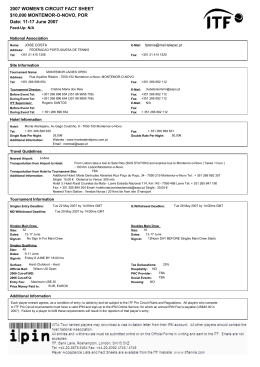

w w w. blta.c o m .br perfil dOs hóspedes origem dos HósPedes 2010 Brasil e u r o pa américa do norte a m é r i c a l at i n a outros 2011 25% 5% 4% 39% 27% 42% Brasil e u r o pa américa do norte a m é r i c a l at i n a outros 23% 5% 5% motivo da viagem 50+10+364l 50% traBalho e negócios 25% 25+75l 10% Forma de cHegada 36% 75% congresso individual turismo e lazer 4% 25% grupo ANNUAL REPORT 2012 outros t o ta l d e H ó s P e d e s r e c e b i d o s aumento de 8,6% 2011 149.519 2010 137.557 BRAZILIAN LUXURY TRAVEL ASSOCIATION t i p o d e o c u pa ç ã o tempo de permanência o r i g e m d a r e s e r va 60% 61% 24% 22% 31% 23% 25% 15% individual dupla ou casal sem filhos casal com filhos 30% 8% at é 3 diárias 4 a 7 diárias mais de 8 diárias agente de viagem operadora c o r p o r at e - empresas Balcão PRESENTATION Dear reader, It is with great pleasure that we present the first annual report of the Brazilian Luxury Travel Association (BLTA), created four years ago and currently comprised of 24 members, including tourism operators, hotels, pousadas (inns) and resorts in Brazil that serve the luxury market. This annual report comes at an opportune moment, in which the world’s eyes are focused on Brazil-with special attention on tourism, on the eve of the Olympic Games and the World Cup. The data com- The data compiled in the following pages help to compose a portrait of the luxury travel market in Brazil, which is better prepared to welcome discerning travelers piled in the following pages help to compose a portrait of this segment that has been gaining more and more importance in the country, which is increasingly better prepared to welcome discerning travelers. One example of this is training: on average, each of our members’ employees are given 45 hours of training per year. The consolidated results for 2011 also attest to growth-- adding up to 12% in hotel revenue and 25% in tour operator revenue. These statistics confirm one characteristic of the luxury travel segment; that it is less susceptible to economic crises. In 2012, despite METHODOLOGY a decrease documented for the first semester, the sector has recuperated, The data presented in this annual report were and projected reservations for the upcoming months are encouraging. obtained via a confidential survey conducted with members, who responded to a specific questionnaire regarding their field of activity (accommodations or tour operations). Filling out this questionnaire was optional and it was conducted anonymously by e-mail. The statistics were projected for the It is worth mentioning that this is the first step in our surveying of the sector. It is our intention to continue with further research of our members, presenting the results each year. After all, helping to construct a historical account of luxury tourism in Brazil and identifying the trends in the sector is our responsibility as well. totality of members from the answers given – in the case of accommodations, they were expanded We welcome you. proportionally to the number of rooms and, for tour Melissa Fernandes Oliveira operators, to the numbers of employees. President of the BLTA ABOUT THE BLTA MEMBERS Roraima Amapá Amazonas 11 Pará Ceará Founded in 2008, the Brazilian Luxury Travel Association (BLTA) brings together the most exclusive hotels, resorts, pousadas (inns) Piauí Acre and specialized tour operators in Brazil to offer authentic, sophis- Rondônia ticated and sustainable experiences throughout the country. In ad- Alagoas Tocantins We work to present contemporary Brazil in a way that is both genuine and innovative – leaving the distinguished mark of Brazilian hospitality and creativity in all that we do innovative – leaving the distinguished mark of Brazilian hospitality and creativity in all that we do. This results in unparalleled travel arrangements 12 Mato Grosso do Sul 2011 19 4 3 4 1 Paraná 14 Santa Catarina Rio Grande do Sul most exclusive Brazilian tourism products, experiences and services among both the domestic and international markets. VISION To make Brazil a nationally and internationally recog- nized luxury destination, positioning the country as the foremost representative of the luxury travel segment in Latin America by 2020. MAIN OBJECTIVES To increase Brazil’s presence in the international luxury travel market • To create partnerships with public institutions, associations, private companies and professionals that engage in similar activities in Brazil and abroad • To act in our associates’ interests to create opportunities for associates to sell their products and services and to attract new business and clients • To promote environmental and cultural preservation by fostering the sustainable development of destinations offered • To prepare studies on luxury tourism in Brazil and to be a source of information and a reference in the luxury tourism segment for both the domestic and international markets. 1. SÃO PAULO HOTEL EMILIANO www.emiliano.com.br tel: +55 11 3069-4369 2. RIO DE JANEIRO HOTEL COPACABANA PALACE www.copacabanapalace.com.br tel: +55 21 2548-7070 HOTEL FASANO SÃO PAULO www.fasano.com.br tel: +55 11 3896-4000 HOTEL FASANO RIO DE JANEIRO www.fasano.com.br tel: +55 21 3202-4000 HOTEL UNIQUE www.hotelunique.com tel: +55 11 3055-4700 CBV INCOMING www.cbvincoming.com.br tel: +55 21 2102-2434 TIVOLI SÃO PAULO MOFARREJ www.tivolihotels.com tel: +55 11 3146-5900 RIOLIFE TOUR www.riolifetours.com tel: +55 21 2142-9352 AURORAECO www.auroraeco.com.br tel: +55 11 3086-1731 MATUETÉ EXPEDIÇÕES E AVENTURAS www.matuete.com.br tel: +55 11 3071-4515 MEMBER SINCE 2012 SHERATON SÃO PAULO WTC HOTEL – CATEGORIA DESIGN www.sheratonsaopaulo wtc.com.br/design-room tel: +55 11 3055-8000 3. PORTO FELIZ HOTEL FASANO BOA VISTA www.fasano.com.br tel: +55 15 3261-9900 4. MAIRIPORÃ HOTEL UNIQUE GARDEN www.uniquegarden.com.br tel: +55 11 4486-8708 5. BÚZIOS INSÓLITO BOUTIQUE HOTEL www.insolitos.com.br tel: +55 22 2623-2172 9 9 14 23 24 6. CORUMBAU HOTEL VILA NAIÁ www.vilanaia.com.br tel: +55 11 3061-1872 7. TRANCOSO POUSADA ESTRELA D’ÁGUA www.estreladagua.com.br tel: +55 11 3848-9197 UXUA CASA HOTEL www.uxua.com tel: +55 73 3668-2277 8. ITACARÉ TXAI RESORT www.txai.com.br tel: +55 11 2627-6363 9. PRAIA DO FORTE TIVOLI ECORESORT PRAIA DO FORTE www.tivolihotels.com tel: +55 71 3676-4000 2012 To innovatively publicize and promote the best and NUMBER OF MEMBERS 2011 pared to welcome discerning guests from all over the world. MISSION Rio de Janeiro 2010 TOUR O P E R AT O R S Espírito Santo 5 2 2009 HOTELS, RESORTS AND POUSADAS (INNS) 13 São Paulo Sergipe 7 8 6 Minas Gerais Goiás 2008 that reveal a country well pre- 15+85l way that is both genuine and 9 Bahia Mato Grosso dition to exceptional service catering to the needs of the international luxury market, we work to present contemporary Brazil in a Rio Grande do Norte Paraíba Pernambuco 10 Maranhão 10. BARRA DE SÃO MIGUEL KENOA – EXCLUSIVE BEACH SPA & RESORT www.kenoaresort.com.br tel: +55 82 3272-1285 11. FERNANDO DE NORONHA POUSADA MARAVILHA www.pousadamaravilha.com.br tel: +55 81 3619-0028 12. PANTANAL REFÚGIO ECOLÓGICO CAIMAN www.caiman.com.br tel: +55 11 3706-1800 13. IGUASSU FALLS HOTEL DAS CATARATAS www.hoteldascataratas.com.br tel: +55 45 2102-7000 14. GOVERNADOR CELSO RAMOS PONTA DOS GANCHOS RESORT www.pontadosganchos.com.br tel: +55 48 3953-7000 GUESTS PROFILE ORIGIN 2010 BRAZIL EUROPE NORTH AMERICA OTHERS 2011 25% 5% 4% L AT I N A M E R I C A 39% 27% 42% BRAZIL EUROPE NORTH AMERICA L AT I N A M E R I C A 23% 5% 5% OTHERS PURPOSE OF TRIP 50+10+364l WORK AND BUSINESS 25+75l 10% HOTEL A R R I VA L S 36% 75% CONFERENCE 50% 25% TOURISM AND LEISURE INDIVIDUAL 4% OTHERS 25% GROUP NUMBER OF GUESTS RECEIVED INCREASE OF 8.7% HOTELS, RESORTS AND POUSADAS (INNS) 2011 149,519 2010 137,557 T Y P E O F O C C U PA N C Y 60% 25% 15% SINGLE DOUBLE/COUPLE WITHOUT CHILDREN COUPLE WITH CHILDREN L E N G T H O F S T AY 62% 30% 8% 3 OVERNIGHTS OR LESS BETWEEN 4 AND 7 OVERNIGHTS MORE THAN 8 OVERNIGHTS ORIGIN OF BOOKING 24% 22% 31% 23% T R AV E L AGENT TOUR O P E R AT O R C O R P O R AT E / BUSINESS COUNTER HOTELS PROFILE PERFORMANCE INDICATORS 3242 HIRED EMPLOYEES 1.4 995 O C C U PA N T S PER ROOM 2011 GROSS REVENUE BRL 603,878,170 2010 BRL 537,451,570 ROOMS OCCUPIED P E R D AY 2.21 M A I N S U S TA I N A B L E P R A C T I C E S HIRING AND TRAINING OF LOCAL COMMUNITY +12,3% EMPLOYEES PER APARTMENT BRL153,264,280 BRL130,558,460 COSTS AND EXPENSES FEES AND TA X E S BRL428,753,502 3.4 BRL66,426,598 NET REVENUE BRL 108,698,070 COSTS AND EXPENSES O V ER N IG H TS PER G U E S T AV E R A G E D A I LY R AT E R A C K R AT E 1392 BAR AND R E S TA U R A N T R$ 603,878,170 1463 USE OF FLUORESCENT LIGHT BULBS AND LEDS BRL320,055,430 EVENTS, S PA C E R E N TA L AND OTHERS T O TA L N U M B E R O F R O O M S WA S T E RECYCLING ROOM O C C U PA N C Y BRL1006 AV E R A G E D A I LY R AT E ACTUAL FEE CHARGED BRL881 GUESTS P E R D AY 41% 6% PERSONNEL A N D R E L AT E D EXPENSES R E V E N U E P E R AVA I L A B L E R O O M ( R E V PA R ) FOOD AND BEVERAGES 14% G A S , WAT E R , E L E C T R I C I T Y, TELEPHONE 39% OTHERS BRL529 2010 BRL599 O C C U PA N C Y R AT E 66% 2010 +13,2% 2011 +3% 68% 2011 9.8% INCREASE FROM 2010 TOUR OPERATORS MAIN SUSTAINABLE PRACTICES INVOLVEMENT OF LOCAL SUPPLIERS 49+12+5133L COSTS BREAKDOWN 2010 2010 49% 12% 5% 1% 33% ENVIRONMENTAL AWARENESS OF PASSENGERS AND EMPLOYEES 44+16+4135L 2011 2011 44% 16% 4% 1% 35% PAY R O L L MARKETING, COMISSIONS ETC. FLEET FINANCIAL COSTS (INTEREST ETC.) S E R V I C E S F R O M T H I R D PA R T I E S + O T H E R S PA R T I C I PAT I O N O F S E G M E N T S O F T O U R I S M I N R E V E N U E 2010 12% I N T E R N AT I O N A L I N B O U N D 55% 12% TOURISM I N T E R N AT I O N A L O U T B O U N D 35% 2011 TOUR OPERATORS 81% LEISURE DOMESTIC OUTBOUND I N T E R N AT I O N A L I N B O U N D 79% LEISURE DOMESTIC OUTBOUND 53% I N T E R N AT I O N A L O U T B O U N D TOURISM 81 +19l 79 +21l 33% 19% BUSINESS T R AV E L 21% BUSINESS T R AV E L PERFORMANCE INDICATORS 2010 TOTAL EARNING S BRL 63,000,000 2011 BRL 79,000,000 +25% 7,950 +17% NUMB ER OF C L IENTS 6,800 AVERAG E EXPEND ITURE PER C L IENT BRL 9,250 LENGTH OF TRIP BRL 9,900 UP TO 7 DAYS 8 TO 14 D AY S 14 DAYS OR MORE I N T E R N AT I O N AL I N B O UN D 18% 65% 17% DOMESTIC O UT B O UN D 72% 19% 9% I N B O UN D 21% 61% 18% BLTA - Brazilian Luxury Travel Association www.blta.com.br President: MELISSA DURÃO FERNANDES DE OLIVEIRA Vice-President: JOSÉ ROMEU FERRAZ NETO Treasurer Director: ROBERT WESTCOTT BETENSON Financial Advisor: LUIZ FELIPE MANCEBO DO AMARAL Financial Advisor: GUILHERME ALVAREZ DE TOLEDO PADILHA Institutional Contact: KAREM BASULTO ([email protected]) Editing and Design: PiU Comunica (with ilustrations by Rafael Quick) Research and databank consultation: Fabrizio Caritatos Translation: Matthew Rinaldi

Baixar