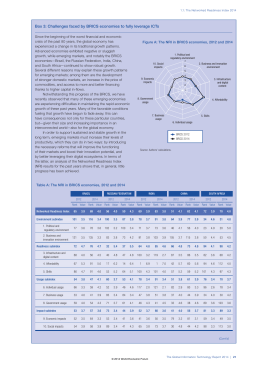

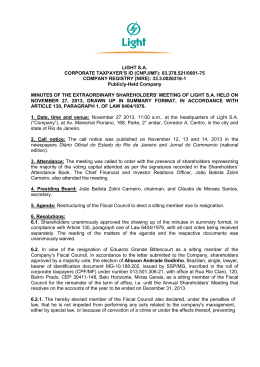

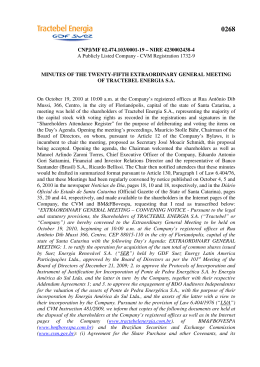

Journal of International Management 16 (2010) 143–153 Contents lists available at ScienceDirect Journal of International Management The role of reference groups in international investment decisions by firms from emerging economies Jiatao Li a,⁎, Fiona Kun Yao b,1 a b Hong Kong University of Science and Technology, Department of Management of Organizations, School of Business and Management, Clear Water Bay, Hong Kong Haas School of Business, University of California, Berkeley, 2220 Piedmont Avenue, Berkeley, CA 94702, United States a r t i c l e i n f o Article history: Received 1 October 2008 Received in revised form 1 September 2009 Accepted 1 January 2010 Available online 8 April 2010 Keywords: Reference groups Emerging economies China a b s t r a c t Investments in China by firms from emerging economies were studied to determine how various reference groups affect their foreign market entry behavior. Imitation was shown to be an important factor, but the mechanism seems to vary depending on the institutional environments in the host and the home market. Firms from emerging economies seem to rely on copying the entry decisions of peers from their home country, especially in locations where the risk of government meddling is greatest. The example of firms from developed economies was found to be less influential. © 2010 Elsevier Inc. All rights reserved. 1. Introduction The factors triggering firms' foreign expansion have received extensive attention in international management literature. Research in this field has embraced the economic perspective viewing cost minimization as a driving force (see Caves, 1996, for a review), the capability-based perspective emphasizing capability building as an inducement (Chang, 1995; Song, 2002), and, more recently, macro-organizational perspectives on international market entry such as institutional theory and organizational ecology (Guillén, 2002). These studies contribute substantially to our understanding of the reasons why multinational corporations (MNCs) expand into foreign arenas. However, they fall short in explaining the pattern of international diversification of firms from emerging economies, and the institutional contexts upon which this pattern is contingent (see Peng, et al., 2008). Research drawing on the institutional perspective has flourished since the 1970s (DiMaggio and Powell, 1983; Meyer and Rowan, 1977). Although the isomorphic pressure faced by organizations has long been a central focus for researchers in this field, those researchers may have overlooked the potentially momentous role of wide-ranging institutional transitions in shaping organizational behavior (Oliver, 1991; Peng et al., 2008). Because a common feature of emerging economies is institutional change—“fundamental and comprehensive changes introduced to the formal and informal rules of the game that affect organizations as players” (Peng, 2003: 275)—research on emerging economies may contribute to a deeper understanding of the dynamic interactions among institutions and organizations in large-scale institutional transitions (Hoskisson et al., 2000; Peng et al., 2008; Wright et al., 2005). Studies focusing predominantly on multinationals from developed economies, mainly Europe, Japan, and the United States, have not attributed adequate importance to emerging economies (Hoskisson et al., 2000). Even in the limited number of studies addressing emerging economies, the focus so far has been on a few countries such as China, Korea, and East European economies. Given the notable variations in economic and institutional development among the 64 countries that have been identified as emerging economies (Hoskisson et al., 2000), more research is necessary to broaden our understanding of the pattern of international expansion of multinationals from dissimilar emerging economies. ⁎ Corresponding author. Tel.: +852 2358 7757; fax: +852 2335 5325. E-mail addresses: [email protected] (J. Li), fi[email protected] (F.K. Yao). 1 Tel.: +1 510 643 1401; fax: +1 510 642 4700. 1075-4253/$ – see front matter © 2010 Elsevier Inc. All rights reserved. doi:10.1016/j.intman.2010.03.005 144 J. Li, F.K. Yao / Journal of International Management 16 (2010) 143–153 Furthermore, past studies have not systematically explored how differences in the institutional environment shape foreign expansions, e.g., how isomorphic pressures shape mimetic strategies. Prior research has documented the crucial role played by institutional frameworks in the host market in shaping foreign direct investment (FDI )location decisions and entry mode choices (Delios and Henisz, 2000, 2003; Henisz and Delios, 2001), yet with insufficient attention to the heterogeneities among MNCs' home countries. Recent work by Wan and Hoskisson (2003) has suggested that home country institutional environments with different levels of munificence have significant implications for success in internationalization. By considering both the home and the host institutional contexts, this study was designed to provide a better understanding of how contextual differences shape the pattern of international expansion from an institutional perspective. The study had two objectives. The first was to identify FDI reference groups which might influence foreign investment decisions. The prior investments by reference firms from the same emerging economy were investigated as one possible influence. FDI reference groups were defined in terms of whether they were from the same home country, from another emerging economy or from a developed economy. Since China was the focus of the study, the groups were further categorized as Asian or non-Asian. In addition, local policy uncertainty in a host location and the institutional differences between the host and home countries were singled out for study as two factors which might moderate imitative entry strategies. Local policy uncertainty was evaluated specifically in terms of political institutions which could induce policy unpredictability in informal and formal institutions in a host location (Henisz and Delios, 2001; Meyer and Nguyen, 2005). The dissimilarity in the institutional profiles of the home and host countries was included as another moderator (Kostova, 1999; Kostova and Zaheer, 1999). Two research questions were addressed: how FDI reference groups affect the foreign market entry behavior of firms from emerging economies; and whether and how imitation depends on the institutional environments in the host and the home markets. This emphasis on the various impacts from different reference groups parallels recent recognition that the firms constituting a regional network are heterogeneous and create different externalities (Chang and Park, 2005). By incorporating the home and the host institutional environments into the study of international expansion, the study was designed to address the question of how the local policy uncertainty and the institutional differences between the host and home countries moderate strategic mimicry. Consider first the impact of prior FDIs from different reference groups on FDI by firms from an emerging economy. The effects of host market policy uncertainty and home country institutional distance on international expansion will then be considered. These relationships were tested in this study using data on manufacturing ventures set up by firms from emerging economies in China from 1979 through 1995. China started an economic and institutional transition in late 1978, officially opening its doors to foreign direct investment. This data set thus allowed study of MNC sub-units from the beginning of China's economic transition, and investment dynamics over time. 2. Theoretical background 2.1. FDI reference groups Several groups can serve as referents for multinationals making FDI decisions. A strategic group is a cluster of firms that are comparable in terms of some aspect relevant to strategy (Caves and Porter, 1977; Hunt, 1972). The notion of strategic groups allows firms to specify rivals and position themselves within industries, which makes more sense of competition (Hatten et al., 1978; Porter, 1980). A strategic group could also act as a reference point for group members making decisions (Fiegenbaum and Thomas, 1995). Inter-firm mimicry and signaling enable strategic group members to tune their strategies toward an appropriate group reference point and formulate strategic moves in concert (Porter, 1980). Additionally, through inter-group comparisons, group members can reposition their strategies using other strategic groups as benchmarks (Kumar et al., 1990). The idea of strategic groups as reference points is further reinforced by institutional and ecological theories, which propose that collections of firm-level strategic recipes can legitimize actions and generate isomorphic pressures (DiMaggio and Powell, 1983; Hannan and Freeman, 1977). In the context of FDI, MNCs belonging to the same strategic group may imitate each other, thus affecting each other's entry decisions. Reference groups based on a multinational's country of origin have previously been applied to define recognizable populations of organizations (Guillén, 2003; Yiu and Makino, 2002). In this study, beyond grouping multinationals from the same home country, a four-cell typology was used, grouping firms in terms of whether or not their country of origin was from the developing world and whether it was Asian or non-Asian. The focus in this study was on the rate at which MNCs from emerging economies enter a host market, and on whether or not the rate can be related to prior entries from different reference groups. The reference groups were defined in terms of home country and emerging economies because multinationals from the same home country tend to have similar organizational structures and to possess comparable resources, facilitating collective strategic moves (Wan and Hoskisson, 2003). So multinationals from the same home country were treated as one reference group. Then, given that emerging economies are “low-income, rapid-growth countries using economic liberalization as their primary engine of growth” (Hoskisson et al., 2000: 249), multinationals from emerging economies are normally regarded as coming from less munificent resource environments compared to firms from developed economies. When investing in other emerging economies, MNCs from emerging economies are thus more likely to formulate similar exploitative strategies to those of firms from other emerging economies (Wright et al., 2005). An institutional setting similar to their home market should facilitate the transfer of resources and capabilities to a new host emerging market (Lee and Beamish, 1995; Pananond and Zeithaml, 1998). Investors from other emerging economies could thus be viewed as another reference group. However, foreign firms from more developed economies might present as a very different reference group for investing firms from emerging economies, and a competitive J. Li, F.K. Yao / Journal of International Management 16 (2010) 143–153 145 effect from these developed economy investors might be expected (Kostova and Zaheer, 1999; Li, 2008; Nachum, 2003; Zaheer, 1995; Zaheer and Mosakowski, 1997). Finally, the Asian and non-Asian firms were differentiated within each reference group. The cultural distance between China and other Asian countries is likely to be relatively low compared with the distance between Chinese and non-Asian economies (Hofstede, 1980). 2.2. Institutional environment: policy uncertainty and institutional differences Uncertaint futures concerning regulations or macroeconomic policies are among the many types of policy uncertainty that concern FDI decision makers (Henisz and Delios, 2001). Political institutions that allow policy-makers to change the policy regime capriciously are a prime influence on investor behavior (Henisz and Delios, 2001; North, 1990). When policies in a host market can change according to the whims of the policy-makers in power, and there are few constraints on policy alteration, firms face great environmental uncertainty, deterring FDI entry decisions (Delios and Henisz, 2000). Empirical work examining foreign market entry has shown that policy uncertainty at the country-level is negatively associated with foreign direct investment (Henisz and Delios, 2001). Rooted in economics and sociology, institutional theory suggests that institutions define the rules of the game in a society and shape the way organizations behave by signaling which actions are acceptable and supported (North, 1990; Oliver, 1991; Scott, 2001). A country's institutional framework has both formal and informal dimensions (North, 1990) that may vary in different regions (Chang and Park, 2005; Meyer and Nguyen, 2005). For instance, special economic zones (SEZs) with good infrastructure and fiscal incentives such as tax holidays or subsidies can greatly facilitate foreign investment (Loree and Guisinger, 1995). Informal local institutions, meanwhile, may draw on distinct local traditions and culture, and may affect the implementation of centrally mandated economic policies. For instance, although many national governments profess favorable attitudes toward FDI, implementation is often at the local level, where potential foreign investors have to negotiate with local authorities over business licenses, real estate, access to public utilities, and in some countries, tax incentives and subsidies (Meyer and Nguyen, 2005). Administrative decentralization can allow local authorities to decide how policies set at the national level are implemented. China is a good example of a country with wide variations in institutional quality across its various regions (Fan and Wang, 2004; Qian and Weingast, 1996). Where administration is decentralized, provincial institutions vary in the extent to which they facilitate access to local resources. Where provincial authorities help to overcome resource constraints, foreign investors will find it easier to establish their operations. Moreover, measures to facilitate resource access may serve as a signal that the province is committed to providing an investor-friendly institutional environment. Any ambiguity in national laws and regulations gives local authorities an important role in their interpretation and implementation. Discrepancies between official policy and local implementation may appear paradoxical, but they are a natural outcome of the interaction between informal and formal institutions within the public sector (Meyer and Nguyen, 2005). For foreign investors, such variation and decentralization offer both opportunities and risks. On the one hand, an investor-friendly local authority may facilitate administrative processes and create its own incentives for investment. On the other hand, local authorities may not have the administrative ability to fulfill their role, or individuals may seek to use their power to obtain personal benefits, raising costs. In general, organizations avoid highly uncertain alternatives (Cyert and March, 1963), so local policy uncertainty would be expected to discourage foreign investment. Prior research has documented the crucial role played by institutional frameworks in the host market in shaping FDI location decisions and entry mode choices (Delios and Henisz, 2000), but insufficient attention has been paid to differences among investors' home countries. Wan and Hoskisson (2003) have suggested that the munificence of a firm's home country institutional environment has significant implications for its success internationally. Past studies have not, however, systematically explored how differences in the home institutional environment shape foreign expansion. By considering the similarities and differences between the institutional profiles in the home and host countries, this study was designed to explore how contextual differences shape the pattern of international expansion. The institutional difference between the home and host country might be expected to predict the difficulty a foreign investor will face in comprehending and responding to the new environment. Institutional difference impedes the international transfer of routines (Kostova, 1999) and complicates building legitimacy in a host market (Kostova and Zaheer, 1999). The greater the difference, the greater the challenge a multinational might face in acquiring legitimacy. A multinational's failure to establish legitimacy can be fatal, with consequences ranging from censure of the firm in the media to direct attacks on multinational operations. This makes a multinational less likely to enter a market where it expects difficulty in establishing legitimacy and heightened exposure to expropriation or other hazards. In addition to this generally expected negative effect on foreign entry, institutional difference may also interact with FDI reference groups in shaping foreign entry decisions. Yet little is known about how these two dimensions of the institutional environment shape FDI patterns and the adoption of imitative strategies in FDI. In the following section we examine different reference groups in FDI, followed by the impact of the above-mentioned two dimensions of institutional environments in shaping the patterns of international expansion. 3. Hypotheses 3.1. Reference group impacts Economists have long noticed the potential benefits of organizational agglomeration, such as increased access to specialized factors, augmented technological spillover, enhanced cooperative opportunities, and so on (Marshall, 1920; Porter, 1980). Consequently, 146 J. Li, F.K. Yao / Journal of International Management 16 (2010) 143–153 organizations tend to locate where many peers have already invested. Besides this economic rationale, the institutional perspective emphasizes the legitimacy benefits of mimetic entry. Imitating prior entry by other organizations gives legitimacy to risky entry decisions (DiMaggio and Powell, 1983). For multinationals, the importance of this social consideration is increased owing to the high levels of uncertainty inherent in FDI (Scott, 2001). Moreover, bounded rationality and information asymmetry assumptions make firms more likely to imitate others that are easily observable, similar to themselves, or socially prominent (Haunschild and Miner, 1997). Therefore, foreign investors who are eager to fit in with the host country environment tend to follow previous FDI entries (Guillén, 2003; Yiu and Makino, 2002). This isomorphic tendency is likely to be particularly strong among foreign investors from the same home country, as they are bonded by a similar identity and inclined to pay more attention to each other (Chang and Park, 2005; Guillén, 2002; Henisz and Delios, 2001). So entry rates should rise with an increasing number of MNC entries from the same home country in a particular location. Hypothesis 1a (H1a). The FDI entry rate of firms from an emerging economy into a given location in China increases as the number of FDIs already established by firms from the same home country in that location increases. Similarly, firms from an emerging economy may also mimic FDI behavior of firms from other emerging economies. Multinationals from emerging economies are normally regarded as coming from environments with less munificent resources and underdeveloped market institutions (Hoskisson et al., 2000). Comparable home country environments make firms from different emerging economies likely to attend to each other and understand each other, strengthening the isomorphic tendency. Therefore, multinationals from an emerging economy tend to follow prior FDI entries from other emerging economies. Hypothesis 1b (H1b). The FDI entry rate of firms from an emerging economy into a given location in China increases as the number of FDIs already established by firms from other emerging economies in that location increases. However, foreign firms from developed economies might present as a very different reference group for investing firms from emerging economies, and a competitive effect from these developed economy investors might be expected (Kostova and Zaheer, 1999; Li, 2008; Nachum, 2003; Zaheer, 1995; Zaheer and Mosakowski, 1997). There tend to be gaps in capital, technology and management capabilities between firms from emerging markets and those from more developed markets (Hitt et al., 2000; Lyles and Baird, 1994; Svetlicic and Rojec, 1994). Developed market firms normally have easy access to financial capital because of welldeveloped financial markets in their home countries (Svetlicic and Rojec, 1994). They may also possess more sophisticated technological and developed management capabilities than firms based in emerging economies (Lyles and Baird, 1994; Svetlicic and Rojec, 1994). When considering entry decisions, firms from emerging economies may attempt to avoid entering strategic groups that are crowded with firms from developed economies. This implies a competitive effect of prior entries from developed economies on further FDI entries from emerging economies. Hypothesis 1c (H1c). The FDI entry rate of firms from an emerging economy into a given location in China decreases as the number of FDIs already established by firms from developed economies in that location increases. The strength of the influences emanating from the three FDI reference groups may, of course, be different (Kostova and Zaheer, 1999). The impact of FDIs from the same home country would be expected to be the greatest (Kostova, 1999). Since each country has a distinctive culture, some experiential knowledge generated through prior investments may be country-specific (Hofstede, 1980), and may not be easily transferable to organizations with different national origins (Chang and Park, 2005). Additionally, a firm may be inclined to pay more attention to the actions of firms from home when searching for information. This home country-based mimicry in market expansion has been emphasized in the international management literature (Guillén, 2002; Henisz and Delios, 2001). The experience of firms from other emerging economies may also be more influential than that of developed economy firms (Kostova and Zaheer, 1999). Coming from similar economic and institutional contexts, multinationals from emerging economies may understand each other better, which would facilitate spillovers among them. Theories about trait-based imitation propose that the practices of a population enjoying high status or with high similarity receive extra weight when mimicking strategy (Fombrun and Shanley, 1990; Haveman, 1993; Haveman and Rao, 1997; Strang and Tuma, 1993). Organizations from emerging economies should thus tend to mimic each other. Applying this logic to the three reference groups, organizations from the same home country would be expected to exert a stronger influence than those in the other two reference groups, and investors from other emerging economies should have a stronger impact than those from developed economies. Therefore, Hypothesis 1d (H1d). The effect of prior FDIs from the same home country on the FDI entry rate of firms from an emerging economy will be stronger than the effects of FDIs from other emerging economies or from developed economies. Hypothesis 1e (H1e). The effect of prior FDIs from other emerging economies on the FDI entry rate of firms from an emerging economy will be stronger than the effects of FDIs from developed economies. 3.2. Moderating impacts of the institutional environments The study also examined how imitation varies according to the institutional environments in the host and the home markets. Two dimensions of the institutional environment were considered: the local (host location) policy uncertainty; and the J. Li, F.K. Yao / Journal of International Management 16 (2010) 143–153 147 institutional distance between the home and host countries, which affects the difficulty of understanding and coping with local institutions. Both types of uncertainties would be expected to play a vital role in foreign expansion decisions (Delios and Henisz, 2000, 2003; Henisz and Delios, 2001; Kostova, 1999; Kostova and Zaheer, 1999). The interactions between the two dimensions and the indicators of inter-organizational mimicry were estimated to test these hypothesized effects on FDI decisions. 3.2.1. Local policy uncertainty Environmental uncertainty (Pfeffer and Salancik, 1978: 67), should be a significant dimension of the context and should help to shape a well run organization's responses to institutional influences (Oliver, 1991). When there is great environmental uncertainty, organizations are motivated to follow others so as to conform to institutional demands and obtain legitimacy (Meyer and Rowan, 1977; Oliver, 1991). Consistent with this institutional logic, organizational learning theory also proposes that one prominent strategy firms adopt to mitigate uncertainty is mimetic learning (Levitt and March, 1988). Environmental uncertainty enhances the importance of social criteria (Abrahamson and Rosenkopf, 1993; DiMaggio and Powell, 1983; Festinger, 1954; Haunschild and Miner, 1997). The greater the uncertainty, the less-inclined organizations are to look internally for solutions, and the more heavily they will rely on social bases for making decisions (Festinger, 1954). How frequently a practice is adopted by other firms represents such social factors, so the number of other firms entering a location should be more important when there is greater environmental uncertainty. This study concentrated primarily on the environmental uncertainty associated with the power of political institutions in the host market and the country's bureaucratic infrastructure (Bergara et al., 1998). When policies in a host market are volatile and there are few constraints on policy alteration, firms face high uncertainty (Delios and Henisz, 2000; Henisz and Delios, 2001). This suggests that Hypothesis 2a (H2a). The positive effect of prior FDIs from the same home country on the FDI entry rate as predicted in H1a will be stronger for markets with a high level of local policy uncertainty. Hypothesis 2b (H2b). The positive effect of prior FDIs from other emerging economies on the FDI entry rate as predicted in H1b will be stronger for markets with a high level of local policy uncertainty. Hypothesis 2c (H2c). The negative effect of prior FDIs from developed economies on the FDI entry rate as predicted in H1c will be stronger for markets with a high level of local policy uncertainty. These hypotheses extend the research on policy uncertainty and imitation by Henisz and Delios (2001). Based on a sample of Japanese firms which made investment decisions in multiple countries, their study found that imitation was not influenced by the extent of policy uncertainty in a host country. Unlike that work, this research examined FDI from several emerging economies in China, another emerging economy. Owing to the fact that the state normally possesses a legal monopoly on coercion and the institutional environment is often unpredictable in emerging economies, multinationals face heightened exposure to expropriation hazards. Therefore establishing legitimacy and alleviating political hazards are more important concerns for foreign firms in emerging economies than in developed economies. The accumulation of host country experience and industry experience has been shown to enhance the abilities of organizations to mitigate such hazards (Delios and Henisz, 2000). The agglomeration of foreign firms in one specific location could generate network externalities to further reduce such hazards (Chang and Park, 2005) because of legitimacy spillover and inter-organizational learning about mitigating hazards. Therefore the more politically hazardous a host market, the more likely organizations will be to follow other firms in FDI entry decisions. 3.2.2. Home country institutional distance The institutional distance between the home and the host country predicts the difficulty a foreign investor will face in comprehending and responding to the new environment (Kostova, 1999; Kostova and Zaheer, 1999). Institutional distance impedes the international transfer of routines (Kostova, 1999), and complicates building legitimacy in a host market (Kostova and Zaheer, 1999). The greater the distance, the greater the challenge of acquiring legitimacy. Therefore in an institutionally distant environment, organizations may try to gain legitimacy by learning more from other firms' entry decisions. However this mimetic process can be highly selective, in that the practices of some subsets of the population weigh more than others. That is, when there is high institutional distance, multinationals rely more on firms from other countries as their reference group, but attach less importance to organizations from the same home country. This is because the prestige or the status of the organizations adopting a practice influences subsequent mimicry by others (Haunschild and Miner, 1997; Strang and Tuma, 1993). Investors from the same country of origin, which is institutionally dissimilar from the host market, face similarly high levels of legitimacy concerns, so have lower status in the host environment and are less useful as models (Fombrun and Shanley, 1990). While both local policy uncertainty and the country-level institutional difference may discourage foreign entry, their interaction could have a substituting effect: institutional difference could weaken the negative effect of local policy uncertainty on market entry. Here, we focus on the attention-based view of the firm (Ocasio, 1997). Attention is a valuable and scarce resource in organizations, because problems compete for the limited attention of decision makers (Barnett, 2008; Cyert and March, 1963). Previous research has found the attention of major decision makers in a firm significantly influences its decisions and outcomes, 148 J. Li, F.K. Yao / Journal of International Management 16 (2010) 143–153 including strategic change (Cho and Hambrick, 2006), investment in new technology (Kaplan, 2008), board activities (Tuggle et al., 2010), and mergers and acquisitions (Yu et al., 2005). When the institutional profiles of the home and host countries are similar, firms might focus their attention in making their location selection decisions on the uncertainties involved in sub-national policy variations, rather than on national political hazards. Investors from institutionally dissimilar countries, however, may get caught up in managing political hazards at the national level and be less sensitive to local heterogeneities in policy implementation. This suggests different location selection rules for MNCs depending on the institutional profile of their home country and its difference with respect to that of the host. MNCs from more institutionally similar countries may focus on their attention on the more refined level of local policy uncertainty when selecting FDI locations; MNCs from institutionally dissimilar countries may focus primarily on national-level political hazards and pay less attention to local policy uncertainties. Hypothesis 3a (H3a). The positive effect of prior FDIs from the same home country on the FDI entry rate as predicted in H1a will be weaker for firms from countries with a high level of institutional distance. Hypothesis 3b (H3b). The positive effect of prior FDIs from other emerging economies on the FDI entry rate as predicted in H1b will be weaker for firms from countries with a high level of institutional distance. Hypothesis 3c (H3c). The negative effect of prior FDIs from developed economies on the FDI entry rate as predicted in H1c will be weaker for firms from countries with a high level of institutional distance. 4. Research methods 4.1. Sample and data sources The hypotheses were tested using data covering all foreign-invested manufacturing ventures established in China over the period 1979–95 by firms from other emerging economies. Several factors make China an excellent setting for the study. First, interorganizational influences on decision making can be followed from the beginning of China's economic transition. Second, China's institutional context during the study period was complex, with high uncertainty (Child, 1994). In such situations, social considerations are likely to be of critical importance (Scott, 2002). This is particularly salient for FDI location decisions, because uncertainty about unfamiliar locations can most easily be reduced by observing and imitating other firms' choices. During the study period, multinationals from 32 emerging economies launched a total of 17,337 manufacturing subsidiaries in China. This study focused on manufacturing entries, excluding those in service sectors where the government tended to have more restrictions on foreign ownership (Fu, 2000). Focusing on manufacturing also facilitated comparison with other recent studies of FDI in China (e.g., Chang and Park, 2005; Guillén, 2002). Three main data sources were used in this study. Raw data on direct investment in China by MNCs from emerging economies was obtained from the research institute of the Ministry of Foreign Trade and Economic Cooperation (MOFTEC) in Beijing. This database contains a brief profile of each foreign-invested firm that has operated in the country from 1979 to 1995, providing data on the location, industry, and national origin of the investment. The second main data source, the China Statistical Yearbook 1980–98, provided data on control variables such as provincial trade growth and industry Rand D intensity. It was also used to derive an indicator of one of the two potential moderators: local policy uncertainty. The political hazard index developed by Henisz (2002) was used to calculate the investing country's institutional distance from China, another hypothesized moderator. The level of analysis of this study was at the industry–home country–host location level. The foreign entry data was first aggregated by home country, industry and host province. The potential number of country–industry–location–year combinations was 401,408 (32 countries × 28 industries × 28 locations × 16 years). Following the lead of previous studies, the first year of FDI entry in the home country/industry data was taken as the beginning of the observation (Carroll and Hannan, 2000; Henisz and Delios, 2001). The final sample consisted of 8716 home country–industry–location–year cells. In order to correct for potential bias generated by excluding country–industry cells without any FDI entries in China, a two-stage sample selection technique was applied (Polillo and Guillén, 2005). In the first stage, the probability of observing an investment for a country–industry–location set during year t was estimated.2 In the second stage, the estimated probability was included as a control variable in the model predicting the FDI entry rate. The results should thus be robust and not biased because of sample selection issues. 4.2. Variables and measures 4.2.1. Dependent variable The dependent variable, FDI entry rate, was measured as the number of FDI entries per year in a particular province and industry from a particular home country. 2 We estimated the following probit model using the longitudinal data set of 25,088 country–industry–location pairs (32 countries× 28 industries × 28 provinces ) over 16 years, where the numbers in parentheses are the standard errors of the coefficients: probability of inclusion in the sample = −2.87(0.02) + 2.92× GDP growth (0.04)+ 0.35× trade growth (.01) + 0.95 × sales volume (0.07) − 0.02 × concentration ratio (0.001) + 0.01× advertising intensity (0.003). J. Li, F.K. Yao / Journal of International Management 16 (2010) 143–153 149 4.2.2. Independent variables All of the independent variables were lagged one year (t − 1) for predicting FDI entries in the following year. To investigate the effects of the three FDI reference groups, density measures were calculated for each group. Same country FDI density was measured by the total number of FDIs from the same home country in the same industry in the previous year. Emerging economy FDI density was measured as the total number of FDIs from all other emerging economies in the data set in the same industry in the previous year. It was further decomposed into Asian emerging economy FDI density, measured as the total number of FDIs from all Asian emerging economies in the same industry in the previous year, and non-Asian emerging economy FDI density, measured as the total number of FDIs from all non-Asian emerging economies in the same industry in the previous year. Developed economy FDI density was measured as the total number of FDIs from developed economies in the data set in the same industry in the previous year, and it too was decomposed into Asian developed economy FDI density and non-Asian developed economy FDI density. To test the moderating effects, the interactions of local policy uncertainty and home country institutional distance (from China) were added separately. A new provincial level index of local policy uncertainty was developed. Capturing policy uncertainty at this more refined level was necessary because China's institutional environment was heterogeneous during the period studied, and the regions differed greatly in market size, technology base, political institutions, and even culture (Chang and Park, 2005). Since economic reform in the late 1970s, much economic decision making power in China has been decentralized to the provincial governments (Zhao and Zhang, 1999). To develop this new provincial level policy uncertainty index, variables which capture China's formal and informal institutions (North, 1990) as they are relevant to FDI decisions were factor analyzed. A provincial-level measure of local policy uncertainty was developed by considering both supply-side and demand-side determinants of policy and institutional changes (Henisz and Delios, 2001; Huang, 2003). Five time-varying, province-level variables were included: lagged unemployment rate; employment in state-owned enterprises (SOEs) as a percentage of provincial population; total provincial government budgetary expenses as a percentage of GDP (a measure of the government's fiscal autonomy); provincial government employment as a percentage of provincial population; and FDI policy incentives (the existence of special economic zones (SEZs) and coastal open cities (COCs) in the province). Principal-components analysis was employed to develop the index. The share of SOE employment and the provincial unemployment rate were included to account for the demand-side determinants of possible government policy interventions. In China, SOEs have long been intertwined with the government, with strong power to exert pressure on government policies. However, SOEs were endangered in the transition to market economies. (See a review by Megginson and Netter, 2001.) Given the SOEs' privileged connections with local governments, the authorities may have felt compelled to protect them from mass layoffs and business failures. High unemployment might similarly pressure policy makers to interfere in the local economy (Bergsten and Cline, 1983; Henisz and Mansfield, 2004; Wallerstein, 1987). On the supply side, the province's fiscal autonomy, government bureaucracy and policy incentives (reversely coded) were considered. China's economic reform since the late 1970s has been characterized by fiscal decentralization, which assigned greater fiscal power and economic control to provincial governments (Zhao and Zhang, 1999). The ratio of budgeted expenses to local GDP could thus capture the province's fiscal autonomy and indicate the authorities' freedom to intervene in the economy in spite of central directives (Poncet, 2005). The proportion of government employment in the population served as an indicator of overregulation. China consisted of 29 provinces and autonomous municipalities before 1995, among which there were five SEZs as well as 14 OCOs designated to attract FDI by providing special policy incentives such as tax holidays, customs duties exemptions, and preferential corporate tax rates (Firoz and Murray, 2003; Zhou et al., 2002). A dummy variable indicating such policy incentives was included in the analysis. These five factors were combined into a single index for each province through principle component analysis. The eigenvalue for the single factor was 2.3, accounting for 44% of the variance. This index was used to indicate policy hazards at the provincial level each year during the study period. Each home country's institutional distance from China was estimated using the yearly, country-level political hazards information of Henisz (2002) as one proxy for the country's institutional profile. All variables for interactions were mean-centered. 4.2.3. Control variables Four sets of control variables were included: home country, host province, industry, and entry year. To control for possible home country heterogeneities, both GDP per capita and trade flow with China for each home country were included in the models. Information on each investing country's trade flow with China was obtained from Freenstra (2000). Most prior research on FDI entry rates has emphasized factors such as market potential, economic growth, and trade (Broadman and Sun, 1997; Cheng and Kwan, 2000; Coughlin and Segev, 2000), so provincial GDP growth and trade growth in each year were included in the models. In all models, industry and year fixed effects were included to control for unobserved heterogeneities. 5. Results Table 1 reports the results of negative binomial regressions (Greene, 1996) modeling the rate of FDIs from the same home country entering a particular industry, incrementally adding the theoretical variables of interest. Model 1 included the three FDI reference groups without differentiating Asian from non-Asian. Model 2 decomposed the FDI into Asian and non-Asian, from emerging and developed home countries. Models 3–4 added the interaction effects of local policy uncertainty and home country institutional distance. 150 J. Li, F.K. Yao / Journal of International Management 16 (2010) 143–153 Table 1 Results of negative binomial analysis: entry rate of foreign subsidiaries from emerging economies in China.a Model Variables FDI reference groups Same country FDI density (/10) Emerging economy FDI density (/100) 1 2 3 4 0.41*** (0.01) 0.32*** (0.07) 0.42*** (0.02) 0.42*** (0.01) 0.61*** (0.09) 0.42*** (.01) 0.32*** (.08) − 0.09*** (0.01) − 0.06*** (0.01) − 0.32*** (0.02) − 0.70*** (0.10) − 0.25*** (0.02) − 0.86*** (0.09) Asian Emerging economy 0.53*** (0.10) 0.87 (0.97) Non-Asian Emerging economy Developed economy FDI density (/100) − 0.06*** (0.01) Asian developed economy Non-Asian developed economy Local policy uncertainty Home country institutional distance − 0.26*** (0.02) − 0.67*** (0.09) − 0.06*** (0.01) − 0.35** (0.12) − 0.28*** (0.02) − 0.67*** (0.09) Moderating effects: Local policy uncertainty: Same country FDI density(/10) × Local policy uncertainty 0.07*** (0.01) 0.60*** (0.08) − 0.07*** (0.02) Emerging economy FDI density(/100) × Local policy uncertainty Developed economy FDI density(/100) × Local policy uncertainty Home country institutional distance: Same country FDI density(/10) × Home country institutional distance − 0.69*** (0.18) 0.66 (0.36) − 0.02 (0.04) Emerging economy FDI density(/100) × Home country institutional distance Developed economy FDI density(/100) × Home country institutional distance Home country-level control variables GDP per capita(/1000) Trade flow with China (/100,000) Host location-level control variables GDP growth Trade growth Fixed year effect Fixed industry effect Probability of sample selection Dispersion parameter (α) Test of coefficient equalityb Same country N Emerging economy Same country N Developed economy Emerging economy N Developed economy Log likelihood Chi-square change vs. Model 1 0.18*** (0.01) 0.02*** (0.01) 0.18*** (0.01) 0.02*** (0.01) 0.19*** (0.01) 0.02*** (0.01) 0.18*** (0.01) 0.02*** (0.01) 2.40*** (0.23) 0.22*** (0.03) Included Included − 0.08 (0.06) 0.50 2.33*** (0.23) 0.22*** (0.03) Included Included − 0.08 (0.06) 0.50 1.81*** (0.23) 0.20*** (0.03) Included Included − 0.05 (0.06) 0.48 2.38*** (0.23) 0.22*** (0.03) Included Included − 0.13* (0.06) 0.49 502.7*** 515.5*** 6.1** − 12,583 − 12,579 − 12,527 112*** − 12,572 22*** a N = 8716; Values in parentheses are standard errors; *** p b 0.001, ** p b 0.01, * p b 0.05. bWald tests. As shown in Model 1, the coefficient for FDI from the same country was positive and significant, supporting H1a. The coefficient for FDI from the other emerging economies was also positive and significant, supporting H1b. Asian and non-Asian emerging economies were distinguished in Model 2, and the coefficient for FDI from Asian emerging economies was positive and significant, but the coefficient for non-Asian emerging economies was not significant. This suggests that the rate at which MNCs from emerging economies enter a host market is predicted by prior entries from Asian emerging economies, but not by entries from non-Asian emerging economies. The coefficients for developed economies (Asia or non-Asia) are negative (Models 1–2), supporting H1c. This suggests that there was competition between firms from emerging economies and those from developed J. Li, F.K. Yao / Journal of International Management 16 (2010) 143–153 151 economies. Competition among organizations drawing on the same resource base is systematically linked to economic adversity and organizational failure (Hannan and Freeman, 1989), so a negative effect on the entry rate is expected as the number of FDIs already established from developed economies increases. To test H1d and H1e, Wald tests were conducted comparing the strength of the influences from the three FDI reference groups (Greve, 2002). Same country FDI density was indeed found to have the strongest impact on the FDI entry rate (Model 1). Emerging economy FDI density was the next most important, and the predictive power of developed economy FDI density was the weakest (Table 1). Therefore, H1d and H1e were supported. Models 3–4 tested interactions between the FDI density in the reference groups and local policy uncertainty and home country institutional distance respectively. The significant Chi-square changes over the baseline model suggest that the theoretical variables added significant predictive power to the effects that have been explored in previous studies. Due to collinearity among the interactions, a model showing all interactions entered simultaneously was not reported. In Model 3, the coefficients on the interactions between the prior FDIs from same country and those from other emerging economies and the provincial policy uncertainty were positive, supporting H2a and H2b. Greater local policy uncertainty in the host environment increases the propensity for MNCs to imitate others' FDI entry decisions (those from the same home country and from other emerging economies), consistent with the institutional theory predictions. However, the interaction of local policy uncertainty with the FDI from other developed economies was negative, suggesting that the competitive effect increased with the greater local uncertainty. This result supported H2c. In Model 4, home country institutional distance was found to significantly moderate the impact of the home country FDI density on the FDI entry rates. The greater the distance, the less likely MNCs were to follow other firms from the same home country in their FDI entry decisions, supporting H3a. The coefficients for interactions with other emerging economies and developed economies were not significant; hence H3b and H3c were not supported. Several control variables representing other factors suspected of influencing the rate of FDI entry also showed the expected relationships. MNCs from countries which traded heavily with China and which had high GDP per capita were most inclined to make investments in China. Using such a two-stage model controlling for the probability of sample selection gives confidence in the robustness of the results. 6. Discussion Emerging-economy firms are becoming important participants in the global economy, and the results of this study tend to confirm that these new multinationals use each other as reference points in their international market entry decisions. Such firms do, however, face competition from more established multinationals from developed economies in this internationalization process, as these results clearly show. This study has examined how mimicry plays a part in the foreign market entry behavior of emerging-economy firms and how imitation mechanisms vary according to the institutional environments in the host and home markets. In examining host location policy uncertainty and home country institutional distance, this study has improved the understanding of how institutional forces shape entry strategies in emerging economies. The results also contribute to the understanding of the influence of reference groups and identities, by showing the influence of prior investments from different reference groups. Multinationals from emerging economies seem more likely to be influenced by prior entries from their home country than by firms from other countries, and more prone to follow the entries of other emergingeconomy firms than those of firms from developed economies. Prior investments by developed economy firms may even deter new entries by emerging-economy multinationals, suggesting that intensified competition from developed economy firms outweighs the potential spillovers from agglomeration and legitimization in foreign market entry. Hence, one of the key challenges for emerging-economy firms is to catch up, as their developed economy peers are likely to have superior resources and capabilities. The results show that Asian emerging-economy firms serve as key reference points for other emerging-economy multinationals in their foreign investment decisions in China. While this might not be surprising, it is important to understand that this is not a simple cultural similarity story, as assumed in most of the earlier studies. As the results have demonstrated, the presence of Asian developed economy firms, such as those from Japan, actually seemed to deter investment by emerging-economy multinationals. Instead, the Asian emerging-economy firms seemed to be most encouraged by institutional and cultural similarities, which may provide them with greater insight and understanding about investing in China than that provided by nonAsian emerging economy firms. By exploring provincial-level policy uncertainty, this study has shed new light on how within-country institutional differences affect FDI decisions. Indeed, location has received little attention in recent years, leading Dunning (1998) to call it ‘the neglected factor’ of the ownership, location, and internalization incentives (OLI) framework. International business studies have largely focused on countries as the unit of analysis and examined how country-level institutional variables influence the selection of host countries (Globerman and Shapiro, 2003; Loree and Guisinger, 1995; Oxelheim and Ghauri, 2004), without paying adequate attention to location decisions within countries. The specific location of operations is, however, a major concern to multinational firms (Shaver and Flyer, 2000) and is of particular importance in large and decentralized emerging markets where policies vary at the provincial or even local level (Head and Ries, 1996; Zhou et al., 2002). Such subnational-level institutions within a country supplement national institutions in influencing foreign entry location decisions (Meyer and Nguyen, 2005). The results of this study have captured the institutional differences among provinces within China, and the new index of provincial-level policy uncertainty developed in this study should help to improve understanding of the relationship between institutions and location decisions at a more refined level. 152 J. Li, F.K. Yao / Journal of International Management 16 (2010) 143–153 Several limitations of the study suggest promising areas for future research. First, this study examined the early stages of foreign direct investment in China from 1979 to 1995. While future research can extend this study with more recent data to capture the changing impacts of market transition in China, we believe that the early period of China's economic transitions (1979–1995) was an excellent setting for testing the hypotheses in this study. In the early stages of market transition in emerging economies, social influences could be of critical importance in decision making, and governmental and social influences are stronger in emerging economies than in developed economies (Hoskisson et al., 2000). This was particularly salient for FDI location decisions, because uncertainty about unfamiliar locations can most easily be reduced by observing and imitating other firms' choices. But as the Chinese market continues to develop, economic explanations should become more important (Hoskisson et al., 2000). Future research with more recent data can compare social and economic influences at different stages of market transition in China. 7. Conclusions The key findings of this research suggest that firms from emerging economies are more likely to invest in China when peers from the same country or from other emerging economies have already done so. In particular, the investment patterns of multinationals from Asian emerging economies serve as a more salient reference point than those of firms from non-Asian emerging economies. In addition, host location policy uncertainty and home country institutional distance moderate these influences, such that mimicry is enhanced under conditions of higher policy uncertainty and narrower institutional distance. Acknowledgments We would like to thank Peter Gammeltoft (the editor), an anonymous reviewer, Sea-jin Chang, and the participants of Copenhagen Conference on Emerging Multinationals for their helpful comments, and Bill Purves for editing assistance. We gratefully acknowledge support from Hong Kong's Research Grants Council through grant HKUST641609. References Abrahamson, E., Rosenkopf, L., 1993. Institutional and competitive bandwagons: using mathematical modeling as a tool to explore innovation diffusion. Academy of Management Review 18, 487–517. Barnett, M., 2008. An attention-based view of real options reasoning. Academy of Management Review 33, 606–628. Bergara, M., Henisz, W.J., Spiller, P.T., 1998. Political institutions and electric utility investment: a cross-nation analysis. California Management Review 40, 18–35. Bergsten, F., Cline, W.R., 1983. Trade policy in the 1980s: an overview. In: Cline, W.R. (Ed.), Trade Policy in the 1980s. Institute for International Economics, Washington, DC. Broadman, H.G., Sun, X., 1997. The distribution of foreign direct investment in China. World Economy 20, 339–361. Carroll, G.R., Hannan, M., 2000. The Demography of Corporations and Industries. Princeton University Press, Princeton, NJ. Caves, R.E., 1996. Multinational Enterprise and Economic Analysis. Cambridge University Press, New York. Caves, R.E., Porter, M.E., 1977. From entry barriers to mobility barriers. Quarterly Journal of Economics 91, 241–262. Chang, S.J., 1995. International expansion strategy of Japanese firms: capability building through sequential entry. Academy of Management Journal 38, 383–407. Chang, S.J., Park, S., 2005. Types of firms generating network externalities and MNCs' co-location decisions. Strategic Management Journal 26, 595–625. Cheng, L.K., Kwan, Y.K., 2000. What are the determinants of the location of foreign direct investment? The Chinese experience. Journal of International Economics 51, 379–400. Child, J., 1994. Management in China during the Age of Reform. Cambridge University Press, Cambridge. China Statistical Yearbook, 1980–98. China Statistical Publishing House, Beijing. Cho, T., Hambrick, D., 2006. Attention as the mediator between top management team characteristics and strategic change: the case of airline deregulation. Organization Science 17, 453–469. Coughlin, C., Segev, E., 2000. Foreign direct investment in China: a spatial econometric study. World Economy 23, 1–23. Cyert, R.M., March, J.G., 1963. A Behavioral Theory of the Firm. Prentice Hall, Endlewood Cliffs, NJ. Delios, A., Henisz, W.J., 2000. Japanese firms' investment strategies in emerging economies. Academy of Management Journal 43, 305–323. Delios, A., Henisz, W.J., 2003. Political hazards, experience, and sequential entry strategies: the international expansion of Japanese firms, 1980–1988. Strategic Management Journal 24, 1153–1164. DiMaggio, P.J., Powell, W.W., 1983. The iron cage revisited: institutional isomorphism and collective rationality in organizational fields. American Sociological Review 48, 147–160. Dunning, J.H., 1998. Location and the multinational enterprise: a neglected factor? Journal of International Business Studies 29, 45–66. Fan, G., Wang, X., 2004. NERI Index of Marketization of China's Provinces. Economics Science Press. Festinger, L., 1954. A theory of social comparison processes. Human Relations 7, 117–140. Fiegenbaum, A., Thomas, H., 1995. Strategic groups as reference groups: theory, modeling and empirical examination of industry and competitive strategy. Strategic Management Journal 16, 461–476. Firoz, N.M., Murray, H.A., 2003. Foreign investment opportunities and customs laws in China's special economic zones. International Journal of Management 20, 109–111. Fombrun, C., Shanley, M., 1990. What's in a name? Reputation building and corporate strategy. Academy of Management Journal 33, 233–258. Freestra, R., 2000. World Trade Flows, 1980–1997. Institute of Governmental Affairs, University of California, Davis, Davis, CA. Fu, J., 2000. Institutions and Investment. The University of Michigan Press, Ann Arbor, MI. Globerman, S., Shapiro, N., 2003. Governance infrastructure and US foreign direct investment. Journal of International Business Studies 34, 19–39. Greene, W., 1996. LIMDEP, ver. 6.0. Econometric Software. . Bellport, NY. Greve, H., 2002. An ecological theory of spatial evolution: local density dependence in Tokyo banking, 1894–1936. Social Forces 80, 847–879. Guillén, M.F., 2002. Structural inertia, imitation, and foreign expansion: South Korean firms and business groups in China, 1987–1995. Academy of Management Journal 45, 509–525. Guillén, M.F., 2003. Experience, imitation, and the sequence of foreign entry: wholly owned and joint venture manufacturing by South Korean firms and business groups in China, 1987–1995. Journal of International Business Studies 34, 185–198. Hannan, M.T., Freeman, J.H., 1977. The population ecology of organizations. American Journal of Sociology 82, 929–964. Hannan, M.T., Freeman, J., 1989. Organizational Ecology. Harvard University Press, Cambridge, MA. J. Li, F.K. Yao / Journal of International Management 16 (2010) 143–153 153 Hatten, K.J., Schendel, D.E., Cooper, A., 1978. A strategic model of the U.S. brewing industry: 1952–1971. Academy of Management Journal 21, 592–610. Haunschild, P.R., Miner, A.S., 1997. Models of interorganizational imitation: the effects of outcome salience and uncertainty. Administrative Science Quarterly 42, 472–500. Haveman, H.A., 1993. Follow the leader: mimetic isomorphism and entry into new markets. Administrative Science Quarterly 38, 564–592. Haveman, H., Rao, H., 1997. Structuring a theory of moral sentiments: institutional and organizational coevolution in the early thrift industry. American Journal of Sociology 102, 1606–1651. Head, K., Ries, J., 1996. Inter-city competition for foreign investment: static and dynamic effects of China's incentive areas. Journal of Urban Economics 40, 38–60. Henisz, W.J., 2002. The institutional environment for infrastructure investment. Industrial and Corporate Change 11, 355–389. Henisz, W.J., Delios, A., 2001. Uncertainty, imitation and plant location: Japanese multinational corporations, 1990–1996. Administrative Science Quarterly 46, 443–477. Henisz, W.J., Mansfield, E., 2004. Votes and vetoes: the political determinants of commercial openness. Working paper. University of Pennsylvania. Hitt, M.A., Dacin, T.M., Levitas, E., Arregle, J.-L., Borza, A., 2000. Partner selection in emerging and developed market contexts: resource-based and organizational learning perspectives. Academy of Management Journal 43, 449–467. Hofstede, G., 1980. Culture's Consequence: International Differences in Work Related Values. Sage Publications, Beverly Hills, CA. Hoskisson, R.E., Eden, L., Lau, C.M., Wright, M., 2000. Strategies in emerging economies. Academy of Management Journal 43, 249–267. Huang, Y., 2003. Selling China: Foreign Direct Investment during the Reform Era. Cambridge University Press, Cambridge. Hunt, M.S., 1972. Competition in the major home appliance industry. Doctoral dissertation, Harvard University. Kaplan, S., 2008. Cognition, capabilities, and incentives: assessing firm response to the fiber-optic revolution. Academy of Management Journal 51, 672–695. Kostova, T., 1999. Transnational transfer of strategic organizational practices: a contextual perspective. Academy of Management Review 24, 308. Kostova, T., Zaheer, S., 1999. Organizational legitimacy under conditions of complexity. Academy of Management Review 24, 64–81. Kumar, K.R., Thomas, H., Fiegenbaum, A., 1990. Strategic groupings as competitive benchmarks for formulating future competitive strategy: a modeling approach. Managerial and Decision Economics 11, 99–109. Lee, C., Beamish, P., 1995. The characteristics and performance of Korean joint ventures in LDCs. Journal of International Business Studies 26, 637–654. Levitt, B., March, J.G., 1988. Organizational learning. Annual Review of Sociology 14, 319–340. Li, J.T., 2008. Asymmetric interactions between foreign and domestic banks: effects on market entry. Strategic Management Journal 29, 873–893. Loree, D., Guisinger, S., 1995. The globalization of service multinationals in the triad nations: Japan, Europe and North America. Journal of International Business Studies 26, 281–299. Lyles, M.A., Baird, I.S., 1994. Performance of international joint ventures in two Eastern European countries: the case of Hungary and Poland. Management International Review 34, 313–329. Marshall, A., 1920. Principles of Economics. Macmillan, London. Megginson, W., Netter, J., 2001. From state to market: a survey of empirical studies on privatization. Journal of Economic Literature 39, 321–389. Meyer, J., Rowan, B., 1977. Institutionalized organizations: formal structures as myth and ceremony. American Journal of Sociology 83, 340–363. Meyer, K.E., Nguyen, H.V., 2005. Foreign investment strategies and sub-national institutions in emerging markets: evidence from Vietnam. Journal of Management Studies 42, 63–93. Nachum, L., 2003. Liability of foreignness in global competition? Financial service affiliates in the city of London. Strategic Management Journal 24, 1187–1208. North, D.C., 1990. Institutions, Institutional Change and Economic Performance. Harvard University Press, Cambridge, MA. Ocasio, W., 1997. Towards an attention-based view of the firm. Strategic Management Journal 18, 187–206. Oliver, C., 1991. Strategic responses to institutional processes. Academy of Management Review 16, 145–179. Oxelheim, L., Ghauri, P. (Eds.), 2004. The European Union and the Race for Foreign Direct Investment in Europe. Elsevier, Oxford. Pananond, P., Zeithaml, C.P., 1998. The international expansion process of MNEs from developing countries: a case study of Thailand's CP Group. Asia Pacific Journal of Management 15, 163–185. Peng, M.W., 2003. Institutional transitions and strategic choices. Academy of Management Review 28, 275–293. Peng, M.W., Wang, D., Jiang, Y., 2008. An institution-based view of international business strategy: a focus on emerging economies. Journal of International Business Studies 39, 920–936. Pfeffer, J., Salancik, G.R., 1978. The External Control of Organizations: a Resource Dependence Perspective. Harper and Row, New York. Poncet, S., 2005. A fragmented China: measures and determinants of Chinese domestic market disintegration. Review of International Economics 13, 409–430. Polillo, S., Guillén, M.F., 2005. Globalization pressures and the state: the worldwide spread of central bank independence. American Journal of Sociology 110, 1764–1802. Porter, M.E., 1980. Competitive Strategy. The Free Press, New York. Qian, Y., Weingast, В.R., 1996. China's transition to markets: market-preserving federalism, Chinese style. Journal of Policy Reform 1, 149–185. Scott, R., 2001. Institutions and Organizations, Sage Publications. 2nd ed. Thousand Oaks, CA. Scott, R., 2002. The changing world of Chinese enterprise: an institutional perspective. In: Tsui, A.S., Lau, C.M. (Eds.), The Management of Enterprises in the People's Republic of China. Kluwer, Boston. Shaver, J.M., Flyer, F., 2000. Agglomeration economies, firm heterogeneity and foreign direct investment in the United States. Strategic Management Journal 21, 1175–1193. Song, J., 2002. Firm capabilities and technology ladders: sequential foreign direct investments of Japanese electronics firms in East Asia. Strategic Management Journal 23, 191–210. Strang, D., Tuma, N.B., 1993. Spatial and temporal heterogeneity in diffusion. American Journal of Sociology 99, 614–639. Svetlicic, M., Rojec, M., 1994. Foreign direct investment and the transformation of Central European economies. Management International Review 34, 293–312. Tuggle, C., Schnatterly, K., Johnson, R., 2010. Attention patterns in the boardroom: how board composition and processes affect discussion of entrepreneurial issues. Academy of Management Journal. Wan, W.P., Hoskisson, R.E., 2003. Home country environments, corporate diversification strategies, and firm performance. Academy of Management Journal 46, 27–45. Wallerstein, M., 1987. Unemployment, collective bargaining, and the demand for protection. American Journal of Political Science 31, 729–752. Wright, M., Filatotchev, L., Hoskisson, R., Peng, M., 2005. Strategy research in emerging economies: challenging the conventional wisdom. Journal of Management Studies 42, 1–33. Yiu, D., Makino, S., 2002. The choice between joint venture and wholly owned subsidiary: an institutional perspective. Organization Science 13, 667–683. Yu, J., Engleman, R., Van de Ven, A., 2005. The integration journey: an attention-based view of the merger and acquisition integration process. Organization Studies 26, 1501–1528. Zaheer, S., 1995. Overcoming the liability of foreignness. Academy of Management Journal 38, 341–363. Zaheer, S., Mosakowski, E., 1997. The dynamics of the liability of foreignness: a global study of survival in financial services. Strategic Management Journal 18, 439–464. Zhao, X.B., Zhang, L., 1999. Decentralization reforms and regionalism in China: a review. International Regional Science Review 22, 251–281. Zhou, C., Delios, A., Yang, J.Y., 2002. Locational determinants of Japanese foreign direct investment in China. Asia Pacific Journal of Management 19, 63–86.

Baixar