INTERIM CONSOLIDATED

FINANCIAL STATEMENTS AND

MANAGEMENT REPORT

I ST HALF 2008

INDEX

Interim Consolidated Management Report

3

Highlights

3

Economic and Financial Analysis

4

Activity by Business Area

7

Share Performance

11

Future Risks and Uncertainties

13

Mandatory Information

15

Share dealings

15

Qualified shareholdings

17

Statements of Compliance

18

Interim Consolidated Financial Statements

21

Consolidated Profit and Loss Account

22

Consolidated Balance Sheet

23

Consolidated Statement of Changes in Equity

24

Consolidated Cash Flow Statement

25

Notes to the Consolidated Financial Statements

26

The interim financial statements for the six months ended 30 June 2008 have not been audited.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

2

INTERIM MANAGEMENT REPORT

The interim financial statements for the six months ended 30 June 2008 have not been audited. This is a translation

from the original report issued in Portuguese.

HIGHLIGHTS

•

Revenues grew 78% to 372,2 million euros

•

EBITDA (*) reached 29,6 million euros, representing a 171% growth and an 8% margin

•

Net profit for the period of 9,7 million euros

1º Half 2008

Weight

1º Half 2007

adjusted**

Revenues

372,2

EBITDA (*)

29,6

8,0%

11,0

EBIT (***)

17,7

4,7%

9,7

2,6%

Net earnings for the period

Average number of employees

2.567

Weight

209,6

Change

1º Half 2007

reported

Weight

78%

209,6

5,2%

171%

11,0

5,2%

7,0

3,3%

153%

7,0

3,3%

5,0

2,4%

93%

18,6

8,9%

1.727

1.727

(*) EBITDA – Earnings before interest, taxes, depreciation, amortization and provisions.

(**) The adjustment to the earnings of the first half of 2007 are a result of the capital gain of 21,1 million euros resulting from the impact

of the dilution of the stake in the share capital of REpower Systems AG in the period as a result of a capital increase not subscribed by

Martifer and a €7,5Mn cost related to the bid on REpower Systems.

(***) EBIT – Earnings before interest and taxes.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

3

ECONOMIC AND FINANCIAL ANALYSIS

In the first half of 2008, Martifer Group showed a good operational performance, with significant improvements in

revenues, operational earnings as measured by EBITDA and profits in the period. This is a result of the positive

evolution of the activity and the improvement of operational results in all business areas of the Group.

(€Mn)

1st Half 2008

1st Half 2007

adjusted *

Change

Revenues

372,2

209,6

78%

EBITDA

29,6

11,0

171%

EBITDA margin

8,0%

5,2%

+2,7p.p.

EBIT

17,7

7,0

EBIT margin

4,7%

3,3%

Financial expenses

4,2

0,8

425%

Taxes

3,7

1,2

223%

Net earnings for the period

9,7

5,0

93%

1,7

0,2

949%

8,0

4,8

64%

Attributable to minority interests

Attributable to the Group

153%

+1,4p.p.

(*) The adjustment to the earnings of the first half of 2007 are a result of the capital gain of 21,1 million euros

resulting from the impact of the dilution of the stake in the share capital of REpower Systems AG in the period as a

result of a capital increase not subscribed by Martifer and a €7,5Mn cost related to the bid on REpower Systems.

Consolidated revenues reached 372,2 million euros, representing a 78% increase versus the same period last year. This

increase is a result of the increased activity in all business areas: in Metallic Construction, the increase in revenues was

of 22%, reaching 154,5 million euros, in Energy Systems the revenues grew 227%, reaching 118,4 million euros and in

the Agriculture & Biofuels business area revenues reached 101,5 million euros, representing a 90% growth. The

revenues from the Electricity Generation business area reached 7,5 million euros, mainly due to the contribution from

the wind farms in Germany acquired in 2007.

Metallic Construction represented 42% of consolidated revenues, Energy Systems 32%, Electricity Generation 2% and

Agriculture & Biofuels 27%.

Earnings before interest, taxes, depreciation and amortization and provisions – EBITDA – reached 29,6 million euros,

representing a 171% growth versus the same period last year. This growth is due to the better operational results in all

business areas. Consolidated EBITDA margin reached 8,0% this period, versus 5,2% in the same period last year.

The 17,7 million euros in earnings before interest and taxes – EBIT – in this period are 153% above the same period

last year and the margin was 4,7% of revenues.

Net financial expenses reached 4,3 million euros and represent a 428% increase on an adjusted basis (adjusting the net

financial expenses in the fist half of 2007 for the capital gain of 21,1 million euros resulting from a capital increase in

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

4

REpower Systems AG not subscribed by Martifer and by a financial cost of 7,5 million euros related to the bid on

REpower Systems AG). The larger net financial expenses are mainly a result of the higher level of indebtedness. The

Group recorded net interest expenses of 9,8 million euros, which were in part compensated by net favourable

currency changes of 3,2 million euros and 2,2 million euros in dividends received from EDP – Energias de Portugal.

As a result, the Group recorded a net profit in the period of 9,7 million euros, representing a 93% growth compared

to the same period last year on an adjusted basis. On a reported basis, the net profit fell 48% versus the 18,6 million

euros recorded in the first half of 2007.

INVESTMENTS

In the period, the Group invested 79,5 million euros in fixed assets, mainly in investments in the Energy Systems

business area, namely to increase capacity in the tower factory, in the wind power components factory, in the turbine

assembly unit and in the photovoltaic modules factory, representing an investment of 29,7 million euros. In the

promotion and development of wind farms and solar parks, the Electricity Generation business unit invested 26,3

million euros in the period. In the Agriculture & Biofuels business area 16,5 million euros were invested, mainly in land,

machinery and in the vegetable oil extraction unit in Romania.

The Group also concluded several financial investments in the period.

In March, the Group increased its stake in the Agriculture & Biofuels business area, through the acquisition of the a

6,5% stake in Prio SGPS SA, for 11,1 million euros, and paid 3,9 million euros for the supplementary capital invested in

the company by the selling shareholder.

The Group, through Martifer Energy Systems, following a capital increase raised its stake in Martifer Solar from 55% to

75% representing a 12,7 million euros investment, including conversion of shareholder loans. Other financial

investment in the period include the acquisition of Navalria, a shipyard in the port of Aveiro, and the 50% the Group

did not own in Solarparks, an associated company that builds solar parks in Spain.

In January 2008, the Group acquired 15.291.383 shares of EDP - Energias de Portugal (EDP) for 60,9 million euros. At

the end of June, the Group held 17.695.505 shares of EDP, representing an investment of 80,1 million euros. At the

end of the period, at the closing price of EDP shares on 30 June 2008, the value of this stake was 58,7 million euros

and a reduction of shareholders equity of 21,4 million euros was recorded through the adjustment of fair value.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

5

INDEBTEDNESS

At the end of June 2008, the Group had a net debt of 428,1 million euros. Comparing with the end of 2007, net debt

increased 216 million euros. The increase is due to the above mentioned investments, both in fixed and financial assets,

as well as working capital investments.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

6

ACTIVITY BY BUSINESS AREA

METALLIC CONSTRUCTION

(€Mn)

Revenues

1st Half 2008

154,5

1st Half 2007

Change

127,1

22%

15,9

11,5

38%

10,3%

9,1%

+1,3 p.p.

EBIT

12,4

8,6

EBIT margin

8,0%

6,8%

Financial expenses

0,8

1,0

-15%

Taxes

3,8

1,8

116%

Net earnings for the period

7,7

5,9

32%

Attributable to minority interests

0,9

0,6

53%

Attributable to the Group

6,9

5,3

29,2%

EBITDA

EBITDA margin

44%

+1,2 p.p.

In this business area, revenues reached 154,5 million euros representing a 22% growth. This increase is mainly due to

the positive performance of the metallic structure activity in Spain and in Central Europe (Poland and Romania).

External markets represented 44% of the revenues, against 36% in the first half of 2007.

EBITDA reached 15,9 million euros, representing a 38% growth versus the same period last year. EBITDA margin was

10,3%, versus 9,1% last year in the same period. This growth results from the increase of margin in all geographic

locations.

Net financial expenses reached 831 thousand euros, recording a 13% decrease versus the same period last year. The

performance is a result of favourable currency changes of 2,3 million euros, resulting from the appreciation of the

Polish and Romanian currencies against the Euro, while net interest expenses reached 3,4 million euros and other net

financial expenses reached 244 thousand euros.

As a result, net profits of this business area reached 7,7 million euros, a 32% improvement versus the first half of 2007.

During the period, 4,8 million euros were invested in fixed assets, part of which in the conclusion of the investment in

the Romanian industrial unit.

The order book at the end of June 2008 in this business area reached 306 million euros. About half of the order book

in value is already coming from outside Iberia (mainly Poland and Romania, but also Ireland and Angola).

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

7

ENERGY SYSTEMS

(€Mn)

1st Half 2008

1st Half 2007

Change

Revenues

118,4

36,3

227%

EBITDA

10,2

2,6

298%

EBITDA margin

8,6%

7,1%

+1,5 p.p.

8,3

1,8

7,0%

5,1%

-0,4

0,3

-

Taxes

2,2

0,1

2596%

Net earnings for the period

6,5

1,4

349%

Attributable to minority interests

1,3

0,1

855%

Attributable to the Group

5,2

1,3

297%

EBIT

EBIT margin

Financial expenses

349%

+1,9 p.p.

In the Energy Systems business area revenues increased 227% to 118,4 million euros. This increase of activity was

mainly registered in the second quarter, reflecting the increasing activity in the construction of turnkey wind farms and

the contribution from of the turnkey construction of solar parks. The tower factory also recorded higher level of

activity in the first half of 2008 as a result of the increase of installed capacity that was finalized in the semester.

EBITDA reached 10,2 million euros, representing a 298% growth versus the same period last year, resulting from the

higher level of activity and the improvement of EBITDA margin, that reached 8,6% versus 7,1% recorded in the first

half of 2007. The improvement in margin in this business area is mainly a result of the contribution of the turnkey

construction activity, both in wind and solar.

Net profit for the period reached 6,5 million euros, of which 1,3 million euros attributable to minorities, mainly in

Repower Portugal (50% held by the Group) and Martifer Solar (75% held by the Group).

Investment in this division reached 29,7 million euros in the period, mainly in industrial units. During this period, the

increase in installed capacity at the tower factory to 400 towers per year was concluded. Still in the wind power

segment, investments were done in the turbine assembly unit and in the components factory, and these units are

expected to start up in the last quarter of the year. In the solar segment, construction started on the photovoltaic

modules factory, with a 50MW installed capacity, and this unit is also expected to start up in the last quarter of the

year.

In the period, the Group increased its stake in Martifer Solar through a capital increase, which represented an

investment of 12,7 million euros, including conversion of shareholder loans. Martifer Solar acquired the 50% it did not

own in Solarparks, which builds solar parks on a turnkey basis. During this first half of the year Martifer Solar began

commercial activities in Italy, Greece, France, Belgium and United States of America.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

8

ELECTRICITY GENERATION

(€Mn)

1st Half 2008

1st Half 2007

Change

Revenues

7,5

0,4

2016%

EBITDA

-0,4

-1,2

-65%

-5,5%

-331,2%

EBITDA margin

-

-3,8

-1,2

-50,3%

-342,2%

-

0,4

-0,2

-

Taxes

-0,6

-0,2

289%

Net earnings for the period

-3,5

-0,9

303%

Attributable to minority interests

-0,6

0,0

-

Attributable to the Group

-3,0

-0,9

244%

EBIT

EBIT margin

Financial expenses

211%

Revenues from the Electricity Generation business unit reached 7,5 million euros, mainly due to the contribution of

the wind farms in Germany acquired at the end of 2007.

The production in the German wind farms was of 57.547 MWh and sales of electricity reached 5,0 million euros.

EBITDA margin of these wind farms was 78%.

EBITDA of this business area in the period was negative 413 thousand euros, as the current revenue base is insufficient

to cover the development costs of the portfolio, the costs related to the increase of portfolio and central costs.

Amortizations reached 3,3 million euros, almost exclusively related to the German wind farms.

Net earnings for the period were negative 3,6 million euros.

In this 6 months period, Martifer Renewables invested 26,3 million euros in fixed assets, namely the acquisition of

equipments for the wind farms in Central Europe and in the construction of solar photovoltaic parks in Spain.

During the second half of the year several solar photovoltaic parks in Spain with an installed capacity of 6MW should

start production. Construction will also begin in the wind farms in Poland and Romania.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

9

AGRICULTURE & BIOFUELS

(€Mn)

1st Half 2008

Revenues

EBITDA

EBITDA margin

1st Half 2007

Change

101,5

53,5

90%

5,2

-2,5

-310%

5,1%

-4,6%

-

2,2

-2,8

-

2,2%

-5,2%

-

3,4

-1,1

-

-1,4

-0,6

-

0,3

-1,1

-

Attributable to minority interests

0,0

-0,5

-

Attributable to the Group

0,2

-0,6

-

EBIT

EBIT margin

Financial expenses

Taxes

Net earnings for the period

In the Agriculture & Biofuels business area, in which Prio, the holding company, is 60% held by Martifer, revenues

reached 101,5 million euros. This amount is not comparable to the first 6 months of 2007 at which time the revenues

were exclusively from the whole sale of fuels. Last year, agriculture activity revenues were only recorded in the second

half of the year and the biodiesel factories only started operations in the second half of the year.

In this period revenues came from agriculture, fuel marketing and biodiesel sales. Agriculture revenues were of 18,1

million euros, of which 9,6 million euros from agriculture, mainly production in progress, and 8,5 million euros from

the sale of vegetable oil.

The fuel distribution and marketing revenues reached 32,6 million euros. The sales of fuel were of 28,7 cubic meters.

At the end of June, the retail network was of 5 Prio branded petrol stations and 11 petrol stations under the

agreement with Jerónimo Martins.

Revenues from the sale of biodiesel were of 59,5 million euros. Sales in the period were of 50,7 million tons. Sales of

biodiesel were negatively impacted by the delay in the publication of the ISP (fuel tax) exemption for 2008 in Portugal

and, in Romania, for the longer than expected negotiations of the 2008 contracts. Globally, sales of biodiesel suffered

from the raw material price increase (vegetable oil).

EBITDA reached 5,2 million euros, representing an EBITDA margin of 5,1%. Net earnings for the period were 269

thousand euros.

In this period, this business area invested 16,5 million euros, mainly in the agriculture activity, namely in land, machinery

and in the construction of the vegetable oil extraction unit in Romania.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

10

At the end of the period, Prio controlled about 45.640 thousand hectares of land in Romania and Brazil, of which

17,390 thousand hectares are cultivated.

FUTURE RISKS AND UNCERTAINTIES

The activities of Martifer Group are conducted under the assumption of continuity of operations and on the basis of

maximization of stakeholder value. In order to achieve sustainable growth, Martifer seeks to strengthen its strategic

and competitive positions in the business areas it operates in. In these, the Group seeks to take full advantage of

growth opportunities, and as such, faces certain risks inherent to these activities. Martifer seeks to identify and

prioritize in a timely and correct manner these risks and to act towards reducing the potential impact of said risks on

the performance of the Group.

The activity of the Metallic Construction division has not been impaired by the deterioration in the economic

environment felt during the year. For the second half, the expectation is that any eventual impact in certain regions will

be compensated by the activity in other regions. The economic environment, however, has contributed to longer

receivables collection period. At this time, no material uncollectible situations are expected. Another risk area in

Metallic Constructions concerns price increases in raw materials, namely steel. The Group considers profitability will

not be influenced as selective stock policies are used and the increase in costs tends to be reflected in prices. Finally,

this business area registered favourable currency movements of €2,3Mn which may not occur in the second half of the

year.

In Energy Systems, the Group expects a significant increase in the activity in the second half mainly due to turnkey

wind and solar projects in construction or expected to start until the end of the year. Inherent to this activity is the

risk of a delay in the execution of the projects resulting from delays in the reception of equipments or in obtaining the

necessary permits on behalf of our clients, which may have an effect on revenues. Additionally, the nature of the

turnkey activity may lead to eventual penalties for late delivery regarding construction deadlines or if performance or

efficiency ratios are below expectations. Nevertheless, based on the projects in hand, the Group does not expect any

material effects in the second half of the year.

In regards to Electricity Generation, given the current market conditions in obtaining wind and solar equipments,

sometimes it is necessary to advance payments to suppliers in order to secure equipments, even without having

obtained full licensing for the projects. This may result in higher than expected working capital requirements. Even

though equipment and turnkey contracts typically include warranties and penalties covering delivery deadlines, delays

may result in less attractive tariffs and, consequently, in lower returns. Finally, the Electricity Generation area requires

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

11

considerable investments usually employing high leverage. The current market conditions and the increase in interest

rates may result in an increase in the required rate of return for certain projects. Nonetheless, Martifer Renewables

does not expect any material impact in its activity during the second half of the arising from these risk factors.

In Agriculture & Biofuels, the recent volatility in the price of goods may affect the return of the agriculture activity.

Nevertheless, current market prices are above the prices in the beginning of the year and usually a lower margin in this

business area implies a better margin in the biofuel activity. In which concerns the sale of biodiesel, both quantities and

margin may be affected by the increase in price due to the increase in price of feedstock. This activity has also been

impacted by the uncertainty regarding future policies for promoting the use of biodiesel, which may continue in the

second half of the year.

The Group held on 30 June 2008 17.695.505 shares of EDP - Energias de Portugal. Given the high volatility witnessed

in financial markets, it is uncertain what the share price evolution will be in the coming months.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

12

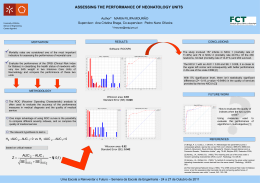

SHARE PERFORMANCE

Martifer is listed on Euronext Lisbon since June 2007. The closing price of Martifer shares on 30 June 30 2008 was 6,97

euros per share, which represents a market capitalization of 697.000.000 euros. Since the beginning of the year,

Martifer stock fell 14,5%. In the same period, the most representative index on the Portuguese market, the PSI20, fell

by 31,6%. Average daily volume in the period was 99.373 shares.

1st Half 2008

Shares traded

Closing price

400.000

10,00

9,50

9,00

8,50

8,00

7,50

7,00

6,50

6,00

5,50

5,00

200.000

0

Dec-07 Jan-08

Feb-08 Mar-08 Apr-08 May-08 Jun-08

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

13

INFORMATION REGARDING THE INTERIM NON CONSOLIDATED FINANCIAL STATEMENTS

In the terms of paragraph b) on the number 3 of article 246 of the Securities code, the interim non consolidated

financial statements of Martifer SGPS SA are not published as they do not contain any relevant information.

Oliveira de Frades, 28 August 2008

__________________________________

Carlos Manuel Marques Martins, Chairman

__________________________________

Jorge Alberto Marques Martins, Vice-Chairman

__________________________________

António Manuel Serrano Pontes, Director

__________________________________

Eduardo Jorge de Almeida Rocha, Director

__________________________________

António Jorge Campos de Almeida, Director

__________________________________

__________________________________

Pedro Álvaro de Brito Gomes Doutel , Director

__________________________________

José Manuel de Almeida Rodrigues, Director

Luís Valadares Tavares, Director

__________________________________

Jorge Bento Ribeiro Barbosa Farinha , Director

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

14

MANDATORY INFORMATION

HOLDINGS OF MEMBERS OF THE MANAGEMENT AND SUPERVISORY BODIES

In accordance with paragraph b) of number 1 of article 9 of the CMVM Regulation number 4/2004, Martifer SGPS, SA

declares to have received the following information:

Management and Supervisory bodies

member

Shares held

on Dec.

31st, 2007

Carlos Manuel Marques Martins

70.030

Jorge Alberto Marques Martins

109.460

António Manuel Serrano Pontes

António Jorge Campos de Almeida

Eduardo Jorge de Almeida Rocha

Share dealings in the first half 2008

Date

Purchase

Sales

Average

Price

Shares held

on Jun.

30th, 2008

70.030

15 Jan

1.300

6,72

17 Mar

5.000

7,71

20 Mar

15.000

7,45

70.447

130.760

70.447

6.520

21 Jan

5.000

5,80

11.520

15.000

4 Jan

5.000

7,70

20.000

José Manuel de Almeida Rodrigues

n.d.

24.453

Pedro Álvaro de Brito Gomes Doutel

n.d.

2.230

Carlos Manuel Marques Martins and Jorge Alberto Marques Martins, Chairman and Vice-Chairman respectively, are

direct shareholders of Martifer SGPS SA and additionally hold the total share capital of MTO - SGPS, SA (MTO). MTO

held on 30 June 2008 a total of 38.532.781 shares of Martifer SGPS SA.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

15

In the following table are the share dealings by MTO during the first half of 2008:

MTO – SGPS, S.A.

Share dealings in the first half 2008

14 Jan

44.000

Average

Price

6,921

16 Jan

50.000

6,239

17 Jan

25.440

6,31

18 Jan

86.735

6,248

21 Jan

30.000

5,897

22 Jan

58.007

5,803

23 Jan

66.822

6,14

24 Jan

67.639

6,132

25 Jan

4.550

6,438

28 Jan

29.296

6,848

29 Jan

16.500

6,132

30 Jan

68.828

7,204

31 Jan

28.664

7,366

1 Feb

9.389

7,282

4 Feb

36.220

7,332

5 Feb

67.037

7,193

6 Feb

58.000

7,046

7 Feb

67.352

6,996

8 Feb

61.098

7,298

7 Mar

14.000

7,669

17 Mar

3.000

7,738

8,82

30 Apr

1.945

8,85

Date

Purchase

16 Apr

Sale

5.000

15 Jan

32.253

Average

Price

6,758

Date

Purchase

Sale

16 May

10.000

8,629

20 May

5.000

8,32

27 May

11.860

7,88

28 May

1.500

7,772

5 Jun

8.870

7,521

16 Jun

5.000

7,170

17 Jun

230

7,36

18 Jun

1.948

7,27

19 Jun

5.000

7,41

20 Jun

125

7,18

23 Jun

1.850

7,36

24 Jun

5.000

7,01

25 Jun

5.000

7,00

26 Jun

5.000

6,829

30. Jun

1.695

7,03

José Manuel de Almeida Rodrigues, Director of Martifer SGPS SA, was elected for that position in the Annual General

Meeting on March 28th, 2008, was a holder, on that date, of 24.453 shares.

Pedro Álvaro de Brito Gomes Doutel, Director, was elected for that position in the Annual General Meeting on March

28th, 2008, was a holder, on that date, of 2.230 shares.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

16

HOLDERS OF QUALIFIED SHAREHOLDINGS

(article 4, paragraph e) of CMVM Regulation nº 4/2004)

In accordance with paragraph e) of the number 1 of article 9 of CMVM Regulation number 4/2004, the company

informs about qualified shareholdings.

As of 30 June 2008, according to information given to the company, the following entities were holders of qualified

shareholdings in the share capital of the company:

Shareholder

Number of Shares

% of

shareholder

equity

% of voting rights

MTO – SGPS, SA

Directly

38.532.781

38,533%

38,533%

Though Director Carlos Manuel Marques

Martins

70.030

0,070%

0,070%

Though Director Jorge Alberto Marques

Martins

130.760

0,131%

0,131%

38.733.571

38,734%

38,734%

37.500.000

37,50%

37,50%

Though Director Eduardo Jorge de Almeida

Rocha

20.000

0,020%

0,02%

Though Director António Jorge Campos de

Almeida

11.520

0,012%

0,012%

37.521.520

37,532%

37,532%

Total attributed

MOTA-ENGIL – SGPS, SA

Directly

Total attributed

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

17

STATEMENTS OF COMPLIANCE

STATEMENT BY THE BOARD OF DIRECTORS

Dear Shareholders,

In accordance with paragraph c) on the number 1 of article 246 of the Securities Code (Código de Valores

Mobiliários), we hereby declare that, as to the best of our knowledge, the financial statements reported in the interim

report of Martifer SGPS SA for the period ended 30 June 2008 was compiled according to the applicable accounting

standards, giving a true and appropriate picture of the assets and liabilities, financial position and results of Martifer

SGPS, SA and of the companies included in its consolidation perimeter; the interim management report of Martifer

SGPS, SA faithfully reviews the relevant events that occurred in the period and the impact of such events on the

financial statements, as well as a description of the main risks and uncertainties it faces for the subsequent six months.

Oliveira de Frades, 28 August 2008

________________________________

Carlos Manuel Marques Martins

Chairman of the Board of Directors

________________________________

José Manuel de Almeida Rodrigues

Director

________________________________

Jorge Alberto Marques Martins

Vice-Chairman of the Board of Directors

________________________________

Pedro Álvaro de Brito Gomes Doutel

Director

________________________________

António Manuel Serrano Pontes

Director

________________________________

Luís Valadares Tavares

Director

________________________________

António Jorge Campos de Almeida

Director

________________________________

Jorge Bento Ribeiro Barbosa Farinha

Director

________________________________

Eduardo Jorge de Almeida Rocha

Director

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

18

STATEMENT BY THE SUPERVISORY BOARD

Dear Shareholders,

In accordance with paragraph c) on the number 1 of article 246 of the Securities Code (Código de Valores

Mobiliários), we hereby declare that, as to the best of our knowledge, the financial statements reported in the interim

report of Martifer SGPS SA for the period ended 30 June 2008 was compiled according to the applicable accounting

standards, giving a true and appropriate picture of the assets and liabilities, financial position and results of Martifer

SGPS, SA and of the companies included in its consolidation perimeter; the interim management report of Martifer

SGPS, SA faithfully reviews the relevant events that occurred in the period and the impact of such events on the

financial statements, as well as a description of the main risks and uncertainties it faces for the subsequent six months.

Oliveira de Frades, 28 August 2008

________________________________

Manuel Simões de Carvalho e Silva

Chairman of the Supervisory Board

________________________________

Carlos Alberto da Silva e Cunha

Member of the Supervisory Board

________________________________

Carlos Alberto de Oliveira e Sousa

Member of the Supervisory Board

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

19

STATEMENT BY THE AUDITOR (Revisor Oficial de Contas)

Dear Shareholders,

In accordance with paragraph c) on the number 1 of article 246 of the Securities Code (Código de Valores

Mobiliários), I hereby declare that, as to the best of my knowledge, the financial statements reported in the interim

report of Martifer SGPS SA for the period ended 30 June 2008 was compiled according to the applicable accounting

standards, giving a true and appropriate picture of the assets and liabilities, financial position and results of Martifer

SGPS, SA and of the companies included in its consolidation perimeter; the interim management report of Martifer

SGPS, SA faithfully reviews the relevant events that occurred in the period and the impact of such events on the

financial statements, as well as a description of the main risks and uncertainties it faces for the subsequent six months.

Oliveira de Frades, 28 August 2008

________________________________

Américo Agostinho Martins Pereira

Revisor Oficial de Contas

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

20

INTERIM FINANCIAL

STATEMENTS

I ST HALF 2008

CONSOLIDATED INCOME STATEMENT BY NATURE FOR THE FIRST HALF

AND QUARTERS ENDED AT 30 JUNE 2008 AND 2007

Notes

Sales and services rendered

1st Half

2008 - IFRS

1st Half

2007 - IFRS

2nd Quarter

2008 - IFRS

2nd Quarter

2007 - IFRS

(not audited)

(not audited)

(not audited)

(not audited)

3e4

327.371.766

187.736.346

184.564.947

109.396.684

5

44.823.197

21.892.192

28.534.824

7.192.794

(276.940.000)

(153.912.359)

(158.527.629)

(82.560.836)

95.254.964

55.716.179

54.572.142

34.028.642

External supplies and services

(40.724.632)

(28.300.012)

(24.262.043)

(19.220.640)

Staff costs

(24.702.544)

(16.434.295)

(14.054.222)

(8.905.412)

(195.904)

(27.605)

731.606

(50.536)

29.631.884

10.954.267

16.987.483

5.852.054

(10.515.374)

(3.861.150)

(5.338.884)

(2.023.325)

(1.456.670)

(125.815)

(1.449.243)

(106.342)

17.659.839

6.967.302

10.199.356

3.722.387

Other income

Cost of goods sold and subcontractors

Gross profit

Other gains and losses

4

Amortizations

Provisions and impairment losses

Operating Income

4

Financial Income

6

11.739.479

27.980.620

6.023.951

27.292.915

Financial Expenses

6

(15.984.416)

(15.183.651)

(6.179.945)

(13.461.258)

(465)

(4.001)

(465)

(1.892)

(3.744.502)

(1.157.520)

(1.815.441)

(439.760)

9.669.935

18.602.750

8.227.456

17.112.392

Minority Interests

1.715.697

163.595

809.990

410.071

Equity Holders of Martifer

7.954.239

18.439.155

7.417.466

16.702.321

Gains and losses on associated companies

Income tax

Profit for the period

Attributable to:

Earnings per share:

Basic

7

0,0795

0,2436

0,0742

0,2207

Diluted

7

0,0795

0,2436

0,0742

0,2207

The accompanying notes are part of these financial statements.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

22

CONSOLIDATED BALANCE SHEETS AT 30 JUNE 2008 AND 31 DECEMBER

2007

2008 - IFRS

2007 - IFRS

Notes

Assets

Non-current assets

Goodwill

Other intangible assets

Tangible assets

Investments on associated companies

Available for sale investments

Other non current assets

Deferred tax assets

Non-current assets held for sale

Current assets

Inventories

Biological assets

Trade debtors

Other debtors

Current tax assets

Other current assets

Derivatives

Cash and cash equivalents

8

9

10

11

12 e 15

33.345.622

48.932.772

264.916.126

10.830.270

3.095.412

2.124.024

506.557.814

363.244.227

13

67.452.210

67.452.210

14

14

122.890.431

9.538.155

183.310.812

53.767.640

50.208.828

71.026.286

3.128.516

47.255.149

96.990.901

2.333.595

147.232.528

14.073.491

34.129.879

38.770.275

2.573.281

32.312.299

541.125.817

368.416.250

1.115.135.841

799.112.687

50.000.000

211.903.328

7.954.239

269.857.567

50.843.872

320.701.439

50.000.000

205.361.289

26.423.647

281.784.936

3.690.499

285.475.435

112.945.977

51.770.885

2.932.486

7.197.885

14.841.001

105.970.188

53.611.131

26.434.025

6.325.137

14.054.601

189.688.234

206.395.082

305.156.682

8.623.822

139.827.258

59.929.804

15.600.640

75.607.962

77.832.753

6.953.706

111.398.253

49.048.133

12.225.293

49.784.031

604.746.168

307.242.169

794.434.402

513.637.251

1.115.135.841

799.112.687

15

Minority Interests

Total Equity

16

Liabilities

Non-current liabilities

Loans

Obligations under finance leases

Other creditors

Provisions

Deferred tax liabilities

Current liabilities

Loans

Obligations under finance leases

Suppliers

Other creditors

Current tax liabilities

Other current liabilities

Total Liabilities

Euro

(audited)

51.455.474

54.214.557

333.047.633

22.500

58.704.653

4.086.558

5.026.439

Total Assets

Equity

Share capital

Reserves

Profit

Euro

(not audited)

17

18

17

The accompanying notes are part of these financial statements.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

23

-

-

-

Other changes in the equity of subsidiaries

Changes in the consolidation perimeter

Profit

186.500.000

-

-

-

-

-

-

-

186.500.000

186.500.000

-

-

-

-

186.500.000

-

13.568.560

-

-

1.428.954

-

-

-

-

12.139.606

12.139.606

-

-

-

-

-

-

12.139.606

reserve

-

Premiums

(21.492.588)

-

-

(21.744.838)

-

-

-

-

252.250

-

-

-

-

-

-

-

-

sale Investments

Available for

24

2.625.439

-

-

110.995

2.151.513

-

-

-

362.931

3.132.426

-

-

1.679.931

-

-

-

1.452.495

Derivatives

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

50.000.000

-

Transfers

Balance at 30 June 2008

-

-

financial statements expressed in foreign currencies

Exchange differences arising on the translation of

premiums

Increase of share capital net of issuance costs and

-

50.000.000

Balance at 1 January 2008

Appropriation of the Profit of 2007

50.000.000

-

Balance at 30 June 2007

-

Profit for the year

-

-

17.999.700

-

32.000.300

Share Capital

Changes in the consolidation perimeter

Other changes in the equity of subsidiaries

financial statements expressed in foreign currencies

Exchange differences arising on the translation of

premiums

Increase of share capital net of issuance costs and

Appropriation of the Profit of 2006

Balance at 1 January 2007

revaluation

Share

Tangible Assets

Fair Value Reserves

(674.941)

-

-

-

-

2.966.546

-

-

(3.641.487)

1.031.497

-

-

-

326.627

-

-

704.870

reserve

translation

currency

Foreign

31.376.859

-

(193.621)

(2.449.644)

(2.151.513)

-

-

26.423.647

9.747.990

10.663.058

-

-

3.783.852

-

(12.536.731)

12.882.793

6.533.144

Other Reserves

7.954.239

7.954.239

-

-

-

-

-

(26.423.647)

26.423.647

18.439.155

18.439.155

-

-

-

-

(12.882.793)

12.882.793

Profit for the year

269.857.567

7.954.239

(193.621)

(22.654.533)

-

2.966.546

-

-

281.784.936

281.905.742

18.439.155

-

5.463.783

326.627

191.962.969

-

65.713.208

Martifer

equity holders of

Attributable to

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE PERIODS ENDED AT 30 JUNE 2008 AND 2007

4

50.843.872

1.715.697

(547.354)

44.307.016

-

1.678.014

-

-

3.690.499

6.161.783

163.595

44.500

206.408

87.784

-

-

5.659.496

Minority interests

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE HALF YEAR ENDED AT

30 JUNE 2008 AND 2007

2008 - IFRS

2007 - IFRS

Euro

Euro

( not audited)

(audited)

Operating Activities

Cash receipts from trade debtors

Cash paid to suppliers

Payments to employees

Cash flow generated by the operations

Income taxes (paid)/received

Other cash receipts/payments relating to operating activities

Others

Net cash flow from operating activities (1)

335.079.347

198.397.253

(323.508.689)

(199.291.190)

(17.877.928)

(6.307.270)

(11.696.302)

(12.590.239)

(3.119.700)

(3.619.691)

(33.831.646)

(36.951.346)

(12.412.742)

(16.032.432)

(43.258.616)

(28.622.671)

Investing Activities

Cash receipts arising from

Investments

2.274.706

250.000

Tangible assets

608.616

21.036

Intangible assets

14.586

Investment Grants

1.111.811

Interest and similar income

1.505.666

Dividends

2.213.388

Others

8.638

396.751

289

45.813

-

7.774.586

676.714

Cash payments arising from:

Investments

(21.437.896)

(7.471.913)

Tangible assets

(42.532.326)

(19.020.918)

Intangible assets

(4.670.434)

(2.021.272)

(859.208)

(69.499.864)

(28.514.104)

(61.725.278)

(27.837.390)

968.082.325

727.250.555

19.131.611

194.131.361

Others

Net cash flow from the investing activities (2)

Financing Activities

Cash receipts arising from:

Loans obtained

Capital increases, supplementary capital and share premiums

Subsidies and donations

-

148.976

Others

-

257.895

987.213.936

921.788.787

(853.009.049)

(781.787.112)

(2.187.949)

(1.019.571)

(12.146.752)

(3.910.895)

Cash payments arising from:

Loans obtained

Leasings

Interest and similar costs

Capital and supplementary capital decreases

Others

Net cash flow from the financing activities (3)

Net increase in cash and cash equivalents (4) = (1) + (2) + (3)

Changes in the consolidation perimeter and others

Effect of foreign exchange currencies

(675.000)

-

-

(732.829)

(868.018.751)

(787.450.407)

119.195.185

134.338.380

14.211.291

77.878.320

832.828

-

(101.269)

10.167

Cash and cash equivalents at the beginning

32.312.299

9.595.570

Cash and cash equivalents at the end

47.255.149

87.484.057

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

25

Introductory Note

Martifer SGPS, SA, has its registered offices in the Industrial Zone of Oliveira de Frades – Portugal (“Martifer SGPS” or “Company”).

The main business of Martifer SGPS and its subsidiaries (“GROUP”) is the construction of metal infrastructures, in the area of

producing equipment for energy, in electricity and biofuel production, as well as the commercialization and management of real

estate projects and also agriculture projects. (Note 4).

Martifer SGPS was set up on 29 October 2004, and its equity was paid up through the handing over of all the shares, assessed at

market value, that the GROUP shareholders had in Martifer – Construções, SA, a subsidiary established in 1990, which was at that

time the parent Company of the present Martifer.

From July 2007, after the successful Initial Public Offering, the group went public and is listed on Euronext Lisbon.

On 30 June 2008 the Group was operating in Portugal, Spain, Poland, Slovakia, Germany, Romania, the Czech Republic, Angola,

Brazil, Sweden, Ukraine, Greece, the United States of America, Austria, Australia, Mozambique, Ireland, Belgium, and Italy.

All the amounts presented in these explanatory notes are in Euro (rounded to units), unless expressly stated otherwise.

1. Accounting Policies

Basis of Preparation

The attached financial statements are the consolidated financial statements of the first half of the companies of the Martifer Group

and have been prepared assuming that the Company will continue as a going concern, based on the books and accounting entries of

the firms comprising the Group so that the consolidated financial statements comply with International Financial Reporting Standards

(‘IAS/IFRS’) (Note 2), in accordance with IAS 34 – “Interim Financial Reporting.

The Group makes no difference between the IFRS as adopted by the European Union and the IFRS published by the International

Accounting Standards Board (IASB).

1 January 2004 signifies the start of the period of first application IAS/AFRS for the Company. in accordance with the IFRS 1 - First

Application of the International Financial Reporting Standards.

During the first half ended at 30th June 2008, there have been no changes in the methods of estimate calculation, as well as the

accounting policies presented on the Consolidated Financial Statements for the year ended at 31 December 2007.

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

26

2. Group Companies Included in the Consolidation Financial Statements

On the 30th of June 2008, the companies included on the consolidation process, the respective methods of consolidation, head

offices, percentage of share capital held, business activity and incorporation or acquisition date are as follows:

Companies Consolidated According to the Full Consolidation Method

Head Office

Percentage of

share capital

held

Business Activity

Incorporation

date

Acquisition

date

Martifer SGPS, S.A.

(Martifer SGPS)

Oliveira de

Frades

Holding

Holding Company

October 2004

-

Martifer Inovação e Gestão, S.A.

(Martifer Inovação)

Oliveira de

Frades

100%

Consulting, research &

development

January

2007

-

Martifer Metallic Constructions

SGPS, S.A. previously Martifer

Indústria SGPS, S.A.

(Martifer Metallic Constructions)

Oliveira de

Frades

100%

Holding Company

December

2006

-

Martifer - Construções

Metalomecânicas, S.A. (Martifer

Construções)

Oliveira de

Frades

Through Martifer

Metallic

Constructions

100%

Metal construction

February

1990

-

Martifer - Gestão de

Investimentos, S.A. (MGI)

Oliveira de

Frades

Through Martifer

Metallic

Constructions

100%

Buying and selling real

estate

May

2000

-

Martifer - Alumínios, S.A.

(Martifer Alumínios)

Oliveira de

Frades

Through Martifer

Metallic

Constructions

55%

Construction of aluminium

façades

September

1990

1999

Martifer - Alumínios, S.A.

(Martifer Alumínios Espanha)

Madrid

Through Martifer

Alumínios

55%

Construction of aluminium

façades

January

2007

-

Martifer Alumínios Angola, S.A.

(Martifer Alumínios Angola)

Luanda

Through Martifer

Alumínios

50,6%

Construction of aluminium

façades

April

2008

-

Sever do Vouga

Through Martifer

Metallic

Constructions

75%

Metalworking

May

1996

1998

Luanda

Through Martifer

II Inox

48%

Metalworking

March

2008

-

Company

Martifer II Inox, S.A. - previously

Martins & Coutinho –Const. em

Aço Inox, S.A. (Martifer II Inox)

Martinox, S.A.

(Martinox Angola)

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

27

Madrid

Through Martifer

Metallic

Constructions

100%

Commerce, assembly,

support for works

management

November

1999

-

Luanda

Through Martifer

Metallic

Constructions

58,125%

Commerce, assembly,

support for works

management

March

2007

-

Dublin

Through Martifer

Metallic

Constructions

100%

Commerce, assembly,

support for works

management

November

2007

-

Gliwice

Through Martifer

Metallic

Constructions

100%

Metal construction

February

2003

-

Gliwice

Through Martifer

Alumínios

55%

Commerce, assembling

aluminium façades

and support for technical

management

December

2004

-

Sidney

Through Martifer

Alumínios

44%

Commerce, assembling

aluminium façades

and support for technical

management

March

2008

-

Bucareste

Through Martifer

Metallic

Constructions

100%

March

2005

-

Praga

80%

Commerce, assembly,

support for works

management

March

2005

-

Gliwice

Through Martifer

Metallic

Constructions

100%

General works management

April

2005

-

Bratislava

Through Martifer

Metallic

Constructions

20%

Through Martifer

Polska

80%

Commerce, assembly,

support for works

management

March

2005

-

Martifer Beteiligungsverwaltungs

GmbH

(Martifer GmbH)

Viena

100%

Holding Company

-

2007

Sociedade de Madeiras do Vouga,

S.A.

(Madeiras do Vouga)

Albergaria

a

Velha

Through Martifer

Metallic

Constructions

100%

Production and

commercialization of timber

and construction materials

-

2007

Martifer – Construcciones

Metálicas España, S.A. (Martifer

Espanha)

Martifer – Construções Metálicas

Angola, S.A.

(Martifer Angola)

Martifer Construction Limited

(Martifer Irlanda)

Martifer Polska Sp. z o.o.

(Martifer Polska)

Martifer Aluminium Sp. z o.o.–

previously MZI Polska SP Z.o.o.

(Martifer Aluminium)

Sassal Aluminium Pty, Ltd

(Sassal)

Martifer Constructii SRL

(Martifer Constructii)

Martifer CZ, SRO

(Martifer CZ)

Martifer Konstrukcje Sp. z o.o.

(Martifer Konstrukcje)

Martifer Slovakia SRO

(Martifer Slovakia)

Commerce, assembling

aluminium façades

and support for technical

management

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

28

Nagatel Viseu, Promoção

Imobiliária, S.A.

(Nagatel Viseu)

Oliveira de

Frades

Through da MGI

100%

Real estate

March

2005

-

Martifer Retail & Warehousing

Angola, S.A.

(Martifer Retail Angola)

Luanda

Through Martifer

Metallic

Constructions

100%

Real estate

December

2007

-

Park Logistyczny Biskupice

(Biskupice)

Gliwice

Through Martifer

Konstrukcje

90%

Real estate

May

2007

-

Liszki Green Park, Sp.Zo.o –

previously Acero (Liszki Green

Park)

Gliwice

Through Martifer

Konstrukcje

90%

Real estate

-

2007

Gliwice

Through Martifer

GmbH

99,8%

Through Martifer

Konstrukcje

0,2%

Real estate

December

2007

-

Gliwice

Through Martifer

GmbH

99,8%

Through Martifer

Konstrukcje

0,2%

Real estate

December

2007

-

Martifer Energy Systems II SGPS,

S.A.

(Martifer Energy Systems II)

Oliveira de

Frades

100%

Holding Company

November

2007

-

Martifer Energia – Equipamentos

para Energia, S.A.

(Martifer Energia)

Oliveira de

Frades

Through Martifer

Energy Systems II

100%

Production of Energy

Equipments

February

2004

-

Martifer Wood Pellets, S.A.

(Wood Pellets)

Oliveira de

Frades

Through Martifer

Energy Systems II

100%

Production of Energy

Equipments

March

2007

-

RPW Investments SGPS, S.A. previously Martifer Energy

Systems SGPS, S.A.

(RPW Investments)

Oliveira de

Frades

100%

Holding Company

December

2006

-

Power Blades, S.A.

(Power Blades)

Oliveira de

Frades

100%

Production of blades for

wind towers

February

2006

-

Aveiro

Through Martifer

Energy Systems II

96,79%

Shipyard

-

2008

Oliveira de

Frades

Through Martifer

Energy Systems II

75%

Installation,

commercialisation and

maintenance of solar and

photovoltaic panels

June

2006

-

S. Francisco CA

Through Martifer

Solar 75%

Consultancy, research and

development

June

2007

-

M City Gliwice SP.So.o

(M City Gliwice)

M City Radom SP.So.o

(M City Radom)

Navalria – Docas, Construções e

Reparações Navais, S.A.

(Navalria)

Martifer Solar, S.A.

(Martifer Solar)

Martifer Solar Inc

(Martifer Inc)

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

29

Oliveira de

Frades

Through Martifer

Solar

52,5%

Installation,

commercialisation and

maintenance of solar and

photovoltaic panels

January

2008

-

Atenas

Through Martifer

Solar

45%

Installation,

commercialisation and

maintenance of solar and

photovoltaic panels

-

2008

Luanda

Through Martifer

Solar

56,25%

Installation,

commercialisation and

maintenance of solar and

photovoltaic panels

December

2006

-

Milão

Through Martifer

Solar

75%

Installation,

commercialisation and

maintenance of solar and

photovoltaic panels

February

2008

-

Madrid

Through Martifer

Solar

75%

Installation,

commercialisation and

maintenance of solar and

photovoltaic panels

February

2007

-

Repower Portugal – Sistemas

Eólicos, S.A.

(Repower Portugal)

Oliveira de

Frades

Through Martifer

Energy Systems II

50%

Production, assembly and

maintenance of

aerogenerators

June

2005

-

Ventinveste Indústria SGPS, S.A.

(Ventinveste Indústria)

Oliveira de

Frades

Through

Ventinveste SA

32,5%

Holding Company

September

2007

-

Ventipower, S.A.

(Ventipower)

Oliveira de

Frades

Through

Ventinveste

Indústria

32,5%

Production of motors and

turbines

September

2007

-

Reblades, S.A.

(Reblades)

Oliveira de

Frades

Through

Ventinveste

Indústria

32,5%

Production of components

for renewable energy

equipments

September

2007

-

Martifer Energia RO SRL

(Martifer Energia SRL)

Bucareste

Through Martifer

Energy Systems II

99%

Through Martifer

Energia

1%

Energy equipments

production

August

2007

-

Martifer Energia Sp Z.o.o

(Martifer Energia Polska)

Gliwice

Through Martifer

Energy Systems II

100%

Energy equipments

production

February

2008

-

Madrid

Through Martifer

Solar Sistemas

Solares

75%

Construction of Solar Parks

August

2007

2008

Deerlijk

Through Martifer

Solar

75%

Installation,

commercialisation and

maintenance of solar and

photovoltaic panels

May

2008

-

Martifer Enerq – Sistemas de

Energias Renováveis, S.A.

(Martifer Enerq)

P.V.I., S.A.

(PVI)

Martifer Solar Angola

(Martifer Solar Angola)

Martifer Solar S.R.L.

(Martifer Solar Itália)

Martifer Solar Sistemas Solares,

S.A.

(Martifer Solar Sistemas Solares)

Solar Parks Construccion

Parques Solares ETVE S.A.

(Solar Parks)

Martifer Solar

(Martifer Solar Bélgica)

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

30

Home Energy II, S.A.

(Home Energy II)

Oliveira de

Frades

Through Martifer

Solar

41,25%

Production and

commercialisation of

energy, energy auditing

May

2008

-

PVGlass, S.A.

(PVGlass)

Oliveira de

Frades

Through Martifer

Solar

52,5%

Production and

commercialisation of glass

items

April

2008

-

Santa Monica CA

Through Martifer

Solar Inc

37,5%

Installation solar panels

-

2008

Prio Sgps, S.A. (Prio Sgps) previously Imavic, Gestão de

Investimentos S.A.

Oliveira de

Frades

60%

Holding Company

March

2005

2008

Prio Advanced Fuels, S.A.

(Prio Advanced Fuels)

Oliveira de

Frades

Through Prio

Sgps 60%

Fuel and biofuel distribution

October

2006

-

Coimbra

Through Prio

Advanced Fuels

60%

Fuel and biofuel distribution

-

2007

Prio Biocombustíveis, S.A. (Prio

Biocombustíveis)

Oliveira de

Frades

Through Prio

Sgps 60%

Biofuel refinery

February

2006

-

Prio Gestão, Trading e Logistica,

S.A.

(Prio GTL)

Oliveira de

Frades

Through Prio

Sgps 60%

Consultancy

May

2007

-

Prio Agricultura, SRL – previously

Agromart Energy SRL

(Prio Agricultura)

Bucareste

Through Prio

Sgps

60%

Agriculture

March

2005

-

Prio Biocombustibil SRL previously Biomart Energy SRL

(Prio Biocombustibil)

Bucareste

Through Prio

Sgps

59,96%

Through Prio

Agricultura

0,04%

Biofuel refinery

March

2005

-

Prio Agricultura e Extracção

LTDA Previously Prio Extracção &

Logística, LTDA

(Prio Agricultura e Extracção)

S. Luís do

Maranhão

Through Prio

Sgps 60%

Crushing of and oil

extraction from seeds

November

2006

-

Prio Biopaliwa, Sp. Z o.o.

(Prio Biopaliwa)

Gliwice

Through Prio

Sgps 60%

Agriculture and storage of

cereals and oils

November

2006

-

Prio Agricultura, S.A.

(Prio Agricultura Moçambique)

Maputo

Through Prio

Sgps 36%

Agriculture

November

2007

-

Bucareste

Through Prio

Agricultura

45%

Through Prio

Biocombustibil

15%

Agriculture

June

2007

-

A&M Energy Solutions

(A&M)

Mondefin

(Mondefin)

Prio Agromart S.R.L.

(Prio Agromart)

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

31

Bucareste

Through Prio

Agricultura

45%

Through Prio

Biocombustibil

15%

Agriculture

June

2007

-

Bucareste

Through Prio

Agricultura

45%

Through Prio

Biocombustibil

15%

Agriculture

June

2007

-

Bucareste

Through Prio

Agricultura

45%

Through Prio

Biocombustibil

15%

Agriculture

June

2007

-

Bucareste

Through Prio

Agricultura

45%

Through Prio

Biocombustibil

15%

Agriculture

June

2007

-

Bucareste

Through Prio

Agricultura

45%

Through Prio

Biocombustibil

15%

Agriculture

June

2007

-

Prio Turism Rural S.R.L

(Prio Turism Rural)

Bucareste

Through Prio

Agricultura

45%

Through Prio

Biocombustibil

15%

Agriculture

June

2007

-

Agromec Balaciu

(Agromec Balaciu)

Bucareste

Through Prio

Agricultura

52,164%

Agriculture

-

2007

Zimbrul, S.A.

(Zimbrul)

Bucareste

Through Prio

Agricultura

60%

Agriculture

-

2007

Agrozootehnica, S.A.

(Agrozootehnica)

Bucareste

Through Prio

Agricultura

31,20%

Através da

Zimbrul

28,78%

Agriculture

-

2007

Martifer Renewables SGPS –

previously Eviva SGPS, S.A.

(Martifer Renewables SGPS)

Oliveira de

Frades

100%

Holding Company

December

2006

-

Martifer Renewables S.A. –

previously Eviva Energy, S.A.

(Martifer Renewables SA)

Oliveira de

Frades

October

2005

-

Prio Balta S.R.L.

(Prio Balta)

Prio Facaieni S.R.L.

(Prio Facaieni)

Prio Ialomita S.R.L.

(Prio Ialomita)

Prio Rapita S.R.L.

(Prio Rapita)

Prio Terra Agricola S.R.L.

(Prio Terra Agricola)

Through Martifer

Production, commercialising

Renewables SGPS

and distribution of energy

100%

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

32

Eviva – Energias Renovables, S.A.

(Eviva Energias Renovables)

Eurocab FV 1 SL

(Eurocab 1)

Eurocab FV 2 SL

(Eurocab 2)

Eurocab FV 3 SL

(Eurocab 3)

Eurocab FV 4 SL

(Eurocab 4)

Eurocab FV 5 SL

(Eurocab 5)

Eurocab FV 6 SL

(Eurocab 6)

Eurocab FV 7 SL

(Eurocab 7)

Eurocab FV 8 SL

(Eurocab 8)

Eurocab FV 9 SL

(Eurocab 9)

Eurocab FV 10 SL

(Eurocab 10)

Eurocab FV 11 SL

(Eurocab 11)

Eurocab FV 12 SL

(Eurocab 12)

Eurocab FV 13 SL

(Eurocab 13)

Madrid

Through Martifer

Production, commercialising

Renewables SGPS

and distribution of energy

100%

May

2007

-

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

33

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Eurocab FV 17 SL

(Eurocab 17)

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Eurocab FV 18 SL

(Eurocab 18)

Madrid

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

-

2007

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

May 2008

-

Madrid

Through Eviva

Energias

Renovables

100%

Production, commercialising

and distribution of energy

May 2008

-

Madrid

Through Eviva

Energias

Renovables

75%

Management of solar parks

Agosto

2007

-

Through Martifer

Production, commercialising

Renewables SGPS

and distribution of energy

100%

March

2005

-

December

2006

-

Eurocab FV 14 SL

(Eurocab 14)

Eurocab FV 15 SL

(Eurocab 15)

Eurocab FV 16 SL

(Eurocab 16)

Eurocab FV 19 SL

(Eurocab 19)

Eurocab FV 20 SL

(Eurocab 20)

Eurocab FV 21 SL

(Eurocab 21)

Solar Planet Promocion de

Parques Solares ETVE S.A.

(Solar Planet)

Eviva Energy SRL - previously

M Wind Energy SRL

(Eviva Energy SRL)

Eviva Nalbant SRO

(Eviva Nalbant)

Bucareste

Bucareste

Through Eviva

Energias

Renovables

100%

Through Eviva

Energy SRL

99%

Through Prio

Agricultura

0,6%

Production, commercialising

and distribution of energy

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

34

Bucareste

Through Eviva

Energy SRL

99%

Through Prio

Agricultura

0,6%

Production, commercialising

and distribution of energy

December

2006

-

Eviva Casimcea SRO

(Eviva Casimcea)

Bucareste

Through Eviva

Energy SRL

99%

Through Prio

Agricultura

0,6%

Production, commercialising

and distribution of energy

December

2006

-

MW Topolog SRL

(MW Topolog)

Bucareste

Through Eviva

Energy SRL

99%

Production, commercialising

and distribution of energy

September

2006

-

Eviva Hidro SRL

(Eviva Hidro)

Bucareste

66%

Through Martifer

Renewables SGPS

33%

Energy production from

small-scale hydroelectric

power stations

December

2006

-

Eviva SRO - previously M Wind

SRO (Eviva SRO)

Bratislava

Through Martifer

Production, commercialising

Renewables SGPS

and distribution of energy

100%

Setember

2006

-

Eviva S.A. - previously

Mzi Megawatt Sp. Z o.o.

(Eviva S.A.)

Gliwice

Through Martifer

Production, commercialising

Renewables SGPS

and distribution of energy

100%

May

2005

-

IWP Sp. Z o.o.

(IWP)

Gliwice

Through Eviva

S.A. 100%

Production, commercialising

and distribution of energy

-

2005

Bukowsko

(Bukowsko)

Gliwice

Through Eviva

S.A. 100%

Production, commercialising

and distribution of energy

-

2007

Eviva Zebowo SP

(Eviva Zebowo)

Gliwice

Through Eviva

S.A. 51%

Production, commercialising

and distribution of energy

-

2007

Eviva Gac SP

(Eviva Gac)

Gliwice

Through Eviva

S.A. 51%

Production, commercialising

and distribution of energy

-

2007

Eviva Drzezewo SP

(Eviva Drzezewo)

Gliwice

Through Eviva

S.A. 51%

Production, commercialising

and distribution of energy

-

2007

Eviva Mepe

(Eviva Mepe)

Atenas

Through Martifer

Production, commercialising

Renewables SGPS

and distribution of energy

100%

May

2007

-

Eviva Beteiligungsverwaltungs

GmbH

(Eviva GmbH)

Viena

Through Martifer

Renewables SGPS

100%

-

2007

Eviva Energy Pty, Ltd.

(Eviva Pty)

Sidney

Through Martifer

Production, commercialising

Renewables SGPS

and distribution of energy

80%

December

2007

-

Bremen

Through Martifer

Deutschland

99,91%

Through Eviva

GmbH

0,09%

-

2007

Eviva Agirghiol SRL

(Eviva Agirghiol)

Windpark Bippen GmbH & Co.

KG

(Bippen KG)

Holding Company

Development, construction

and management of wind

farms

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

35

Windpark Holleben GmbH & Co.

KG

(Holleben KG)

Bremen

Through Martifer

Deutschland

99,91%

Through Eviva

GmbH

0,09%

Martifer Deutschland GmbH

(Martifer Deutschland)

Berlim

Through Eviva

GmbH

100%

Holding Company

October

2005

-

S. Francisco CA

Through Martifer

Renewables SGPS

80%

Electricity production

December

2007

-

San Diego

CA

Through Eviva

LLC

72%

Wind energy projects

development

January

2008

-

San Diego CA

Through Eviva

LLC

80%

Solar energy projects

development

January

2008

-

March

2008

-

Eviva Electricity LLC

(Eviva Electricity)

Eviva Spinnaker Energy LLC

(Eviva Spinnaker)

Eviva California Solar

Holdings LLC

(Eviva Solar LLC)

Development, construction

and management of wind

farms

-

2007

Through Martifer

Production, commercialising

Renewables SGPS

and distribution of energy

100%

Eviva Itália, S.R.L.

(Eviva Itália)

Milão

Eviva Bippen GmbH

(Eviva Bippen)

Berlim

Through Eviva

GmbH

100%

Wind farm management

-

2008

Eviva Rumsko Sp Z.o.o

(Eviva Rumsko)

Slupsk

Through Eviva

GmbH 51%

Production, commercialising

and distribution of energy

-

2008

Eviva Redecin Sp Z.o.o

(Eviva Redecin)

Slupsk

Through Eviva

GmbH 51%

Production, commercialising

and distribution of energy

-

2008

Oliveira de

Frades

Through Martifer

Renewables SGPS

75%

Development and

construction of energy

plants

May 2008

-

Clean Energy Solutions

(Clean Energy Solutions)

Suécia

Through Martifer

Renewables SGPS

50,1%

Producing energy

-

2007

Nova Eco LLC

(Nova Eco LLC)

Ucrânia

Through Clean

Energy Solutions

50,1%

Producing energy

-

2007

Gesto Energia SA

(Gesto Energia)

INTERIM MANAGEMENT REPORT AND CONSOLIDATED FINANCIAL STATEMENTS | 1ST HALF 2008

36

Companies consolidated through the proportional method

Companies consolidated through the proportional method, head offices, percentage of share capital held, business activity,

incorporation or acquisition date are as follows:

Company

Head Office

Percentage of

share capital

held

Business activity

Incorporati

on date

Acquisitio

n date

Gebox, S.A.