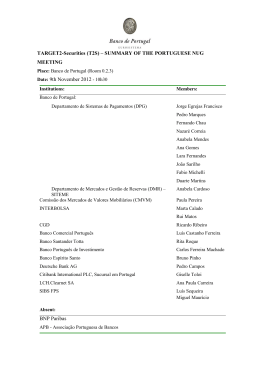

TARGET2-Securities (T2S) - Summary of the Portuguese NUG meeting Place: Banco de Portugal (Room 0.2.3) Date: 27th September 2010 – 10:00 am Institution: Participants: Banco de Portugal: Departamento de Sistemas de Pagamentos (DPG) António Garcia Departamento de Sistemas de Pagamentos (DPG) Egrejas Francisco Departamento de Sistemas de Pagamentos (DPG) Nazaré Correia Departamento de Sistemas de Pagamentos (DPG) Fernando Chau Departamento de Sistemas de Pagamentos (DPG) Anabela Mendes Departamento de Sistemas de Pagamentos (DPG) Inês Lopes Departamento de Mercados e Gestão de Reservas (DMR) – SITEME Jorge Mourato Comissão dos Mercados de Valores Mobiliários (CMVM) Manuel Ribeiro da Costa INTERBOLSA Abel Sequeira Ferreira Rui de Matos Caixa Geral de Depósitos Ricardo Ribeiro Joana Filipa Marcos Banco Comercial Português Luís Ferreira Citibank International PLC, Sucursal em Portugal Giselle Toloi Deutsche Bank AG LCH.Clearnet SA Pedro Campos Ana Paula Carreira Absent: Banco Santander Totta/Santander Negócios Banco Espírito Santo Banco Português de Investimento BNP Paribas APB - Associação Portuguesa de Bancos 1. Overview of T2S project development: presentation by Banco de Portugal - Project Plan; - Recent Developments; - Major issues. The T2S chronogram has milestones and a set of activities to be developed by 4CB, Eurosystem and CSDs. Concluding the Framework Agreement (FA) is the most important task in the short run. A provisional version of the FA was sent by the Governing Council (GC) to the Regulators (CESR) for evaluation; it is expected that, in February 2011, GC would send a final version of the FA to CSDs for consideration and signing (July or September 2011). In the last AG meeting, on the 7 and 8 September, the T2S Project Team presented new projections for the T2S transaction volume as well as new scenarios of T2S DvP prices (see point 3 for further details). Interbolsa mentioned that there are many open issues still in the negotiations between CSDs and Programme Board (PB), which can delay the implementation of the Project. As a positive contribution, Interbolsa mentioned that, in the PMSG meeting of September 1st, the CSDs proposed a new methodology with the purpose of accelerating those negotiations. In the same meeting, and preparation of the CCG workshop of 22 and 23 September, PMSG members worked on the (i) prioritisation of the open issues (more than 100) and on the (ii) organisation and approval of the consensus that have already been reached. Overall, the T2S plan was considered to be very ambitious, as many of the stated issues remained open. Additionally, it was mentioned that the stabilised URD v5.0 is being subject to changes, which can imply additional costs to the project. 2. Major issues concerning Framework Agreement: presentation by Interbolsa - Governance; - Liabilities; - Contract termination; - T2S legal nature and Outsourcing; - Gap Analysis and Operational Risks – to CESR/Regulators; - Planning; - Migration; - Service Level Agreement. Interbolsa mentioned that there was no progress in the FA negotiations being the major unsolved issues: the nature of the contract, T2S governance, liabilities and contract termination clauses. CSDs need to keep control over activities which are under their responsibility. In Interbolsa’s point of view, the situation is close to a breakdown in negotiations in CCG, as PB remains inflexible in those areas. On the other hand, TCI has not been convened, which is delaying the preparation of the FA. CMVM representative informed NUG-PT that the FA is in the agenda of the CESR meeting in October, being the most important issues T2S systemic risks and operational risks as well as the issue of governance. Regulators will keep their active role in monitoring T2S Project and its development, namely the supervision requirements of a post-trading platform. Concerning the Gap Analysis undertaken by Interbolsa and delivered to CMVM, there were no “show stoppers” on T2S identified. 3. September AG meeting’s main conclusions: presentation by Banco de Portugal and Interbolsa Major issues: – T2S price scenarios; The T2S Project Team provided price scenarios (DvP) in the latest AG meeting, depending on the number of participating CSDs, the DvP price varied between 13 and 24 cents. The DvP price of 24 cents was considered to be too high by NUG-PT members; furthermore, adding matching and daytime settlement would raise T2S costs compared to current costs. Reacting to this scenario, a Portuguese market representative referred that the current cost is around 10 cents (including netting and for domestic trades – which represent the majority of the transactions). In T2S, the DvP price includes the securities leg and the cash leg but T2S prices do not include communication costs with T2S – another add-on to costs. Overall, the T2S price scenarios present no advantage to domestic trade, which represent 80%+ of current transactions. It was agreed that, in order ensure a better analysis of the impact of T2S in the Portuguese market, NUG-PT members would be asked to provide additional information on this issue.. – Development in “smooth cross-CSD” settlement workshops; Regarding this recent issue, under analysis in AG, the Interbolsa representatives provided information on the 3 workshops dedicated to this subject (Interbolsa was present in the last workshop). In terms of planning, it is not expected that AG receives proposal for recommendations before June 2011. 4. CSD Contact Group (CCG) and TCI activities: presentation - Interbolsa CCG activities were mentioned in point 2 dedicated to FA negotiations. It was highlighted that TCI – dealing with FA legal issues – has not convened meetings. 5. Project Manager Sub-Group (PMSG) activities: presentation - Banco de Portugal e Interbolsa As mentioned in point 1., PMSG efforts aimed at prioritising open FA negotiations issues. PMSG organised workshops dedicated to Change and Release Management (14th September), Project Planning (15th September) and User Testing (21st September), which are important to plan activities in CSD. In this respect the UDFS are very important and they will be available at the 3rd quarter of 2011. The migration waves issue is not yet clarified and a proposal by the CSDs shall be presented. Some participants considered that this issue is not a priority and its clarification will only be needed in 2012. 6. Other business Next NUG-PT meeting should take place in February 2011.

Download