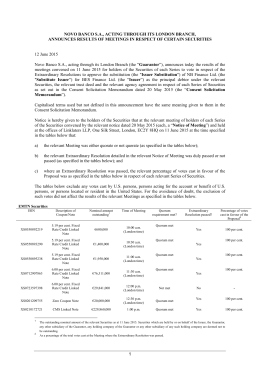

OXFORD UNIVERSITY GAZETTE UNIVERS ITY OF OXFORD: FINANCIAL BU DGET FOR 2006–2007 S U P P L E M EN T ( 3 ) TO NO . 4 7 83 W E D N E S DAY, 18 OCT OB ER 2 0 0 6 Contents Summary outcomes for 2006–7 244 The public funding context and the central allocation of resources 244 Key financial assumptions for 2006–7 244 Comments on the budgeting process for 2006–7 244 Income and expenditure budgets: University summary 245 Medical Sciences 246 Social Sciences 246 Mathematical, Physical and Life Sciences 246 Humanities 247 Continuing Education 247 Academic Services and University Collections 247 University Services and Administration 247 Council Departments 247 Estates 248 Capital expenditure plans 248 Comments on cash flow and the balance sheet 248 The 2006–7 budget and longer term financial trends 248 243 244 Oxford University Gazette · Supplement (2) to No. 4783 · 18 October 2006 Summary outcomes for 2006–7 In the face of significant cost pressures from several sources and the need to invest ahead of the RAE, Council has decided to set a deficit budget for 2006–7. The University budget has for several years been finely balanced at close to break-even level. In 2006–7, necessary new investments in academic staff and other areas of £10.1m together with the impact of the single spine have resulted in a budgeted deficit of £8.9m. General cash reserves set aside in previous years will be called on to finance this deficit. Several of the University divisions have relatively strong financial positions with small deficits and healthy reserves. These include Medical Sciences and Social Sciences. Other divisions have weaker financial positions that will require concerted efforts to remedy. These include Mathematical, Physical and Life Sciences (MPLS), Academic Services and Collections (ASUC) and University Services and Administration. Plans to address the financial position will be developed in each of these areas and to support and supplement this work the University is already turning its attention to planning for 2007–8 and beyond to ensure that the longer-term trend once again becomes positive. The public funding context and the central allocation of resources In March HEFCE announced that the grant allocation for the Higher Education sector had increased by 5.9 per cent compared with 2005–6. Oxford University was awarded a headline total grant figure of £159.6m, giving a like-forlike increase of 6.5 per cent. This comprised a 3.2 per cent increase in total teaching funds and an 8.6 per cent increase in headline research funding, thus continuing the trend established over the recent period of greater increases in funding allocated to research than to teaching. As in previous years, the total grant figure was allocated to departments throughout the University in accordance with the principles of the Resource Allocation Model (RAM). These principles are well established and the process is straightforward. The 2006–7 HEFCE grant was first adjusted by deducting lines of funding for specific purposes such as widening participation and minority subjects, before being supplemented by the estimated amount for home and European Union student fees, including, for the first time, the estimated amount for the new variable fee. The resultant total for allocation in 2006–7 was £177.3m and with the inclusion of £5.8m for the new variable fee was 9.3 per cent higher than the equivalent figure for 2005–6. From this amount a ‘topslice’ amounting to £60.4m is taken before allocating the remaining sum to departments of the University. The largest component of the top-slice is the college fee transfer (also referred to as the ‘quantum’) of £43m. The remainder of the top-slice includes the estimated cost of undergraduate bursaries of £1.9m, £2.3m for museums, £4.6m for University Services and Administration and £6.0m for libraries. The balance of the total for allocation is first split in the ratio 60:40 between research and teaching before allocation to departments using various allocation drivers related to staff numbers, student numbers and space occupied. Important features of the 2006–7 allocation process included the ending of moderation and the end of supple- mentary funding grants. The process of moderation was originally introduced as part of the RAM in order to temper the impact of the allocation drivers on certain departments, and had the effect of ‘taxing’ the RAM allocation for Medical Sciences and redistributing funds to other departments, most notably those within Mathematical and Physical Sciences and Life and Environmental Sciences. Moderation has gradually been phased out over the life of the RAM and as planned came to an end in 2005–6, with the result that no moderation was applied in 2006–7. Supplementary funding grants of a more ad hoc nature were awarded by the Planning and Resource Allocation Committee (PRAC) in order to alleviate particularly difficult funding outcomes in certain divisions. PRAC decided not to apply this ad hoc measure in 2006–7. The other key part of the central allocation process is setting the amount of inflationary increase applied to the internal charges (known as the infrastructure charge) made by services such as the libraries and University Services and Administration to the academic divisions. For 2006–7 PRAC decided to increase the infrastructure charge by a core inflationary increase of 5 per cent, and in addition sought to make special investments in the development office and public affairs and in funding more repairs and maintenance. Incremental funds of £3.4m have been awarded to the development office over and above the core 5 per cent inflationary multiplier in order dramatically to improve the University’s fundraising capabilities. Secondly, £1.0m of new funds has been allocated to repairs and maintenance. The University has an estate of some 520,000 square metres and recent benchmarking work suggests that the current spend on repairs and maintenance is around one third of the ideal amount. Whilst the University cannot afford to triple the current repairs and maintenance spend of approximately £10m per annum, a 10 per cent real increase is at least a step in the right direction. As a result of these areas of investment over and above the core inflationary allowance of 5 per cent, the overall increase in the infrastructure charge is 9 per cent. Key financial assumptions for 2006–7 In April, following the receipt of the grant letter, planning guidelines were published to divisions and departments. The guidelines contained details of the RAM allocations and other key financial assumptions to be used in drawing up departmental budgets together with spreadsheet based financial templates to aid detailed budgeting. The most important financial assumptions concerned pay costs, and departments were asked to make a central assumption of a 3 per cent pay increase for all staff in addition to applying an inflationary multiplier to take account of the introduction of the new national pay framework commonly referred to as the ‘single spine’. The impact of the single spine varies by grade and category of staff. On average it is expected to add a further 3 per cent inflationary pay impact with 4.3 per cent for Lecturers, Readers and Professors. In effect therefore there is double the usual impact from pay cost inflation in 2006–7, and as we shall see later this has a significant impact on the overall University budget. Comments on the budgeting process for 2006–7 Much greater stability of the Oracle financial system and the ability to produce more detailed and meaningful Oxford University Gazette · Supplement (2) to No. 4783 · 18 October 2006 financial reports have greatly enhanced the ability of the University to produce a more detailed and comprehensive budget than ever before. Not to be underestimated, though, are the very considerable efforts made within departments and within central administration to input more detailed financial data and to work with the financial system. The outcome is an overall University budget and three-year trend which can be reconciled to the audited financial statements of the University and broken down into departmental level components. The good progress made with the budgeting process cannot disguise the fact that the current method of allocating resources does not cope with the systematic underfunding of many elements of the University’s operations. The first draft of the budget showed a much greater budget deficit of £22.9m than the revised operating deficit of £8.9m. In order to achieve this reduced level of deficit, budget improvement targets of £19.3m were issued to all divisions and service areas. All areas responded positively to the requests for budget improvements and £15.8m of improvements were delivered against the target of £19.3m. Additional unbudgeted costs of £0.8m and an overall contingency of £1m have reduced the net improvements to £14m. Clearly, however, even the reduced level of operating deficit is unsatisfactory on any continuing basis. Income and expenditure budgets Income and expenditure budgets have been prepared for each department and consolidated to produce the overall University budget. For comparative purposes actual figures are available for 2004–5 and forecast figures for 2005–6. University summary 2004–5 Income 530 Surplus/(deficit)* 4.5 2005–6 584 0.0 2006–7 638 (8.9) * Operating surplus before exceptional and one-off items. The budgeted growth in total income is very strong at 9.8 per cent and is influenced partly by the addition of new activities at the Saïd Business School, the Jenner Institute and the Grey Laboratories. The underlying rate of growth in income before additions is 8 per cent. Research income including overheads is forecast to grow by over 9 per cent, and, as a result of the new variable fee, student fees by 13 per cent. Despite the strong growth in income, the University is facing a combination of investment needs and unusually high cost inflation in a number of areas, resulting in an overall budget deficit of £8.9m. The University has been relatively close to break-even for several years. The following chart shows the historical trend both as reported and as adjusted for one-off items such as the profits from the sale of spin-out company investments. In 2000–1 and 2001–2 the University was in surplus before and after deducting one-off items. 2002–3 was a year in which income growth was relatively low, and in particular the total HEFCE grant income (recurrent and nonrecurrent) increased by only 1.37 per cent. At the same time, non-contract research expenditure increased by 8.6 per cent. The financial outcome of the last RAE exercise was not particularly favorable to Oxford and 2002–3 was the first grant year to which the current RAE quality 245 weightings were applied. In that year the research grant fell by 0.06 per cent. In 2003–4 and 2004–5 the HEFCE grant settlements were more closely aligned with the growth in expenditure, but the University was unable to recover from the impact of the decline in the 2002–3 grant. Moving to 2006–7, the following table provides an overall explanation of the budget deficit for 2006–7. Reconciliation of the forecast deficit for 2005–6 to the budgeted deficit for 2006–7 £m £m Forecast deficit 2005–6 0 Changes in income —increased HEFCE grant 11 —increased trust fund income 5 —increased variable fees 6 —increased student fees (other than home/EU) 4 —assumed additional FEC income 5 —increased donation income (incl. £2m from OUP) 4 —growth in core research income 19 —additions (incl. Said, Jenner,Grey) 6 —less one-off FEC grant (6) 54 Changes in expenditure —increased pay costs due to additional staff including investment in development office and RAE and additions —increased pay costs due to inflation —other non-pay increases including investment in repairs and maintenance and the development office —increased contract grant expenditure —increased quantum settlement —cost of new bursary scheme —increased utility costs Budgeted deficit 2006–7 (11) (13) (15) (19) (2) (2) (1) (63) (9) A number of the items in this table have significant new impacts on the budgetary position of the University. The variable fee is expected to bring in approximately £6m of new income in its first year of operation, rising to approximately £18m after three years. Partially offsetting this benefit is the additional £2m cost of the new bursary scheme in the first year, rising to £6.5m after four years. One of the more uncertain aspects of the budget is the impact of FEC. For 2006–7 the year-on-year impact of FEC is likely to be slightly adverse, because a one-off FEC grant of £6m was recorded in 2005–6. In future years we would ex- 246 Oxford University Gazette · Supplement (2) to No. 4783 · 18 October 2006 pect FEC to have a significantly beneficial effect but there remains considerable uncertainty as to the amount and timing of additional funds. The £11m of increased pay costs resulting from additional non-contract research staff is equivalent to approximately 200 new heads across the University. Much of the new investment in headcount relates to recruitment needed to strengthen the academic quality of several key departments across the academic divisions ahead of the RAE. Of the approximately £140m of staff costs in divisional budgets (excluding externally funded research) approximately £5m has been identified as investment for the RAE in 2006–7. £3.8m of this is the 2006–7 element of the total of £12m made available by PRAC for restructuring and new academic development and a further £1.2m is being made available from departmental funds. A further important element of increased headcount is the investment being made in the Development Office. In total £3.4m of new funds is being made available to strengthen substantially the operation of the development office with a view to radically improving the scale of the University’s fundraising. As with investment ahead of the RAE the University is expecting to see a longer term return from the investments planned for 2006–7. The final major component of the budgetary shift in 2006–7 is the effect of pay inflation brought about by the normal annual inflationary pay increase of 3 per cent (equivalent to £6m) on top of the impact of the new national pay scheme or ‘single spine’. The single spine is expected to add approximately £6m to the non-contract research funded cost base, roughly doubling the annual impact of pay inflation. There is some uncertainty here, especially with respect to future years. The budgetary assumption is that single spine costs of contract research will be fully recovered from research sponsors. Although the move to the single spine adds to the inflationary impact in 2006–7, future years should benefit from the introduction of more cost-effective working arrangements as part of the national settlement. Some of the budgetary impacts noted above represent step-changes in the University cost base. For example, RAE investment, development office investment and the single spine represent a step up to a new level of expenditure, and the University would not expect to see comparable step-ups in 2007–8. However, other impacts will continue to accelerate. Most notably, the annual pay award has now been negotiated on a national basis through to 2008. We can therefore anticipate further inflationary rises in pay costs of 1 per cent on 1 February 2007, 3 per cent on 1 August 2007, 3 per cent on 1 May 2008 and 2.5 per cent (or RPI if greater) on 1 October 2008. With this level of inflationary multiplier effectively already committed across more than 50 per cent of the total University cost base (i.e. pay costs) future budgets will continue to be challenging. Transfers received from OUP have become increasingly important and in 2006–7 the budget includes a revenue transfer of £36.6m. £5m of this amount is to pay for the Clarendon Scholarship program and a further £5m is earmarked for the John Fell research fund. The remaining £26.6m is transferred to strategic reserves and is being used to make new strategic investments and to meet funding shortfalls in 2006–7. Turning to individual academic divisions and services areas, the following pages provide more detail area by area of the budgets for 2006–7. Medical Sciences Income Income per head Income per square metre Surplus/(deficit) 2004–5 2005–6 182 196 6 2.7 2006–7 204 85,000 2,731 (1.8) Medical Sciences is the largest academic division, representing almost one third of total University income and expenditure. It has some 2,400 staff and some 74,000 square metres of chargeable space for infrastructure charge purposes. In the previous two years the division has produced sizeable surpluses. In 2006–7 despite a strong RAM settlement the division expects to have a deficit of £1.8m but to return to surplus thereafter. In common with other divisions the double pay inflation impact is significant, adding £2.4m to the cost base, and RAE investment is the largest single factor driving £1.3m of extra costs due to new staff. In addition, the division is facing some £1m of incremental utilities costs, partly as a result of NHS charges. The comparatively robust financial position of the division is reflected in the healthy ratio of income per head at 85,000 and the level of income per square metre of chargeable space at 2,731. Social Sciences Income Income per head Income per square metre Surplus/(deficit) 2004–5 2005–6 55 64 (0.4) (0.5) 2006–7 73 90,000 2,962 (0.8) Social Sciences is expected to continue to grow strongly in 2006–7 with total income up by 14 per cent. In 2004–5 the divisional budget was almost in balance. The division leads the way in attracting overseas students and expects to earn 30 per cent of its income from overseas and other student fees in 2006–7. The average across the University, by way of comparison, is 10 per cent. The original forecast for 2005–6 indicated a £0.5m deficit but the Division now expects to do a little better and may earn a small surplus. For 2006–7 a small deficit is planned in view of the RAE investments and double impact of pay inflation. Mathematical, Physical and Life Sciences (MPLS) 2004–5 2005–6 2006–7 Income 111 112 117 Income per head 71,000 Income per square metre 1,425 Surplus/(deficit) (1.3) (1.9) (9.1) MPLS faces significant financial challenges. Total income is virtually static, costs are increasing as for all divisions, and structurally the division is earning too little income per square metre of chargeable space occupied. At more than 87,000 square metres of chargeable space occupied the division has a similar footprint to Medical Sciences with 44 per cent less income. Latest estimates for 2005–6 indicate that the Division will do better than the forecast deficit of £1.9m but there is little doubt that the situation will worsen in 2006–7. In addition to the cost increases faced by all other divisions and discussed elsewhere in this paper, the division has absorbed two departments, Zoology and Plant Sciences, Oxford University Gazette · Supplement (2) to No. 4783 · 18 October 2006 which are in deficit. It has also suffered from the end of moderation and the loss of one-off FEC grant income and no longer receives £2.6m of supplementary funding allocated in 2005–6. Humanities 2004–5 2005–6 Income Income per head Income per square metre Surplus/(deficit) 33 36 (0.8) (0.5) 2006–7 40 65,000 3,517 (0.4) In common with the previous two years, Humanities is budgeting for a small deficit in 2006–7. For 2006–7 this has only been achieved through stringent attention to costs. The 2006–7 RAM settlement was relatively healthy, with 10 per cent more funds made available. Because it has the largest number of students, Humanities received the largest proportion of the new variable fee, helping to fund new RAE investment. Continuing Education 2004–5 2005–6 Income Income per head Income per square metre Surplus/(deficit) 15 13 2.9 (0.3) 2006–7 14 69,000 1,368 (0.6) Continuing Education has historically been able to run at a surplus but faces similar cost pressures to the divisions in 2006–7. Around 70 per cent of income comes from student fees and a further 16 per cent from the RAM settlement. For 2006–7 Continuing Education was adversely affected by the ending of moderation and suffered a 5 per cent drop in RAM income as a result. This, in combination with the double pay inflation, has led to a budgeted deficit of £0.6m. Relative to its size, however, Continuing Education has healthy reserves and is aiming to return to a balanced budget in 2007–8. Academic Services and University Collections (ASUC) 2004–5 2005–6 Income Surplus/(deficit) 45 (0.4) 44 (3.0) 2006–7 46 (3.4) Despite 4.5 per cent more income available in 2006–7, the cost pressures from the double pay impact, higher space costs (87,000 square metres of chargeable space) and double digit increases in the cost of some materials result in a worsening deficit in 2006–7. £3.1m of the deficit arises in the Oxford University Library Service (OULS). OULS has developed a long-term financial recovery plan and is currently in the process of reviewing that plan. We may now turn to areas of University activity that focus primarily on providing services to the academic divisions but which have limited external income-generating capacity. University Services and Administration University services include veterinary, biomedical, operating central computer systems, academic and student administration, research services, property management, personnel administration, financial transaction process- 247 ing and legal services. University administration includes the work of the Vice-Chancellor, Pro-Vice-Chancellors, Registrar, Audit and the senior officers in each service area including Finance, Academic Services, Planning, the Legal Office, the Development Office, Public Affairs and Research Services. University Services and Administration has a total expenditure budget of £53.5m and comprises several departments that are involved in providing services to departments and divisions, in addition to acting as a central policy-making body for the University and providing stewardship of its assets. Over the last few years the demands on University Services both in terms of volume and complexity and the need to improve quality have steadily increased and the level of funding has remained fairly static. Between 2005–6 and 2006–7 infrastructure charge and other funding is flat at £38.4m, whilst at the same time new investment is being made and inflationary cost pressures, particularly in terms of pay costs, are similar to those facing other departments across the University. In order to meet the costs of these new initiatives and to provide adequate funds for the increasingly complex service requirements, it has been necessary once again to call on strategic reserves. The funding position is described in the following chart. University Administration University Services Professorial Merit Awards Investments* Total Costs 17.2† 27.8† 4.4 4.1 53.5 Infrastructure charge and other funding 14.0 22.9 1.5 Transfer from strategic reserve 3.2 4.9 2.9 4.1 15.1 Total funding 17.2 27.8 4.4 4.1 53.5 38.4 * Includes Development Office of £3.4m and Public Affairs investment of £0.7m. † Estimated split of costs. Strategic reserves are being deployed to support the unfunded element of the professorial merit award scheme (total costs of £4.4m are part-funded by HEFCE RDS funds of £1.5m). They are also supporting new investment of £3.4m in the Development Office in order to enhance the fundraising capability of the University and £0.7m in the Public Affairs Directorate in order to enhance public understanding of the University and its aspirations. In addition, strategic reserves are being called upon to address the under-funding of University administration activities and the under-funding of University services provided to the academic divisions. Council Departments Council departments include the Careers Service, the Sports Department, the Proctors’ Office, the University Club, the Counselling Service, the Learning Institute, the Sheldonian Theatre and the Childcare Advisory Panel. Income and expenditure are in balance overall, with income of £9m, and each department with the exception of the University Club is able to balance its budget. The University Club is in deficit and alternative recovery options are currently under review. The funding position is described in the following chart. 248 Costs Infrastructure charge funding Sales and services Other Total funding Oxford University Gazette · Supplement (2) to No. 4783 · 18 October 2006 £m 8.7 3.3 3.5 1.9 8.7 Estates The Estates department is to receive enhanced funding commensurate with the drive to increase the funding of repairs and maintenance. Of the total £34m budget, £18m is funded through the infrastructure charge to other departments, £7.5m relates to direct external grants and £8.5m is the internal recharge of costs incurred on behalf of other departments. The £18m infrastructure charge is used to fund departmental costs, to pay for site security, to pay for rent and rates and £10.7m (up from £9.7m in 2005–6) is to pay for repairs and maintenance across 520,000 square metres of University space. The funding position is described in the following chart: Costs Infrastructure charge funding Direct grants Internal recharges Total funding £m 34.5 18.5 7.5 8.5 34.5 Capital expenditure plans In parallel with the budgeting process, the University has been drawing up a long-term capital plan which provides for substantial ongoing investment to improve and expand the University’s facilities over the next five years. In the period from 2005–6 to 2009–10, the University currently plans to invest some £588m in capital projects and £243m of that investment has already been approved and committed. This is comparable with the actual spend of £434m over the preceding five years after allowance is made for the gradually increasing size of the University estate. Included within the five-year plan are many projects l a rge and small. Some of the larger projects are the redevelopment of the Ashmolean Museum, the new book depository at Osney Mead, a major new building for th e Biochemistry department, a substantial new cancer res e a rch centre on the Old Road campus, significant refurbishment works at the New Bodleian, new buildings for Humanities and for the Department of Mathematics on the RI site, a new facility for the Department of Earth Sciences, expansion of the facilities for microbiological and e m e rging diseases and expansion of the facilities for clinical and basic neuroscience. For some projects much work is re qu i red to develop business plans and to comp l e te fund- raising before approval can be given. Nevertheless 2006–7 will be a year of relative ly high capital expenditure with some £130m of planned spend as a number of already approved projects move into the const ruction phase. Comments on cash flow and the balance sheet Largely as a result of the financial recovery program in the research billing and cash management areas, the University’s cash position has improved significantly during 2005–6, leaving the University reasonably well positioned for 2006–7 despite a budgeted operating deficit and heavier capital expenditure. University general cash balances Actual Forecast Budget 2004–5 2005–6 2006–7 Cash flow from operations (20) 30 9 Net capital flows (11) (18) (40) Other flows (36) (4) (1) Net cash flow before financing (67) 8 (38) Opening cash position 162 95 103 Closing cash position 95 103 65 The above cash forecast indicates the likely swing from being cash generative in 2005–6 to cash negative in 2006–7 as the benefits from better working capital management are largely a feature of 2005–6 and the University’s approved capital spending program is geared up. Clearly the University has limited ability to sustain annual cash outflow at this level without resorting to asset disposals or increased borrowings. Currently the University has unused and committed borrowing facilities of £75m and Council has approved the drawing down of £50m of those facilities as and when required. The University’s net assets are budgeted to grow to £1.4Bn by July 2007 and continue to be highly concentrated on fixed assets and endowments. 6 per cent of the total net assets are in a current asset form capable of being turned into more liquid assets in the short term. The 2006–7 budget and longer term financial trends The University is seeking to invest in important areas such as the RAE and to expand its fundraising capability. At the same time it is facing ever-increasing demands for more and better space and to properly care for the amount of space already occupied. In 2006–7 these factors have come together with a three-year fixed inflation deal for pay, the single biggest part of the cost base, in addition to the impact of the single spine. Taken together this has resulted in a deficit budget for 2006–7 and all parts of the University must now turn their attention to planning for 2007–8 and beyond to ensure that the longer term trend once again becomes positive.

Baixar