Recte Rempublicam Recte Rempublicam GerereGerere Gerindo a coisa pública corretamente Management of the Public Good Gerindo a coisaProper pública corretamente Proper Management of the Public Good The Brazilian Federation: Financing Cities and Mega Cities Foro de Capitalidad/Capital Forum Ciudad de Mexico July 19th, 2010 Renato Villela Secretaria de Fazenda Estado do Rio de Janeiro 1 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Background Financing the Cities Large and Mega Cities Main Services Other Relevant Issues Final Remarks 2 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good • Federative Republic of Brazil (since 1988) • 26 States + 1 Federal District • 5,560 Municipalities • 4,491 in 1990 • 3,991 in 1980 More than 1,500 created after 1988 3 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Population: 190 million Urbanization rate: 82% Annual population growth (2008): 1.01% GDP (2008): US$ 1,575.9 billion GDPpc (2008): US$ 8,311 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Population Percentiles, 2008. 700,000 600,000 500,000 Largest São Paulo Smallest Borá Population 10,886,518 804 Population City 400,000 300,000 200,000 100,000 0 5 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good • In 1988 the Federal Constitution was voted. • It marked the end of a 20-year dictatorship. • Restoration of democracy and civil liberties were the main drive, and decentralization was viewed as a major way to achieve that. • The Constitution decentralized – not merely deconcentrated: – Revenue mobilization (strengthened tax base and transfers) – Expenditure functions • Municipalities were recognized in 1988 as having the same hierarchy of states in the Brazilian federation 6 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Background Financing the Cities Large and Mega Cities Main Services Other Relevant Issues Final Remarks 7 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Tax Assignment by government tier Municipal • on Urban Property • on Services • Real estate transfers by inheritance or legacy • fees and improvement charges State • “VAT” • on Motor vehicles • Real estate transfers (market operations) Central • on Foreign trade • on Rural property • on Income (corporate and personal) • on Industrial products • on Financial operations • Payroll tax (social security general regimen) • Social contributions • Economic contributions 8 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good 2008 Municipal States Central Tax Revenue (US$ billion) 22.4 129.2 138.6 % 7.7 44.6 47.7 9 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good TAX BURDEN IN BRAZIL Own tax collection Available after transfers Percent of GDP % Percent of GDP % Total 38.9 100 38.9 100 Central 26.7 69 22.5 58 State 10.1 26 9.8 25 Municipal 2.1 5 6.6 17 Source: Afonso & Araújo (2006) 10 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Expenditure Assignment Gov´t tier Shared (M, S and C) Function Local Source: Afonso & Araujo (2006) Function Distribution Health and social Total cultural heritage preservation; environment; education and culture; agriculture and food distribution; housing and sanitation; transportations and traffic safety; small business improvement; and tourism and sports. Education 23.7% Health 21.6% Administration 13.8% Urban services 12.4% Pensions 4.6% Transportation 3.5% Social assistance 2.9% Pre-school and primary education; and preventive health care Sanitation 2.6% Housing 0.8% Public order 0.8% Other (incl legislative and debt) 13.3% Expenditure assignent assistance; historic and Mainly local Municipal expenditure by Functions Intra-city public transportation; and land use regulation US$ 39.3 Source: Afonso & Araújo (2006) 11 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good VERTICAL IMBALANCE MUNICIPALITIES Own revenue and loans Total Expenditure 100% 32% Tax sharing Mandatory transfers 68% Discretionary transfers Source: Brazilian National Treasury 12 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good HORIZONTAL IMBALANCE Population brackets (thousand inhabitants) Tax Revenue US$ per capita Total Population in the Bracket (million inhabitants) Less than 50 178 61.1 50 to 100 339 20.0 100 to 500 541 39.5 500 to 1,000 654 12.0 1,193 33.3 521 166.5* More than 1,000 Total Source: National Treasury and Brazilian Statistics Bureau (IBGE) * Corresponds to the population of the municipalities for which there was fiscal data. 13 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Central States Three major types: • Tax sharing • Based on the Constitution or the law (mandatory) • Discretionary Municipalities 14 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Tax Sharing: Municipalities get • 25% of the state VAT [main criteria: economic activity (3/4), population, area, local tax collection] • 50% of the state tax on motor vehicles (# of licensed vehicles in the municipality) • 50% of the federal tax on rural property (property localization) • 70% of the federal tax on financial operations with gold (amount of gold extracted locally) 15 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Equalization fund (22.5% of the federal income tax and of the tax on indl products) 10% of the fund to the state capitals f(Population + Income per capita -1) 90% to remaining municipalities Population: 16 brackets with index varying from: Less than 1,188 inhabitants => 0.6 …. More than 156,216 inhabitants => 4.0 Smaller municipalities get proportionally much more 16 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Compensation/cooperation purposes • • • • • • Loss of tax on industrial products due to exports exemption Loss of VAT due to exports of primary and manufactured goods Royalties and other compensations on oil and natural gas production, hydroelectricity, and mineral resources 25% of the states quota on a federal contribution on fuels Fund for basic education (better described later) National Health Fund (better described later) 17 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Discretionary Transfers • Depend on political will and agreement between administrations • Very small (only about 0.2 % of GDP), but increasing very fast • Project linked: consistent with federal or state policies • Matching funds (at least 20%, with few exceptions) • Concentrated on 2 ministries (health and education), but recently the Ministry of the Cities (Urban Affairs) has become also an important player. Program for Acceleration of Growth – mostly paying for investment in sanitation services. 18 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Background Financing the Cities Large and Mega Cities Main Services Other Relevant Issues Final Remarks 19 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good The Health Sector The 1988 Federal Constitution ensured universal access to publicly provided health services. Centralized financing (only the federal government), and decentralized service delivery based on strict rules and government and social oversight Public providers (central, state, and municipal) Private providers Managing health care centers, hospitals, and clinics Are reimbursed by the Central government for medication, consultations, exams, and surgeries and complex treatments 20 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Municipal service delivery The Health Sector (cont.) Municipalities also spend their own resources in health (12% of taxes and general purpose transfers => health services) Large and Mega Cities have their own health network, which is only partially funded by the NHS Metropolitan problems are dealt with by States and the NHS - coordination problems The dynamics of the costs of services are posing an increasing challenge for local public and state public health networks 21 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Education The sector benefits from a earmarking of 25% of own taxes and general purpose transfers Fund for Basic Education Development (FUNDEB) • One fund for each state and corresponding municipalities: – 20% of the own taxes and transfers of each entity go to the fund – The resources of the fund are redistributed according to the number of students enrolled in the respective basic-education public school system of unit The idea is to ensure that the public funds earmarked to basic education (first 9 years, pre-school included) are matched with the actual supply of the service In Rio, the municipality covers all public primary education and the State responds for the high school system 22 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Water and Sanitation Before 1988: • State responsibility – State enterprises • collected, treated, and distributed water • collect, and disposed of the sewage – Billing according to consumption, allowing for some subsidy of low consumption levels and some cross-subsidies for poorer areas – Municipalities had no influence on the enterprises´ investment plans 23 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Water and Sanitation (cont.) After 1988: – Companies are still there (some privatized) – Fierce dispute over the concession powers – Mid-size cities in rich areas took over the concessions, and either set-up their own companies or auctioned the concession to private partners. – Some new experiments with PPPs. – Larger cities mostly are still with the state companies, and many of them have opened their capital. 24 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Background Financing the Cities Large and Mega Cities Main Services Other Relevant Issues Final Remarks 25 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Municipal borrowing All municipalities are free to borrow and issue bonds, both domestically and abroad – except those that signed debt agreements with the Federal government (183 municipalities, representing around 90% of municipal debt) – And provided that the legal debt rules be complied with 26 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Subnational Debt is constrained by several mechanisms and ratios FRL & Senate Observance of maximum service and debt ratios to be able to contract new debt CMN Rationing of total credit to the public sector (excp. for multilaterals) Prudential limit by bank (45% of capital) PAF Declining Debt Trajectory Multiyear limit for new operations 27 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Budget rigidity (mostly due to earmarking) Constitution: • • 12% for health (NHS not included) 25% for education (FUNDEB included) Debt agreements: 13% of state/municipal revenues to debt service (25 states and 183 municipalities) Personnel and pensions – public servants cannot be fired Not much money left for other functions, especially investments Bottom-line: the mayors – especially from Mega Cities have very little space to implement their own policies or to meet other needs of their constituency 28 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Background Financing the Cities Large and Mega Cities Main Services Other Relevant Issues Final Remarks 29 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good • Municipalities have the same status in the federation as states: the Central government deals directly with the municipal government. • Small, large and Mega cities in Brazil are bound to the same legal and institutional framework, but very different problems • The bulk of the transfers are not attached to federal or state programs. Which is good, but… • High budget rigidity leaves very few resources available to the discretion of the municipal authorities 30 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Rio de Janeiro, o melhor lugar para trabalhar Thank you ! Rio de Janeiro, the best place to work [email protected] 31 Recte Rempublicam Gerere Gerindo a coisa pública corretamente Proper Management of the Public Good Thank you Teresópolis Niterói Campos Costa Verde Sefaz/RJ – excelência de serviços 32

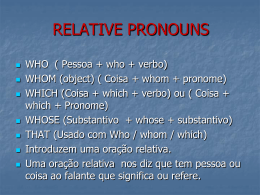

Baixar