SAG GEST – Soluções Automóvel Globais, SGPS, SA Listed Company Estrada de Alfragide, nº 67, Amadora Registered Share Capital: 169,764,398 euros Registered at the Amadora Registrar of Companies under the single registration and taxpayer no. 503 219 886 PRESS RELEASE Six months ended 30 June 2011 ¾ SAG’S TURNOVER IN THE SIX MONTHS PERIOD ENDED 30 JUNE 2011 WAS € 456,6 MILLION, REPRESENTING A 9.3% DECREASE WHEN COMPARED WITH THE SAME PERIOD IN 2010 ¾ EBITDA INCREASED 12%, TO THE AMOUNT OF € 65.5 MILLION ¾ CONSOLIDATE NET RESULTS WERE NEGATIVE FOR THE AMOUNT OF € 34.5 MILLION, REFLECTING THE IMPACT OF € 27.2 MILLION OF NON-RECURRING ITEMS (ASSOCIATED WITH DIVESTMENT IN NON-CORE ACTIVITIES) AND THE STILL NEGATIVE CONTRIBUTION OF UNIDAS (€ 10.8 MILLION) ¾ NET RESULTS OF THE OPERATING ACTIVITIES IN PORTUGAL (AUTOMOTIVE TRADE) REACHED € 16.1, RECORDING A 2.5% INCREASE WHEN COMPARED WITH THE SAME PERIOD IN 2010 1. GENERAL COMMENTS • Pursuant to the resolution adopted at the Shareholders Meeting of Unidas held on 13 July 2011, the automotive business capitalization operation in Brazil totaling R$ 300 million was completed with the entry of three Brazilian Investment Funds (Kinea – Grupo Itaú – Gávea and Vinci) in Unidas’ capital. Unidas now has the financial resources needed to fully maximize the growth and valuation potential of its business activities. Following this operation, SAG’s stake in Unidas diluted to approximately 53%. Although the relevant binding agreements (still subject to the fulfillment of conditions precedent of a predominantly administrative nature) were signed on 2 June 2011, the capital increase only materialized on 13 July 2011, and therefore the impacts of this transaction do not affect SAG’s Consolidated Financial Statements as at 30 June 2011. • In the first half of the year, SAG concluded a lengthy process of corporate reorganization, which included the divestment of several assets considered as not strategic for its future development. Overall, these transactions had a negative impact of approximately € 27.2 million in SAG’s consolidated net results for the period. • In Portugal, the Group’s activities in the Automotive Retail area (Import and Retail of the Volkswagen - Passenger and Commercial Vehicles - Audi and Škoda) continued to perform well, SAG GEST – Soluções Automóvel Globais, SGPS, SA – Sociedade Aberta C.R.C. Amadora nº 503219886 – Capital Social: EUR 169.764.398 – Contribuinte Nº 503 219 886 Sede: Estrada de Alfragide, Nº 67 Amadora although still reflecting the downward trend of the overall Portuguese Automotive Market during the first six monthsr of 2011, with improved profitability and increased market share. • In Brazil, and although results were still negative, there was a positive evolution when compared with the same period of 2010, with losses decreasing by more than € 4.3 million (approximately 30%) as a result of the Company’s turn around and of the substantial reduction in the depreciation of vehicles. 2. BUSINESS ACTIVITIES 2.1. Portugal – Automotive Retail • Passenger and light commercial vehicle markets decreased 20.3% and 21.1% respectively when compared with the same period in 2010. • In this context, the Makes represented by SIVA performed considerably well and volume decreased 11.9%, which was significantly lower that the market’s volume reduction which, overall, (PC+CV) was 20.4%. • Consequently, SIVA increased its market share (PC+CV) to 14.1%, with 15,356 vehicles sold during the period, strengthening its top position in the ranking of car distribution companies in Portugal. • In the Passenger Car (PC) market, SIVA sold 14,177 units, representing a 15.4% market share which compares to 14.4% in the 1st Half of 2010. • Volkswagen, which sold 8,767 units in the period, increased its market share in light passenger cars to 9.5% against 8.4% in the same period in 2010. Audi, with 3,720 vehicles sold and a 4.1% share maintained sustained growth in its positioning in the market. Škoda sales reached 1,687 units, with a 1.8% share in the passenger car market. Volkswagen Commercial Vehicles, with 1,177 vehicles sold, +35.6% more than in the same period in the previous year, increased its market share from 3.9% to 6.8%. 2.2. Brazil • Revenue from the rent-a-car business during the six months ended 30 June 2011 increased 9.6% in Brazilian Reals, compared to the same period in 2010, with a volume of 764,540 rental days, which was 2.1% higher than the volume recorded in the same period of 2010. • In the Renting business, revenue decreased 3.8% in Brazilian Reals. The number of cars in the Renting fleet was 16,380 units at the end of the period, 12.4% less that the number of units in the fleet at the end of the 1st Half of 2010. The Renting fleet was intentionally restructured following the 2008 financial crisis, and suffered a continuous decrease until September 2010, having started to increase from October 2010 onwards. • During the first six months in 2011, Unidas’s cumulative Turnover including the sale of semi-new cars was R$ 328 million, a 8.9% decrease the same period in 2010, mainly due to a decrease in the number of semi-new cars sold. 3. CORPORATE DEVELOPMENT Within the corporate restructuring process conducted at SAG, and in order to enable the focusing of resources in activities with higher growth and return potential, several operations of strategic importance were conducted during the Semester to ensure the Group’s sustained development. A final and binding contract was completed in respect of a R$ 300 million share capital increase at Unidas. Such capital increase was fully subscribed and paid up by three new Shareholders, Investment SAG GEST – Soluções Automóvel Globais, SGPS, SA – Sociedade Aberta C.R.C. Amadora nº 503219886 – Capital Social: EUR 169.764.398 – Contribuinte Nº 503 219 886 Sede: Estrada de Alfragide, Nº 67 Amadora Funds managed by Gávea Investimentos, Kinea Investimentos and Vinci Capital. This capital increase will enable Unidas to keep up again with market growth in the coming years. Several assets that were considered as non-strategic were also sold or subject to sales agreements. Therefore, effective 30 June 2011, the total share capital of Ecometais (a company operating in the end-of-life vehicle recycling and fragmentation) was sold. This operation had a negative impact of approximately € 7 million on the results as at 30 June 2011. SAG also agreed with Santander Consumer Finance the sale of the 40% stakes it held in the capital it Spanish company Santander Consumer Iber-Rent SL and in the Polish company Santander Consumer Multirent Sp.z.o.o.. The impairment impact resulting from these transactions that occurred in July 2011 had a negative impact of approximately € 20.2 million on the accounts for the 1st Half of 2011. These two transactions, which were part of the Group’s strategic redefinition process, occurred during a period that was not favorable to this type of operations. In the case of the Companies which, since 2006, were part of the joint venture with Santander Consumer Finance, the minority shareholder position held by SAG Gest did not make it possible to consider other potentially interested parties. 4. CONSOLIDATED RESULTS FOR THE 1ST HALF OF 2011 Consolidated Turnover for the six months ended 30 June 2011 was € 456.6 million showing a decrease of 9.3% when compared with the amounts recorded during the same period in 2010. In Portugal, the decrease in Turnover, when compared with the first six months in 2010 was 10.7%, totaling € 313.6 million. Contribution from Unidas’s turnover, expressed in Euros, was € 143.0 million, a decrease of 6.1% when compared with the amount recorded during the 1st Half of 2010. Consolidated EBITDA totaled € 65.5 million, a 12% increase in relation to the amount for the same period in 2010, with positive contributions from both the activities in Portugal and in Brazil. In Portugal, EBITDA was € 24.5 million, representing a 15.2% increase. Contribution from Unidas was approximately € 41 million, an increase of 10.2% when compared with the amount recorded in the first six months of 2010. EBIT (Earnings Before Interest and Taxes) was € 26.2 million, a 100% increase when compared with amount for the first six months of 2010. This increase was mostly due to the reduction in the amount of the additional depreciation on Unidas’s semi-new and used cars, which, on the other hand, recognized an additional non-recurrent cost of approximately € 4.3 million during the period concerning impairments in its Accounts Receivable. Contribution from business conducted in Portugal to the Consolidated EBIT totaled € 17.7 million, a 15.5% increase when compared with the same period in 2010. Consolidated Net Interest (expense) showed a 25.3% increase in relation to the same period in 2010, reflecting essentially the increase in financing costs. On 30 June 2011, Consolidated Net Debt was € 606.0 million, a € 91.8 million increase when compared with the amount recorded on 31 December 2010. Unidas’ net debt on 30 June 2011 was € 226.7 million (R$ 511.5 million), representing approximately 37% of the Group’s Consolidated Net Debt, and recording an increase of € 3.0 million versus the amount as at 31 December 2010. In the context of the Group’s acquisition of the Imocar Real Estate Fund (an entity that owns the real estate assets assigned to the Groups Automotive business in Portugal) during the 1st Semester, SAG assumed the bank debt that was directly linked to these assets, in a total of € 35.7 million, while the overall decrease in the automotive business in the Portuguese market caused a significant increase in working capital requirements. As a result, the Group’s net debt in Portugal on 30 June 2011 was € 379.4 million, a € 88.8 million increase when compared with the amount as at 31 December 2010. SAG GEST – Soluções Automóvel Globais, SGPS, SA – Sociedade Aberta C.R.C. Amadora nº 503219886 – Capital Social: EUR 169.764.398 – Contribuinte Nº 503 219 886 Sede: Estrada de Alfragide, Nº 67 Amadora SAG’s Consolidated Net Result for the 1st six months of 2011 was € 34.5 million negative, impacted by non-recurrent effects resulting from the recognition of impairments associated with the divestment from stakes held in non-strategic businesses and from the already mentioned recognition of impairments in Unidas’s Accounts Receivable. Excluding those non-recurring effects and the result of discontinued operations, the net result on a recurrent basis was € 4.5 million negative, as a consequence of the still negative contribution from Unidas to the consolidated result. Alfragide, 31 August 2011 José Maria Cabral Vozone Investor Relations SAG GEST – Soluções Automóvel Globais, SGPS, SA – Sociedade Aberta C.R.C. Amadora nº 503219886 – Capital Social: EUR 169.764.398 – Contribuinte Nº 503 219 886 Sede: Estrada de Alfragide, Nº 67 Amadora CONSOLIDA C ATED INCOM ME STATEM MENT SIX MON NTHS ENDE ED 30 JUNE (Unaudite ed) SAG GEST – Soluções Automóóvel Globais, SGP PS, SA – Sociedad de Aberta C.R.C C. Amadora nº 50 03219886 – Capitaal Social: EUR 169 9.764.398 – Contribuinte Nº 503 2119 886 Sede: Estradda de Alfragide, Nº 67 Amadora CONSOLIDATED INCOME STATEMENT THREE MONTHS ENDED 30 JUNE (Unaudited) SAG GEST – Soluções Automóvel Globais, SGPS, SA – Sociedade Aberta C.R.C. Amadora nº 503219886 – Capital Social: EUR 169.764.398 – Contribuinte Nº 503 219 886 Sede: Estrada de Alfragide, Nº 67 Amadora C CONSOLIDA ATED STAT EMENT OF THE FINANCIAL POSIT TION 30 JUNE E (Unaudite ed) SAG GEST – Soluções Automóóvel Globais, SGP PS, SA – Sociedad de Aberta C.R.C C. Amadora nº 50 03219886 – Capitaal Social: EUR 169 9.764.398 – Contribuinte Nº 503 2119 886 Sede: Estradda de Alfragide, Nº 67 Amadora

Baixar

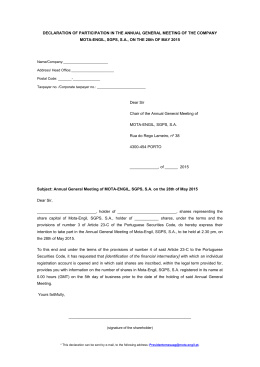

![[pdf 97KB]](http://s1.livrozilla.com/store/data/001607732_1-3465a30a2107a47668ea035ec32c9087-260x520.png)