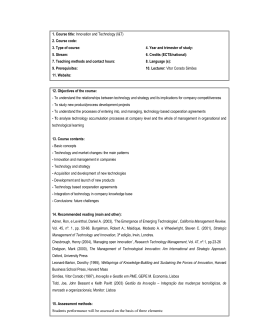

M E M O R A N D U M T O C L I E N T S “CRISIS REFIS” – CONSOLIDATION OF THE DEBTS Date 02/04/2011 Today, February 4, 2011, was published the Joint Ordinance PGFN/RFB nº 2, enacted on 02/03/2011 by the Office of Attorney of the National Treasury (“PGFN”) and by the Brazilian Internal Revenue Service (“RFB”), establishing the proceedings to be followed in the consolidation of the debts of the taxpayers opting for cash payment and installment types provided by Law no. 11.941/09 (“Refis da Crise”). Such Joint Ordinance brought the following schedule for the consolidation of the debts, which shall be done, exclusively, on the RFB and PGFN’s websites: Term st March 1 to 31, 2011 Providence i) Consult the offsettable debts in each category; and ii) Amend installment types, if applicable. April 4 to 15, 2011 Provide the necessary information for the consolidation, in the case of legal entities that elected for cash payment with the use of credits arising from tax losses or negative basis of the Social Contribution on Net Profit. May 2 to 25, 2011 Provide the necessary information for the consolidation: i) for all installment types, in the case of individuals; and ii) for the installment of debts resulting from improper use of IPI credits. June 7 to 30, 2011 Provide the necessary information for the consolidation, in the case of legal entities: i) subject to differential and special economic and tax monitoring in 2011, or ii) who opted for taxation of income and Social Contribution on Net Profit in calendar year 2009 based on presumed income, and which DIPJ of the year 2010 has been presented until September 30, 2010. Este memorando, elaborado exclusivamente para os clientes deste Escritório, tem por finalidade informar as principais mudanças e notícias de interesse no campo do Direito. Surgindo dúvidas, os advogados estarão à inteira disposição para esclarecimentos adicionais. SSP - 73206v1 July 6 to 29, 2011 st August 1 to 12, 2011 Provide the necessary information for the consolidation of other installment types, in the case of other legal entities. Provide the necessary information for the consolidation, in the case of legal entities who fit the hypothesis provided by the Ordinance No. 24/2011, from the Department of the Treasury (Portaria MF nº 24/2011) (taxable persons domiciled in the cities of Areal, Bom Jardim, Nova Friburgo, Petrópolis, São José do Vale do Rio Preto, Sumidouro and Teresópolis, in the State of Rio de Janeiro) In addition, the Joint Ordinance still provides: i) Migration of the payments in installments made under the provisions of Provisory Measure no. 449/2008; ii) Amendment of the installment types, in order to cancel the type chosen before and replace it for another type, or include a new type, maintaining the others previously chosen; iii) Indication of lax losses and negative basis of the Social Contribution on Net Profit available; iv) Reopening of the term for drop/withdraw the defenses and appeals filed in administrative proceedings or the lawsuits in course, related to debts which are with its enforceable liability suspended; v) Review of consolidation; vi) Review of the use of tax losses and negative basis of Social Contribution on Net Profit; vii) Tax treatment of the debts in which the liability derives from split up; viii) Ex officio offset; and ix) Recognition of the reduction by the anticipation of the installments. Este memorando, elaborado exclusivamente para os clientes deste Escritório, tem por finalidade informar as principais mudanças e notícias de interesse no campo do Direito. Surgindo dúvidas, os advogados estarão à inteira disposição para esclarecimentos adicionais. SSP - 73206v1 Shortly, we will issue a new Memorandum to our Clients, in which it will be exposed and analyzed all the rules provided by the Joint Ordinance PGFN/RFB nº 2/2011. If you need any additional information regarding the consolidation proceedings, as well as about the administrative proceedings and lawsuits that will be included in the consolidation, please do not hesitate to contact us. Responsáveis: Igor Nascimento de Souza ([email protected]) Tel.: 55 11 3201-7553 Eduardo Pugliese Pincelli ([email protected]) Tel.: 55 11 3201-7552 Bruno Baruel Rocha ([email protected]) Tel.: 55 11 3201-7588 Este memorando, elaborado exclusivamente para os clientes deste Escritório, tem por finalidade informar as principais mudanças e notícias de interesse no campo do Direito. Surgindo dúvidas, os advogados estarão à inteira disposição para esclarecimentos adicionais. SSP - 73206v1

Baixar