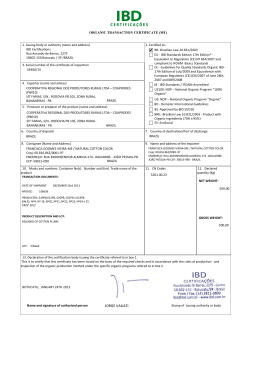

BRAZILIAN ORGANIC MARKET TRENDS AND NEWS BIOFACH 2015 MING LIU – IPD/ORGANICS BRASIL Marketing to and from Brazil – Regulatory Issues Brazil has a recent organic Regulation 2011 No signed regulatory equivalence agreement in International Trade Imported products have to comply with the Brazilian Regulation Limited Certification Body accredited by the MAPA Brazil has signed Equivalency Agreement of compliance evaluation system All imported products need to have the organic seal label Initial conversation has been established with CEE in 2014 Marketing to and from Brazil – Regulatory Issues • • • • Food/drinks label is mandatory to have the national organic seal Imported food products need to comply with the regulation and have the seal approved and printed in the label. Cosmetics are not regulated. Organic ingredients can be printed in packaging of cosmetics products as ingredient Organic textile cotton can be certified and use the organic seal. 7 ACCREDITTED CERTIFICATION AGENCIES IN BRAZIL INTERNATIONAL NATIONAL • Foreign certification agencies can be accreditted with the Minister of Agriculture. • At the moment 2 new foreign agencies submitted application to be accreditted by the MAPA. Brazil – Organic Production Figures • • • • • • • • • Total Production Units in all States : 10.750 1215 PU are sorted processing units 65 PU are associations and coops 4593 PU are certified by accredited certification bodies 3096 PU are OCS – No certification required Total Farmers certified: 15,000 Fruits – Grains – Vegetable Oil – Sugar Agriculture – Extrativism – Agri-ecological production Limited animal Based (poultry-swine-cattle) products chain Brazil - Organic Market figures & trends • • • • Estimated total turnover in 2014: 692 million EUR 50-60% for Export markets Forecast for 2015: 900 million EUR Sales channels: 2/3 conventional retailers and 1/3 specialized shops, online and farmers markets • Imports (USA-EU) EUR$ 40 million • Largest retailer: Casino Group – Organic & conventional - Sales growth – 30-40% yearly Organic Farmers Market in Brazil • • • • • 115 street farmer’s market Growth 20% year Direct sales farmers-consumer Certification PGS- Direct Register Turnover EUR$ 21,3 Million /year MAJOR RETAILERS Turnover US$ 13,0 Billion US$ 24,7 Billion US$ 11,1 Billion Stores 241 1999 544 Year 1975 1948 1998 Workforce 70.000 140.000 83.000 Organic ND US$ 60,5 Million ND Growth ND 12,8% yearly ND NATURAL/SPECIALIZED FOOD STORES Year Turnover Stores • • • • • • • 2014 EUR $138,5 Million 300 2018 EUR$ 370,0 Million 650 Founded in 1987 by Antunes Brothers sold in 2009 to AXXON Group 2014 AXXON Group sold to entrepreneur Carlos Wizard 1200 suppliers, 30.000 itens – food/supplements/natural/books/cd/cosmetics BODY / SOUL / MIND – SAFE PLANET Growth in 2013 - 14% For 2014-2018 20% year Average store sales EUR$45.000,00 ROI - 10%-14% International stores - Portugal Today 57 companies 30 cooperatives – representing almost 12.000 families farming producers Forcasting 2014-2016 100 companies Trend of Brazilian Consumer Characteristics and demographics Characteristics of Consumer Trends % of Consumers trying to increase • Whole Grains 53% • Fiber content 53% • Protein 50% • Calcium 36% • Omega3 21% • Potassim 19% • Probiotic 18% • Omega6 11% • Omega9 19% • Oils and fats 8% % of Consumers trying to Decrease • Sodium 53% • Sugar content 50% • Fat Trans 49% • Saturated fat 47% • Oils and fats 39% • Food preserves 37% • Mono/poli Fats 26% • Cafeine 31% • Food Coloring 21% • Gluten 13% Brazil – Natural & Organic Market - 2014 Health claim food sector revenue US$36,4 Billion Major claims for Health related foods are Fat free, sugar free, no salt, Lactose free, Gluten Free Functional Foods market US$14,4 Billion Market growth 2014 - 37% Vegetarian consumers are at 8% of the market Organic consumers are leveled at 2,5% of the market Thank You! Ming C. Liu [email protected]

Download