Notice to the Market

PUBLIC OFFERING OF THE 4TH (FOURTH) DEBENTURES ISSUANCE OF EDP

NOTICE TO THE MARKET OF MODIFICATION OF OFFER

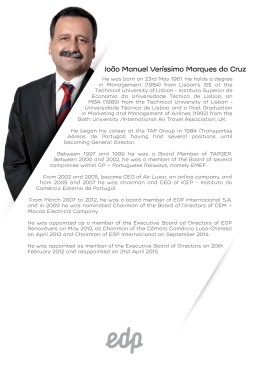

São Paulo, September 21, 2015 – EDP – Energias do Brasil S.A. (“EDP” or the “Company”)

(“BM&FBOVESPA: ENBR3”), a publicly held company duly registered in the category "A" with the

Securities Exchange Commission ("CVM"), hereby informs the market for purposes of the public offering

of the simple debentures, not convertible into shares, unsecured, up to four series, of the fourth issuance

of the Company ("Offer"), the following:

(i) with the resume of the Offer, and in order to provide more transparency to investors regarding the

procedures described in the section “Information Relative to the Issue, Offer and Debentures – Offer

Features – Offer Plan”, of the Preliminary Prospectus, the Coordinators and the Company:

(a) have adjusted the sharing procedures in the event of excess of demand, pursuant to items (ix)

and (x) of the Offer Plan of the Preliminary Prospectus;

(b) have adjusted the references to the Debentures that will be aimed to the Retail Investors,

contained in items Offer Plan and Retail Offer of the Preliminary Prospectus, in order to clarify that

the Retail Investors are only entitled to make their respective Reservation Requests for the Third

Series Debentures and the Fourth Series Debentures for the purposes of the Retail Offer;

(c) have enhanced the risk factor relative to the possibility that can be sent few intentions and/or

investment orders by the Institutional Investors during the Bookbuilding Process, which may

adversely affect the definition of the Remuneration on the Third Series Debentures and the

Remuneration on the Fourth Series Debentures and the investment in the Third Series Debentures

and in the Fourth Series Debentures”; and

(d) have reflected such adjustments on the specific procedures of the Retail Offer and of the

Institutional Offer described in sections “Information Relative to the Issue, Offer and Debentures –

Offer Features – Retail Offer” of the Preliminary Prospectus and “Information Relative to the Issue,

Offer and Debentures – Offer Features – Institutional Offer” of the Preliminary Prospectus,

respectively, so that the investors have access to clear and concise information on the Offer

procedures.

(ii) no deadline shall be given for the ratification of the investment intentions, as provided by the sole

paragraph of article 27 of CVM Instruction 400, taking into account that, up to this date, the Reservation

Period to receive the investment intentions from the Retail Investors has not started, which shall

correspond to September 24, 2015, as well as due to the fact that the Bookbuilding Process, on which

occasion the investment intentions from the Institutional Investors shall be received, has not been taken,

and will take place on September 25, 2015; and

1

Notice to the Market

(iii) the other terms and conditions of the Offer remain unchanged, as provided in the Press Release, in

the Notice to the Market of Revocation of Offer Suspension and Modification and in the Preliminary

Prospectus, except where affected by the facts informed hereunder.

Investors wishing to obtain a copy of the Preliminary Prospectus with the modifications indicated in this

Notice to the Market of Modification of Offer or additional information on the Offer shall refer, as of the

date of publication of this Notice to the Market of Modification of Offer, to the following addresses and

internet webpages of the Company, of the Offer Coordinators and/or of the institutions taking part in the

Offer indicated below or before the CVM:

COMPANY:

EDP – Energias do Brasil S.A.

Rua Gomes de Carvalho, 1996, 8º andar, Bairro Vila Olímpia

CEP 04547-006 – São Paulo, SP

C/o: Mr. Cassio Carvalho Pinto Vidigal

Phone.: + 55 (11) 2185-5085

Fax: + 55 (11) 2185-5167

(http://www.edp.com.br, click on “Investors”, then click on “Investor’s Kit” and, finally, click on “Preliminary

Prospectus of Public Distribution of the 4th Issue of Debentures of EDP – Energias do Brasil S.A.”).

OFFER COORDINATORS:

LEADING COORDINATOR:

HSBC Bank Brasil S.A. – Banco Múltiplo

Avenida Brigadeiro Faria Lima, 3064, 10º andar

CEP 01451-000 – São Paulo, SP

C/o: Mr. Antonio Marques de Oliveira Neto

Phone.: + 55 (11) 3847-5078

Fax: + 55 (11) 3847 9832

(http://www.hsbc.com.br/mercadodecapitais, on such page click on “Prospectus of Public Distribution of the

4th Issue of Debentures of EDP – Energias do Brasil S.A.”

COORDINATORS:

Banco BTG Pactual S.A.

Avenida Brigadeiro Faria Lima, 3.477, 10º a 15º andares

CEP 04538-133 – São Paulo, SP

C/o: Mr. Daniel Vaz

Phone.: + 55 (11) 3383-2000

Fax: + 55 (11) 3383-2001

(https://www.btgpactual.com/home/InvestmentBank.aspx/InvestmentBanking/MercadoCapitais, on such

page click on “2015” on the left menu and then on “Preliminary Prospectus” just below “Public Distribution

of the 4th Issue of Debentures of EDP – Energias do Brasil S.A.”)

BB – Banco de Investimento S.A.

Rua Senador Dantas, 105, 36º andar

CEP 20.031-923 – Rio de Janeiro, RJ

2

Notice to the Market

C/o: Mr. Erison A. Furtado

Phone.: + 55 (21) 3808-3625 / (11) 3149-8504

Fax: + 55 (21) 3808-3239 / (11) 3149-8529

(http://www.bb.com.br/ofertapublica, on this website click on “EDP – Energias do Brasil” and click on “Read

the Prospectus”).

The Preliminary Prospectus shall also be available at the following addresses and websites: (i) Comissão de

Valores Mobiliários – CVM [Brazilian Securities and Exchange Commission], with addresses at Rua Sete de

Setembro, 111, 5º andar, CEP 20159-900, Rio de Janeiro, RJ, and Rua Cincinato Braga, 340, 2º, 3º e

4º andares, CEP 01333-010 – São Paulo, SP (http://www.cvm.gov.br, on such page click on item “Data Base

Consultation”, then select “Companies” and click on “Company Documents and Information”). On the new

page, type “EDP Energias” and click on “Continue”. Then, click on "EDP – Energias do Brasil S/A” and select

“Public Distribution Offer Documents”. Click on download of the Preliminary Prospectus with the most recent

date; (ii) BM&FBOVESPA S.A. – Bolsa de Valores, Mercadorias e Futuros [São Paulo Stock Exchange], with

address at Praça Antonio Prado, 48, CEP 01010-901 – São Paulo, SP (http://www.bmfbovespa.com.br/ptbr/mercados/acoes/ofertas-publicas/ofertas-publicas.aspx?Idioma=py-br, on such page click on “Offers in

Progress”, then on “EDP Energias” and select item “Preliminary Prospectus”); (iii)

CETIP

S.A.

–

Mercados Organizados, with address at Avenida Brigadeiro Faria Lima, 1.663, 1º andar – São Paulo, SP

(http://www.cetip.com.br, on such page select link “Prospectus” in section “Notices and Documents”, then

“Debenture Prospectus”, type “EDP Energias” and year “2015” and click on SEARCH; then, click on the link

relative to the Preliminary Prospectus); and (iv) Associação Brasileira das Entidades dos Mercados

Financeiro e de Capitais – ANBIMA, (http://cop.anbima.com.br, on this website click on “Follow Up Review

of Offers”, then click on protocol “003/2015” or “EDP – Energias do Brasil S.A.” and, finally, click on

“Preliminary Prospectus EDP – Energias do Brasil S.A.” on the most recent version made available.

All capitalized terms used in this Notice to the Market of Revocation of Offer Suspension and Modification

which are not defined herein have the same meaning ascribed to them in the “Preliminary Prospectus of

Public Offer of Distribution of the Fourth Issue of Debentures of EDP – Energias do Brasil S.A.” and its exhibits

or documents incorporated by reference thereto (“Preliminary Prospectus”).

READ THE PRELIMINARY PROSPECTUS AND THE REFERENCE FORM, WHICH IS INCORPORATED INTO IT BY

REFERENCE, BEFORE ACCEPTING THE OFFER, MAINLY THE SECTIONS “RISKS RELATED TO THE OFFER AND

THE DEBENTURES” OF THE PRELIMINARY PROSPECTUS, AS WELL AS SECTIONS “4. RISK FACTORS” AND “5.

RISKS RELATED TO THE MARKET” OF THE REFERENCE FORM, WHICH IS INCORPORATED INTO IT BY

REFERENCE, FOR A DESCRIPTION OF CERTAIN RISK FACTORS RELATED TO THE SUBSCRIPTION OF THE

DEBENTURES THAT SHOULD BE CONSIDERED BEFORE MAKING INVESTMENT DECISIONS IN RELATION TO

THE OFFER AND TO THE INVESTMENT IN THE DEBENTURES.

THE OFFER AND, AS A CONSEQUENCE, THE INFORMATION CONTAINED IN THE PRELIMINARY PROSPECTUS

ARE UNDER THE REVIEW OF BOTH ANBIMA AND CVM AND, FOR THIS REASON, THEY ARE SUBJECT TO

COMPLEMENTATION OR RECTIFICATION. THE DEFINITIVE PROSPECTUS WILL BE MADE AVAILABLE TO

INVESTORS AT THE ABOVE MENTIONED PLACES, AS OF THE DATE OF DISCLOSURE OF THE

ANNOUNCEMENT OF BEGINNING, WHICH WILL DEPEND ON THE GRANTING OF REGISTRATION OF THE

OFFER BY THE CVM. UPON ITS DISCLOSURE, THE DEFINITIVE PROSPECTUS SHALL BE USED AS YOUR MAIN

CONSULTATION SOURCE FOR ACCEPTANCE OF THE OFFER, AND THE INFORMATION CONTAINED THEREIN

SHALL PREVAIL ON ANY OTHER.

3

Notice to the Market

The request of previous review of the Offer was requested before ANBIMA on August 5th, 2015, the Offer

being subject to the review and approval of both ANBIMA and CVM. The Offer will be registered in conformity

with the procedures provided by CVM Instruction 400, by CVM Instruction 471, by the ANBIMA Code of

Convening Activities and other applicable legal and regulatory provisions.

THE REGISTRATION OF THIS DISTRIBUTION DOES NOT IMPLY, ON THE PART OF CVM, THE GUARANTEE OF

VERACITY OF THE INFORMATION PROVIDED OR IN JUDGMENT ON THE QUALITY OF THE COMPANY, AS

WELL AS ON THE DEBENTURES TO BE DISTRIBUTED.

+

4

Baixar