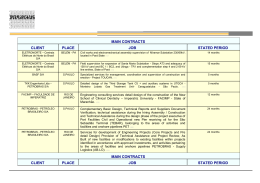

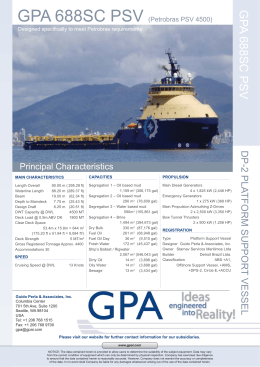

Xx xxxxxxxx 20xx Equity Research Petrobras xxxxxxxxxxxxxxxxxxxxxxxxxxx The Petrobras Handbook An investor’s guide to a unique oil company March 2014 Research Analysts The oil company FOTO Vinicius Canheu, CFA + 55 11 3701 6310 vinicius.canheu@credit–suisse.com Andre Sobreira, CFA + 55 11 3701 6299 andre.sobreira@credit–suisse.com With over 85 thousand employees, $140bn in revenues, 2,000kbd of oil production, 16bn barrels of reserves, privileged access to one of the world’s largest oil frontiers and to a large and growing Brazilian fuel market, Petrobras is Brazil’s most important company and also one of the most unique and intriguing oil companies in the planet. Founded 60 years ago, the company is now at a crucial moment in its history, facing great opportunities but also meaningful challenges. Understanding the company, its opportunities and challenges have never been more important. The investor Investors, as the company, are also at one of the most unique, controversial, and important moments in their investment decisions in Petrobras’ shares. Despite close to $200bn in investments over the past five years, Petrobras’ financial performance and balance sheet is at one of the lowest points in history. Production has not grown significantly since 2010, Downstream losses have never been higher, and the balance sheet has never been as stretched. The share price has reflected those trends, and Petrobras’ market value today is at similar levels as 2005, before the discovery of the pre-salt, and lower than in 2008, when the oil price hit close to $30/bbl, compared to $100/bbl today. Looking ahead, production can finally get back to a strong growth path, but issues remain, especially regarding how the new pricing policy will be implemented in a year with a number of economic challenges, and Brazilian presidential elections. Does the current share price offer an opportunity, or is Petrobras a value trap? The guide At such an important moment for the company and for investors, a deep understanding of Petrobras and the factors influencing the share price is paramount. With this in mind, we provide a detailed but user-friendly 120-page guide, addressing current debates in the investment case, key new and old themes for a better understanding of Petrobras, how to deal with a tough valuation dilemma, further detail on each of the company’s divisions, extensive comparison with other Global Oil Companies, and other topics relevant from a wider Brazilian Oil sector perspective. Vinicius Canheu, CFA 55 11 3701.6310 [email protected] DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, AND THE STATUS OF NON-US Andre Sobreira, CFA Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm ANALYSTS. US Disclosure: 55 3701.6299 may11 have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. [email protected] DISCLOSURE APPENDIX CONTAINS ANALYST CERTIFICATIONS AND THE STATUS OF NON-US ANALYSTS. U.S. Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment® CREDIT SUISSE SECURITIES RESEARCH & ANALYTICS BEYOND INFORMATION decision. Client–Driven Solutions, Insights, and Access March 2014 LatAm Oil & Gas Equity Research Table of Contents Four slides you can’t forget (pages 3-7) A little m ore on Upstream (pages 66-81) If we had to pick four slides to understand Petrobras and the investment case, these would be it: (1) a summary slide explaining how PBR works, (2) an explanation of production growth, (3) PE and EV/EBITDA sensitivities, (4) mathematics of the impact of 10% change in key variables for PBR. We provide detail and a recap of the Brazilian pre-salt, and also analyse Petrobras’ ten most important fields, which represent almost 70% of current production and therefore are very relevant to understanding the company. Six debates you need to know (pages 8-32) A little m ore on Downstream (pages 82-95) A deeper explanation on the six themes most debated by investors: (1) production growth and decline rates, (2) the Downstream pricing dilemma, (3) Libra, (4) Transfer of Rights, (5) Dividend rules and differentials, (6) the balance sheet and hypothetical capitalisation scenarios. In this section, we overview Petrobras’ refineries, study the Brazilian Downstream demand alongside the drivers for each fuel type, and also the Distribution segment, with detailed analysis on pricing and profitability dynamics in each region of Brazil. How to value Petrobras? (pages 33-40) Understanding Gas & Power (pages 96-99) For every year since 2010, anyone who would have tried to make a value call on PBR would have been wrong. We discuss the PBR value trap dilemma, the problems of a DCF for PBR, absolute and relative value references, and why we think PBR shouldn’t trade like the Russian Oils. Gas & Power is one of Petrobras’ least known business, partly because of its smaller size, but also because of complexity. Results are volatile, and rising energy prices can actually imply in lower profitability for the business. Petrobras vs Big Oil: The Order of Merit (pages 41-59) Petrobras financial statem ents (pages 100-107) In this section, we provide a thorough analysis of Petrobras versus the Global Oil Industry across a number of financial and operational metrics, using the depth and breadth of Credit Suisse’s Global Energy coverage. A numerical review of PBR’s financials The business plan (pages 60-65) Other Braz ilian oil them es (pages 108-119) In the longer-term, Petrobras should be able to cater for the Brazilian market, with production = refinery capacity = domestic demand, and PBR partners exporting. We also provide a view of how the plans evolved over time and impact of Graça’s structural programmes. We analyse two wider topics for the Brazilian Oil Industry: (1) Labour trends and wage inflation – Brazil has presented one of the highest wage inflations in the oil sector globally; and (2) The comeback of the licensing rounds, with 2013 seeing three rounds – Equatorial Margin, Libra, and Onshore. Disclosures (pages 120-124) 2 March 2014 LatAm Oil & Gas Equity Research Four slides you can’t forget FOTO #1: Petrobras in one slide Petrobras’ business model is unique among oil companies in that Petrobras is close to fully integrated between Upstream and Downstream. The E&P assets are just off the Brazilian coast, which is also the company’s Downstream market. Both E&P assets and the Downstream market have strong growth potential. In one slide, we show the main volumes, costs and prices of PBR’s Upstream and Downstream, a quick way to understand the company’s business model. #2: Production will grow now The Petrobras growth story has proved to be a disappointment for the past four years. Since 2010, Petrobras has not managed to grow its oil production above the current 2,000kbd level. Causes for lack of growth are by now well-known: (1) Capacity additions delays, (2) Focus of resources (human and financial) on exploration and discovery of the pre-salt province, (3) a resulting lack of focus in the Campos basin, which have increased observed decline rates above 10% and decreased efficiency to c.70%. All of these three main reasons are being resolved now: (1) Platforms are finally coming on stream, with 2013 being the highest year ever for additions (660kbd), (2) Focus is back on production, (3) Efficiencies in Campos are being resolved. The growth path is back. #3: Back-of-the-envelope sensitivities Ever since Petrobras announced the possibility of a transparent pricing mechanism by end November, knowing the impacts of gasoline and diesel price increases became paramount. If Petrobras indeed manages to grow production by 7%+ pa in the next years and closes the gap with international prices, the performance of the business can improve significantly, implying in a cheap valuation for the shares. If the FX depreciates further to 2.6x, if Petrobras manages to grow production by c.15% and increase prices by 10-15% in the next two years, it would be trading at 5.5-6.3x PE and 6.0-6.6x EV/EBITDA. A comeback to sector-average performance in the medium-term would put PBR at $25/ADR, a significant upside to current levels. #4: 10% m athem atics We provide simple mathematics on the impact of a 10% increase in production, a 10% depreciation of the BRL, a 10% increase in gasoline and diesel prices, and a 10% domestic-international price gap. March 2014 LatAm Oil & Gas Equity Research Four slides you can’t forget #1: Petrobras in one slide Integrated. Petrobras’ business model is unique among oil companies in that the company is close to fully integrated between Upstream and Downstream. The E&P assets are just off the Brazilian coast, the company’s Downstream market, which enable significant logistics advantages. Both E&P assets and the Downstream market have strong growth potential. Below we show the main volumes, costs and prices of PBR’s Upstream and Downstream, the core of the company’s operations and value. E&P Refining Distribution FOTO FOTO FOTO Crude oil import/export to adequate refinery mix Revenues at $10/bbl discount to crude 300kbd lighter oil imports $10/bbl royalties $8/bbl Special Participation tax $15/bbl lifting costs $5/bbl of exploration costs and SG&A Crude Oil Production 2,000kbd 300kbd heavier oil exports 2,000kbd refining capacity 200kbd Diesel imports 50kbd Gasoline imports 200kbd Other products 200kbd Jet and Fuel Oil 200kbd Naphtha 200kbd LPG 500kbd Other product imports 1,000kbd Gasoline Gasoline and diesel future growth at c.5% per year Refined Products 2,300kbd 18% 18% 4% Other 5% Diesel 30% Fuel imports to supply domestic market White Flag 25% Refined products sold at a discount to international levels $50/bbl cash generation Source: Petrobras, Credit Suisse Research. Products sold at parity / moving average to international levels 4 March 2014 LatAm Oil & Gas Equity Research Four slides you can’t forget #2: Production will grow now It’s different this tim e. The Petrobras growth story has proved to be a disappointment for the past four years. Since 2009-10, Petrobras has not managed to grow its oil production above the current 2,000kbd level. Causes for lack of growth are by now well-known: (1) Capacity additions delays, (2) Focus of resources (human and financial) on exploration and discovery of the pre-salt province, (3) a resultant lack of focus in the Campos basin, which have increased observed decline rates above 10% and decreased efficiency to c.70%. All of these three main reasons are being resolved now: (1) Platforms are finally coming on stream, with 2013 being the highest year ever for additions (660kbd net to PBR), (2) Focus is now on production, (3) Efficiencies in Campos are being resolved. The growth path is back. Petrobras production profile 4.5 CS estimates 10%+ p.a. growth after 2016 Historical production 4.0 3.5 3.0 7%+ p.a. growth until 2016 No growth since 2010 2.5 Franco (Buzios) 2 P-75 150kbd Espadarte Cd. Rio de Janeiro 100kbd Polvo 90kbd Piranema 30kbd Golfinho Cd. Vitória 100kbd Marlim Leste P-53 180kbd Golfinho Cd. Vitoria 100kbd Roncador P-52 180kbd Siri Pilot Cd. Rio das Ostras 15kbd Roncador P-54 180kbd Marlim South P-51 180kbd 2007 2008 Tupi South Cid Sao Vicente 30kbd Frade Frade FPSO 100kbd Marlim Leste Cd. Niteroi 100kbd Lula Pilot Cd. Angra dos Reis 100kbd Sidon / Tiro Atlantic Zephyr 20kbd Parque das Conchas 100kbd Jubarte FPSO P-57 180kbd Source: Petrobras, Credit Suisse Research. Sapinhoa Pilot Cd São Paulo 120kbd FPSO Capixaba Cachalote/Balei a Franca 100kbd Camarupim Cid Sao Mateus 25kbd 2009 Lula NE Cd Paraty 120kbd 2010 Papa – Terra P-63 150kbd Roncador P-55 180kbd Marlim Sul SS P-56 100kbd 2011 Baleia Azul Cid Anchieta 100kbd 2012 Bauna / Piracaba Cid Itajai 80kbd 2013 Sapinhoá Norte Cid. Ilhabela 150kbd (Start-up Q3) Franco (Buzios) 1 P-74 150kbd Iracema Sul Cd. Mangaratiba 150kbd (Start-up Q4) Papa – Terra P-61 & TAD (Start-up Q2) 2014e Franco (Buzios) 3 (NW) P-76 150kbd Carioca (Lapa) Cd. Caraguatatuba 100kbd Iara Horst P-70 150kbd Lula Central Cid Saquarema 150kbd Iracema Norte Cd Itaguai 150kbd (Start-up Q3) 2015e Franco (Buzios) 4 (Sul) P-77 150kbd Lula Norte P-67 150kbd Lula Sul P-66 150kbd Pq. Baleias P-58 FPSO 180kbpd (Start-up Q1) Roncador module 4 P-62 180kbd (Start-up Q2) mnbpd Petrobras targets Lula Alto Cd Marica 150kbd 2016e Lula Oeste P-69 150kbd 2.0 Tupi NE P-72 150kbd Entorno de Iara P-73 150kbd 1.5 Pre-Salt + Libra Iara NW P-71 150kbd Transfer of Rights Sul Pq Baleias FPSOs already contracted Post-Salt Carcará Deepwater Espirito Santo Florim Libra Lula Ext Sul + ToR Sul de Lula Deepwater P-68 Sergipe I 150kbd Tartaruga Verde e Mestiça 2017e Deepwater Sergipe II Maromba Franco (Buzios) 5 (Leste) Marlilm Revitali II Marlim Revital I Júpiter Espadarte III 2018e 2019e 2020e 5 March 2014 LatAm Oil & Gas Equity Research Four slides you can’t forget #3: Back-of-the-envelope sensitivities Know the num bers. Ever since Petrobras announced the possibility of a transparent pricing mechanism by end November, knowing the impacts of gasoline and diesel price increases became paramount. If Petrobras indeed manages to grow production by 7%+ pa in the next years and close the gap with international prices, the performance of the business can improve significantly, implying in a cheap valuation for PBR shares. In the charts below we show how much. 2014 bear case: 5% production growth EV/EBITDA sensitivities 0% 5% 10% 15% 20% 25% 2.0 4.4 3.9 3.4 3.1 2.8 2.6 FX rate (BRL/USD) 2.2 2.4 6.0 8.5 5.1 6.9 4.4 5.8 3.9 5.1 3.5 4.5 3.2 4.0 2.6 13.1 9.9 8.0 6.7 5.7 5.0 2.8 24.7 15.8 11.6 9.2 7.6 6.5 Price increases Price increases P/E sensitivities 0% 5% 10% 15% 20% 25% 2.0 4.8 4.4 4.0 3.7 3.4 3.1 FX rate (BRL/USD) 2.2 2.4 5.9 7.3 5.4 6.5 4.9 5.9 4.4 5.3 4.1 4.9 3.8 4.5 2.6 8.9 7.9 7.1 6.4 5.8 5.3 2.8 11.0 9.6 8.5 7.6 6.9 6.3 2.0 4.6 4.1 3.8 3.5 3.2 3.0 FX rate (BRL/USD) 2.2 2.4 5.5 6.7 5.0 6.0 4.6 5.5 4.2 5.0 3.9 4.6 3.6 4.2 2.6 8.1 7.2 6.5 5.9 5.4 5.0 2.8 9.8 8.7 7.8 7.0 6.4 5.8 2.0 4.5 4.1 3.8 3.5 3.2 3.0 FX rate (BRL/USD) 2.2 2.4 5.4 6.3 4.9 5.8 4.5 5.3 4.1 4.8 3.8 4.5 3.5 4.1 2.6 7.5 6.7 6.1 5.6 5.2 4.8 2.8 8.7 7.9 7.1 6.5 6.0 5.5 2014 base case: 7% production growth EV/EBITDA sensitivities 0% 5% 10% 15% 20% 25% 2.0 4.1 3.6 3.3 3.0 2.7 2.5 FX rate (BRL/USD) 2.2 2.4 5.5 7.4 4.7 6.2 4.1 5.3 3.7 4.7 3.3 4.1 3.0 3.7 2.6 10.8 8.5 7.0 6.0 5.2 4.6 2.8 17.4 12.5 9.7 7.9 6.7 5.8 Price increases Price increases P/E sensitivities 0% 5% 10% 15% 20% 25% 2015 bull case: 20% production growth in two years EV/EBITDA sensitivities 0% 5% 10% 15% 20% 25% Source: Credit Suisse Research. 2.0 3.6 3.2 2.9 2.6 2.4 2.2 FX rate (BRL/USD) 2.2 2.4 4.5 5.9 4.0 5.0 3.5 4.4 3.2 3.9 2.9 3.5 2.7 3.2 2.6 7.8 6.5 5.5 4.8 4.3 3.9 2.8 10.9 8.6 7.1 6.1 5.3 4.7 Price increases Price increases P/E sensitivities 0% 5% 10% 15% 20% 25% 6 March 2014 LatAm Oil & Gas Equity Research Four slides you can’t forget #4: 10% mathematics A 10% increase in production equals… A 10% FX depreciation equals… 2,000kbd of current oil production $80bn of revenues in USD x 10% increase in production $60bn of revenues in BRL = 200kbd x 10% BRL depreciation x $50/bbl cash margin per Upstream barrel = $6bn decrease in BRL-related revenues (i) x 0.365 = $3.6bn/ year in additional cash generation $85bn of cash costs in USD $10bn of cash costs in BRL x 10% BRL depreciation A 10% gasoline and diesel price increase equals… = $1bn decrease in BRL-costs (ii) (i)+(ii) = $5bn decrease in cash generation 500kbd gasoline sold by PBR x $90/bbl price of domestic gasoline (with FX at 2.3) x 10% gasoline price increase x 0.365 = $1.6bn/ year in additional cash generation from gasoline 1,000kbd diesel sold by PBR x $100/bbl price of domestic diesel (with FX at 2.3) x 10% diesel price increase x 0.365 = $3.6bn/ year in additional cash generation from diesel Source: Credit Suisse Research. A 10% gap with international prices equals… 200kbd of current diesel imports + 50kbd of current gasoline imports = 250kbd of imports x $10/bbl (equal to a 10% gap with int’l prices) x 0.365 = $900m / year of losses PS: note current gap is around 20% 7 March 2014 LatAm Oil & Gas Equity Research Six debates you need to know FOTO #1: Production growth and decline rates Petrobras’ production has been one of the most hotly debated topic in the past three years. Despite all the capex involved, production has remained stubbornly stable at 2,000kbd. Decline rates in the Campos basin, alongside capacity addition delays, have had a strong influence on production. In this section we review the decline rate topic, and provide detail on how PBR’s decline rates seem to be evolving recently (increasing in 2010-12, but in a downward trend in 2013). #2: The Downstream dilemma Downstream has been one of the main responsible for a deterioration in PBR’s financials since 2010. High domestic gasoline and diesel demand coupled with fixed refining capacity means rising imports. High and rising domestic inflation means there is resistance to let Petrobras increase domestic prices. Rising oil price and a depreciating BRL increase the difference between domestic and international prices, and PBR’s losses with imports. We deep-dive in the Downstream dilemma, including its importance for the country and whether it’s better for PBR to build a new refinery or to keep importing at a loss. #3: Libra was better than you thought In our view, a high quality consortium (Shell and Total with a combined 40% stake) and a bid at the minimum 41.65%, plus a technical body at the PPSA helm are reasons for optimism that Libra can yield good returns, contrary to wider investor perception. #4: Transfer-of-rights renegotiation. Will PBR have to pay? 2014 is the year when discussions for the ToR renegotiation between Petrobras and the Federal Government will start. The market is generally of the view that higher oil prices will mean a higher valuation for the 5bn bbls, and that Petrobras will have to pay up more to the Government. We propose that higher costs and delays almost fully offset the increase in oil prices. We provide extensive background in the ToR discussion in this section, including valuation of the barrels and timing for the discussion. #5: Different dividends, different ON-PN spread In 2012 (and 2013), for the first time in its history, Petrobras decided to pay different dividends for the different classes of shareholders. Extremely low earnings and tight cash balances were the culprits. This has a direct implication for the PBR/PBRa (PETR3/PETR4) spreads. We detail the dividend discussion in this section, suggesting investors should think about three scenarios for the spread: R$1.0-1.4-2.0. #6: The balance sheet In this section, we provide a recap of Petrobras’ balance sheet, showing how it deteriorated to the worst levels in PBR’s history. We also discuss expensing vs capitalising debt. March 2014 LatAm Oil & Gas Equity Research Debate #1: Production growth and decline rates The production equation Production (t) = Production (t-1) + Additions (t) – Decline (t). Petrobras’ production has been one of the most hotly debated topics in the past three years. Despite all the capex involved, production has remained stubbornly stable at the 2,000kbd. Growing production revolves around a fairly simple equation that is difficult to put into practice. The production additions in any given year depends not only on the volume of new projects (and keeping them on schedule), but also on how quickly those projects ramp-up production once onstream (here, the supply chain is also important to keep drilling and plugging new wells fast enough, and also weather conditions needed to allow the installation of the new wells). The production decline, on its turn, is dependent both on geological factors that determine the actual decline rate of the fields, and on operational efficiency factors that include adequate equipment maintenance. Both the additions (delays of new capacity, slower ramp-up) and decline (seemingly less an issue of geology but more of operational efficiency) have been responsible for PBR not growing production and coming short of targets (which were arguably more aggressive in the past than they are now). Petrobras production breakdown (kbd): new capacity additions, ramp-up, and decline are key 4,000 Domestic oil production (kbd) 3,500 Growth projects: 43 new platforms from 2010 to 2020 3,000 2,500 2,000 1,500 Legacy offshore production: trying to manage decline rates and increase operational efficiency 1,000 500 0 Q1 06 Onshore production Q1 07 Q1 08 Source: Petrobras, ANP, Credit Suisse Research. Q1 09 Q1 10 Q1 11 Q1 12 Q1 13 Q1 14E Q1 15E Q1 16E Q1 17E Q1 18E Q1 19E Q1 20E 9 March 2014 LatAm Oil & Gas Equity Research Debate #1: Production growth and decline rates Decline rates, a global issue Diagnosis. Increasing decline rates are not only a potential problem to Petrobras in the Campos basin. Indeed, this is an important trend globally, as evidenced by an IEA study (World Energy Outlook 2008). The IEA concluded that decline rates for fields which started producing in the 1990s-2000s (the same period where most of Petrobras’ fields in Campos had first oil) are on average 10.6%-12.6%, much higher than decline rates of 3.9%-7.9% in the three decades preceding this period (top right chart). Reasons. The IEA gives a number of reasons for the increase in decline rates over the years, with field size and location being the two most important factors in explaining a field production profile (and thus its decline rates). Small fields reach peak production sooner, produce a higher share of initial reserves at peak, but decline more rapidly than large fields. This rule only does not apply to deepwater fields. Although deepwater fields are usually large in size, their production profile behaves similarly to the ones of small offshore fields, with peak production being achieved relatively quickly and representing a larger share of total field reserves, implying a shorter plateau and steeper decline rates. The IEA attributes this in part to the need of offshore developers to bring in production faster as a means to justify the larger capital expenditures relative to onshore fields. IEA observed post-peak decline rates by vintage (%) 14.5% OPEC Newer fields showing higher decline rates Non-OPEC 12.6% 11.6% World 10.6% 8.3% 6.8% 5.9% 5.9% 5.0% 4.6% 3.9% 3.5% 2.8% 7.9% 7.5% Outlook. The IEA argues that natural decline rates could change significantly in the future in all regions, with a higher mix of smaller, offshore reservoirs. This would be offset by large-onshore developments in the Middle East. Decline rates in US shale are still unknown at this stage. IEA-projected change in decline rates and RP ratios by 2030 22% 2030 Pacific 20% Natural decline rate 1970s 2007 Super-giant Giant Large All fields World 8.9% Latin America 6.6% 5.6% Africa 6% 10.9% 7.7% Asia 8% 2000s Deepwater, large sandstone fields showing the highest decline rates 14.2% 13.3% 13.1% 8.8% Europe 12% 10% 1990s 11.2% North America 14% 1980s IEA observed post-peak decline rates by field type (%) 18% 16% Pre 1970s E. Europe/ Eurasia Midde East 3.4% 6.5% 6.6% 6.3% 4.8% 3.4% 4.3% 3.4% 2.3% 4% 2% 0% 0 10 20 30 40 50 60 Remaining reserves/ production ratio (years) 70 80 Onshore Offshore - shelf Offshore deepwater Carbonate Sandstones Source: ©OECD/IEA, World Energy Outlook 2008. Definition: Super Giant field defined as a fields with initial 2P reserves > 5bn bbls. Giant fields have initial 2P reserves between 500mmbbls and 5bn bbls, and large fields contain more than 100mmbbls of reserves. 10 March 2014 LatAm Oil & Gas Equity Research Debate #1: Production growth and decline rates Campos basin decline rates by vintage* Looking at vintages. Vintages are the best way we found to assess the decline rate issue for the Campos basin. Looking at field-by-field or platform-by-platform production has the shortcome of not distinguishing between ‘old’ production that is declining and ‘new’ production that comes from new platforms or from new wells in existing platforms. Looking at vintages gets around these issues by looking at the production profile of wells that started in any given year, and also allows us to see how the decline varies with time. We look at vintage production both on an aggregate basis and on a per well basis. Conclusions: (1) Wells from 2005 and before show the lowest and more stable decline rate within the PBR portfolio, which is expected given they have been declining for longer; (2) 2009 and 2010 wells have so far shown the higher decline rates, mostly above 25%. FPSO Capixaba and P-57 have been declining strongly and certainly have an impact in the 2010 vintage. P-51, P-53, Cid de Vitoria and Frade explain the 2009 vintage; (3) We observe a rise in decline rates in most vintages in 2010-2012, when PBR has not managed to grow production. More recently in 2013, decline rates seem to be coming down, arguably due to PBR’s efforts to increase operational efficiency (PROEF) together with a wider catch-up on maintenance. Im portant caveat. Decline rates are a technically complex issue. To be able to fully, correctly, and technically analyse decline rates, one would have to look not on a field basis, platform basis, or even vintage basis, but on a reservoir basis. One would have to consider initial reservoir potential, and try to break down the decline into geological decline and declines due to operational efficiency. New wells being drilled in an existing reservoir are part of reservoir management and should also be considered in decline rate analysis. The public data provided by the ANP is already one of the most extensive compared to any other country, but it does not allow the equity markets to break-down production by reservoir, or to distinguish what part of the decline is due to operational efficiency vs geology. Petrobras is vocal about these points when defending its c.10% decline rate. Our analysis is therefore a simplified version of reality, but which we believe serves the purpose of educating the market in a very important topic for the Petrobras investment case. Campos decline rates by vintage over time** (%) 40% 2009 wells 35% 30% 25% 2006 wells 2007 wells 20% 15% 2010 wells 2005 and before wells 10% 2008 wells 5% 0% 2006 2007 2008 2009 2010 2011 2012 2013 Campos basin production by vintage (kbd) 2,000 1,800 1,600 2013 1,400 2012 1,200 2011 2010 2009 2008 2007 2006 1,000 800 600 400 2005 and before 200 0 Jan-05 Aug-05 Mar-06 Oct-06 May-07 Dec-07 Jul-08 Feb-09 Sep-09 Apr-10 Nov-10 Jun-11 Jan-12 Aug-12 Mar-13 Oct-13 Source: ANP data, Credit Suisse Research analysis. Note: * We define vintage as the year in which a well starts production. ** Chart shows until 2010 wells – 2011 onwards wells were still either ramping up or with just one year of decline for us to observe proper decline trends. 11 March 2014 LatAm Oil & Gas Equity Research Debate #1: Production growth and decline rates Vintage production: 2005-2008 Campos basin 2005 and before vintage production (kbd) 1,600 1,400 Campos basin 2006 vintage production (kbd) 3.0 Average production per well (RHS) Decline of 13% p.a since 2005 1,200 2.5 Vintage production (LHS) 1.0 0.5 200 0.0 Jun-06 Nov-07 Apr-09 Sep-10 Feb-12 Jul-13 Campos basin 2007 vintage production (kbd) Decline of 17% p.a since 2007 7 6 5 Average production per well (RHS) 200 Decline of 19% p.a since 2008 150 Vintage production (LHS) 50 350 8 7 2 0 Apr-07 Jul-08 Oct-09 Jan-11 Apr-12 Jul-13 May-12 Sep-13 10 Average production per well (RHS) Decline of 14% p.a since 2009 300 9 8 7 6 250 6 5 200 5 4 150 0 Source: ANP data, Credit Suisse Research analysis. 0 Jan-06 9 1 Jan-11 3 Vintage production (LHS) 1 400 2 Sep-09 50 10 3 May-08 4 100 Campos basin 2008 vintage production (kbd) 250 0 Jan-07 200 8 1.5 400 100 Average production per well (RHS) 150 800 0 Jan-05 9 2.0 1,000 600 250 4 Vintage production (LHS) 3 100 2 50 0 Jan-08 1 0 Dec-08 Nov-09 Oct-10 Sep-11 Aug-12 Jul-13 12 March 2014 LatAm Oil & Gas Equity Research Debate #1: Production growth and decline rates Vintage production: 2009-2013 Campos basin 2009 vintage production (kbd) 400 Campos basin 2010 vintage production (kbd) 12 Average production per well (RHS) 350 10 300 8 200 6 150 4 Vintage production (LHS) 100 2 50 0 Jan-09 0 Dec-09 Nov-10 Oct-11 Sep-12 Campos basin 2011 vintage production (kbd) 500 350 12 300 350 10 250 300 8 200 450 400 Decline of 28% since 2012 Aug-13 200 150 150 4 100 100 50 0 Jan-11 2 Vintage production (LHS) 0 Sep-11 May-12 Jan-13 Source: ANP data, Credit Suisse Research analysis. Sep-13 Decline of 27% p.a since 2011 50 0 Jan-12 Vintage production (LHS) Jun-12 Nov-12 10 300 8 250 6 200 150 100 4 Vintage production (LHS) 2 50 0 Jan-10 0 Oct-10 Average production per well (RHS) 250 6 12 400 Campos basin 2012 vintage production (kbd) 14 Average production per well (RHS) Average production per well (RHS) 350 Decline of 30% p.a since 2010 250 450 2012 vintage apparently reached peak, but not enough time for us to reach decline conclusions Apr-13 Sep-13 Jul-11 Apr-12 Jan-13 Oct-13 Campos basin 2013 vintage production (kbd) 16 160 14 140 12 120 10 100 8 80 6 60 4 40 2 20 0 0 8 Average production per well (RHS) 7 6 5 Production still ramping-up 4 3 2 Vintage production (LHS) 1 0 Jan-13 Apr-13 Jul-13 Oct-13 13 March 2014 LatAm Oil & Gas Equity Research Debate #1: Production growth and decline rates Two other themes: Watercuts and capacity additions Watercuts in the Campos basin (%): producing more water than oil 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Jan-05 % of oil + NGL Watercuts above 50% for the first time end 2013 % of water Aug-05 Mar-06 Oct-06 May-07 Dec-07 Jul-08 Feb-09 Sep-09 Apr-10 Capacity additions: a key driver of future production growth Espadarte Cd. Rio de Janeiro 100kbd Polvo 90kbd Piranema 30kbd Golfinho Cd. Vitória 100kbd Marlim Leste P-53 180kbd Golfinho Cd. Vitoria 100kbd Roncador P-52 180kbd Siri Pilot Cd. Rio das Ostras 15kbd Roncador P-54 180kbd Marlim South P-51 180kbd 2007 2008 Tupi South Cid Sao Vicente 30kbd Frade Frade FPSO 100kbd Marlim Leste Cd. Niteroi 100kbd FPSO Capixaba Cachalote/Balei a Franca 100kbd Camarupim Cid Sao Mateus 25kbd Sidon / Tiro Atlantic Zephyr 20kbd Parque das Conchas 100kbd Jubarte FPSO P-57 180kbd 2009 2010 Source: ANP data, Petrobras, Credit Suisse Research. Very little additions in 2011-2012 contributed for low growth Marlim Sul SS P-56 100kbd 2011 Baleia Azul Cid Anchieta 100kbd 2012 Jun-11 Franco (Buzios) 2 P-75 150kbd Lula NE Cd Paraty 120kbd Lula Pilot Cd. Angra dos Reis 100kbd Nov-10 Sapinhoa Pilot Cd São Paulo 120kbd Papa – Terra P-63 150kbd Roncador P-55 180kbd Bauna / Piracaba Cid Itajai 80kbd 2013 Sapinhoá Norte Cid. Ilhabela 150kbd (Start-up Q3) Strong additions in Iracema Sul Cd. Mangaratiba 2013-2014 150kbd (Start-up Q4) key for future growth Papa – Terra P-61 & TAD (Start-up Q2) 2014e Franco (Buzios) 3 (NW) P-76 150kbd Carioca (Lapa) Cd. Caraguatatuba 100kbd Iara Horst P-70 150kbd Lula Central Cid Saquarema 150kbd Iracema Norte Cd Itaguai 150kbd (Start-up Q3) 2015e Franco (Buzios) 4 (Sul) P-77 150kbd Lula Norte P-67 150kbd Lula Sul P-66 150kbd Pq. Baleias P-58 FPSO 180kbpd (Start-up Q1) Roncador module 4 P-62 180kbd (Start-up Q2) Franco (Buzios) 1 P-74 150kbd Jan-12 Lula Alto Cd Marica 150kbd 2016e Lula Oeste P-69 150kbd Aug-12 Mar-13 Tupi NE P-72 150kbd Entorno de Iara P-73 150kbd Pre-Salt + Libra Iara NW P-71 150kbd Transfer of Rights Sul Pq Baleias FPSOs already contracted Post-Salt Carcará Deepwater Espirito Santo Florim Libra Lula Ext Sul + ToR Sul de Lula Deepwater P-68 Sergipe I 150kbd Tartaruga Verde e Mestiça 2017e Oct-13 Deepwater Sergipe II Maromba Franco (Buzios) 5 (Leste) Marlilm Revitali II Marlim Revital I Júpiter Espadarte III 2018e 2019e 2020e 14 March 2014 LatAm Oil & Gas Equity Research Debate #2: The Downstream dilemma Downstream losses in context Down 55% since end 2010. That’s how much the PBR share price has moved over the past three years. A number of factors contributed to that, from poor corporate governance perception post the 2010 follow-on and Transfer of Rights, and lack of production growth since then. But Downstream, too, has been a key contributor. Until end 2010, the business was run at a profit, with still low demand and low imports, and domestic refinery prices above international levels. Since 2010, higher domestic demand and a fully utilised refinery park meant that gasoline and diesel imports soared. In addition, higher oil prices (from $70/bbl to a $100-120/bbl range), a depreciated BRL (from 1.7x to 2.3-2.4x), and slow-to-increase domestic prices meant that Petrobras has been losing more money the more the domestic fuel market grows. The chart below illustrates this well: Petrobras-refinery prices are now c.20% below international levels, and Downstream has been a loss-making business, to the tune of $10bn/year. This has been a strong drag to Petrobras group earnings, which have fallen by 50%, precisely the $10bn Downstream is losing. It’s no surprise that the share price is down by a similar amount. Therefore, understanding the Downstream dynamics is crucial to the investment case. Gasoline and diesel gap vs international prices and Downstream EBITDA (% and BRLm) Downstream quarterly EBITDA (BRLm) 8,000 Low consumption: no need to import fuels High consumption and discount on domestic prices: PBR needs to import fuels with losses 60% 40% 6,000 Diesel gap (%) 4,000 20% 2,000 F 0 0% Downstream EBITDA (2,000) -20% (4,000) Gasoline gap (%) (6,000) -40% Gasoline and diesel gap vs int'l (%) 10,000 (8,000) (10,000) Jan-07 -60% Jul-07 Jan-08 Jul-08 Jan-09 Source: Credit Suisse Research based on Petrobras, ANP and Bloomberg. Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 15 March 2014 LatAm Oil & Gas Equity Research Debate #2: The Downstream dilemma Pieces of the puzzle: The price gap Diesel Gasoline 2.0 Oil prices and int’l gasoline and diesel prices have rallied since 2010 3 Diesel GoM 2.5 BRL to USD 120 70 Brent 20 Jan-07 Gasoline GoM Jan-10 Jan-13 2 1.5 1 Jan-07 Jan-10 Source: Credit Suisse Research based on Petrobras, ANP and Bloomberg. Jan-13 INTERNATIONAL PREMIUM (+), DISCOUNT (-) TO DOMESTIC PRICES (%) 170 $/bbl The Braz ilian Real has depreciated strongly since 2010 too DOMESTIC VS INTERNATIONAL PRICES (R$/LITER) 2.5 2.0 1.5 1.5 Domestic diesel (R$/l) 1.0 1.0 0.0 Jan-07 Jan-09 Jan-11 Jan-13 0.0 Jan-07 60% 60% 30% 30% 0% 0% (30%) (30%) (60%) Jan-07 Jan-09 Domestic Gasoline 0.5 Diesel Gulf (R$/l) 0.5 Gasoline Gulf (R$/l) Jan-11 Jan-13 (60%) Jan-07 Jan-09 Jan-09 Jan-11 Jan-11 Jan-13 Jan-13 16 March 2014 LatAm Oil & Gas Equity Research Debate #2: The Downstream dilemma Pieces of the puzzle: Rising imports Source: Credit Suisse Research based on Petrobras, ANP and Bloomberg. 1,000 0 (1,000) (2,000) (3,000) (4,000) (6,000) Q1 13 (5,000) Q1 12 (100) 2,000 Q1 11 (50) 3,000 Q1 10 0 4,000 Q1 09 50 Q1 13 Q1 13 Q1 12 Q1 11 Q1 10 Q1 09 Q1 08 Q1 07 5 100 Q1 12 Output of dom estic refineries 150 Q1 11 10 200 Q1 10 kbd 15 Q1 07 Imports (exports), kbd 250 Q1 09 20 0 Diesel Gasoline 300 Q1 08 Dom estic dem and Q1 08 350 25 … Higher im ports coupled with a higher dom estic-international price differential im ply in a higher Downstream losses, to the tune of $10bn/ year. Q1 07 … Rising dem and im plies in higher im ports. Petrobras today on average im porting 200kbd of gasoline and diesel com bined… Downstream quarterly net income ($m) Braz il has not added a new refinery since the 1980s: the sm all increm ental output is com ing from higher utilisation (today already 90%+) or debottlenecking (already done). Dem and continues to grow at 6% per year…. 17 March 2014 LatAm Oil & Gas Equity Research Debate #2: The Downstream dilemma Macroeconomic background: difficulty to increase prices Government primary surplus (% of GDP) 4.6% 4.3% Diesel and gasoline price composition to the final consumer: taxes are a large chunk of it (BRL/liter) 4.8% 4.3% 2.9 Lowest result since 2003 lim its relief of federal taxes 4.0% 4.1% 2.8% Resale margin 13% 4% 27% 3.1% 7% 1% 13% 2.4% 2.0% 1.9% Distribution margin 2.5 11% 6% 14% 6% 1% 5% State taxes 57% Gasoline A Federal Taxes Freight Anhydrous Ethanol 1.3% 35% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014e Inflation close to top range of target limits fuel price increase (%) Biodiesel Gasoline Diesel Inflation: Fuels weight in IPCA Index A 10% increase in gasoline increases inflation by 0.28pp 8% 7% Food and beverages Top range of target 22% Habitation 16% 6% Transportation 4% 14% 5% 5% 2% Jan-06 19% IPCA, 12m 25% Healthcare and Personal Other 4% 3% Diesel A 1% 0% Gasoline Ethanol Diesel and GNV Jun-07 Nov-08 Apr-10 Sep-11 Source: Credit Suisse Research, Credit Suisse Economics, MME, Bloomberg, ANP, IBGE. Feb-13 18 March 2014 LatAm Oil & Gas Equity Research Debate #2: The Downstream dilemma To build or to import? Is it better to keep im porting or to build a new refinery? We make the case* that the choice for Petrobras face within Downstream capital allocation is relatively simple. It is less about whether the new refineries will be NPV positive or negative, but whether that NPV will be higher or lower than the negative NPV of continued imports into the country. If we compare the economics of building a new-refinery in Brazil to continuation of imports, the decision of whether to build or not is independent of domestic pricing policy, and rather on international gasoline-diesel spreads, freight, and capex/opex for the refinery. The scheme below shows why. Choice 1: Build a new refinery Crude oil price Refinery capex Refinery opex Decision taking: To build, or to import? Crude oil price Domestic gasoline/diesel prices Refinery capex Refinery opex Logistics capex International gasoline/diesel prices Freight/cost to internalize products Domestic prices cancel out when comparing both options Choice 2: Keep importing International gasoline/diesel prices Domestic gasoline/ diesel prices Freight/cost to internalize products Capex to increase import logistics, already strained Refinery capex MINUS the capex needed to increase import logistics Refinery opex International gasoline/diesel SPREADS Freight/cost to internalize products Source: Credit Suisse Research. Note: * IMPORTANT ASSUMPTION: This exercise assumes that the decision to build or import be taken strictly on an NPV basis and without any balance sheet constraints. With balance sheet constraints, the balance favors a continuation of imports given the capex to finance the construction of a refinery could imply in expensive capital-raise needs. 19 March 2014 LatAm Oil & Gas Equity Research Debate #2: The Downstream dilemma It’s better to build, if the newbuild capex is right We reach the conclusion* that if Petrobras manages to keep new refinery capex at $33k/bbl as planned (Abreu e Lima was $87k/bbl! but the overrun was very significant. Recent refineries have averaged $18k/bbl), building a new 300kbd refinery has a NPV $3bn higher than importing, equivalent to a 15% ‘relative-IRR’. Step 1: Decision taking: To build, or to import? Crude oil price Step 2: Setting the assumptions International Refinery capex gasoline/diesel prices Refinery opex Freight/cost Capex to increase Key assumptions for building a new 300kbd refinery: $33/bbl capex $3/bbl opex Heavy-crude purchases at $10/bbl discount to $100/bbl Brent to internalize products import logistics, already strained Conclusion: ‘Building advantage’ cashflow IRRs Key assumptions for importing 300kbd of oil products: Diesel spread to Brent of 15/bbl Import costs of $7/bbl Capex to increase import infrastructure not taken into account (conservative) as hard to gauge Step 3: Modeling and comparing both options 25% 15,000 CS base case: building can be better than importing if the 20% 10,000 IRRs (%) newbuild capex is right 10% 0 (5,000) 5% (10,000) 0% 20,000 30,000 40,000 50,000 Capex ($/bbl) Costs to keep im porting 5,000 USDm 15% 60,000 70,000 80,000 (15,000) Costs to build and operate a refinery Building vs import advantage 2013 2016 2019 2022 2025 2028 2031 2034 2037 2040 Source: Credit Suisse Research. Note: * IMPORTANT ASSUMPTION: This exercise assumes that the decision to build or import be taken strictly on an NPV basis and without any balance sheet constraints. With balance sheet constraints, the balance favors a continuation of imports given the capex to finance the construction of a refinery could imply in expensive capital-raise needs. 20 March 2014 LatAm Oil & Gas Equity Research Debate #2: The Downstream dilemma Single refinery economics Northeast Premium refineries (focussed on diesel, not gasoline), could yield a 6% IRR if capex is controlled and kept at $33/bbl (implying a $10bn budget for one train), and if long-term prices are aligned with international levels. This single simulation is testimony to the lower returns Downstream face vs Upstream. Sensitivities: Budget overruns and pricing policy are the two single most important factors that affect refining project profitability. A 20% capex overrun from $33/bbl to $40/bbl capex would bring IRRs down from 6% to 4%. A 5% decrease on long-term pricing would bring returns down from 6% to close to zero. Partnerships: In order to enhance expertise in design and operations, PBR executed a Letter of Intent with Sinopec for the development of the Premium I refinery in Maranhão. PBR had a similar LOI with Korean GS Energy for the Premium II in Ceara, but it did not go through. In ‘exchange’ for expertise and a stake in the refinery, PBR would have to ‘guarantee’ export-price parity for the partners, to ensure the economics of the project work-out. Brazil is a country long-crude and short-refined products which in theory would be a good place to build a refinery. Refinery IRR sensitivity to capex at three pricing scenarios 6,4 50 4,7 40 2,6 30 20 0 100 200 Size (Kbd) 300 400 10 5% above int'l levels 10% IRRs (%) 60 15 13% 5 8% 0 CS base case International price levels 3% Increase in capex 0% (3%) 70 300kbd refinery train base case cash-flows (USDm) 15% 5% PBR current park refining costs by size ($/bbl) Age (years) Conclusion: A single 300kbd train with the product slate similar to the new (10) Decrease in price (15) 5% below int'l levels (5%) 20,000 30,000 40,000 Source: Petrobras, Credit Suisse Research. 50,000 60,000 Capex ($/bbl) (5) (20) 70,000 80,000 2012 2015 2018 Construction capex 2021 2024 2027 Maintenance capex 2030 2033 EBITDA 2036 2039 Free cash-flow 21 March 2014 LatAm Oil & Gas Equity Research Debate #3: Libra was better than you thought Libra basics The first pre-salt auction. In 2010, a new law established that future pre-salt areas would have to be auctioned under a PSC contract, with PBR mandatory operatorship and a minimum 30% stake, and the oversight of a government company that has a 50% weight and veto power in the operating committee. Much industry and equity market skepticism surrounded the new model, especially in 2013, when the bid rules dictated a R$15bn fixed bonus payment, and a minimum bid of 41.65% government share of profit oil that could scare Big Oil away. Final results were announced on Oct 21st. In our view, a high quality consortium (Shell and Total with a combined 40% stake) and a bid at the minimum 41.65%, plus a technical body at the PPSA helm are reasons for optimism that Libra can yield good returns, contrary to wider investor perception. Map of the Libra prospect and other pre-salt acreage Uruguá Tambuatá Carapia Florim Franco Iara Entorno SP RJ Abaré Oeste Source: Credit Suisse Research, Woodmackenzie, ANP. Tupi NE Cernambi Lula Carioca Iguaçu Abaré Sapinhoá $100bn field-life spend 12 FPSOs first assessment, starting in 2020 Oil com panies: Petrobras (Operator, 40%), Shell (20%), Total (20%), and the Chinese: CNPC (10%), CNOOC (10%) Minim um exploratory com m itm ents: 1,547km2 of 3D seismic that covers the full area of the block, two exploration wells and 1 extended well test 15% royalty Gato do Mato Bem-Te-Vi Developm ent strategy: Fiscal term s for the pre-salt PSC: Dolomita Sul Carcará Resource siz e: 8-12bn bbls Bonus paym ent: R$15bn due December 2013 Oliva Macunaíma Libra basic facts Lula Sul Jupiter Libra 41.65% base government share of profit oil, variable according to well productivity and oil prices 50% cost-recovery ceiling Other taxes: up to 9% sales tax, 34% Brazilian income tax, 1% of profit R&D spend Local content rules: 37% in the exploration phase, 55-59% in development phase depending on year of production PPSA: PPSA (Pre-Sal Petroleo S.A.) is a government created company which will act as the manager of the contract and have a 50% weight and veto power in the operating committee. Executive directors appointed with a technical, not political, profile/background. Sul de Guará 22 March 2014 LatAm Oil & Gas Equity Research Debate #3: Libra was better than you thought IRRs, government take, and oil break-even Decent returns, if execution is sound. We make the case that the consortium bid at the low 41.65% ensured an adequate ‘margin of safety’ to guarantee decent returns. With the fiscal terms now known, Petrobras and partners will have to deliver on execution. Libra is a $100bn development with high 60% local content requirements that will start-up at a time the local supply chain might still be busy with Petrobras’ current demands. Our calculations lead us to healthy high-teens project IRRs under the following assumptions: – Capex : $12/bbl – Opex : $7/bbl opex – Well productivity: 20kbd, each FPSO drains 600mmbbls of oil – Developm ent schedule: 12-14 FPSOs in total, gradually from 2020-24 IRR sensitivity in different oil price scenarios Royalties Special participation Libra 70% 74% 6% 40% 34% 12% Income tax 85% 6% Profit oil Signature bonus 91% 6% 96% 6% 51% 59% 68% 13% 7% 18% 21% 21% 4% 21% 1% 21% Concession PSC 40% (Min) PSC 60% PSC 70% PSC 80% Break-even oil prices for 10% and 15% IRRs regimes 35% 10% IRR 30% 15% IRR 140 Concession 109 25% IRRs Total government take on various fiscal regimes Libra Libra PSC 40% (min) 20% PSC 60% PSC 70% PSC 80% 15% 90 80 75 60 63 70 53 43 10% 5% 0% 40 50 60 70 80 90 Oil price levels ($/bbl) Source: Credit Suisse Research. 100 110 120 Concession PSC 40% (Min) PSC 60% PSC 70% PSC 80% 23 March 2014 LatAm Oil & Gas Equity Research Debate #3: Libra was better than you thought Four tables with further economics Libra Government share of profit oil for well productivity and oil prices Oil price ($/bbl) Production per well (kbd) Min 8 10 12 14 16 18 20 22 Min Max 10 12 14 16 18 20 22 24 0 60 35.3% 37.4% 39.1% 40.2% 40.8% 41.4% 41.9% 42.3% 42.8% 60 80 37.0% 38.7% 40.2% 41.1% 41.7% 42.1% 42.6% 43.0% 43.3% 80 100 39.1% 40.5% 41.7% 42.4% 42.8% 43.2% 43.5% 43.8% 44.1% 100 120 40.5% 41.7% 42.6% 43.2% 43.5% 43.8% 44.1% 44.4% 44.6% 120 140 41.5% 42.4% 43.2% 43.7% 44.0% 44.3% 44.5% 44.7% 44.9% 140 160 42.2% 43.0% 43.7% 44.1% 44.4% 44.6% 44.8% 45.0% 45.2% 160 43.3% 44.0% 44.5% 44.8% 45.0% 45.1% 45.3% 45.4% 45.6% 60 6 8 10 12 14 16 18 20 bn barrels 2.5 3.7 4.9 6.1 7.3 8.5 9.7 10.9 12.1 PSC 40 (Min) 14.0% 15.8% 17.1% 17.9% 18.6% 19.1% 19.5% 19.8% 20.1% PSC 50 12.8% 14.6% 15.8% 16.6% 17.3% 17.7% 18.1% 18.5% 18.8% PSC 60 11.2% 13.0% 14.1% 14.9% 15.5% 16.0% 16.3% 16.6% 16.9% PSC 70 9.5% 11.1% 12.2% 12.9% 13.5% 13.9% 14.3% 14.6% 14.9% PSC 80 7.4% 9.0% 10.0% 10.7% 11.2% 11.6% 11.9% 12.2% 12.5% # FPSOs 4 6 8 10 12 14 16 18 20 bn barrels 2.5 3.7 4.9 6.1 7.3 8.5 9.7 10.9 12.1 PSC 40 (Min) 0.37 0.69 1.01 1.30 1.60 1.87 2.14 2.40 2.66 PSC 50 0.25 0.52 0.79 1.04 1.29 1.52 1.75 1.97 2.19 70 80 90 100 110 120 PSC 40 (Min) (1.26) (0.73) (0.19) 0.34 0.78 1.19 1.50 1.87 2.17 2.52 PSC 50 (1.35) (0.85) (0.34) 0.16 0.56 0.92 1.20 1.52 1.78 2.08 PSC 60 (1.46) (0.99) (0.53) (0.06) 0.29 0.61 0.83 1.10 1.30 1.56 PSC 60 0.11 0.32 0.53 0.72 0.92 1.10 1.28 1.46 1.63 PSC 70 (1.57) (1.14) (0.71) (0.28) 0.03 0.30 0.46 0.68 0.83 1.03 PSC 70 (0.04) 0.12 0.27 0.41 0.55 0.68 0.82 0.94 1.07 PSC 80 (1.68) (1.29) (0.89) (0.50) (0.24) (0.02) 0.10 0.26 0.36 0.50 PSC 80 (0.18) (0.09) 0.01 0.09 0.18 0.26 0.35 0.43 0.51 Source: Credit Suisse Research, ANP. 50 4 PBR’s Libra NPV-10 under various fiscal regimes and sizes, at $100/bbl (US$/ADR) Oil prices ($/bbl) 40 # FPSOs 24 PBR’s Libra NPV-10 under various fiscal regimes and oil prices ($/ADR) 30 IRRs at $100/bbl for different Libra sizes and fiscal terms 24 March 2014 LatAm Oil & Gas Equity Research Debate #3: Libra was better than you thought PSC vs concession A quick recap. The schemes below provide a brief overview of how the oil money flows between oil company and government, for the current concession regime and the pre-salt PSCs. In the current concession regime, the oil company simply pays three types of 'taxes' to the government: a 10% royalty on sales, a tax on operating profit called Special Participation Tax, which varies from 0-40% dependent on type of field (onshore, shallow water, deepwater – high productivity fields pay more tax than less productive fields), year of production, and amount of oil produced, and a 34% tax on income. In the PSC regime, the oil company stills pays royalty (a higher, 15% of revenues) to the government. Then it recovers the amount invested to bring the field onstream (capex+opex) through cost oil or cost recovery. What is left after cost oil is called excess oil or profit oil, which is then split between the oil company and the Government. Current concession regime Libra and future pre-salt PSCs Revenues Government cashflows Oil company cashflow Revenues Sales tax (up to 9%) & Royalties (10%) Government cashflows Sales tax (up to 9%) & Royalties (15%) Net revenues Net revenues Cost recovery (50% ceiling) Opex & depreciation Operating profit Excess oil, or profit oil Special participation tax (0-40% of profit variable on productivity, year of production, water depth) Contractor share of excess oil Government share (min 41.65% at $100/ bbl and 10-12kbd/well) Profit before tax Depreciation Income tax (34%) Oil company cashflow Source: Credit Suisse Research. Income tax (34%) Oil company post-tax cashflow 25 March 2014 LatAm Oil & Gas Equity Research Debate #4: ToR renegotiation. Will PBR have to pay? Transfer-of-Rights basics Back to Septem ber 2010. Petrobras conducted a c.$70bn capitalisation, of which $42bn was used as an ‘oil for shares’ mechanism by which Petrobras acquired the right to produce up to 5bn barrels from certain pre-salt blocks (“Transfer of Rights”). Transfer of rights maps and key metrics Key features of Transfer of Rights: – Price: $8.5/bbl – Fiscal terms: 10% royalties, 0.5% R&D spend – Local content: Exploration 37%, Development 65% – Terms: 40 years, 4 of which exploration period – Renegotiation: After the declaration of commerciality, PBR and the Franco $9/bbl 3bn bbls Government will renegotiate the economics. This has been a key focus point for the equities market, which we discuss in the next slide. Parati Valuation detail by block Area Price ($/bbl) Volume (mmbbls) Value (US$bn) Florim 9.0 467 4.2 Franco 9.0 3,058 27.6 South of Guará 7.9 319 Carcará Bem-te-vi 5.8 600 3.5 South of Tupi 7.9 128 1.0 Northeast of Tupi 8.5 428 3.7 - - - $8.5/bbl 5,000 mmbbls $42.5bn Iara NE of Tupi $8.5/bbl 428mn bbls Sapinhoá Abaré Abaré Oeste Caramba Lula Surround Iara $5.8/bbl 600mn bbls Júpiter Carioca Biguá 2.5 Surround Iara Libra Florim $9/bbl 467mn bbls South of Guará $7.9/bbl 319mn bbls South of Tupi $7.9/bbl 128mn bbls Peroba Contingent block Transfer of Rights Peroba (Contingent) Total Source: Petrobras, ANP, Credit Suisse Research. Libra Pre-salt concession 26 March 2014 LatAm Oil & Gas Equity Research Debate #4: ToR renegotiation. Will PBR have to pay? The renegotiation Why now? With the exploratory period of the ToR areas ending in September Renegotiation mathematics: little to be paid ($bn) 2014, the market has started to focus on the renegotiation, concerned that PBR would have to pay more to the government as oil prices are higher now, which would stress even more the company’s balance sheet. +$20/ bbl in oil prices offset by a 20% inflation and a 2 year delay. ‘Only’ further $4bn to be paid (on a bear case inflation can be higher than 20% and future oil prices lower due to US shale) Tim eline. Petrobras has to declare any commerciality by September 2014 (end of the exploratory period). 10 months prior to the DoC of each area, PBR has to notify the Brazilian Government and the ANP of its intentions to DoC, so that the renegotiation process can start. The review process will only be concluded when PBR have declared commercial all the areas it intends to. The review will include a renegotiation of the volumes (up to the 5bn bbls limit), price, and level of local content. Once the review is completed, the parties have up to 3 years to pay. 7.7 18.3 6.6 46.5 42.5 42.5 Mechanism . If the revised valuation is higher than in 2010, Petrobras can opt to either (i) pay the difference in cash or equivalents or (ii) relinquish some areas. If the revised price is lower, the Government will have to pay Petrobras in cash. What we think. We don’t think valuation will be too different: higher oil prices now are offset by delays and cost inflation. Furthermore, even if PBR had to pay up, the company would have up to three years after the renegotiation was completed to pay (ie, probably at a time when the balance sheet was healthier). Price paid (2010) +$20/bbl in oil price 20% cost inflation 2 year delay Renegotiated price (2013) Price paid (2010) Renegotiation timeline Signature of the PBR to notify Gov and ANP of intention to DoC: renegotiation begins No set period for how long review should take DoC deadline Review ends and new valuation, volumes and local content are set ToR contract Sep-10 … … Nov-13 4 years exploratory period Source: Petrobras, Credit Suisse Research. Sep-14 … 2 Franco FPSOs … Review ends … 2016 1 FPSO in Iara 1 FPSo in NE of Tupi 2 Franco FPSOs 2017 1 Franco FPSOs 2018 2019 End of 40-year contract 1 FPSO in Florim 2020 … … Sep-50 3 years for parties to pay revised values 27 March 2014 LatAm Oil & Gas Equity Research Debate #4: ToR renegotiation. Will PBR have to pay? Follow-on recap and shareholder structure The chart on the right shows the structure of the 2010 follow-on. Of the c.$70bn equity raise, c.$42bn was used to purchase the 5bn bbls from the Government, in a transaction that was close to cash-neutral for the Government. Of the $70bn, ‘only’ $28bn was injected in the company to recompose cash balances. Of the $28bn, minorities participated with $23bn. Cash Raised in the Capitalization (R$ bn) Oil for shares: c. R$ 80bn raised from public entities, c. R$ 75bn im m ediately given back to buy oil from the governm ent in the ToR agreem ent. Before and after. With the ToR, the Government increased its stake from 40% 37 to 49% of the total shares of Petrobras. Government participation in the voting shares increased from 58% to 70%, and from 16% to 34% in the non-voting shares. 29 45 40 Others BNDES* Shareholding Structure (mn shares) Before capitalization 75 14 Governance discussion. Because the purchase of barrels and the follow-on were characterised as two different transactions, minorities could not vote on the barrels acquisition. In practice, minorities were effectively diluted to fund a deal that they did not had the opportunity to vote for (or against). 120 Sovereign Federal Fund Government Total Transfer or Rights Net cash Raised After capitalization 13,044 51% 8,774 60% 5,073 42% 2% 56% Common 7,442 3,701 84% 16% Preferred Federal Governemt 40% 10% 8% 32% Total BNDES* 5,602 50% 66% 7% 27% Common Preferred Other Source: Petrobras, Credit Suisse. Note: Shareholding structure shown in number of local shares. Each ADR is equivalent to two shares. 3% 17% 29% Total Free-float 28 March 2014 LatAm Oil & Gas Equity Research Debate #5: Different dividends, different ON-PN spread There’s always a first time Petrobras has always paid sim ilar dividends to ordinary (ON) and preferred (PN) shareholders. Firstly, balance sheet has never been an impediment, so the company always distributed more than the minimum 25% payout required by law. Secondly, the earnings levels were high enough so that the 25%+ payout has always been close to 2x the book value rules that put a floor on the PN dividend. This apparent stability meant that through most of its history, the ON shares have traded at an average 13% premium vs the PNs. Better liquidity plus voting power justified that premium. But 2012 (and 2013) were the first tim e when dividends were different. By end 2012, earnings level were low enough, one of the lowest of PBR’s history. PN’s book value dividend rules were higher than the ON’s minimum 25% payout, so that PBR implemented different payments (PNs got R$0.96/sh, ONs R$0.47/sh in 2012, in 2013 the values were 97 and 52 cents respectivelly). This caused a major shift in the PN-ON spread. With different dividends, PNs shares started to trade at a premium to the ONs, which persists to this day. Dividends vs Interest on Equity PBR dividend distribution rules In Brazil, companies have the choice of distributing cash to shareholders in the form of dividends, or alternatively as ‘interest on equity’ (IOE). Key differences are: (1) dividends do not pass onto companies’ P&L, and shareholders do not pay tax on received dividends; and (2) IOE enters the P&L as a financing cost, thus decreasing the tax bill; but shareholders have to pay a 15-25% tax rate on IOE received. Historically, Petrobras has paid 88% of distributions as IOE. Preferred shares (PNs): the higher of: 3% of PN book value; 5% of PN paid-in capital; 25% of net income; The ON dividend. Ordinary shares (ONs): by law, PBR is required only to distribute a minimum of 25% of net income to shareholders, but does not specify which type of shareholder. Therefore, in theory, the ON dividend could be zero if the PN dividend already consumed the full 25% of net profit. However, PBR has an explicit commitment to pay the ONs at least 25% of net profit. A dividend story: low earnings forcing different dividends 4.5 Low level of earnings forced different dividend payments for the first time in Petrobras’ history in 2012… Earnings per share 4.0 3.5 R$/sh 3.0 2.5 4 2 (4) 1.5 PN dividend 1.0 ON dividend 0.5 2006 2007 2008 2009 Source: Bloomberg, Company data, Credit Suisse Research. 2010 2011 2012 2013 0% PN discount to ONs (R$/sh) (10%) (6) (10) Nov 08 (20%) PN discount to ONs (%) (8) 0.0 10% 0 (2) 2.0 20% … resulting in PNs having a premium vs the ONs for the first time too. (30%) Jul 09 Mar 10 Nov 10 Jul 11 Mar 12 Nov 12 Jul 13 29 March 2014 LatAm Oil & Gas Equity Research Debate #5: Different dividends, different ON-PN spread What should the spread be? A first approach: “2 x 50cents = R$1.0 spread”. With 2012 and 2013 dividends differing in around 50 cents between the two classes of shares, we think a simple way to think about the spread is as follows: if Petrobras takes two years to return to adequate performance levels to reestablish equal payments, a fair spread should therefore be R$1.0/sh. Indeed, this was our approach through much of the recent past, recommending going long or short the spread whenever it went too far off R$1.0. Justifying a R$1.4 spread. "R$1.40 = 2 x R$0.70/ sh = 3x R$0.50". Earnings and book value in 2013 did not differ much from 2012’s, resulting in a close to R$0.50/sh differential between the ON and PN dividends. However, with a deteriorated 2014 outlook, earnings will decrease, implying in a lower 2014 dividend for the ONs and a differential of R$0.70/sh in our view. Therefore a simple way to see a R$1.40/sh fair spread would be to assume the R$0.70/sh would persist for two years, or alternatively to assume that the current R$0.50/sh dividend difference will persist for three years, and not two, given a 'lost‘ 2014. R$2.0 = could the balance sheet force PBR to cut the ON dividend to z ero? Technically, Petrobras can cut the ON dividend to zero. The company is only obliged to (1) distribute a minimum 25% of earnings as dividends, regardless if it is to ON, PN or both types of shareholders, and (2) pay the PNs the minimum 3% of book value or 5% of share capital, equivalent to the current R$0.96/sh dividend. Technically, R$0.96/sh distributed to the preferred shareholders is already equivalent to a 25% current payout required by corporate law, and would even be higher than 25% on lower 2014 earnings. This would allow PBR to distribute zero to common shareholders. The company, however, has made an explicit commitment of also paying a minimum 25% payout to the ONs. With a tight balance sheet in 2014, that commitment could be relaxed to save PBR R$3.4bn in cash. If the ON dividend is zeroed, the dividend gap would be c. R$1.0 per year. With two years of zeroed ON dividend, the ON-PN spread could go to close to R$2.0. The lack of a clear formula and a tough 2014 could warrant a new R$1.0-1.4-2.0/sh spread range in our view Short-term history of the PN-ON spread (R$/sh) Different dividends and new earnings level warranted a change in the spread, with a fair value of R$1.0 initially 2.00 1.50 1.00 0.50 Very low current spread levels Mar 14 Feb 14 Jan 14 Dec 13 Nov 13 Oct 13 Sep 13 Aug 13 Jul 13 Jun 13 May 13 Apr 13 Mar 13 Feb 13 (0.50) Jan 13 0.00 (1.00) Source: Bloomberg, Credit Suisse Research. 30 March 2014 LatAm Oil & Gas Equity Research Debate #6: The balance sheet Balance sheet overview The tightest levels ever. No matter how we look at it, Petrobras’ balance sheet is at the worst situation in history, and notably worse than in 2009, prior to the capitalisation. Debt levels are at peak, cash levels close to lowest, gearing and leverage ratios also. No covenants. While Petrobras doesn’t have any formal covenants in its debt structure, high debt levels coupled with still negative free-cash flow for the next couple of years (1) put PBR in an increasingly fragile position to keep investing, (2) also leave the company overly dependent on external debt markets for financing, at a time concerns for Brazil’s investment grade are resurfacing, and (3) destroy value for the shareholders. Total debt levels, net debt levels, and cash levels ($bn) 140,000 Peak debt levels. Cash levels dangerously low, at same levels as in 2009, prior to the capitalisation 120,000 100,000 Total debt levels 80,000 60,000 Net debt levels 40,000 Cash levels 20,000 0 2006 Net debt / EBITDA (x) and Net debt / (net debt + equity) (%) 45% 3.5 40% ND/EBITDA (x) 35% Net debt / (ND + Equity) 3.0 2.5 30% 25% 2.0 Net debt/EBITDA 1.5 20% 15% 1.0 10% 0.5 5% 0.0 0% 2006 2007 2008 2009 Source: Company data, Credit Suisse analysis. 2010 2011 2012 2013 2008 2009 2010 2011 2012 2013 Petrobras Enterprise Value split (Book value + Net debt) (USDm) 300,000 250,000 ND/(ND+Equity) (%) 4.0 2007 200,000 Growing ‘book value’ of the enterprise until 2010, via equity. Post 2010, destruction of value to the shareholders Net debt 150,000 100,000 Book value 50,000 0 2006 2007 2008 2009 2010 2011 2012 2013 31 March 2014 LatAm Oil & Gas Equity Research Debate #6: The balance sheet Capitalising vs expensing debt costs The fact. Accounting wise, Petrobras is allowed to capitalise borrowing costs directly attributable to acquire or construct particular assets. These borrowing costs bypass the P&L, go into PP&E. Whenever the asset is on productive stage, those costs go back to the P&L, amortised over the useful life of the asset. Because a large part of Petrobras debt is used to finance capex and specific projects, PBR does capitalise a large portion of its borrowing costs. Since 2007, on average 74% of borrowing costs have been capitalised. Investors’ argum ent. Because of this issue and of Petrobras’ high capital needs, some investors argue that Petrobras’ earnings are overstated compared to peers, and therefore should be adjusted. This is usually an argument of bear investors making the case that Petrobras PEs, while optically cheap, are not so. If we were to expense all borrowing costs, Petrobras earnings would have been 8-40% lower than reported since 2007. Because the company has been gearing up substantially, the earnings downgrade are greater for recent years. The question: should we adjust? While we understand the willingness to adjust earnings downwards due to debt costs, we make the point that such an adjustment would mean expensing a cost that does not generate revenue yet. Conceptually, one could argue that this would be equivalent to expensing capex in the P&L, which to us sounds too extreme. We therefore would look at PBR’s PEs at face value, and would get around the high-capital intensity issue directly via longer-term DCFs. Petrobras borrowing costs and capitalised/expensed split Borrowing costs (USDm) 5,000 % of debt capitalised 100% Reported net income 90% Net income if all debt was expensed in the P&L 80% Expensed debt 4,000 70% 60% 3,000 50% 40% 2,000 30% Capitalised debt 1,000 20% 10% 0 % of debt costs that are capitalised 6,000 Petrobras earnings and impact of expensing all debt costs (USDm) 19,994 18,432 16,982 16,850 14,491 12,866 11,048 9,345 19,948 15,540 10,807 -16% -8% 10,912 -22% 7,016 -11% -15% 6,977 -35% -40% 2012 2013 0% 2007 2008 2009 Source: Company data, Credit Suisse analysis. 2010 2011 2012 2013 2007 2008 2009 2010 2011 32 March 2014 LatAm Oil & Gas Equity Research How to value Petrobras? FOTO Valuation dilem m a For every year since 2010, anyone who would have tried to make a value call on PBR would have been wrong. The share price has fallen on average 25% per year since then, and the downward trend continues. We discuss the PBR value trap dilemma, the problems of a DCF for Petrobras, and argue that up until 2013, it would have been ‘easier’ to avoid the value trap, whereas now that dilemma is more difficult with the ‘only’ variable left being domestic price increases. The problems of a DCF for Petrobras Deriving an absolute valuation reference for Petrobras is not straightforward, in our view, due to three inter-related issues: (1) negative cashflows for a long time, leaving much of the value of the company far out in the future, (2) uncertainty on future performance, (3) uncertainty whether high capital intensity with price controls could imply in further dilution to current shareholders. HOLT®: Share price implying current performance into eternity Using HOLT lead us to two interesting conclusions: (1) the current PBR share price is implying current (trough?) business performance into perpetuity, and (2) Global Oils as a whole are pricing in low levels of return – if PBR’s performance doesn’t improve, PBR would be the third most expensive stock within Global Oils. Should Petrobras trade like Gazprom? We argue it shouldn’t. PBR returns have historically been significantly above GAZP’s (current returns are not, though), and Brazil discount rates are lower than Russia’s. These two points argue for PBR to trade at a higher multiple than GAZP. Absolute value reference and other value guideposts: is now the time? Hypothetical equity issuance: at what price would you buy? ‘Petrobras in 2020’ is the best way we found to come up with an absolute value reference for PBR, which would get us close to book value of $25/ADR, significantly higher than current prices. Trying to look at other metrics, we (1) derive a conservative level of earnings, (2) look what Big Oil PE on trough earnings, (3) want PBR to be offering a high dividend+buyback yield compared to global peers, and (4) incorporate balance sheet deterioration on valuation. These approaches get us to a c.$12/ADR. While PBR is vocal about not having to issue equity, we think it’s useful for investors to run a scenario of where the share price would go to should there be future dilution, in a way to test the downside. In a scenario where the FX goes up to 2.8x and with little price increases, PBR would need to raise $10-25bn in equity. In our view, the price of this hypothetical issuance would have to be at the $7.5/ADR level in our view, so that investors would get a cheap PE of c.6.0x on earnings that are reasonably conservative. March 2014 LatAm Oil & Gas Equity Research How to value Petrobras? Valuation dilemma The value trap. For every year since 2010, anyone who would have tried to make a value call on PBR would have been wrong. The share price has fallen on average 25% per year since then, and the downward trend continues. PBR historical PE multiples (x) 16x Before it was ‘easy’ to avoid the trap. We argue that up until 2013, it would 14x have been easier not to fall in that trap, as a sluggish production profile and the always present issue of the Downstream pricing policy effectively decreased the likelihood of a better underlying business performance. 12x Now it’s a harder decision. Starting from 2013, however, that job has become more difficult, in our opinion. With a production profile that is now on the cusp of turning around with record-high 840kbd capacity additions last year and early this year, the main 'piece of the puzzle' left for earnings to revert the downward trend is the Downstream pricing policy. Unfortunately, the balance sheet is in an extremely fragile position, 2014 is an election year in Brazil, inflation is at the forefront of politicians' minds, and the FX, as important to Petrobras as gasoline and diesel price increases, is on an unhelpful trend, with the USD appreciating vs the BRL to the highest levels since 2009. 10x 8x 6x Close to 6x PE, almost as low as end 2008 when the oil price hit $30/bbl 4x 2x 0x Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 PBR historical price-to-book multiples (x) PBR historical EV/EBITDA multiples (x) 5.0x 9x Jan-12 Jan-13 Jan-14 8x 4.0x 7x 6x 3.0x Below book since late 2011. Now PBR below 0.5x book, lowest levels ever 2.0x 5x 4x High and increasing net debt levels keep the EV/EBITDA multiple stable at 5-6x despite a market cap that is down more than 50% since 2010. Given PBR’s vast capex plan, there is significant debt that does not generate EBITDA yet 3x 2x 1.0x 1x 0.0x Jan-07 Jan-08 Source: Bloomberg. Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 0x Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 34 March 2014 LatAm Oil & Gas Equity Research How to value Petrobras? The problems of a DCF for Petrobras Absolute valuation: a way out of the value trap. One way to avoid the PBR value ROEs and ROCEs (%): falling since 2008. What will future levels be? trap dilemma would be to come up with a conservative, absolute value reference for the company. In that way, time would ensure that the shares would converge to that absolute value reference, and investors, with a decent margin of safety, would be ‘safer’ from the trap. 35% 30% Three issues. Unfortunately, coming up with such a value reference is no easy job for Petrobras, for three inter-related reasons, in our view: 25% 1. Negative cashflows for long. The first, more evident issue to built a DCF for 20% Petrobras are negative cashflows. Petrobras has been cashflow negative since 2007, and that is likely to continue into 2016-2017. A great part of value is therefore far away in the future. 2. Uncertainty of future performance. Not only is current capex intensity high, but 10% the returns on those heavy-investments are also uncertain. PBR has seen declining returns since 2008, and since 2010 we have been below cost-ofcapital territory. Will returns ever pick-up again? 0% uncertain returns and high capital intensity, do current shareholders face the risk of future dilution, such as happened in 2010? Cash from operations 21,087 25,814 (21,265) 2007 22,636 (28,325) 2008 Capex 28,173 (34,480) 2009 Source: Petrobras, Credit Suisse estimates. Free-cashflow 29,457 (41,573) 2010 29,000 (41,584) 2011 27,901 (40,440) 2012 ROCE 5% 3. Will there be future dilution? A third issue derives of the first two: with Petrobras cashflows (USDm): very negative for very long ROE 15% 2006 2008 2010 2012 2014E 2016E 2018E 2020E Negative cash-flows for a long time. Capex intensity is high, and investments are so far not translating into higher cash generation. Will future cashflows be positive enough for a DCF? Will there be future dilution? 70,667 61,850 52,035 43,364 37,772 25,775 22,636 (45,388) 2013 (41,420) 2014E (41,420) 2015E (41,420) 2016E (41,420) 2017E (41,420) 2018E (41,420) 2019E (41,420) 2020E 35 March 2014 LatAm Oil & Gas Equity Research How to value Petrobras? Arriving at an absolute value reference: ‘Petrobras in 2020’ Looking at 2020. One of the best ways we found to look for absolute value in Petrobras is using our ‘Petrobras in 2020’ approach. The approach consists of looking at asset valuation in a ‘normalised’ state in 2020, assuming Petrobras Upstream will continue to perform strongly, while the Downstream will either be worth zero (not creating, but not destroying any value) or else restore profitability to Global Industry average (which is still poor). We then translate that asset valuation into equity value today, by accounting for changes in net debt from today to 2020, and also by time-value-of-money differences. $25/ ADR. That exercise gets us to an intrinsic value of $25/ADR, incredibly close to book value. Another way to intellectualize the $25/ADR would be to look at Petrobras business plan capex: with c. 60% of the capex in Upstream (where returns are c.20%), and the remaining in Downstream and other sectors (where we’d assume returns would be zero in the long-run). This would yield a blend-return close to cost of capital, and therefore Petrobras would have to trade close to book value. Step 1: Arriving at an asset valuation in 2020 E&P division Units Values 2020 Oil & Gas production kboed 5,200 2020 Oil & Gas production mmbbls 1,898 Net income per boe $/boe 24 PBR 2020 R&P net income and FCF USDm 45,552 Upstream asset value (i) USDm 455,520 Downstream, scenario 1 Refining asset value (ii) Unit Values PBR asset value in 2020, scenario 1 USDm 455,520 PBR asset value in 2020, scenario 2 USDm 479,217 PBR net debt in 2020 USDm (80,645) PBR equity value in 2020 scenario 1 USDm 374,875 PBR equity value in 2020 scenario 2 USDm 398,572 PBR equity value in 2014 scenario 1 USDm 162,069 Brought to 2014 at a 15% Ke PBR equity value in 2014 scenario 2 USDm 172,314 Brought to 2014 at a 15% Ke PBR equity value in 2014 scenario 1 USD/ADR 25 PBR equity value in 2014 scenario 2 USD/ADR 26 Source: Credit Suisse Research. Comments USDm Comments 2020 refining capacity kbd 2,497 2020 refining capacity mmbbls 911 $/bbl 2.6 PBR 2020 Refining net income and FCF USDm 2,370 Refining asset value (iii) USDm 23,697 Global Oils average refining NI/bbl 10% real rate, ex-growth Assumes Downstream does not destroy value on the long term 0 (net income offset by loss-making imports) Downstream, scenario 2 Step 2: Translating asset value in 2020 to equity value in 2014 Industry average $15/bbl, PBR E&P more profitable Comments Does it m ake a difference? Petrobras has been trading below our $25/ADR reference since late 2011. Therefore, being pragmatic, such a value reference would have not helped investors avoid a significant fall in the share price. We have to try to look elsewhere for value guideposts to try to judge at what price we should buy into. Comments PBR asset value Doesn't assume new Premiums or Comperj2 PBR is able to restablish refining profitability 10% real rate, ex-growth Comments Scenario 1 USDm 455,520 Sum of (i)+(ii) Scenario 2 USDm 479,217 Sum of (i)+(iii) 36 March 2014 LatAm Oil & Gas Equity Research How to value Petrobras? Other value guideposts: Is now the time? Beyond absolute value. We try to look at other value guideposts outside our ‘Petrobras in 2020’ absolute value reference. To try to buy into Petrobras on a weak year for operational performance, we would: (1) derive a reasonably conservative level of earnings, (2) look what Big Oil PE on trough earnings was, (3) want PBR to be offering a high tangible support of value, with a high dividend+buyback yield compared to global peers, and (4) try to incorporate some degree of balance sheet deterioration. These four approaches would get us to a c.$12/ADR (R$14/share) for the preferred shares, similar to current levels. Deriving a conservative earnings estimates for PBR: $7bn (US$bn) 0.5 2.0 4.5 $7bn: a conservative earnings estim ate? At $1.5bn, Q3’13 earnings were the second worst levels in PBR history since 2006 (losing only to Q2’12 when PBR posted a loss due to $3.8bn of non-cash FX losses). From Q3’13, we derive a $7bn annual earnings level including production growth, the 4-8% price increases late 2013, and further FX depreciation to 2.6. This looks to us as a reasonably conservative earnings level to start from. 3.0 $77bn ($12/ ADR): a conservative m arket cap? As a group, Big Oil had a PE on trough earnings of 11x. If applied to PBR, we’d get to a $77bn market cap, already above current levels. 7.0 6.0 7.2% dividend yield: the highest am ong global peers. At the current share price, Petrobras preferred shares are offering the highest yield within global oils. 1.5 Writing-off $25bn of the m arket cap. Before the pricing formula announcement last November, Source: Bloomberg, Credit Suisse Research. +4% gasoline +8% diesel -15% FX 2014 earnings CNOOC Total Statoil Sinopec RDShell BP 11.0 CVX 16 14 12 10 8 6 4 2 0 Petrochina Petrochina BP CNOOC Statoil Sinopec XOM Repsol Total RDShell CVX ENI 5.3% +7% production Big Oil PE on trough earnings is c. 11x, implying a PBR market cap of $77bn, already above current levels Repsol 7.2% PBRa 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% Q3 annualised XOM PBRa / PETR4 now offer the highest dividend+buyback yield in Global Oils Q3 13 earnings ENI PBR’s market cap was c. $100bn. One simplistic way to incorporate a tougher outlook (assuming a flat EV and that any further debt issuance would come at the expense of the equity) would be to write-off $25bn of the market cap, getting us to the current $75bn. 37 March 2014 LatAm Oil & Gas Equity Research How to value Petrobras? HOLT®: Share price implying current performance into eternity 20% 10% 5% (10%) The charts on the right compare PBR with other global oil peers. As the top-right chart (15%) CFROI Source: Credit Suisse HOLT®. Forecast CFROI Market implied CFROI NVTK ROSN ECOPETROL XOM GALP BG REP PBR PRE PETROCHINA BP TOTF STL CVX COP SHELL ENI OMVV GAZP YPF RNHS GALP BG PBR REP ROSN YPF XOM TOTF BP STL COP ENI PETROCHINA 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013E 2015 2017 NVTK 0 SHELL 2 CVX 4 GAZP 6 If performance does not improve, PBR is the third most expensive oil stock globally SINOPEC 8 0.3% ECOPETROL 10 10% 5% 0% (5%) (10%) (15%) (20%) (25%) OMVV CFROI (%) 12 Spread: implied CFROI® minus CFROI expected by the sell-side PRE PBR share price implying that current business performance will be perpetuated into eternity SINOPEC (5%) shows, all global oil stocks are pricing in low returns into eternity, and PBR, despite pricing-in the current low performance, is actually one of the highest implied returns in the global oil universe. The bottom-right chart shows that in another way, comparing the spread (implied CFROI in the share price minus CFROI expected to consensus). Another way to illustrate that, if current business performance does not improve, PBR is actually fairly priced and one of the most expensive oil stocks globally. 14 3.2% 0% bars), compares that with the expected future performance from consensus (red bars), and with what expectations are embedded in the current share price (brown circle). What the chart tells us is that the current share price is implying that PBR’s current weak performance levels is being priced to eternity. This can be interpreted as extreme, and as a buying signal. PBR historical, forecast, and implied CFROI® (%) PBR implied returns one of the highest amidst Global Oils 15% RNHS The chart on the bottom left shows what PBR historical CFROI performance has been (blue Global Oils implied CFROI® in the current share price LKOH on future discounted cashflows, and uses cashflow returns on investment (CFROI®) as a key performance and valuation metric. A key appeal of the methodology, in our opinion, is to be able to compare companies of different geographies and accounting standards, and to derive what the current share price is implying in terms of future performance. Comparing those implied returns in one stock with implied returns in other stocks can provide interesting insights, and also comparing implied returns in one stock against what we expect the company will be able to deliver. LKOH HOLT’s appeal. HOLT is a proprietary valuation framework of Credit Suisse’s. HOLT is based 38 March 2014 LatAm Oil & Gas Equity Research How to value Petrobras? Should Petrobras trade like Gazprom? A bear case. An often-cited bear case for Petrobras is that, due to increasingly deteriorating performance of the business, and perceived higher Government intervention in the company, Petrobras could end up trading like Gazprom, at 3x PE, 3x EV/EBITDA, and at c.35% of book value. Should it, or should it not? To answer this question, we compare two key determinants of multiple ratios (including the PE): returns, and cost of ownership. (1) Returns-wise, in the bottom-right chart, we see that, Gazprom has never managed to sustain CFROI above the 5% level for long. Petrobras, on the other hand, has historically achieved much higher return levels, sometimes above 10%. Higher returns should warrant a higher PE. However, Petrobras recent returns profile has been similar or worse than Gazprom’s. A higher PE multiple for Petrobras should be warranted inasmuch as investors believe that Petrobras’ could return to historical levels, or if current poor performance should be extrapolated into perpetuity. (2) Cost of ownership wise, in the bottom left chart we look at HOLT’s countryimplied discount rates. With Brazil having a lower discount rate than Russia for much of the past 20 years, a higher multiple for Brazilian companies is also warranted. For an in-depth discussion of the drivers and meaning of a Price/Earnings multiple, we recommend an insightful reading from Credit Suisse’s Michael Mauboussin: ‘What Does a Price-Earnings Multiple Mean? An Analytical Bridget between P/Es and Solid Economics’, January 29 2014. Brazil and Russia HOLT-implied discount rates* (%) Petrobras and Gazprom PEs over time (x) 16.0x 12.0x 8.0x 6.0x GAZP 4.0x 2.0x 0.0x Jan-07 Nov-07 Sep-08 Jul-09 May-10 18% 18 Brazil’s lower market-implied discount rates historically should warrant a higher PE multiple, ceteris paribus 16 14 Russia 12 10 Jan-12 Nov-12 Sep-13 PBR’s historically higher returns should warrant a higher PE, if PBR manages to revert the recent poor trend, which is worse than GAZP’s 16% 14% 12% PBR 10% 8% 6% GAZP 4% Brazil 6 4 1994-Feb Mar-11 Petrobras and Gazprom CFROI over time (%) CFROI (%) HOLT-aggregate discount rates (%) PBR 10.0x 20 8 PBR historical PE premium to GAZP. Should they trade at a similar multiple? 14.0x 2% 1997-Jun 2000-Oct 2004-Feb 2007-Jun 2010-Oct 2014-Feb 0% 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013E Source: Bloomberg, Credit Suisse Research, Credit Suisse HOLT®, Aswath Damodaran. Note: full link to Michael Mauboussin’s report on https://plus.credit-suisse.com/u/kw6kLT. *Definition: HOLT discount rates are solved for using firms' forecasted cash flows and market prices. HOLT derives discount rates by equating firms' enterprise values to the net present value of their forecasted free cash flows (FCFFs). 39 March 2014 LatAm Oil & Gas Equity Research How to value Petrobras? Hypothetical equity issuance: At what price would you buy? Hypothetical. Petrobras is extremely vocal about not needing to issue further equity to finance the current capex plan, which demonstrates management confidence that domestic prices will rise enough to deleverage the company and that the company will be able to tap the debt markets for further external finance if the short term scenario becomes (more) challenging. That confidence, while unshakable, should not preclude an analysis of what should happen in an extreme scenario where the company needs to come to be equity markets again, and a view of at what price such hypothetical capitalisation would need to happen. We address this frequent investor concern below. Equity needs for PBR to keep cash levels at $25bn under different FX and price increase scenarios ($m) FX 2.0 2.2 2.4 2.6 2.8 3.0 0% 565 8,520 15,150 20,760 25,599 29,800 5% 0 6,382 13,190 18,950 23,919 28,232 10% 0 4,243 11,229 17,140 22,238 26,664 15% 0 2,105 9,269 15,331 20,558 25,095 20% 0 0 7,309 13,521 18,878 23,527 production growth of 7% in 2014 and slightly higher 10% in 2015, (2) that the debt markets will be accessible up to $20bn/year of net new issuance, and (3) that PBR would need to raise equity to recompose cash in the balance sheet of $25bn (= a minimum level of $15bn needed to run the business + $10bn cushion in case of macro deterioration) – this assumption would require less capital than an alternative scenario where PBR raised equity to get back to its 2.5x ND/EBITDA target, and implicitly assumes that the scenario would improve further in the future. Conclusions: (1) PBR would need to raise $10-25bn in equity in scenarios where the FX goes up to 2.8x and price increases until 2015 are between 5-15%, (2) even with the incremental issuance, PBR would remain geared at c.4.0x ND/EBITDA – performance would need to improve in the future to de-lever the company, (3) the price of the issuance would have to be at the $7.5/ADR level in our view, so that investors would get a cheap PE of c.6.0x on earnings that are reasonably conservative (ie price increases only close half of today’s gap, and the FX goes to 2.6x). PEs of an issuance done at $7.5/ADR under various FX and price increase scenarios Price increases in 2014-2015 Assum ptions. In the exercise below, we use the following two important assumptions: (1) PEs of an issuance done at the current c.$11.5/ADR share price under various FX and price increase scenarios FX 2.0 2.2 2.4 2.6 2.8 3.0 0% 2.8 4.2 6.3 9.8 16.4 34.2 5% 2.4 3.5 5.1 7.6 11.7 19.9 10% 2.2 3.0 4.3 6.1 9.0 13.9 15% 2.0 2.5 3.6 5.1 7.3 10.6 20% 1.8 2.2 3.1 4.3 6.0 8.4 Source: Company data, Credit Suisse analysis. Price increases in 2014-2015 Price increases in 2014-2015 FX 2.0 2.2 2.4 2.6 2.8 3.0 0% 4.2 6.1 8.9 13.4 22.2 45.5 5% 3.7 5.1 7.3 10.5 15.9 26.7 10% 3.3 4.4 6.1 8.6 12.3 18.7 15% 3.0 3.8 5.3 7.2 10.0 14.3 20% 2.7 3.4 4.6 6.2 8.3 11.5 40 March 2014 LatAm Oil & Gas Equity Research Petrobras vs Big Oil: The Order of Merit FOTO Credit Suisse Order of Merit Every year, the Credit Suisse Global Energy team publishes a comprehensive analysis of the Integrated Oil Companies across a number of financial and operational performance metrics. In this context, we analyse how Petrobras screen vs its global peers in Upstream, Downstream and Overall. Upstream vs Downstream Returns: Lower for longer Probably one of the most interesting trends of the global integrated oil industry is the fact that it has not benefited from higher oil prices: returns in 2012 remained at c.9% levels for the past four years, despite a rise in oil price from $60/bbl to $110/bbl. This is also the same level of returns as in 2002, when oil prices were at c.$30/bbl. Both in Upstream and Downstream, higher prices are not translating in higher returns. Capital intensity is the reason returns have not improved. Rising capital intensity entirely offset rising profitability. Global oils as a group has been investing close to 90% of cash-generation for the past four years, a stark contrast to the c.60% invested in the early 2000s. Even more impressive is the fact that, as a group, our universe has not managed to significantly increase production despite rising intensity. Another interesting conclusion of our analysis is a clear ‘bifurcation’ in Petrobras Upstream and Downstream businesses. Petrobras Upstream is one of the bestperforming globally, in all metrics we analyse: it grows more, it has the highest profitability, cash-generation, and also returns. Downstream, on the other hand, stands-out as the worst business globally: it is the only that is significantly loss making, and capital intensity is three times above the industry average. The downstream drag is so strong that as an integrated business, Petrobras, ranks lowly in our analysis: (1) 2012 returns of 7% are the lowest in our universe, (2) capital intensity is among the three highest, and (3) at 36% gearing, Petrobras is by far the most-levered company in our analysis, which is a major impairment to the company’s ability to keep investing in the future. With a growing production profile from 2014, this will partially change, but a more efficient Downstream pricing policy is needed for PBR to start to be competitive on a global scale. March 2014 LatAm Oil & Gas Equity Research Order of Merit Returns trends All-tim e high oil prices, all-tim e low returns. Probably one of the most interesting trends of the global integrated oil industry is the fact that it has not benefited from higher oil prices: returns in 2012 remained at c.9% levels for the past four years, despite a rise in oil price from $60/bbl to $110/bbl. This is also the same level of returns as in 2002, when oil prices were at c.$30/bbl. Both in Upstream and Downstream, higher prices is not translating in higher returns. Upstream vs Downstream . Comparing both charts on the right, we see two clear trends, both which are crucial to the Petrobras investment case: (1) Upstream has significantly higher returns than Downstream – both for PBR and for the Industry; and (2) Petrobras performs significantly better than peers on Upstream, but lags significantly on Downstream. The Downstream drag is so significant that it brings the overall Petrobras returns below industry average, as we can see on the bottom left chart. Upstream ROGIC over time (%) 40% 35% 16% 14% 12% 10% 8% 6% 4% 2% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Sector Petrobras 80 25% 20% 60 15% 40 10% 20 5% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Sector Petrobras Oi price ($/bbl) 0 Downstream ROGIC over time (%) 18% 0% 100 30% 0% Consolidated ROGIC over time (%) 120 Oi price ($/bbl) 120 20% 100 15% 80 10% 60 5% 40 0% 20 (5%) 0 (10%) (15%) Sector Petrobras 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: Company data, Credit Suisse analysis. Note: ROGIC calculated as EBIDAX divided by Gross Invested Capital; all averages are weighted by company scale. 42 March 2014 LatAm Oil & Gas Equity Research Order of Merit Returns rankings Petrobras best-in-class Upstream returns. The three charts on this slide show a similar conclusion to the previous slide. Petrobras Upstream business generates one of the highest Upstream returns in our universe, testimony to the quality of the company’s assets, and even despite of lack of production growth in the past years, something which has impacted the industry as a whole. Upstream ROGIC rankings (%) 2011 21% 18% Petrobras worst-in-class Downstream returns. The bottom-right chart makes 16% 14% 13% very clear the impact Downstream has for Petrobras. It is the only company in our universe that has significantly negative returns in Downstream. The only other company that has a loss-making Downstream is ENI, but close to break-even. 13% 12% 11% 11% 11% 10% 9% 9% 2012 8% 7% Consolidated ROGIC rankings (%) 12% 9% 9% 9% Repsol Marathon Total ConocoPhillips BP R.D. Shell ExxonMobil BG Average Hess Statoil Chevron ENI Downstream ROGIC rankings (%) 2011 11% 11% 10% Petrobras Downstream drag is so significant that it puts Petrobras on the bottom of the list on a consolidated basis, with 7% returns level below the company’s cost of capital and therefore value destructive. This also shows an opportunity: should PBR achieve pricing parity, we can see the company quickly going close to the top in our overall returns rankings in a very short timeframe. OMV The need for transparent pricing. As the chart on the bottom-left shows, the 9% 9% 8% 8% 8% 7% 7% 2012 11% 9% 9% 2011 7% 7% 7% 5% 4% 3% 2012 3% 7% Source: Company data, Credit Suisse analysis. Note: ROGIC calculated as EBIDAX divided by Gross Invested Capital; all averages are weighted by company scale. Petrobras ENI R.D. Shell Average Repsol Total Hess Statoil BP OMV Chevron (9%) ExxonMobil Repsol Marathon Petrobras Total ENI R.D. Shell ConocoPhillips OMV Average ExxonMobil BP Hess Statoil BG Chevron (0%) 43 March 2014 LatAm Oil & Gas Equity Research Order of Merit Capital deployment trends The reason returns have not im proved. Rising capital intensity is the reason returns have not improves in the past decade, despite higher oil prices. Higher oil prices also resulted in industry cost inflation. Coupled with the need to increase investments in ever more complex environments to sustain an ever larger production base, this means that wider industry capex in 2012 is at all-time high levels, close to the $300bn mark. Investing m ost of the cash. Global oils as a group has been investing close to 90% of cash-generation for the past four years, a stark contrast to the c.60% invested in the early 2000s. Here, Petrobras also stands out. The company has been investing substantially more than cash generated since 2007, testimony to a huge resource base. At some point, as production ramps-up and the benefits of capex are reached, capital intensity should come down. Petrobras expects to become free-cash positive by 2015-2016, an assumption dependent on Downstream performance. Capex/EBIDAX over time (%) 180% 160% Sector 140% Petrobras 120% 100% 80% 60% 40% 20% 0% Capex/Gross Invested Capital over time (%) Aggregate segmental capex over time (US$bn) 25% Upstream Downstream Other Sector 20% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Petrobras 297 263 231 293 248 205 15% 176 10% 83 81 96 95 103 127 5% 0% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 44 March 2014 LatAm Oil & Gas Equity Research Order of Merit Capital deployment rankings Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 72% ExxonMobil OMV 73% 76% BP 76% Repsol 80% ENI 84% StatoilHydro 84% Chevron 93% 94% 2011 5 5 3 OMV 8 Marathon 11 Repsol 14 Hess 18 BG 19 ConocoPhillips 19 ENI BP Total Chevron 2012 30 Average 34 Statoil 38 R.D.Shell ExxonMobil Petrobras Repsol ENI OMV ExxonMobil BP R.D.Shell Marathon ConocoPhillips Total Average Statoil Chevron Petrobras BG Average 95% R.D.Shell 105% 135% 106% Total Hess 40 5% 6% 6% 7% 7% 8% 8% 8% 8% 43 24 Hess ConocoPhillips 2012 2012 Aggregate capex rankings (US$bn) 9% 9% 10% 11% 2011 2011 Marathon 15% 16% Capex/Gross Invested Capital rankings (%) Petrobras clearly illustrated by company performance is the fact that Upstream is a much higher capital intensity business than Downstream. Petrobras, BG and Hess, thre three most-E&P focussed companies in our universe, are also the three that present the higher capital intensity, both on a capex/EBIDAX and Capex/GIC basis. BG High E&P capital intensity. Another interesting feature of the industry that is Capex/EBIDAX rankings (%) 149% by Exxon ($40bn) and Shell ($38bn), with Shell being the company with most capex hikes in the past year. With its $237bn plan for the next five years, we would expect Petrobras to keep the highest spend in the industry in the future. 153% The largest capex in the industry is from Petrobras ($43bn in 2012), followed 45 March 2014 LatAm Oil & Gas Equity Research Order of Merit Balance sheet and leverage 5% Petrobras m ost-levered balance sheet. Petrobras gearing levels have OMV R.D.Shell BG ExxonMobil Average Total Hess Marathon Petrobras ConocoPhillips BP 20% 2012 1% 9% 14% 17% 19% 20% 25% 20% 21% 30% 2011 24% Petrobras 26% Sector 27% Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. R.D.Shell Statoil Average Total BP OMV ENI BG ExxonMobil 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Marathon 0% Hess 5% ConocoPhillips Petrobras 10% Repsol (9%) 15% Chevron 35% (7%) (8%) (11%) Net debt/Total capital rankings (%) 27% Net debt/Total capital trends (%) (1%) (2%) (2%) (3%) (3%) (4%) (5%) 30% remained above those of the industry for most of the past decade. 2010 was the exception year, when the company recapitalised, but it took only one year for PBR to already be back to the highest gearing in the sector. The company is not only the highest levered balance sheet, but also the one that is gearing up the fastest. PBR’s gearing increased by 6 percentage points from 2011 to 2012, only behind Conoco, and at a time most competitors delevered their balance sheets. So far in 2013, gearing has continued to increase strongly, reaching 36% in Q3’13. With production set to resume growth from 2014-onwards, a decrease in gearing is now dependent on the Downstream pricing mechanism. 1% ENI 3% Repsol 6% Statoil 6% Chevron mark. The sector never went up above the 25% mark in the past ten years. Low gearing allows re-investment and capital intensity to remain high, which bodes well for the oil services industry and for further M&A as a means to improve RRRs, especially in U.S shale. Net debt/Total capital change in 2012 over 2011 (% points change) 25% Gearing levels rem ain com fortable (for m ost) global oils, below the 20% 46 March 2014 LatAm Oil & Gas Equity Research Production & Reserves Production overview Oil and gas production rankings (million barrels per day) 4.4 2011 55% 55% 55% 55% 54% 1.6 Repsol OMV 2012 1.2 1.0 1.0 0.9 0.8 Marathon ConocoPhillips ENI Statoil Average Total R.D.Shell Chevron Petrobras BP ExxonMobil BG Repsol R.D.Shell ConocoPhillips ExxonMobil ENI Statoil Average OMV Total BP Chevron Marathon 0.3 0.3 1.6 0.3 Hess Hess BG ConocoPhillips ENI Statoil Average Total BP 1.8 26% Petrobras 0.4 2011 2.1 2.0 44% Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 0.5 Oil production rankings (kbd, Thousands) 2.2 50% 50% 49% 1.6 0.3 0.2 0.2 0.1 Repsol 61% 1.8 OMV 69% 68% 1.8 BG 73% 2012 2.2 Hess 2011 84% 2.4 0.7 R.D.Shell Oil production rankings and oil as % of total oil as % of total production 2.6 ExxonMobil companies in our universe, with 84% of total production being oil. We expect this picture to continue in the future. LatAm has a large gas potential (coming from pre-salt gas and some potential shale structures in Brazil – like Solimoes, Sao Francisco, Parnaiba, and from shale in Argentina, mostly in the Vaca Muerta formation), but Petrobras visible future production is still very levered to oily presalt. 2012 3.3 Petrobras is oily. Another interesting metric is the fact that PBR is the most oily Marathon 3.4 Petrobras analysis universe, only behind Exxon, BP, Shell and Chevron. On the oil side, PBR’s position is even more relevant, the third largest producer only behind Exxon and BP. If PBR manages to get close to its goal of doubling production by 2020, it will not take long for us to see PBR on top of that list. Chevron Petrobras is big. Petrobras is the 5th largest oil and gas producer among our 47 March 2014 LatAm Oil & Gas Equity Research Production & Reserves Production growth (poor) track-record Growing is not easy. Production growth is one of the items that always gets our Oil and gas production growth rankings (%) attention. Despite this being well-known, it is always impressive how difficult it is for the industry to grow. We complain that Petrobras has not grown for the past four years, but the industry has not grown significantly since 2001! 2011 19% 12% 11% 9% 2011 was bad, 2012 better (but not good). 2011 was a poor year for the industry, with production decreasing 4% mostly driven by Libya, asset disposals and PSC effects. As a whole, the industry did not grow in 2012, with growth from the ‘smaller’ companies (MRO, REP, STL, Hess) offsetting the lack of growth and decline from the ‘big’ companies (XOM, BP, COP, CVX, TOT). Going forward, Petrobras has the chance to stand-out it it achieves multi-year 6%+ growth, double the industry aspired growth of 2-3%. 7% 6% 3% 2% 1% 2012 0% ExxonMobil ConocoPhillips BP Chevron Total Average Petrobras R.D.Shell BG OMV ENI Hess Statoil Repsol Marathon -1% -2% -3% -4% -6% Oil and gas production growth over time (YoY growth) (%) Sector 12% 11% 5% 4% 10% 9% 4% 1% 3% 3% Petrobras 5% 1% 5% 6% 0% 1% 2% 0% -1% 0% -1% 1% 1% -1% -4% 2000 2001 2002 2003 2004 2005 Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 2006 2007 2008 2009 2010 2011 2012 48 March 2014 LatAm Oil & Gas Equity Research Production & Reserves Reserves base Oil reserves (proven SEC) rankings (mmbbls, Thousands) 12.8 2011 Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 0.4 Repsol 0.6 OMV 1.2 Hess 1.4 BG 1.6 Marathon Statoil Average Total BP Petrobras 2.3 2011 2012 42.8 40.3 Hess 2.8 2.3 Marathon 2.8 OMV 4.9 Repsol Petrobras 12.2 11.6 BG Statoil ConocoPhillips ENI 23.1 21.0 19.6 17.0 Average Chevron Total 30.9 29.2 ExxonMobil Repsol BG Statoil R.D.Shell ENI ExxonMobil ConocoPhillips Total Average OMV Chevron BP Hess 3.4 74.1 BP 2012 R.D.Shell 2011 77% 75% Marathon 3.5 Gas reserves (proven SEC) rankings (bcf, Thousands) 59% 57% 57% 54% 52% 52% 51% 49% 46% 45% 41% 35% Petrobras 5.7 4.3 ExxonMobil 85% 6.2 ENI 6.5 to production. This is also illustrated by the fact that Petrobras ranks close to the bottom of the list in gas reserves. Oil as % of oil and gas reserves rankings (%) 2012 9.9 Oily reserves, too. PBR has the most oily reserves in our universe, 85%, similar ConocoPhillips 11.0 R.D.Shell relevant player in LatAm when it comes to reserves. Using the SEC criteria, PBR is the second largest reserve base in our coverage, behind Exxon. When the presalt discoveries are fully incorporated in PBR’s reserve base, there is a 30bn bbls potential that could easily put the company in a far 1st place position. Chevron Petrobras is big, again. Similarly to production, Petrobras is by far the most 49 March 2014 LatAm Oil & Gas Equity Research Production & Reserves Reserves life 15.8 company consistently had very high reserves life for most of the decade (c.14-18 years), and is likely to continue to be so as pre-salt resource is converted into proven reserves. As production evolves and the company incorporates reserves, the aim is to keep the reserve life at the 14 year level, one of industry’s best. 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. Statoil Hess Repsol R.D.Shell ENI Marathon Average ConocoPhillips Chevron Total OMV 8.3 2012 6.6 Statoil 12.7 Repsol 12.8 11.6 Chevron 11.5 R.D.Shell 11.6 10.6 10.4 10.4 10.4 10.0 ENI 11.6 13.2 13.2 12.7 12.3 12.0 OMV 11.8 14.8 Hess 12.1 14.6 Average 12.1 14.0 14.7 ConocoPhillips 12.5 13.6 14.7 Total 12.8 14.6 15.0 BP 16.0 15.4 Marathon 16.9 2011 Petrobras 12.7 17.1 22.1 BG 12.7 16.9 Petrobras ExxonMobil 16.4 11.9 11.8 11.8 11.8 11.4 11.0 10.6 10.3 10.0 Proven oil reserves life rankings (Years) Sector 18.2 14.3 13.5 13.4 2012 8.0 ExxonMobil Industry oil and gas reserves life over time (Years) 2011 14.6 BP Petrobras’ strength is im pressive when it comes to resource potential: the Proven oil and gas reserves life rankings (Years) BG decreasing reserves life from the 12-13 to the 11-12 level, the industry jumped back to 12.8 years of reserve life in 2011, remaining at that level in 2012. Petrobras Im proving reserves life in 2011, stable in 2012. After years of slightly 50 March 2014 LatAm Oil & Gas Equity Research Production & Reserves Reserves replacement ratio Organic oil and gas reserve replacement ratio rankings (3-year average, %) Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 61% OMV Total 77% 91% BP 92% 93% ConocoPhillips R.D.Shell 94% ExxonMobil 101% 97% Chevron Statoil 114% Average 121% Hess 129% Petrobras 137% 137% ENI 51% 50% OMV BP 2012 R.D.Shell 75% 79% 101% 105% 113% 117% 122% 144% 142% 89% Total ConocoPhillips 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Petrobras 74% 83% 2011 91% Repsol 71% 104% ExxonMobil 100% 103% 111% 129% Statoil 77% 105% Average 86% 78% Chevron 120% 101% 141% Hess 92% 128% 2010 ENI 112% 110% 110% 165% 160% BG 161% 177% 186% 167% 186% Petrobras Marathon Sector 2012 Organic oil and gas reserve replacement ratio rankings (yearly average, %) 192% Industry organic oil and gas reserve replacement ratio (3 year average, %) Marathon BG 100% RRR in two of the past 13 years. Yearly numbers can be more volatile as timing for reserve recognition is variable. Taking three-year averages, PBR continues to post 130%+ RRRs, the same level as the more E&P-like companies such as BG and Marathon. 160% … but not for Petrobras. Contrary to the industry, Petrobras was only below 2011 Repsol industry only managed to do it, on a sustainable 3-year average, in six out of the past 13 years. Of those six years, three were in the beginning of the decade. More recently, the industry is increasingly more dependent on inorganic measures (ie acquisitions) to adequately replace reserves. 217% 100% organic reserve replacem ent ratio (RRR) is hard to achieve… The 51 March 2014 LatAm Oil & Gas Equity Research Upstream returns breakdown Returns overview: Profitability vs capital intensity Breaking-down the industry returns profile. In analysing the industry Upstream returns profile, we look at two key elements: profitability and capital intensity. As we have highlighted, the Upstream is generating a similar level of returns in 2012 (c.12%) as it was in 2002, when oil prices were c.$30/bbl, vs c.$110/bbl in 2011. Profitability has gone up.... Higher oil prices meant that Upstream profitability has gone up. Industry EBIDAX/bbl (our best proxy for cash generation) has increased from c.$10/boe to c.$36/boe. Petrobras stands out with a best in class $41/bbl EBIDAX generation. ...but so has capital intensity, and this is key to a flat returns profile despite rising profitability. Upstream spends roughly 90% of cash-generated in 2012, up from 50% in the beginning of the decade. PBR capital deployment has not been dissimilar to that of the industry. Upstream ROGIC over time (%) 40% Sector 35% Petrobras Sector 20% 12.8 11.4 11.3 11.0 8.6 9.8 13.4 10.4 16.4 17.7 60 15% 40 10% 20 5% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 0 Upstream Capex/EBIDAX over time (%) 25.4 23.0 22.0 80 25% Petrobras 21.2 100 Oi price ($/bbl) 30% 0% Upstream EBIDAX per bbl over time (US$/boe) 120 25.5 32.8 33.9 30.3 40.8 41.1 36.6 36.9 Sector 120% 30.0 73% 77% 70% 23.3 19.2 Petrobras 49% 70% 53% 58% 66% 58% 65% 66% 60% 64% 80% 90% 87% 91% 72% 75% 69% 13.0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 52 March 2014 LatAm Oil & Gas Equity Research Upstream returns breakdown Upstream profitability Upstream revenues per boe produced (US$/boe) Upstream net income per boe produced (US$/boe) 2012 49 46 23 2012 Repsol 55 48 BG 64 ExxonMobil 66 ConocoPhillips 68 BP 72 OMV 72 Marathon 72 Hess 73 ENI Total Chevron 74 Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 43 43 42 41 40 35 35 33 29 28 25 2012 22 22 BG Hess Repsol ConocoPhillips BP ExxonMobil OMV Marathon ENI R.D.Shell Total Average Chevron 9 Statoil BG 10 Marathon 11 Repsol 11 Hess 12 ConocoPhillips 13 ExxonMobil 13 R.D.Shell 15 Total 15 Statoil 16 ENI BP Average OMV Chevron Petrobras 18 2011 76 2011 Petrobras 2011 19 80 Upstream EBIT per boe produced (US$/boe) 28 20 81 R.D.Shell 83 Statoil 91 Petrobras expenses (due to higher exploratory success) and lower DD&A (lower depletion, differences in accounting), Petrobras business is the most profitable in the industry. Petrobras is generating close to $10/bbl more net income in Upstream than the average oil company. Another interesting feature is PBR’s oily production profile: Petrobras has the highest revenue per barrel in our universe. Average High profitability. With higher cash-generation per barrel,, lower exploration 53 March 2014 LatAm Oil & Gas Equity Research Upstream returns breakdown Upstream cost structure Costs keep rising. Like capital intensity, costs have been increasing at an average 12% CAGR over the past decade. Upstream cash-costs reached $23/boe in 2012, flat vs 2011 and up from c.$6/boe in 2000. Upstream cash-costs per boe over time (US$/boe) Sector Operating cash-costs vs taxes. When we analyse cash costs before and after taxes, we reach an interesting conclusion. Petrobras cash-costs (including royalties) are the highest in our coverage, probably due to a high $18/bbl of combined royalties + special participation cash costs. This is offset by a lower corporate tax. PBR’s Upstream tax rate of 35% is virtually the lowest in our universe. We note that average tax rate in the industry has been rising from c.45% in 2000 to 56% in 2012, significant and a sign that Governments worldwide are taking a higher toll of oil profits with rising oil prices. Petrobras 34.5 34.8 22.5 22.5 26.5 23.7 14.6 7.9 5.8 7.1 6.3 8.0 10.1 10.6 7.1 8.2 6.1 16.3 18.5 17.2 14.3 10.8 22.9 15.3 16.6 11.6 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 69% 68% 64% 61% 61% 58% 56% 56% 55% 2011 51% 50% 44% OMV Hess Chevron BG Average Repsol ConocoPhillips ENI ExxonMobil Total R.D.Shell 12 2012 38% 35% Petrobras 76% Statoil 13 Total 14 BG 14 Repsol 15 ENI 15 Chevron 17 Marathon 19 OMV 19 ExxonMobil 20 Hess 23 Average 23 BP 23 R.D.Shell ConocoPhillips Petrobras 24 2012 Marathon 2011 Statoil 35 Upstream income tax rates rankings (%) BP Upstream cash-costs per boe rankings (excluding income taxes) (US$/boe) 54 March 2014 LatAm Oil & Gas Equity Research Upstream returns breakdown Upstream capital intensity Capital intensity is key to returns: it has been the reason for a flat returns profile despite rising profitability. Upstream spent roughly 90% of cash-generated in 2012, up from 50% in the beginning of the decade. Yearly performance has been volatile for all the companies, but overall all of them are spending larger portions of cash-flow vs 2000. Upstream capex / EBIDAX over time (%) Sector Petrobras 120% Upstream capex as % of Gross Invested Capital has remained relatively stable through the decade at c.10% level. PBR has presented above-average investment rates since most of the period analysed. F&D costs are lower for Petrobras vs Big Oil, mostly due to prolific acreage leading to high exploratory success (leading to low finding costs) and high reserves accretion. Industry organic F&D costs averaged $23/boe in 2012, close to five times 2000’s $4.7/boe. Higher F&D are testimony not only to cost inflation, but also to the increasingly tougher environments (deepwater, arctic, heavier oil) oil companies need to go to replace reserves. Going forward, this trend could change somewhat as shale increases its importance. Upstream capex / GIC over time (%) Sector 73% 77% 70% 58% 49% 53% 60% 58% 66% 70% 64% 65% 66% 87% 91% 72% 75% 69% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Organic F&D costs over time (3-year average) (US$/boe) Sector Petrobras Petrobras 22.8 18.4 24.0% 15.9 16.5% 10.2%10.2% 9.7% 9.9% 80% 90% 8.8% 9.4% 18.1% 17.0% 10.7%11.9% 18.0% 13.5% 13.4 9.3% 10.9%10.6% 10.4 10.1%12.5%12.9%12.9% 4.7 4.7 3.7 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 8.3 6.3 5.3 3.5 6.5 3.7 19.1 15.3 16.0 16.1 15.5 14.7 14.0 19.8 11.7 9.7 6.6 3.5 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 55 March 2014 LatAm Oil & Gas Equity Research Upstream returns breakdown Upstream capital intensity (cont’d...) 10.2 Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 60% 61% 70% 72% 78% OMV ENI BP Petrobras ExxonMobil Statoil Chevron ConocoPhillips Average Marathon Repsol 2011 21 20 Petrobras Chevron R.D.Shell ConocoPhillips Average Statoil Total OMV 19 19 18 16 14 BP 22 Repsol 23 ENI 23 ExxonMobil 26 Marathon 28 2012 13 BG 36 8% Repsol 8% ExxonMobil 8% Marathon 8% ConocoPhillips 10% ENI 7% BP 10% Total 12% Chevron 11% 14% 2012 28 Average R.D.Shell 13% Petrobras 10% Statoil 12% OMV Total F&D costs rankings (3-year average) (US$/boe) 2011 18% Hess BG 16% Upstream capex / GIC rankings (%) R.D.Shell 3.5 3.6 3.9 2.9 2.5 2.6 2.5 3.6 1.1 1.0 0.9 0.9 0.9 1.0 1.3 1.9 2.3 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Hess 8.0 BG 3.5 6.1 2012 11.4 11.8 11.7 Hess 5.0 12.0 79% 16.5 14.0 84% 89% 97% 101% 110% 2011 115% 136% Dev costs 142% Finding costs Upstream capex / EBIDAX rankings (%) 140% Organic F&D costs over time (3-year average), with F&D split (US$/boe) 56 March 2014 LatAm Oil & Gas Equity Research Downstream Refining overview Refinery cover ratio (Refining capacity / oil & gas production) Long Refining / Short Upstream Refining capacity rankings (kbd) 3,360 1,953 0% ConocoPhillips 0% Marathon 18% Statoil 47% ENI 75% Chevron 80% BP Average Total Repsol 83% 767 ExxonMobil 5,000 4,000 Royal Dutch Shell 3,000 Petrobras 2,000 442 Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 316 Statoil Repsol Chevron Total Average Petrobras BP R.D.Shell ExxonMobil 998 OMV 2,048 ENI 2,107 93% 6,000 2012 Crude oil refined 2011 2,249 93% 2012 Crude oil refined vs oil product sold (kbd) 6,253 2,681 101% R.D.Shell 150% 143% every barrel refined. Globally, refining throughput is at 67% of marketing barrels sold. This ratio is down for the 6th year in a row, as majors continue to rely more on trading to supply marketing networks. two decades as demand shrank and integrated companies continue to divest downstream assets (Conoco spin off of PSX in 2012, Marathon’s spin off of MPC in 2011). 2011 Petrobras More trading. In general, the industry is selling 1.5x barrels of oil product for Spin-off. Both marketing volumes and refining throughput fell to lowest levels in Short Refining / Long Upstream 311% ExxonMobil Downstream positioning, with refining capacity roughly similar to total production. In practice however, Downstream dominates the returns profile of the company as PBR supplies a growing local Brazilian market with loss-making imports subsidised by the company. Repsol/OMV/Exxon/Shell are long Refining, whereas Total/BP/CVX/ENI/Statoil are long Upstream. OMV Integration m atters. Petrobras is theoretically on a neutral Upstream vs Chevron 1,000 EcopetrolOMV ENI Statoil 0 0 YPF Repsol YPF ConocoPhillips Hess 1,000 BP 2,000 3,000 Total 4,000 5,000 6,000 7,000 Oil products sold 57 March 2014 LatAm Oil & Gas Equity Research Downstream Dark Ages in Europe, better elsewhere Dark Ages. Downstream returns peak in 2005-2006 at the 10% level, and have been in continued decline since then. 2012 returns of 3.3% are at decade-lows, skewed by Petrobras’ strong loss-making Downstream. Ex-Petrobras, returns remain tepid at the 5.0% level. Downstream ROGIC over time (%) 15% Declining profitability. The first element for a declining returns profile in 10% Downstream is a structural profitability decline since 2005-2006. Profitability is close to all time low levels at $1.1/bbl, barely profitable, though highly skewed by Petrobras high losses of close to $15/bbl. 5% No capital discipline is the second element for a declining returns profile. Even with a poor returns profile, capital intensity has not decreased significantly over time. Capex was 5% of GIC in 2012, similar to 10-year average. Petrobras capital intensity is close to 3x industry average at 15% of Gross Invested Capital. Excluding Petrobras, the industry invested c.60% of cashflow (EBIDA) generation in 2012, below 2009’s peak 123% but in line with ten-year average. Downstream Net income per barrel sold over time (US$/bbl) Sector 0% Petrobras (5%) (10%) 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Downstream capex / GIC over time (%) 25% 15 Petrobras 10 5 Petrobras 20% Sector 15% 0 10% -5 5% -10 Sector -15 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 0% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 58 March 2014 LatAm Oil & Gas Equity Research Downstream Profitability and capital intensity rankings Illustrating the dam age. All three figures in this slide illustrate well the negative impact of Brazilian fuel pricing policy on Petrobras. Petrobras is by far the least profitable refining business globally (bottom-left chart, net loss of $15/bbl), and is by far the company that shows higher capital intensity (bottom-right, PBR invests almost three times the industry average in Downstream). This has a devastating effect on returns, with PBR ranking on the bottom of our universe (top-right chart). Downstream ROGIC rankings (%) 11% 9% 9% 2011 7% 7% 7% 5% 4% 3% 2012 3% Opportunity? In a way, we could also see this as an ‘opportunity’. Should PBR 0% achieve pricing parity, capital intensity will remain high, but profitability will return more in line to industry average and PBR’s Downstream business can start to become competitive again. Downstream Net income per barrel sold rankings (US$/bbl) 3.0 2.9 2.5 2.1 1.4 1.4 2012 5% 5% 6% 5% 4% Source: Company data, Credit Suisse analysis. Note: all averages are weighted by company scale. 2% ENI Total BP Statoil Chevron Average OMV Repsol Petrobras Petrobras ENI Average Hess Total Repsol BP Statoil ExxonMobil R.D.Shell Petrobras ENI 4% -14.5 OMV R.D. Shell Average Repsol Total 10% 3% Chevron 2012 14% -0.9 2011 Hess Statoil BP OMV 2011 1.1 2% 3% ExxonMobil 3.5 Hess 3.8 Downstream capex / GIC rankings (%) R.D.Shell 3.9 Chevron ExxonMobil -9% 59 March 2014 LatAm Oil & Gas Equity Research The business plan FOTO The long-term : 2030 ‘Petrobras self-sufficient, partners exporting’: this is a simple but yet effective way to see long-term trends of the Brazilian oil sector. From 2020 to 2030, Petrobras expects Brazilian oil production to remain relatively flat at the 5mbpd level. PBR will follow the domestic demand with refinery additions, in a way to be close to fully integrated (PBR oil production = PBR refinery capacity = Brazilian oil product demand, with PBR’s partners and the Government’s share oil being exported). Short-to-m edium term : 2014-2018 We provide a simple view of PBR’s 2014-2018 business plan, including how it has evolved over time and the impact of Graça’s structural programmes in earnings and cash balances. On the plan itself, we make the following observations: (1) a $220bn capex plan is visually better than last year's $236bn, with an optically better mix (E&P is 70% of the capex vs 62% in the last plan); (2) however, a $207bn for projects being implemented / in bidding is virtually flat vs the last plan, and now include the Northeast Premium refineries, which bidding will start in 2014 - a negative, in our view; (3) a FX assumption to finance the plan of BRL/USD 2.231.92 looks aggressive and could generate skepticism in the market; (4) the only true undisputed positive in the plan was a strong 7.5% growth announcement for 2014, with a +-1% range that is tighter than the usual +-2% - which we interpret as a sign of greater management confidence. This is important as it comes at a moment where consensus was turning incrementally negative on production. March 2014 LatAm Oil & Gas Equity Research The business plan The long-term: 2030 ‘Petrobras self-sufficient, partners exporting’: this is a simple but yet effective way to see long-term trends of the Brazilian oil sector. As the chart below illustrates, Brazilian production is expected to more than double from today’s 2mpbd levels, to 5mpbd by 2020, of which Petrobras will be responsible for 4.2mbpd. From 2020 to 2030, Petrobras expects Brazilian oil production to remain relatively flat at the 5mbpd level, and PBR’s share also relatively flat at the 3.7mbpd level. Oil product demand is expected to grow by 2-3% p.a., increasing from today’s 2.3mbpd levels to c.3.0mbpd by 2020 and 3.7mbpd by 2030. PBR will follow the higher domestic demand with refinery additions, in a way to be close to fully integrated (PBR oil production ~ PBR refinery capacity ~ Brazilian oil product demand, with PBR’s partners and the Government’s share of crude oil production being exported). Brazilian oil outlook: crude oil production, oil product demand, and refinery capacity 6 Average oil production in Brazil Petrobras+Third Parties+Government 2020-2030: 5.2 millions bpd Oil Products Self-sufficiency: Total throughput = Total demand 5 Million bpd 4 Volumes Self-sufficiency: Oil production = oil products consumption Petrobras average oil production in Brazil 2020-2030: 3.7 million bpd Average demand for oil products in Brazil 2020-2030: 3.4 million bpd 3 2 1 0 2013 2014 2015 2016 2017 2018 2019 Throughput in Brazil Source: Petrobras. 2020 Brazil 2021 2022 2023 2024 Oil Products Demand in Brazil 2025 2026 2027 2028 2029 2030 Petrobras 61 March 2014 LatAm Oil & Gas Equity Research The business plan The short-medium term: 2014-2018 Business plan budgets over time ($bn) $224bn $225bn 2014-2018 business plan budget split (%) $237bn $237bn $221bn $174bn $112bn A budget that is optically down 7% YoY masks a flat budget 'under implementation/bidding' ($207bn), with the inclusion of the Premium refineries – a negative in our view. $87bn $54bn Another optically positive is the higher E&P mix and lower Downstream mix in the new plan vs the past. If we look at the projects under implementation, the mix barely changed from the previous plan Downstream 18% G&P 5% International 4% Biofuels 1% Distribution 1% Others E&P 70% 1% 5-year E&P plan over time: steady increase ($bn and %) E&P spend 57% $49bn $74bn Downstream E&P share 51% 5-year Downstream budget over time ($bn and %) $105bn 58% 60% $65bn $28bn Source: Petrobras, Credit Suisse analysis. $154bn $142bn $148bn $128bn 70% $119bn 62% 60% 57% 53% $71bn Downstream share $66bn $65bn $43bn $13bn $22bn 24% 25% $39bn $30bn 26% 25% 33% 31% 28% 27% 18% 62 March 2014 LatAm Oil & Gas Equity Research The business plan ‘In implementation’ vs ‘under evaluation’ and financing of the plan Projects under implementation in the past three business plans ($bn and %) $209bn $207bn $207bn $19bn $17bn $14bn 25% $52bn 21% $43bn 19% $39bn 66% $138bn 71% $147bn 74% $154bn 2012-2016 plan 2013-2017 plan E&P Downstream Dividing the business plan budget in ‘projects under implementation’ and ‘projects under evaluation’ was an initiative from the current management team. When we analyse this part of the plan, the past three plans look incredibly similar, with c. $207-209bn of projects being implemented (compatible with a c.$40bn/year spend), with roughly 70% dedicated to E&P and 20% to refining. RNEST, COMPERJ and the Premium refineries remain much contested projects by investors from an economic perspective 2014-2018 plan Others Financing of the business plan ($bn and %) $207bn $207bn $10bn $11bn $10bn $9bn $6bn $21bn $182bn $165bn 2013-2017 plan Net cash flow New issuance Source: Petrobras. Cash 2014-2018 plan Divestments / business models Both 2013-2017 and 2014-2018 plans have similar budget levels, but are financed differently. The 2014 version counts with a much higher percentage of cash from operations, and less debt issuances (a difficult assumption to see without meaningful price increases, in our view). A 2.23-1.92 BRL/USD rate in the new could be seen as aggressive by the market, with a strong BRL vs current 2.4 levels. Even though, in the long term, Petrobras would benefit from a stronger dollar (as a net oil exporter with domestic prices following international levels in USD), in the short term the company is negatively affected as a net importer, with most revenues in BRL. This is important given the current situation of the balance sheet. 63 March 2014 LatAm Oil & Gas Equity Research The business plan Divisional summary E&P 5-year capex summary ($bn and %) Product Development 112.5 (73.1%) Logistics for Oil 1.4 (3%) Refining Capacity Expansion 16.8 (43%) Downstream US$ 38.7 billion Gas and Power capex summary ($bn and %) Regas – LNG 0.1 (1%) Energy 1.3 (13%) Projects Under Im plem entation Projects Under Im plem entation RNEST (Pernambuco) UNF III (Mato Grosso do Sul) UNF V (Minas Gerais) Route 2: Gas pipeline and NGPU Route 3: Gas pipeline and NGPU COMPERJ 1st phase (RJ) Gas, Energy and Gas-Chemical US$ 10.1 billion PROMEF - 45 Vessels to transport Oil and Oil Products Premium I - 1st phase (Maranhão) Premium II (Ceará) Operational Improvement 9.4 (24%) Source: Petrobras. Total with Partners US$ 198.7 billion (100%) Projects Under Bidding Process Quality and Conversion 5.5 (14%) E&P Partners US$ 44.8 billion (23%) Pre-Salt (concession + ToR + Libra) 82.0 (60%) Downstream capex summary ($bn and %) Fleet Expansion 3.3 (9%) Post-Salt 53.9 (40%) Infrastructure and Support, 18.0 (11.7%) Exploration 23.4 (15.2%) Distribution 0.3 (1%) Corporate 0.3 (1%) Logistics for Ethanol 0.4 (1%) Petrochemical 1.4 (4%) E&P Petrobras US$ 153.9 billion (77%) Production Development + Exploration RS$ 135.9 billion Total E&P RS$ 152.9 billion Gas-Chemical Operational Units (Nitrogenous 2.6 (25%) Network 6.1 (61%) 64 March 2014 LatAm Oil & Gas Equity Research The business plan Graça’s programmes: PROCOP, PROEF, PRODESIN, INFRALOG, PRC-Poço Impact of structural programmes in PBR’s net income (R$bn) Impact of structural programmes in PBR’s cash balances (R$bn) R$ -9.7 billion (-41%) 23.6 R$ +14.7 billion (+47%) 46.3 4.3 +130 kbpd 3.3 2.1 +100 kbpd +63 kbpd 8.9 0.8 0.7 4.3 13.9 31.6 Structural programmes gains are equivalent of exports results of +293 kbpd of crude oil 2013 Net Income PROCOP Operating Costs Optimization Program PRODESIN Divestment Program PROEF Program to Increase Operational Efficiency of UO-BC and UO-RIO PROCOP in lifting costs (R$/boe) 34.8 +0.78% p.a. 32.7 2014 Cash Position 2013 PRODESIN Divestment Program PROCOP in Downstream logistics (R$/bbl) -5.9% p.a. -7.2% p.a. 2013 Net Income without Structuring Program 27.3 24.2 2018 INFRALOG Integrated Management of Logistics Projects PRC Poço Program to Reduce Well Costs PROCOP Cash Position Operating Costs without Optimization Structuring Program Programs PROCOP in refining costs (R$’000/UEDC) +1.32% p.a. 10.8 1,177 10.5 +0.12% p.a. 10.1 10.1 2014 2018 1,029 1,240 1,013 -0.40% p.a. 2014 2018 Gains from PROCOP reduce Lifting Cost Gains from PROCOP reduce Logistic Cost Gains from PROCOP reduce Refining Cost Optimization of routine processes and resources used in the production of oil & gas. Integrating common and interdependent activities among refineries. Excellence level in the management of material and spares. Reduction in shipping costs simplification of customs procedures; optimization of fuel consumption; and implementation of new management tools. Adequacy of overhead. Optimization of inventory level of oil and oil products. Optimization in the consumption of energy, catalyzers and chemicals. Reduction of stored water in the logistics system. Without PROCOP Source: ANP data, Credit Suisse Research analysis. Optimized use of support resources. With PROCOP 65 March 2014 LatAm Oil & Gas Equity Research A little more on Upstream FOTO Braz ilian Pre-Salt We provide a brief recap of the pre-salt, a new oil province discovered in 2006 and which has been one of the major new oil frontiers globally. In 2005-2010, Brazil was 62% of new deepwater discoveries globally, led by the pre-salt. Only in the Santos basin (there is also pre-salt oil production in Campos and Espirito Santo), there is a potential 23bn bbls of oil from the concession, transfer of rights and Libra areas. The pre-salt currently represents ‘only’ around 7% of Petrobras’ production, but its importance is expected to rise to 50% by 2020. We also provide a brief overview of geology and the main technological challenges to explore hydrocarbons below 2km of salt layer. Ten fields to rem em ber A lot of investor attention is given to Petrobras’ new projects and upcoming platforms. These of course do matter, as are the source of future capacity addition, and thus production. However, we think little attention is given to the existing fields. And these do matter: despite having one of the largest production bases in the world, Petrobras’ output is extremely concentrated around very large fields. We provide useful detail on 10 selected fields that represent almost 70% of Petrobras current oil production. Of the 10 fields we chose, 9 are among the top-ten producers in Brazil (Marlim, Marlim Sul, Marlim Leste, Roncador, Jubarte, Barracuda, Albacora, Lula and Baleia Azul), and the remaining one will be a large producer and at the same time illustrates the challenges of the pre-salt and project implementation (Sapinhoá). March 2014 LatAm Oil & Gas Equity Research Brazilian Pre-Salt What, Where and Who What. The pre-salt has been one of the major new oil frontiers globally. In 20052010, Brazil was 62% of new deepwater discoveries globally, led by the pre-salt. Santos pre-salt map, key blocks, discoveries and PBR partners Where and who. There are currently 16 major pre-salt blocks in the Santos BM-S-11 (Lula, Iara and Cernambi): Petrobras (65%) BG (25%) Petrogal (10%) basin, holding ‘at least’ 23bn bbls of oil: – 10bn bbls in 9 blocks in the concession regime (BM-S-8, 9, 10, 11, 21, 22, 24), one of which was recently relinquished by Exxon (BM-S-22). Petrobras partners in those blocks are BG, Petrogal, Repsol-Sinopec, QGEP and Barra Energia. – 5bn bbls in 6 blocks acquired by Petrobras in 2010 as part of the Transfer of Rights (ToR) transaction (by order of size: Franco, Surround Iara, Florim, Northeast of Tupi, South of Guara, South of Tupi). Petrobras owns 100% of the areas. – 8-12bn bbls in Libra, auctioned in 2013 as part of the first pre-salt auction under the new PSC terms. Shell (20%), Total (20%), CNOOC (10%) and CNPC (10%) are the partners. Cam pos and Espirito Santo too. Most pre-salt resources are located in the Santos basin, but there is also pre-salt oil in Campos basin (beneath existing post-salt reservoirs and producing platforms) and also in the border with Espirito Santo basin in Parque das Baleias. Libra Petrobras (40%) Total (20%) Shell (20%) CNOOC (10%) CNPC (10%) BM-S-10 Petrobras (65%) BG (25%) Partex (10%) Atlanta Oliva Franco Libra Cernambi Florim BM-S-8 Petrobras (66%) Petrogal (14%) Barra Energia (10%) QGEP (10%) BM-S-10 Parati Surround Iara Iara NE of Tupi Lula Carcará Carioca Bem-te-vi Júpiter Sapinhoá South of Tupi Biguá Global oil discoveries (2005-2010): 34bn bbls Abaré Abaré Oeste Others 49% Deepwater 51% Source: Petrobras, ANP, Credit Suisse Research. Other countries 38% BM-S-21 Caramba Braz il 62% BM-S-9 (Sapinhoá and Carioca) Petrobras (45%) BG (30%) Repsol Sinopec (25%) Peroba South of Guará Producing units BM-S-24 (Júpiter) Petrobras (80%) Petrogal (20%) Transfer of Rights Libra Units to start production Pre-salt concession 67 March 2014 LatAm Oil & Gas Equity Research Brazilian Pre-Salt Pre-salt’s early history It all started in 2000 and 2001, when PBR and partners participated in the 2nd Key pre-salt blocks, discoveries, partners and size and 3rd licence rounds and won the rights to explore 9 blocks in the Santos basin. Of the 9 blocks, PBR was the operator with a majority 45-80% stake in 8 of them. The remaining block was BM-S-22, operated and already relinquished by Exxon. In 2001, the largest 3D seismic programme at the time was hired to cover the area. In 2003, seismic interpretation started to corroborate with the thesis that there could be hydrocarbons beneath the salt layer. The decision to drill, however, was more difficult given the high costs involved in drilling a UDW well, 300km from the coast, below a 2km salt-layer and total depth of more than 6,000m. Drilling go-ahead was taken in 2003, and in March 2004 the Parati well in BM-S-10 was chosen as the first location, and drilling started December 2004. Above the salt-layer, Parati found a water-bearing reservoir, but gas shows led to the decision of keeping drilling to reach the pre-salt. The well finished July 2006 and found gas condensate. Parati results motivated Petrobras to drill Tupi in 2006, opening up one of the world’s largest exploratory frontiers to date. Block 100 Parati Tupi Jun-06 Sep-06 90 Tupi Sul Carioca Caramba Jul-07 Sep-07 Dec-07 Júpiter Bem-te-vi Guará Iara Jan-08 May-08 Jun-08 Aug-08 Iguaçu Iracema Abaré W Tupi NE Declaration of Recoverable Commerciality volume Discoveries BM-S-8 PBR (66%), Petrogal (14%), QGEP (10%), Bem-te-vi, Biguá, Barra (10%) Carcará BM-S-9 Petrobras (45%), BG (30%), Repsol (25%) BM-S-10 Petrobras (65%), BG (25%), PAX (10%) Petrobras share price and key pre-salt discoveries (US$/ADR) 110 Consortium Requested Extension to ANP Dec-11 Dec-13 Sapinhoá (Guará) Carioca 2.1bn bbls - Mar-16 - Lula (Tupi) BM-S-11 Petrobras (65%), BG (25%), Petrogal (10%) Cernambi (Iracema) Iara Dec-10 Dec-10 Dec-13 6.5bn bbls 1.8bn bbls 3-4bn bbls BM-S-21 Petrobras (80%), Petrogal (20%) Caramba Apr-15 - BM-S-24 Petrobras (80%), Petrogal (20%) Petrobras (100%) ToR PBR (40%), Shell (20%), Total (20%), Libra CNOOC (10%), CNPC (10%) Jupiter 7 Blocks Feb-16 Sep-14 5bn bbls Libra Dec-17 8-12bn bbls Apr-09 Jun-09 Sep-09 Nov-09 Guará N Tupi OW Franco Tupi Alto Mar-10 Apr-10 May-10 Jun-10 Iracema N Tupi SW Libra Tupi W Oct-10 Oct-10 Oct-10 Dec-10 80 70 Parati - Carioca NE Macunaíma Iara-Horst Guará S Biguá Abaré Jan-11 Feb-11 Mar-11 Jul-11 Nov-11 Nov-11 60 50 Carioca Sela Franco NW Carcará Tupi NE Dolomita S Iara W Sul de Guará Franco SW Júpiter NE Carioca N Feb-12 Feb-12 Mar-12 Mar-12 Apr-12 Apr-12 Jun-12 Aug-12 Oct-12 Oct-12 40 30 20 10 Jan-06 Jun-06 Nov-06 Apr-07 Sep-07 Source: Petrobras, IPEA, Credit Suisse, Woodmac. Feb-08 Jul-08 Dec-08 May-09 Oct-09 Mar-10 Aug-10 Jan-11 Jun-11 Nov-11 Apr-12 Sep-12 Feb-13 Jul-13 68 March 2014 LatAm Oil & Gas Equity Research Brazilian Pre-Salt Importance for PBR’s production profile PBR production mix: pre-salt gaining share The pre-salt will be a key part of PBR’s future growth. Out of the 38 platforms Petrobras is adding in the 2013-2020 period, 26 are in pre-salt areas. Currently pre-salt production is around 7% of Petrobras’ total. Petrobras has an aspiration to increase that share to 42% by 2017 (35% pre-salt concession, 7% ToR), and to 50% by 2020 (31% pre-salt concession, 19% ToR), without including any production for Libra. In addition to production, pre-salt could change PBR’s E&P profitability in a couple of ways: (1) higher productivity means that Lula’s lifting cost today is almost half PBR’s c.$15/bbl average; (2) ToR areas will not have SPT, which was already paid by PBR, and (3) when Libra comes in, a PSC will result in lower profitability vs current fiscal terms. Pre-Salt (Concession) Post-Salt 2012 New Discoveries 2017 2.0 million bpd 2020 2.75 million bpd 7% 4.2 million bpd 7% 58% Transfer of Rights 6% 44% 19% 93% 35% 31% Petrobras production profile 4.5 CS estimates 10%+ p.a. growth after 2016 Historical production 4.0 3.5 7%+ p.a. growth until 2016 No growth since 2010 Espadarte Cd. Rio de Janeiro 100kbd Polvo 90kbd Piranema 30kbd Golfinho Cd. Vitória 100kbd Marlim Leste P-53 180kbd Golfinho Cd. Vitoria 100kbd Roncador P-52 180kbd Siri Pilot Cd. Rio das Ostras 15kbd Roncador P-54 180kbd Marlim South P-51 180kbd 2007 2008 Source: Petrobras, Credit Suisse. Tupi South Cid Sao Vicente 30kbd Frade Frade FPSO 100kbd Marlim Leste Cd. Niteroi 100kbd Lula Pilot Cd. Angra dos Reis 100kbd Sapinhoa Pilot Cd São Paulo 120kbd FPSO Capixaba Cachalote/Balei a Franca 100kbd Camarupim Cid Sao Mateus 25kbd Sidon / Tiro Atlantic Zephyr 20kbd Parque das Conchas 100kbd Jubarte FPSO P-57 180kbd 2009 Lula NE Cd Paraty 120kbd 2010 Papa – Terra P-63 150kbd Roncador P-55 180kbd Marlim Sul SS P-56 100kbd 2011 Baleia Azul Cid Anchieta 100kbd 2012 Bauna / Piracaba Cid Itajai 80kbd 2013 Franco (Buzios) 2 P-75 150kbd Sapinhoá Norte Cid. Ilhabela 150kbd (Start-up Q3) Franco (Buzios) 1 P-74 150kbd Iracema Sul Cd. Mangaratiba 150kbd (Start-up Q4) Papa – Terra P-61 & TAD (Start-up Q2) Roncador module 4 P-62 180kbd (Start-up Q2) 2014e Lula Norte P-67 150kbd Franco (Buzios) 3 (NW) P-76 150kbd Carioca (Lapa) Cd. Caraguatatuba 100kbd Iara Horst P-70 150kbd Lula Sul P-66 150kbd Pq. Baleias P-58 FPSO 180kbpd (Start-up Q1) Lula Central Cid Saquarema 150kbd Iracema Norte Cd Itaguai 150kbd (Start-up Q3) 2015e Franco (Buzios) 4 (Sul) P-77 150kbd Lula Alto Cd Marica 150kbd 2016e Lula Oeste P-69 150kbd Tupi NE P-72 150kbd 3.0 2.5 Entorno de Iara P-73 150kbd Iara NW P-71 150kbd Sul Pq Baleias Carcará Deepwater Espirito Santo 2.0 1.5 Pre-Salt + Libra Transfer of Rights Post-Salt FPSOs already contracted Florim Libra Lula Ext Sul + ToR Sul de Lula Deepwater P-68 Sergipe I 150kbd Tartaruga Verde e Mestiça 2017e mnbpd Petrobras targets Deepwater Sergipe II Maromba Franco (Buzios) 5 (Leste) Marlilm Revitali II Marlim Revital I Júpiter Espadarte III 2018e 2019e 2020e 69 Brazilian Pre-Salt Geology & Challenges Ocean Production platforms (FPSOs) need to (1) have larger production facilities to deal with higher flow of oil; (2) have more complex topsides to treat high CO2 and H2S contents; (3) have more robust mooring systems to resist higher tensions and riser weight March 2014 LatAm Oil & Gas Equity Research Historically PBR used flexible risers for most developments. In a minority of pre-salt fields, hybrid or rigid solutions are required given a higher level of wax and contaminants in the oil (CO2, H2S) and the lack of flexibles qualification to resist high pressure and low temperature for the full life of the field. The first hybrid installation is occurring in Tupi NE and Sapinhoá, after substantial delays and overruns from supplier Subsea7. Petrobras is conducting a number of pilot tests to develop subsea oil, water gas gas separation, reinjection of produced water into the seabed, gas-lift technology enhancement, subsea gas compression, oil boosting from the seabed, and a new generation of electric submersible pumps capable of working in UDW conditions. 0m 3.000m Post Salt Salt A thick salt-layer with heterogeneous mechanical properties, in addition to high depths, presents a significant challenge for drilling, well casing and geometry. The first pre-salt well, Parati, took 1year and 3 months to be completed. Today average pre-salt drilling time is 150 days. Only in 2013, six years after the Parati well, was PBR able to perform horizontal drilling (85o angle) through the salt-layer Pre-salt Large Campos basin fields such as Marlim, Albacora and Roncador have high porosity/permeability sandstone reservoirs. Oil quality is heavy, c.20oAPI. Some post salt reservoirs, such as Papa-Terra and BS-4, are more challenging due to even heavier oil (15oAPI) and shallow reservoir – both which would call for TLPs rather than FPSO development The salt layer is a barrier for traditional seismic to illuminate hydrocarbons. Advanced seismic techniques such as wide-azimuth (WAZ) shooting were required before oil companies could ‘see’ through the salt. The most tangible example has been Shell relinquishing part of the BS-4 block that contained the Franco pre-salt discovery because of lack of proper seismic imaging. PBR has recently specifically highlighted the greater precision obtained in the ToR areas by WesternGeco’s Coil Shooting technique. 4.000m 6.000m Pre-salt reservoirs are mainly microbialite carbonates, less known and more heterogeneous rocks than Campos’ basin sandstones. While so far the reservoirs have shown to be extremely potent and productive, it is still unknown how the reservoirs will respond to water and gas injection, and how fast decline will be. Pre-salt oil, contrary to Campos, is light, in the high 20s-30oAPI. 7.000m Source: Credit Suisse Research. 70 March 2014 LatAm Oil & Gas Equity Research Ten fields to remember PBR’s 10 most important fields They are im portant. Historically, a lot of investor attention is given to Petrobras’ new projects and upcoming platforms. These of course are important as a source of future capacity addition, and thus production. However, we think little attention is given to the existing fields. And these do matter: despite having one of the largest production bases in the world, Petrobras’ output is extremely concentrated around very large fields. We selected 10 fields that are already producing that represent almost 70% of Petrobras current oil production. Of the 10 fields we chose, 9 are among the top-ten producers in Brazil (Marlim, Marlim Sul, Marlim Leste, Roncador, Jubarte, Barracuda, Albacora, Lula and Baleia Azul), and the remaining one will be a large producer and at the same time illustrates the challenges of the pre-salt and project implementation (Sapinhoá). Table with 10-fields production, ranking of production, reserves, and play type Production Ranking Field (2013) Oil Oil % of PBR Production reserves Basin Production (kbd) (mmbbl) Marlim Sul 291 15% 1,002 Campos Post-salt 22 Roncador 245 13% 1,297 Campos Post-salt 33 Marlim 177 9% 536 Campos Post-salt 44 Jubarte 138 7% 771 Campos Pre and Post salt 55 Marlim Leste 108 6% 268 Campos Post-salt 66 Barracuda 107 6% 278 Campos Post-salt 77 Baleia Azul 63 3% 406 Campos Pre and Post salt 88 Lula 63 3% 8,172 99 Albacora 58 3% 186 22 22 Sapinhoá 13 Source: ANP, Woodmac, Credit Suisse Research. 1% 1,797 Pre-salt Campos Post-salt Santos 1,400 70% 1,200 60% 1,000 50% 800 40% 600 30% 400 20% 200 10% Play type 11 Santos ‘Ten fields’ oil production and importance to Petrobras (production in kbd, share in %) Pre-salt 0 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 0% MARLIM MARLIM SUL RONCADOR MARLIM LESTE ALBACORA BALEIA AZUL BARRACUDA JUBARTE LULA SAPINHOÁ % of total 71 March 2014 LatAm Oil & Gas Equity Research Ten fields to remember Marlim Oil production by vintage (kbd) 600 2013 Ownership Location Peak Production Oil Quality Petrobras 100% Campos Basin 595 kbd (2002) 18-24º API Remaining Reserves Water Depth Oil: 536mmbbls 650-1,050 Gas: 5bcf meters With initial reserves estimated at 2.7bn bbls, Marlin was Petrobras largest discovery until the emergence of the pre-salt. After peak production of 595kbd in 2002, the field has declined c.12% per year since, which led to increased efforts to improve productivity, including infill drilling and a 4D seismic programme, and also the Varredura project – Petrobras has made the pre-salt Brava discovery in 2010, below Marlim reservoirs. 2012 2011 2010 Small amount of wells drilled post 2008 coupled with natural decline 400 300 200 100 0 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Average well production by vintage (kbd) 600 25 20 400 P-37 300 P-35 P-33 P-26 P-20 P-19 P-18 200 100 pre 2009 500 Oil production by platform (kbd) 500 2009 Sharp decline of most wells drilled post-2008 2012 15 0 Jan-05 Dec-05 Nov-06 Oct-07 Sep-08 Aug-09 Jul-10 Jun-11 May-12 Apr-13 Source: ANP, Woodmac, Credit Suisse Research. 2009 10 pre 2009 2011 2013 5 2010 0 Jan-05 Dec-05 Nov-06 Oct-07 Sep-08 Aug-09 Jul-10 Jun-11 May-12 Apr-13 72 March 2014 LatAm Oil & Gas Equity Research Ten fields to remember Marlim Sul Oil production by vintage (kbd) 350 Ownership Location Oil Quality Remaining Reserves Water Depth Petrobras 100% Campos Basin 13-27º API Oil: 1,0bn bbls Gas: 261bcf 1,159-1,874 meters Marlim Sul has a similar size to neighbour Marlim, with 1.8bn bbls of initial reserves. Both fields were discovered only two years apart, but Marlim’s development took priority due to a thinner and more heterogeneous reservoirs at Marlim Sul. The field was developed in two phases. Phase 1 started in 2001 and aimed at exploring reserves at up to 1,500m water depth. Phase two started in 2011 with the P-56 platform. Good productivity of new P-56 wells led to an increase in production 300 2013 2012 250 200 2010 150 2009 100 Pre - 2009 50 0 Jan-05 Dec-05 Nov-06 Oct-07 Sep-08 Aug-09 Jul-10 Jun-11 May-12 Apr-13 Oil production by platform (kbd) Average well production by vintage (kbd) 350 30 300 25 250 P-56 P-56 2011 Good productivity and slow decline of wells drilled in 2011-2013 20 2009 2010 2011 2012 200 15 150 100 50 P-51 P-51 P-26 and others FPSO Marlim Sul P-40 P-40 0 Jan-05 Dec-05 Nov-06 Oct-07 Sep-08 Aug-09 Jul-10 Jun-11 May-12 Apr-13 Source: ANP, Woodmac, Credit Suisse Research. pre 2009 10 2013 5 0 Jan-05 Dec-05 Nov-06 Oct-07 Sep-08 Aug-09 Jul-10 Jun-11 May-12 Apr-13 73 March 2014 LatAm Oil & Gas Equity Research Ten fields to remember Marlim Leste Oil production by platform (kbd, LHS) and average well (RHS) 200 180 Ownership Location Oil Quality Petrobras 100% Campos Basin 23º API 180 160 160 Oil: 268mmbbls Gas: 98bcf 933-2,444 meters 120 25 100 20 20 Flat number of producing wells 18 20 5 FPSO Cidade de Niteroi 0 Oil production by vintage (kbd, LHS) and number of wells (RHS) 200 12 120 100 10 100 8 80 6 60 40 4 40 20 2 20 20 Number of wells count 180 120 Source: ANP, Woodmac, Credit Suisse Research Others 0 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12 Sep-12 May-13 140 0 10 40 160 0 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12 Sep-12 May-13 15 60 14 60 P- 53 80 140 Total 30 140 16 80 35 Water Depth Oil production (kbd, LHS) and average production per well (RHS) Average prduction per well (bbl/day) Average well production Cid. De Niteroi Remaining Reserves Marlim Leste is smaller than Marlim and Marlim Sul, with c.470mmbbls of initial oil reserves, and still 270mmbbls remaining. Given the smaller size versus the larger fields, Marlim Leste full-development occurred 22 years after discovery. Discovery was roughly at the same time as Marlim and Marlim Sul in the late 80s, but definitive units FPSO Cidade de Niteroi and P-53 only started in 2008-2009. There is also one producing pre-salt well in the Tracaja discovery linked to P-53. Average well production has seen a strong decline, with current 6kbd being half of 12kbd in 2010. 200 40 Decline of old wells connected to Cid. de Niteroi 18 16 2011 2012 2013 2010 14 12 10 8 2009 Pre - 2009 0 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12 Sep-12 May-13 6 4 2 0 74 March 2014 LatAm Oil & Gas Equity Research Ten fields to remember Roncador Oil production by platform: P-55 and P-62 to come online in 2013 and 2014 (kbd) 400 Ownership Location Oil Quality Remaining Reserves Water Depth Petrobras 100% Campos Basin 18-31º API Oil: 1,3bn bbls Gas: 338bcf 1,700 meters Maintenance in P-54 350 300 250 P-54 200 With initial oil reserves of 2bn bbls and remaining reserves of 1.3bn bbls, Roncador is one of Petrobras’ most important fields, something illustrated by the fact there are two additional large units to start-up late 2013/early 2014 (P-55 and P-62, both 180kbd). Given its size, the field will be developed in four phases: (1) starting 1999 with P-36, which sank due to a gas explosion in 2011, and Brasil and P-52, starting 2002/2007; (2) With P-54 in 2007 to explore the heavier oil in the Southwest, and modules 3 (P-55, Southeast) and module 4 (P-62, South/Central) upcoming. 150 P-52 100 Maintenance in P-52 50 FPSO Brasil 0 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Oil production (kbd, LHS) and number of wells (RHS) Average production by well (kbd, LHS) and number of wells (RHS) 400 35 16 35 350 30 14 30 300 25 250 200 150 20 Number of wells count (RHS) 25 10 15 Flat number of wells, declining productivity Oil production (LHS, kbd) 0 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Source: ANP, Woodmac, Credit Suisse Research. 10 6 4 20 Average production per well (LHS, kbd) 8 100 50 12 15 10 Number of wells count (RHS) 5 2 0 0 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 5 0 75 March 2014 LatAm Oil & Gas Equity Research Ten fields to remember Barracuda Oil production by platform (kbd) 200 180 Ownership Location Peak Production Petrobras 100% Campos Basin 163 kbd (2006) Oil Quality Remaining Reserves Water Depth 160 25º API Oil: 278mmbbl Gas: 50bcf 800-873 meters 120 140 With 710mmbbls of initial reserves, full production started in late 2004, reaching a peak in 2006. Barracuda has so far produced 60% of initial reserves. The field is facing an average 10% decline in observed production, though development drilling on the eastern flank of the field with P-48 provided a rise in production in 2011-2012. Like many other fields in the Campos basin, there is pre-salt potential below existing post-salt reservoirs in the Nautilus discovery (made in 2010). Oil production (kbd, LHS) and average well production (RHS) 200 180 160 Average well production (RHS, kbd) Well additions on P-48 offset declining productivity 140 120 100 80 60 40 20 Oil production (LHS, kbd) 0 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Source: ANP, Woodmac, Credit Suisse Research. Maintenance in P-43 100 P-48 80 60 P-43 40 20 Others 0 Jan-05 Dec-05 Nov-06 Oct-07 Sep-08 Aug-09 Jul-10 Jun-11 May-12 Apr-13 Average well production (kbd, LHS) and number of wells (RHS) 12 12 30 10 10 8 8 20 6 6 15 4 4 2 2 0 0 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 25 Number of wells (RHS) Average production per well (LHS, kbd) 10 5 0 76 March 2014 LatAm Oil & Gas Equity Research Ten fields to remember Albacora Average well production by vintage (kbd) 8 Ownership Location Peak Production Petrobras 100% Campos Basin 156 kbd (1999) Remaining Reserves Water Depth 19-29º API Oil: 186mmbbl Gas: 6bcf 380-590 meters 6 Albacora is a historically important field for Petrobras. Discovered in the mid 1980’s, one year before Marlim, it led Petrobras to shift its focus to deepwater turbidite sandstones. Given a wide range of water depths within the field, Petrobras opted for a phased development. Production 1987, peaked in 1999 with the second phase, and has been in a c. 7% decline since then. As part of the Varredura project, Petrobras made a small 50mmbbls discovery in 2011, which has yet to be tested. Other initiatives such as raw seawater injection are currently being tested in the field. Oil production (kbd, LHS) and average well production (RHS) 140 2013 2012 2011 120 2010 2009 pre 2009 Well productivity (RHS, bbls/day) 5 4 2009 3 2 pre 2009 1 2012 0 Jan-05 Dec-05 Nov-06 Oct-07 Sep-08 Aug-09 Jul-10 3,500 3,000 140 80 2,000 80 60 1,500 60 40 1,000 40 20 500 20 Source: ANP, Woodmac, Credit Suisse Research. 0 Maintenance in P-25 and P-31, ended in June 120 100 0 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jun-11 May-12 Apr-13 Oil production by platform (kbd) 2,500 100 2011 Low well productivity in a very mature field 7 Oil Quality P-50 P-31 P-25 Others 0 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 77 March 2014 LatAm Oil & Gas Equity Research Ten fields to remember Parque das Baleias: Baleia Azul Oil production per well (kbd) 35 Ownership Location Petrobras 100% Campos Basin Oil Quality 17º (post-salt) 30º (pre-salt) Remaining Reserves Water Depth Oil: 406mmbbl Gas: 14bcf 1,338-1,348 meters Baleia Azul is a medium sized (c.400mmbbls) oil field located within Petrobras Parque das Baleias complex, northern Campos basin. Other fields in Parque das Baleias are Jubarte, Cachalote, Baleia Franca and Baleia Ana. Parque das Baleias is interesting because it contains significant pre-salt oil reserves, to the tune of 1.52.0bn bbls, in addition to the known post-salt. Baleia Azul reserves are c.60% presalt. Field production started in 2012 already focused on the pre-salt, via FPSO Cid Anchieta, and P-58 to start-up soon. Post salt will be targeted in 2014 with P-34. Fields within the Parque das Baleias (Whale’s Park) complex BM-C-25 BM-C-25 Argonauta Baleia Azul 20 7BAZ6ESS 15 10 7BAZ2ESS 5 7BAZ3ESS 0 Sep-12 Nov-12 Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13 Total and average well production (kbd, LHS) and well-count (RHS) 6 70 Number of wells (RHS) 5 4 50 Nautilus 40 3 30 Mangangá Average well production (LHS, kbd) 20 Caxareu Pirambu 6BRSA631DBE SS 60 Baleia Franca Jubarte 25 80 Cachalote Baleia Anã ES 7BAZ4ESS 30 C-M-61 Oil production (LHS, kbd) 2 1 10 0 0 Sep-12 Source: ANP, Woodmac, Credit Suisse Research. Nov-12 Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13 78 March 2014 LatAm Oil & Gas Equity Research Ten fields to remember Parque das Baleias: Jubarte Oil production (kbd, LHS) and number of wells (RHS) 200 180 Ownership Location Oil Quality Petrobras 100% Campos Basin 17º (post-salt) 30º (pre-salt) Remaining Reserves Water Depth Oil: 771mmbbl Gas: 20bcf 1,245-1,347 meters Like Baleia Azul, Jubarte is a field within Parque das Baleias that has both post-salt and pre-salt reserves. Pre-salt is estimated at c. 30% of total initial reserves. Postsalt development started in 2002 via an EWT. A pilot project using FPSO JK (P-34) went from 2006 to 2012, producing from both pre and post-salt. End 2010, two units started: P-57 targeting the post-salt, and FPSO Capixaba targeting the pre-salt. FPSO Cid de Anchieta started in 2013, draining pre-salt oil mostly from Baleia Azul, but also a smaller part from Jubarte. FPSO P-58 is due to start-up by year end 2013, and will produce from both pre-salt and post-salt, also a unit that will drain oil from Baleia Azul and Jubarte. Oil production by platform (kbd) 160 Decline offset by the increasing number of producing wells 14 120 12 100 10 Number of wells (RHS) 80 60 160 100 60 20 2 0 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 15 0 Strong decline of P-57 wells since 2010 2010 pre 2009 2012/13 P-57 10 Maintenance in FPSO JK 40 20 6 4 20 120 8 40 180 FPSO Cidade de Anchieta to produce from Jubarte, Baleia Azul and Pirambu fields 16 140 25 140 18 Oil production (LHS, kbd) Average well production by vintage (kbd) 200 80 20 5 FPSO JK 0 Jan-05 Dec-05 Nov-06 Oct-07 Sep-08 Aug-09 Jul-10 Source: ANP, Woodmac, Credit Suisse Research. FPSO Capixaba Jun-11 May-12 Apr-13 2011 0 Jan-05 Dec-05 Nov-06 Oct-07 Sep-08 Aug-09 Jul-10 Jun-11 May-12 Apr-13 79 March 2014 LatAm Oil & Gas Equity Research Ten fields to remember Lula (former Tupi) Scheduled maintenance, ended in June Well-by-well production (kbd) 35 Ownership Location Petrobras: 65% BG: 25% Petrogal: 10% Oil Quality Remaining Reserves Water Depth Santos Basin 28º API Oil: 8,172mmbbl Gas: 3,934bcf 2,200 meters 30 140 Number of wells (RHS) 120 20 3 Oil production (LHS, kbd) 2 1 20 0 Sep-10 0 Feb-11 Jul-11 Dec-11 Source: ANP, Woodmac, Credit Suisse Research. May-12 Oct-12 Mar-13 3BRSA496RJS 9BRSA908DRJS 10 5 9BRSA716RJS 7LL3DRJS 0 Sep-10 Jan-11 May-11 Sep-11 Jan-12 May-12 Sep-12 Jan-13 May-13 Sep-13 140 FPSO Cid. de Paraty 120 100 80 40 6 4 Average pruduction per well (LHS, kbd) 15 Oil production per FPSO (kbd) 5 100 60 7LL11RJS 25 Discovered in 2006, Lula was not the first pre-salt discovery (it was Parati), but surely the most prominent. With 8bn bbls, the field will be developed with 8 FPSOs, with upside for more. Lula wells are producing at 20-30kbd and since 2010 when full-development started with FPSO Cd Angra dos Reis, there has been no decline observed. FPSO Cd Paraty recently started up in the NE flank, but with only one well due to delays with the hybrid riser system. There is an ongoing discussion between Petrobras and the ANP regarding the connectivity of Lula and Cernambi, which is important due to fiscal treatment implications (if Lula and Cernambi are treated as one field, higher Special Participation Tax is due). Oil production, average production per well and number of producing wells (kbd) High quality wells: slow decline and high production Aug-13 80 60 40 FPSO Cid. de Angra dos Reis 20 0 Sep-10 Feb-11 Jul-11 Dec-11 May-12 Oct-12 Mar-13 Aug-13 80 March 2014 LatAm Oil & Gas Equity Research Ten fields to remember Sapinhoá (former Guará) Oil production (kbd): only one flexible riser producing so far 35 30 Ownership Location Petrobras: 45% BG: 30% Repsol: 25% Oil Quality Santos Basin 28-30º API Remaining Reserves Water Depth 25 Oil: 1,797mmbbl Gas: 1,209bcf 2,141 meters 20 Discovered in 2008 and holding 2.1bn bbls, Sapinhoá is not the largest pre-salt discovery, but its reservoirs are understood to be the best in the whole pre-salt. So far two FPSOs are ascribed to the field: Cid de Sao Paulo (started in 2013) and Cid de Ilhabela (due 2014). Together with Lula NE, Sapinhoá is facing strong delays in the supply and installation of the hybrid riser systems (buoys), provided by Subsea7. Both FPSOs (Cd Paraty in Lula NE and Cd Sao Paulo in Sapinhoá) are currently producing from one flexible riser each. With each well capable of producing more than 20kbd, the delays cost Petrobras 60kbd of production in 2013. 15 10 5 0 1-Jan 1-Feb 1-Mar 1-Apr 1-May 1-Jun 1-Jul 1-Aug 1-Sep 1-Oct 1-Nov Illustration of a hybrid riser system FPSO Flexible jumpers Buoy Steel Catenary Risers Due to the characteristics of the fields, Lula NE and Sapinhoa required the use of relatively new hybrid technology, a departure from PBR’s widely used flexible riser systems. Providor Subsea7 faced numerous delays and overruns with its $1bn workscope. Initial deadline was for mid’12, whereas most likely date now is end’14 Mooring lines Wellheads Source: ANP, Woodmac, Credit Suisse Research. 81 March 2014 LatAm Oil & Gas Equity Research A little more on Downstream FOTO Refineries overview In theory, Brazil is a great market for refineries to be set up. The market is large, it grows, and it’s just next to large oil reserves in the Campos and Santos basin, taking much of logistics and raw material purchase issues. In practice, government influence on prices have eroded the economics, and lack of inter-regional logistics and higher obstacle to build refineries in the NE (the highest growing region with a regional supply gap) further increases costs of the Downstream business in Brazil. Downstream demand Brazil’s transportation matrix is extremely road-dependent. Together with Brazil’s continental size, a high dependence on road-transportation is a strong driver of diesel demand. Add to that incentives to the automotive industry (7% p.a growth in the fleet), and you have a complete equation of diesel demand in Brazil. Gasoline being pretty much driven by the light-vehicle fleet in Brazil, demand has been highly correlated to the rise in the income of the middle class (together with reduction of taxes for purchase of vehicles). Easy substitution between gasoline and ethanol are now increasingly a reality, with the ethanol+flex-fuel fleet being 50% of total light vehicle fleet. Therefore, effects in the ethanol industry have an implication for the gasoline market in Brazil. Distribution In this section we provide the evolution of the consumer price of gasoline, diesel and LPG, across Brazil, alongside a breakdown of the constituents of the pump price. The data gives interesting insights into the fuel pricing dynamics in Brazil, for instance: (1) the multiplier effect of higher refinery prices into sometimes higher distribution and resale margins, state taxes, offset by the decrease in Federal taxes (CIDE) to keep a lid on inflation; (2) on the LPG side, Petrobras prices have remained flat, alongside distributors profitability, but that has not prevented wider cost inflation to push LPG bottles’ prices from increasing; (3) higher profitability of gasoline than diesel due to the large scale nature of diesel consumers commanding stronger pricing power; (4) different profitability amongst regions within Brazil (higher convenience needs in the S/SE can command higher prices in the region, higher white-flag competition in the Northeast keeps a lid on profitability, whereas in the North, despite higher informality, a low-density network of distribution channels and resellers gives them better pricing power, making margins in the North one of the highest in the country). March 2014 LatAm Oil & Gas Equity Research Refineries overview Old refineries and poor distribution infrastructure Refinery capacity (kbd) • REMAN (built in 1949) • LUBNOR (1966) • RPCC (2009) 393 • RNEST (2014) 281 252 239 195 189 172 151 • RLAM (1956) • REGAP (1968) • REDUC (1961) • REVAP (1980) • REPAR (1977) • RPBC (1952) • REFAP (1968) 36 8 Output of refined products over time (kbd) 2,500 1,500 1,000 500 0 Jan-00 Oct-01 Other Source: Credit Suisse research based on Petrobras and the ANP. 46 2,000 • REPLAN (1972) • RECAP (1954) 53 Jul-03 Naphtha Apr-05 Jan-07 Oct-08 LPG Fuel Oil Jul-10 Gasoline A Apr-12 Diesel 83 March 2014 LatAm Oil & Gas Equity Research Refineries overview Southeast surplus, Northeast deficit Theory. In theory, Brazil is a great market for refineries to be set up. The market is large, grows, and is just next to large oil reserves in the Campos and Santos basin, taking much of the logistics and raw material purchase issues. Practice. In practice, there have been a couple of problems with the Brazilian downstream market. Firstly, and most importantly, government influence on prices have eroded the economics. Secondly, even though now Brazil is a net importer of diesel and gasoline, regional supply-demand is not balanced. A high concentration of refining capacity in the Southeast has created a surplus in that region and a deficit in the Northeast. As a country, we could have two options: (1) keep building in the SE but increase interregional distribution, which is poor; (2) build refineries in the Northeast – which recent experience has proved problematic – Abreu e Lima will have total costs of c.$20bn, vs an initial budget of c.$2bn. The lack of infrastructure in the Northeast makes building a refinery in the NE in theory more expensive than in the SE. Gasoline production and consumption per region (kbd) Consumption Diesel consumption and production per region (kbd) Production Production Surplus in the Southeast Production 537 312 245 400 Fastest growing regions: high expansion in disposable incom e coupled with lack of production 110 107 195 181 NE Source: Credit Suisse research based on the ANP. Data for 2013. 156 107 51 120 96 35 8 0 S Abreu e Lima refinery to increase Northeast production capacity 104 65 SE Consumption MW N 14 0 SE S NE MW N 84 March 2014 LatAm Oil & Gas Equity Research Refineries overview Southeast overview Southeast: Refinery capacity and product yield (kbd) • REGAP (1968) • REDUC (1961) • REVAP (1980) • REPLAN (1972) • RPBC (1952) 450 400 350 300 250 200 150 100 50 0 • RECAP (1954) REPLAN REVAP REDUC RPBC REGAP Other Naphtha LPG Fuel Oil Gasoline A Diesel and gasoline production surplus in the Southeast (kbd) Southeast: Output of refined products over time (kbd) 200 1,400 RECAP Diesel 1,200 Diesel 150 1,000 800 100 600 400 50 200 Gasoline A 0 Jun-00 Feb-02 Oct-03 Jun-05 Source: Credit Suisse research based on the ANP. Feb-07 Oct-08 Jun-10 Feb-12 0 Jan-00 Nov-01 Sep-03 Jul-05 May-07 Mar-09 Jan-11 Nov-12 Other Naphtha LPG Fuel Oil Gasoline A Diesel 85 March 2014 LatAm Oil & Gas Equity Research Refineries overview North and Northeast overview North/Northeast: Refining capacity and product yield (kbd) • REMAN (built in 1949) • LUBNOR (1966) • RPCC (2009) • RNEST(2014) • RLAM (1956) 300 250 200 150 100 50 0 RLAM Other REMAN Naphtha Fuel oil RPCC Gasoline LUBNOR Diesel Consumption of oil distillates: N/NE highest growing regions Index (2000 = 100) North/Northeast: Output of refined products over time (kbd) 185 175 165 155 145 135 125 115 105 95 85 400 350 300 250 200 150 100 50 2000 2002 Midwest 2004 2006 2008 2010 Northeast North Southeast Source: Credit Suisse research based on the ANP. 2012 South 0 Jan-00 Dec-01 Nov-03 Oct-05 Sep-07 Diesel Gasoline A Fuel Oil Aug-09 Jul-11 Jun-13 Naphtha Other 86 March 2014 LatAm Oil & Gas Equity Research Downstream demand Diesel demand driven by economic activity, Gasoline by income Diesel consumption per region (kbd) 1,200 Diesel consumption growth among regions is more evenly distributed than gasoline, where the North-NE grow disproportionally more (income effect) 1,000 800 600 Diesel consumption x Industrial production index (2002 = 100) (kbd and index ) 1,100 CAGR North Midwest 5% 4% Northeast 5% South 3% 400 Southeast 4% Apr-02 Jul-04 Oct-06 Jan-09 900 140 130 800 120 110 700 600 500 400 300 900 North Midwest 8% 6% Northeast 7% 700 South 5% 600 Southeast 100 Jul-04 Oct-06 Sep-01 May-03 Jan-05 Sep-06 May-08 90 Jan-10 80 Sep-11 May-13 1,000 CAGR 2,500 Seasonal increase during year end due to 13rd salary income boost and vacation period Jan-09 Source: Sindicom; Credit Suisse Research based on the ANP. Apr-11 3% 2,000 800 500 200 Apr-02 Diesel (kbd, LHS) Gasoline and Ethanol consumption vs average income in Brazil (kbd of gasoline equivalent, BRL) Growth in gasoline consumption is concentrated in North, Midwest and Northeast regions 800 100 600 500 Jan-00 Apr-11 Gasoline consumption per region (kbd) 0 Jan-00 150 Industrial production (index, RHS) 1,000 700 200 0 Jan-00 160 1,500 Fuel consumption (kbd, LHS) Average Income (R$, RHS) 400 300 Jan-02 1,000 500 Jul-03 Jan-05 Jul-06 Jan-08 Jul-09 Jan-11 Jul-12 87 March 2014 LatAm Oil & Gas Equity Research Downstream demand Diesel demand fueled by transportation matrix and fleet growth Hit the road. As we show on the top-right chart, Brazil’s transportation matrix is extremely road-dependent. Together with Brazil’s continental size, a high dependence on road-transportation is a strong driver of diesel demand. Add to that incentives to the automotive industry (7% p.a growth in the fleet), and you have a complete equation of diesel demand in Brazil. For those reasons, there is a high correlation between diesel demand and economic activity in Brazil. Transportation matrix in selected countries (%) 17% 25% 4% 43% 13% 11% 37% 46% 25% 43% 58% Brazil Licensing of new diesel vehicles (thousand units) 420 Heavy Vehicles 140 70 0 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 Source: Credit Suisse Research. China Road Rail 32% Canada USA Water & Others 8% Russia 123 Road-intensive transportation matrix and continental dimension puts Brazil as 3rd largest consumer in the road sector 33 32 31 28 210 43% Consumption of diesel in the road sector (kt of oil equivalent) 2000-2012 CAGR: 7% 280 Australia 50% 81% 17 15 15 15 14 13 11 10 9 9 6 5 5 5 4 4 4 3 3 3 United States India Brazil France Germany Canada Saudi Arabia Russia Mexico Korea Indonesia Thailand Australia Poland Turkey Egypt Vietnam South Africa Malaysia Philippines Colombia Sweden Peru Chile Venezuela 350 Light Vehicles 53% 11% 88 March 2014 LatAm Oil & Gas Equity Research Downstream demand Gasoline and Ethanol are substitutes Incom e. Gasoline being pretty much driven by the light-vehicle fleet in Brazil, demand has been highly correlated to the rise in the income of the middle class (together with reduction of taxes for purchase of vehicles). Flex -fuel. Gasoline-ethanol substitution is also an important factor to monitor. Easy substitution by drivers is now increasingly a reality: ethanol + flex fuel cars now represent c.50% of the light vehicle fleet, a strong increase vs the 20% back in 2005. In general terms, if hydrous ethanol is being sold at any price below 70% the price of gasoline at the pump, consumer will use ethanol. The ratio is based on the energy efficiency of the two fuels. Ethanol. Therefore, effects in the ethanol industry have an implication for the gasoline market in Brazil. For instance, from 2010-2012, high sugar prices and a weak harvest made sugarcane producers shift ethanol production to sugar, putting a cap on ethanol supply, and forcing all the growth of the market to de catered by gasoline imports. In this spirit, incentives to the ethanol industry are crucial to ensure adequate ethanol supply, and in turn decrease the gasoline import needs from Petrobras. Gasoline and hydrous ethanol consumption (kbd) 900 Growth in Fuel demand answered by ethanol 800 700 100 0 Jan-00 4 Flex fuel and ethanol went from 21% of the fleet in 2005 to c.50% in 2012, and is expected to rise to 68% by the end of the decade 3 20 2 10 1 0 2005 2006 2007 2008 Gasoline Fleet, LHS Ethanol fleet, LHS 75% 70% 2009 2010 2011 2012 0 Flex fuel, LHS Net additions to flex fuel, RHS Gasoline more competitive Max. Parity 65% 400 200 30 80% Pressure on Gasoline C demand due to high ethanol prices at the pump Gasoline C 300 40 Price parity in São Paulo between Gasoline C and Ethanol (%) 600 500 Light vehicles fleet by fuel type (mn vehicles) 60% 55% Hydrous Ethanol Oct-01 50% Jul-03 Apr-05 Jan-07 Source: UNICA, Bloomberg, Conab, Credit Suisse Analysis. Oct-08 Jul-10 Apr-12 Price ratio Ethanol m ore com petitive 45% Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12 Sep-12 89 March 2014 LatAm Oil & Gas Equity Research Distribution Pricing overview Domestic gasoline pump prices breakdown (%) Domestic diesel pump prices breakdown (%) 18% Resale and distribution 13% Anhydrous ethanol cost 27% ICMS (state tax) 7% CIDE, PIS/ PASEP, CONFINS (Federal taxes) 35% Refinery gasoline price (Petrobras) Gasoline pump prices comparison across countries (US$/liter) 16% 4% 14% 6% Resale and distribution Biodiesel cost ICMS (state tax) CIDE , PIS/ PASEP, CONFINS (Federal taxes) 60% Refinery diesel price (Petrobras) Domestic LPG consumer price breakdown (%) 2.6 2.2 1.9 1.5 Resale / Distribution margin Taxes 1.1 0.7 Anhydrous ethanol Refinery price Source: Petrobras, ANP, MME, Credit Suisse Research. Brazil Uruguay Chile Argentina USA Canada China Japan UK Germany 0 Italy 0.3 56% Resale and distribution 12% 5% ICMS (state tax) CIDE, PIS/ PASEP, CONFINS (Federal taxes) 27% Petrobras price realisation 90 March 2014 LatAm Oil & Gas Equity Research Distribution Consumer price dynamics The charts in this slide show an average of the consumer price of gasoline, diesel and LPG, across Brazil, alongside a breakdown of the constituents of the pump price. Even with the caveat that prices are Brazil-wide (and therefore different pricing strategies within regions and an increasing mix to the North/NE could pollute the trends), we find the data gives an interesting insight into the dynamics of the fuel pricing policy in Brazil. Petrobras’ prices of gasoline, diesel and LPG are not increasing fast enough (gasoline and diesel) or not increasing at all (LPG). When Petrobras does increase prices, we see somewhat a multiplier effect, with sometimes higher distribution and resale margins, and an offsetting effect from a decrease in federal taxes (CIDE). A changing ethanol (20-25%) mix also has an impact on pump prices. On the LPG side, increasing resale and distribution ‘margins’ have been pushing prices higher, despite relatively flat taxes and Petrobras LPG prices. This however seems not to come from distributors higher profitability (Ultrapar, a listed company with business in LPG distribution, has struggled to keep profitability of the business flat in the past five years) but rather from wider cost inflation or even some regional mix effects. Gasoline pump price evolution over the years (R$/liter) 3.0 Local taxes 2.5 1.0 Federal Taxes Transportation costs Resale margin Distribution margin Anhydrous ethanol 0.5 Gasoline 2.0 1.5 0.0 May-08 Apr-09 Mar-10 Feb-11 Jan-12 Dec-12 Nov-13 LPG consumer price evolution over the years (R$/bottle) Diesel pump price evolution over the years (R$/liter) 45 2.5 40 35 30 Local Taxes Federal Taxes Transportation Costs Resale Margin 2.0 Distribution Margin 1.0 25 20 15 Federal Taxes Transportation costs Resale margin Distribution margin Biodisel 1.5 Diesel 10 LPG 5 0 May-08 Local taxes Apr-09 Mar-10 Source: MME, Credit Suisse Research. Feb-11 Jan-12 Dec-12 Nov-13 0.5 0.0 May-08 Apr-09 Mar-10 Feb-11 Jan-12 Dec-12 Nov-13 91 March 2014 LatAm Oil & Gas Equity Research Distribution Distribution, resale and refinery price trends In this slide we analyse Brazilian wide trends for refinery prices, and compare them with distribution and resale margins. On the top right chart, we illustrate a relatively known fact: gasoline is more profitable than diesel, and resellers, on a per liter basis, make more money than distributors. Gasoline margins are higher than diesel due to less consumer pricing power of individuals driving cars vs large corporations fueling their fleet or diesel-consuming industries. On the charts in the bottom, we illustrate a more general trend of rising distribution margins, alongside higher refinery prices. Distribution margins have been increasing in the past years for a number of reasons, formalisation of the industry, better competitive practices from key incumbent players (BR, Ipiranga, Raizen), but also due to increase (albeit not as frequently as PBR needs) refinery prices, which makes it easier for distributors and resellers to have pricing power with customers. The volatility in the distribution margins in the charts below, in our view, also reflects other factors such as monthly regional mix in sales. As we will see in the next slides, different regions command different profitability over time for both distributors and resellers (a number of factors come into play here – higher convenience needs in the S/SE can command higher prices in the region, higher white-flag competition in the Northeast keeps a lid on profitability, whereas in the North, despite higher informality, a low-density network of distribution channels and resellers gives them better pricing power, making margins in the North one of the highest). Distribution margin (R$/l) 0.16 0.14 Gasoline 0.12 0.10 0.08 0.30 0.25 Diesel resale margins 0.20 Gasoline distribution margins 0.15 0.10 Diesel distribution margins 0.05 0.00 May-08 1.60 1.40 1.20 1.00 0.80 0.60 0.40 0.06 0.20 0.04 May-08 Feb-09 Nov-09 Aug-10 May-11 Feb-12 Nov-12 Aug-13 0.00 Source: MME, Credit Suisse Research. 0.35 Jan-09 Sep-09 May-10 Jan-11 Sep-11 May-12 Jan-13 0.16 Distribution margin (R$/l) Distribution margin Gasoline resale margins 0.40 Sep-13 Diesel margins vs refinery price (R$/liter) Gasoline refinery price (R$/l) 0.18 0.45 1.80 1.60 0.14 1.40 Diesel 1.20 0.12 0.10 0.08 1.00 0.80 Distribution margin 0.60 0.40 Diesel refinery price (R$/l) Gasoline margins vs refinery price (R$/liter) Gasoline and diesel distribution and resale margins (R$/liter) 0.20 0.06 May-08 Feb-09 Nov-09 Aug-10 May-11 Feb-12 Nov-12 Aug-13 0.00 92 March 2014 LatAm Oil & Gas Equity Research Distribution Which region is more profitable? Gasoline distribution margins by region (R$/liter) Gasoline resale margins by region (R$/liter) 0.30 0.50 N 0.25 0.45 0.20 MW 0.40 SE 0.15 NE 0.35 0.10 S 0.05 0.00 May-08 N NE Sep-09 SE 0.25 MW Jan-09 0.30 May-10 Jan-11 Sep-11 May-12 Jan-13 Sep-13 0.20 May-08 S Jan-09 Sep-09 May-10 Jan-11 Sep-11 Diesel distribution margins by region (R$/liter) Diesel resale margins by region (R$/liter) 0.35 0.33 0.30 0.27 N 0.25 MW SE 0.21 0.10 0.00 May-08 0.19 Sep-09 Source: MME, Credit Suisse Research. May-10 Jan-11 Sep-11 May-12 S NE MW 0.17 S Jan-09 SE N 0.23 0.05 Sep-13 0.29 0.25 0.15 Jan-13 0.31 NE 0.20 May-12 Jan-13 Sep-13 0.15 May-08 Jan-09 Sep-09 May-10 Jan-11 Sep-11 May-12 Jan-13 Sep-13 93 March 2014 LatAm Oil & Gas Equity Research Distribution The market share game Brazil Distribution market share Market share evolution 40% 22% Other 22% 30% 4% 20% 10% 19% North/ Northeast/ Mid-West 33% 0% Jan-09 Nov-09 Sep-10 50% 27% 4% North/Northeast/Mid-West 40% 30% 20% 14% 10% 41% 0% Jan-09 Oct-09 Jul-10 Apr-11 Jan-12 Oct-12 Jul-13 14% South/ Southeast Jul-11 May-12 Mar-13 South/SE 27% 20% 4% 21% 28% 30% 25% 20% 15% 10% 5% 0% Jan-09 Oct-09 Jul-10 Apr-11 Jan-12 Oct-12 Jul-13 Other Source: Credit Suisse research based on Sindicom. 94 March 2014 LatAm Oil & Gas Equity Research Distribution The fight against the white flags Brazil Number of gas stations (thousands) and white flag market share Current share of number of Gas stations 5% WF share 19% White-flag 39% 38% 16% 9% Other 12% North/ Northeast/ Mid-West 42% 41% 40% 39% Branded 22.8 21.9 22.7 23.5 24.3 White-flag 14.0 15.8 15.6 15.7 15.5 2008 2009 2010 2011 2012 49% 48% 47% 46% 7.4 7.0 7.5 7.8 8.2 6.0 6.7 6.8 7.1 7.1 2008 2009 2010 2011 2012 38% 37% 35% 34% 15.4 14.8 15.2 15.7 16.1 7.9 9.1 8.8 8.6 8.4 2008 2009 2010 2011 2012 4% 20% North/Northeast/Mid-West 46% 45% 9% 8% 13% South/SE South/ Southeast 5% 19% 34% 34% 21% 14% 7% Other Source: Credit Suisse research based on Sindicom. White-flag Branded WF share 95 March 2014 LatAm Oil & Gas Equity Research Understanding Gas & Power FOTO The black-box Gas & Power is one of Petrobras’ least known business, partly because of its smaller size relative to E&P and R&M, but also because of complexity. Results are volatile, and rising energy prices can actually imply in lower profitability for the business. It is therefore, a business hard to understand and to model. In three slides, we provide a simple but effective overview of G&P, a first step for the market to try to better understand this business. March 2014 LatAm Oil & Gas Equity Research Understanding Gas & Power A brief overview G&P and Petrobras Revenues of c.$12bn and EBITDA of c. $2bn Natural Gas Revenues 8.2% Revenues of c. $8bn Three main markets for natural gas are: - Industrial, commercial and retail customers - Thermoelectric generation - Petrobras refineries and fertilizer plants c. 65% of revenues Power 91.8% Revenues of c. $3.7bn Petrobras has participation c. 30% of revenues EBITDA in Thermopower, wind and small-scale hydroelectric plants 6,235 MW of installed capacity 7.2% Fertilizers c. 5%of revenues 92.8% G&P Revenues of c.$600m The company is focused on the production of ammonia and urea for the Brazilian market Petrobras ex-G&P Source: Petrobras, Credit Suisse research. 97 March 2014 LatAm Oil & Gas Equity Research Understanding Gas & Power The Gas Supply Sources of natural gas supply (%) 11% LNG 36% Domestic production 53% Imported from Bolivia Natural gas pipeline network Pipeline networks footprint Total Natural Gas supply of 75MM3/d LNG Pecem LNG Bahia LNG Baía de Guanabara Three main markets Petrobras natural gas pipeline network has a total extension of 9,190 km The company invested $13bn between 2006 and 2012 22% Gas-fired power plants The integrated system centered around two main interlinked pipeline networks allows the company to deliver natural gas from main offshore natural gas producing fields in the Santos, Campos and Espírito Santo Basins, as well as from three LNG Terminals (one of which is under construction), and a gas pipeline connection with Bolivia 25% Internal consumption 53% Local distribution companies Natural gas demand (%) Total Natural Gas sales of 55MM3/d and internal consumption of 19MM3/d Gas contracts Gas is sold primarily to distribution companies and to power plants generally based on standard take-or-pay long term supply contracts (72% of total sale volumes) where the prices are indexed to an international fuel oil basket. Petrobras also has contracts designed to create flexibility in matching customers demand. These include flexible and interruptible long-term gas supply contracts, auction mechanisms for short-term contracts, weekly electronic auctions and a new gas sale contract, which consists of a seller delivery option aiming to help balance natural gas supply and demand in case of a low dispatch of natural gas from power plants. Source: Credit Suisse research based on Petrobras. 98 March 2014 LatAm Oil & Gas Equity Research Understanding Gas & Power The Power Brazil installed capacity by type (%) Brazil installed capacity by operator (%) Brazil installed capacity of 134,912 MW as of February 2014 CESP, 7% CEMIG, 6% Eletrobrás, 30% Thermo power, 19% Itaipu, 6% Tractebel, 6% Hydro, 63% Petrobras, 6% Biomass, 8% Copel, 4% CPFL, 2% AES Tietê, 2% Duke Energy, 2% Wind, 2% Imports from Itaipú (Hydro), 8% Petrobras currently operates 21 thermopower plants. There are roughly three types of contracts/needs under which Petrobras sells its certified power capacity: (1) contracts in auction power (standby availability), (2) bilateral contracts with free customers and (3) energy for PBR own needs. – Under the standby availability contracts, the power plants shall produce energy whenever requested by the national operator. In this type of contract, in addition to a capacity payment, the plants also receive from the Electric Energy Trading Chamber (CCEE) a reimbursement for its declared variable costs incurred whenever they are called to generate electricity. – Under merchant bilateral contracts, Petrobras sells the energy at market prices in contracts usually adjusted by inflation, and usually under longerterm contracts. Source: ANEEL, Tractebel, Petrobras. Others, 29% Volumes of electricity sold by Petrobras MW avg 2012 2011 2010 Total sales commitments 4,438 3.991 3,853 2,318 2,000 2,024 423 395 438 1,697 1,596 1,391 Generation volume 2,699 653 1,837 Revenues (US$ mm) 3,755 2,336 2,752 Bilateral merchant contracts Self-production Standby-availability 99 March 2014 LatAm Oil & Gas Equity Research Petrobras financial statements FOTO March 2014 LatAm Oil & Gas Equity Research Key Petrobras financials P&L Group P&L 2006 2007 2008 2009 2010 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 2019E 2020E Revenues USDm 72,837 87,606 126,186 91,355 121,178 146,213 143,561 141,153 142,650 159,948 169,049 183,033 208,243 236,121 228,652 COGS USDm (43,575) (53,617) (85,597) (54,519) (77,302) (99,963) (107,384) (108,206) (113,791) (122,483) (123,220) (140,274) (154,550) (170,121) (169,972) SG&A USDm (5,330) (6,414) (8,224) (7,281) (9,464) (10,537) (9,921) (9,885) (10,053) (10,254) (10,459) (10,669) (10,882) (11,100) (11,322) Exploration costs, write-offs USDm (958) (1,549) (2,489) (2,001) (2,157) (2,651) (4,016) (2,984) (2,804) (2,804) (2,804) (2,804) (2,804) (2,804) (2,804) Other expenses (R&D, others) USDm (3,533) (5,179) (5,092) (4,491) (5,518) (5,874) (5,711) (4,168) (4,500) (4,500) (4,500) (4,500) (4,500) (4,500) (4,500) EBIT USDm 19,442 20,847 24,784 23,064 26,737 27,187 16,529 15,909 11,502 19,907 28,065 24,786 35,507 47,597 40,054 Financial income USDm 1,095 1,288 2,064 1,753 2,579 3,918 3,694 1,811 855 804 988 1,147 1,391 1,694 2,037 Financial expense USDm (1,712) (1,691) (2,851) (2,927) (1,881) (1,450) (2,015) (2,683) (1,913) (2,360) (2,657) (2,941) (3,214) (3,295) (3,283) FX variation & others USDm 4 (1,616) 2,973 (245) 759 (2,395) (3,579) (1,999) 0 0 0 0 0 0 0 Associates USDm (107) (350) (217) (42) 118 231 43 507 200 200 200 200 200 200 200 EBT USDm 18,721 18,478 26,753 21,603 28,311 27,492 14,672 13,545 10,644 18,550 26,596 23,192 33,883 46,196 39,008 Income taxes USDm (5,476) (5,790) (8,858) (4,989) (6,952) (6,731) (3,466) (2,383) (3,193) (5,581) (7,811) (6,762) (10,156) (13,860) (11,704) Minorities & employee contribution USDm (1,315) (1,640) 537 (2,124) (1,365) (813) (399) (250) (250) (250) (250) (250) (250) (250) (250) Net income USDm 11,930 11,048 18,432 14,491 19,994 19,948 10,807 10,912 7,202 12,719 18,536 16,180 23,478 32,086 27,055 number of ADRs millions 4,387 4,387 4,387 4,387 6,522 6,522 6,522 6,522 6,522 6,522 6,522 6,522 6,522 6,522 6,522 number of shares millions 8,774 8,774 8,774 8,774 13,044 13,044 13,044 13,044 13,044 13,044 13,044 13,044 13,044 13,044 13,044 Earnings per ADR (EPADR) $/ADR 2.72 2.52 4.20 3.30 3.07 3.06 1.66 1.67 1.10 1.95 2.84 2.48 3.60 4.92 4.15 EPS R$/sh 2.95 2.45 3.87 3.30 2.70 2.55 1.62 1.81 1.38 2.51 3.76 3.38 5.05 7.11 6.17 Tax rate % 29% 31% 33% 23% 25% 24% 24% 18% 30% 30% 30% 30% 30% 30% 30% EBIT margin % 27% 24% 20% 25% 22% 19% 12% 11% 8% 12% 17% 14% 17% 20% 18% EBITDA margin % 32% 29% 25% 33% 28% 25% 19% 21% 17% 21% 25% 25% 28% 31% 29% Revenue YoY growth % 20% 44% (28%) 33% 21% (2%) (2%) 1% 12% 6% 8% 14% 13% (3%) EBITDA YoY growth % 10% 20% (4%) 14% 9% (27%) 7% (14%) 38% 25% 6% 29% 25% (8%) EPADR YoY growth % (7%) 67% (21%) (7%) (0%) (46%) 1% (34%) 77% 46% (13%) 45% 37% (16%) P&L metrics Memo: EBITDA reconciliation EBIT USDm 19,442 20,847 24,784 23,064 26,737 27,187 16,529 15,909 11,502 19,907 28,065 24,786 35,507 47,597 40,054 DD&A USDm 4,522 5,493 6,538 7,384 8,455 10,622 11,105 13,179 13,425 14,424 14,987 20,838 23,234 25,809 27,343 Impairment and others USDm (551) (520) (228) (476) (918) (537) (369) 63 0 0 0 0 0 0 0 EBITDA USDm 23,413 25,820 31,094 29,972 34,274 37,273 27,265 29,151 24,927 34,330 43,052 45,623 58,740 73,405 67,397 Source: Credit Suisse estimates. 101 March 2014 LatAm Oil & Gas Equity Research Key Petrobras financials Cash-flow statement Cash-flows, CS adjusted EBITDA Tax payments (P&L) Deffered tax payments, other adjustments Cash earnings Inventories increase (-), decrease (+) Receivables increase (-), decrease (+) Payables increase (+), decrease (-) Working capital movements USDm USDm USDm USDm USDm USDm USDm USDm 2006 23,413 (5,476) 0 17,937 0 2007 25,820 (5,790) 245 20,276 (2,452) (818) 4,081 811 2008 31,094 (8,858) 2,592 24,828 1,398 300 (713) 985 2009 29,972 (4,989) 159 25,142 (3,776) (3,094) 4,364 (2,506) 2010 34,274 (6,952) 3,292 30,614 447 (2,147) (742) (2,441) 2011 37,273 (6,731) 3,687 34,229 (3,266) (2,833) 1,327 (4,772) 2012 27,265 (3,466) 2,171 25,970 555 1,863 612 3,030 2013 29,151 (2,383) 150 26,918 335 2,043 (1,394) 984 2014E 24,927 (3,193) 150 21,883 0 0 0 0 2015E 34,330 (5,581) 150 28,898 0 0 0 0 2016E 43,052 (7,811) 150 35,390 0 0 0 0 2017E 2018E 2019E 2020E 45,623 58,740 73,405 67,397 (6,762) (10,156) (13,860) (11,704) 150 0 0 0 39,011 48,584 59,545 55,693 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 CFO Capex Divestments CFI USDm USDm USDm USDm 17,937 21,087 25,814 22,636 28,173 29,457 29,000 27,901 21,883 28,898 35,390 39,011 48,584 59,545 55,693 0 (21,265) (28,325) (34,480) (41,573) (41,584) (40,440) (45,388) (41,420) (41,420) (41,420) (41,420) (41,420) (41,420) (41,420) 3,824 4,500 4,500 0 0 0 0 0 0 (21,265) (28,325) (34,480) (41,573) (41,584) (40,440) (41,564) (36,920) (36,920) (41,420) (41,420) (41,420) (41,420) (41,420) Free-cash-flow to the firm (FCFF) Financial expenses (cap + expensed) Financial income Issuance of debt Repayment of principal Equity issuance Dividend payment CFF USDm USDm USDm USDm USDm USDm USDm USDm 17,937 0 0 0 0 0 0 0 (178) (2,257) 1,427 4,549 (6,169) 0 (4,009) (6,459) Change in cash before FX variation FX, accounting change Change in cash and equivalents Capex breakdown Exploration & Production Refining, Transportation and Marketing Gas & Power International Distribution Biofuel Corporate PBR capex Reported capex USDm USDm USDm 17,937 (6,637) 1,284 (5,353) (265) (533) (799) 3,401 6,306 9,707 18,313 (1,197) 17,116 (4,935) (847) (5,782) (4,459) 497 (3,963) (126) (4,092) (4,217) USDm USDm USDm USDm USDm USDm USDm USDm USDm 7,049 1,925 721 3,296 296 0 417 13,703 0 9,459 4,947 830 3,376 858 0 449 19,919 21,265 13,403 5,495 2,077 3,333 303 0 674 25,286 28,325 15,410 8,254 3,281 3,417 318 0 1,153 31,832 34,480 18,424 15,913 2,775 2,711 509 0 1,505 41,836 41,573 20,510 16,238 2,304 2,659 693 301 737 43,441 41,584 21,923 14,724 2,126 2,601 667 153 733 42,927 40,440 27,775 14,231 2,740 2,374 519 149 553 48,341 45,388 Source: Credit Suisse estimates. (2,511) (11,844) (13,400) (12,127) (11,440) (13,662) (15,037) (2,298) (2,385) (4,060) (4,878) (5,136) (5,499) (7,246) 1,641 694 1,255 2,938 1,695 1,289 855 15,429 29,731 21,331 24,211 24,965 38,736 30,000 (7,779) (5,084) (10,852) (8,696) (11,386) (18,315) (8,000) 0 0 29,388 0 0 0 0 (4,747) (7,712) (5,349) (6,383) (3,157) (2,674) (4,085) 2,246 15,245 31,713 7,192 6,981 13,537 11,525 (8,022) (7,867) 804 30,000 (8,000) 0 (3,510) 11,427 (6,030) (8,857) 988 30,000 (8,000) 0 (4,575) 9,556 (2,409) 7,164 18,125 14,273 (9,805) (10,713) (10,983) (10,942) 1,147 1,391 1,694 2,037 30,000 20,000 15,000 15,000 (8,000) (8,000) (8,000) (8,000) 0 0 0 0 (5,763) (5,525) (7,022) (8,846) 7,580 (2,848) (9,311) (10,751) (3,513) 3,405 3,527 5,171 4,317 8,814 3,522 (3,513) 3,405 3,527 5,171 4,317 8,814 3,522 29,500 8,640 1,180 640 580 220 660 41,420 29,500 8,640 1,180 640 580 220 660 41,420 29,500 8,640 1,180 640 580 220 660 41,420 29,500 8,640 1,180 640 580 220 660 41,420 29,500 8,640 1,180 640 580 220 660 41,420 29,500 8,640 1,180 640 580 220 660 41,420 29,500 8,640 1,180 640 580 220 660 41,420 102 March 2014 LatAm Oil & Gas Equity Research Key Petrobras financials Balance sheet Balance sheet Cash and equivalents Receivables and tax receivables Inventories Others Current assets PP&E and investments Intangibles LT receivables and advances to suppliers Deferred taxes, judicial deposits Others Non-current assets Total assets Current debt Suppliers and tax payables Dividends, labour and pension Others Current liabilities Non-current debt LT taxes payables Pension benefits and legal provisions Decommissioning provisions Others Non-current liabilities Share capital Profit reserves and others Minorities Equity Total equity + Liabilities Balance sheet metrics Total debt Net debt Net debt/EBITDA Net debt / (ND + Equity) Total debt to equity Book value Book value per share Book value per ADR Returns ROE ROA ROCE Memo: Capital employed Source: Credit Suisse estimates. USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm 2006 13,065 9,971 7,484 1,038 31,558 56,383 2,072 2,029 4,975 1,826 67,286 98,844 5,879 9,354 4,389 2,987 22,609 14,809 4,280 5,384 0 2,464 26,937 22,659 23,130 3,509 49,299 98,844 2007 7,712 10,789 9,936 1,695 30,133 83,421 3,123 2,717 7,092 4,056 100,409 130,541 4,799 13,435 5,166 3,448 26,848 16,828 6,631 7,786 0 4,612 35,857 29,721 34,557 3,560 67,837 130,541 2008 6,914 10,489 8,537 1,229 27,169 83,701 3,420 2,529 2,648 5,388 97,688 124,856 5,673 12,722 5,591 2,748 26,734 21,388 6,151 5,886 2,813 1,621 37,859 33,747 25,384 1,134 60,264 124,856 2009 16,621 13,583 12,313 1,548 44,066 134,126 3,913 2,632 9,935 3,954 154,559 198,625 8,556 17,086 3,353 4,355 33,350 48,680 10,616 8,526 2,814 2,067 72,703 45,383 46,263 925 92,572 198,625 2010 33,737 15,730 11,866 2,551 63,883 174,681 49,759 5,947 11,987 5,102 247,476 311,359 9,382 16,344 4,493 3,813 34,032 61,226 15,665 9,970 3,895 807 91,563 122,968 60,724 2,071 185,763 311,359 2011 27,955 18,563 15,131 2,799 64,449 188,572 43,768 6,380 10,751 4,777 254,248 318,697 10,088 17,671 4,514 4,010 36,283 72,653 17,696 9,582 4,702 1,066 105,699 109,245 66,202 1,269 176,715 318,697 2012 23,992 16,700 14,576 2,625 57,893 211,369 39,807 7,610 13,469 2,066 274,321 332,214 7,510 18,283 5,973 2,362 34,127 88,723 19,246 10,558 9,457 773 128,756 100,682 67,494 1,154 169,330 332,214 2013 19,775 14,657 14,241 4,041 52,714 234,827 15,436 7,770 3,638 7,395 269,067 321,781 8,026 16,888 6,846 3,506 35,267 106,426 9,917 13,017 7,141 725 137,226 87,782 60,910 596 149,288 321,781 2014E 16,262 14,657 14,241 4,041 49,201 258,522 15,436 7,770 3,488 7,395 292,613 341,814 8,026 16,888 6,846 3,506 35,267 123,094 9,917 13,017 7,141 725 153,893 87,782 64,027 845 152,654 341,814 2015E 19,667 14,657 14,241 4,041 52,607 281,219 15,436 7,770 3,339 7,395 315,159 367,766 8,026 16,888 6,846 3,506 35,267 139,587 9,917 13,017 7,141 725 170,386 87,782 73,236 1,095 162,113 367,766 2016E 23,194 14,657 14,241 4,041 56,133 307,852 15,436 7,770 3,189 7,395 341,643 397,776 8,026 16,888 6,846 3,506 35,267 155,387 9,917 13,017 7,141 725 186,186 87,782 87,197 1,344 176,323 397,776 2017E 28,365 14,657 14,241 4,041 61,304 328,634 15,436 7,770 3,040 7,395 362,276 423,580 8,026 16,888 6,846 3,506 35,267 170,523 9,917 13,017 7,141 725 201,323 87,782 97,614 1,594 186,990 423,580 2018E 32,682 14,657 14,241 4,041 65,621 347,020 15,436 7,770 3,040 7,395 380,662 446,283 8,026 16,888 6,846 3,506 35,267 175,024 9,917 13,017 7,141 725 205,823 87,782 115,567 1,843 205,192 446,283 2019E 41,496 14,657 14,241 4,041 74,435 362,831 15,436 7,770 3,040 7,395 396,473 470,908 8,026 16,888 6,846 3,506 35,267 174,336 9,917 13,017 7,141 725 205,135 87,782 140,631 2,093 230,506 470,908 2020E 45,018 14,657 14,241 4,041 77,958 377,108 15,436 7,770 3,040 7,395 410,750 488,707 8,026 16,888 6,846 3,506 35,267 173,677 9,917 13,017 7,141 725 204,476 87,782 158,839 2,342 248,964 488,707 USDm USDm x % x USDm R$/sh $/ADR 20,688 7,623 0.37 16% 45% 45,789 11 10 21,627 13,915 0.53 19% 34% 64,277 14 15 27,061 20,147 0.85 26% 46% 59,130 12 13 57,236 40,615 1.19 31% 62% 91,647 21 21 70,608 36,871 1.03 17% 38% 183,692 25 28 82,741 54,787 1.66 24% 47% 175,446 22 27 96,232 72,240 2.77 30% 57% 168,176 25 26 114,453 94,678 3.52 39% 77% 148,692 25 23 131,120 114,858 4.61 43% 86% 151,809 29 23 147,613 127,946 3.73 44% 92% 161,018 32 25 163,413 140,219 3.26 44% 93% 174,979 36 27 178,550 150,185 3.29 45% 96% 185,397 39 28 183,051 150,369 2.56 42% 90% 203,349 44 31 182,363 140,867 1.92 38% 80% 228,413 51 35 181,703 136,685 2.03 35% 74% 246,622 56 38 % % % USDm 26% 14% 25% 56,921 17% 12% 18% 81,752 31% 13% 20% 80,412 16% 9% 14% 133,187 11% 6% 9% 222,635 11% 6% 9% 231,502 6% 4% 5% 241,570 7% 4% 6% 243,966 5% 2% 3% 267,512 8% 4% 5% 290,059 11% 5% 6% 316,542 9% 4% 5% 337,175 12% 6% 7% 355,561 14% 7% 9% 371,373 11% 6% 7% 385,649 103 March 2014 LatAm Oil & Gas Equity Research Key Petrobras financials E&P operational metrics E&P 2007 2008 2009 2010 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 2019E 2020E x 1.95 1.84 2.00 1.76 1.67 1.96 2.16 2.50 2.57 2.65 2.73 2.81 2.89 2.97 Brazilian inflation (IGPM) % 3.6% 5.7% 4.9% 5.0% 6.6% 5.4% 6.3% 5.3% 5.0% 5.0% 5.0% 5.0% 5.0% 5.0% US inflation (PPI) % 3.1% 3.5% (0.1%) 1.5% 3.3% 2.0% 1.6% 1.7% 2.0% 2.0% 2.0% 2.0% 2.0% 2.0% kbd 3,622 Macro BRL-USD (average) Production Oil production 1,792 1,855 1,971 2,004 2,022 1,980 1,931 2,077 2,341 2,377 2,623 3,054 3,524 Gas production kboed 273 321 317 334 355 375 389 418 447 475 620 701 782 862 Total production kboed 2,065 2,176 2,288 2,338 2,377 2,355 2,320 2,494 2,787 2,852 3,243 3,755 4,305 4,485 Oil production YoY growth % 4% 6% 2% 1% (2%) (2%) 8% 13% 2% 10% 16% 15% 3% Revenues Brent $/bbl 73 97 62 79 111 112 109 110 110 112 114 117 119 121 Domestic discount (-), premium (+) $/bbl (11) (15) (8) (5) (9) (7) (10) (10) (10) (10) (10) (10) (10) (10) Domestic oil price $/bbl 62 82 54 75 102 105 98 100 100 102 104 107 109 111 Domestic gas price $/boe 35 40 23 16 53 48 47 45 45 45 45 45 45 45 Domestic gas price $/mcf 6.3 7.2 4.0 2.8 9.5 8.7 8.5 8.0 8.0 8.0 8.0 8.0 8.0 8.0 Costs & Taxes Royalties per bbl $/bbl 5 7 5 6 9 9 8 9 9 9 9 9 9 9 SPT per bbl $/bbl 5 8 5 7 10 9 8 8 8 8 10 10 10 10 Other production taxes $/bbl 2 2 2 2 2 2 2 2 2 2 2 2 2 2 Total production taxes $/bbl 12 17 12 15 20 20 18 19 19 19 21 21 21 21 DDA per bbl $/bbl 4 4 5 6 7 8 9 9 9 9 13 13 13 13 Lifting costs $/bbl 8 9 9 10 13 14 15 14 15 16 17 17 18 19 Lifting cost nominal inflation % 20% (5%) 14% 26% 11% 6% (3%) 5% 5% 5% 5% 5% 5% USD-BRL exposure Portion of lifting costs in BRL % 50% 49% 46% 46% 46% 46% 46% 46% 46% Portion of lifting costs in USD % 50% 51% 54% 54% 54% 54% 54% 54% 54% Lifting costs in BRL BRL/bbl 14 15 16 18 19 21 22 24 26 Lifting costs in USD USD/bbl 7 7 8 8 9 9 9 10 10 Total lifting costs USD/bbl 14 14 14 15 16 17 17 18 19 Memo: Capex USDm Capex per bbl $/bbl Source: Credit Suisse estimates. 9,459 13,403 15,410 18,424 20,510 21,923 27,775 27,775 27,775 27,775 27,775 27,775 27,775 27,775 13 17 18 22 24 26 33 31 27 27 23 20 18 17 104 March 2014 LatAm Oil & Gas Equity Research Key Petrobras financials E&P financials E&P Divisional P&L Revenues COGS SG&A Exploration costs Other expenses (R&D, others) EBIT Financials & associates EBT Income taxes Minorities & employee contribution Net income E&P tax rate EBIT margin EBITDA margin Memo: EBITDA reconciliation EBIT DD&A Impairment and others EBITDA Returns Asset base ROA Unit P&L Revenues Royalties SPT Lifting costs SG&A Exploration costs Other costs & Taxes EBITDA DD&A Impairment EBIT EBT Net income Source: Credit Suisse estimates. 2007 2008 2009 2010 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 2019E 2020E USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm % % % 41,648 (17,942) (293) (622) (872) 21,919 (260) 21,658 (7,301) (579) 13,778 34% 53% 60% 57,722 (23,793) (435) (1,386) (1,130) 30,977 0 30,977 (10,450) (20,887) (360) 34% 54% 60% 38,092 (19,570) (330) (1,536) (1,670) 14,986 0 14,986 (5,012) (174) 9,801 33% 39% 49% 54,234 (25,172) (451) (1,478) (1,381) 25,752 (306) 25,447 (8,652) 0 16,794 34% 47% 56% 74,268 (33,005) (490) (2,200) (1,536) 37,037 (248) 36,789 (12,493) 11 24,308 34% 50% 58% 74,272 (33,495) (491) (3,630) (1,342) 35,313 (176) 35,137 (11,947) (3) 23,187 34% 48% 56% 68,186 (34,221) (443) (2,804) (896) 29,822 (175) 29,647 (10,080) (25) 19,543 34% 44% 55% 74,836 (36,966) (466) (2,804) (896) 33,704 (175) 33,529 (11,400) 0 22,129 34% 45% 60% 84,781 (42,208) (490) (2,804) (896) 38,383 (175) 38,209 (12,991) 0 25,218 34% 45% 60% 88,311 (44,003) (514) (2,804) (896) 40,094 (175) 39,920 (13,573) 0 26,347 34% 45% 59% 101,173 (58,529) (540) (2,804) (896) 38,404 (175) 38,229 (12,998) 0 25,231 34% 38% 56% 121,042 (69,149) (567) (2,804) (896) 47,626 (175) 47,452 (16,134) 0 31,318 34% 39% 56% 143,181 (80,856) (595) (2,804) (896) 58,030 (175) 57,855 (19,671) 0 38,185 34% 41% 57% 151,115 (85,774) (625) (2,804) (896) 61,016 (175) 60,842 (20,686) 0 40,156 34% 40% 56% USDm USDm USDm USDm 21,919 3,082 (186) 24,814 30,977 3,382 86 34,444 14,986 4,081 (244) 18,823 25,752 5,177 (365) 30,564 37,037 6,411 (46) 43,403 35,313 6,512 (138) 41,687 29,822 7,809 (172) 37,458 33,704 8,395 2,804 44,904 38,383 9,381 2,804 50,569 40,094 9,599 2,804 52,498 38,404 15,386 2,804 56,594 47,626 17,818 2,804 68,248 58,030 20,428 2,804 81,262 61,016 21,279 2,804 85,100 USDm % 50,390 43% 50,524 61% 74,702 20% 136,288 19% 140,798 26% 152,058 23% 152,876 20% 55 (5) (5) (8) (0) (1) (3) 33 (4) 0 29 29 18 73 (7) (8) (9) (1) (2) (3) 43 (4) (0) 39 39 (0) 46 (5) (5) (9) (0) (2) (2) 23 (5) 0 18 18 12 64 (6) (7) (10) (1) (2) (2) 36 (6) 0 30 30 20 86 (9) (10) (13) (1) (3) (2) 50 (7) 0 43 42 28 86 (9) (9) (14) (1) (4) (1) 48 (8) 0 41 41 27 81 (8) (8) (15) (1) (3) (1) 44 (9) 0 35 35 23 82 (9) (8) (14) (1) (3) 2 49 (9) (3) 37 37 24 83 (9) (8) (15) (0) (3) 2 50 (9) (3) 38 38 25 85 (9) (8) (16) (0) (3) 2 50 (9) (3) 39 38 25 85 (9) (10) (17) (0) (2) 1 48 (13) (2) 32 32 21 88 (9) (10) (17) (0) (2) 1 50 (13) (2) 35 35 23 91 (9) (10) (18) (0) (2) 0 52 (13) (2) 37 37 24 92 (9) (10) (19) (0) (2) 0 52 (13) (2) 37 37 25 $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl 105 March 2014 LatAm Oil & Gas Equity Research Key Petrobras financials Refining operational metrics RTM (Refining, Trading, Marketing) 2006 2007 Crude destillation capacity Crude destillation capacity kbd 1,986 Utilization % 90% Feedstock processed kbd 1,787 Oil product multiplier x 1.00 Output of oil products kbd 1,795 Diesel kbd 674 682 Gasoline kbd 347 352 Naphtha kbd 149 159 Fuel Oil kbd 261 265 LPG kbd 143 147 Others (Jet, Kerosene, Coke, Asphalt) kbd 190 Diesel yield % 38% Gasoline yield % 19% Naphtha yield % 8% Fuel Oil yield % 15% LPG yield % 8% Others (Jet, Kerosene, Coke, Asphalt) yield % 0% Domestic market demand = PBR volumes sold Diesel kbd 700 Gasoline kbd 269 Naphtha kbd 166 Fuel Oil kbd 106 LPG kbd 206 Others (Jet, Kerosene, Coke, Asphalt) kbd 242 Total kbd 1,689 Diesel YoY% Gasoline YoY% Total products YoY% Oil product imports / inventory decrease (+), exports / inventory buildup (-) Diesel kbd 26 Gasoline kbd (78) Others kbd (54) Oil product imports (+), exports (-) kbd (106) Crude oil import & exports Feedstock processed kbd 1,787 Share of domestic oil % 78% Domestic oil processed kbd 1,394 Crude oil import needs kbd 393 Prices International diesel price $/bbl 89 International gasoline price $/bbl 85 Diesel: domestic vs international % 121% Gasoline: domestic vs international % 104% Domestic diesel price $/bbl 108 Domestic gasoline price $/bbl 89 Domestic diesel price BRL/liter 1.32 Domestic gasoline price BRL/liter 1.09 Source: Credit Suisse estimates. 2008 2009 2010 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 2019E 2020E 1,942 91% 1,767 1.01 1,787 707 346 140 252 143 199 40% 19% 8% 14% 8% 11% 1,942 92% 1,787 1.02 1,823 739 333 145 242 135 228 41% 18% 8% 13% 7% 13% 1,942 93% 1,806 1.01 1,832 714 355 127 239 132 265 39% 19% 7% 13% 7% 14% 2,013 92% 1,852 1.02 1,896 733 389 109 227 136 301 39% 21% 6% 12% 7% 16% 2,018 96% 1,937 1.03 1,997 782 440 110 237 143 285 39% 22% 6% 12% 7% 14% 2,102 97% 2,039 1.04 2,124 858 494 93 257 138 284 40% 23% 4% 12% 6% 13% 2,102 94% 1,976 1.02 2,015 814 469 88 244 131 270 40% 23% 4% 12% 6% 13% 2,145 94% 2,016 1.02 2,057 835 469 94 248 133 278 41% 23% 5% 12% 6% 14% 2,459 94% 2,311 1.02 2,358 976 491 129 280 149 332 41% 21% 5% 12% 6% 14% 2,597 92% 2,389 1.02 2,437 1,020 480 146 287 153 351 42% 20% 6% 12% 6% 14% 2,597 92% 2,389 1.02 2,437 1,020 480 146 287 153 351 42% 20% 6% 12% 6% 14% 2,597 92% 2,389 1.02 2,437 1,020 480 146 287 153 351 42% 20% 6% 12% 6% 14% 3,197 92% 2,941 1.02 3,000 1,302 480 230 344 181 463 43% 16% 8% 11% 6% 15% 741 281 151 97 213 226 1,709 6% 4% 1% 730 300 164 102 210 200 1,705 (2%) 7% (0%) 794 354 167 100 218 272 1,905 9% 18% 12% 862 434 167 82 224 289 2,059 9% 23% 8% 919 521 165 84 224 305 2,218 7% 20% 8% 965 529 171 98 231 309 2,303 5% 2% 4% 1,013 556 177 101 238 318 2,402 5% 5% 3% 1,064 584 182 104 245 328 2,506 5% 5% 3% 1,117 613 187 107 252 338 2,614 5% 5% 3% 1,150 631 193 110 260 348 2,692 3% 3% 3% 1,185 650 199 113 268 358 2,773 3% 3% 3% 1,220 670 205 117 276 369 2,856 3% 3% 3% 1,257 690 211 120 284 380 2,942 3% 3% 3% 34 (65) (48) (78) (10) (33) (75) (118) 80 (1) (6) 73 129 45 (12) 163 137 81 3 221 107 36 37 179 199 87 101 387 229 115 105 449 141 122 (6) 256 130 151 (26) 255 165 170 2 336 200 189 30 419 (45) 209 (223) (58) 1,767 78% 1,378 389 1,787 79% 1,411 375 1,806 82% 1,481 325 1,852 82% 1,519 333 1,937 82% 1,589 349 2,039 82% 1,672 367 1,976 82% 1,620 356 2,016 82% 1,653 363 2,311 82% 1,895 416 2,389 82% 1,959 430 2,389 82% 1,959 430 2,389 82% 1,959 430 2,941 82% 2,412 529 118 98 97% 96% 114 94 1.32 1.09 69 67 140% 125% 96 84 1.21 1.06 90 86 112% 112% 102 96 1.13 1.06 125 115 87% 88% 108 102 1.13 1.07 128 117 78% 83% 100 98 1.23 1.21 126 113 83% 87% 105 99 1.42 1.34 127 115 77% 77% 98 88 1.54 1.39 127 115 82% 82% 105 94 1.69 1.53 130 117 95% 95% 123 111 2.06 1.85 133 119 95% 95% 126 113 2.16 1.94 135 122 95% 95% 128 116 2.27 2.04 138 124 95% 95% 131 118 2.38 2.14 141 127 95% 95% 134 120 2.50 2.25 106 March 2014 LatAm Oil & Gas Equity Research Key Petrobras financials Refining financials RTM (Refining, Trading, Marketing) Divisional P&L Revenues COGS SG&A Other expenses (R&D, others) EBIT Financials & associates EBT Income taxes Minorities & employee contribution Net income Downstream tax rate EBIT margin EBITDA margin Memo: EBITDA reconciliation EBIT DD&A Impairment and others EBITDA Returns Asset base ROA Unit P&L (per barrel sold) Revenues Crude purchase costs Refining costs Oil product import costs Other costs EBITDA DD&A Impairment, others EBIT EBT Net income Source: Credit Suisse estimates. 2006 USDm USDm USDm USDm USDm USDm USDm USDm USDm USDm % % % 57,880 (51,770) (145) (1,604) 4,360 38 4,398 (1,424) (161) 2,812 32% 2007 2008 2009 68,384 100,752 (61,076) (100,056) (2,064) (2,851) (535) (692) 4,709 (2,846) 14 (301) 4,722 (3,147) (1,538) 1,020 (149) (64) 3,035 (2,191) 33% 32% 7% (3%) 8% (2%) 73,384 (60,431) (2,336) (377) 10,241 85 10,326 (3,437) (224) 6,666 33% 14% 16% 2010 2011 2012 2013 2015E 2016E 2017E 2018E 2019E 2020E 97,993 118,872 116,144 110,816 117,480 133,792 141,875 154,992 179,314 206,282 197,880 (91,115) (123,352) (129,538) (119,471) (134,866) (147,844) (145,868) (158,562) (182,135) (208,259) (198,129) (2,953) (3,315) (3,028) (2,773) (2,919) (3,065) (3,219) (3,380) (3,549) (3,726) (3,912) (678) (892) (1,011) (1,025) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) (1,000) 3,247 (8,687) (17,433) (12,453) (21,306) (18,117) (8,212) (7,950) (7,370) (6,703) (5,161) (56) (307) (241) (58) (58) (58) (58) (58) (58) (58) (58) 3,191 (8,995) (17,673) (12,511) (21,363) (18,175) (8,270) (8,008) (7,428) (6,761) (5,219) (1,031) 3,025 5,974 4,279 7,306 6,216 2,828 2,739 2,540 2,312 1,785 0 9 0 8 8 8 8 8 8 8 8 2,160 (5,961) (11,699) (8,224) (14,049) (11,951) (5,433) (5,261) (4,879) (4,441) (3,426) 32% 34% 34% 34% 34% 34% 34% 34% 34% 34% 34% 3% (7%) (15%) (11%) (18%) (14%) (6%) (5%) (4%) (3%) (3%) 4% (6%) (13%) (9%) (16%) (12%) (4%) (3%) (2%) (2%) (1%) USDm USDm USDm USDm 4,709 994 (142) 5,561 (2,846) 1,329 (153) (1,670) 10,241 1,430 (134) 11,538 3,247 1,148 (215) 4,180 (8,687) 1,579 (42) (7,150) (17,433) 2,096 (278) (15,614) (12,453) 2,705 (131) (9,880) USDm % 31,193 15% 27,685 (10%) 50,070 20% 70,434 5% 84,141 (10%) 91,615 (19%) 92,209 (14%) 111 (84) (3) 5 (20) 9 (2) 0 8 8 5 162 (112) (3) 4 (53) (3) (2) 0 (5) (5) (4) 118 (78) (3) 5 (23) 19 (2) 0 16 17 11 141 (93) (4) (4) (34) 6 (2) 0 5 5 3 158 (120) (5) (10) (33) (10) (2) 0 (12) (12) (8) 143 (112) (4) (13) (34) (19) (3) 0 (22) (22) (14) 132 (101) (3) (10) (30) (12) (3) 0 (15) (15) (10) $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl $/bbl 2014E (21,306) 2,566 (131) (18,871) (18,117) 2,619 (131) (15,630) (8,212) 3,002 (131) (5,341) (7,950) 3,103 (131) (4,978) (7,370) 3,103 (131) (4,398) (6,703) 3,103 (131) (3,732) (5,161) 3,820 (131) (1,473) 134 (104) (2) (20) (29) (22) (3) 0 (24) (24) (16) 146 (110) (2) (23) (28) (17) (3) 0 (20) (20) (13) 149 (112) (3) (13) (27) (6) (3) 0 (9) (9) (6) 158 (121) (3) (13) (26) (5) (3) 0 (8) (8) (5) 177 (137) (3) (16) (26) (4) (3) 0 (7) (7) (5) 198 (154) (3) (20) (25) (4) (3) 0 (6) (6) (4) 184 (160) (3) 2 (25) (1) (4) 0 (5) (5) (3) 107 March 2014 LatAm Oil & Gas Equity Research Other Brazilian oil themes FOTO Labour trends and wage inflation Brazil, as a country, is seeing of quasi-full employment levels. In the oil industry, the situation is even better (or worse), given the sheer volume of activity, spearheaded by Petrobras. Brazil has presented one of the highest wage inflations in the oil sector globally. Oil salaries in Brazil are amongst one of the highest globally. There is evidence of saturation of the local labour market. In this section, we provide extensive analysis of the oil labour market in Brazil and Latin America. The comeback of licensing rounds Welcome back. The pre-salt was discovered in 2006 and by 2008-2009 was relatively well appraised so that the industry knew the province was high potential. That has increased the Governmental ‘protection’ of such an strategic area, resulting in a temporary pause in the licensing rounds that has been going on since 1997 with the opening up of the sector to foreign companies. In the 2010-2012 period, a number of discussions took place, such as (i) capitalisation of Petrobras, (ii) acquisition of the ToR areas, (iii) change in the regulatory regime from Concession to PSC in the pre-salt areas; (iv) creation of a government-controlled company (PPSA) to oversee and audit future pre-salt contracts, (v) distribution of petroleum royalties among producing and non-producing states and municipalities. With most of those discussions having concluded by 2013 and a strong industry lobby to the comeback of license rounds, activity is finally picking-up: (i) the 11th round focussed on the equatorial margin areas, North Brazil, which happened in may, (ii) the first pre-salt PSC round with the auction of Libra in October and (iii) the 12th round, focussed on onshore areas in the country-side, in November 2013. March 2014 LatAm Oil & Gas Equity Research Labour trends and wage inflation Another oil salary increase 2012 oil salary changes in selected countries (%) increase in the next twelve months (see next slide). -4 -5 -7 -10 Venezuela -2 Saudi Arabia -2 Norway 0 Iran Brazil 7 South Africa 7 Canada 9 USA 15 Russia 18 Singapore Next year shows few signs of slowdown, with 58% of respondents expecting a 5%+ China Argentina highest wage inflation in the past four years: Colombia has seen wage inflation of 30%, Brazil 15%, and Argentina 13%. This illustrates well what happens to a market that needs to develop local skills when faced by increasing activity. Yearly figures are more variable: Brazil decreased in 2012 vs 2011 (Hays cites delays in the licensing rounds as key reason – if this assessment is correct we could see a rebound in 2013 with re-start of the rounds), and Argentina saw a 37% rise in 2012. Brazil/Arg rank 8th/10th highest wages globally. Iraq The chart below has surprised us. LatAm has three countries out of the four with UK 23 Global average 28 Australia 37 Mexico c.6.0%, the oil labour market shows no signs of slowdown: 2012 oil salaries increased by 8.5% in 2012, according to Hays. This does not necessarily come as a surprise in an industry that has through most of its history seen costs and capital intensity increase. This year, Hays mentions key reasons for increased salaries were (1) a wave of hiring from proliferation of unconventional field developments and (2) increasing trend for a global labour market to address the skill gap in a number of countries seeing rising oil spend. Colombia Another oil salary increase. After a 2011 that saw global oil salaries increase by -15 -16 -18 2009 – 2012 YoY% average oil salary changes – LatAm winning the inflation race (%) 0 0 Libya Azerbaijan Russia Venezuela Mexico* Angola (3) (4) (4) (5) (5) India 1 UK 3 USA 3 Canada 5 Global average 6 Australia 6 Netherlands 8 Oman 8 Iran 9 Saudi Arabia 9 New Zealand 10 China 10 Norway 10 Algeria 11 Kazakhstan 12 Indonesia 13 Iraq 13 Argentina 14 Singapore Brazil Colombia* 15 Malaysia LatAm: three of top four highest wage inflation countries globally 28 (8) * 2010-2012 CAGR Source: Credit Suisse analysis based on Hays – The Oil and Gas Global Salary Guide. 109 March 2014 LatAm Oil & Gas Equity Research Labour trends and wage inflation We wish we worked there Salary changes in the last 12 months, % of the workforce 4% 4% Decrease 30% 30% Flat 16% 17% Expected salary changes for the next 12 months, % of the workforce 1% 18% Decrease Flat 24% Increase up to 5% 30% Increase between 5-10% 32% 28% Increase more than 10% 2011 2012 1% 16% 21% Increase up to 5% 30% 50% 50% 2011 Increase more than 10% 2012 Average salaries in USD/year – Norway and Australia still top payers, Brazil and Argentina also among highest globally 2012 200,000 2011 160,000 120,000 80,000 Source: Credit Suisse analysis based on Hays – The Oil and Gas Global Salary Guide. Sudan Pakistan Romania Yemen Philippines India Ghana Egypt Libya Kazakhstan Algeria Poland Iran Indonesia Iraq Malaysia Thailand Azerbaijan Mexico Portugal Angola Vietnam Russia Nigeria Trinidad Venezuela Spain China Italy Oman Turkey South Africa South Korea Colombia Singapore Saudi Arabia Global average UK France Denmark Argentina Brazil Kuwait USA Canada Netherlands New Zealand Norway 0 Australia 40,000 110 March 2014 LatAm Oil & Gas Equity Research Labour trends and wage inflation Local vs imported labour Increasing trend towards local labour, where possible. As the chart on the bottom left shows, there is an increasing trend for a higher mix of local labour in most regions of the world, South America included. The only two regions which have shown a decrease in % of local workers have been the Middle East and Australasia. In our view this reflects a local labour market that is already saturated, therefore growth comes only via imported labour. Curious trend in 2012 in Braz il. We find it curious that in 2012 the local labour participation in Brazil has actually fallen to 67% from a peak of 73% in 2011. With the increasing ‘demand’ for foreigners, it has become again more expensive to import labour vs hire locally (in 2011, local salaries were 12% higher than imported salaries. In 2012, local salaries were 16% lower than imported salaries). We wonder if this is just ‘normal’ year on year volatility, or the beginning of the same trend seen in Australasia and the Middle East, with the saturation of the local labour market. This may as well be the case – Brazil has all time low unemployment levels, close to ‘technical’ full employment. Local labour participation by region – trend towards local until saturation 2009 100% 2010 2011 Low unemployment rate in Brazil and Argentina 16% Colombia 14% Eurozone 12% 10% 6% Brazil 4% Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Local salaries premium and use of local workforce in Brazil 2012 Local labor participation 80% USA Argentina 8% 59% 65% 60% Local salaries premium (+) 73% 67% 12% 40% 0% 20% 0% -16% Africa Asia Australasia CIS Europe Middle East North America South America Source: Credit Suisse analysis based on Hays – The Oil and Gas Global Salary Guide and Bloomberg. -26% 2009 2010 2011 2012 111 March 2014 LatAm Oil & Gas Equity Research Labour trends and wage inflation Local vs imported labour Braz il and Argentina stand out as two countries where the local wages are Local-foreign labor participation by region in 2012 67% 49% 64% 51% 59% 86% Imported Workforce 14% Local Workforce 41% Middle East 72% 36% CIS Europe 33% Australasia 82% Asia 86% industry working to iron out the extreme variations in pay between locals and foreigners. This is a natural trend as companies try to arbitrage local-international markets to keep costs under control and the global labour market becomes more mobile. 28% Africa Interestingly, Hays mentions it is increasingly observing recruiting in the oil 18% South America 14% North America one of the highest compared to imported wages. Through the past three years, Brazil has had an average local wage 13% cheaper than imported wages, and Argentina 18% cheaper. This is good news for Brazilian and Argentinean oil workers: most countries in the Hays survey have local salaries being 40-70% lower than imported salaries (other LatAm countries such as Colombia, Mexico and Venezuela are also within this range). 2009 – 2012 Average local labor premium: Brazil and Argentina are remarkably close to parity (%) Philippines -74% Indonesia -71% Iraq -70% -69% Vietnam Ghana -69% -69% Kazakhstan Azerbaijan -68% Romania Thailand -67% -68% -69% Egypt Nigeria -64% -67% Malaysia -63% Trinidad India -59% Yemen Portugal -59% -65% Algeria Poland -55% -58% Russia -53% Angola Sudan -52% -57% Colombia -51% -57% Pakistan -51% Mexico Iran -47% China South Korea -45% -56% Venezuela Libya Singapore -29% -44% Denmark -34% UAE -27% -28% -40% Oman -23% Bahrain Turkey -22% Qatar Italy -21% Source: Credit Suisse analysis based on Hays – The Oil and Gas Global Salary Guide. -31% Argentina Spain South Africa -18% -18% France -18% Brazil -13% -14% Australia Korea 0% -2% Local labor cheaper than imported -12% 4% 3% USA UK New Zealand 5% Canada 21% 6% Netherlands Saudi Arabia 29% 22% Brunei Norway Kuwait 48% Local labour more expensive 112 March 2014 LatAm Oil & Gas Equity Research Labour trends and wage inflation Employer concerns: skill shortage, economic instability and environment Skill shortage is the top concern of employers for three consecutive years, both Employer concern by region – skill shortage still top concern globally and in South America. Economic instability and environmental concerns come in second and third places. Another interesting trend to observe is how Environment and Safety were at extremely high levels in 2010, the year of Macondo, and fell in the following years. Last year, in South America, we have seen a rebound of those two concerns, we think likely due to the Frade incident with Chevron in Brazil, and the initial strong reactions by parts of the Brazilian Government, Institutions and the Media. 100% Other Security/social unrest Immigration/visa Safety regulations 80% 60% Lack of skilled labour is notable at the junior-entry levels. As we show on the next Environmental concerns 40% slide, Graduates were the ones with the highest pay increase last year – 12% vs an average increase of 8.5% industry-wide. Scarcity at entry levels is also evident: the % of employees with less than 4 years experience fell from 36% in 2011 to 28% in 2012. Economic instability 20% Do you want to be em ployed by a super m ajor or by an oil services com pany? Skills shortages Africa Middle East Asia CIS South America World North America Europe Australasia 0% Also on the next slide, we show that the majors are still the highest payers in the industry. On the other hand, they are also the ones capable of ‘imposing’ the lowest pay rises in the industry. This is a power equipment providers don’t have: they were the companies seeing the highest wage inflation levels (17%!), a mix of lower base and need to have more skilled labour as OFS is increasingly responsible to solve industry’s technological challenges. South America employers main concerns for next year – skill shortages still on top of the list 2010 2011 2012 45% 37% 28% 25% 25% 14% 28% 25% 12% 16% 3% Skills shortages Economic instability Environmental concerns Source: Credit Suisse analysis based on Hays – The Oil and Gas Global Salary Guide. 7% Safety regulations 10% 3% 7% Immigration/visa 2% 6% Security/social unrest 2% 3% 2% Other 113 March 2014 LatAm Oil & Gas Equity Research Labour trends and wage inflation Super majors pay more, OFS inflation is higher, Graduate scarcity Average salaries by company type in 2012, yearly $116k $108k Wage inflation by company type in 2012 – manufacturers saw a 17% increase 17% $99k $96k $83k $73k 12% $72k 11% 9% 8% 6% Operator Global Super Major EPCM Consultancy Contractor Oil Field Services Equipment manufacture and supply Years of experience in the industry – Lack of entry level expertise 2011 36% 28% 22% 23% 21% 24% 2012 Equipment manufacture and supply Operator Contractor Oil Field Services EPCM Consultancy Global Super Major Wage inflation by current level in 2012 – Entry level saw highest growth 12% 9% 25% 9% 9% 21% 5% Less than 4 5-9 years 10-19 years Source: Credit Suisse analysis based on Hays – The Oil and Gas Global Salary Guide. 6% 20+ years Graduate Operator/ technician Senior 4% VP/Director Manager lead/ Intermediate Principal 114 March 2014 LatAm Oil & Gas Equity Research Labour trends and wage inflation South America’s high benefit levels (but training is not one of them) Share of the workforce receiving benefits by region, % 2010 South America the highest benefits ‘penetration’ globally 76% 72% 75% South America 77% 75% 74% 77% 75% 73% Asia Middle East 70% 70% 66% 74% 72% North America 64% 67% Africa 63% 60% CIS 58% 65% 57% 2011 2012 57% 57% Australasia 51% Europe South America – Share of the workforce receiving each benefit 2010 36% 37% 39% 2012 39% 34% Training not among top benefits in 2012 31% 30% 24% 19% Bonuses 2011 Health plan Meal allowance Source: Credit Suisse analysis based on Hays – The Oil and Gas Global Salary Guide. 22% 17% 21% 17% Transport 17% 15% Pension 28% 24% 25% 19% 12% Training No benefits 115 March 2014 LatAm Oil & Gas Equity Research The comeback of the licensing rounds 4 years without rounds, then 3 rounds in one year Welcom e back. The pre-salt was discovered in 2006 and by 2008-2009 was relatively well appraised so that the industry knew the province was high potential. That has increased the Governmental ‘protection’ of such an strategic area, resulting in a temporary ‘hault’ in the licensing rounds that has been going on since 1997 with the opening up of the sector to foreign companies. In the 2010-2012 period, a number of discussions took place, such as (i) capitalisation of Petrobras, (ii) acquisition of the ToR areas, (iii) change in the regulatory regime from Concession to PSC in the pre-salt areas; (iv) creation of a governmentcontrolled company (PPSA) to oversee and audit future pre-salt contracts, (v) distribution of petroleum royalties among producing and non-producing states and municipalities. With most of those discussions having concluded by 2013 and a strong industry lobby to the comeback of license rounds, 2013 is bound to see three rounds at the same time: (i) the 11th round focussed on the equatorial margin areas, North Brazil, which happened in may, (ii) the first pre-salt PSC round with the auction of Libra in October and (iii) the 12th round, focussed on onshore areas in the country-side, in November 2013. Brazilian sedimentary basins and 2013 license rounds Foz do Amazonas Pará-Maranhao Barreirinhas Amazonas Ceará Solimões Potiguar Alto Tapajós Parnaíba Acre Tucano Round Zero 1999 Round 1 Camamu Jequitinhonha São Francisco 2000 2001 Round 2 Round 3 2002 2003 2004 2005 Round 4 Round 5 Round 6 Round 7 Sergipe-Alagoas Recôncavo Parecis Licensing round calendar 1998 Pernambuco Paraiba Espiríto Santo Paraná Campos Brazil’s sedimentary basins Libra License rounds in 2013: Santos Round 11 2006 Round 8 2007 Round 9 Source: Credit Suisse Research based on the ANP. 2008 2013 Round 12 Round 10 Round 11 Round 12 Libra Libra PSC Pelotas 116 March 2014 LatAm Oil & Gas Equity Research The comeback of the licensing rounds License rounds over the years Number of bidders and foreign/domestic composition Blocks auctioned (number of blocks and as % of blocks offered) 300 100% 50 100% 250 80% 40 80% 60% 30 60% 40% 20 40% 20% 10 20% 200 150 100 50 0 0% 1999 2000 2001 2002 2003 2004 2005 2007 2008 2013* Auctioned blocks Auctioned blocks as % of total blocks offered 0 0% 1999 2000 2001 2002 2003 2004 2005 2007 2008 2013* Domestic Bidders Foreign Bidders Domestic Bidders (%) Signature bonus and minimum exploratory programme (USDm) Local content bids 5,000 100% 4,000 Bonus (USDm) 90% MEP (USDm) 80% LC development phase 70% 3,000 60% 2,000 1999-2002: Minimum exploratory programme not disclosed 1,000 0 50% 40% LC exploration phase 30% 20% 1999 2000 2001 2002 2003 2004 2005 2007 2008 2013* Source: Credit Suisse Research based on the ANP; * Note: data for 2013 only includes Round 11 (and not Libra or Round 12). 1999 2000 2001 2002 2003 2004 2005 2007 2008 2013* 117 March 2014 LatAm Oil & Gas Equity Research The comeback of the licensing rounds Key learnings from round 11 Coordination from all players will be needed to face the operational challenges in the Equatorial Margin FZA-M-57 FZA-M-59 bp FZA-M-86 FZA-M-88 FZA-M-90 CE-M-603 FZA-M-125FZA-M-127 CE-M-661 SFZA-AP1 CE-M-663 CE-M-665 FZA-M-184 CE-M-715 CE-M-717 Foz do Amazonas SCE-AP3 Pará-Maranhao Barreirinhas Ceará Amazonas Solimões Foz do Amazonas: Total showing strong presence. The company also has acreage/operations on nearby F. Guiana. Potiguar Alto Tapajós Acre Parecis Ceará: A timid but interesting return from Exxon and Chevron to Brazil. Round continuity is key for US players. Pernambuco Paraiba Tucano Sergipe-Alagoas Recôncavo Camamu São Francisco Jequitinhonha Parnaíba BAR-M-213 BAR-M-215BAR-M-217 ES-M-669 ES-M-596 ES-M-598 ES-M-671 ES-M-673 Espiríto Santo Paraná BAR-M-252 BAR-M254 Campos BAR-M-298BAR-M-300 E3-M-743 Libra Santos SBAR-AP1 BAR-M-340BAR-M-342BAR-M-344BAR-M-346 bp Pelotas SES-AP2 Barreirinhas: BG bidding alone and securing operatorship in a number of blocks. Being operator in Brazil is strategic. Source: Credit Suisse Research based on the ANP. Espírito Santo: Statoil faced little competition and secured interest in a number of blocks in this less-sought area 118 March 2014 LatAm Oil & Gas Equity Research The comeback of the licensing rounds Key learnings from round 12 Acre – 9 blocks offered, 1 taken A ‘seed’. A very timid participation in round 12 means the round was just what the ANP wanted, a ‘seed’ indeed. Key things we note: Parnaiba – 32 blocks offered, 1 taken Reconcavo – 50 blocks offered, 30 taken 10 6 – Of the 240 blocks offered, only 30% (72) received bids; – Of those 72, the great majority (80% or 58 blocks) 1 received a single bid; 8 4 2 – Petrobras participated in 49 blocks of the 72 bid. In 43 of those PBR was the operator and in 27 it was operator with no partners; – Mature provinces such as onshore Sergipe-Alagoas and – Reconcavo were responsible for 75% of the bids, Parecis – 14 blocks offered, none taken showing little exploratory appetite for onshore gas exploration; Sergipe / Alagoas – 80 blocks offered, 24 taken – Two of the six basins offered (Sao Francisco and Parecis) 7 received no bids. Acre and Parnaiba only received one bid each; 1 – 12 companies won blocks as operators or partners, one of the lowest numbers in history. Of those 12 companies, four are non-oil and gas (utilities or engineering companies); – Aside Petrobras, there was no Big Oil major, which was somewhat expected and an attempt from the Agency to offer a round capable of incentivising smaller E&Ps (Alvopetro, Cowan, Geopark, Novapetroleo, Ouro Preto, Petra, Trayectoria). Two utilities, Copel and GDF Suez, participated in the round as partners: Copel partnered with Petra in three blocks in Parana, and GDF Suez partnered with Petrobras in six blocks in Reconcavo. Source: Credit Suisse Research based on the ANP. 4 Parana – 19 blocks offered, 16 taken 4 3 4 1 Sao Francisco – 36 blocks offered, none taken 2 3 7 4 119 Companies Mentioned March 2014 LatAm Oil & Gas Equity Research Price as of 10-March-2014 BP (BP.L, 484.0p) Chevron Corp. (CVX.N, $115.84) ENI (ENI.MI, €17.42) ExxonMobil Corporation (XOM.N, $95.5) Hess Corporation (HES.N, $82.24) OMV (OMVV.VI, €32.31) Petrobras (PBR.N, $10.68, NEUTRAL[V], TP $14.0) Repsol (REP.MC, €18.1) Royal Dutch Shell plc (RDSa.L, 2193.0p) Statoil (STL.OL, Nkr161.7) 120 Important Global Disclosures March 2014 LatAm Oil & Gas Equity Research Vinicius Canheu, CFA and Andre Sobreira, CFA, each certify, with respect to the companies or securities that the individual analyzes, that (1) the views expressed in this report accurately reflect his or her personal views about all of the subject companies and securities and (2) no part of his or her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report. 3-Year Price and Rating History for Petrobras (PBR.N) PBR.N Date 17-Mar-11 15-Aug-11 17-Aug-11 20-Nov-11 26-Feb-12 20-Jun-12 24-Jun-12 07-Mar-13 16-Jul-13 28-Oct-13 01-Dec-13 Closing Price (US$) 39.10 29.23 29.37 26.65 30.08 20.47 19.60 17.56 13.42 17.35 15.94 Target Price (US$) 48.00 38.00 38.00 34.00 32.00 27.00 25.00 25.00 25.00 14.00 Rating N O N O * O U N EU T RA L O U T PERFO RM U N D ERPERFO RM * Asterisk signifies initiation or assumption of coverage. The analyst(s) responsible for preparing this research report received Compensation that is based upon various factors including Credit Suisse's total revenues, a portion of which are generated by Credit Suisse's investment banking activities As of December 10, 2012 Analysts’ stock rating are defined as follows: Outperform (O) : The stock’s total return is expected to outperform the relevant benchmark*over the next 12 months. Neutral (N) : The stock’s total return is expected to be in line with the relevant benchmark* over the next 12 months. Underperform (U) : The stock’s total return is expected to underperform the relevant benchmark* over the next 12 months. *Relevant benchmark by region: As of 10th December 2012, Japanese ratings are based on a stock’s total return relative to the analyst's coverage universe which consists of all companies covered by the analyst within the relevant sector, with Outperforms representing the most attractive, Neutrals the less attractive, and Underperforms the least attractive investment opportunities. As of 2nd October 2012, U.S. and Canadian as well as European ratings are based on a stock’s total return relative to the analyst's coverage universe which consists of all companies covered by the analyst within the relevant sector, with Outperforms representing the most attractive, Neutrals the less attractive, and Underperforms the least attractive investment opportunities. For Latin American and non-Japan Asia stocks, ratings are based on a stock’s total return relative to the average total return of the relevant country or regional benchmark; Australia, New Zealand are, and prior to 2nd October 2012 U.S. and Canadian ratings were based on (1) a stock’s absolute total return potential to its current share price and (2) the relative attractiveness of a stock’s total return potential within an analyst’s coverage universe. For Australian and New Zealand stocks, 12-month rolling yield is incorporated in the absolute total return calculation and a 15% and a 7.5% threshold replace the 10-15% level in the Outperform and Underperform stock rating definitions, respectively. The 15% and 7.5% thresholds replace the +10-15% and -10-15% levels in the Neutral stock rating definition, respectively. Prior to 10th December 2012, Japanese ratings were based on a stock’s total return relative to the average total return of the relevant country or regional benchmark. Restricted (R) : In certain circumstances, Credit Suisse policy and/or applicable law and regulations preclude certain types of communications, including an investment recommendation, during the course of Credit Suisse's engagement in an investment banking transaction and in certain other circumstances. Volatility Indicator [V] : A stock is defined as volatile if the stock price has moved up or down by 20% or more in a month in at least 8 of the past 24 months or the analyst expects significant volatility going forward. Analysts’ sector weightings are distinct from analysts’ stock ratings and are based on the analyst’s expectations for the fundamentals and/or valuation of the sector* relative to the group’s historic fundamentals and/or valuation: Overweight : The analyst’s expectation for the sector’s fundamentals and/or valuation is favorable over the next 12 months. Market Weight : The analyst’s expectation for the sector’s fundamentals and/or valuation is neutral over the next 12 months. Underweight : The analyst’s expectation for the sector’s fundamentals and/or valuation is cautious over the next 12 months. *An analyst’s coverage sector consists of all companies covered by the analyst within the relevant sector. An analyst may cover multiple sectors. 121 Important Global Disclosures March 2014 LatAm Oil & Gas Equity Research Credit Suisse's distribution of stock ratings (and banking clients) is: Global Ratings Distribution Rating Versus universe (%) Of which banking clients (%) Outperform/Buy* 43% (53% banking clients) Neutral/Hold* 40% (49% banking clients) Underperform/Sell* 15% (43% banking clients) Restricted 2% *For purposes of the NYSE and NASD ratings distribution disclosure requirements, our stock ratings of Outperform, Neutral, and Underperform most closely correspond to Buy, Hold, and Sell, respectively; however, the meanings are not the same, as our stock ratings are determined on a relative basis. (Please refer to definitions above.) An investor's decision to buy or sell a security should be based on investment objectives, current holdings, and other individual factors. Credit Suisse’s policy is to update research reports as it deems appropriate, based on developments with the subject company, the sector or the market that may have a material impact on the research views or opinions stated herein. Credit Suisse's policy is only to publish investment research that is impartial, independent, clear, fair and not misleading. For more detail please refer to Credit Suisse's Policies for Managing Conflicts of Interest in connection with Investment Research: http://www.csfb.com/research and analytics/disclaimer/managing_conflicts_disclaimer.html Credit Suisse does not provide any tax advice. Any statement herein regarding any US federal tax is not intended or written to be used, and cannot be used, by any taxpayer for the purposes of avoiding any penalties. Price Target: (12 m onths) for Petrobras (PBR.N) Method: Our new target price (TP US$14/ADR) methodology incorporates a more bearish outlook for Petrobras based on signals of higher political interference. 90% of our target price is based on (1) a required 9% earnings yield on trough 2014 earnings, (2) the need for PBR to offer a top-tier 5.5% dividend yield on a minimum R$0.96/sh dividend to attract investors amid more uncertainty, (3) a write-off of $25bn of value in the company's valuation, equivalent to 2014's funding gap. The remaining 10% of our valuation incorporates a more fundamental view, and our estimate of intrinsic value when the companies reaches a 'steady-state' business performance by 2020. Risk: Risks to our US$14/ADR target price for Petrobras include, but are not restricted to, (1) changes in oil prices, (2) foreign exchange rate variations, (3) changes in the regulatory environment in Brazil, (4) political interference (Petrobras is controlled by the Brazilian government), (5) delays in the execution of its main E&P projects, and (6) potential controls on domestic prices of refined products. Please refer to the firm's disclosure website at https://rave.credit-suisse.com/disclosures for the definitions of abbreviations typically used in the target price method and risk sections. See the Companies Mentioned section for full company names The subject company (PBR.N) currently is, or was during the 12-month period preceding the date of distribution of this report, a client of Credit Suisse. Credit Suisse provided investment banking services to the subject company (PBR.N) within the past 12 months. Credit Suisse has managed or co-managed a public offering of securities for the subject company (PBR.N) within the past 12 months. Credit Suisse has received investment banking related compensation from the subject company (PBR.N) within the past 12 months Credit Suisse expects to receive or intends to seek investment banking related compensation from the subject company (PBR.N) within the next 3 months. As of the date of this report, Credit Suisse makes a market in the following subject companies (PBR.N). 122 March 2014 LatAm Oil & Gas Equity Research Important Regional Disclosures Singapore recipients should contact Credit Suisse AG, Singapore Branch for any matters arising from this research report. The analyst(s) involved in the preparation of this report have not visited the material operations of the subject company (PBR.N) within the past 12 months Restrictions on certain Canadian securities are indicated by the following abbreviations: NVS--Non-Voting shares; RVS--Restricted Voting Shares; SVS--Subordinate Voting Shares. Individuals receiving this report from a Canadian investment dealer that is not affiliated with Credit Suisse should be advised that this report may not contain regulatory disclosures the non-affiliated Canadian investment dealer would be required to make if this were its own report. For Credit Suisse Securities (Canada), Inc.'s policies and procedures regarding the dissemination of equity research, please visit http://www.csfb.com/legal_terms/canada_research_policy.shtml. Credit Suisse has acted as lead manager or syndicate member in a public offering of securities for the subject company (PBR.N) within the past 3 years. As of the date of this report, Credit Suisse acts as a market maker or liquidity provider in the equities securities that are the subject of this report. Principal is not guaranteed in the case of equities because equity prices are variable. Commission is the commission rate or the amount agreed with a customer when setting up an account or at any time after that. Vinicius Canheu, CFA & Andre Sobreira, CFA each certify that (1) The views expressed in this report solely and exclusively reflect my personal opinions and have been prepared independently, including with respect to Banco de Investimentos Credit Suisse (Brasil) S.A. or its affiliates ("Credit Suisse"). (2) Part of my compensation is based on various factors, including the total revenues of Credit Suisse, but no part of my compensation has been, is, or will be related to the specific recommendations or views expressed in this report. In addition, Credit Suisse declares that: Credit Suisse has provided, and/or may in the future provide investment banking, brokerage, asset management, commercial banking and other financial services to the subject company/companies or its affiliates, for which they have received or may receive customary fees and commissions, and which constituted or may constitute relevant financial or commercial interests in relation to the subject company/companies or the subject securities. Vinicius Canheu, CFA is the responsible analyst for this report according to Instruction CVM 483 To the extent this is a report authored in whole or in part by a non-U.S. analyst and is made available in the U.S., the following are important disclosures regarding any non-U.S. analyst contributors: The non-U.S. research analysts listed below (if any) are not registered/qualified as research analysts with FINRA. The non-U.S. research analysts listed below may not be associated persons of CSSU and therefore may not be subject to the NASD Rule 2711 and NYSE Rule 472 restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account. Banco de Investm ents Credit Suisse (Brasil) SA or its affiliates. Vinicius Canheu, CFA ; Andre Sobreira, CFA For Credit Suisse disclosure information on other companies mentioned in this report, please visit the website at https://rave.credit-suisse.com/disclosures or call +1 (877) 291-2683. 123 Disclaimers March 2014 LatAm Oil & Gas Equity Research References in this report to Credit Suisse include all of the subsidiaries and affiliates of Credit Suisse operating under its investment banking division. For more information on our structure, please use the following link: https://www.credit-suisse.com/who_we_are/en/This report may contain material that is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Credit Suisse AG or its affiliates ("CS") to any registration or licensing requirement within such jurisdiction. All material presented in this report, unless specifically indicated otherwise, is under copyright to CS. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of CS. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of CS or its affiliates. The information, tools and material presented in this report are provided to you for information purposes only and are not to be used or considered as an offer or the solicitation of an offer to sell or to buy or subscribe for securities or other financial instruments. CS may not have taken any steps to ensure that the securities referred to in this report are suitable for any particular investor. CS will not treat recipients of this report as its customers by virtue of their receiving this report. The investments and services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. CS does not advise on the tax consequences of investments and you are advised to contact an independent tax adviser. Please note in particular that the bases and levels of taxation may change. Information and opinions presented in this report have been obtained or derived from sources believed by CS to be reliable, but CS makes no representation as to their accuracy or completeness. CS accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that such liability arises under specific statutes or regulations applicable to CS. This report is not to be relied upon in substitution for the exercise of independent judgment. CS may have issued, and may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented in this report. Those communications reflect the different assumptions, views and analytical methods of the analysts who prepared them and CS is under no obligation to ensure that such other communications are brought to the attention of any recipient of this report. CS may, to the extent permitted by law, participate or invest in financing transactions with the issuer(s) of the securities referred to in this report, perform services for or solicit business from such issuers, and/or have a position or holding, or other material interest, or effect transactions, in such securities or options thereon, or other investments related thereto. In addition, it may make markets in the securities mentioned in the material presented in this report. CS may have, within the last three years, served as manager or co-manager of a public offering of securities for, or currently may make a primary market in issues of, any or all of the entities mentioned in this report or may be providing, or have provided within the previous 12 months, significant advice or investment services in relation to the investment concerned or a related investment. Additional information is, subject to duties of confidentiality, available on request. Some investments referred to in this report will be offered solely by a single entity and in the case of some investments solely by CS, or an associate of CS or CS may be the only market maker in such investments. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information, opinions and estimates contained in this report reflect a judgment at its original date of publication by CS and are subject to change without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of such securities or financial instruments. Investors in securities such as ADR's, the values of which are influenced by currency volatility, effectively assume this risk. Structured securities are complex instruments, typically involve a high degree of risk and are intended for sale only to sophisticated investors who are capable of understanding and assuming the risks involved. The market value of any structured security may be affected by changes in economic, financial and political factors (including, but not limited to, spot and forward interest and exchange rates), time to maturity, market conditions and volatility, and the credit quality of any issuer or reference issuer. Any investor interested in purchasing a structured product should conduct their own investigation and analysis of the product and consult with their own professional advisers as to the risks involved in making such a purchase. Some investments discussed in this report may have a high level of volatility. High volatility investments may experience sudden and large falls in their value causing losses when that investment is realised. Those losses may equal your original investment. Indeed, in the case of some investments the potential losses may exceed the amount of initial investment and, in such circumstances, you may be required to pay more money to support those losses. Income yields from investments may fluctuate and, in consequence, initial capital paid to make the investment may be used as part of that income yield. Some investments may not be readily realisable and it may be difficult to sell or realise those investments, similarly it may prove difficult for you to obtain reliable information about the value, or risks, to which such an investment is exposed. This report may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the report refers to website material of CS, CS has not reviewed any such site and takes no responsibility for the content contained therein. Such address or hyperlink (including addresses or hyperlinks to CS's own website material) is provided solely for your convenience and information and the content of any such website does not in any way form part of this document. Accessing such website or following such link through this report or CS's website shall be at your own risk. This report is issued and distributed in Europe (except Switzerland) by Credit Suisse Securities (Europe) Limited, One Cabot Square, London E14 4QJ, England, which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. This report is being distributed in Germany by Credit Suisse Securities (Europe) Limited Niederlassung Frankfurt am Main regulated by the Bundesanstalt fuer Finanzdienstleistungsaufsicht ("BaFin"). This report is being distributed in the United States and Canada by Credit Suisse Securities (USA) LLC; in Switzerland by Credit Suisse AG; in Brazil by Banco de Investimentos Credit Suisse (Brasil) S.A or its affiliates; in Mexico by Banco Credit Suisse (México), S.A. (transactions related to the securities mentioned in this report will only be effected in compliance with applicable regulation); in Japan by Credit Suisse Securities (Japan) Limited, Financial Instruments Firm, Director-General of Kanto Local Finance Bureau (Kinsho) No. 66, a member of Japan Securities Dealers Association, The Financial Futures Association of Japan, Japan Investment Advisers Association, Type II Financial Instruments Firms Association; elsewhere in Asia/ Pacific by whichever of the following is the appropriately authorised entity in the relevant jurisdiction: Credit Suisse (Hong Kong) Limited, Credit Suisse Equities (Australia) Limited, Credit Suisse Securities (Thailand) Limited, having registered address at 990 Abdulrahim Place, 27 Floor, Unit 2701, Rama IV Road, Silom, Bangrak, Bangkok 10500, Thailand, Tel. +66 2614 6000, Credit Suisse Securities (Malaysia) Sdn Bhd, Credit Suisse AG, Singapore Branch, Credit Suisse Securities (India) Private Limited regulated by the Securities and Exchange Board of India (registration Nos. INB230970637; INF230970637; INB010970631; INF010970631), having registered address at 9th Floor, Ceejay House, Dr.A.B. Road, Worli, Mumbai - 18, India, T- +91-22 6777 3777, Credit Suisse Securities (Europe) Limited, Seoul Branch, Credit Suisse AG, Taipei Securities Branch, PT Credit Suisse Securities Indonesia, Credit Suisse Securities (Philippines ) Inc., and elsewhere in the world by the relevant authorised affiliate of the above. Research on Taiwanese securities produced by Credit Suisse AG, Taipei Securities Branch has been prepared by a registered Senior Business Person. Research provided to residents of Malaysia is authorised by the Head of Research for Credit Suisse Securities (Malaysia) Sdn Bhd, to whom they should direct any queries on +603 2723 2020. This report has been prepared and issued for distribution in Singapore to institutional investors, accredited investors and expert investors (each as defined under the Financial Advisers Regulations) only, and is also distributed by Credit Suisse AG, Singapore branch to overseas investors (as defined under the Financial Advisers Regulations). By virtue of your status as an institutional investor, accredited investor, expert investor or overseas investor, Credit Suisse AG, Singapore branch is exempted from complying with certain compliance requirements under the Financial Advisers Act, Chapter 110 of Singapore (the "FAA"), the Financial Advisers Regulations and the relevant Notices and Guidelines issued thereunder, in respect of any financial advisory service which Credit Suisse AG, Singapore branch may provide to you. This research may not conform to Canadian disclosure requirements. In jurisdictions where CS is not already registered or licensed to trade in securities, transactions will only be effected in accordance with applicable securities legislation, which will vary from jurisdiction to jurisdiction and may require that the trade be made in accordance with applicable exemptions from registration or licensing requirements. Non-U.S. customers wishing to effect a transaction should contact a CS entity in their local jurisdiction unless governing law permits otherwise. U.S. customers wishing to effect a transaction should do so only by contacting a representative at Credit Suisse Securities (USA) LLC in the U.S. Please note that this research was originally prepared and issued by CS for distribution to their market professional and institutional investor customers. Recipients who are not market professional or institutional investor customers of CS should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. This research may relate to investments or services of a person outside of the UK or to other matters which are not authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority or in respect of which the protections of the Prudential Regulation Authority and Financial Conduct Authority for private customers and/or the UK compensation scheme may not be available, and further details as to where this may be the case are available upon request in respect of this report. CS may provide various services to US municipal entities or obligated persons ("municipalities"), including suggesting individual transactions or trades and entering into such transactions. Any services CS provides to municipalities are not viewed as "advice" within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. CS is providing any such services and related information solely on an arm's length basis and not as an advisor or fiduciary to the municipality. In connection with the provision of the any such services, there is no agreement, direct or indirect, between any municipality (including the officials, management, employees or agents thereof) and CS for CS to provide advice to the municipality. Municipalities should consult with their financial, accounting and legal advisors regarding any such services provided by CS. In addition, CS is not acting for direct or indirect compensation to solicit the municipality on behalf of an unaffiliated broker, dealer, municipal securities dealer, municipal advisor, or investment adviser for the purpose of obtaining or retaining an engagement by the municipality for or in connection with Municipal Financial Products, the issuance of municipal securities, or of an investment adviser to provide investment advisory services to or on behalf of the municipality. If this report is being distributed by a financial institution other than Credit Suisse AG, or its affiliates, that financial institution is solely responsible for distribution. Clients of that institution should contact that institution to effect a transaction in the securities mentioned in this report or require further information. This report does not constitute investment advice by Credit Suisse to the clients of the distributing financial institution, and neither Credit Suisse AG, its affiliates, and their respective officers, directors and employees accept any liability whatsoever for any direct or consequential loss arising from their use of this report or its content. Principal is not guaranteed. Commission is the commission rate or the amount agreed with a customer when setting up an account or at any time after that. Copyright © 2014 CREDIT SUISSE AG and/or its affiliates. All rights reserved. Investment principal on bonds can be eroded depending on sale price or market price. In addition, there are bonds on which investment principal can be eroded due to changes in redemption amounts. Care is required when investing in such instruments. When you purchase non-listed Japanese fixed income securities (Japanese government bonds, Japanese municipal bonds, Japanese government guaranteed bonds, Japanese corporate bonds) from CS as a seller, you will be requested to pay the purchase price only. 124