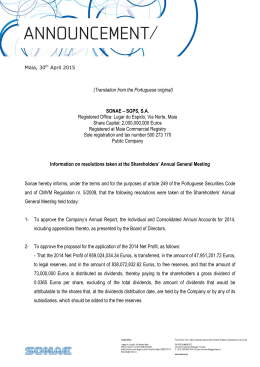

To the Chairman of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA Lugar do Espido Via Norte 4471-907 Maia (Translation from the Portuguese Original) Item number 1 PROPOSAL We propose that the Report of the Board of Directors, the individual and the consolidated Financial Statements for 2010, including appendices thereto, are approved as presented. Maia, 2 March 2011 On behalf of the Board of Directors, To the Chairman of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA Lugar do Espido Via Norte 4471-907 Maia (Translation from the Portuguese Original) Item number 2 PROPOSAL Under the terms of the law and of the Articles of Association, the Board of Directors proposes to the Shareholders General Meeting that the 2010 Net Profit of 2,324,988.08 euro, has the following appropriation: Legal Reserve 116,249.40 Free Reserves 2,208,738.68 Maia, 2 March 2011 On behalf of the Board of Directors, To the Chairman of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA Lugar do Espido Via Norte 4471-907 Maia (Translation from the Portuguese Original) Item number 4 Following the approval of Decree Law 49/2010 of 19 March, which endorses European Parliament and Council Directive number 2007/36/CE of 11 July within Portuguese Law, changes were made to the Portuguese Securities Code, with the objective of simplifying the exercise of voting rights by shareholders of listed companies. Changes in law impose changes to articles 21 and 23 of the Articles of Association to ensure the necessary compliance. As a result we propose the following changes to the Articles of Association: a) To change number 1 of article 21, to the following wording: One – Shareholders may be present at the Shareholders’ General Meeting under the terms of the law. (…) b) To change number 1 and 4 of article 23, to the following wording: One – Shareholders may be represented at the Shareholders’ General Meeting under the terms of the law and of the respective notice of meeting. (…) Four – Written voting papers shall only be considered valid, if they are received at the company’s registered office at least three days before the date of the Shareholders’ General Meeting. Voting papers must be sent by registered post with acknowledgement of receipt, and addressed to the Chairman of the Board of the Shareholders’ General Meeting, with the necessary proof of shareholder quality as at the record date. Electronic voting papers can be accepted, under the same terms, if that specific option is made available to shareholders and included in the notice of meeting of the respective Shareholders’ General Meeting. c) To supress number 2 of article 23; d) To change current numbers 3, 4, 5, 6, 7, 8, 9, 10 and 11 of article 23 to, respectively, numbers 2, 3, 4, 5, 6, 7, 8, 9 and 10; With the approval of proposed changes those articles will have the following wording: ARTICLE TWENTY ONE One – Shareholders may be present at the Shareholders’ General Meeting depends under the terms of the law. Two – The presence at a Shareholders’ General Meeting of Shareholders holding non-voting preference shares, and their presence in the discussion of the points on the agenda for the Shareholders’ General Meeting will depend on the authorisation of the Shareholders’ General Meeting. ARTICLE TWENTY THREE One – Shareholders may be represented at the Shareholders’s General Meeting under the terms of the law and of the respective notice of meeting. Two – As long as the company is considered to be a “publicly quoted company”, shareholders are allowed to vote in writing. Three – Written voting papers shall only be considered valid, if they are received at the company’s registered office at least three days before the date of the Shareholders’ General Meeting. Voting papers must be sent by registered post with acknowledgement of receipt, and addressed to the Chairman of the Board of the Shareholders’ General Meeting, with the necessary proof of shareholder quality as at the record date. Electronic voting papers can be accepted, under the same terms, if that specific option is made available to shareholders and included in the notice of meeting of the respective Shareholders’ General Meeting. Four – Written voting papers must be signed by the shareholders or by their legal representatives. Individual shareholders must attach a certified copy of their identity card or passport and, for corporate shareholders, the signature must be authenticated confirming that the signatory is duly authorised and mandated for the purpose. Five – Written voting papers will only be considered to be valid when they clearly set out in an unambiguous manner: a) the agenda item or items to which they refer; b) the specific proposal to which they relate, with an indication of the respective proposer or proposers; c) the precise and unconditional voting intention on each proposal. Six – Voting papers will be considered to be revoked if the shareholder, or his representative, is present at the General Meeting. Seven – It is assumed that shareholders who send their voting papers abstain from voting any proposals that are not specifically included in their voting papers, when the respective proposals had been presented before the date in which such votes were cast. Eight – Written voting papers shall be deemed as votes against any proposals presented after the issuance of such written voting papers. Nine – The Chairman of the Board of the Shareholders’ General Meeting, or his or her substitute, is responsible for verifying that written voting papers comply with all the above requirements and, any that are not accepted, are treated as null and void. Ten – The company shall assure confidentiality of written voting papers until the moment of the issuing of casting of votes in the Shareholders’ General Meeting. Maia, 2 March 2011 On behalf of the Board of Directors, EFANOR INVESTIMENTOS, SGPS, SA To the Chairman of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA Lugar do Espido, Via Norte, Apartado 3053 4471-907 Maia (Translation from the Portuguese Original) PROPOSAL We propose to change the wording of number 1 of article 9 and of article 29, to the following: ARTICLE NINE One – The Board of Director is made up of an odd or even number of members, with a minimum of three members and a maximum of seven members, elected at the Shareholders’ General Meeting. The Chairman of the Board of Directors has a casting vote. (…) ARTICLE TWENTY NINE The mandate of the members of the statutory bodies shall be for two years, and they may be reelected one or more times. With the approval of these changes, articles 9 and 29 will have the following wording: ARTICLE NINE One – The Board of Director is made up of an odd or even number of members, with a minimum of three members and a maximum of seven members, elected at the Shareholders’ General Meeting. The Chairman of the Board of Directors has a casting vote. Two – The Board of Directors will appoint its Chairman, as well as, if it so decides, one or more Managing Directors or an Executive Committee, to which it shall delegate the powers to manage the business that the Board may determine. Three – The Board of Directors will decide how the Executive Committee will function and how it will exercise the powers that have been delegated. ARTICLE TWENTY NINE The mandate of the members of the statutory bodies shall be for two years, and they may be reelected one or more times. Porto, 28 February 2011 On behalf of the Board of Directors, SEDE: AVENIDA DA BOAVISTA 1277/81 – 4º • 4100-13 PORTO • PORTUGAL TEL. +351.22.6077740 • FAX: +351.22.6077750 CAPITAL SOCIAL 250.000.000 € MATRICULADA NA CRC DO PORTO COM O Nº ÚNICO DE MATRÍCULA E PESSOA COLECTIVA 502 778 466 EFANOR INVESTIMENTOS, SGPS, SA To the Chairman of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA Lugar do Espido Via Norte 4471-907 Maia (Translation from the Portuguese Original) PROPOSAL We propose that a resolution is passed to elect the following members to the new mandate: a) Board of the Shareholders’ General Meeting Chairman: António Agostinho Cardoso da Conceição Guedes Secretary: Maria Daniela Farto Baptista Passos b) Board of Directors: Belmiro Mendes de Azevedo Álvaro Carmona e Costa Portela Francisco de La Fuente Sánchez Maria Cláudia Teixeira de Azevedo Paulo José Jubilado Soares de Pinho c) Fiscal Board: Chairman: Manuel Heleno Sismeiro Member: Armando Luís Vieira Magalhães Member: Jorge Manuel Felizes Morgado Substitute: Carlos Manuel Pereira da Silva d) Remuneration Committee: Chairman: Efanor Investimentos, SGPS, SA , represented by Belmiro Mendes de Azevedo Member: José Fernando Oliveira de Almeida Corte Real SEDE: AVENIDA DA BOAVISTA 1277/81 – 4º • 4100-13 PORTO • PORTUGAL TEL. +351.22.6077740 • FAX: +351.22.6077750 CAPITAL SOCIAL 250.000.000 € MATRICULADA NA CRC DO PORTO COM O Nº ÚNICO DE MATRÍCULA E PESSOA COLECTIVA 502 778 466 EFANOR INVESTIMENTOS, SGPS, SA Two – To set that the members of the Board of Directors shall provide a guarantee for their responsibilities for an amount of 250,000 euro (two hundred and fifty thousand euro), by any means permitted by Law; Three – To authorise Directors to hold positions, besides those currently held, on the Board of Directors of affiliated companies in which the proponent company holds, directly or indirectly, a controlling interest, having access to all the information under the terms and for the effects of number 4 of article 398 of the Portuguese Company Law. Information required by paragraph d) of number 1 of article 289 of the Portuguese Company Law is included as an appendix to this proposal. Porto, 28 February 2011 On behalf of the Board of Directors, BOARD OF SHAREHOLDERS’ GENERAL MEETING António Agostinho Guedes CURRICULUM VITAE Personal Data Name: António Agostinho Cardoso da Conceição Guedes Date and place of birth: 04/06/61, Paranhos, Porto Address: Alameda Jardins da Arrábida, 1114, 6º C, 4400-478 V. N. de Gaia Telephone nr.: 226166950 / 938389622 Fax: 226163810 e.mail: [email protected] Education Graduation in Law by Universidade Católica Portuguesa, Porto Regional Center, concluded on 22 July 1985, with a score of 17 (0-20 scale). Attendance of an extracurricular course of Accounting for Lawyers in Universidade Católica (equivalent to an annual assignment). Course of Business Administration Basics in Universidade Católica (equivalent to an annual assignment). Attendance of Community Law course in Universidade Católica (equivalent to a semester assignment), promoted by the Center of Documentation and European Studies. Full attendance of the academic modules of the Master course in Law and Civil Sciences in Universidade Católica Portuguesa, Lisbon, in 1986/87. Master in Law and Civil Sciences by the Law School of Coimbra, concluded on 9 May 1998 (grade: Very Good). Doctor in Law and Civil Sciences by the Law School of Universidade Católica Portuguesa, concluded on 18 October 2005, with a score of 18 (0-20 scale). Alameda Jardins da Arrábida, 1114, 6º C, 4400-478 V. N. Gaia António Agostinho Guedes Papers "A limitação dos poderes dos administradores das sociedades anónimas operada pelo objecto social no novo Código das Sociedades Comerciais", published in Revista de Direito e Economia, Ano XIII (1987). "A responsabilidade do banco por informações à luz do artº 485º do Código Civil", published in Revista de Direito e Economia, Ano XIV (1988). "Algumas considerações sobre a transferência do trabalhador, nomeadamente no que concerne à repartição do ónus da prova" in collaboration with Júlio Gomes, published in Revista de Direito e Estudos Sociais, Ano XXXIII (1991), V, 2ª série, Ns. 1-2. "Acção de despejo (parecer)" co-author with Raúl Guichard Alves, published in Colectânea de Jurisprudência, Ano XVI (1991), Tomo IV. "Venda de animal defeituoso (parecer)" in collaboration with Prof. Doutor António Pinto Monteiro, published in Colectânea de Jurisprudência, Ano XIX (1994), Tomo V. "A responsabilidade do construtor no contrato de empreitada" in Contratos: Actualidade de Evolução (Minutes of the International Congress on Contract Law promoted by Universidade Católica Portuguesa in Porto on November 1991), Porto, 1997 (October). “Algumas notas sobre os artigos 150º, 149 e 147º do Código Civil” in Iuris et de Jure, publication celebrating the 20 years of the Law Course of UCP, Porto, 1998. “A Natureza Jurídica do Direito de Preferência”, master thesis, Publicações Universidade Católica Portuguesa, Porto, April 1999. “Stocznia Gdanska SA v Latvian Shipping Co and others — Case Note” in European Review of Private Law, volume 7, nº 3, 1999. “Efeitos da declaração de preferência”, in Estudos dedicados ao Prof. Doutor Mário Júlio de Almeida Costa, Lisboa, 2002. Alameda Jardins da Arrábida, 1114, 6º C, 4400-478 V. N. Gaia António Agostinho Guedes “O Exercício do Direito de Preferência”, doctorate thesis, Publicações Universidade Católica Portuguesa, Porto, September 2006. Professional Activity Assistant Professor at Universidade Católica Portuguesa, Porto, since October 1985. Auxiliar Professor in the Law School of Universidade Católica Portuguesa since 2006. Responsible for the Contract Technics Law subject in the "Business Law" course, promoted by Associação Industrial Portuense for graduates in Law, between 1991 and 1992. Professor at Instituto Empresarial Portuense (Associação Industrial Portuense) in the Executive MBA in International Trade and Commercial and Management Engineering Courses, from 1993 until 2000, in the Business Law and Contract Law assignments. Professor at Escola de Gestão do Porto in the Executive MBA in International Trade and Commercial and Management Engineering Courses, from 2000 until 2002, in the Contract Law assignment. Teacher in the MBA in Construction Course since 1997, promoted by Universidade do Minho (module related to civil contruction works). Contribution in the preparation of several legal opinions within the Studies and Opinions Cabinet of the Law Course in Universidade Católica Portuguesa, Porto. Consultant in Morais Leitão, Galvão Telles, Soares da Silva e Associados — Sociedade de Advogados RL, registered in the Lawyers Institute. President of the National Evaluation Commission of the Lawyers Institute in 2006. Principal of the Law School of Universidade Católica Portuguesa, Porto, since May 2006. Chairman of the Board of the Shareholders’ General Meeting of Sonae Capital SGPS SA since 2007. Chairman of the Board of the Shareholders’ General Meeting of Sonae Investimentos SGPS SA since 2007. Alameda Jardins da Arrábida, 1114, 6º C, 4400-478 V. N. Gaia António Agostinho Guedes Secretary of the Board of the Shareholders’ General Meeting of Sonae Indústria SGPS SA since 2007. Secretary of the Board of the Shareholders’ General Meeting of Sonaecom SGPS SA since 2007. Arbitrator of Instituto de Arbitragem Comercial (Portuguese Chamber of Commerce and Industry /Porto Chamber of Commerce and Industry). Founding member of Associação Portuguesa de Arbitragem (Portuguese Arbitration Association). Holds 3,724 shares in Sonae Capital SGPS SA. Alameda Jardins da Arrábida, 1114, 6º C, 4400-478 V. N. Gaia Statement I hereby declare, as required by law, that, as a member of the Board of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA, I do not incur in any of the incompatibilities referred to in number 1 of Article 414-A of the Portuguese Company Law, nor am I involved in any circumstance capable of affecting my independence under the terms of number 5 of Article 414 of the Portuguese Company Law, applicable under the terms of article 374 – A of the same Law. I will immediately disclose to the company any event that, in the course of the mandate, generates incompatibilities or loss of independence under the terms of the legal requirements. Porto, 21 February 2011 ______________________________________ António Agostinho Guedes Daniela Baptista Passos CURRICULUM VITAE Personal Data Name: Maria Daniela Farto Baptista Passos Date and Place of Birth: 05 June 1975, St.º Ildefonso, Porto Address: Rua Amadeu de Sousa Cardoso, n.º 120 – 6.º poente; 4150‐065 Porto Telephone nr.: 919 966 182 e.mail: [email protected] Education Graduation in Law by the Law School of Universidade Católica Portuguesa – Porto, in July 1999, with a score of 17 (0‐20 scale); “Award Professor Francisco Carvalho Guerra” for the best Graduation in Law final score in the Law School of Universidade Católica Portuguesa – Porto, in 1998/1999; Specialization course in Legal and Commercial Sciences in the Law School of Universidade Católica Portuguesa – Porto, with a score of 18 (0‐20 scale); Master in Legal and Commercial Sciences, in January 2004, with a score of 18 (0‐20 scale). Professional Activity Concluded the Lawyer training, under the coordination of the Training Center of the Porto District Board of the Portuguese Lawyers Institute, in 2001. Trainee Assistant in the Law School of Universidade Católica Portuguesa – Porto, between 2000 and 2004. Member of the Board of Directors of the Law School of Universidade Católica Portuguesa – Porto, between 2002 and 2008. Assistant Professor in the Law School of Universidade Católica Portuguesa – Porto, since 2004. Teacher in the Post‐Graduation course of Commercial Law of Universidade Católica Portuguesa – Lisbon, since 2004. 1 Daniela Baptista Passos Co‐author of “Manual das Sociedades Anónimas” – Verlag Dashöfer, between 2005 and 2007. Trainer at the Training Center of the District Board of the Lawyers Institute of Porto, between 2006 and 2007. Teacher in the Commercial Law assignment of the Philosophy and Company Development course, of the Philosophy Faculty of Universidade Católica Portuguesa – Braga, in 2007. Secretary of the Board of the Shareholders’ General Meeting of SONAE Capital, SGPS, SA since December 2007. Registered in the Doctorate Course of the Law School of Universidade Católica Portuguesa – Porto, since 2008. Teacher in several Courses, Seminars and Post‐Graduation Courses on Company Law and Securities Law. Papers “O Direito de Exoneração dos Accionistas – Das Suas Causas”, Coimbra Editora, 2005. “Alterações ao Contrato de Sociedade”, in AA.VV. – Manual das Sociedades Anónimas, Lisbon: Verlag Dashöfer, 2006, Number 4, Chapter 4, Subchapter 3, pages 1‐24. “Direito de Exoneração dos Accionistas no CSC”, in AA.VV. – Manual das Sociedades Anónimas, Lisbon: Verlag Dashöfer, 2007, Number 6, Chapter 3, Subchapter 5, pages 1‐ 44. “O Princípio da Tipicidade e os Valores Mobiliários”, in AA. VV. – Jornadas Sociedades Abertas, Valores Mobiliários e Intermediação Financeira, Coimbra: Almedina, 2007, pages 87‐121. “Direito de Exclusão: Fundamento e Admissibilidade nas Sociedades Anónimas”, in AA.VV. – Text Book in Memory of Paulo Sendin, Lisboa: Editora da UCP, waiting for publication. Other information required by article 289º of the Portuguese Company Law Does not hold any shares representative of the share capital of Sonae Capital, SGPS, SA 2 Statement I hereby declare, as required by law, that, as a member of the Board of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA, I do not incur in any of the incompatibilities referred to in number 1 of Article 414-A of the Portuguese Company Law, nor am I involved in any circumstance capable of affecting my independence under the terms of number 5 of Article 414 of the Portuguese Company Law, applicable under the terms of article 374 – A of the same Law. I will immediately disclose to the company any event that, in the course of the mandate, generates incompatibilities or loss of independence under the terms of the legal requirements. Porto, 21 February 2011 ______________________________________ Daniela Baptista Passos BOARD OF DIRECTORS Belmiro Mendes de Azevedo Age: 73 Nationality: Portuguese Education: Graduation in Chemical Engineering ‐ Porto University (1963) PMD (Programme for Management Development) ‐ Harvard Business School (1973) Financial Management Programme ‐ Stanford University (1985) Strategic Management ‐ Wharton University (1987) Position held in Sonae Capital, SGPS, SA: Positions held in Group Companies: Positions held in Other Companies: Main Professional activities in the last five years: Chairman of the Board of Directors and Chief Executive Officer Chairman of the Board of Directors of the following companies: SC, SGPS, SA Sonae Turismo, SGPS, SA Spred, SGPS, SA Selfrio, SGPS, SA Member of the EGP‐UPBS (University of Porto Business School) General Board Founding Member of Manufuture Portugal Forum Member of the European Advisory Board of Harvard Business School Member of WBCSD ‐ Order of Outstanding Contributors to Sustainable Development Member of the International Advisory Board of Allianz AG Member of the European Union Hong‐Kong Business Cooperation Committee 1999‐2007 ‐ Chairman and CEO of Sonae, SGPS, SA Since 2003 ‐ Chairman of the Board of Directors of Sonae Indústria, SGPS, SA Since 2007 ‐ Chairman of the Board of Directors of Sonae, SGPS, SA Chairman and CEO of Sonae Capital, SGPS, SA Shares held in Sonae Capital, SGPS, SA 838,862 shares1 49,999,997 shares held through Efanor Investimentos, SGPS, SA 1 Shares held directly or by family members CURRICULUM VITAE Àlvaro Carmona e Costa Portela Born: July 4th, 1951 Married, 3 sons Nationality: Portuguese Residence: Porto, Portugal ACADEMIC TRAINING Graduate in Mechanical Engineering (FEUP - 1974) MBA, Master of Business Administration (Universidade Nova de Lisboa - 1983) AMP / ISMP (Harvard Business School – 1997) ACADEMIC ACTIVITIES 1974/77 Faculdade de Engenharia da Universidade do Porto - Lecturer at Department of Mechanics PROFESSIONAL ACTIVITIES 1972/79 Laboratórios BIAL, Porto, Portugal (Pharmaceutical Industry) - Director (72/76) and President and CEO (76/79) 1979/ COPAM - Companhia Portuguesa de Amidos, SA, Lisboa, Portugal (Maize derivatives industry) Executive Director of Finance, Planning and Exports (1979/85) Non-Executive Director (2010/ ) 1979/ CASA AGRICOLA HMR SA (ex-CADE), Vidigueira, Portugal Non-Executive Director 1985/ SONAE GROUP, Maia, Portugal: 1985/91 SONAE DISTRIBUIÇÃO (Retail) -Deputy Managing Director (85/86) and Managing Director (86) of MODIS– Distribuição Centralizada SA (Logistics and Retail Procurement); - Managing Director (86/88), CEO (88/90) and Chairman (89/91) of Sonae Distribuição SGPS and all of its affiliates; 1990/2010 SONAE SIERRA (Shopping Centres) - Executive President and CEO of Sonae Sierra SGPS and all its affiliates; 1992/ SONAE SGPS - Member of the Council of Presidents (92/96) and of the Coordination Board (97/98) of the Sonae Group; - Executive Director and Vice-President (99/ 2010) - Non-Executive Director (2010/ ) 2010/ SONAE RP (Retail Properties) Non-Executive Director 2010/ MAF Properties, Dubai, UAE Non-Executive Chairman 2010/ ECE European Prime Shopping Centre Fund, Hamburg, Germany Investment Committee Member 2011/ PanEuropean Property Limited Partnership, London, UK Investment Advisory Committee Member Other Professional activities: EPRA- European Public Real Estate Association, Amsterdam, Netherlands 1999/2002: Co-founder and Board Member ICSC – International Council of Shopping Centres, New York City, USA 1996/2001: ICSC-Europe Awards Jury Member 2005/2008: Trustee and International Advisory Board member European Shopping Centre Trust, London, UK 2004/2009 Trustee Eurohypo, Frankfurt, Germany 2004/2009: International Advisory Board member Faculdade de Economia, Oporto University, Portugal 2010/ : Chairman of the Council of Representatives ULI – Urban Land Institute, Washington DC, USA 2010/2013: Trustee Other Fellow of the Royal Institute of Chartered Surveyors (FRICS), London, UK Other information required by article 289 of the Portuguese Company Law: Holds 3,242 shares representative of the share capital of Sonae Capital, SGPS, SA Francisco de La Fuente Sánchez Age: 69 Nationality: Portuguese Education: Positions held in Sonae Capital, SGPS, SA: Positions held in Other Companies: Main Professional activities in the last five years: Graduation in Electro technical Engineering – Instituto Superior Técnico (1965) Non Executive Director (2008/2010) Chairman of the Board of the Shareholders’ General Meeting of Iberwind – Desenvolvimento e Projectos, SA Co‐option member of Instituto Superior Técnico School Council Non Executive Chairman of the Board of Directors of EFACEC Capital Member of Conselho Nacional da Água Chairman of the General Council of PROFORUM Member of the Consultative Council of the Department of Electro technical and Computer Engineering of Instituto Superior Técnico Chairman of the National Council of the Electro technical Engineering Board of the Engineers Institute Member of the Patronage of Hidroeléctrica del Cantábrico Foundation Member of the Consulting Council of the Competitiveness Forum Honorary Chairman of Hidroeléctrica del Cantábrico, SA Member of the Curators Council of the Luso‐Brazilian Foundation Member of the Ibero American Forum Member of the Curators Council of the Luso‐Spanish Foundation In the EDP Group and Electrical Sector in Portugal: 2005 ‐ 2009 – Chairman of EDP Foundation 2006 ‐ 2007 – Advisor to the Board of Directors of EDP – Electricidade de Portugal, SA 2004 ‐ 2006 – Chairman of ELECPOR ‐ Associação Portuguesa das Empresas do Sector Eléctrico 2003 ‐ 2006 – Chairman of the Board of Directors of EDP ‐ Energias de Portugal, SA In the Electrical Sector outside Portugal: Since 2005 ‐ Honorary Chairman of Hidroeléctrica del Cantábrico, SA 2002 ‐ 2005 – Board Member of Hidroeléctrica del Cantábrico, SA In Other Sectors: Since2010 – Chairman of the Board of the Shareholders’ General Meeting of Iberwind – Desenvolvimento e Projectos, SA Since 2009 ‐ Co‐option member of Instituto Superior Técnico School Council Since 2007 ‐ Non Executive Chairman of the Board of Directors of EFACEC Capital ‐ Member of Conselho Nacional da Água ‐ Chairman of the General Council of PROFORUM ‐ Member of the Consultative Council of the Department of Electro technical and Computer Engineering of Instituto Superior Técnico ‐ Chairman of the National Council of the Electro technical Engineering Board of the Engineers Institute Since 2005 ‐ Member of the Patronage of Hidroeléctrica del Cantábrico Foundation ‐ Member of the Consulting Council of the Competitiveness Forum Since 2004 ‐ Member of the Curators Council of the Luso‐Brazilian Foundation Since 2003 ‐ Member of the Ibero American Forum Since 2002 ‐ Member of the Curators Council of the Luso‐Spanish Foundation 2007 ‐ 2009 ‐ Chairman of the Corporate Governance Committee of the Supervisory Board of Millennium BCP –Banco Comercial Português 2006 ‐ 2009 ‐ Membro do Conselho Geral e de Supervisão do Millennium BCP – Banco Comercial Português 2006 ‐ 2007 ‐ Non Executive Vice‐Chairman of the Board of Directors of Efacec 2004 ‐ 2010 ‐ Member of the Consultative Council of the Portuguese Institute of Corporate Governance 2004 ‐ 2007 ‐ Chairman of BCSD Portugal – Business Council for Sustainable Development ‐ Chairman of PROFORUM – Associação para o Desenvolvimento da Engenharia 2003 ‐ 2005 ‐ Director of the Competitiveness Forum 2001 ‐ 2006 – Member of the Consulting Council of APDC – Associação Portuguesa para o Desenvolvimento das Comunicações 2000 ‐2010 – Non Executive Director of Portugal‐África Foundation 2000 ‐ 2006 – Member of the Superior Council of BCP – Banco Comercial Português ‐ Non Executive Chairman of the Board of Directors of ONI ‐ Member of the General Council of AIP – Associação Industrial Portuguesa Does not hold any share representative of the share capital of the Company Francisco de La Fuente Sánchez To Sonae Capital, SGPS, SA Lugar do Espido, Via Norte Maia Statement I hereby declare, as required by law, that I do not incur in any of the incompatibilities referred to in number 1 of article 414-A of the Portuguese Company Law, nor am I involved in any circumstance capable of affecting my independence under the terms of number 5 of Article 414 of the Portuguese Company Law, applicable under the terms of article 374 – A of the same Law. I will immediately disclose to the company any event that, in the course of the mandate, generates incompatibilities or loss of independence under the terms of the legal requirements. Lisbon, 28 February 2011 Maria Cláudia Teixeira de Azevedo Education: Date of Birth: 13 January 1970 Nacionality: Portuguesa Graduation in Business Management - Universidade Católica Portuguesa MBA by INSEAD (Fontainebleau) Offices held in companies Chairman of the Board of Directors of the following companies: Digitmarket – Sistemas de Informação, S.A. in which Sonaecom is a Lugares Virtuais, S.A. Shareholder M3G – Edições Digitais, S.A. Mainroad – Serviços de Tecnologias de Informação, S.A. Miauger – Organização e Gestão de Leilões Electrónicos, S.A. Saphety Level – Trusted Services, S.A. WeDo Technologies Americas, INC. Member of the Board of Directors of the following companies: Público Comunicação Social, S.A. Optimus – Comunicações, S.A. Sonaecom, SGPS, SA Sonaecom Sistemas de Informação, SGPS, S.A. WeDo Consulting, Sistemas de Informação, S.A. Director of the following companies:: Other Offices held: WeDo Technologies Mexico, S. De R.L. De C.V WeDo Technologies Egypt WeDo Technologies, B.V. Cape Technologies Limited (Ireland) WeDo Poland Sp. Z.o.o. WeDo Technologies Australia PTY Limited WeDo Technologies (UK) Limited WeDo Technologies Chile, SPA WeDo Technologies Panamá, S.A. WeDo Technologies Singapore PTE LTD Sonaecom – Sistemas de Información España, S.L Praesidium Services Limited Chairman of the Board of Directors of the following companies: Efanor – Serviços de Apoio à Gestão, S.A. Imparfin, SGPS, S.A. Linhacom, SGPS, S.A. Member of the Board of Directors following companies: Efanor Investimentos, SGPS, S.A. Fundação Belmiro de Azevedo Praça Foz – Sociedade Imobiliária, S.A. Executive Director of Sonaecom, SGPS, S.A. Main Professional activities of the last five Member of the board of Directors of the following companies: years: Sonaecom Sistemas de Informação, SGPS, S.A. Sonae Matrix Multimédia Wedo Consulting, Sistemas de Informação, S.A. Profimetrics Efanor Investimentos, SGPS, S.A. Shares held in Sonae Capital, SGPS, S.A. 43,912 through Linhacom, SGPS, S.A. CURRICULUM VITAE Paulo José Jubilado Soares de Pinho Curriculum Vitae Personal Information: Born: Lisbon, Portugal Birthday: 30 August 1962 Nationality: Portuguese Marital Status: Married Children: 1 Professional Address: Faculdade de Economia Universidade Nova de Lisboa Rua Marquês de Fronteira, 20 1099-038 Lisbon Portugal Email: [email protected] Academic Degrees: 1994 PhD in Banking and Finance City University Business School, London 1989 MBA – Master in Business Administration Fac. Economia da Univ. Nova de Lisboa 1985 Graduation in Economics Fac. Economia da Univ. Nova de Lisboa Executive Training: 2007 Private Equity and Venture Capital Programme Harvard Business School 2007 Valuation Guidelines Masterclass European Venture Capital and Private Equity Association Page 1 of 2 CURRICULUM VITAE 2006 Advanced Course European Venture Capital and Private Equity Association 2005 Negotiation Analysis Amsterdam Institute of Finance Professional Activity: Actual: Associate Professor 2002- Fac. Economia da Univ. Nova de Lisboa (FE-UNL) Fields: Banking; Corporate Finance; Entrepreneurial Finance e Venture Capital 2003 - President of the General Council Fundo de Sindicação de Capital de Risco PMEIAPMEI (Venture Capital Syndication Fund) 2007- Senior Advisor New Next Moves Consultants, Portugal. 2007- Representative Director (Portugal) Venture Valuation, Switzerland 2010 - Member of the Board of Directors Change Partners, Soc. Capital de Risco Past/Recent: 2007 - 10 Senior Advisor for Iberia Profit Technologies, EUA. 2007 - 08 Member of the Board of Directors XisVending – Serviços de Vending, SA 2004-07 Executive Director and Member of the Board of Directors REN – Redes Energéticas Nacionais, SA 2002-04 Economic Advisor to Portugal´s Minister of Economy Positions held in Sonae Capital SGPS, SA 2008 – 10 Non Executive Director Holds 12,500 shares in Sonae Capital, SGPS, SA Page 2 of 2 Paulo José Jubilado Soares de Pinho To Sonae Capital, SGPS, SA Lugar do Espido, Via Norte Maia Statement I hereby declare, as required by law, that I do not incur in any of the incompatibilities referred to in number 1 of article 414-A of the Portuguese Company Law, nor am I involved in any circumstance capable of affecting my independence under the terms of number 5 of Article 414 of the Portuguese Company Law, applicable under the terms of article 374 – A of the same Law. I will immediately disclose to the company any event that, in the course of the mandate, generates incompatibilities or loss of independence under the terms of the legal requirements. Lisbon, 28 February 2011 FISCAL BOARD Curriculum Vitae Name: Manuel Heleno Sismeiro Birth Date: 5 January 1945 Birth Place: Colmeias, Leiria Education: Graduation in Finance, ISCEF, Lisbon, 1971 Accountant, ICL, Lisbon, 1964 Professional Degree: Statutory Auditor nr. 202, 1974 Professional Curriculum: July 2008 Consultant, namely on internal audit and internal control. 1980‐2008 Partner of Coopers & Lybrand and of Bernardes, Sismeiro & Associados – since 1998 PricewaterhouseCoopers – auditors and statutory auditors. Responsible for the audit and statutory audit in several industries. More important companies: Sonae (group); Amorim (group); Unicer (group); Sogrape (group); Barros (group); TMG (group); Lactogal (group); Aveleda (group); RAR (group); Cires; Ford; REN. Responsible for the management of the Porto office of the mentioned companies. Manager of the Audit department in the period 1998‐2002 and member of the management board of PricewaterhouseCoopers, in the same period. 1977‐1980 CTT – Correios e Telecomunicações de Portugal: Responsible for the Warehouse Management and Control division. Responsible for stock management of central warehouses and of a project aimed at implementing a computer tool for stock management and control. 1975‐1977 Banco Borges & Irmão: performed functions at the Economic Studies Department and at the Control Department of associated companies. 1974‐1975 Arthur Young & Co: already qualified and registered as Statutory Auditor and audit assistant 1971‐1974 Ministry of Navy: compulsory military service at the Provisioning Service Division. Responsible for the stock control division for the whole of the Navy, including provisioning of the military forces in ex‐colonies. 1970‐1971 Banco da Agricultura: performed functions at the Organisation and Methods division. Academic Curriculum: 1971‐1981 Instituto Superior de Economia, Lisboa: assistant of Mathematics, Statistics, Econometry and Operational Investigation. 1974‐1976 Universidade Católica de Lisboa: assistant (first year) and regent (second year) of Accountancy in the Business Administration course. 1965‐1966 Escola Industrial e Comercial de Leiria: Accounting and Commercial Calculus teacher in the general Commerce course. Owned shares: Does not own Sonae Capital, SGPS, SA’s shares. Positions held: Chairman of the Fiscal Board of OCP Portugal Produtos Farmacêuticos, S.A. Chairman of the Fiscal Board of Sonae Indústria, SGPS, S.A. Chairman of the Board of the Shareholders’ General Meeting of Segafredo Zanetti (Portugal), S.A. March 2011 Statement I hereby declare, as required by law, that by taking office on the Fiscal Board of Sonae Capital, SGPS, SA I do not incur in any of the incompatibilities envisaged in number 1 of Article 414-A of the Company Law, nor am I involved in any circumstance capable of affecting my independence under the terms of number 5 of Article 414 of the Company Law. I will immediately disclose to the Company any event that, in the course of the mandate, generates incompatibilities or loss of independence under the terms of legal requirements. Maia, 21 February 2011 ______________________________________ Manuel Heleno Sismeiro Governing Bodies of Sonae Capital, SGPS, SA – Curriculum Vitae Jorge Manuel Felizes Morgado Jorge Manuel Felizes Morgado Contacts Mobile + 351 917 540 850 Telephone + 351 226 052 761 [email protected] Education Statutory Auditor nr. 775 MBA in Management and Information Systems, Faculdade de Economia e Gestão, Universidade Católica MBA in Finance, IEDE Madrid Graduation in Management, ISEG, Universidade Técnica de Lisboa Professional Activity Since 2004 – Individual Statutory Auditor and Partner of Econotopia – Consultoria e Gestão, S.A. Education Statutory Auditor MBA in Management and Information MBA in Finance Graduation in Management From 1991 to 2004, Partner of Deloitte: Fiscal Board and Statutory Auditor of several companies; Responsible for consulting in the North of Portugal; Responsible for Corporate Finance in Portugal, until 2001; Languages English and French From 1989 to 1991 responsible for the Planning and Control department and Internal Audit of the Coelima Group From 1980 to 1989, Audit Assistant to Audit Manager at Coopers & Lybrand Credentials As an Auditor and Statutory Auditor: Worked in a significant number of Portuguese and international entities (see appendix), among which Sonae Group, Amorim Group (Corticeira Amorim and Inacor), Somelos Group, BPI, Dow Chemical, DeBeers (Angola), Barlows (Angola), Coats & Clark, etc. Currently is a Statutory Auditor at Vadeca Group and Jofabo. As a Consultant: Implementation of management accounting systems and budget control systems. Diagnosis of the strategy and organisational model of companies. Responsible for the development of cost optimisation services. Evaluation of companies and of acquisitions and sales of companies. Responsible for the development of management information systems. Leadership of reorganisation projects and companies recovery. As a consultant, worked for BVLP, Somelos Group, Hedva (Czech Republic), BAI (Angola), Vaz Pinheiro Group, Siemens, Corticeira Amorim, etc. Page 1 of 5 Governing Bodies of Sonae Capital, SGPS, SA – Curriculum Vitae Training and seminars, amongst which: Several seminars about information systems and e-commerce; Several seminars and conferences about Management, Strategy, Marketing and Corporate Finance; Teacher/instructor at: MBA from European University Several seminars about management control and ABC/M. Shares held: Does not hold Sonae Capital, SGPS, SA shares Page 2 of 5 Governing Bodies of Sonae Capital, SGPS, SA – Curriculum Vitae Appendix I Companies in which has worked for 2 or more years System Publishing (Portugal) Ford Lusitana Dun & Bradstreet Johnson & Johnson Epsi (Sines) Vale do Lobo Glaxo Farmacêutica British Leyland Texaco (Angola) Agip (Angola) Delong Hersent (Base do Kwanda) Printer Pillar Alumínios Polimaia Alfa Porto Barros Grupo Taylors Quinta do Noval Wirsbo – Tubos da Suécia Soja de Portugal Jerónimo Martins Leasinvest Poliplastic Felino Banco Éfisa BCI (Angola) Porto Calem Ara Rieker Oliva Page 3 of 5 Governing Bodies of Sonae Capital, SGPS, SA – Curriculum Vitae Appendix II Companies in which presently works as a Statutory Auditor Statutory Auditor of Vadeca Equipamentos, SA Statutory Auditor of GRIN - Gestão de Resíduos Urb. e Ind., SA Statutory Auditor of Vadeca Imobiliária, SA Statutory Auditor of Sucitesa Portugal, SA Statutory Auditor of Vadeca Org. e Gestão, SA Statutory Auditor of Vadeca Serviços - Limpeza Industrial, SA Statutory Auditor of Vadeca Jardins, SA Statutory Auditor of Vadeca Ambiente - Preservação e Controlo, SA Statutory Auditor of Vadeca Quimica - Higiene Profissional, SA Statutory Auditor of Vadeca Manutenção - Serviços Integrados, SA Statutory Auditor of E3C - Comunicação e Eventos, SA Statutory Auditor of Timeloft, SA Statutory Auditor of ValorInveste - Soc. Invest. Imob., SA Statutory Auditor of Jofabo - Construção e Imobiliária, SA Statutory Auditor of Polibrás - Polimentos e Abrasivos, SA Statutory Auditor of Know it - Soluções Formação Tecnologia, SA Statutory Auditor of J. Medeiros, SGPS, SA Statutory Auditor of Hidroeléctrica S. Pedro, SA Statutory Auditor of Hidroeléctrica S. Nicolau, SA Statutory Auditor of JIZ - Arquitectura de Interiores e Pub., SA Statutory Auditor if Cortwoo - Marketing, SA Statutory Auditor of Mindegames-Soc. Comum., Produções Audivisuais Futebol,SA Statutory Auditor of FeedWater - Tubos, SA Statutory Auditor of SkyWorld, SA Statutory Auditor of Blue Share, SA Statutory Auditor of VNG - Gestão, Consultoria e Gestão, SA Statutory Auditor of PM. IQS - Projecto, Gestão e Supervisão, SA Statutory Auditor of Imoguedes - Imobiliária e Engenharia, SA Statutory Auditor of Praianorte - Hotelaria e Turismo, SA Statutory Auditor of Companhia das Pastas - Empreend. e Invest. Hoteleiros,SA Statutory Auditor of PREC - Projectos de Engenharia e Construções, SA Statutory Auditor of AD Venture S.G.P.S., SA Statutory Auditor of Delvepe - Projectos e Construção, S.A. Statutory Auditor of ERPA II - Emp.,Recup., Pat., Arquitet.,SA Statutory Auditor of House Demand, SA Statutory Auditor of IberiaPremium, Oil & Gas, SA Statutory Auditor of Listradema - Gestão de Parques Empresariais Statutory Auditor of Luso-Insular, Projectos e Invest., SA Statutory Auditor of PMVA - Imobiliaria, SA Statutory Auditor of Silvil - Construções Silva Lopes, SA Statutory Auditor of Silvil - SGPS, SA Statutory Auditor of Write UP SA Statutory Auditor of Strong Management, SA Statutory Auditor of Vadeca SGPS SA Statutory Auditor of Fundação Universidade do Porto Page 4 of 5 Governing Bodies of Sonae Capital, SGPS, SA – Curriculum Vitae Appendix III Offices held in other Companies Member of the Fiscal Board of the following companies: - Sonae Indústria, SGPS, SA - Sonae, SGPS, SA - Sonae Sierra, SGPS, SA Page 5 of 5 Statement I hereby declare, as required by law, that by taking office in the Fiscal Board of Sonae Capital, SGPS, SA I do not incur in any of the incompatibilities envisaged in number 1 of Article 414-A of the Company Law, nor am I involved in any circumstance capable of affecting my independence under the terms of number 5 of Article 414 of the Company Law. I will immediately disclose to the Company any event that, in the course of the mandate, generates incompatibilities or loss of independence under the terms of the legal requirements. Maia, 21 February 2011 ______________________________________ Jorge Manuel Felizes Morgado Governing Bodies of Sonae Capital, SGPS, SA – Curriculum Vitae ACADEMIC AND PROFESSIONAL CURRICULUM of ARMANDO LUÍS VIEIRA DE MAGALHÃES 1. Education - Bachelor degree in Accounting (ex-ICP and currently ISCAP), concluded in 1972. - Graduation in Economics (FEP), concluded in 1978. - Executive MBA - European Management (IESF/IFG), concluded in 1996. 2. Professional Curriculum - Worked in a Portuguese financial institution from 1964 to 1989, as . Analyst of companies; . Head of the Planning and Control Department for the Northern Region; . Head of Accounting Services; . Submanager; . Assistant manager, responsible for the Executive Operations department in the Northern Region. - Statutory Auditor since 1972. - Individual Statutory Auditor since 1989. - Statutory Auditor in Santos Carvalho & Associados, SROC, S.A., from 1989 to 2010. - Since 31 May 2010, Statutory Auditor in Armando Magalhães, Carlos Silva & Associados, SROC, Lda. - Member of the Fiscal Board of the following companies: - Sonae Indústria, SGPS, SA; - Sonae Capital, SGPS, SA; - Sonaecom, SGPS, SA; - Fundação Eça de Queiroz; - Futebol Clube do Porto – Futebol S.A.D; -Porto Comercial – Sociedade de Comercialização, Licenciamento e Sponsorização, S.A.; - Porto Estádio – Gestão e Exploração de Equipamentos Desportivos, S.A.. Vila Nova de Gaia, 2 September 2010 Armando Luís Vieira de Magalhães Page 1 of 1 Statement I hereby declare, as required by law, that by taking office on the Fiscal Board of Sonae Capital, SGPS, SA I do not incur in any of the incompatibilities envisaged in number 1 of Article 414-A of the Company Law, nor am I involved in any circumstance capable of affecting my independence under the terms of number 5 of Article 414 of the Company Law. I will immediately disclose to the Company any event that, in the course of the mandate, generates incompatibilities or loss of independence under the terms of the legal requirements. Maia, 21 February 2011 ______________________________________ Armando Luís Vieira de Magalhães ACADEMIC AND PROFESSIONAL CURRICULUM of CARLOS MANUEL PEREIRA DA SILVA 1. Education - Graduation in Economics (FEP), concluded in January 1978. 2. Professional curriculum - Worked in the international auditing company PRICE WATERHOUSE, from 1980 to 1985, assuming different tasks increasingly demanding. - Administrative and financial managing director in an international company. - Began to work as a statutory auditor since 1992, first individually and, from June onwards in the firm SANTOS CARVALHO & ASSOCIADOS, SROC, S.A. - Since 31 May 2010 continued to work as a statutory auditor in the firm ARMANDO MAGALHÃES, CARLOS SILVA & ASSOCIADOS, SROC, Lda. - Does not hold any shares of SONAE CAPITAL, SGPS, S.A. Vila Nova Gaia, 21 February 2011 Carlos Manuel Pereira da Silva COMPANIES IN WHICH CARLOS MANUEL PEREIRA DA SILVA PRESENTLY WORKS AS A STATUTORY AUDITOR - ARQUIPORTAL , S.A. AVEVO - Sociedade Imobiliária, S.A. AZEVEDOS INDÚSTRIA - Máquinas e Equipamentos Industriais, S.A. BERNARDINO & FERREIRA, S.A. BIGPORTAL - Gestão de Imóveis, S.A. CAMARC - Carpintaria e Marcenaria de Arouca, Lda. CENTRALGEST, SA CENTRAL LOBÃO - Ferramentas Eléctricas, S.A. CEVAQOE - Investimentos, SGPS, S.A. CILAN - Centro de Formação Profissional para a Indústria de Lanifícios CLIMAFEIRA - Climatização, Ar Condicionado e Electricidade da Feira, S.A. COLORCAIMA - Materiais de Construção, S.A. COMPRA E VENDA DE IMÓVEIS NALJOMAR, S.A. CONSTRUÇÕES FERNANDO SOARES FERREIRA, S.A. CONSTRUÇÕES NORDESFEIRA, S.A. CORGAGEST - Gestão e Administração de Patrimónios, S.A. CORTIÇA BENÍCIA, S.A. ELECTROSANJO - Iluminação e Material Eléctrico, Lda. ESMOGEST - Sociedade Imobiliária e Gestão Património, S.A. FIAVERDE - Combustíveis e Estação de Serviço, S.A. FIAVERDE - Gestão Imobiliária, S.A. FILIPE OLIVEIRA, LDA. FIRST IMO - Desenvolvimento Imobiliário, S.A. FOSFOREIRA PORTUGUESA, S.A. GESPATRIMÓNIO, S.A. GESTPATRÍCIOS - Gestão e Compra e Venda de Imóveis, S.A. GOMES & MENDES, LDA. HABIFEIRA - Investimentos Imobiliários da Feira, S.A. I.R.G. - Inspecções Técnicas, S.A. IMAP - Indústria de Madeiras Patrícios, S.A. IMOAVINHÓ - Promoção Imobiliária, S.A. IMOPREDI - Sociedade Imobiliária, S.A. LAFITTE CORK PORTUGAL, LDA. MANUEL DE OLIVEIRA LEITE, LDA. NORINTER - Construtora de Auto-Estradas, ACE OPERANDI - Sociedade de Prestação de Serviços Administrativos a Empresas, S.A. PATRICIMÓVEIS - Sociedade Imobiliária, S.A. PATRÍCIOS, S.A. PATRÍCIOS - S.G.P.S., S.A. PLANO MARAVILHA, S.A. POLICLÍNICA SÃO TIAGO DE LOBÃO, S.A. PRISMA - Combustíveis e Lubrificantes, S.A. SILF - Sociedade Imobiliária Luso-Francesa, S.A. - SOLUCINOX - Construção e Representação de Máquinas Industriais e Sistemas em Inox, S.A. - SOVE - Sociedade de Vedantes e Máquinas, S.A. - STELICORTE - Comércio de Ferramentas e Madeiras, S.A. - TECNÁREA - Indústria e Decoração, S.A. - TOURIGAIMO- Imobiliária, S.A. - TRANSCINCO - Trânsitos e Serviços, Lda. - TRANSPORTES ESTRELA DE MONTEMOR-O-VELHO, LDA. - VIEIRA ARAÚJO, S.A. - WS, S.A. Statement I hereby declare, as required by law, that by taking office in the Fiscal Board of Sonae Capital, SGPS, SA I do not incur in any of the incompatibilities envisaged in number 1 of Article 414-A of the Company Law, nor am I involved in any circumstance capable of affecting my independence under the terms of number 5 of Article 414 of the Company Law. I will immediately disclose to the Company any event that, in the course of the mandate, generates incompatibilities or loss of independence under the terms of the legal requirements. Vila Nova de Gaia, 21 February 2011 ______________________________________ Carlos Manuel Pereira da Silva REMUNERATION COMMITTEE Belmiro Mendes de Azevedo Age: 73 Nationality: Portuguese Education: Graduation in Chemical Engineering ‐ Porto University (1963) PMD (Programme for Management Development) ‐ Harvard Business School (1973) Financial Management Programme ‐ Stanford University (1985) Strategic Management ‐ Wharton University (1987) Position held in Sonae Capital, SGPS, SA: Positions held in Group Companies: Positions held in Other Companies: Main Professional activities in the last five years: Chairman of the Board of Directors and Chief Executive Officer Chairman of the Board of Directors of the following companies: SC, SGPS, SA Sonae Turismo, SGPS, SA Spred, SGPS, SA Selfrio, SGPS, SA Member of the EGP‐UPBS (University of Porto Business School) General Board Founding Member of Manufuture Portugal Forum Member of the European Advisory Board of Harvard Business School Member of WBCSD ‐ Order of Outstanding Contributors to Sustainable Development Member of the International Advisory Board of Allianz AG Member of the European Union Hong‐Kong Business Cooperation Committee 1999‐2007 ‐ Chairman and CEO of Sonae, SGPS, SA Since 2003 ‐ Chairman of the Board of Directors of Sonae Indústria, SGPS, SA Since 2007 ‐ Chairman of the Board of Directors of Sonae, SGPS, SA Chairman and CEO of Sonae Capital, SGPS, SA Shares held in Sonae Capital, SGPS, SA 838,862 shares1 49,999,997 shares held through Efanor Investimentos, SGPS, SA 1 Shares held directly or by family members CURRICULUM VITAE Personal Information Name Address Telephone Telephone ‐ Work Birthday Born JOSÉ FERNANDO OLIVEIRA DE ALMEIDA CÔRTE‐REAL Rua Afonso Baldaia, 368 – 1º Dto. 4150‐016 Porto 226101788 222454024 16 May 1954 Massarelos, Porto Academic Degrees Graduation in Psychology and Education Sciences – Faculdade de Psicologia e Ciências da Educação, Universidade do Porto Professional Activity 1983/1986 1986/1988 1988/1990 1990/1993 1993/2007 Since 2007 Human Resources Manager at Ed. Ferreirinha, Motores e Máquinas EFI, SARL Human Resources Manager at Feruni, Sociedade de Fundição, SARL Human Resources Director at Modis, Distribuição Centralizada, SA Human Resources Director at Modelo Continente Hipermercados, SA Human Resources Director at Sonae Distribuição Human Resources Director at Sonae Chairman of the Human Resources Consulting Council from the Sonae Group Other positions held Member of the Board of Directors/Management Board at: BB Food Service, SA Best Offer – Prestação de Informações pela Internet, S.A. Bikini – Portal de Mulheres, S.A. Bom Momento – Comércio Retalhista, S.A. Carnes do Continente – Indústria e Distribuição de Carnes, S.A. Conticomba – Comércio e Distribuição da Combustíveis, S.A. Continente Hipermercados, S.A. Edições Book.it ‐ S.A. Efanor – Design e Serviços, S.A. Estevão Neves ‐ Hippermercados da Madeira, S.A. Farmácia Selecção, S.A. Fashion Division, S.A. Global S – Hipermercado, Lda. Good and Cheap – Comércio Retalhista, S.A. Hipotética – Comércio Retalhista, S.A. Infofield – Informática, S.A. Just Sport – Comércio de Artigos de Desporto, S.A. Marcas MC Services private Company Limited by Shares Modalfa – Comércio e Serviços, S.A. Modalloop – Vestuário e Calçado, S.A. Modelo Continente Hipermercados, S.A. Modelo Continente International Trade, S.A. Modelo.Com – Vendas Por Correspondência, S.A. NA – Comércio de Artigos de Desporto, S.A. NA – Equipamentos Para o Lar, S.A. Peixes do Continente – Indústria e Distribuição de Peixes, S.A. Pharmaconcept – Actividades em Saúde, S.A. Pharmacontinente – Saúde e Higiene, S.A. Solaris – Supermercados, S.A. Sonae Center Serviços II, S.A. Sport Zone – Comércio de Artigos de Desporto, S.A. Sport Zone España – Comércio de Articulos de Deporte, S.A. Têxtil do Marco, S.A. Todos os Dias – Comércio Retalhista e Exploração de Centros Comerciais, S.A. Well W – Electrodomésticos e Equipamentos, S.A. Worten – Equipamentos Para o Lar, S.A. Worten España Distribución, S.L. Zippy – Comércio e Distribuição, S.A. Zippy – Comercio y Distribución, S.A. Does not hold any shares representative of the share capital of Sonae Capital, SGPS, SA To the Chairman of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA Lugar do Espido Via Norte 4471-907 Maia (Translation from the Portuguese Original) Item number 6 PROPOSAL Considering that: Under the terms of paragraph b) number 2 of article 420 of Portuguese Company Law, the Fiscal Board proposes to the Shareholders’ General Meeting the appointment of the Statutory Auditor of the company. In order to prepare this proposal, the Fiscal Board supervised, during 2010, an extensive selection process, in which several audit companies of renowned national and international reputation were invited to participate. With that purpose eligibility conditions were pre-determined, including the number of years of experience and competence of candidates, the sufficiency and availability of the proposed work team, as well as the price for the service. After weighting all criteria, the Fiscal Board decided to propose to the Shareholders’ General Meeting the election of Pricewaterhousecoopers & Associados, SROC, represented by Hermínio António Paulos Afonso or by António Joaquim Brochado Correia, as Statutory Auditor for the new mandate. Attached to this proposal is the information required by paragraph d) of number 1 of article 289 of the Portuguese Company Law. Maia, 2 March 2011 On behalf of the Fiscal Board, Herminio António Paulos Afonso Rua António Bessa Leite, 1516 B, $º Esq. 4150-074 PORTO Herminio António Paulos Afonso, married, born on 15 August 1961 in Bragança. Bachelor degree in Accounting and graduation in Financial Management by Instituto Superior de Contabilidade e Administração do Porto. Partner of PricewaterhouseCoopers since 1996 and Statutory Auditor since 1990, being responsible for the coordination of several Audit and Statutory Audit clients, at Group level, namely Martifer, Robert Bosch Portugal, Cires, Douro Azul, Gamobar, Aveleda, Chamartin, S. Gobain Portugal, Indáqua and Soja. Works as Statutory Auditor exclusively in PricewaterhouseCoopers & Associados, S.R.O.C., Lda., for more than five years, and is registered with number 712. Partner responsible for PwC office in Cape Verde, member of the Technical Committee of PwC Portugal and responsible for matters regarding IAS/IFRS in the Porto office, with past experience as instructor in several seminars on theme and in projects involving the conversion from POC (Old Portuguese GAAP) to IAS/IFRS (International GAAP) and SNC (New Portuguese GAAP). Participant and instructor in several audit courses included in the internal training programmes of PricewaterhouseCoopers. Does not hold any Sonae Capital shares. António Joaquim Brochado Correia Rua Arq. Cassiano Barbosa, 569 C2 2º Dto. Trás 4100-009 Porto António Joaquim Brochado Correia, married, born on 26 June 1969 in Cinfães. Graduation in Business Administration by Universidade Católica Portuguesa (1988-1993). Partner of PricewaterhouseCoopers since 2003 and Statutory Auditor since 1999, being responsible for the coordination of several Audit and Statutory Audit clients, at Group level, namely Sonae Industria, Efacec, TMG, Unicer and Amorim. Works as Statutory Auditor exclusively in PricewaterhouseCoopers & Associados, S.R.O.C., Lda., for more than five years, and is registered with number 1076. Responsible for Audit and Consulting areas of the firm in Portugal, with expertise in Corporate Governance, Organisation and Sustainability. University teacher in related matters. Does not hold any Sonae Capital shares. EFANOR INVESTIMENTOS,SGPS,SA To the Chairman of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA Lugar do Espido, Via Norte Apartado 3053 4471-907 Maia (Translation from the Portuguese Original) PROPOSAL We hereby propose that the remuneration policy of the members of the Remuneration Committee for the new mandate, consists of a fixed annual amount of 1,000.00 euro paid to its members that are not members of any statutory body of the proponent or of companies in which it has controlling interests, directly or indirectly, in which case they are not entitled to any remuneration. Porto, 28 February 2011 On behalf of the Board of Directors, SEDE: AVENIDA DA BOAVISTA 1277/81 – 4º • 4100-13 PORTO • PORTUGAL TEL. +351.22.6077740 • FAX: +351.22.6077750 CAPITAL SOCIAL 250.000.000 € MATRICULADA NA CRC DO PORTO COM O Nº ÚNICO DE MATRÍCULA E PESSOA COLECTIVA 502 778 466 To the Chairman of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA Lugar do Espido Via Norte 4471-907 Maia (Translation from the Portuguese Original) Item number 8 PROPOSAL The Remunerations Committee proposes to the Shareholders’ General Meeting the approval, under the terms and for the purpose of number 1 of Article 2 of Law 28/2009 of 19 June, of the remuneration and compensation policy for statutory governing bodies and to key management staff (“dirigentes”), as follows: 1. Principles of the Remuneration and Compensation Policy of Statutory Governing Bodies The remuneration and compensation policy regarding statutory governing bodies and key management staff (“dirigentes”) follows guidelines from the European Commission, Portuguese law and recommendations from the Portuguese Securities Exchange Commission, based on the understanding that initiative, effort and commitment are essential foundations for delivering good performance, and that the latter should be aligned with the medium and long term objectives of the company, ensuring its sustainability. In determining the compensation plan, market benchmarks from several market studies available in Portugal and remaining European markets, as well as information from listed companies of similar size, are taken as comparables when setting remuneration. Compensation packages for executive directors are defined using market research for top executives (Portugal and Europe), aiming at a market positioning of median pay for fixed remuneration and the third quartile for total pay, on a comparable basis. Fixed and variable remuneration of statutory governing bodies are decided by the Remunerations Committee, in close contact with the Board Nomination and Remunerations Committee. The Remuneration Policy of the company maintains the principle of non attribution of remuneration or compensation to directors, or members of other statutory governing bodies, in case of termination of the mandate, either at the end of the mandate period or, by any reason, before the end of the mandate period, always in compliance with legal requirements on this matter. The Remuneration and Compensation policy does not include any benefit system, namely pension plans, involving members of the statutory governing bodies, fiscal bodies and remaining key management staff (“dirigentes”). To ensure effectiveness and transparency of the objectives of the Remuneration and Compensation Policy, executive directors: - have not signed contracts with the company or third parties aimed at mitigating the risk inherent to changes in the remuneration that was set by the company; - have not sold, in 2010, year of the term of their mandate, shares of the company that were attributed as variable remuneration. 2. According to the principles defined, remuneration and compensation of members of the statutory governing bodies follows these guidelines: Executive Directors Remuneration and compensation policy for Executive Directors (ED) may include (i) a fixed remuneration, including a Base Salary, established on an annual basis (paid in 14 months) and an annual responsibility allowance (ii) a Short Term Variable Bonus, paid in the first quarter of the following year to which it relates, and (iii) a Medium Term Variable Bonus, determined in April of the following year to which it relates, as deferred remuneration under the terms of the Medium Term Incentives Plan, which will be payable on the third anniversary of the granting date. (i) Individual compensation packages are defined according to the responsibility level of each ED and will be reviewed annually. Each ED may be attributed a job grade, internally known as functional group. These job grades are structured according to an international job grading model of corporate functions with the objective of facilitating market comparisons and internal equality. (ii) The Short Term Variable Bonus aims at rewarding the achievement of predefined objectives, based on key performance indicators of business activity (Business KPIs) and on personal key performance indicators (Personal KPIs). The bonus target to be attributed will be based on a percentage of the fixed component of the compensation package, which may vary between 33% and 75%, according to the functional group of the ED. Business KPIs, with a significant part of economic and financial indicators, account for 70% of the annual performance bonus and are made up of objective indicators. The remaining 30% result from personal KPIs, based on subjective indicators. Amounts paid are the outcome of actual performance (business results/personal contribution) and may vary between 0% and 148% of the target bonus. (iii) The Medium Term Bonus aims at strengthening the ED loyalty, aligning his/her interests with those of shareholders and at enhancing the impact of his/her performance in the overall performance of the Company. The amounts of the Medium Term Bonus are defined annually and for ED correspond to 100% of the short term variable bonus. The amount in euro is divided by the minimum of the following: closing share price of the first day of trading after the General Meeting of Shareholders or the average closing share price of the thirty-day period of trading prior to the General Meeting of Shareholders, to determine the number of shares to be granted. The amount converted in shares will be adjusted for any changes occurred in equity or dividends (Total Shareholder’s Return) for a deferred period of 3 years. On the vesting date, shares are delivered at nil cost. The Company has the choice to settle in cash instead of shares. The regulation regarding the plan of attribution of shares is enclosed in Appendix I. Non Executive Directors The remuneration of Non Executive Directors (NED) is determined according to market data and based on the following principles: (1) payment of a fixed remuneration, dependent on the presence at the Board of Directors and Board Nomination and Remunerations Committee and Board Audit and Finance Committee meetings; (2) payment of an annual responsibility allowance. There is no payment of a variable remuneration of any kind. Fiscal Board Remuneration of members of the Fiscal Board of the company is made up solely of a fixed amount in accordance with fees for similar services and market practices. There is no payment of a variable remuneration of any kind. This remuneration includes an annual responsibility allowance. Statutory External Auditor The Statutory External Auditor of the company is remunerated in accordance with fees for similar services and market practices, by proposal of the Fiscal Board and the Board Audit and Finance Committee. Board of the Shareholders’ General Meeting Remuneration of the members of the Board of the General Shareholders’ Meeting is made up of a fixed amount, based on the Company situation and market practices. Key Management Staff (“Dirigentes”) In accordance with number 3 Article 248-B of the Portuguese Securities Markets Code, managers with regular access to relevant information and that take part in the strategy and decision making process are considered “Dirigentes” (Key Management Staff). The Remunerations Committee proposes that the remuneration policy of Key Management Staff is similar to the remuneration of other Senior Staff with similar job and responsibility levels without any additional benefits when compared to conditions for the same functional group. 3. Compliance with Recommendation II.1.5.2 of the Portuguese Securities Market Commission (CMVM) According to the requirements of this Recommendation we hereby declare: (i) that entities considered as benchmark for the definition of remuneration are those referred above in item number 1; (ii) that no payments were made regarding dismissal or termination of functions of directors. Maia, 2 March 2011 The Remunerations Committee, Belmiro Mendes de Azevedo Bruno Walter Lehman . ATTRIBUTION PLAN OF SONAE SHARES (Medium term variable bonus – MTVB) Characteristics and Regulation 1. Characteristics of MTVB MTVB is one of the components of Sonae Capital’s Remuneration and Compensation Policy. This component is distinct from others due to its restrictive and volunteer nature, with attribution conditional to the eligibility rules described in this document. MTVB allows participants to share with shareholders value created, through their direct intervention in strategy definition and business management, based on the result of the annual performance evaluation. 2. Scope of MTVB MTVB aims to align executive directors’ interests with the objectives of the organisation, strengthening their commitment and the perception of the importance of their performance to Sonae Capital’s success, reflected in the market capitalisation of the share. The amount of MTVB attributable to each member corresponds to the total medium term bonus attributed to executive directors under the terms of the Remuneration and Compensation Policy approved by the Shareholders’ General Meeting. 3. Elegibility Executive directors are eligible for the attribution of Sonae Capital’s MTVB. According to the remuneration policy, the Board of Directors may also extend the MTVB to staff members. MTVB corresponds to 50% of total remuneration set as objective. 4. Duration of MTVB MTVB is set on an annual basis, for a period of three years. From the beginning of the third consecutive plan, in each moment, three plans with a three year duration will coexist. 5. MTVB reference amount The MTVB amount in euro is valued at the date of attribution using prices which represent the price of the share, considering the lower of the following: closing share price of the first day of trading after the General Meeting of Shareholders or the average closing share price of the thirty-day period of trading prior to the General Meeting of Shareholders. Members entitled to MTVB have the right to acquire a number of shares corresponding to the division between the amount of MTVB granted and the price of the share at the date of attribution calculated under the terms of the previous paragraph. Such right can be exercised three years after attribution. Executive directors eligible for MTVB, acquire shares without paying any cash consideration. Other staff entitled to that right, acquire shares in the conditions established by the Board of Directors. . If dividends are distributed, changes in the nominal value of shares or in the share capital of the company occur or any other change in equity with impact in the economic value of attributed rights, after the granting date and before its exercise, the amount converted in shares will be adjusted to an equivalent figure considering the effect of the mentioned changes. 6. Delivery by the Company On the vesting date of the MTVB plan, the company reserves the right to settle in cash, equivalent to the market value as at the date of the respective delivery, instead of shares. 7. Due date of MTVB The right to acquire shares granted via MTVB expires three years after its attribution . 8. Conditions to exercise acquisition rights The right to exercise acquisition rights of shares granted under MTVB plans expires if the contractual link between the member and the company ceases before the three year period subsequent to its attribution, not withstanding situations included in the following paragraphs. The right will remain valid in case of permanent incapacity or death of the member, in which case payment is made to the member himself or to his/her heirs on the vesting date. In case of retirement of the member, the attributed right can be exercised in the respective vesting date. To the Chairman of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA Lugar do Espido Apartado 3053 4471-907 Maia (Translation from the Portuguese Original) Item number 9 PROPOSAL We propose that approval be granted to the Board of Directors to: a) purchase, on the stock exchange and/or through over the counter transactions in case the seller is a company directly or indirectly controlled by this company, over the next 18 months and up to the limit permitted under the terms of number 2 of Article 317 of the Company Law, own shares, for a price per share not lower than the average share price in the ten-day period prior to the date of purchase, less 50%, and not higher than the average share price in the ten-day period prior to the date of purchase, plus 10%; b) sell, on the stock exchange and/or through over the counter transactions in case the buyer is a company directly or indirectly controlled by this company, over the next 18 months and up to the limit permitted by law, a minimum of one hundred own shares, for a price per share not lower than the average share price in the ten-day period prior to the date of sale, less 10%. In addition it is proposed that the Board of Directors be authorized to decide on the timeliness of operations – which may translate into sale or attribution of shares to members of statutory bodies and staff members of the company, according to the terms of the remuneration policy of the company – always, taking into consideration market conditions, the interests of the Company and of its shareholders. Maia, 2 March 2011 On behalf of the Board of Directors, To the Chairman of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA Lugar do Espido Apartado 3053 4471-907 Maia (Translation from the Portuguese Original) Item number 10 We propose that approval be granted to the Board of Directors to: a) purchase, on the stock exchange and/or through over the counter transactions in case the seller is a company directly or indirectly controlled by this company, over the next 18 months and up to the limit permitted by law, bonds issued by the company, for an unit price not lower than the average of the last 10 bond prices prior to the date of purchase, less 50%, and not higher than the average of the last 10 bond prices prior to the date of purchase, plus 10%; b) sell, on the stock exchange and/or through over the counter transactions in case the buyer is a company directly or indirectly controlled by this company, over the next 18 months and up to the limit permitted by law, a minimum of one hundred bonds issued by the company, for an unit price not lower than the average of the last 10 bond prices prior to the date of sale, less 10%. The Board of Directors should decide if and when transactions referred to in a) and b) should be made, taking into consideration market conditions, the interests of the Company and of its shareholders. Maia, 2 March 2011 On behalf of the Board of Directors, To the Chairman of the Shareholders’ General Meeting of Sonae Capital, SGPS, SA Lugar do Espido Via Norte 4471-907 Maia (Translation from the Portuguese Original) Item number 11 PROPOSAL We propose that companies controlled, directly or indirectly, by this Company on the date of acquisition, as defined in Article 486 of the Company Law, are authorized to acquire and hold shares issued by the Company under the terms of number 2 of Article 325-B of the Company Law. Such shares may be acquired, on the stock exchange, and/or over the counter in case of the seller is this company or other company directly or indirectly controlled by this company, over the next 18 months and up to the limit of 10% as consolidated in the mother company, for a price per share not lower than the average share price of the tenday period prior to the date of acquisition, less 50%, and not higher than the average share price in the tenday period prior to the date of purchase, plus 10%. The resolution should be implemented by the Board of Directors of those companies, taking into consideration companies needs - namely the sale of shares to Directors and key staff according to the respective policy -, as well as market conditions and the interests of the Company and of its shareholders. Maia, 2 March 2011 On behalf of the Board of Directors,

Baixar