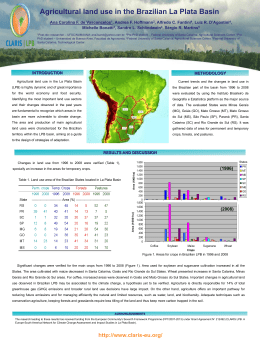

A Look on the Productive Reality Apple Brazilian Scenario Pierre Nicolas Pérès Associação Brasileira de Produtores de Maçã ABPM Madrid 21st. October 2011 About ABPM ABPM – Associação Brasileira de Produtores de Maçã •Non-profit association with a permanent secretariat based in Fraiburgo •Created in 1978 to set up a national forum of discussion for issues affecting apple production, regulation, research and trade •Incorporate the 3 states Association, Cooperatives and apple Producers, representing 90% of the volume produced . •President elected ABPM’s objective • Mission – Facilitate to the associate access to private and publics means financial and scientific for production of high quality fruits, using technology respecting the environment and consumer health. • Vision – To be the reference in the brazilian fruit sector, contribute to the economy of the apple regions, looking for the engagement of federal, state and municipal authorities • Principles • Principles – Ethic and integration of the producers, social responsibility, respect of environment, respect of individual value, equilibrium between the fruit growing segments and client’s satisfaction. BRAZILIAN DATA PRODUCTION SURFACE AND VARIETIES PRODUCTION (t) Source: IBGE, ABPM, AGAPOMI, EPAGRI, DEROL APPLE PRODUCTION PER STATE 2010-11 (VOLUME – T) STATE Santa Catarina R. Grande do Sul Paraná Others (BA, MG,SP) Total Production (t) 689.876 605.177 56.000 1.851 1.355.904 Source: IBGE/ABPM/AGAPOMI/FRUTIPAR (%) 51% 45% 4% 0% 100% APPLE SURFACE (ha) Source: ABPM, AGAPOMI, EPAGRI, DEROL, IBGE APPLES VARIETIES ( %) Others 5% Fuji's 35% Gala's 60% Source: ABPM, AGAPOMI Cold Capacity (T) and Packings State AC AN 90 242.726 136.152 378.878 110 207.880 107.670 315.550 PARANA 19 - 11.172 11.172 BRASIL 220 450.606 254.994 705.600 SANTA CATARINA RIO GRANDE DO SUL PH Source: ABPM TOTAL EXPORT and IMPORT APPLE EXPORT (T) Fonte: ABPM, SECEX EXPORT PRICE FOB ($/kg) Source: SECEX EXPORT PRICE FOB (R$/kg) DESTINATION (2008 in %) Other 19% Holland 32% Finland 4% Bangladesh 4% Germany 5% Spain 5% Sweeden 5% Portugal 5% UK 16% France 6% Fonte: ABPM, SECEX DESTINATION (2011 in %) Other 11% Denmark 3% Finland 4% Holland 31% UK 5% Germany 6% Ireland 8% Bangladesh 13% Spain 9% Portugal 9% Fonte: ABPM, SECEX IMPORTAÇÃO DE MAÇÃS 2010 (T) 120.000 100.000 80.000 60.000 40.000 20.000 2007 2008 2009 Source: ABPM, SECEX 2010 2011 f ORIGIN 2010 (%) France 4% Spain 1% Italy 2% Others 1% Chile 30% Argentina 63% Source: ABPM, SECEX TRADE POSITIVES ASPECTS • • • • • According to the POF-IBGE, brazilian apple was the 4th. fruit most consume in 2008. In 2011, CNA realize a study regarding fruit consumption, apple became the 2nd. fruit most remembered by the public. In the same CNA’s study apple became the 2nd. Fruit most consumed and the brazilian’s preferred fruit. Apples do have an appeal for health and good taste. Wholesalers and retailers do recognize the importance to have apples in their mix and in the shelves. Actual situation Apples is the second fruit most consumed in important cities like São Paulo and Belo Horizonte: 46 Banana 24 Maçã Banana 48 Maçã 31 13 Laranja Mamão Abacaxi 2 Pera 3 Mexirica 3 Outras 3 14 Laranja 6 Mamão São Paulo 4 Abacaxi 2 Outras 1 Belo Horizonte Source: Connection Pesquisa e Análise de Mercado, 2004 25 Wealth Distribution Source: Centro de Polliticas Sociais FGV Demography Source: Mundo Corporativo n. 28 - Deloitte Source: Mundo Corporativo n. 28 - Deloitte DEMOGRAPY BONUS • Unique moment in the brazilian history and will not repeat. • During the next 3 decades the economically active population (PEA) will be more important than the other kinds, non working, kids and elderly. • => More saving • => More Job • => More investment and consumption • More GROWTH Brazilian Apple Market 2007 2008 2009 2010 2011 * Production 993.227 983.240 1.052.514 1.226.338 1.200.000 Domestic offer in Natura 632.728 731.032 765.825 906.536 966.378 Export 112.073 112.250 98.203 90.839 48.622 Domestic Production in Natura 564.154 675.990 704.482 829.657 851.378 68.574 55.042 61.343 76.879 115.000 Industry 317.000 195.000 249.829 305.842 300.000 Brazilian Population – IBGE in (000) 187.796 189.736 191.592 193.224 194.933 3,37 3,85 4.00 4.69 4.96 Import Consumption in natura kg/hab Fonte: ABPM, SECEX Sales Prices nominal 18 kg boxes 75.00 67.79 64.32 65.00 63.78 64.92 60.52 56.67 52.47 55.00 49.14 51.20 49.42 47.04 44.99 45.86 43.40 45.00 36.70 48.95 45.35 42.76 38.19 37.85 35.18 32.08 35.00 28.10 24.27 25.00 22.14 21.42 16.30 22.32 25.92 23.40 15.45 15.00 21.78 18.90 14.04 25.92 23.70 18.18 16.74 10.98 5.00 1999 2000 2001 2002 2003 2004 Beneficiador 2005 2006 CEAGESP 2007 2008 2009 2010 2011 Varejo Source: ABPM; CEAGESP; IEA – Instituto de Economia Agrícola - 2011: up to May YEARLY AVERAGE SALES OF PACKED APPLES Cat 1, 2 e 3 Gala R$/kg Fuji R$/kg 2003 1,127 1,292 10,38% 8,69% 2004 0,874 1,195 6,13% 12,42% 2005 1,196 1,477 5,05% 1,20% 2006 1,428 1,579 2,81% 3,84% 2007 1.105 1,490 5,16% 7,74% 2008 1,338 1,615 6,48% 9,81% 2009 1,184 1,343 4,114% -1,712% 5,058% 3,947% 47,50% 49,31% Variation 2003/2009 INPC Supermarkets: 2003 a 2009 +45% Source: ABPM IGPM SUPERMARKETS STRUCTURE 2009 (R$177bi, +11,7%) 3 Maiores Supermercados 40,44% 77,811 Outros Supermercados 32% 480 Seguintes 14,39% Source: NIELSEN 2009 17 Seguintes 14,08% Increased role of exchange rate on trade OUTLOOK 2012 2012 CROP • • • • • • Very good winter Climate condition during blooming good No frost No hail so far Thinning under way May be a bumper crop FINAL COMMENTS Review of concerns Sustainability • Increased costs for supply ( food safety, logistics, packaging, actives substances, labor, ...) • Return often below cost of production for many growers • Supply fragmentation v. retail concentration • Emergence of discounter and impact for suppliers • Multiplication /proliferation of requirements • Consequences on demand of changing consumer behavior • Improved postharvest techniques making a flat price along the year Review of concerns Consumption • Stagnating consumption and increased competition from other products • Limited initiatives on promotion, need to enhance marketing campaign, how? Financing of marketing - growers, state, both? • Role of innovation and varietal or club development • How to benefit from healthy assets of apples, • consumer purchasing patterns and dietary behaviors will influence demand for apples? • Quality, how to cope with fruits under standard – Rito Sumario Review of concerns Market • Concentration of buyers versus pulverization of growers/packers – Consortium – Growers Concentration • Promoting Consumption – – – – Government? Fruits in the school Army Global marketing project Review of concerns Emerging issues • Role of unexpected climatic conditions on production and trade ( snow, frost, drought, flood,..) and also on consumption • Role of currency fluctuation ( € ; £, $, zl, Ruble, SH currencies, …) • Future impact of the climate change debate ( environment, water, waste, packaging , logistics,..) • Coping with NGO negative campaign in Europe affecting image of produce and consumer confidence Review of concerns CLIMATE • Mainly Hail – Insurance – Netting • Lower taxes on investment against hail • Subsidy of interest rates • Long term loan MECANIZATION • Orchard and Packing FINANCIAL DEBTS • Retruscturation CONCLUSION • Brazilian Government through law n. 4504 – 30/11/64, is encouraging the producers to create a consortium to get back power of negotiation to the growers, allowing to form one legal entity for sales and for buying. • Boost Internal market – Project: More fruits at school – Project: Healthy Tourism – Project: Bella • • • • • • Fruits presentation in supermarket Degustation Communication Merchandising Reinforcement Action in the press Web Marketing • To increase consumption we must offer improved quality, have a better divulgation throughout the media, • we do have an asset, our apple is recognized for its flavor that is nationally recognized. • Apple cannot missed at home and in the supermarket, according to consumer • It is an item of the shopping list Consumers want to buy good quality apples. • Strengthening Farmers organization – Association – Cooperative – Consortium • Qualify the offer • Marketing, communication, promotional events, listening to the consumer’s wishes • Give value to our products • Invest in fundamental research, biotechnology • Better clones, productivity, mechanization, orchard conduction GRACIAS WWW.ABPM.ORG.BR

Baixar