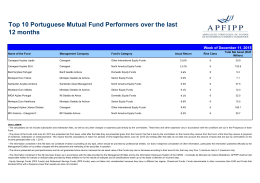

Inspirar para Transformar Leviathan as a Minority Shareholder: Firm-Level Implications of Equity Purchases by the State Carlos F. K. V. Inoue Sergio G. Lazzarini Aldo Musacchio Insper Working Paper WPE: 282/2012 Inspirar para Transformar Copyright Insper. Todos os direitos reservados. É proibida a reprodução parcial ou integral do conteúdo deste documento por qualquer meio de distribuição, digital ou impresso, sem a expressa autorização do Insper ou de seu autor. A reprodução para fins didáticos é permitida observando-sea citação completa do documento 0 Leviathan as a Minority Shareholder: Firm-Level Implications of Equity Purchases by the State* Carlos F. K. V. Inoue Insper Institute of Education and Research R. Quatá, 300 São Paulo, SP Brazil 04546-042 E-mail: [email protected] Sergio G. Lazzarini Insper Institute of Education and Research R. Quatá, 300 São Paulo, SP Brazil 04546-042 Phone: 55-11-4504-2432 E-mail: [email protected] Aldo Musacchio Harvard Business School and the National Bureau of Economic Research Soldiers Field Boston, Massachusetts 02163 Phone: 617-496-0995 E-mail: [email protected] This version: October, 2012 * Research assistance was ably provided by Cláudia Bruschi, Daniel Correa de Miranda, Darcio Lazzarini, Diego Ten de Campos Maia, Fabio Renato Fukuda, Fernando Graciano Bignotto, Guilherme de Moraes Attuy, Luciana Shawyuin Liu, Lucille Assad Goloni, Marcelo de Biazi Goldberg, Rafael de Oliveira Ferraz, and William Nejo Filho. The authors are grateful for conversations with and comments on early drafts from Dirk Boehe, Vinicius Carrasco, Rafael Di Tella, Rosilene Marcon, João M. Pinho de Mello, and Luiz Mesquita, as well as seminar participants at Harvard, FEA/USP, Insper, and the 2011 Strategic Management Society Special Conference in Rio. We also are thankful for the insightful comments and suggestions by three anonymous referees and the associate editor, Gerard George. Part of this research was conducted during Sergio Lazzarini’s visit to the Weatherhead Center for International Affairs at Harvard University, with financial support from Insper and CAPES (process BEX 3835/09-0). An older version of the paper, written by the last two authors, was circulated with the title “Leviathan as a Minority Shareholder: A Study of Equity Purchases by the Brazilian National Development Bank, 1995–2003” and won the Best Presentation Prize of the 2011 Strategic Management Society Special Conference in Rio. Data for subsequent years were then collected and used in the leading author’s master’s thesis at Insper. Sergio Lazzarini and Aldo Musacchio acknowledge the financial support from CNPq (Brazilian National Council for Scientific and Technological Development), Insper, and Harvard Business School. Any errors and omissions are the sole responsibility of the authors. 1 Leviathan as a Minority Shareholder: Firm-Level Implications of Equity Purchases by the State Abstract In many countries, firms face institutional voids that raise the costs of doing business and thwart entrepreneurial activity. We examine a particular mechanism to address those voids: minority state ownership. Due to their minority nature, such stakes are less affected by the agency distortions commonly found in full-fledged state-owned firms. Using panel data from publicly traded firms in Brazil, where the government holds minority stakes through its development bank (BNDES), we find a positive effect of those stakes on firms’ return on assets and on the capital expenditures of financially constrained firms with investment opportunities. However, these positive effects are substantially reduced when minority stakes are allocated to business group affiliates and as local institutions develop. Therefore, we shed light on the firm-level implications of minority state ownership, a topic that has received scant attention in the strategy literature. Keywords: State ownership, performance, business groups, development banks, state capitalism 2 INTRODUCTION Strategy scholars adopting an institutions-based view have argued that emerging economies are plagued with myriad voids that critically affect firm-level behavior and performance (e.g. Chacar, Newburry, & Vissa, 2010; Cuervo-Cazurra & Dau, 2009; Hoskisson, Eden, Lau, & Wright, 2000; Khanna & Palepu, 2000; Peng, Sun, Pinkham, & Chen, 2009). Shallow capital markets, ineffective legal systems, and a poor supply of qualified labor, among other things, are typical voids that raise the cost of doing business and thwart entrepreneurial activity. Scholars have studied various strategies to overcome these voids. One possibility is to forge collaborative networks to build trust and pool collective resources (Boisot & Child, 1996; Mesquita & Lazzarini, 2008; Peng & Heath, 1996). Firms can also build large business groups: collections of units belonging to common controlling shareholders, usually in the form of cascading chains of ownership. Through their internal, corporate markets, groups can provide affiliates with capital, labor, or other inputs that are scarce in external markets (Khanna & Yafeh, 2007; Leff, 1978; Wan & Hoskisson, 2003). This paper examines another possibility to address institutional voids: minority ownership by the state. Development economists have emphasized that an important constraint in emerging markets is the scarcity of long-term capital to fund promising entrepreneurial projects (Armendáriz de Aghion, 1999; Rodrik, 2004; Torres Filho, 2009; Yeyati, Micco, & Panizza, 2004). Following this argument, state capital can help boost entrepreneurial activity by stimulating investments in projects that would otherwise remain unfunded (George & Prabhu, 2000; Mazzucato, 2011). However, state capital also entails various risks. Agency theory suggests that state ownership creates a host of distortions because governments may force firms to appoint particular managers or pursue projects based on political criteria instead of efficiency and profitability (Alchian, 1965; Cuervo & Villalonga, 2000; Dharwadkar, George, & Brandes, 2000; Shleifer, 1998; Shleifer & Vishny, 3 1994). Consistent with this view, a flurry of empirical research has found that state-owned enterprises (SOEs) typically underperform private firms (see, for a review, Chong & Lopezde-Silanes, 2005; Megginson & Netter, 2001). Full state control has therefore been viewed as a dysfunctional or at best temporary organizational strategy: a “grabbing hand” detrimental to performance (Shleifer & Vishny, 1998). The extant literature, however, has not paid sufficient attention to a new form of state involvement that does not entail majority state control. In several countries, the state instead participates in the ownership of corporations as a minority shareholder. To illustrate, consider the following information on the largest 100 publicly traded corporations in Brazil, Russia, India, and China, from the Standard & Poor’s Capital IQ database. In 2007, firms with more than 10% of state ownership represented between 33% (Brazil) and 50% (China) of the total market capitalization of those top firms. Instances with minority stakes were nontrivial. Thus, in 39% of the observed cases, the state had less than 50% of the company’s equity. Although governments sometimes purchase minority equity positions as part of a bailout (as in the case of General Motors in 2008), in many countries governments actively invest in equity through various vehicles, such as development banks, sovereign wealth funds, and pension funds (Bremmer, 2010). Yet, state minority stakes remain a poorly understood phenomenon, despite their prevalence and relevance in the public debate (see e.g. The Economist’s special report on state capitalism: Wooldridge, 2012). Building on complementary theoretical perspectives, we offer an integrative set of hypotheses to explain the emergence and firm-level implications of minority state ownership. In a nutshell, our theory is as follows. As noted before, minority state capital can supplant institutional voids in emerging economies by allowing resource-constrained firms to invest in productive assets and profitable projects. Given the minority nature of those stakes, majority control will be in the hands of profit-oriented shareholders. Thus, agency distortions 4 commonly found in full-fledged SOEs should be less intense when the state participates with minority capital. But why should ownership (equity) have this effect, instead of, say, loans (debt) from state-owned banks? Based on Williamson’s (1988) transaction cost logic, we propose that the positive effect of equity investments will depend on the nature of the underlying assets. Compared to debt, equity does not imply a prespecified rate of return and is more flexible to future strategic adjustments. Thus, equity should be particularly helpful when firms have opportunity to engage in long-term, fixed investments for which, however, they do not have enough capital. In some sense, the government will act as a venture capitalist, supporting firms with constrained investment opportunity. Furthermore, if government allocations are carried out through minority stakes with restrained political interference, then the positive effect on firm-level outcomes may occur without the downside of the state’s grabbing hand. We also propose two key contingencies affecting the benefits of state minority ownership. First, we submit that the positive effect of such minority stakes will be attenuated when target firms belong to business groups. If groups already reduce resource constraints through their internal markets, then government equity should be more beneficial when it is not allocated to group affiliates. Furthermore, agency theory also supports the view that minority state capital may be used to rescue other companies in the pyramid or simply expropriated by the majority shareholders of the group (Bertrand, Mehta, & Mullainathan, 2002; Morck, Wolfenzon, & Yeung, 2005). Therefore, from the point of view of group affiliates, state and group capital will act as substitutes; however, business groups and state minority investments can act as complements in the economy as a whole if governments target independent firms. Second, we argue that the positive effect of minority state ownership is reduced when institutional improvements progressively attenuate or mitigate voids. For instance, a substantial development of local capital markets will greatly enhance 5 firm access to market-based sources of financing, thereby reducing the need of state capital. Thus, we not only examine firm-level implications of minority state ownership, but also discuss factors that should make those stakes conducive to superior performance. We test our theory using panel data from 367 publicly listed Brazilian companies observed between 1995 and 2009. Brazil is an appropriate empirical context for our purposes for at least three reasons. First, in that period, Brazil’s average stock market capitalization to gross domestic product (GDP) was 43.1%, compared to 98.7% in Chile and 129.7% in the United States. Thus, relative to other countries, Brazilian firms were more constrained in terms of equity financing. Second, our chosen temporal window encompasses an important privatization wave—by itself, an external shock that changed the ownership structure of many companies. Interestingly, the process of privatization in Brazil was accompanied by the rise of a new form of indirect state ownership of corporations via equity purchases by the Brazilian National Development Bank (BNDES), through its investment subsidiary, BNDESPAR. Responsible for executing Brazil’s privatization program, the bank actively sought to form consortia with private acquirers, relinquishing majority control even in cases where it provided loans and equity (De Paula, Ferraz, & Iootty, 2002). The size of these allocations—US$53 billion by 2009—triggered criticism that equity purchases favor large local business groups with financial clout to execute their projects alone, without help from the development bank (e.g. Almeida, 2009). Third, also during the sample period, Brazil made important pro-market reforms that affected local institutional voids. For instance, stock market capitalization to GDP in Brazil jumped from 19% in 1995 to 73% in 2009. This phenomenon allows us to examine how the effect of minority stakes varies over time, according to changes in the extent of local voids. We develop our analysis as follows. In the next section, we explain our theory and outline testable hypotheses. We next provide details of the privatization process in Brazil and 6 the role of remaining (minority) stakes by the government, followed by a description of our data and methods. The results are discussed in subsequent sections. The final section presents implications for theory and practice. THEORY: MINORITY STATE OWNERSHIP UNDER INSTITUTIONAL VOIDS We propose a theory that explains how minority state ownership affects firm-level investment and performance in an environment where firms face critical voids that undermine their ability to pursue profitable projects. As such, we integrate several theoretical strands: the institution-based view of strategy (Hoskisson et al., 2000; Peng et al., 2009), agency theory (Cuervo & Villalonga, 2000; Dharwadkar et al., 2000; Vickers & Yarrow, 1988), and transaction cost economics (Williamson, 1988, 1996). We start with a discussion on how minority stakes by the state differ from the more traditional forms involving full state control and under which conditions they can positively influence firm-level performance. Next, we outline contingencies that should moderate this positive effect. Majority versus Minority Stakes by the State The bulk of the literature on government ownership compares two polar modes of ownership: privately controlled firms and SOEs, in which governments hold majority stakes. Most studies adopt an agency theory perspective by outlining the intrinsic conflicts that occur between the agents and principals of those firms. Under state ownership, conflicts are exacerbated because society (as a principal) delegates the monitoring of SOEs to politicians in charge of the government, who in turn are supposed to monitor SOE managers (Cuervo & Villalonga, 2000). Thus, SOEs will typically suffer interference from politicians trying to use those firms as mechanisms to transfer rents to their particular constituencies (Shleifer, 1998; Shleifer & Vishny, 1998). Governments may also pursue a “double bottom line” by requiring SOEs to meet outcomes other than profitability, such as high employment or low consumer prices (Mengistae & Xu, 2004; Shapiro & Willig, 1990). Furthermore, given the lack of 7 profit-oriented owners, SOE managers typically lack the high-powered incentives commonly found in private firms (e.g., aggressive profit sharing) and are not subject to close monitoring by private owners acting as residual claimants (Gupta, 2005; Vickers & Yarrow, 1988). All these factors should have a negative effect on firm-level economic performance—a prediction is generally supported by empirical research (e.g. Anuatti-Neto, Barossi-Filho, Carvalho, & Macedo, 2005; Boardman & Vining, 1989; Kikeri, Nellis, & Shirley, 1992; La Porta & López-de-Silanes, 1999; Megginson & Netter, 2001; Yiu, Bruton, & Lu, 2005). Fewer studies examine cases in which the government holds minority stakes. From a theoretical standpoint, if governments are minority shareholders, then they relinquish control of SOEs to other owners holding majority stakes. Consequently, the ability of governments or politicians to interfere in pricing or investment decisions is curtailed if these actions conflict with the objectives of controlling owners. Furthermore, if majority owners are profit maximizers, they will want to closely monitor executives or implement pay-for-performance practices that help reduce agency conflicts. Consistent with this prediction, some studies find that firms with minority stakes owned by the government perform better than SOEs with majority state control, although not necessarily better than pure private companies (Boardman & Vining, 1989; Majumdar, 1998; Wu, 2011). However, if state minority ownership stakes only attenuate the agency problems rampant in SOEs and are therefore not expected to improve performance relative to privately owned firms, then why are such minority stakes prevalent in several countries? A possible explanation is that those stakes result from complex political processes whereby governments try to preserve their influence in the economy through embedded, intertwined networks with local capitalists (Pistor & Turkewitz, 1996; Stark, 1996). But this explanation says little about the conditions under which minority equity may or may not affect performance. In 8 what follows, we offer a theory proposing conditions under which minority stakes may actually improve firm-level profitability and investment. State Minority Ownership in a Constrained Environment Drawing from institutional theorists who argue that emerging countries are frequently inhibited by poorly enforced contracts and high transaction costs (North, 1990; Stone, Levy, & Paredes, 1996), strategy scholars propose that weak country-level institutions have important implications for firm-level performance (e.g. Hermelo & Vassolo, 2010; Hoskisson et al., 2000; Khanna & Palepu, 2000; Peng et al., 2009). Weak institutions are associated with numerous voids represented by shallow capital markets, costly legal enforcement, a scarce supply of skilled labor, and ineffective anti-competitive regulation, among other factors that severely constrain the entrepreneurial activity of local firms (e.g. Chacar et al., 2010; Cuervo-Cazurra & Dau, 2009; Khanna & Palepu, 1997). For instance, voids associated with scarce capital markets can pose limits on firms’ ability to invest in profitable projects, especially projects requiring large, fixed capital allocations with long maturity (Levine, 2005; Rajan & Zingales, 1996). Starting from the premise that local entrepreneurs in less developed countries may be constrained by such voids, a vast literature on development finance has evolved to argue that government loans can alleviate capital constraints in the private sector and promote projects with positive net present value that might not otherwise have been undertaken (Rodrik, 2004; Torres Filho, 2009; Yeyati et al., 2004). With new long-term capital unavailable or excessively costly in existing (private) markets, firms will be able to achieve economies of scale, improve their operations, revamp new technology, and so forth—all factors that should lead to superior performance. “Latent” capabilities can therefore turn into actual projects and spur the growth of new firms and industries (Hausmann, Hwang, & Rodrik, 2007). Development scholars, however, have focused exclusively on the role of debt (i.e., loans, 9 often subsidized) provided by state-owned banks. How can equity stakes help in the context of local voids compared to what can be achieved through government loans? Here we borrow from Williamson’s (1988, 1996) discussion on the relative merits of debt and equity as alternative governance mechanisms. Using transaction cost logic, Williamson (1988, 1996) argues that nonredeployable investments required to revamp production capabilities (such as dedicated technology and infrastructure) are best served by equity due to the higher flexibility of this financing mode. While debt requires a fixed return over the duration of the contract, equity can better adapt to changing circumstances that might negatively affect the value of such assets. Shareholders have more discretion to meet and discuss strategies to reorganize the company and provide a longer-term time frame for the necessary changes. Furthermore, because state actors value social goals other than pure profit maximization, minority state capital will tend to be more “patient” (Kaldor, 1980). While private investors may seek short-term gains and exit in moments of market turmoil, state capital will more likely commit to projects with longer time horizons (McDermott, 2003). With such an important long-term shareholder, target firms may more easily attain legitimacy and reputation in the marketplace, with positive consequences for their capacity to attract valuable resources and partners (George & Prabhu, 2000; Wu, 2011). In addition, because minority stakes do not grant direct government control of the target firms, there will be less perceived risk that they will be subject to dysfunctional political interference. In sum, with reduced agency hazards, the cost of state equity should be compensated for by the benefit of an improved capacity to undertake profitable projects at the firm level. Therefore we have the following hypothesis: Hypothesis 1. In less-developed institutional settings, minority state ownership positively affects firm-level economic performance. 10 Given that superior investment capacity is a key mechanism underlying the positive effect of minority state equity, we again use Williamson’s (1988, 1996) framework to propose that minority equity stakes will help improve firm performance by promoting capital expenditures (investment in long-term, fixed assets). Although not all fixed assets are nonredeployable (e.g., generic land), the extent to which a firm invests in fixed capital is a signal that its business involves longer-term, riskier projects that can benefit from the flexibility of equity as a financing mode. However, investment per se may be neither necessary nor desirable (David, Yoshikawa, Chari, & Rasheed, 2006; Lang, Ofek, & Stulz, 1996). Even in an environment with critical voids, one may find heterogeneity at the firm level. Thus, a firm with access to multiple sources of capital will not be financially constrained (Fazzari, Hubbard, & Petersen, 1988) and hence should not necessarily alter its investment activity simply because the state becomes a minority shareholder. Likewise, not all firms will have promising projects with positive economic value (David et al., 2006). In such cases, state-led injections of capital can be redirected to uses other than supporting profitable investment. We thus propose that minority state capital positively promotes investment when firms face a condition of constrained opportunity. We define firms with constrained opportunity as those that have a valuable investment opportunity but are at the same time limited in their ability to attract long-term funding. We expect to find a positive association between minority state equity and investment in firms that have latent valuable projects but lack the necessary capital to consummate the required fixed investments. Thus: Hypothesis 2. In less-developed institutional settings, minority state ownership promotes capital expenditures by firms with constrained opportunity. 11 Contingent Effect of Target Firms’ Participation in Business Groups We also have reason to expect the effect of government equity to vary with the ownership structure of target firms. Since Leff’s (1978) original contribution, scholars have proposed that business groups—that is, collections of firms under the same controlling entity—provide their affiliates with resources flowing through internal capital markets. Because resource allocations within groups are defined by fiat, according to the objectives of controlling shareholders, groups use internal capital markets to overcome the voids posed by scarce capital, labor, and product markets (Khanna & Palepu, 2000; Khanna & Yafeh, 2007; Wan & Hoskisson, 2003). But if internal markets reduce external voids, we should expect state minority stakes to be more effective at increasing firm performance and promoting capital expenditures when target firms are not affiliated to groups. The latter should be relatively more affected by external voids than firms that have internal, group-level resources at their disposal. Moreover, groups may be associated with the risk of minority shareholder expropriation. Most business groups are organized through complex pyramids involving firms that have stakes in other firms (Morck et al., 2005). In countries with weak minority owner protection, state equity may be “tunneled” through complex pyramids to support controlling owners’ private projects or rescue struggling internal units (Bae, Kang, & Kim, 2002; Bertrand, Djankov, Hanna, & Mullainathan, 2007). Here the agency conflict involves the majority owners of the group and minority investors—including the state—providing group affiliates with extra capital. The state may thus increase the wealth of the business group’s majority owners without necessarily improving the performance of the companies in which it invests. That is, the effect of state equity is attenuated by possible tunneling inside business groups. Consistent with this prediction, Giannetti and Laeven (2009) find that 12 minority holdings by public pension funds increase firm value, but the effect is reduced when firms are part of business groups. These two effects—groups substituting for external financing and their potential use of tunneling—lead to the following hypotheses: Hypothesis 3. In less-developed institutional settings, the positive effect of minority state ownership on firm-level performance is attenuated when the firm belongs to a pyramidal business group. Hypothesis 4. In less-developed institutional settings, the positive effect of minority state ownership on the capital expenditures of a firm with constrained opportunity is reduced when the firm belongs to a pyramidal business group. Contingent Effect of Evolving Institutions We argue that minority equity purchases by the state can help firms alleviate constraints in less-developed institutional settings. Consequently, as institutions develop, the positive effect of those stakes should decline. For instance, in more developed capital markets, firms can raise equity capital in various forms. While firms that are already listed can issue new equity in stock markets, private firms can go public for the first time or, alternatively, lure private equity investors who could use stock markets as a future exit (divestment) mechanism. But shallow capital markets not only pose constraints in terms of scarce capital; they also lack more transparent mechanisms to reveal company-level information and monitor managers. Dyck and Zingales (2004) and Nenova (2005) assert that underdeveloped capital markets make takeovers less likely and magnify governance conflicts. Lending some support to this claim, Sarkar, Sarkar, and Bhaumik’s (1998) comparison of state-owned and private banks in India indicate that, in the absence of well-functioning capital markets, private companies are not unambiguously superior to SOEs. However, as capital markets develop, with more sophisticated mechanisms for capitalization and 13 monitoring, new private investors will tend to emerge and gradually replace governments as sources of capital. Strategy research adopting an institution-based view also provides support for this argument. Thus, in emerging market contexts firms benefit from a more network-based strategy of growth as a form to overcome the lack of scarce resources (Boisot & Child, 1996; Peng & Heath, 1996). Such networks can involve complex entanglements between firms and governments acting as providers of capital and other valuable resources (McDermott, 2003). But if institutional reforms promote the development and sophistication of capital, labor, and product markets, then strategies based on public–private connections should become relatively less important (Li, Park, & Li, 2004; Peng & Luo, 2000). Hence, firms may gradually reduce their dependence on the state to obtain scarce resources (Keister, 2004). A key element of our theory involves firm-level investment; therefore we examine how institutional development affects the behavior of firms with constrained opportunity. An implication of the above discussion is that a progressive reduction in institutional voids should alleviate the resource constraints of firms with valuable projects that require large capital expenditures. Therefore, the state will become less instrumental in fostering new investment. Furthermore, given that group affiliates can overcome institutional voids through internal markets, it follows that the attenuation of constraints posed by external voids should especially affect firms that do not belong to groups. Thus, stand-alone firms will more likely be relieved of their resource constraints as improvements in local institutions deepen the capital, labor, and product markets. This logic leads to our final set of hypotheses: Hypothesis 5. The positive effect of minority state ownership on the capital expenditures of a firm with constrained opportunity is reduced as local institutions develop. 14 Hypothesis 6. The attenuation effect described by Hypothesis 5 should be greater in the case of firms that do not belong to business groups. PRIVATIZATION AND MINORITY STATE OWNERSHIP IN BRAZIL In Brazil, SOEs have prevailed in diverse sectors, including banking and railways, since the nineteen19th century. But the state’s sphere of influence increased after World War I, especially in the 1940s, when the government of Getúlio Vargas inaugurated an ambitious plan of government investment in steel mills, mining, chemicals, and a wide array of other sectors (Baer, Kerstenetzky, & Villela, 1973; Musacchio, 2009). Throughout the subsequent decades, pyramidal business groups began to be organized, with 10 or more SOEs in multiple sectors linked to a holding company at the top (Trebat, 1983). A series of joint studies conducted in 1952 by the governments of Brazil and the United States concerned with investing in the expansion of Brazil’s infrastructure led to the creation of a national development bank to provide long-term credit for energy and transportation investments. The Brazilian National Bank of Economic Development (BNDE in Portuguese, later changed to BNDES when “social development” was added to its mission) assumed over the following decade other roles, including financing machinery purchases in foreign currency, serving as guarantor in credit operations abroad, and lending directly to Brazilian companies. In the 1970s, BNDES began, through different programs, to invest directly in the equity of Brazilian companies. In 1982, it created BNDES Participations (BNDESPAR) to manage those holdings. In the early 1990s, in the midst of financial instability, hyperinflation, and high budget deficits, the Brazilian government began to reconsider investment in SOEs due to the high opportunity cost of holding equity in these companies (Pinheiro & Giambiagi, 1994). Thus, the governments of Fernando Collor (1990–1992) and especially Fernando Henrique Cardoso (1995–2002) undertook a major privatization program aimed at reducing debt and improving 15 productivity, eventually collecting about $87 billion dollars in privatization revenues. At the same time, a process of market liberalization was being undertaken, with diminished tariffs in various sectors and the progressive entry of foreign capital. Between 1996 and 2000, the participation of foreign companies in the total revenues of industries increased from 27% to 42% (De Negri, 2003). BNDES played three roles in the privatization process. First, it served as an agent of the government in privatization transactions, selling and sometimes financing operations. Second, it provided loans to private and public enterprises. Third, through its equity-holding arm BNDESPAR, the bank purchased minority stakes in a variety of publicly traded firms. BNDES was involved in the privatization process not only to deflect criticism that the state was losing its grip on the economy, but also, by making available substantial capital, to attract private players to the ongoing auctions. Approximately 86% of the revenues collected from privatization auctions came from block sales, acquirers typically forming consortia that included domestic groups, foreign investors, and public entities such as BNDESPAR and pension funds of state-owned companies (Anuatti-Neto et al., 2005; De Paula et al., 2002; Lazzarini, 2011). Table 1 shows how BNDES’ holdings (through BNDESPAR) evolved in our sample of firms between 1995 and 2009. Such holdings can be direct or indirect (i.e., BNDES owning an intermediate firm that in turn owns the final target firm). As an illustration, consider the case of Vale, depicted in Figure 1. In that year, BNDES’ stake in Vale was indirect because BNDES had stakes in a holding company, Valepar, which in turn had stakes in Vale. Because pyramidal structures are complex and often involve unlisted companies, the size of BNDES’ indirect holdings is not always publicly available. Table 1 shows that, in each of those years, BNDES held equity stakes in several companies, more than half being direct equity purchases. BNDES’ direct equity stakes averaged 16% of the firms’ total 16 equity. Active bailouts and conversions of debt for equity notwithstanding, most of these equity holdings were part of an explicit strategy of investment management formulated by BNDESPAR analysts in tandem with the restructuring events of the 1990s. Using this empirical context, we next describe our database and then proceed with the test of our hypotheses. <<Table 1 and Figure 1 around here>> DATA AND METHODS Database We use a database that tracks basic financial information and ownership for 367 Brazilian firms between 1995 and 2009. All enterprises listed in the stock market during that period for which we could collect reliable financial and ownership information are included. We analyze these firms’ ownership profiles and financial information using such diverse sources as reports filed with the Brazilian Securities and Exchange Commission (CVM), as well as the Economática, Interinvest, and Valor Grandes Grupos databases. We cleaned the database in several ways. First, we dropped financial firms and publicly listed holding corporations (i.e., we only kept their affiliates). Second, we eliminated inconsistent financial information, such as cases where total assets were different from total liabilities. Third, to mitigate distortions by extreme values, we winsorized at the 1% and 99% percentiles those key variables that vary substantially (chiefly performance and investment variables). The panel is unbalanced due to mergers, acquisitions, and business attrition, as well as missing information for some financial variables. Our variables are described below. Table 2 gives descriptive statistics. <<Table 2 around here>> 17 Dependent Variables Firm-level performance. We employ two measures of performance. Our first measure, return on assets (ROA), corresponds to net profits over total assets in a given year. To incorporate long-term performance effects and gauge sources of value not fully captured by accounting data (e.g., intangibles), we also collected data on firms’ stock market valuation. Our second measure, Market-to-book, is then computed as the total market value of stocks divided by the book value of equity (e.g. Fama, 1992). It is an indicator of the future return on equity and hence incorporates future market expectations about firm-level performance (Penman, 1996). Fixed investment. Following previous work (Behr, Norden, & North, 2012; Fazzari et al., 1988), we measure fixed investment as the ratio of yearly capital expenditures to the initial stock of fixed capital (observed at end of the previous year). Unfortunately, we were unable to find reliable data on more refined measures of nonredeployable investment, such as R&D expenditures. However, in less-developed markets, firms tend to have pressing needs to invest in infrastructure and machinery so as to build industrial production capacity. Development scholars see accelerated fixed investment as critical in helping emerging nations “catch up” to advanced, industrialized economies (Amsden, 1989; Chang, 2002; Cimoli, Dosi, Nelson, & Stiglitz, 2009). We thus believe that the extent of fixed asset investments is correlated with firms’ orientation towards complex, long-maturity projects, for which the flexibility of equity can be of particular help. Explanatory Variables State minority equity. Given the prevalence of pyramidal ownership structures in Brazil (Valadares & Leal, 2000), we code both direct and indirect equity stakes. Direct equity holdings by the state (through BNDESPAR) constitute a continuous variable, MinorityDir, which measures the percentage of equity held by the bank (from 0% to 100%). 18 Our measure of total stakes (direct or indirect) is discrete because, as discussed before, we do not have precise information on the magnitude of indirect BNDES’ equity holdings in pyramidal chains. We thus create a dummy variable, Minority, which is set equal to one for a company among whose owners is another company in which BNDES has equity and zero otherwise. 1 Membership in business groups. We also code for when the state (via BNDESPAR) owns equity in a company that belongs to a pyramidal business group. Figure 1 shows that Vale is, itself, a pyramidal group, given that the company has stakes in several other firms (Samitri, MRS, Samarco, etc.). Thus, in 2003 BNDES had an indirect stake in a pyramidal group. Our criteria to classify firms into groups are as follows. Membership in a group was considered when a firm is controlled by an owner or group of owners who control other firms in our database. To detect the existence of controlling stakes, we conducted a detailed analysis of shareholder agreements available at the website of the Brazilian Securities Exchange Commission. Thus, we identified owners who had distinctive control rights over a firm (i.e., more seats in the board of directors). Multinationals with single subsidiaries in Brazil were not treated as groups, even though they usually control multiple units across the world. Our goal was to find instances in which local controlling shareholders could use new allocations to transfer funds to local units. Using such criteria, we created the dummy variable Group, which is equal to one if the company belongs to some business group and zero otherwise. About 45% of the observations in our database are from firms belonging to some group. To test our hypotheses that the effect of state equity depends on business group membership, we multiply the MinorityDir and Minority variables with the dummy variable Group. 1 We focus on at most two layers of ownership, that is, cases in which BNDES participates in a firm that in turn has stakes in another firm. 19 Constrained opportunity. To measure constrained opportunity, we need to observe cases where firms have investment opportunities but are at the same time constrained in their ability to attract funding. We measure such constrained opportunities by creating a composite variable with two key elements. First, following previous work (David et al., 2006), we compute the Tobin’s Q of the firms in the database (proxied by the market value of stocks plus the book value of debt, divided by the book value of total assets). We then measure investment opportunity with a dummy variable Q, which is equal to one if Tobin’s Q exceeds unity and zero otherwise. Thus, cases with Q = 1 indicate that a unit increase in total assets is expected to yield an increase in firm market value by more than one monetary unit. In other words, the firm can create market value by expanding its assets (David et al., 2006). Second, we gauge financial constraints by computing the ratio of net profits to the initial stock of fixed capital (Behr et al., 2012; Fazzari et al., 1988). The larger this ratio, the higher a given firm’s ability to invest using profits from its own operations. We thus measure constraint, C, as a dummy variable coded as one if the firm has a ratio of net profits to the stock of fixed capital that is below the sample median and zero otherwise. Compared to other companies in the sample, a firm with C = 1 has a reduced amount of cash flow, given its stock of fixed assets, and thus needs to attract more external capital in case of a planned expansion. Finally, we combine Q and C to create our measure of Constrained opportunity and end up with a dummy variable coded as one if both Q and C are equal to one and zero otherwise. Constrained opportunity is then interacted with the minority state equity variables, as well as with the Group dummy. Institutional variables. To test our hypothesis of a diminished effect of state equity in promoting investment as institutions develop, we begin by using as an interacted variable a simple measure of time count (e.g. Hermelo & Vassolo, 2010), Time, beginning with a value of one in the first year of the series (1995). The objective is to assess how the effect of state 20 equity changed over the years. We then follow Chacar et al. (2010) and add more direct measures of institutional development related to the capital, product, and labor markets. The variables Ease of credit, Competition legislation and Availability of skilled labor were obtained from the World Competitiveness Report (WCR), published by the International Institute for Management Development, Geneva. Ease of credit is measured by the WCR survey item asking senior and middle managers to what extent credit is easily available for business. Competition legislation is measured by the WCR item asking respondents whether competition legislation is efficient in preventing unfair competition. Availability of skilled labor, in turn, is measured by the WCR item asking respondents to what extent skilled labor is readily available. We further collected two variables to assess the level of financial market development: Country credit rating and Stock market capitalization to GDP. Country credit rating is based on a scale assessed by the Institutional Investor Magazine. Finally, Stock market capitalization to GDP was obtained from the World Bank’s World Development Indicators database and gauges the market capitalization of listed companies as a percentage of GDP. Because these measures are highly correlated with Time (e.g., Stock market capitalization has a correlation coefficient of 0.73), they may spuriously pick a natural improvement trend in the local environment. To avoid this confounding effect, we measured instead the percentage yearly variation in those variables, using three-year moving average windows to reduce distortions by short-term effects.2 In addition, whenever we add a specific institutional variable, we also add, as controls, Time and its interaction with our key variables of interest. With this procedure, our institutional variables essentially measure percentage variations above or below a natural trend captured by the variable Time. 2 For instance, the financial crisis of 2008 sharply reduced the level of stock market capitalization, which nonetheless quickly recovered in Brazil, as well as in other emerging markets. 21 Control Variables Control variables include a measure of size, Ln(Revenues), which is the logarithm of gross revenues, in thousands of US dollars, as well as financial controls, Fixed (fixed assets to total assets) and Leverage (debt to total assets). Distinct ownership patterns are captured by two dummies, Foreign control and State control, coded for whether a firm’s majority (controlling) owner is the state or a foreign entity, respectively; thus, domestic private control is the baseline case. Because state minority ownership may jointly occur with industrial concentration (e.g., the state may try to create “national champions” in a given sector), we add the control Merger, which assumes value of one if the target firm resulted from a merger or acquisition deal and zero otherwise. All variables used in interactions with minority stakes by the state (Group, Constrained opportunity, and institutional variables) are additionally employed as controls to guarantee that any measured effect of the interactions is not driven by omitted main effects. Estimation Approach In an ideal experimental situation, we would like the state (via BNDES) to buy shares of Brazilian companies randomly. However, BNDES selectively chooses its target firms. Therefore, simple regressions assessing the effect of BNDES stakes on firm-level outcomes may suffer from selection bias or endogeneity caused by unobservable factors affecting both the likelihood of state ownership and the outcomes under examination (performance and investment). To circumvent this problem, we proceed in several complementary ways. First, in our panel regressions we adopt a fixed-effects approach (Wooldridge, 2002) by including time-invariant company-specific effects, time-varying industry-level effects (i.e., industry membership dummies interacted with year dummies), and year effects. We thus essentially measure within-firm performance variations net of fixed and temporal factors that will simultaneously affect all companies in the same industry. This is possible in our data because 22 our period is associated with intense corporate restructuring and changes in corporate control (e.g., privatization). In other words, our database exhibits variation over time in terms of ownership. Second, following the approach proposed by Heckman, Ichimura, and Todd (1997), we run additional regressions combining fixed-effects estimation with propensity score matching. While fixed effects control for unobservable factors potentially causing spurious inference, propensity score matching allows for the creation of comparable control groups with traits similar to those of the firms observed with BNDES stakes during our temporal window. Namely, using variables observed in the first year of the sample (1995), we run probit regressions to assess which firm-level traits explain whether a given company will be observed with a BNDES stake in the two ways described before (i.e., directly or indirectly through layers of ownership). Firm-level traits include Ln(Revenues), Leverage, Fixed assets, Foreign control, State control, and a host of industry dummies. Propensity scores are then computed using kernel matching and those scores generate regression weights for the subsequent panel regressions, where performance and investment are dependent variables (Nichols, 2007). This technique guarantees that firms without BNDES stakes but with traits similar to those of BNDES companies will receive more weight in the performance and investment regressions. Furthermore, we restrict our analysis to firms with and without BNDES stakes in regions of common support, that is, a subset of firms with attributes within a similar range based on computed propensity scores (Heckman et al., 1997). Although at the cost of a reduced sample size, this procedure makes the subgroups with and without BNDES stakes more directly comparable. Third, we run additional regressions, checking alternative explanations for our results. Thus, we run selection equations to see if the state is choosing high-performing firms to invest, which could yield a spurious causal inference between minority state ownership and 23 performance. If, as critics of industrial policy contend, governments frequently “pick winners” (e.g. Pack & Saggi, 2006), the apparent positive effect of stakes may be spurious; that is, past performance may be affecting government equity instead of the other way around. We also check whether BNDES equity stakes have implications for the attraction of debt, which represents an alternative, non-hypothesized channel for the effect of minority state ownership. To examine this possibility, we use Leverage (as previously defined) and Financial expenses (the ratio of interest payments and amortizations to total debt) as dependent variables in regressions where minority state equity and controls are added as independent variables. FINDINGS Effect of Minority State Equity on Performance Table 3 reports the results of our regressions assessing the effect of minority state equity on performance. Models 1 to 4 examine the effect of stakes on ROA: The first two models measure the effect of direct and indirect equity stakes (Minority), whereas the last two models assess direct equity stakes only (MinorityDir). We show estimates with and without weights based on propensity score matching. The number of observed firms in the regressions with control for matching is lower because, as explained earlier, our adopted technique restricts the analysis to data points in regions of common support (i.e. comparable firms). <<Table 3 around here>> Consistent with Hypotheses 1 and 2, we generally find positive effects of minority stakes and negative effects when those stakes are interacted with group membership. Model 1 shows that companies with the state as a minority shareholder (directly or indirectly) have a return on assets 11.1 percentage points higher than that of other firms, although the effect is wiped out when stakes are allocated to firms belonging to pyramidal groups (p < 0.05). 24 Namely, the coefficient of Minority×Group indicates that state ownership associated with group affiliates reduces the aforementioned positive effect by 13.1 percentage points. However, the results are not robust to the specification with matching (Model 2): The coefficients become statistically insignificant. More robust effects are found when we use the continuous measure coding the state’s direct percentage participation in the equity. The coefficient of MinorityDir is positively significant in the regressions with and without control for matching. For instance, estimates of Model 4 (with matching) indicate that an increase of 1 percentage point of BNDES’ direct equity is expected to increase the firm’s return on assets by 0.4 percentage points (p < 0.01).3 Again, this effect disappears when the target firm belongs to a pyramidal group: The coefficient of Minority×Group shows that group membership attenuates that positive effect by 0.7 percentage points (p < 0.05). Thus, Hypotheses 1 and 2 are consistently supported only when the state participates directly in the equity of the target firms. Possibly, if the state provides capital to controlling firms in the pyramid instead of directly to the target firms, that capital may also be allocated to uses other than the financing of the target firms’ own projects. Models 5 to 8 in turn show similar specifications using the Market-to-book ratio as a dependent variable. Although all coefficients have the expected sign, we were unable to detect statistically significant effects. Therefore, we find support for Hypothesis 1 and 2 only when ROA is used as a dependent variable. A possible explanation is that state equity may be alleviating the short-term constraints of the target firms, which are reflected in its current accounting indicators, but this effect is not valued by market participants in their long-term 3 We also tested for nonlinear effects by adding the quadratic term MinorityDir2. However, the coefficient was found to be insignificant. Although our estimates may indicate a linear effect, it is important to recall that the stakes are minority ones: Acquiring majority control is not part of BNDES’ policy. Furthermore, the bank avoids concentrating too much capital in a single firm because of demands to provide capital to firms in multiple sectors. 25 projections. Another possibility is that market investors may detect firms with valuable opportunity just awaiting extra capital; hence these firms might attain superior market value even before their new capitalization. Accounting measures may thus better assess the direct operational gains emanating from new injections of state capital. Effect of Minority State Equity on Fixed Investments We next test Hypotheses 3 and 4 by assessing how state equity affects the investment of firms with constrained opportunity. Tests are carried out by interacting Minority and MinorityDir with Constrained opportunity and Constrained opportunity×Group. As per Hypothesis 3, we expect the interactions between the minority stake variables and Constrained opportunity to be positive: State capital will trigger new investment, especially in the case of financially constrained firms with valuable projects. As for Hypothesis 4, we expect the interactions between the stake variables and Constrained opportunity×Group to be negative: The positive effect of state capital will be larger in the case of firms that do not belong to groups. Given that we are introducing three-way interactions, we also add as controls all possible two-way interactions between key variables (e.g. Chari & David, 2012). <<Table 4 around here>> Table 4 shows the corresponding regressions. As in our previous performance results, Hypotheses 3 and 4 are only consistently supported when minority stakes are direct (Models 3 and 4). The inference is robust to the alternative methods with and without matching. If we use the estimates with matching (Model 4), we see that an increase in 1 percentage point in state equity is expected to increase capital expenditures by more than three times the initial stock of the fixed capital of firms with constrained opportunity (p < 0.05). This result suggests that these firms are in a process of accelerated growth or with a very low initial stock of fixed capital. In addition, the coefficient of the three-way interaction MinorityDir×Constrained opportunity×Group indicates that, again, the aforementioned 26 positive effect disappears in the case of firms belonging to groups. The main effect of state capital (Minority or MinorityDir) is insignificant. In sum, minority state equity promotes investment only in the case of stand-alone firms with constrained opportunity and when equity investments are directly allocated to target firms instead of indirectly through layers of ownership. Effect of Institutional Development Given that we only find significant effects of direct minority capital, to test Hypotheses 5 and 6 we restrict our analysis of institutional effects only to those direct stakes. For robustness, we also control for matching in all regressions.4 Table 5 essentially expands Model 4 of Table 4 by adding interactions between the institutional variables and the previous interacted variables MinorityDir×Constrained opportunity and MinorityDir×Constrained opportunity×Group. Given that we have three- and four-way interactions, we again add all possible lower-order interactions as controls (Chari & David, 2012). Every column in Table 5 introduces a particular institutional variable, beginning with the simple time count variable (Time) in Model 1 and the other, more refined variables in Models 2 to 6. <<Table 5 around here>> Consistent with Hypotheses 5 and 6, estimates from the first model show that the positive effect of state equity in promoting new investments for firms with constrained opportunity has diminished over time, especially in firms that do not belong to groups (p < 0.01). A similar pattern is found for the institutional variables Ease of credit (Model 3), Stock market capitalization to GDP (Model 4), and Availability of skilled labor (Model 6). Recall that, to avoid spurious inference due to natural improvement trends in the local 4 The results, however, are similar in regressions without matching (not reported here but available upon request). 27 economy correlated with these particular institutional variables, in Models 2 to 6 we add Time and all its interactions as controls. Thus, our results confirm that positive improvements in local institutions—in other words, a gradual mitigation of voids—tend to reduce the benefits of minority state capital. For instance, the significant effect of the capital market variables suggests that local firms may become progressively less dependent on state capital as credit and equity markets develop. Robustness Check: Are Our Results Driven by Selection? As an additional robustness test complementing our fixed-effects approach with and without matching, we unveil the selection process by performing additional regressions using state equity as a dependent variable. Our goal is to determine whether firm-level variables such as ROA, Market-to-book, Leverage, and Fixed are associated with the likelihood of the state being a minority owner. We use the lagged values of these variables because BNDES likely observes past variables in its equity investment decisions. Also, given that Minority is a discrete variable and we want to control for unobservable firm-specific characteristics that may affect BNDES’ choice of companies in which to participate, we adopt the so-called conditional logit model (Chamberlain, 1980), which is a fixed-effects specification for discrete data. To check whether effects change when we consider the percentage of direct stakes held by the state, we run additional fixed-effects regressions using our continuous measure, MinorityDir, as a dependent variable. Moreover, because our period of analysis covers the term of two distinct presidents, Fernando Henrique Cardoso (1995–2002) and Luiz Inácio Lula da Silva (2003–2010), we separate our regressions into two periods: 1995–2002 and 2003–2009. This separation is carried out to determine whether the changes in the effect of state equity found over the years are the result of changes in the government itself. 28 Models 1 and 4 of Table 6 show the results for the whole period. All variables are insignificant at conventional levels, suggesting that our results are not driven by selection.5 Thus, Models 1 and 4 of Table 6 indicate that during the whole period the bank did not systematically select companies based on past performance or other financial indicators. Splitting our regressions for the two periods also fails to reveal substantial differences. While during 1995–2002 we detect significant effects of Market-to-book and Constrained opportunity when stakes are assessed indirectly or directly (Model 2), these effects do not hold when we consider direct stakes only (Model 5). Estimates when the dependent variable measures direct stakes (Models 4 to 6) are widely insignificant, except for the marginally significant effect of Fixed assets or Foreign control in the subsample for the 2003–2009 period. However, this should not be a source of concern because those variables are themselves controls in our performance and investment regressions (Tables 3 and 4). In addition, given that only direct stakes yield consistent effects in those regressions, we thus conclude that our previous results are not likely driven by selection. <<Table 6 around here>> Additional Robustness Check: Are Our Results Driven by Improved Access to Debt? Our key predicted mechanism is that state ownership alleviates investment constraints, especially for companies with large capital needs. An alternative mechanism is that BNDES could increase leverage in a firm in which it has bought equity by opening lines of credit (from its own banking arm or from other banks). We therefore run our regressions with two distinct dependent variables: Leverage and Financial expenses. Models 1 to 4 of Table 7 indicate that state equity does not significantly change leverage. That is, when BNDES becomes a minority shareholder, it does not appear to improve access to loans. 5 The number of observations in the conditional logit model is substantially reduced because the model drops cases without within-firm variance in allocations (i.e., firms in which BNDES never invested or equally invested during the whole period). 29 Models 5 to 8, in turn, examine whether state equity affects financial expenses. Although we find a significantly negative effect of Minority in Model 5, the effect does not hold when we control for matching (Model 6). Thus, we fail to find consistent support for the alternative explanation that state equity may be affecting firms’ ability to attract loans. <<Table 7 around here>> Some Illustrations Aracruz and NET are Brazilian companies that illustrate the effects unveiled in our quantitative analysis. A leading worldwide exporter of cellulose, Aracruz managed a complex, vertically integrated chain with investments in forest cultivation as well as in processing plants. BNDES was instrumental in promoting Aracruz’s initial development. With 38% of voting shares in 1975, BNDES helped fund approximately 55% of the industrial investments that enabled the firm initiate cellulose production in 1978 (Spers, 1997). Production efficiency was substantially improved through capital expenditures that supported a new capitalization program in the 1990s. Aracruz’s processing capacity jumped from 400,000 tons of cellulose per year in 1978 to 1,070,000 tons in 1994 and 1,240,000 tons in 1998. A new expansion plan approved by the board in 2000 triggered some $800 million dollars in new capital expenditures between 2001 and 2003, 75% allocated to industrial processing plants and 20% to investments in land and forest technology. Although BNDES contributed to an important portion of Aracruz’s equity in its stage of accelerated growth, the bank acted as a minority shareholder and progressively sold some of its shares to private owners Safra and Lorentzen. The presence of private controllers notwithstanding, Aracruz was practically managed as a focused, stand-alone firm, with improved governance practices (after its period of initial growth, the firm even managed to list Advisory Depository Shares in the New York Stock Exchange). This case therefore 30 illustrates how minority equity by the state can be used to boost productive fixed investments in a context of reduced risk of expropriation. In contrast, NET illustrates a potential negative effect of group membership. The firm was a subsidiary of Globo, a large media group in Brazil founded by journalist Irineu Marinho in 1925. Indirectly through Globopar, the Marinho family held stakes in publishing and printing companies as well as in cable, satellite, and Internet service providers, among other businesses. By 1999, the Marinho family, through Globopar’s pyramid, had acquired majority control of Globo Cabo, also known as NET. To support its ambitious plans to expand broadband infrastructure in Brazil, BNDESPAR agreed to capitalize NET with the purchase of shares worth around $89 million dollars. The currency crisis that affected Brazil in the late 1990s, however, drove up Globo’s debt and put financial strain on Globopar and a number of its group affiliates, including NET. When NET’s market expansion proved unsuccessful, with demand (the number of subscribers) falling short of expectations, it posted successive losses. In March 2002, the situation having become critical, the group announced a capitalization plan of around $430 million dollars. BNDES again agreed to contribute. The bank’s involvement was, however, heavily criticized, some suggesting that it was acquiescing to the pressure of a strong domestic group. BNDES’ new capital injections were then made conditional on a change in NET’s governance practices—which, according to Eleazar de Carvalho, then President of BNDES, were “the basic and primordial element” of the problem.6 This illustration is therefore consistent with our hypothesis and finding that the positive effect of state equity is attenuated when investments are allocated to pyramidal groups. 6 Interview in the newspaper article “Para BNDES, ajuda à Globo não é garantida,” O Estado de São Paulo, March 17, 2002. 31 DISCUSSION AND FINAL REMARKS From a theoretical standpoint, our paper contributes with a new framework explaining the performance implications of minority state ownership. Received agency-based theories stressing the detrimental effects of majority state participation (e.g., Shleifer and Vishny, 1998) suggest that private firms with minority stakes should outperform state-controlled firms because of reduced political interference and improved managerial monitoring. However, if the only benefit of such minority participation is to reduce the negative effects of state interference, then we should not expect any performance gain beyond what is found in privately controlled firms without government minority stakes. The benefits of more dispersed forms of state ownership, compared to full private ownership, have not been examined. Yet, as discussed in the introduction, minority state equity remains widespread and important in several countries. How can we explain this phenomenon? Building on the institution-based view of strategy, our theory posits that minority stakes can have a positive impact on firm performance and investment, especially in the case of firms with latent investment opportunities but, at the same time, with severe constraints in their ability to assess external capital, which is often the case in developing and emerging economies. We also theorize and find supporting evidence that this performance effect is attenuated when target firms belong to business groups. Furthermore, we submit that the effect depends on institutional development. If minority state equity helps reduce voids in the local environment, then the value of those capital injections should diminish as capital, product, and labor markets develop. Thus, we unveil complex interactions between state ownership, group ownership, and environmental conditions commonly found in emerging markets. In this sense, our theory advances our understanding of the relatively overlooked phenomenon of minority state investment in emerging markets and contributes to the 32 discussion about the pros and cons of state capitalism (Bremmer, 2010). We inform this debate from the point of view of firms, by examining the conditions that make state ownership positively affect firm-level performance and investment. Furthermore, given our study’s emphasis on firm-level outcomes, it also adds to the current debate in strategic management on non-market sources of performance heterogeneity associated with public policy and country-level institutional factors (Hoskisson et al., 2000; Mahoney, McGahan, & Pitelis, 2009; Peng et al., 2009; Spencer, Murtha, & Lenway, 2005). Although there has been a flurry of research on how emerging market conditions affect firm-level strategies, studies focusing on the role of the state as a source of differential performance have been scant. Our study also has important practical implications. While some studies contend that government interference in the economy creates inefficiency and crowds out private entrepreneurship, our evidence suggests that the state-led purchase of equity stakes in publicly traded corporations may not be problematic, depending on the governance profile of the target firm and the stage of institutional development. In a context of poorly developed capital markets, state-backed, long-term equity can allow firms to undertake performanceenhancing projects and promote capital expenditures needed to achieve efficiency gains. The potential for political distortions associated with government ownership is attenuated in the case of minority holdings because these holdings leave other investors and managers to play the key roles in the private companies in which it invests. Only when the government injects capital into pyramidal groups (especially domestic and state-owned ones) does its equity participation tend to be associated with negative effects. In such cases, capital injections apparently either become unnecessary (perhaps because of the existence of internal capital markets within groups) or are tunneled through the pyramid to support inefficient allocations. In conclusion, our results suggest that policy makers considering minority equity stakes as an industrial policy tool should avoid pyramidal groups with poor governance and 33 target instead stand-alone firms; focus investments where there is a clear need to undertake productive capital expenditures by well-run firms; allocate equity capital directly in target firms instead of indirectly through layers of ownership; and progressively exit targeted firms as the local institutional context develops. Following these guidelines, the grabbing hand of the state (Shleifer & Vishny, 1998) may eventually become a helping hand. Admittedly, some of our results may be idiosyncratic to Brazil and to its particular mechanisms of minority state participation. Thus, future work is needed to verify the generalizability of our results to other developing and emerging economies using other channels of state capital and other types of outcomes. Although we focus on how state capital can revamp fixed assets, it would also be interesting to examine its effect on more intangible aspects, such as R&D expenditures and knowledge spillover across firms. More theoretical work is also needed to explain why minority state equity remains generally widespread, as discussed in the introduction. Our theory rests on the idea that those minority stakes can help firms subject to scarce external financing and therefore is unable to predict any performance-based impact in more developed economies with active and liquid capital markets (e.g. OECD, 2005). Along these lines, it would also be important to examine not only the effect of state equity, but also debt. As of 2011, Lazzarini, Musacchio, Bandeira-deMello, and Marcon (2012) identified 286 development banks throughout the world that heavily provide firms with long-term loans besides equity. We argue here that, from a transaction cost standpoint, equity has the advantage of supporting risky, nonredeployable investment. However, given the prevalence of loans from development banks, it would also be informative to examine the conditions under which loans can also prop up firm-level development. Through their loans, development banks can also help restructure the targeted firms and improve their performance as a result (George & Prabhu, 2000). 34 Minority stakes may also come in various forms and shapes: Beyond development banks, governments have variously used public pension funds, life insurance companies, sovereign wealth funds, state-owned holding companies, and so forth (Wooldridge, 2012). It would be interesting to assess how these various forms of equity differ and affect firm performance. Furthermore, the governance of such minority investments should be studied in a more microanalytical way. Do governments, as minority shareholders, appoint representatives to sit on companies boards and influence decisions? Do they form alliances with other private owners to pursue certain types of strategies? Arguably, governments may participate in coalitions with other shareholders and hence exert influence on firm-level decisions even if they hold only minority stakes. For instance, in 2009, the Brazilian government, as a minority shareholder through BNDES and public pension funds (Figure 1), was able to pressure mining firm Vale to invest locally in steel mills and buy ships assembled in the country. This form of residual interference will be observed, however, only when other minority shareholders collude with the state, which is not always a feasible outcome. This is a very interesting topic to be examined in future work. To be sure, opportunities abound to study the various forms through which the state can either promote or derail firm-level development through its complex interactions with investors and entrepreneurs. We sincerely hope that our work helps spark future work in strategic management and related disciplines to more closely assess alternative forms of state capitalism and their firm-level implications. REFERENCES Alchian, A. A. 1965. Some economics of property rights. Il Politico, 30: 816-829. Almeida, M. 2009. Desafios da real política industrial brasileira no século XXI. Texto para discussão 1452, IPEA. Amsden, A. H. 1989. Asia's next giant: South Korea and late industrialization. New York: Oxford University Press. Anuatti-Neto, F., Barossi-Filho, M., Carvalho, A. G. d., & Macedo, R. 2005. Costs and benefits of privatization: evidence from Brazil. In A. Chong, & F. Lopez-de-Silanes 35 (Eds.), Privatization in Latin America: myths and reality: 145-196. Washington DC: World Bank and Stanford University Press. Armendáriz de Aghion, B. 1999. Development banking. Journal of Development Economics, 58: 83-100. Bae, K.-H., Kang, J.-K., & Kim, J.-M. 2002. Tunneling or value added? Evidence from mergers by Korean business groups. The Journal of Finance, 57(6): 2695-2740. Baer, W., Kerstenetzky, I., & Villela, A. 1973. The changing role of the state in the Brazilian economy. World Development, 11(1): 23-34. Behr, P., Norden, L., & North, F. 2012. Financial contraints of private firms and bank lending behavior, Working paper, EBAPE. Bertrand, M., Djankov, S., Hanna, R., & Mullainathan, S. 2007. Obtaining a driver's license in India: an experimental approach to studying corruption. Quarterly Journal of Economics, 122(4): 1639-1676. Bertrand, M., Mehta, P., & Mullainathan, S. 2002. Ferreting out tunneling: an application to Indian business groups. Quarterly Journal of Economics, 117(1): 121-148. Boardman, A. E., & Vining, A. R. 1989. Ownership and performance in competitive environments: a comparison of the performance of private, mixed, and state-owned enterprise. Journal of Law and Economics, 32: 1-33. Boisot, M., & Child, J. 1996. From fiefs to clans and network capitalism: explaining China's emerging economic order. Administrative Science Quarterly, 41: 600-628. Bremmer, I. 2010. The end of the free market: who wins the war between states and corporations? New York: Portfolio/Penguin. Chacar, A. S., Newburry, W., & Vissa, B. 2010. Bringing institutions into performance persistence research: exploring the impact of product, financial, and labor market institutions. Journal of International Business Studies, 41: 1119-1140. Chang, H.-J. 2002. Kicking away the ladder - development strategy in historical perspective. London: Anthem Press. Chari, M. D. R., & David, P. 2012. Sustaining superior performance in an emerging economy: an empirical test in the Indian context. Strategic Management Journal, 33: 217-229. Chong, A., & Lopez-de-Silanes, F. (Eds.). 2005. Privatization in Latin America: myths and reality. Washington DC: World Bank and Stanford University Press. Cimoli, M., Dosi, G., Nelson, R., & Stiglitz, J. E. 2009. Institutions and policies shaping industrial development: an introductory note. In M. Cimoli, G. Dosi, & J. E. Stiglitz (Eds.), Industrial policy and development: the political economy of capabilities accumulation: 19-38. Oxford: Oxford University Press. Cuervo-Cazurra, A., & Dau, L. A. 2009. Promarket reforms and firm profitability in developing countries. Academy of Management Journal, 52(6): 1348-1368. Cuervo, A., & Villalonga, B. 2000. Explaining the variance in the performance effects of privatization. Academy of Management Review, 25(3): 581-590. David, P., Yoshikawa, T., Chari, M. D., & Rasheed, A. A. 2006. Strategic investments in Japanese corporations: do foreign portfolio owners foster underinvestment or appropriate investment. Strategic Management Journal, 27: 591-600. De Negri, F. 2003. Empresas estrangeiras na indústria brasileira: características e impacto sobre comércio exterior. In M. Laplane, L. Coutinho, & C. Hiratuka (Eds.), Internacionalização e desenvolvimento da indústria no Brasil: 215-250. São Paulo: Editora Unesp. De Paula, G. M., Ferraz, J. C., & Iootty, M. 2002. Economic liberalization and changes in corporate control in Latin America. The Developing Economies, 40(4): 467-496. 36 Dharwadkar, R., George, G., & Brandes, P. 2000. Priatization in emerging economies: an agency theory perspective. Academy of Management Review, 25(3): 650-669. Dyck, A., & Zingales, L. 2004. Private benefits of control: an international comparison. Journal of Finance, 59(2): 537-600. Fama, E. F. 1992. The cross-section of expected stock returns. Journal of Finance, 47: 427465. Fazzari, S. M., Hubbard, R. G., & Petersen, B. C. 1988. Financing constraints and corporate investment. Brookings Papers on Economic Activity, 1: 141-195. George, G., & Prabhu, G. N. 2000. Developmental financial institutions as catalysts of entrepreneurship in emerging economies. Academy of Management Review, 25(3): 620-629. Giannetti, M., & Laeven, L. 2009. Pension reform, ownership structure, and corporate governance: evidence from a natural experiment. The Review of Financial Studies, 22(10): 4091-4127. Gupta, N. 2005. Partial privatization and firm performance. Journal of Finance, 60: 9871015. Hausmann, R., Hwang, J., & Rodrik, D. 2007. What you export matters. Journal of Economic Growth, 12(1): 1-25. Heckman, J. J., Ichimura, H., & Todd, P. E. 1997. Matching as an econometric evaluation estimator: evidence from evaluating a job training programme. The Review of Economic Studies, 64(4): 605-654. Hermelo, F. D., & Vassolo, R. 2010. Institutional development and hypercompetition in emerging economies. Strategic Management Journal, 31: 1457-1473. Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. 2000. Strategy in emerging economies. Academy of Management Journal, 43(3): 249-267. Kaldor, N. 1980. Public or private enterprise – the Issue to be considered. In W. J. Baumol (Ed.), Public and private enterprises in a mixed economy: 1-12. New York: St. Martin's. Keister, L. A. 2004. Capital structure in transition: the transformation of financial strategies in China's emerging economy. Organization Science, 15(2). Khanna, T., & Palepu, K. 1997. Why focused strategies may be wrong in emerging markets. Harvard Business Review(July-August): 3-10. Khanna, T., & Palepu, K. 2000. The future of business groups in emerging markets: long-run evidence from Chile. Academy of Management Journal, 43(3): 268-285. Khanna, T., & Yafeh, Y. 2007. Business groups in emerging markets: paragons or parasites? Journal of Economic Literature, 45: 331-372. Kikeri, S., Nellis, J. N., & Shirley, M. M. 1992. Privatization: the lessons of experience. Washington, D.C.: World Bank. La Porta, R., & López-de-Silanes, F. 1999. The benefits of privatization: evidence from Mexico. Quarterly Journal of Economics, 114: 1193-1242. Lang, L., Ofek, E., & Stulz, R. M. 1996. Leverage, investment, and firm growth. Journal of Financial Economics, 40: 3-29. Lazzarini, S. G. 2011. Capitalismo de laços: os donos do Brasil e suas conexões. Rio de Janeiro: Campus/Elsevier. Lazzarini, S. G., Musacchio, A., Bandeira-de-Mello, R., & Marcon, R. 2012. What do development banks do? Evidence from Brazil, 2002-2009, Insper Working paper, Available at SSRN: http://ssrn.com/abstract=1969843. Leff, N. H. 1978. Industrial organization and entrepreneurship in the developing countries: the economic groups. Economic Development and Cultural Change, 26(4): 661-675. 37 Levine, R. 2005. Finance and growth: theory and evidence. In P. Aghion, & S. Durlauf (Eds.), Handbook of economic growth, Vol. 1: 865-934. Amsterdam: Elsevier. Li, S., Park, S. H., & Li, S. 2004. The great leap forward: the transition from relation-based governance to rule-based governance. Organizational Dynamics, 33(1): 63-78. Mahoney, J. T., McGahan, A. M., & Pitelis, C. N. 2009. The interdependence of private and public interests. Organization Science, 20(6): 1034-1052. Majumdar, S. K. 1998. Assessing comparative efficiency of the state-owned mixed and private sectors in Indian industry. Public Choice, 96(1/2): 1-24. Mazzucato, M. 2011. The entrepreneurial state. London: Demos. McDermott, G. A. 2003. Embedded politics: industrial networks & institutional change in postcommunism. Ann Arbor: University of Michigan Press. Megginson, W. L., & Netter, J. M. 2001. From state to market: a survey of empircal studies of privatization. Journal of Economic Literature, 39: 321-389. Mengistae, T., & Xu, L. C. 2004. Agency theory and compensation of CEOs of Chinese state enterprises. Journal of Labor Economics, 22: 615-637. Mesquita, L., & Lazzarini, S. G. 2008. Horizontal and vertical relationships in developing economies: implications for SMEs' access to global markets. Academy of Management Journal, 51(2): 359-380. Morck, R., Wolfenzon, D., & Yeung, B. 2005. Corporate governance, economic entrenchment, and growth. Journal of Economic Literature, 43(3): 655-720. Musacchio, A. 2009. Experiments in financial democracy: corporate governance and financial development in Brazil, 1882-1950. Cambridge: Cambridge University Press. Nenova, T. 2005. Control values and changes in corporate law in Brazil. Latin American Business Review, 6(3): 1-37. Nichols, A. 2007. Causal inference with observational data. Stata Journal, 7: 507-541. North, D. C. 1990. Institutions, institutional change and economic performance. Cambridge: Cambridge University Press. OECD. 2005. OECD, Corporate Governance of State-Owned Enterprises: A Survey of OECD Countries Organisation for Economic Co-operation and Development. Paris. Pack, H., & Saggi, K. 2006. Is there a case for industrial policy? A critical survey. The World Bank Research Observer, 21(2): 267-297. Peng, M. W., & Heath, P. S. 1996. The growth of the firm in planned economies in transition: institutions, organizations, and strategic choice. Academy of Management Review, 21(2): 492-528. Peng, M. W., & Luo, Y. 2000. Managerial ties and firm performance in a transition economy: the nature of a micro-macro link. Academy of Management Journal, 43(3): 486-501. Peng, M. W., Sun, S. L., Pinkham, B., & Chen, H. 2009. The institution-based view as a third leg for a strategy tripod. Academy of Management Perspectives, 23(3): 63-81. Penman, S. H. 1996. The articulation of price-earnings ratios and market-to-book rations and the evaluation of growth. Journal of Accounting Research, 34(2): 235-259. Pinheiro, A. C., & Giambiagi, F. 1994. Lucratividade, dividendos e investimentos das empresas estatais: uma contribuição para o debate sobre a privatização no Brasil. Revista Brasileira de Economia, 51: 93-131. Pistor, K., & Turkewitz, J. 1996. Coping with hydra - state ownership after privatization. In R. Frydman, C. W. Gray, & A. Rapaczynski (Eds.), Corporate governance in Central Europe and Russia, Vol. 2. Budapest: Central European University Press. Rajan, R. G., & Zingales, L. 1996. Financial dependence and growth. The American Economic Review, 88(3): 559-586. Rodrik, D. 2004. Industrial policy for the twenty-first century. CEPR Discussion Paper. 38 Sarkar, J., Sarkar, S., & Bhaumik, S. K. 1998. Does ownership always matter? Evidence from the Indian bank industry. Journal of Comparative Economics, 26: 262-281. Shapiro, C., & Willig, R. D. 1990. Economic rationales for the scope of privatization. In E. N. Suleiman, & J. Waterbury (Eds.), The political economy of public sector reform and privatization: 55-87. London: Westview Press. Shleifer, A. 1998. State versus private ownership. Journal of Economic Perspectives, 12(4): 133-150. Shleifer, A., & Vishny, R. W. 1994. Politicians and firms. The Quarterly Journal of Economics, 109: 995-1025. Shleifer, A., & Vishny, R. W. 1998. The grabbing hand: government pathologies and their cures. Cambridge: Harvard University Press. Spencer, J. W., Murtha, T. P., & Lenway, S. A. 2005. How governments matter to new industry creation. Academy of Management Review, 30(2): 321-337. Spers, E. E. 1997. Aracruz Celulose S.A.: uma estratégia financeira de emissão de ADRs, PENSA case study, University of São Paulo. Stark, D. 1996. Recombinant property in East European capitalism American Journal of Sociology, 101(4): 993-1027. Stone, A., Levy, B., & Paredes, R. 1996. Public institutions and private transactions: a comparative analysis of legal and regulatory enviornment for business transactions in Brazil and Chile. In L. J. Alston, T. Eggertsson, & D. C. North (Eds.), Empirical studies in institutional change: 95-128. Cambridge: Cambridge University Press. Torres Filho, E. T. 2009. Mecanismos de direcionamento do crédito, bancos de desenvolvimento e a experiência recente do BNDES. In F. M. R. Ferreira, & B. B. Meirelles (Eds.), Ensaios sobre Economia Financeira. Rio de Janeiro: BNDES. Trebat, T. J. 1983. Brazil's state-owned enterprises: a case study of the state as entrepreneur. Cambridge: Cambridge University Press. Valadares, S. M., & Leal, R. P. C. 2000. Ownership and control structure of Brazilian companies. Abantes, 3(1): 29-56. Vickers, J., & Yarrow, G. 1988. Privatization: an economic analysis. Cambridge: MIT Press. Wan, W. P., & Hoskisson, R. E. 2003. Home country environments, corporate diversification strategies, and firm performance. Academy of Management Journal, 46(1): 27-45. Williamson, O. E. 1988. Corporate finance and corporate governance. Journal of Finance, 43: 567-591. Williamson, O. E. 1996. The mechanisms of governance. New York: Oxford University Press. Wooldridge, A. 2012. The visible hand, The Economist. 01/21/2012 Wooldridge, J. M. 2002. Econometric analysis of cross-section and panel data. Cambridge: MIT Press. Wu, H.-L. 2011. Can minority state ownership influence firm value? Universal and contingency views of its governance effects. Journal of Business Research, 64: 839845. Yeyati, E. L., Micco, A., & Panizza, U. 2004. Should the government be in the banking business? The role of state-owned and development banks, RES Working Papers 4379, Inter-American Development Bank, Research Department. Yiu, D., Bruton, G. D., & Lu, Y. 2005. Understanding business group performance in an emerging economy: acquiring resources and capabilities in order to prosper. Journal of Management Studies, 42(1): 183-206. 39 FIGURE 1 Pyramid of the Brazilian Mining Group Vale in 2003 Source: Brazilian Securities and Exchange Commission (CVM), Valor Grandes Grupos. TABLE 1 Evolution of Minority State Ownership through the Brazilian Development Bank (BNDES) Year Number of firms with minority state ownership through BNDESPAR Direct or indirect stakes Direct stakes only Average direct equity purchase as a percentage of total equity 1995 23 11 17% 1996 18 11 19% 1997 27 15 15% 1998 26 14 14% 1999 29 13 19% 2000 29 14 19% 2001 28 16 16% 2002 23 14 17% 2003 24 14 19% 2004 22 13 15% 2005 25 17 15% 2006 37 21 13% 2007 44 26 12% 2008 48 28 13% 2009 47 32 13% Total in the period 89 51 Source: Compiled by the authors from data on publicly traded corporations. See the “Data and Methods” section for further details. Indirect stakes occur when BNDESPAR participates in pyramidal ownership structures (e.g., BNDES owns Valepar, which in turn owns Vale; see Figure 1). 40 TABLE 2 Summary Statistics 1. ROA 2. Market-to-book 3. Fixed Investment 4. Minority 5. MinorityDir 6. Constrained opportunity 7. Group 8. Ln(Revenues) 9. Leverage 10. Financial expenses 11. Fixed assets 12. Foreign control 13. State control 14. Merger 15. Time count 16. Country credit rating 17. Ease of credit 18. Stock market capitalization/GDP 19. Competition legislation 20. Availability of skilled labor Mean (Std. Dev) -0.079 (0.530) 1.574 (2.590) 10.679 (62.663) 0.126 (0.332) 1.096 (4.813) 0.187 (0.390) 0.450 (0.498) 11.946 (2.062) 0.516 (5.792) 0.305 (0.206) 0.299 (0.250) 0.184 (0.388) 0.070 (0.256) 0.011 (0.105) 6.846 (4.280) 4.385 (5.419) 3.123 (9.818) 16.975 (14.669) 1.063 (3.368) -0.219 (4.918) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 1.00 -0.03 1.00 0.04 0.02 1.00 0.04 0.01 0.03 1.00 0.02 0.01 0.06 0.60 1.00 -0.43 0.29 -0.01 -0.02 0.01 1.00 0.08 0.03 0.07 0.17 0.06 -0.05 1.00 0.37 0.12 -0.01 0.23 0.09 -0.24 0.39 1.00 -0.39 0.14 -0.01 0.00 0.02 0.13 -0.02 -0.18 1.00 -0.01 -0.02 -0.05 -0.12 -0.07 0.05 -0.07 -0.12 -0.05 1.00 -0.02 -0.12 -0.21 0.10 -0.02 0.11 -0.02 0.08 0.05 0.00 1.00 0.10 0.03 0.00 -0.04 -0.02 -0.01 0.23 0.24 -0.03 -0.03 0.01 1.00 0.05 -0.07 0.00 0.16 0.07 -0.05 -0.03 0.23 -0.02 -0.07 0.28 -0.13 1.00 0.02 0.09 0.05 0.04 0.02 -0.02 0.11 0.10 -0.01 -0.05 -0.06 -0.01 -0.03 1.00 0.00 0.28 0.07 0.10 0.05 0.09 -0.03 0.05 0.06 -0.10 -0.21 -0.02 -0.07 0.12 1.00 0.02 0.14 0.01 0.09 0.04 0.02 -0.02 0.08 0.04 -0.11 -0.03 -0.01 -0.01 0.04 0.54 1.00 -0.01 0.02 -0.04 0.00 0.00 0.02 0.00 -0.09 -0.01 0.07 0.00 0.00 0.01 -0.01 0.03 0.07 1.00 0.03 0.06 0.05 0.02 0.01 0.01 -0.01 0.07 0.01 -0.10 -0.02 0.00 -0.01 0.01 0.17 0.04 -0.44 1.00 -0.02 -0.01 -0.03 0.02 0.00 0.03 0.01 -0.03 0.01 0.12 0.06 0.03 0.00 0.00 -0.20 -0.03 0.33 -0.48 1.00 0.00 -0.13 -0.04 -0.04 -0.02 -0.02 0.02 -0.07 -0.04 0.15 0.11 0.02 0.01 -0.07 -0.75 -0.15 0.09 0.10 0.44 1.00 TABLE 3 Effect of Minority State Ownership on Performance ROA (1) (2) 0.111** (0.055) Market-to-book (3) (4) (5) (6) 0.003 0.108 0.065 (0.039) (0.378) (0.310) -0.131** -0.041 -0.056 -0.165 (0.061) (0.045) (0.462) (0.379) (7) (8) Hypothesized effects Minority (direct or indirect stakes, dummy) Minority×Group MinorityDir (direct only, percentage) MinorityDir×Group 0.009** 0.004*** 0.048 0.012 (0.004) (0.002) (0.042) (0.017) -0.012*** -0.007** -0.038 -0.018 (0.005) (0.003) (0.044) (0.021) Controls Group Ln(Revenues) Leverage Fixed assets Foreign control State control Merger Constant Year, firm, firm–industry fixed effects Weights using propensity score matching N (total observations) N (number of firms) p (F-test) 0.124** 0.101 0.116** 0.096 0.579 0.883 0.595 0.828 (0.051) (0.079) (0.050) (0.096) (0.514) (0.600) (0.505) (0.575) 0.078*** 0.027** 0.079*** 0.032*** 0.096 0.172** (0.025) (0.013) (0.025) (0.011) (0.101) (0.069) -0.012 -0.380*** 1.264 2.397** -0.012 -0.387*** 0.093 0.140** (0.104) (0.062) 1.168 1.857** (0.008) (0.057) (0.008) (0.056) (0.863) (1.060) (0.840) (0.841) -0.280** -0.223** -0.281** -0.225** -1.236 -0.688 -1.287* -0.96 (0.115) (0.090) (0.115) (0.091) (0.765) (0.721) (0.766) (0.863) 0.035 -0.029 0.031 -0.038 0.410 0.781* 0.372 0.643* (0.033) (0.027) (0.034) (0.037) (0.382) (0.436) (0.365) (0.379) 0.01 -0.019 -0.003 -0.073 1.170* 0.861 1.021* 0.894 (0.046) (0.063) (0.055) (0.078) (0.633) (0.594) (0.526) (0.767) -0.019 -0.031 -0.007 -0.081 0.058 -0.545 -0.033 -0.413* (0.045) (0.051) (0.046) (0.060) (0.443) (0.411) (0.374) (0.214) -0.175 -2.650*** -0.189 -0.329 -11.894*** -0.634 -21.176*** -0.168 (0.422) (0.212) (0.257) (0.202) (1.204) (1.200) (1.271) (1.128) Yes Yes Yes Yes Yes Yes Yes Yes No Yes No Yes No Yes No Yes 2,920 1,169 2,919 1,194 2,209 946 2,208 968 125 345 127 < 0.001 < 0.001 < 0.001 367 128 367 130 345 < 0.001 < 0.001 < 0.001 < 0.001 < 0.001 *** p < 0.01, ** p < 0.05, * p < 0.10. Robust standard errors (clustered on each firm) are in parentheses. 42 TABLE 4 Effect of Minority State Ownership on Fixed Investments (1) Hypothesized effects Constrained opportunity ×Minority Constrained opportunity ×Minority×Group Constrained opportunity ×MinorityDir Constrained opportunity ×MinorityDir×Group Controls Minority Minority×Group 53.032 (48.268) -52.350 (48.084) 5.732 (3.927) -5.906 (3.889) Fixed investment (2) Constrained opportunity ×Group Ln(Revenues) Leverage Fixed assets Foreign control State control Merger Constant Year, firm, firm–industry fixed effects Weights using propensity score matching N (total observations) N (number of firms) p (F test) 7.114*** (1.697) -7.113*** (1.693) 3.767** (1.641) -3.710** (1.659) 0.284 (0.381) -0.438 (0.373) -3.566* (1.875) -5.859 (3.863) 0.263 (2.890) -2.278** (0.954) -1.387 (3.641) 7.852 (12.527) 4.447* (2.599) -4.805 (4.237) -5.649 (3.799) 20.641 (15.304) Yes 3.433 (3.603) -5.079 (3.897) -1.968 (1.457) -0.077 (1.008) 1.48 (1.761) -0.768 (0.698) -0.002 (0.031) -4.689 (5.837) 2.677 (2.273) -5.127 (6.091) 0.313 (1.411) 55.65 (39.939) Yes -2.706 (1.657) -3.133 (2.974) 0.317 (2.372) -2.252** (1.106) -6.641 (4.296) 2.92 (8.051) 2.907 (2.214) -6.810 (6.546) -5.968 (3.725) 52.498** (23.571) Yes 0.502 (0.402) -0.651 (0.401) -2.452* (1.341) -1.014 (1.008) 1.591 (1.444) -1.207* (0.661) -0.001 (0.029) -1.477 (3.300) 3.882 (2.487) -0.773 (1.498) 0.116 (1.453) 30.171*** (9.568) Yes No Yes No Yes 1,970 314 < 0.001 861 122 < 0.001 1,969 314 < 0.001 878 124 < 0.001 MinorityDir×Group Group (4) 21.657 (13.371) -18.091 (13.544) MinorityDir Constrained opportunity (3) *** p < 0.01, ** p < 0.05, * p < 0.10. Robust standard errors (clustered on each firm) are in parentheses. 43 TABLE 5 Moderating Effect of Institutional Variables on Fixed Investments Fixed investment as the dependent variable. Institutional variable is… Stock market Country credit Competition Availability of Time Ease of credit capitalization rating legislation skilled labor to GDP (1) (2) (3) (4) (5) (6) Hypothesized effects Constrained opportunity ×MinorityDir×Institutional Constrained opportunity ×MinorityDir×Group×Institutional Controls MinorityDir -1.361*** (0.445) 1.401*** (0.454) 1.398 (1.181) -1.489 (1.182) -0.649*** (0.030) 0.680*** (0.033) -0.523** (0.231) 0.528** (0.231) -1.084 (0.971) 1.157 (0.971) -3.138*** (0.489) 3.217*** (0.492) 0.480 (0.608) Group -1.892 (3.186) Constrained opportunity 1.690 (3.339) Institutional variable (see header) -0.585 (0.538) MinorityDir×Group -0.766 (0.596) Constrained opportunity -10.454* ×Group (5.473) Constrained opportunity 14.087*** ×MinorityDir (5.032) Constrained opportunity -14.127*** ×MinorityDir×Group (5.055) MinorityDir×Institutional -0.059* (0.035) MinorityDir×Group×Institutional 0.083** (0.038) Group×Institutional -0.361 (0.518) Constrained opportunity 1.114 ×Institutional (0.815) Constrained opportunity 0.596 ×Group×Institutional (1.502) Already added Above interactions with time count as regressors Ln(Revenues), Leverage, Fixed assets Yes Foreign control, State control, Merger Yes Year, firm, firm–industry fixed effects Yes Weights using propensity score Yes matching N (total observations) 878 p (F-test) < 0.001 2.898*** (0.579) 5.433* (3.221) 10.067 (7.565) -0.363 (0.424) -2.866*** (0.562) -17.067* (9.360) 23.114*** (2.804) -22.182*** (2.819) 0.055 (0.037) -0.063* (0.034) -0.043 (0.108) 0.233 (0.310) -0.246 (0.420) 2.978*** (0.513) 6.341* (3.258) 10.171 (6.671) -0.171 (0.138) -2.831*** (0.514) -16.040** (7.998) 18.205*** (0.571) -16.053*** (1.053) 0.020 (0.019) -0.017 (0.020) 0.044 (0.052) 0.008 (0.122) 0.095 (0.167) 2.028*** (0.643) 4.538 (3.090) 10.174 (6.362) 0.033 (0.086) -1.930*** (0.604) -16.230** (7.568) 32.967*** (5.722) -33.383*** (5.720) 0.029*** (0.004) -0.031*** (0.005) 0.075 (0.049) 0.138* (0.081) -0.119 (0.125) 3.370*** (1.049) 6.612* (3.626) 11.954 (8.809) -0.657 (0.650) -3.312*** (0.970) -17.736 (11.920) 17.752*** (3.066) -16.350*** (3.142) -0.099* (0.059) 0.108* (0.062) -0.256 (0.258) -0.404 (0.720) 0.26 (1.009) 1.133*** (0.381) 4.535 (3.963) 10.366 (6.555) 1.436 (1.528) -0.920 (0.595) -18.867* (11.225) 47.630*** (4.011) -48.544*** (4.087) 0.124*** (0.043) -0.130*** (0.046) 0.17 (0.213) 0.213 (0.288) 0.018 (0.586) Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes 660 < 0.001 660 < 0.001 660 < 0.001 660 < 0.001 660 < 0.001 *** p < 0.01, ** p < 0.05, * p < 0.10. Robust standard errors (clustered on each firm) are in parentheses. All institutional variables (except time count) are computed as percentage variations within three-year moving windows. 44 TABLE 6 Selection Analysis: Factors Affecting the State’s Presence as a Minority Owner Minority (direct or indirect, dummy) (conditional logit) ROAt-1 Market-to-bookt-1 Constrained opportunityt-1 Groupt-1 Ln(Revenues)t-1 Leveraget-1 Fixed assetst-1 Foreign controlt-1 State controlt-1 Mergert-1 1995-2009 1995-2002 2003-2009 1995-2009 1995-2002 2003-2009 (1) (2) (3) (4) (5) (6) 1.289 3.114 6.776 4.224 5.586 -0.381 (1.438) (7.174) (9.547) (4.364) (6.042) (1.421) -0.076 (0.229) 0.886** (0.418) -0.476 (0.761) 0.038 (0.038) 0.078 (0.086) 0.014 (0.038) 0.164 -2.499* 4.88 0.326 -0.089 0.294 (0.574) 2.238* (1.321) -30.961 (3.755) 14.305 (0.368) -0.664 (0.635) -2.161 (0.376) 0.431 (1.180) (3,109.987) (3,094.068) (0.964) (1.511) (1.111) -0.441 (0.365) -1.355 (1.182) 4.698 (3.660) -0.502 (0.664) -0.997 (0.821) -0.423 (0.324) 0.773 -5.318 5.512 0.564 -2.126 3.931 (1.733) 0.463 (4.632) -2.66 (5.406) 4.748 (1.232) 1.289 (1.892) -0.702 (2.852) 2.450* (1.615) (4.596) (5.047) (1.394) (2.008) (1.317) -2.018* (1.047) -1.608 17.172 (1.851) (2,283.934) 0.51 (1.728) -0.730 (1.386) 6.720* (3.537) -16.53 -0.423 -1.447 (1.130) (2,186.026) -17.964 (1.139) 0.017 (1.412) -0.302 (987.023) Year and firm fixed effects Year-industry fixed effects N (total observations) N (number of firms) p (LR test) p (F-test) MinorityDir (direct, percentage) (OLS with fixed effects) -2.378 (0.446) (1.828) Yes Yes Yes Yes Yes Yes No 329 No 110 No 95 Yes 1,573 Yes 861 Yes 712 39 23 17 279 239 188 < 0.001 < 0.001 < 0.001 < 0.001 < 0.001 < 0.001 *** p < 0.01, ** p < 0.05, * p < 0.10. Standard errors are in parentheses. Models (4) to (6) present robust standard errors clustered on each firm. Year–industry fixed effects are excluded from the conditional logit model to facilitate convergence of the maximum likelihood estimation. In addition, State control and Merger are excluded from some regressions due to the lack of sufficient within-firm variability in particular subsamples. 45 TABLE 7 Effect of Minority State Ownership on Leverage and Financial Expenses Leverage Minority Minority×Group (1) (2) -0.011 (0.037) (5) (6) 0.043 (0.057) -0.061** (0.025) -0.016 (0.044) 0.033 -0.022 0.042 -0.013 (0.044) (0.063) (0.038) (0.063) MinorityDir MinorityDir×Group ROA Market-to-book Financial expenses (3) (4) Group Ln(Revenues) Leverage Fixed assets Foreign control State control Merger Year, firm, firm–industry fixed effects Weights using propensity score matching N (total observations) N (number of firms) p (F-test) (8) -0.001 0.001 -0.002 -0.002 (0.002) (0.002) (0.002) (0.001) 0.000 (0.003) -0.003 (0.003) 0.000 (0.003) 0.000 (0.003) -0.373*** -0.357*** -0.375*** -0.358*** -0.476*** -0.382*** -0.480*** -0.386*** (0.050) 0.009*** (0.082) 0.015*** (0.050) 0.009*** (0.094) 0.020*** (0.065) 0.013*** (0.089) 0.015*** (0.065) 0.013*** (0.093) 0.018** (0.002) (0.003) (0.002) (0.004) (0.003) (0.004) (0.003) (0.007) Leverage Financial expenses (7) -0.765*** -0.853*** -0.772*** -0.674*** (0.069) (0.090) (0.068) (0.101) -0.282*** -0.316*** -0.284*** -0.306*** (0.021) -0.036 (0.026) -0.019 (0.021) -0.032 (0.031) -0.023 0.042 0.078* 0.041 0.043 (0.028) (0.047) (0.029) (0.064) (0.035) (0.046) (0.035) (0.065) -0.002 (0.006) 0.000 (0.007) -0.001 (0.006) 0.002 (0.007) 0.017** (0.008) 0.014** (0.007) 0.017** (0.007) 0.013* (0.007) -0.025 -0.109* -0.022 -0.146* -0.042 -0.114 -0.040 -0.146 (0.049) 0.01 (0.065) -0.002 (0.049) 0.009 (0.078) 0.046 (0.056) 0.044 (0.101) 0.065 (0.057) 0.050 (0.120) 0.116*** (0.027) (0.032) (0.028) (0.058) (0.032) (0.042) (0.033) (0.040) -0.037 (0.037) 0.078 (0.068) -0.041 (0.036) -0.003 (0.060) 0.08 (0.051) 0.291*** (0.076) 0.084 (0.051) 0.120 (0.091) -0.071 -0.066 -0.201*** (0.050) -0.200*** (0.046) -0.011 0.043 (0.071) -0.061** -0.016 (0.071) (0.037) (0.057) (0.025) (0.044) Yes Yes Yes Yes Yes Yes Yes Yes No Yes No Yes No Yes No Yes 1,664 727 1,663 749 1,664 727 1,663 749 303 < 0.001 119 < 0.001 303 < 0.001 121 < 0.001 303 < 0.001 119 < 0.001 303 < 0.001 121 < 0.001 *** p < 0.01, ** p < 0.05, * p < 0.10. Robust standard errors (clustered on each firm) are in parentheses. The variables State control and Merger are excluded from some regressions due to the lack of sufficient within-firm variability, given the other existing controls and fixed effects. 46