.2 ( + )Financial Result, Net 25.8 21.3 53.8 36.5 (R$ MM) Net Income ( + )Depreciation and Amortization 63.7 51.6 125.1 99.9 317.6 241.0 509.6 373.1 ( + ) Stock Option Plan 7.5 7.0 14.0 9.9 ( + ) Result on Disposal or Write-Off of Fixed Assets 1.1 0.1 1.4 0.2 Total EBITDA In the light of the factors discussed above - resulting in significant increases in the Retailing Operation margins Total Adjusted EBITDA rose by 31.5% to R$ 326.2 million, while the Total Adjusted EBITDA Margin was 24.1%, a 1.8p.p. improvement on the 2Q14 margin. *Pursuant to Article 4 of CVM instruction 527, the Company has chosen to show its Adjusted EBITDA as in the above table in order to provide the information that best reflects the Total Adjusted EBITDA Margin 24.1% 22.3% 22.2% 19.9% gross operational cash generation from its activities. These adjustments are based on: a) the Stock Option Plan – corresponding to the fair value of the respective financial instruments recorded “pro rata temporis”, during the period services are rendered and offset by the Equity Capital Reserve and thus not representing a cash outflow; b) Statutory Participations are of a contingent nature and are related to the generation of profits pursuant to Article 187 of Law 6.404/76; and c) the Write-off of Fixed Assets relates to the results recorded from the divestment or write-off of fixed assets, largely without a cash Total Adjusted EBITDA* 326.2 248.1 525.0 383.1 NET FINANCIAL RESULT Financial Result, Net (R$ MM) 2Q15 2Q14 Var. % 1H15 1H14 Var. % 15.5 14.0 10.3% 29.5 29.3 0.8% 15.5 13.7 13.0% 29.4 28.8 1.8% 0.0 0.4 -90.1% 0.2 0.4 -62.9% (42.6) (35.2) 21.1% (90.0) (68.8) 30.7% Interest on Loans, Debentures and Borrowings (38.0) (30.0) 26.8% (80.5) (58.6) 37.3% Other Finance Costs (4.6) (5.2) -11.9% (9.5) (10.2) -7.2% Exchange Variation, Net 3.3 (1.8) -284.8% 2.7 0.1 3677.5% Hedge Operations (Debt Swap), Net (1.9) 1.6 -220.0% 4.0 2.9 36.9% (25.8) (21.3) 21.1% (53.8) (36.5) 47.2% Financial Income Gains on Cash Equivalents Other finance income Financial Costs Financial Result, Net In 2Q15, the Company reported a negative Net Financial Result of R$ 25.8 million compared with a negative R$ 21.3 million in 2Q14, largely a reflection of higher interest rates in the quarter in relation to the same quarter in 2014. In the first six months of 2015, the Company registered a negative Net Financial Result of R$ 53.8 million. NET DEBT Net Debt (R$ MM) Borrowings and Financing Jun.15 Dec.14 Jun.14 (1,173.5) (1,142.2) (1,082.2) Current (296.4) (210.2) (58.2) Noncurrent (877.1) (932.0) (1,024.0) 696.6 834.3 719.6 (476.9) (307.9) (362.6) 0.40x 0.29x 0,39x (834.7) (758.8) (761.5) Current (420.1) (345.2) (350.7) Noncurrent (414.6) (413.7) (410.8) (1,311.6) (1,066.7) (1,124.1) Cash and Cash Equivalents Net Debt Net Debt / Total Adjusted EBITDA (12M) Operational Financing Net Debt (Including Operational Financing) servicing charges are booked to the Net Financial Result. Operational Financing liabilities Products and Imports, the cost of which are reflected in the Operational Result www.lojasrenner.com.br/ri Página 6 de 10 As of June 30, 2015, Renner’s Net Debt stood at R$ 476.9 million. This debt is a consequence of capital management decisions and is currently made up of debentures issued in the past few years and by loans from the Brazilian Development Bank – BNDES and the Banco do Nordeste in addition to working capital credit lines to Camicado. Debt are linked to Financial LOJAS RENNER S.A. EARNINGS RESULTS FOR THE SECOND QUARTER (2Q15) NET INCOME The Company recorded Net Income in 2Q15 of R$ 158.2 million, a growth of 33.5% in relation to 2Q14, Net Margin increasing from 10.7% in 2Q14 to 11.7% in 2Q15. In 1H15, Net Income was R$ 231.4 million, a year-on-year growth of 36.6%. INVESTMENTS (CAPEX) In 2Q15, investments in fixed assets totaled R$ 146.6 million against R$ 116.0 million in 2Q14. Of this amount, R$ 50.0 million New Stores 50.0 52.8 82.8 90.5 was dedicated to the opening Remodeling of Installations 44.7 27.0 70.0 43.4 of new stores, R$ 44.7 million to store modernization, R$ 35.2 IT Equipament & Systems 35.2 37.1 43.7 37.4 million for IT Systems and Equipment as well as Distribution Centers 15.8 (5.8) 20.1 15.7 investments of R$ 15.8 million in Distribution Centers and R$ 0.9 Others 0.9 4.9 1.4 6.4 million in Others. In 1H15, Total 146.6 116.0 218.0 193.4 Investments in fixed assets amounted to R$ 218.0 million against R$ 193.4 million in 1H14. During the quarter, Renner rolled out 18 stores, 10 under the Renner name and a further five and three stores for Camicado and Youcom, respectively. CAPEX Summary (R$ MM) 2Q15 2Q14 1H15 1H14 In June 2015, Renner operated out of 259 stores and Youcom, from 28 stores, with a total selling area of 472.8 thousand m2 and 3.8 thousand m2, respectively. In turn, Camicado, had 63 stores with an aggregate selling area of 28.9 thousand m2. Depreciation and Amortization expenses totaled R$ 63.7 million in 2Q15, a year-on-year variation of 23.3%. In 1H15, these expenses were R$ 125.1 million, a growth of 25.1% against 1H14. This increase is predominantly due to the larger number of stores as a consequence of the Company’s current expansion plan. DIVIDENDS In 2Q15, Lojas Renner credited dividends of R$ 26.7 million to its Shareholders in the form of Interest on Capital in the amount of R$ 26.7 million, corresponding to R$ 0.2086 per share. In IH15, R$ 50.5 million were credited and corresponding to R$ 0.3954 per share. SUBSEQUENT EVENT On July 29, 2015, the Board of Directors authorized the Company to request the Central Bank of Brazil (“Bacen”) authorization for the organization and operation of a legal entity to be named as Realize - Crédito, Financiamento e Investimento S.A. ("Realize CFI"), which will have as its object the performance of financial institutions activities in accordance with the provisions of the Resolution No. 4.122/2012 of the National Monetary Council (Conselho Monetário Nacional) and the Circular Bacen No. 3.649/2013, and any other applicable legal and regulatory provisions; and to formalize, with both parties agreement, the termination of the Commercial Partnership Agreement (Acordo de Parceria Comercial) executed on 12/05/2014 by and between the Company and Banco Indusval S.A. (“BI&P”), which objective, in sum, was to establish a commercial partnership so that BI&P could explore, together with the Company, the activities related to the issuance of “Visa” or “Mastercard” credit cards considering the Company's customers base, an agreement that did not start due to operational impediments, not having any effects between the parties, their clients and third parties. www.lojasrenner.com.br/ri Página 7 de 10 LOJAS RENNER S.A. EARNINGS RESULTS FOR THE SECOND QUARTER (2Q15) ABOUT THE COMPANY Lojas Renner is the largest fashion retailer in Brazil, in June 2015 with 259 stores, 63 Camicado units and 28 Youcom stores, the large majority of which are situated in shopping centers. Renner designs and sells quality apparel, footwear and underwear for women, men, adolescents and children under 17 private labels of which 6 represent the Lifestyle concept, each one reflecting a style of being and dressing. Lojas Renner also sells accessories and cosmetics under two proprietary brands as well as offering specific items bearing third party labels. In May 2011, Renner acquired Camicado, a company in the home and decoration segment and in 2013, launched Youcom, a new business model focused on the younger generation in a specialized store environment. The target customers of Renner and Camicado are women between the ages of 18 and 39 who are in the medium-high consumer groups. Conversely, Youcom caters for the younger consumer between the ages of 18 and 35. Lojas Renner offers its customers fashion products in various styles with quality and competitive prices in practical and pleasant shopping environments. CONSOLIDATED RESULT STATEMENT Income Statement (in R$ '000) Net Operating Revenue 2Q15 2Q14 Var % 1H15 1H14 Var % 1,536,401 1,255,227 22.4% 2,710,348 2,194,126 23.5% Net Revenue from Merchandise Sales 1,354,226 1,111,197 21.9% 2,365,121 1,925,712 22.8% Net Revenue from Financial Products 182,175 144,030 26.5% 345,227 268,414 28.6% Costs of Sales and Services (618,617) (512,788) 20.6% (1,090,792) (909,330) 20.0% Cost of Goods Sold (604,983) (509,222) 18.8% (1,065,565) (901,446) 18.2% (13,634) (3,566) 282.3% (25,227) (7,884) 220.0% Cost of Financial Products Gross Profit 917,784 742,439 23.6% 1,619,556 1,284,796 26.1% (663,910) (553,031) 20.0% (1,235,107) (1,011,653) 22.1% Selling (343,999) (286,169) 20.2% (651,291) (542,367) 20.1% General and Administrative (116,651) (92,299) 26.4% (217,004) (173,933) 24.8% (74,136) (54,043) 37.2% (119,873) (83,214) 44.1% (129,124) (120,520) 7.1% (246,939) (212,139) 16.4% Financial Products Expenses (40,433) (34,028) 18.8% (78,054) (63,506) 22.9% Other Operating Results (88,691) (86,492) 2.5% (168,885) (148,633) 13.6% Operating profit before Financial Results 253,874 189,408 34.0% 384,449 273,143 40.8% Financial Result (25,785) (21,291) 21.1% (53,770) (36,537) 47.2% Financial Revenue 28,035 17,297 62.1% 59,770 36,817 62.3% Financial Expense (53,820) (38,588) 39.5% (113,540) (73,354) 54.8% 228,089 168,117 35.7% 330,679 236,606 39.8% Operating Expenses Losses on Receivables, Net Other Operating Results Income Before Income & Soc. Cont. Taxes Income and Social Contribution Taxes (69,920) (49,639) 40.9% (99,320) (67,222) 47.7% 158,169 118,478 33.5% 231,359 169,384 36.6% Earnings per Share - Basic R$ 1.2396 0.9407 31.8% 1.8146 1.3451 34.9% Earnings per Share - Diluted R$ 1.2309 0.9322 32.0% 1.8041 1.3339 35.3% 127,840 126,024 - 127,840 126,024 - Net Income for the Year Number of shares at the End of Year (in thousands) www.lojasrenner.com.br/ri Página 8 de 10 LOJAS RENNER S.A. EARNINGS RESULTS FOR THE SECOND QUARTER (2Q15) CONSOLIDATED BALANCE SHEET Balance Sheet (in R$ '000) Assets Jun.15 Dec.14 Jun.14 TOTAL ASSETS 5.224.002 5.321.540 4.407.842 Current Assets 3.307.172 3.499.343 2.780.762 Cash and Cash Equivalents 696.597 834.340 719.629 Trade Accounts Receivable 1.746.081 1.908.518 1.414.358 688.231 612.300 568.293 590.035 499.786 509.454 98.196 112.514 58.839 Recoverable Taxes 92.741 68.127 38.489 Derivative 27.799 33.324 2.844 Other Accounts Receivable 46.291 39.337 29.081 Inventories Inventories Imports in Transit Prepaid Expenses Noncurrent Assets Judicial Deposits 9.432 3.397 8.068 1.916.830 1.822.197 1.627.080 8.151 6.833 7.072 42.164 39.984 35.671 8.576 7.498 5.434 94.156 95.670 100.119 63 63 63 1.391.883 1.304.065 1.138.162 371.837 368.084 340.559 Jun.15 Dec.14 Jun.14 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 5.224.002 5.321.540 4.407.842 Current Liabilities 1.317.281 Recoverable Taxes Other Accounts Receivable Deferred Taxes Investments Property, Plant and Equipment Intangible Liabilities and Shareholders' Equity 1.854.113 2.037.362 Loans, Financing and Debentures 296.392 210.246 58.240 Financing - Financial Products Operations 419.648 336.719 307.172 473 8.442 43.516 Financing - Imports Lease Suppliers Commercial Suppliers Antecipation of Payments Suppliers of Material for Consumption 6.446 4.130 13.806 489.860 561.480 396.496 587.402 690.651 500.535 (180.228) (231.361) (165.194) 82.686 102.190 61.155 Taxes and Contributions Payable 167.956 337.935 125.820 Accrued Salaries and Vacations Payable 103.903 124.662 82.278 Rentals Payable 38.457 41.266 30.047 Statutory Liabilities 44.434 124.312 31.256 Provision for Civil and Labor Risks 23.916 23.998 19.529 194.803 196.988 132.408 22.343 Obligations with Card Administrators Derivative 1.799 - 66.026 67.184 54.370 1.366.376 1.428.910 1.522.677 Loans, Financing and Debentures 877.062 931.950 1.023.971 Financing - Financial Products - FIDC 414.604 413.659 410.837 42.205 49.860 48.519 243 300 335 29.160 26.259 34.211 Other Accounts Payable Noncurrent Liabilities Financing Lease Taxes and Contributions Payable Provision for Tax Risks Other Accounts Payable 3.102 6.882 4.804 2.003.513 1.855.268 1.567.884 1.128.234 750.853 725.054 Capital Reserves 259.870 245.860 230.793 Revenue Reserves 417.831 839.257 489.287 16.683 19.298 180.895 - Shareholders' Equity Capital Carrying Value Adjustments Retained Earnings Accumulated www.lojasrenner.com.br/ri Página 9 de 10 (11.479) 134.229 LOJAS RENNER S.A. EARNINGS RESULTS FOR THE SECOND QUARTER (2Q15) CONSOLIDATED CASH FLOW Statement of Cash Flows - Indirect Method (in R$ '000) 2Q15 2Q14 1H15 1H14 158.169 118.478 231.359 169.384 63.685 51.633 125.070 99.937 1.063 79 1.429 217 260 259 519 517 39.426 30.829 83.367 60.372 7.543 7.003 14.010 9.886 359 2.528 2.819 3.975 69.920 49.639 99.320 67.222 3.490 (2.024) (3.259) 1.764 (2.682) (71) 4.169 3.807 (11.606) (7.213) Cash Flow from Operating Activities Net Income for the Year Adjustment to Reconcile Net Income to Net Cash and Cash Equivalents Provided from Operating Activities Depreciation and Amortization Result in the Sale or Disposal of Fixed Assets, Net (or Write-off) Transaction Costs of Debentures Interest Expense on Loans, Debentures and Lease Stock Option Plan Provision for Tax, Civil and Labor Risks Deferred and Current Taxes Loss (Gain) on Derivative Net Foreign Exchange Variation Provision (Reversal) for Adjustment to Net Realizable Value Provision (Reversal) for Loss on Assets (977) 2.614 36.675 30.140 6.036 10.292 381.500 294.135 548.664 417.132 (88.620) Changes in Assets and Liabilities (Increase) Reduction in Accounts Receivable (166.871) 154.522 157.244 1.612 (63.161) (63.815) (18.715) (3.663) (36.561) 19.771 (Increase) in Judicial Deposits (2.884) (131) (1.318) Increase (Reduction) in Funding - Financial Products Operations 36.331 88.351 (Reduction) in Financing - Imports (3.422) Increase (Reduction) in Suppliers 86.347 Reduction (Increase) in Inventories 6.839 (Increase) Reduction in Other Assets (Reduction) in Salaries and Vacations Pay (181) 83.876 110.950 (47.592) (7.969) (33.216) 37.467 (68.224) (74.543) (27.758) (7.014) (20.758) (4.865) Increase (Reduction) in Taxes Payable 32.056 21.277 (123.468) (90.410) Increase (Reduction) Obligations with Card Administrators 18.510 17.973 (2.185) 18.157 (Reduction) in Other Liabilities (2.205) (43.232) (4.937) (34.501) 2.865 (2.809) (4.625) (5.615) (11.657) Increase (Reduction) in Rent Payable 5.152 (Reduction) in Statutory Obligations (11.657) Cash Generated (Used by) Operating Activities 333.223 267.813 Payment of Income Tax and Social Contribution (59.167) Payment of Interest on Loans, Financing and Debentures (20.549) 253.507 Net cash Generated (Used by) Operating Activities (5.615) 444.015 411.483 (55.198) (149.877) (132.334) (17.572) (58.617) (48.348) 195.043 235.521 230.801 Cash Flow from Investing Activities Purchases of Property, Plant and Equipment Assets Additions to Intangible Assets (117.814) (73.870) (178.282) (147.669) (28.793) (17.740) (39.818) (21.439) Proceeds from Disposal of Fixed Assets 7 Net Cash Used in Investing Activities (146.600) 119 (91.491) 30 (218.070) 257 (168.851) Cash Flow from Financing Activities Capital increase 23.073 5.319 23.073 5.319 Borrowings 24.000 15.180 46.373 15.180 (27.180) (3.215) (37.843) (6.250) Repayment of loans and financing Consideration of leasing 555 Payment of interest on equity and dividends Net Cash Used in Financing Activities (7.880) (3.023) (178.941) (155.139) (178.941) (155.139) (158.493) (137.317) (155.218) (143.913) Effect of exchange rate changes on cash and cash equivalents Reduction in Cash and Cash Equivalents 538 (53) - 24 - (51.639) (33.765) (137.743) (81.963) Cash and Cash Equivalents at the Beggining of the Quarter 748.236 753.394 834.340 801.592 Cash and Cash Equivalents at the End of the Quarter 696.597 719.629 696.597 719.629 www.lojasrenner.com.br/ri Página 10 de 10

Baixar