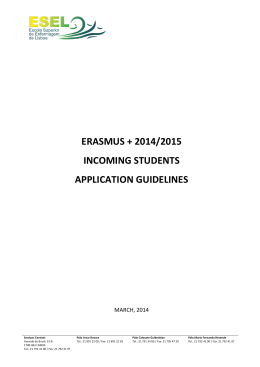

2Q15 EARNINGS RESULTS São Paulo, August 4, 2015 HIGHLIGHTS OF THE PERIOD, AND SUBSEQUENT EVENTS: • Agreement signed between Renova and SunEdison / TerraForm Global. • Contract signed for SunEdison to buy shares in Renova held by Light Energia, and enter the controlling stockholding block of Renova. • First full year of operation of the wind farms commercialized on LER 2009 auction– generation 10.8% higher than power volume sold. • Alto Sertão III projects timetable – Status of Phase A. • 2Q15 net operational revenue R$ 119.5 million – up 109.4% year-on-year. • 2Q15 EBITDA R$ 58.2 million – up 149.3% from 2Q14 – with EBITDA margin 48.7%. INVESTOR RELATIONS OFFICE Pedro Pileggi Vice-president for Finance, Business Development and Investor Relations Flávia Carvalho Investor Relations Manager Thatiana Zago Investor Relations Analyst [email protected] +55 (11) 3509-1104/1174 MEDIA OFFICE Josy Alves - [email protected] (11) 3095-1100 STOCK PRICE AT AUGUST 3, 2015: RNEW11 = R$ 32.10/Unit MARKET VALUE ON BM&FBOVESPA R$ 3,410.9 billion [email protected] 1 INDEX 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. About Renova…………………………………………………………………………………………………………………………………………………………….2 Message from management………………………………………………………………………………………………………………………………………4 Highlights in detail……………………………………………………………………………………………………………………………………………………..5 Renova’s power trading company………………………………………………………………………………………………………………………………9 Consolidated profit and loss account………………………………………………………………………………………………………………………….9 Cash flow………………………………………………………………………………………………………………………………………………………………….16 Main indicators of the financial statements………………………………………………………………………………………………………………17 Stock price performance……………………………………………………………………………………………………………………………………………20 Stockholding structure………………………………………………………………………………………………………………………………………………21 Glossary …………………………………………………………………………………………………………………………………………………………………...22 1 – ABOUT RENOVA ENERGIA Renova Energia S.A. (‘Renova’, or ‘the Company’) generates electric power from renewable sources, focusing on wind farms, small hydroelectric plants (SHPs) and solar energy. It is the largest company generating electricity from renewable sources in Brazil, by contracted installed capacity. It has been prospecting, developing and implementing projects to generation power from renewable sources for 13 years – having invested to build a highly qualified multidisciplinary team of experienced electricity sector professionals over this period. It has placed 1,609.1 MW of contracted power in Brazil’s regulated market and 1,239.9 MW in the country’s Free Market – a total of 2,849.0 MW. RENOVA – INSTALLED GENERATING CAPACITY (MW) 2,741.0 1,492.0 1,129.0 769.9 579.7 938.8 4.8 2,849.0 58.3 58.3 2,492.5 2,600.5 1,709.3 58.3 1,297.0 1,460.8 190.2 190.2 190.2 190.2 190.2 190.2 In operation 2015 2016 2017 2018 2019 SHP Wind Solar [email protected] 2 Parks Installed Capacity (MW) Energy Sold (avg MW) Number of wind farms Start of the contract Source Complex LER 2009 LER 2010 Wind Wind Alto Sertão I Alto Sertão II 294.4 167.7 127.0 78.0 14 6 Jul-12 Oct-14 LEN A-3 2011 LEN A-5 2012 Wind Wind Alto Sertão II Alto Sertão III - Fase A 218.4 18.9 103.6 10.2 9 1 Mar /Sep-15 Jan-17 LER 2013 LEN A-5 2013 LEN A-5 2014 LER 2014 Wind Wind Wind Wind Alto Sertão III - Fase A Umburanas Umburanas Alto Sertão 159.0 355.5 108.0 43.5 73.7 178.0 49.4 20.9 9 17 5 3 Sep-2015 May-18 Jan-19 Oct-17 Solar Alto Sertão 53.5 10.9 4 Oct-17 SHP - 41.8 18.7 3 2008 Brasil PCH REGULATED MARKET SHP - - 148.4 1,609.1 95.8 766.3 13 84 2008/2009 - Light I Light II Mercado Livre I Mercado Livre II Wind Wind Wind Wind Alto Sertão III - Fase A Alto Sertão III - Fase B Alto Sertão III - Fase B Alto Sertão III - Fase B 200.7 202.8 21.6 101.4 100.2 100.2 11.0 50.0 12 12 2 8 Sep-15 /Jan-16 Sep-16 Jan-16 Jan-17 Mercado Livre III Wind Alto Sertão III - Fase A 32.4 15.0 2 Sep-2015 Wind Solar - Jacobina Alto Sertão - 676.2 4.8 1,239.9 354.0 1.0 631.4 TBD 1 37 Sep-18 2016 - - - 2,849.0 1,397.7 121 - 1 3 LER 2014 ESPRA 4 5 PPA Cemig Híbrido FREE MARKET TOTAL ¹ ² ³ 4 5 6 6 2 2 2 2 Contracted under the LER 2009 (reserve auction); ready for operation since July 2012. Projects awaiting transmission lines. Refers to 50% equity interest, reflecting the joint venture with SunEdison. This figure is for Renova’s 51% interest. Reflects 100% participation in the project, since Cemig did not exercise its right to acquire 50% of the assets. Of the nine wind farm complexes established under the LEN (new energy) A-3 2011 auction, four have started commercial operation – on March 4, 2015; and the other five are awaiting their transmission lines. For all these, the start date of the supply contract has been adjusted (‘synchronized’) to coincide with the start date of operation of the transmission lines. [email protected] 3 2. MESSAGE FROM MANAGEMENT Renova has just taken one more important step in maintaining its leadership in the development of renewable energy projects in Brazil: Signature of an agreement with TerraForm Global and SunEdison, to increase its competitiveness, value creation and growth capacity. The first phase of the agreement comprised signature of share purchase contracts for sale of the assets of ESPRA (three SHPs with a total of 41.8 MW installed capacity), and the assets of the Bahia project (five wind farms contracted for construction in the 2009 Reserve Energy auction, with 99.2 MW of installed capacity), for R$ 587.0mn. Also in the first phase was signature of a contract to exchange shares in the assets of the Salvador project (nine wind farms which placed power supply in the LER 2009 auction, with 195.2 MW of installed capacity), for a total value of R$ 1.026 billion receivable by the Company in the form of shares in TerraForm Global. The second phase of this agreement includes signature of contracts to exchange further shares in TerraForm Global for contracted assets of Renova with long-term Power Purchasing Agreements for total installed capacity of 2,204.2 MW, totaling enterprise value of R$ 13.4 billion. Also negotiated in this second phase is an option contract, in which TerraForm Global will have a first refusal option to acquire any renewable energy projects to be developed by the Company that sell power in long-term contracts. Also under the contract and subject to its conditions, Renova will have the right to appoint a member of the Board of Directors of TerraForm Global. With this agreement includes the Company will recycle the capital invested, at an attractive and predictable cost; and new options in the future for financing based on exchange contracts, and on the shares to be received from TerraForm Global. Also, the dividends that Renova will receive from TerraForm Global will be a source of funding for Renova’s multiple growth possibilities. TerraForm Global is a globally diversified company, oriented to payment of growing dividends, created to hold and operate clean power generation assets in emerging markets where there is high growth. SunEdison is the controlling stockholder of TerraForm Global. SunEdison has also signed a share purchase agreement to acquire the shares in Renova owned by Light Energia. As a result of this, Renova will have all the expertise of SunEdison – the world’s largest developer of renewable energy – within its controlling stockholding block. Renova remains committed to quality in all its works and operations. The works on the Alto Sertão III wind complexes continue to make progress. The transmission line that connects some of the wind farms is delayed, and Renova is negotiating with the parties involved and considering market options to mitigate the negative impact of this delay. On the operational side, the wind farms contracted in the LER 2009 auction have now been operating for one year, generating in accordance with the Company’s expectations, but at a rate 10% higher than the level of power placed in the auction. The Company also continues to operate the wind farms that placed their contracted output in the LER 2010 auctions, and those contracted in the LEN A-3 2011 auction, which are connected, and continues to have confidence in further progress of alternative electricity sources in Brazil. [email protected] 4 3. HIGHLIGHTS IN DETAIL: 3.1. Agreement signed between Renova and SunEdison / TerraForm Global On July 15, 2015 Renova took one more important step in its history, concluding the agreement for contribution of assets to TerraForm Global, Inc. (‘TerraForm Global’). This transaction both inaugurates a new way for Brazilian electricity companies to raise funding and also places Renova once again in an outstanding strategic position in the renewable energy market. The model of the transaction will enable capital to be recycled at lower and more predictable costs, sustaining the full execution of the Company’s business plan. The transaction is divided into two phases. The first phase, announced on May 7, 2015, involved signature of the following contracts: (i) Share purchase agreement for the sale of the assets of the ESPRA project, corresponding to three Small Hydroelectric Plants with aggregate installed capacity of 41.8 MW and supply contracts in place under the Proinfa program, for equity valuation of R$ 136 million, to be paid in cash. (ii) A share purchase agreement for sale of the assets of the Bahia project: five wind farms that placed supply in the LER 2009, with 99.2 MW of installed capacity, assessed at equity value of R$ 451 million, to be paid in cash. (iii) An agreement to exchange the shares of the Company’s subsidiaries that hold assets of the Salvador project – nine wind farms that placed supply in the LER 2009, with 195.2 MW of installed capacity, with equity value of R$ 1.026 billion – for shares in TerraForm Global, on the basis of the price per share paid in the IPO held by TerraForm Global on July 31, 2015. The amounts referred to above are subject to adjustments specified in each contract. The second phase of the transaction was announced on July 15, and deals with other assets that have long-term electricity sale contracts, both operational and not yet operational (‘the backlog’), and also projects in development or to be developed by the Company that sell power supply in long-term contracts in the future (‘the pipeline’). This phase includes signature of the following contracts: (i) A share exchange contract in which shares in the subsidiaries of the Company that own the assets of each project of the backlog, as listed below, are exchanged at the Company’s enterprise value (i.e. including debt in the valuation of the asset), of R$ 13.4 billion. The amounts will be adjusted on the date of exchange in accordance with applicable terms of the contracts. The assets, with installed capacity for 2,204.2 MW, will be exchanged after starting commercial operation and in accordance with the timetable below negotiated by the parties. Renova will receive the corresponding amount in shares of TerraForm Global based on the average market trading price in the 30 trading sessions prior to the closing date. [email protected] 5 Asset Light I Light II LEN A-5 2012 LER 2010 LEN A-3 2011 LER 2014 – wind LER 2014 - solar¹ LER 2013 PPA Cemig² LEN A-5 2013 LEN A-5 2014 ¹ ² Installed capacity (MW) 200.7 202.8 18.9 167.7 218.4 43.5 53.5 159.0 676.2 355.5 108.0 Year of exchange 2017 2017 2017 2018 2018 2018 2018 2019 2019 2020 2020 Refers to 50% of the PPA, reflecting the joint venture with SunEdison. Reflects 100% of the Cemig PPA, since Cemig did not exercise its right to acquire 50% of the asset. (ii) A contract giving TerraForm Global, until December 31, 2016, an option and first refusal to purchase any renewable energy projects that the Company has in development and /or to be developed that sell power supply under long-term contracts. The quantity of shares of TerraForm Global to be received by Renova will be determined based on a multiple of the cash available for distribution from each project in the years subsequent to the transfer, in accordance with a model agreed between the parties. After this period, the parties will negotiate a new mechanism for the purchase option and first refusal right on acquisition of the projects, intended to reflect the market conditions and the Company’s competitiveness. It was also agreed that subject to certain conditions of the contract, Renova will have the right to appoint a member of the Board of Directors of TerraForm Global. As well as the advantages set out above, the objective of the transaction is to increase Renova’s competitiveness, value creation and capacity for growth. With this transaction, Renova will have further new options for financing based on the contracts for exchange of the backlog and on the shares in Terraform Global received as payment, strengthening the capital structure for the development of the projects. [email protected] 6 3.2. Contract signed for SunEdison to buy shares in Renova held by Light Energia, and enter the controlling stockholding block of Renova On July 2, Light Energia S.A. announced that its Board of Directors had approved the share purchase agreement for sale of the shares in Renova held by Light Energia S.A. (‘Light’) to SunEdison, Inc. (‘SunEdison’). The contract was signed on July 15, and the amount to be paid for the 50,561,797 common shares is US$250,000,000.00, equivalent to US$14.83 per Unit. Completion of this transaction is subject to certain conditions precedent, including: regulatory approvals, waivers of restrictions on transfer of shares, first refusal rights, and joint sale, under existing Stockholders’ Agreements. On conclusion of the agreement, SunEdison will adhere to the existing Stockholders’ Agreement of the Company and will be part of the controlling stockholding block of Renova. It is important to note that this transaction will not result in disposal of control, neither direct nor indirect, of the Company, nor in acquisition of the power of control of the Company by SunEdison. New stockholding structure after entry of SunEdison into the controlling stockholder block: RENOVA ENERGIA Controlling shareholder block RR Participações SunEdison Cemig GT Other stockholders RR Participações* BNDESPAR InfraBrasil FIP Caixa Ambiental Others Total ON Shares 188,309,630 79.6% 50,561,797 21.4% 50,561,797 21.4% 87,186,035 36.8% 48,534,656 20.4% 8,250,393 3.5% 9,311,425 3.9% 11,651,467 4.9% 5,470,293 2.3% 13,890,247 5.8% 236,883,455 100.0% PN Shares 0.0% 0.0% 0.0% 0.0% 81,889,474 100.0% 1,280,600 1.6% 18,622,850 22.7% 23,302,933 28.5% 10,940,586 13.4% 27,742,505 33.8% 81,889,474 100.0% Total Shares 188,309,629 59.1% 50,561,797 15.9% 50,561,797 15.9% 87,186,036 27.3% 130,345,793 40.9% 9,530,993 3.0% 27,934,275 8.8% 34,954,400 11.0% 16,410,879 5.1% 41,515,246 13.0% 318,772,929 100.0% * Holding of RR Participações outside the controlling block Nota: Bloco de controle considera ações sujeitas ao acordo de acionistas 3.3. First full year of operation of the wind farms commercialized on LER 2009 auction– generation 10.8% higher than power volume sold. The 14 wind farms that commercialized on LER 2009 auction have completed one year of operation. They were declared ready to operate as from July 2012, but with the delay in the transmission line, they started commercial operation only in July 2014. The volume of electricity that they placed in the initial auction was 127.0 MW average; but in this first year they generated 140.7 MW – a level of generation 10.8% higher than the level contracted. [email protected] 7 The capacity factor was 48%, close to the P50 estimate for these wind farms. Also, in this first year of operation there were some non-recurring events, such as disconnections of rotors to make possible the connection of other wind farms to the same transmission line. There are reimbursement clauses (constrained off clauses) in the contract for these events, and the amounts will be calculated by Aneel. LER 2009 200.0 48% 120.0 140.74 MWm 160.0 80.0 40.0 3Q14 4Q14 1Q15 Generated energy 2Q15 Sold¹ Avg Capacity factor ¹ Volume sold has been seasonalized in accordance with the contract. 3.4. Alto Sertão III projects timetable – Status of Phase A Some of the Company’s projects of Phase A of Alto Sertão III were scheduled for inauguration in September 2015. According to Aneel’s SIGET transmission line scheduling publication, however the transmission line that will connect these wind farms is planned for September 30, 2015. The Company is taking measures for this to cause the minimum possible impact. In the case of Light I, with installed capacity of 200.7 MW, and a power output of 100.2 MW average currently contracted, two-thirds of the contract was renegotiated for supply to start in January 2016. One-third of the contract maintains the 2015 date, and the Company has bought backup supply to make good the energy needs. The price of electricity is declining, since the hydrological situation has improved, with higher than average rainfall in the South and Southeast; there are signs of reduction in the load forecasts produced by the National System Operator (ONS), and there are attempts to decide on a regulatory solution for the GSF (Generation Scaling Factor) of the large generation companies. For the Mercado Livre III wind farm, with installed capacity of 32.4 MW and a total of 15.0 MW average contracted, the Company is also negotiating purchase of backup supply. For the facilities that were built under the LER 2013 auction, with installed capacity of 159.0 MW and a total of 73.7 MW average contracted, the Company is studying the alternative solutions. [email protected] 8 4. RENOVA’S POWER TRADING COMPANY Renova created its power trading company to manage its portfolio and mitigate risks. In the second quarter of 2015 Renova Comercializadora de Energia S.A. (‘Renova Comercializadora’, or ‘RC’) transacted electricity contracts generating revenue of R$ 2.3 million, with electricity purchase costs of R$ 2.6mn. With other costs, principally of personnel and consultancy, RC reported a loss of R$ 25,000 (twenty-five thousand Reais) for the quarter. RC’s result in the half-year is a loss of R$ 0.5 million. Renova Comercializadora S.A. R$ ’000 Net revenue Purchase of electricity Other costs Financial revenue (expenses) Net profit 2Q15 2Q14 Change 1H15 1H14 Change 2,595 (2,595) (83) 58 (25) 5,423 (3,393) (2,058) (28) -52.1% -23.5% -96.0% 12.0% 4,909 (5,161) (366) 107 (511) 5,423 (3,393) (2,058) (28) -9.5% -52.1% -82.2% 1725.0% 5. CONSOLIDATED PROFIT AND LOSS ACCOUNT Renova Energia S.A. R$ ’000 2Q15 2Q14 Change 1H15 1H14 Change 124,064 59,597 108.2% 231,314 115,215 100.8% (4,530) (2,502) 81.1% (8,737) (4,519) 93.3% 119,534 57,095 109.4% 222,577 110,696 101.1% (5,903) (2,627) 124.7% (11,922) (4,975) 139.6% Manageable Costs (19,722) (7,458) 164.4% (30,294) (7,011) 332.1% Depreciation (21,256) (17,348) 22.5% (52,902) (34,861) 51.8% 72,653 29,662 144.9% 127,459 63,849 99.6% (31,198) (20,416) 52.8% (56,646) (32,924) 72.1% (577) (424) 36.1% (1,300) (734) 77.1% (46,376) (5,967) 677.2% (91,528) (23,655) 286.9% Equity gain (loss) in subsidiaries (4,474) (3,233) 38.4% (2,765) (6,211) -55.5% Amortization of goodwill (9,077) - - (18,152) - - Income Tax and Social Contribution Tax (8,238) (2,944) 179.8% (13,476) (6,391) 110.9% (27,287) (3,322) 721.4% (56,408) (6,066) 829.9% -22.8% -5.8% -17.0 p.p. -25.3% -5.5% -19.9 p.p. Gross operational revenue (-) Taxes - PIS, Cofins and ICMS Net operational revenue Non-Manageable Costs – Total Operational profit Administrative Expenses Administrative Depreciation Financial revenues (expenses) Net profit (loss) Net margin [email protected] 9 5.1. Consolidated net operational revenue Renova reports net operational revenue in 2Q15 of R$ 119.5 million – an increase of 109.4% from 2Q14. Renova Energia S.A. R$ ’000 Net revenue – Wind power Net revenue – SHPs Net revenue – Solar power Net revenue – Power trading Net operational revenue 2Q15 2Q14 Change 1H15 1H14 Change 110,669 48,115 130.0% 205,693 96,229 113.8% 6,191 3,456 79.1% 11,752 8,943 31.4% 79 101 -21.8% 223 101 120.8% 2,595 5,423 -52.1% 4,909 5,423 - 119,534 57,095 109.4% 222,577 110,696 101.1% The higher revenue is primarily higher revenue from the wind farms – up 130.0% year-on-year, with the start of operation of two groups of wind farms: the plants contracted at the LER 2010 Auction, as from October 2014; and four complexes contracted at the LEN A–3 2011 auction, in March of this year. Both these revenue sources were not yet in existence in the second quarter of last year. In this quarter there were also financial adjustments applied to generation by the wind farms, in the amount of R$ 23.5 million, since the complexes built under the LER 2009 and LER 2010 auctions generated a higher volume of output than the volume contracted, and there were also adjustments to the LER 2009 auction, accounted in the transition period between the facilities being ready to operate and commercial operation. The revenue from the Small Hydro Plant (SHPs) was 79.1% higher than in 2Q14 – this continues to be affected by the provision of R$ 2.3 million for the financial adjustment resulting from trading on the CCEE of output by Renova’s SHPs. In this quarter, however, the provision was lower than in 2Q14 (when it was R$ 7.5mn). Two of Renova’s SHPs – Cachoeira da Lixa and Colino I – are included in the Energy Reallocation Mechanism (ERM). This mechanism makes an accounting reallocation of the total volume of electricity generated in the country, transferring the excess of those that generated more than their physical guarantee to those that generated less. Since the MRE plants generated less than their aggregate physical guarantee and the spot price is high due to the thermal plants having been activated, the Company made a provision in the amount of its portion of the adjustment of the accounting of the ERM amounts. The financial settlement of these amounts takes place only in the following year, after the accounting of the whole of the current year. The Colino II SHP is outside the ERM, and either receives or reimburses to Eletrobras depending on its generation output. In this quarter there was also revenue from solar power due to development of a distributed generation project. Finally, the revenue from trading in the quarter was R$ 2.6 million, 52.1% lower than in 2Q14. In the half year, net operational revenue was R$ 222.6 million, or 101.1% higher than in 1H2014. The variation mainly refers to the start of operation of the wind farms built under the LER 2010 and LEN A–3 2011 auctions, as noted above. [email protected] 10 5.2. Consolidated costs Electricity production costs are separated into manageable, and non-manageable, components. Non-manageable costs are: (i) The tariff for use of the distribution system (TUSD), for the use of the distribution system of Coelba – the concession holder to which the SHPs are connected – and the tariff for use of the transmission system (TUST), for the transmission lines and substations of the wind farms; and (ii) the inspection charge made by Aneel. These costs are related to the small hydro plants and the wind plants that are in operation. Manageable costs are the costs of operation and maintenance of the SHPs of the subsidiary Energética Serra da Prata S.A. (‘ESPRA’) and of the wind farms in operation. Costs excluding depreciation (R$ 000) 42,216 11,922 25,625 5,903 10,085 2,627 7,458 11,986 4,975 7,011 30,294 19.722 2Q14 2Q15 1H14 1H15 Manageable Non-manageable In 2Q15 manageable costs totaled R$ 5.9 million, 124.7% higher than in 2Q14. The increase reflected the higher payment of TUST and regulatory charges due to the start of operation of the wind farms of the LER 2010 auction and four wind farms of the LEN A–3 2011 auction. In the half year, non-manageable costs were R$ 11.9 million, or 139.6% more than in first half 2014, for the same reason. In 2Q15, manageable costs were R$ 19.7 million. The year-on-year increase of R$ 12.3 million was primarily due to: • • Expenses on third party services R$ 13.9 million higher, mainly for maintenance of the wind farms, following expiration of the grace period. The amount for the half-year was accounted in full in this second quarter. Rentals and leasing R$ 0.7 million lower in the second quarter due to a change in the rule for capitalization of sites leased for Alto Sertão III. [email protected] 11 • • • Total expense on purchase of electricity for resale R$ 0.8 million lower in the quarter. Expense on material for use and consumption R$ 0.2 million higher, reflecting purchase of material for maintenance and replacement parts for the wind farm. The item ‘Other costs’ was R$ 0.3 million lower. In the half year, manageable costs totaled R$ 30.3 million, or 332.1% more than 1H2014, mainly due to higher expenses on third party services. Depreciation in the quarter was R$ 21.3 million, or 22.5% higher than in 2Q14. In the half year, depreciation was R$ 52.9 million, up 51.8% due to the start of operation of the wind farm complexes under the LER 2010 auction and four wind farms from the LEN A–3 2011 auction. Note that under IFRS 5 / CPC 31, assets held for sale are not to be depreciated. Thus, no depreciation was accounted in the quarter for the complexes built under the 2009 LER auction, and the SHPs of ESPRA. 5.3. Consolidated administrative expenses Renova Energia S.A. R$ ’000 2Q15 2Q14 Change 1H15 1H14 Change Personnel and management 10,733 5,012 114.1% 17,954 8,769 104.7% Outsourced services 13,398 10,764 24.5% 24,910 17,075 45.9% 837 257 225.7% 1,328 444 199.1% 2,044 1,100 85.8% 3,941 1,516 160.0% - 1,343 -100.0% - 1,343 -100.0% (137) 61 -324.6% 491 146 236.3% Telephony and IT 335 532 -37.0% 1,632 1,141 43.0% Material for use and consumption 762 208 266.3% 1,064 420 153.3% 3,226 1,139 183.2% 5,326 2,070 157.3% 31,198 20,416 52.8% 56,646 32,924 72.1% Rentals and leasing Travel Projects discontinued Insurance Others Total *Excludes administrative depreciation. Administrative expenses in 2Q15 were R$ 31.2 million, 52.8% higher than in 2Q14. This reflects: • • • • • • Personnel and administration: higher number of employees – 328 at June 30, 2015 vs. 237 at June 30, 2014; the wage increase under the union agreement of April 2015; and bonuses; Outsourced services: R$ 2.6 million higher than in 2014, due to higher expenses on consultancy and lawyers; Rentals and leasing: higher due to new rentals for the Salvador and São Paulo offices. Travel: higher, reflecting the Company’s projects. Insurance, telephony and IT: lower, on reclassifications between accounts and reversal of a provision. Others: freight and mail costs, expenses on social programs for communities where the Company operates, and non-recurring items. The higher total than in 2Q14 is mainly due to higher expenditure on events this year, and expenses of the power trading company. [email protected] 12 In the first half of 2015 administrative expenses totaled R$ 56.6mn, or 72.1% more than 1H14, mainly reflecting personnel and administration and higher expenses on third party services. 5.4. Consolidated financial revenue (expenses) Renova Energia S.A. R$ ’000 2Q15 2Q14 Change 1H15 1H14 Change Financial revenues 8,687 19,144 -54.6% 18,904 26,155 -27.7% Revenue from cash investments 8,057 18,974 -57.5% 18,270 25,982 -29.7% 630 170 270.6% 634 173 266.5% Financial expenses (55,063) (25,111) 119.3% (110,432) (49,810) 121.7% Costs of debt (50,415) (23,617) 113.5% (101,752) (46,758) 117.6% (4,648) (1,494) 211.1% (8,680) (3,052) 184.4% (46,376) (5,967) 677.2% (91,528) (23,655) 286.9% Other financial revenues Other financial expenses Financial revenue (expenses) Renova reports net financial expenses in 2Q15, of R$ 46.4 million. Financial revenues were 54.6% below their level of 2Q14, mainly due to the Company holding less cash. Financial expenses increased by 119.3%, YoY, mainly on three factors: (i) higher financing volume in the quarter, especially with the new debenture issue by the holding company, issued in December, and bridge loans for Alto Sertão III; (ii) higher interest rates resulting from the indexers of the financings (TJLP and CDI); and (iii) accounting in the profit and loss account of the financing of the 2010 LER projects and part of the 2011 A–3 LEN projects, since their costs are no longer capitalized after they started operation. The reported net financial result for the first half of the year was net financial expenses of R$ 91.5mn, 286.9% higher than in 1H14. The variation also arises from the lower cash balance, and the higher expenses on debt costs. 5.5. Equity gain / Loss – Brasil PCH Renova made the acquisition of 51% of Brasil PCH as part of the transaction which increased the share capital and included Cemig GT in the controlling stockholding block. The acquisition was made through a subsidiary (Chipley), in which until 3Q14 Renova owned 60%, and with completion of the capital increase, as from 4Q14 Renova owned 100%. [email protected] 13 R$ ’000 Brasil PCH (100%) 2Q15 1H15 Net revenue 44,188 98,443 Costs (8,030) (15,632) Expenses (2,847) (6,503) Depreciation (10,770) (21,641) Financial revenue (expenses) Income tax and Social Contribution tax Net profit (29,750) (56,060) (1,564) (4,028) (8,773) (5,421) Brasil PCH reported a loss of R$ 8.8 million in the second quarter, and Renova (through Chipley) has the right to 51% of the result of Brasil PCH. The total goodwill in the acquisition was R$ 656.7 million. The Company assessed the fair value of the assets and liabilities in Brasil PCH, based on the best existing estimate. Thus the monthly value of the amortization of goodwill was recorded in the month of the acquisition. The total amortization of goodwill accounted in the quarter was R$ 9.1 million. This table shows the effect of the acquisition of Brasil PCH in Renova: Renova 2Q15 1H15 Equity method gains (losses) (4,474) (2,765) Amortization of goodwill (9,077) (18,152) (13,551) (20,917) Net profit 5.6. Income tax, social contribution tax and net profit Renova’s revenues from generation are taxed by the Presumed Profit method of tax reporting. Under this regime, the amount on which the tax is calculated is the sum of 8% of gross revenues arising from electricity generation and 100% of financial revenues. To this amount, Income Tax is applied, at the regular rates: 15% basic rate plus an additional 10% over a threshold figure. The Social Contribution tax is calculated, at its regular rate of 9%, on: 12% of gross revenues from electricity generation, plus 100% of financial revenues. Income tax and social contribution tax in 2Q15 totaled R$ 8.2 million, which compares to R$ 2.9 million in 2Q14, mainly reflecting higher revenues with the new wind farms coming into operation. Income tax and social contribution tax in the half year totaled R$ 13.5 million. For second quarter 2015, Renova reported a net loss of R$ 27.3 million, which compares with a loss of R$ 3.3 million in second quarter 2014. In the first half of 2015, Renova reported a net loss of R$ 56.4 million. [email protected] 14 5.7. EBITDA Renova Energia S.A. R$ ’000 2Q15 2Q14 Change 1H15 1H14 Change Net operational revenue 119,534 57,095 109.4% 222,577 110,696 101.1% Net profit (loss) (27,287) (3,322) 721.4% (56,408) (6,066) 829.9% 8,238 2,944 179.8% 13,476 6,391 110.9% (+) Depreciation 30,910 17,772 73.9% 72,354 35,595 103.3% (+) Financial expenses 55,063 25,111 119.3% 110,432 49,810 121.7% (-) Financial revenues (8,687) (19,144) -54.6% (18,904) (26,155) -27.7% Ebitda 58,237 23,361 149.3% 120,950 59,575 103.0% Ebitda margin 48.7% 40.9% 7.8 p.p. 54.3% 53.8% 0.5 p.p. (+) Equity method gains (losses) 4,474 3,233 38.4% 2,765 6,211 -55.5% (21,173) 7,488 -382.8% 19,848 12,580 57.8% - - - - (4,645) - 41,538 34,082 21.9% 143,563 73,721 94.7% 34.7% 59.7% -24.9 p.p. 64.5% 66.6% -2.1 p.p. (+) Income Tax and Social Contribution tax (+) Financial adjustments – generation (+) Provision for 2010 LER Adjusted EBITDA Adjusted EBITDA margin EBITDA in 2Q15 was R$ 58.2 million, that is to say an increase of 149.3% over 2Q14 – and with EBITDA margin of 48.7%. EBITDA adjusted for equity gains/losses and generation adjustments was R$ 41.5 million, 21.9% higher than in 2Q14, with EBITDA margin 34.7%. In the first half of the year EBITDA was R$ 120.9 million – an increase of 103.0% from 1H15, and EBITDA margin in the first half of 2015 was 54.3%. Adjusted EBITDA for the first half of the year was R$ 143.6 million, or 94.7% more than in 2H14, with EBITDA margin of 64.5%. [email protected] 15 6. CASH FLOW 2Q15 Cash Flow 90,550 178,469 47,478 46,929 49,898 (252,454) (13,596) Initial Cash 97,376 Operational Financing Cash Investiments Investments Final Cash Cash Investments (total) Availabilities (total) * In the cash flow statements, cash investments are classified as investing activities. Renova’s cash position at June 30 was R$ 3.0 million higher than at March 31, 2015, with cash and cash equivalents R$ 78.5 million lower. The main factors are: • • • • R$ 14.3 million used in operational activities. Cash inflow of R$ 178.5 million in financings, from the bridge loan from the BNDES for Alto Sertão III – Phase A. Cash investments of R$ 90.6 million – positions held in investment funds, to be used in the construction of the Alto Sertão III complexes. Outflow of R$ 252.5 million in investments, mainly for works on Alto Sertão III. In addition to cash, Renova has R$ 47.5 million in cash investments, resulting in cash and cash equivalents of R$ 97.4 million. Note that R$ 23.6 million of the R$ 49.9 million in cash refers to assets of the LER 2009 project and of ESPRA, which are classified in the balance sheet as held for sale. Of the R$ 97.4 million total of cash and cash equivalents, R$ 59.2 million refers to the assets of the LER 2009 projects, and of ESPRA. [email protected] 16 7. ANALYSIS OF MAIN ECONOMIC AND FINANCIAL INDICATORS Balance Sheet Amounts in R$ thousands Consolidated Assets 6/30/2015 Current Assets 1.734.469 Consolidated Liabilities 3/31/2015 12/31/2014 284.843 692.655 3/31/2015 Current Liabilities Cas h and ca s h equiv. 26.336 46.929 86.599 Inves tments 11.834 128.934 509.018 Clients 18.198 70.309 68.627 Suppli ers Other 32.198 38.671 28.411 Others 1.645.903 Long-term Assets 4.055.099 5.213.309 4.849.587 3 171.021 160.487 Others Inves timents Fixed As s ets in Us e 2.460 11.393 8.745 692.395 705.946 713.312 1.242.508 Debentures Li abili ties as s oci ated with as s ets for s a le As s ets for Sa le Loa ns a nd Financing Loans and Fi na ncing 2.625.531 Long-term Liabilities 3/31/2015 3/31/2014 1.787.590 357.321 517.165 484.016 121.269 355.442 7.576 22.738 884 278.319 154.724 100.200 34.824 58.590 60.639 982.855 - - 1.548.082 2.659.985 2.515.436 Loans and Fi na ncing 891.510 1.990.509 1.917.051 Debentures 649.451 641.239 572.315 7.121 28.237 26.070 Shareholder´s Equity 2.453.896 2.480.846 2.509.641 Ca pita l Stock 2.526.249 2.526.240 2.526.240 55.830 55.502 55.176 Other 2.175.130 Ca pita l Res erve Fixed As s ets in Progres s 2.117.733 1.699.418 1.791.913 Reta ined Los s es Total Assets 5.789.568 5.498.152 5.542.242 Total Liabilities - 128.183 5.789.568 100.896 5.498.152 71.775 5.542.242 As noted (3.1 above), the board has approved the agreement between Renova, SunEdison and TerraForm Global. IFRS 5 / CPC 31 requires that assets of which a sale is highly probable, with management engaged for this to happen, and where the sale is likely to take place by the end of a year, should be classified as assets held for sale. Thus, all the lines of assets relating to the LER 2009 projects and ESPRA have now been classified in current assets, in a single line – assets held for sale. The same takes place in liabilities: all the lines in liabilities relating to the projects have been classified in a single line – liabilities directly associated with assets held for sale. [email protected] 17 7.1. Main variations in assets The main variation in current assets in this quarter, and in the year, was in Assets held for sale – this line now consolidates all the assets of the LER 2009 projects and ESPRA: a total amount of R$ 1.646 billion. Also in current assets, Cash and cash equivalents (cash plus financial investments) on June 30, 2015, was R$ 38.2 million. We expect the Company’s cash position to be strengthened with: the long-term disbursement from the BNDES for Alto Sertão III; the cash inflow of R$ 587.0 million from the transaction with SunEdison/TerraForm Global; and new financings that are being structured. In non-current assets, the main variation in the quarter, and in the year, was the account of Deposits. On June 30, 2015 Renova had only R$ 3,000 (i.e. three thousand Reais) under this account, compared to R$ 171.0 million on March 31, and R$ 160.5 million on December 31, 2014. This was because a total of R$ 171.9 million in deposits relates to the 2009 LER projects and ESPRA which (as explained above) has now been reclassified to Assets held for sale. The majority of the Deposits account consists of a specific reserve for O&M, and service of debt of the BNDES contract – to guarantee full payment of the installments and principal of the debt, to ensure its coverage. The Investments line refers to Renova’s 51% equity in Brasil PCH. The change of R$ 1.383 billion in fixed assets in service from March 31, 2014 also relates to the classification of the assets of the LER 2009 projects and of ESPRA in assets held for sale. The change in fixed assets and progress mainly reflects the progress on the works of Alto Sertão III. 7.2. Main changes in liabilities The main variation in Current liabilities in this quarter, and in the year, has been the line of Liabilities directly associated to the assets held for sale, bringing together all the liabilities of the LER 2009 projects and of ESPRA, in a total of R$ 982.9 million. Short-term loans and financing totaled R$ 484.0 million. The increase of R$ 362.7 million from the end of the first quarter was due to the bridge loan from the BNDES, now disbursed, which ceased to be long-term and became a part of short-term liabilities. There was also a further disbursement of a bridge loan for Alto Sertão III. Suppliers at June 30, 2015 was R$ 278.3 million: the increase of R$ 123.6 million in the quarter, and of R$ 178.1 million since December 31, 2014, reflects the current stage of work on building of the Alto Sertão III wind farm complexes. In Non-current liabilities, the main change was in Loans and financings, which was R$ 891.5 million at the end of the quarter or R$ 1.099 billion less than at the end of 1Q15, and R$1.026 billion less than at the end of 2014. The reduction is mainly due to: (i) the BNDES bridge loan which was reallocated from long-term to short-term; and (ii) R$ 858.7 million of loans relating to the LER 2009 projects and the ESPRA assets, which were grouped in the line specifically for liabilities directly associated with assets held for sale. Stockholders’ equity at the end of the quarter was R$ 2.454 billion, in line with previous quarters, with some variation within Retained losses. [email protected] 18 7.2.1. Financing The total of short and long-term Loans, financings and debentures at the end of 2Q15 was R$ 2.984 billion¹, with tenors and rates as follows: Contract BNDES – LER 2009 Rate TJLP + 1.92% R$ ’000 562,514 BNDES – LER 2009 TJLP + 2.18% 275,217 BNDES – LER 2009 (Social sub-credit) TJLP BNDES – Renova Eólica TJLP + 2.45% 676,635 BNDES – Renova Eólica TJLP + 2.60% 264,654 BNDES – Renova Eólica (Social sub-credit) TJLP BNDES – Bridge Loan 1, Diamantina Eólica TJLP + 3.55% 146,465 BNDES – Bridge Loan 1, Diamantina Eólica TJLP + 2.5% 283,447 BNB² – ESPRA 9.5% p.a. 93,779 3.5% p.a. 6,355 Finep – Itaparica Wind Power Consortium 6,594 1,361 rd 123.45% of CDI st IPCA + 7.60% p.a. Debentures – 3 issue – Holding Company Debentures – 1 issue – Renova Eólica 503,458 Total indebtedness 163,646 2,984,125 Funding cost (22,000) Transfer of liabilities associated with assets held for sale (929.572) Debt net of costs 2,032,553 Cash & cash equivalents 38,170 Net debt³ 1,994,383 ¹ The total represents the amount accounted, plus the interest generated, without considering the funding costs of the transactions. ² Financings have interest rates of 9.5% p.a. (able to be reduced to 8.08% by a 15% non-default bonus) ³ Cash equivalents plus cash investments. Maturities timetable (R$ million) 2.984.125 1.803.597 563.835 untill 12 months 66.653 136.004 207.877 206.159 2015 2016 2017 2018 After 2018 [email protected] Total 19 8. STOCK PRICE: RNEW11 ON THE BM&FBOVESPA This chart compares the stock price of RNEW11, the Bovespa index and the Brazil electricity index, in the last 12 months. R$ 32.10 August 3, 2015 RNEW11 50,00 40,00 30,00 20,00 10,00 ago-14 set-14 out-14 nov-14 dez-14 jan-15 fev-15 mar-15 abr-15 mai-15 jun-15 jul-15 mar-15 abr-15 mai-15 jun-15 jul-15 RNEW x IBOV x IEE 140 120 100 80 60 40 20 0 ago-14 set-14 out-14 nov-14 dez-14 jan-15 Rnew fev-15 Ibov IEE Source: Bloomberg. [email protected] 20 RNEW11¹ In R$ IPO (July 2010) 11.67 Close of August 3, 2015 32.10 Highest price since IPO: 50.00 Appreciation since IPO 174.1% Appreciation, LTM -17.6% Appreciation in 2015 -13.9% With the tools of the Company’s website and the constant relationship with stockholders and potential investors at public events and events organized by investment banks, Renova’s Investor Relations Department seeks to operate in a transparent relationship with the market, updating investors on its positioning, its projects under development and its outlook. The company’s information and publications can be accessed on our website (www.renovaenergia.com.br), which also carries leading news on the sector that could be relevant to our business plan. ¹ Adjusted for corporate action. 9. STOCKHOLDING STRUCTURE Controlling stockholder block 79.6% ON RR Participações 21.4% ON 0.0 % PN 15.9% total Light Energia 21.4% ON 0.0% PN 15.9% total Cemig GT 36.8% ON 0.0% PN 27.3% total RR Participações1 3.5% ON 1.6% PN 3.0% total BNDESPAR FIP InfraBrasil 3.9% ON 22.8% PN 8.8% total 4.9% ON 28.5% PN 11.0% total FIP Caixa Ambiental 2.3% ON 13.4% PN 5.1% total Others 5.8% ON 33.7% PN 13.0% total Base date: June 2015 ¹ Shares held by RR outside the controlling block. Share capital of Renova on June 30, 2015: RENOVA ENERGIA ON shares 236,844,286 PN shares 81,811,136 Total shares 318,655,422 For calculation of market capitalization, the total number of shares of Renova is divided by 3 (due to its trading in Units – one common share and two preferred shares) and multiplied by the price of the security RNEW11 on the date in question. [email protected] 21 10. GLOSSARY A–3 or A–5 Auctions ‘New-build’ auctions, to contract supply starting respectively 3 and 5 years ahead. Alto Sertão I 14 wind farms owned by Renova in the interior of Bahia State, with installed capacity of 294.4 MW, which contracted electricity sales in the 2009 Reserve Energy auction (LER). Alto Sertão II 15 Renova wind farms in the interior of Bahia State, with installed capacity of 386.1 MW, which contracted electricity sales in the Reserve Energy (LER) Auction of 2010 and the A–3 Auction of 2011. Alto Sertão III 44 Renova wind farms in the interior of Bahia, which sold supply in the 2012 (A–5) LEN Auction, in the 2013 LER auction, and in the Free Market, with total installed capacity of 736.8MW. Alto Sertão III Phase A 23 Renova wind farms in the interior of Bahia with installed capacity of 411.0MW, which sold power supply in the 2012 (A–5) LEN auction, the 2013 LER auction, and in the Free Market. Aneel Brazil’s electricity regulator (Agência Nacional de Energia Elétrica – National Electricity Agency). CCEE ESPRA Free Market ICB ICSD LEN LER MCPSE Mercado Livre I Mercado Livre II Mercado Livre III MRE O&M P50 P90 PCHs The Electricity Trading Chamber (Câmara de Comercialização de Energia Elétrica): Brazil’s Wholesale Electricity Market. The company Energética Serra da Prata S.A., indirect subsidiary of Renova and holder and operator of Renova’s three Small Hydro Plants. Contracting environment in which prices for electricity supply are freely negotiated between the consumer and the generating agent or trader. Cost-Benefit Index (Índice Custo Benefício) calculated by Aneel for new-build auctions. Debt servicing coverage index (Índice de Cobertura do Serviço da Dívida). ‘New-build’ auction: Auction to contract energy supply to be provided by facilities yet to be built (Leilão de Energia Nova – ‘New Electricity Auction’). ‘Reserve Capacity’ auction (Leilão de Energia de Reserva – ‘Reserve Energy Auction’). Electricity Sector Assets Property Management Manual (Manual de Controle Patrimonial do Setor Elétrico). A Renova wind farm with installed capacity of 21.6MW, in the interior of Bahia State, which has sold power supply in the Free Market. A group of eight Renova wind farms in the interior of Bahia, with installed capacity of 101.4MW, which have sold power supply in the Free Market. A Renova wind farm with installed capacity of 32.4MW, in the interior of Bahia State, which has sold power supply in the Free Market. Electricity Reallocation Mechanism (Mecanismo de Realocação de Energia). Operation and maintenance An estimate of average electricity output for which the possibility of its being exceeded in the long term is estimated at 50%. Regarded as an average estimate for electricity production. An estimate of average electricity output for which the possibility of its being exceeded in the long term is estimated at 90%. Regarded as a conservative estimate for electricity production. SHPs – Small Hydroelectric Plants (Pequenas Centrais Hidrelétricas, in Portuguese). Regulated market SHPs The Spot Market Price (Preço de Liquidação das Diferenças – ‘Differences Settlement Price’), published weekly by the CCEE. Power Purchase Agreement – contract to buy power supply. The Program to Encourage Alternative Sources of Electric Power (Programa de Incentivos às Fontes Alternativas de Energia). Contracting environment in which prices are laid down by the regulator, Aneel. Small Hydroelectric Plants (Pequenas Centrais Hidrelétricas, or PCHs, in Portuguese). SPC Special-purpose company (in Portuguese, Sociedade de Propósito Específico or ‘SPE’). PLD PPA Proinfa In accordance with CVM Instruction 381 (of January 14, 2003), the Company reports that it has signed a contract with Deloitte Touche Tohmatsu Auditores Independentes (‘Deloitte’) to provide services of auditing of the accounting and financial statements of the Company and its subsidiaries. [email protected] 22 Individual and Consolidated Interim Financial Information As of June 30, 2015 1 CONTENTS (Page) Balance sheets ........................................................................................................................................................... 3 Income statements ..................................................................................................................................................... 5 Statements of comprehensive income ....................................................................................................................... 7 Statements of changes in equity ................................................................................................................................ 8 Statement of cash flows ............................................................................................................................................ 9 Statements of value added ....................................................................................................................................... 10 NOTES TO THE FINANCIAL STATEMENTS 1. General information......................................................................................................................................... 11 2. Basis of preparation ......................................................................................................................................... 18 3. Basis of consolidation...................................................................................................................................... 19 4. Authorizations ................................................................................................................................................. 20 5. Power sale........................................................................................................................................................ 22 6. Segment reporting ........................................................................................................................................... 24 7. Cash and cash equivalents and short-term investments ................................................................................... 26 8. Trade receivables ............................................................................................................................................. 26 9. Recoverable taxes ............................................................................................................................................ 27 10. Advances to suppliers ...................................................................................................................................... 27 11. Collaterals and restricted deposits ................................................................................................................... 28 12. Deferred taxes .................................................................................................................................................. 29 13. Investments ...................................................................................................................................................... 30 14. Property, plant and equipment ........................................................................................................................... 42 15. Trade payables ................................................................................................................................................. 50 16. Borrowings, financing and debentures ............................................................................................................ 51 17. Taxes payable .................................................................................................................................................. 58 18. Accounts payable / receivable - CCEE/Eletrobras .......................................................................................... 59 19. Provision for civil, tax and labor risks ............................................................................................................. 60 20. Provision for environmental costs ................................................................................................................... 61 21. Equity and shareholders’ compensation .......................................................................................................... 62 22. Net revenue ...................................................................................................................................................... 64 23. Costs and expenses .......................................................................................................................................... 65 24. Finance income (costs) .................................................................................................................................... 66 25. Income tax and social contribution .................................................................................................................. 67 26. Related-party transactions ............................................................................................................................... 68 27. Financial instruments and risk management.................................................................................................... 72 28. Earnings per share ........................................................................................................................................... 80 29. Assets classified as held for sale...................................................................................................................... 81 30. Insurance coverage .......................................................................................................................................... 84 31. Commitments .................................................................................................................................................. 86 32. Non-cash transactions ...................................................................................................................................... 86 33. Subsequent events ........................................................................................................................................... 86 2 BALANCE SHEETS As of June 30, 2015 In thousands of Brazilian reais - R$ ASSETS CURRENT ASSETS Cash and cash equivalents Short-term investments Trade receivables Accounts receivable - CCEE Recoverable taxes Prepaid expenses Collaterals and restricted deposits Dividends receivable Advances to suppliers Other receivables Assets classified as held for sale Note 7 7 8 18 9 11 13.4 10 29 Total current assets NONCURRENT ASSETS Accounts receivable - CCEE Related parties Collaterals and restricted deposits Deferred taxes Other receivables Investments Property, plant and equipment Construction in progress Total noncurrent assets TOTAL ASSETS 18 26 11 12 13 14 14 Consolidated 06/30/2015 12/31/2014 26,336 11,834 18,198 13,058 546 1,835 12,157 4,602 88,566 1,645,903 86,599 509,018 68,627 199 15,064 721 40 8,575 3,812 692,655 - Parent 06/30/2015 12/31/2014 1,391 3,535 85 9,218 324 1,835 2,561 10,945 4,604 34,498 655,185 28,598 171,027 8,476 219 40 539 6,033 4,118 219,050 - 1,734,469 692,655 689,683 219,050 2,214 3 131 115 692,395 1,242,508 2,117,733 4,055,099 6,100 160,487 2,495 150 713,312 2,175,130 1,791,913 4,849,587 3,094 115 1,445,107 36,242 801,358 2,285,916 55,063 115 1,973,507 30,285 758,554 2,817,524 5,789,568 5,542,242 2,975,599 3,036,574 The accompanying notes are an integral part of these interim financial information. 3 BALANCE SHEETS As of June 30, 2015 In thousands of Brazilian reais - R$ EQUITY AND LIABILITIES CURRENT LIABILITIES Trade payables Borrowings and financing Debentures Taxes payable Payroll and related taxes Accounts payable - CCEE/Eletrobras Provision for social and environmental costs Other payables Liabilities directly associated with assets classified as held for sale Note 15 16 16 17 18 20 29 Total current liabilities NONCURRENT LIABILITIES Borrowings and financing Debentures Deferred taxes Accounts payable - CCEE/Eletrobras Provision for social and environmental costs Provision for civil, tax and labor taxes Total noncurrent liabilities EQUITY Capital (-) Costs on issuance of shares Capital reserve Accumulated losses Total equity 16 16 12 18 20 19 Consolidated 06/30/2015 12/31/2014 278,319 484,016 7,576 15,827 12,006 6,476 515 804,735 982,855 100,200 355,442 884 17,561 13,974 22,339 6,686 79 517,165 - Parent 06/30/2015 12/31/2014 11,532 2,554 3,727 12,006 33 29,852 10,989 217 3,002 13,974 33 28,215 - - 1,787,590 517,165 29,852 28,215 891,510 649,451 149 1,928 4,956 88 1,548,082 1,917,051 572,315 424 15,627 9,940 79 2,515,436 491,763 88 491,851 498,639 79 498,718 2,568,006 (41,757) 55,830 (128,183) 2,453,896 2,567,997 (41,757) 55,176 (71,775) 2,509,641 2,568,006 (41,757) 55,830 (128,183) 2,453,896 2,567,997 (41,757) 55,176 (71,775) 2,509,641 5,789,568 5,542,242 2,975,599 3,036,574 21 TOTAL LIABILITIES AND EQUITY The accompanying notes are an integral part of these interim financial information. 4 INCOME STATEMENTS As of June 30, 2015 In thousands of Brazilian reais - R$ Note NET REVENUE COST OF SERVICES Depreciation Operating costs Charges on use of distribution system Total 119,534 57,095 222,577 110,696 14, 23 (21,256) (19,722) (5,903) (46,881) (17,348) (7,458) (2,627) (27,433) (52,902) (30,294) (11,922) (95,118) (34,861) (7,011) (4,975) (46,847) 72,653 29,662 127,459 63,849 (30,934) (577) (264) (31,775) (19,820) (424) (596) (20,840) (55,495) (1,300) (1,151) (57,946) (32,240) (734) (684) (33,658) (13,551) (45,326) (3,233) (24,073) (20,917) (78,863) (6,211) (39,869) 27,327 5,589 48,596 23,980 8,687 (55,063) (46,376) 19,144 (25,111) (5,967) 18,904 (110,432) (91,528) 26,155 (49,810) (23,655) (19,049) (378) (42,932) (7,779) (459) (8,238) (3,149) 205 (2,944) (12,769) (707) (13,476) (6,722) 331 (6,391) (27,287) (3,322) (56,408) (6,066) 23 14, 23 23 Share of profit (loss) of subsidiaries Total 01/01/2014 to 06/30/2014 22 GROSS PROFIT INCOME (EXPENSES) General and administrative Depreciation and amortization Other expenses 04/01/2015 to 06/30/2015 Consilidated 04/01/2014 01/01/2015 to to 06/30/2014 06/30/2015 13.3 PROFIT BEFORE FINANCE INCOME (COSTS) FINANCE INCOME (COSTS) Finance income Finance costs Total 24 (LOSS) PROFIT BEFORE INCOME TAX AND SOCIAL CONTRIBUTION Income tax and social contribution - current Income tax and social contribution - deferred Total 12.1 25 325 LOSS FOR THE PERIOD The accompanying notes are an integral part of these interim financial information. 5 INCOME STATEMENTS As of June 30, 2015 In thousands of Brazilian reais - R$ Note NET REVENUE COST OF SERVICES Depreciation Operating costs Total 22 14, 23 04/01/2015 to 06/30/2015 79 Parent 04/01/2014 01/01/2015 to to 06/30/2014 06/30/2015 101 223 01/01/2014 to 06/30/2014 101 (1,239) (184) (1,423) (451) (40) (491) (2,297) (299) (2,596) (833) (40) (873) (1,344) (390) (2,373) (772) (21,656) (656) (238) (22,550) (13,000) (420) (596) (14,016) (42,372) (1,290) (1,015) (44,677) (23,143) (727) (777) (24,647) 10,033 (12,517) 3,202 (10,814) 16,654 (28,023) 14,483 (10,164) PROFIT BEFORE FINANCE INCOME (COSTS) (13,861) (11,204) (30,396) (10,936) FINANCE INCOME (COSTS) Finance income Finance costs Total 1,093 (14,519) (13,426) 14,290 (6,408) 7,882 4,099 (30,111) (26,012) 17,247 (12,377) 4,870 (27,287) (3,322) (56,408) (6,066) 23 GROSS PROFIT INCOME (EXPENSES) General and administrative Depreciation and amortization Other expenses 14, 23 23 Share of profit (loss) of subsidiaries Total 13.3 24 (LOSS) PROFIT BEFORE INCOME TAX AND SOCIAL CONTRIBUTION Income tax and social contribution - current Income tax and social contribution - deferred Total 12.1 25 (27,287) LOSS FOR THE YEAR Loss per share (in Brazilian reais - R$) Basic Diluted - 28 28 - (3,322) - - (56,408) (6,066) (0.177) (0.177) (0.026) (0.026) The accompanying notes are an integral part of these interim financial information. 6 STATEMENTS OF COMPREHENSIVE INCOME As of June 30, 2015 In thousands of Brazilian reais - R$ 04/01/2015 to 06/30/2015 Loss for the period Other comprehensive income TOTAL COMPREHENSIVE INCOME FOR THE PERIOD (27,287) - (27,287) Consolidated 04/01/2014 01/01/2015 to to 06/30/2014 06/30/2015 (3,322) - (3,322) (56,408) - (56,408) Parent 01/01/2014 to 06/30/2014 (6,066) - (6,066) 04/01/2015 to 06/30/2015 (27,287) - (27,287) 04/01/2014 to 06/30/2014 (3,322) - (3,322) 01/01/2015 to 06/30/2015 (56,408) - (56,408) 01/01/2014 to 06/30/2014 (6,066) - (6,066) The accompanying notes are an integral part of these interim financial information. 7 STATEMENTS OF CHANGES IN EQUITY As of June 30, 2015 In thousands of Brazilian reais - R$ Capital Note BALANCES AT DECEMBER 31, 2013 Cost on issuance of shares Paid-in 1,017,697 Capital increase - issuance of shares Funds for future capital increase Loss for the period (36,112) 17 - - Capital reserve Reserve of benefits to employees settled with equity instruments Goodwill Accumulated losses 1 (36,052) - - - (6,066) 810,129 810,129 - 1,017,714 (36,112) 55,066 1 (42,118) BALANCES AT DECEMBER 31, 2014 2,567,997 (41,757) 55,175 1 (71,775) 654 - - (56,408) 55,829 1 (128,183) BALANCES AT JUNE 30, 2015 21.b 26.4 9 2,568,006 (41,757) Total parent´s equity 55,066 BALANCES AT JUNE 30, 2014 Capital increase - issuance of shares Recognition of share-based payment Loss for the period Funds for future capital increase - 17 810,129 (6,066) 1,804,680 2,509,641 - 1,000,600 9 654 (56,408) 2,453,896 The accompanying notes are an integral part of these interim financial information. 8 STATEMENT OF CASH FLOWS As of June 30, 2015 In thousands of Brazilian reais - R$ Note CASH FLOWS FROM OPERATING ACTIVITIES Loss for the period Adjustments to reconcile loss to cash provided by (used in) operating activities: Depreciation Finance charges on intragroup loans (net) Residual value of fixed assets disposed of Interest on debentures and borrowings Recognition of costs on debentures and borrowings Interst on short-term investments and collaterals Provision CCEE/Eletrobras, net Deferred taxes Expense on share-based payment Accured bonuses Provision for social and environmental costs Provision for civil, tax and labor taxes Share of profit (loss) of subsidiaries Consolidated 06/30/2015 06/30/2014 Parent 06/30/2015 06/30/2014 (56,408) (6,066) (56,408) (6,066) 54,202 1,403 101,752 1,151 (18,270) (19,999) 1,545 654 4,369 1,066 9 20,917 35,595 1,343 46,760 516 (14,974) 7,935 (717) 2,363 6,211 3,587 (75) 29,031 526 (4,024) 654 4,369 9 (16,654) 1,560 (342) 1,343 11,651 208 (5,859) 2,363 (14,483) (Increase) decrease in operating assets: Trade receivables Recoverable taxes Prepaid expenses Advances to suppliers Other receivables 27,154 (390) 111 (4,899) (1,094) (10,178) (1,293) (4,706) (880) (936) (85) (742) (105) (4,912) (486) (56) 539 (5,382) 233 (824) Increase (decrease) in operating liabilities: Trade payables Taxes payable Payroll and accrued vacation Accounts payable - CCEE / Eletrobras Other payables 3,101 10,147 (6,337) (5,718) 448 4,334 4,818 (3,716) (3,153) 170 543 725 (6,337) - 1,490 1,303 (3,716) 3 (5,614) (86,473) - (3,805) (56,019) - (33,359) - 15,310 22,827 3,602 (83,743) (725) Payment of income tax and social contribution Payment of interest on borrowings and financing Dividends received 14, 23 26 14 16.4 16.4 18.1 12 26.4 13.3 18.1 16.4 Net cash provided by (used in) operating activities CASH FLOWS FROM INVESTING ACTIVITIES Capital contribution in investees Short-term investments Collaterals and restricted deposits Purchase of property, plant and equipment Payment of property, plant and equipment purchased in prior years Intragroup loans - granted Intragroup loans - received Net cash provided by (used) in investing activities CASH FLOWS FROM FINANCING ACTIVITIES Payments of shares Funds for future capital increase Borrowings and financing Costs on debentures and borrowings Borrowings repaid Intragroup loans - receivable Intragroup loans - payable Net cash (used in) provided by financing activities 13.3 14, 32 21.b 16.4 16.4 16.4 (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS 479,210 (8,722) (516,565) (80,442) (126,519) (1) (42,194) (13,279) (298,961) (226,657) (581,092) (112,153) 171,516 (1,795) (44,831) (966) 53,010 64,781 (30,750) (190,195) 453 (375,895) (2,506) 64 (598,829) 9 383,958 (9,838) (307,138) 66,991 17 810,129 14,946 (1,228) (33,468) 790,396 9 (8,254) (8,245) 17 810,129 44 (1) 810,189 (36,701) 212,906 (27,207) 210,635 86,599 49,898 132,598 345,504 28,598 1,391 110,686 321,321 (36,701) 212,906 (27,207) 210,635 The accompanying notes are an integral part of these interim financial information. 9 STATEMENTS OF VALUE ADDED As of June 30, 2015 In thousands of Brazilian reais - R$ Note REVENUE Electric power sales Revenue from construction of own assets Parent 06/30/2015 06/30/2014 231,314 47,466 115,215 69,319 244 25,877 116 28,743 INPUTS ACQUIRED FROM THIRD PARTIES Cost of sales Materials, power, outside services and other (44,558) (36,850) (11,986) (26,302) (299) (24,637) (40) (17,301) Gross value added 197,372 146,246 1,185 11,518 (54,202) (35,595) (3,587) (1,560) 143,170 110,651 (2,402) 9,958 16,654 4,099 14,483 17,247 Depreciation and amortization 22 Consolidated 06/30/2015 06/30/2014 14, 23 NET WEALTH CREATED WEALTH RECEIVED IN TRANSFER Share of profit (loss) of subsidiaries Finance income TOTAL WEALTH TO BE DISTRIBUTED 13.3 (20,917) 22,819 (6,211) 31,942 145,072 136,382 18,351 41,688 17,955 6,700 3,897 1,520 14,372 2,660 2,916 1,119 17,955 6,700 3,897 1,520 14,372 2,660 2,916 1,119 25,921 - 15,198 4 5,023 - 3,968 4 Lessers and lessors: Interest Rentals Other 139,264 2,039 4,184 102,332 1,255 2,592 36,650 2,035 979 20,860 1,255 600 Loss for the period (56,408) (56,408) (6,066) TOTAL WEALTH DISTRIBUTED 145,072 18,351 41,688 DISTRIBUTION OF WEALTH Personnel Payroll and related taxes Management fees Benefits FGTS Taxes and contributions: Federal (6,066) 136,382 The accompanying notes are an integral part of these interim financial information. 10 NOTES TO THE FINANCIAL STATEMENTS As of June 30, 2015 In thousands of Brazilian reais - R$ 1. General information Renova Energia S.A. (“Renova” or “Company” or “Parent”) is a publicly-held company enrolled with CNPJ under no. 08.534.605/0001-74, with shares traded at BM&FBOVESPA (“BOVESPA”) under the Corporate Governance Level 2. Headquartered at Av. Roque Petroni Júnior, 999, 4o andar, City of São Paulo, State of São Paulo, the Company is primarily engaged in the development, implementation and operation of projects for generation of energy from renewable sources – wind, small hydroelectric plants (PCHs) and solar, and in the sale of power and related activities. The Company’s corporate purposes are the generation and sale of power of all types, manufacturing of fuel from natural and renewable sources, provision of logistics supporting services to companies or environmental advisory companies, provision of advisory services for power solutions relating to the generation, sale, transmission and other businesses involving alternative power sources, provision of engineering, construction and logistics services, and development of studies and projects related to the power generation plants of all types and systems, as well as the implementation, operation, maintenance and development, manufacturing and sale of parts and equipment for power generation, transmission and distribution, operation in the electric power generation market through solar power generation equipment, including, but not limited to, sale of solar power and equipment for generation, transmission and distribution of solar power, processing of polysilicon, ingots, wafers, cells, panels, modules and inverters, sale, lease, rental or other type for provision of power generation assets, and investment in other companies’ capital. As of June 30, 2015, the Company holds equity interests in the following direct and indirect subsidiaries which are in the operating and preoperating stages and under construction (“Renova Group”): Consolidation PCH Enerbras Centrais Elétricas S.A. (Holding) (a) Full Energética Serra da Prata S.A. Renova PCH LT DA. Chipley SP Participações S.A. (Holding) (b) Full in Enerbras (c) Full (d) Full Wind Farms Nova Renova Energia S.A. (Holding) Bahia Eólica Participações S.A. (Holding) (*) Centrais Eólicas Candiba S.A.(*) Centrais Eólicas Igaporã S.A. (*) Centrais Eólicas Ilhéus S.A. (*) Centrais Eólicas Licínio de Almeida S.A. (*) Centrais Eólicas Pindaí S.A. (*) C onsolidation (e) (e) (f) (f) (f) (f) (f) Full Full in Full in Full in Full in Full in Full in Nova Renova Bahia Eólica Bahia Eólica Bahia Eólica Bahia Eólica Bahia Eólica Equity inte re st - % 06/30/2015 12/31/2014 Dire ct Indire ct Dire ct Indire ct 100.00 100.00 99.99 99.99 99.00 99.00 100.00 - Equity inte re st - % 06/30/2015 12/31/2014 Dire ct Indire ct Dire ct Indire ct 99.99 99.99 100.00 100.00 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 - CONTINUED - 11 - CONTINUATION – Wind Farms Salvador Eólica Participações S.A. (Holding) (*) Centrais Eólicas Alvorada S.A.(*) Centrais Eólicas Guanambi S.A. (*) Centrais Eólicas Guirapá S.A. (*) Centrais Eólicas Nossa Senhora Conceição S.A.(*) Centrais Eólicas Pajeú do Vento S.A.(*) Centrais Eólicas Planaltina S.A. (*) Centrais Eólicas Porto Seguro S.A.(*) Centrais Eólicas Rio Verde S.A. (*) Centrais Eólicas Serra do Salto S.A. (*) Renova Eólica Participações S.A. (Holding) Centrais Eólicas da Prata S.A. Centrais Eólicas dos Araçás S.A. Centrais Eólicas Morrão S.A. Centrais Eólicas Seraíma S.A. Centrais Eólicas T anque S.A. Centrais Eólicas Ventos do Nordeste S.A. Centrais Eólicas Ametista S.A. Centrais Eólicas Borgo S.A. Centrais Eólicas Caetité S.A. Centrais Eólicas Dourados S.A. Centrais Eólicas Espigão S.A. Centrais Eólicas Maron S.A. Centrais Eólicas Pelourinho S.A. Centrais Eólicas Pilões S.A. Centrais Eólicas Serra do Espinhaço S.A. Alto Sertão Participações S.A. (Holding) Diamantina Eólica Participações S.A. (Holding) Centrais Eólicas São Salvador S.A. Centrais Eólicas Abil S.A. Centrais Eólicas Acácia S.A. Centrais Eólicas Angico S.A. Centrais Eólicas Folha da Serra S.A. Centrais Eólicas Jabuticaba S.A. Centrais Eólicas Jacarandá do Serrado S.A. Centrais Eólicas T aboquinha S.A. Centrais Eólicas T abua S.A. Centrais Eólicas Vaqueta S.A. Centrais Eólicas Unha d'Anta S.A. Centrais Eólicas Cedro S.A. Centrais Eólicas Vellozia S.A. Centrais Eólicas Angelim S.A. Centrais Eólicas Facheio S.A. Centrais Eólicas Sabiu S.A. Centrais Eólicas Barbatimão S.A. Centrais Eólicas Juazeiro S.A. Centrais Eólicas Jataí S.A. Centrais Eólicas Imburana Macho S.A. Centrais Eólicas Amescla S.A. Centrais Eólicas Umbuzeiro S.A. Centrais Eólicas Pau d'Água S.A. Centrais Eólicas Manineiro S.A. Consolidation (e) (f) (f) (f) (f) (f) (f) (f) (f) (f) (e) (g) (g) (g) (g) (g) (g) (h) (h) (h) (h) (h) (h) (h) (h) (h) (e) (e) (i) (j) (j) (j) (j) (j) (j) (j) (j) (j) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Full in Nova Renova Salvador Eólica Salvador Eólica Salvador Eólica Salvador Eólica Salvador Eólica Salvador Eólica Salvador Eólica Salvador Eólica Salvador Eólica Nova Renova Renova Eólica Renova Eólica Renova Eólica Renova Eólica Renova Eólica Renova Eólica Renova Eólica Renova Eólica Renova Eólica Renova Eólica Renova Eólica Renova Eólica Renova Eólica Renova Eólica Renova Eólica Alto Sertão Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Diamantina Equity inte re st - % 06/30/2015 12/31/2014 Dire ct Indire ct Dire ct Indire ct 100.00 100.00 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 100.00 100.00 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 99.99 100.00 99.99 100.00 99.99 100.00 99.99 100.00 99.99 100.00 99.99 100.00 99.99 100.00 99.99 100.00 99.99 100.00 99.99 99.00 99.99 99.00 99.99 99.00 99.99 99.99 99.00 99.99 99.00 99.99 99.99 99.99 99.00 99.99 99.99 99.99 99.00 99.99 99.00 99.99 99.00 - - CONTINUED – 12 - CONTINUATION – Wind Farms Centrais Elétricas Botuquara S.A. Centrais Eólicas Anísio T eixeira S.A. Centrais Eólicas Cabeça de Frade S.A. Centrais Eólicas Canjoão S.A. Centrais Eólicas Carrancudo S.A. Centrais Eólicas Conquista S.A. Centrais Eólicas Coxilha Alta S.A. Centrais Eólicas Ipê Amarelo S.A. Centrais Eólicas Jequitiba S.A. Centrais Eólicas Macambira S.A. Centrais Eólicas T amboril S.A. Centrais Eólicas T ingui S.A. Centrais Eólicas Alcacuz S.A. Centrais Eólicas Caliandra S.A. Centrais Eólicas Cansanção S.A. Centrais Eólicas Embiruçu S.A. Centrais Eólicas Ico S.A. Centrais Eólicas Imburana de Cabão S.A. Centrais Eólicas Lençóis S.A. Centrais Eólicas Putumuju S.A. Centrais Elétricas Itaparica S.A. Centrais Eólicas Bela Vista XIV LT DA. Centrais Eólicas Bela Vista XV LT DA. Centrais Eólicas Itapuã IV LT DA. Centrais Eólicas Itapuã V LT DA. Centrais Eólicas Itapuã VII LT DA. Centrais Eólicas Itapuã XV LT DA. Centrais Eólicas Itapuã XX LT DA. Centrais Eólicas Umburanas 1 S.A. Centrais Eólicas Umburanas 2 S.A. Centrais Eólicas Umburanas 3 S.A. Centrais Eólicas Umburanas 4 S.A. Centrais Eólicas Umburanas 5 S.A. Centrais Eólicas Umburanas 6 S.A. Centrais Eólicas Umburanas 7 LT DA. Centrais Eólicas Umburanas 8 LT DA. Centrais Eólicas Umburanas 9 LT DA. Centrais Eólicas Umburanas 10 LT DA. Centrais Eólicas Umburanas 11 LT DA. Centrais Eólicas Umburanas 12 LT DA. Centrais Eólicas Umburanas 13 LT DA. Centrais Eólicas Umburanas 14 LT DA. Centrais Eólicas Umburanas 15 LT DA. Centrais Eólicas Umburanas 16 LT DA. Centrais Eólicas Umburanas 18 LT DA. Powe r Sale Renova Comercializadora de Energia S.A. Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Full Equity inte re st - % 06/30/2015 12/31/2014 Dire ct Indire ct Dire ct Indire ct 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 100.00 99.00 99.00 99.00 99.00 100.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 - (l) Full Equity inte re st - % 06/30/2015 12/31/2014 Dire ct Indire ct Dire ct Indire ct 100.00 100.00 - (m) Full Equity inte re st - % 06/30/2015 12/31/2014 Dire ct Indire ct Dire ct Indire ct 100.00 100.00 - C onsolidation (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) (k) C onsolidation C onsolidation Holding Renovapar S.A. 13 PCH Brasil PCH S.A. Share d control (not consolidate d) (n) Indirect by Chipley Equity inte re st - % 06/30/2015 12/31/2014 Dire ct Indire ct Dire ct Indire ct 51.00 - (*) in May 2015 these investments were transferred to line of assets classified as held for sale, in the current assets (see note 29). (a) Enerbras Centrais Elétricas S.A. (“Enerbras”), a direct subsidiary, is a privately-held company, headquartered in the State of Bahia, exclusively engaged in holding equity interest in Energética Serra da Prata S.A. (“Espra”). (b) Energética Serra da Prata S.A. (“Espra”), an indirect subsidiary, is a privately-held company, exclusively engaged in the generation and sale of electric power from Serra da Prata Hydroelectric Complex, which are comprised of PCHs Cachoeira da Lixa, Colino I and Colino II, located in the State of Bahia. Under an authorization regime, 100% of its production is contracted with Centrais Elétricas Brasileiras (“Eletrobras”), in the context of the Alternative Electric Power Source Incentive Program (PROINFA). Espra started operations in 2008. (c) Renova PCH Ltda. (“Renova PCH”), a direct subsidiary, is mainly engaged in the construction, implementation, operation, maintenance and generation of water source power. The company is in the preoperating stage. (d) Chipley SP Participações S.A. (“Chipley”) is a privately-held company, mainly engaged in holding equity interests in other businesses, as partner or shareholder, which may include participating in consortia, and operating, directly or indirectly, as the case may be, electric power services, encompassing generation systems and other related services. (e) Privately-held companies, headquartered in São Paulo, which are mainly engaged in holding equity interests in other companies that operate, directly or indirectly, in the wind power generation. (f) Privately-held companies which are mainly engaged in the design, implementation, development and operation of specific wind farm, located in the State of Bahia. Under an authorization regime, 100% of its production is contracted with the Electric Power Trade Chamber (“CCEE”), in the context of the Reserve Auction – 2009 (“LER 2009”). (g) Privately-held companies which are mainly engaged in the design, implementation, development and operation of specific wind farm, located in the State of Bahia. Under an authorization regime, 100% of its production is contracted with CCEE, in the context of the Reserve Auction – 2010 (“LER 2010”). (h) Privately-held companies which are mainly engaged in the design, implementation, development and operation of specific wind farm, located in the State of Bahia. Under an authorization regime, 100% of its production is contracted with those distributors which declared demand in the New Power Auction – 2011 (“LEN 2011 [A3]”). (i) Centrais Eólicas São Salvador S.A. (“São Salvador”), direct subsidiary, is a privately-held company specifically engaged in the design, implementation, development and operation of São Salvador wind farm, located in the State of Bahia. Under an authorization regime, 1005 of its production is contracted with those distributors which declared demand in the New Power Auction – 2012 (“LEN 2012 [A-5]). The wind farm is under implementation. 14 (j) Direct subsidiaries which are mainly engaged in the design, implementation, development and operation of specific wind farm, located in the State of Bahia. Under an authorization regime, 100% of its production is contracted with CCEE, in the context of the Reserve Auction – 2013 (“LER 2013”). The wind farm is under implementation. (k) Direct subsidiaries which are mainly engaged in the construction, implementation, operation, maintenance and generation of wind power. These companies are under implementation. (l) Renova Comercializadora de Energia S.A. (“Renova Comercializadora”), a direct, wholly-owned subsidiary, which is mainly engaged in the sale of power of all types. (m) Renovapar S.A. (“Renovapar”), a direct subsidiary, wholly-owned subsidiary, is a privately-held company, mainly engaged in holding equity interests in other companies which operate, directly or indirectly, in the generation and sale of power of all types. (n) Brasil PCH S.A. (“Brasil PCH”) is a privately-held company, mainly engaged in holding equity interests in other businesses, as partner or shareholder, which may include conducting activities related to the management, construction, planning, operation, maintenance and development of renewable electric power generation projects through PCHs. As required by CVM Instruction 381/03, we disclose that in the period ended June 30, 2015 independent auditors Deloitte Touche Tohmatsu Auditores Independentes (“Deloitte”), which provides services to the Company and its subsidiaries and jointly-controlled subsidiaries, did not conduct any services not related to external audit that accounted for more than 5% of the annually contracted fees. 1.1 Admission of Cemig Geração e Transmissão S.A. (“CEMIG GT”) to the Company´s controlling block On September 29, 2014, CEMIG GT subscribed and paid in 87,186,035 common shares issued by Renova, in the total amount of R$1,550,072, through the capitalization of an advance for future capital increase, in the amount of R$810,129, made on March 31, 2014 and through the assignment to Renova of the amount relating to the advance for future capital increase in Chipley on February 14, 2014, in the amount of R$739,943. Upon the subscription and payment, a new Shareholders Agreement was entered into between Cemig GT, RR Participações and Light Energia. On October 27, 2014, the Company’s Board of Directors’ meeting approved the capital increase made by CEMIG GT, which subscribed and paid in 87,186,035 common shares issued by Renova, in the total amount of R$1,550,072, of which R$810,129 through the capitalization of the advance for future capital increase made in the Company and R$739,943 through assignment to the Company of the advance for future capital increase made by CEMIG GT in Chipley. In addition to CEMIG GT, preemptive rights relating to 10,866 common shares were exercised by the Company’s other shareholders, totaling 87,196,901 subscribed and paid-in common shares, in the total amount of R$1,550,265. 15 1.2 Acquisition of the shared control of Brasil PCH As disclosed by Renova in the material facts issued on August 8, 2013 and October 28, 2013, the Company’s subsidiary Chipley SP Participações S.A. acquired, on February 14, 2014, 51% of the shares in Brasil PCH, thus sharing its control. Brasil PCH holds 13 small hydroelectric plants (PCHs), with an installed capacity of 291 MW and average guaranteed power of 194 MW. All PCHs have long-term agreements (20 years) for the sale of electric power in the context of PROINFA (physical information and information relating to power capacity measures not revised by the independent auditors). The total amount of the acquisition of Brazil PCH was R$754,906, which comprises: (i) R$739,943 paid on February 14, 2014; (ii) R$23,522 paid on August 14, 2014 as a purchase price acquisition; less (iii) R$8,559 relating to the recognition and receipt of dividends originally due to the sellers of the shares in Brasil PCH. Because the company control is shared, Chipley’s equity interest in Brasil PCH is recorded under the equity method, as required by IFRS 11 / CPC 19 (R2) – Joint Arrangements. Additional information on the acquisition of jointly-controlled subsidiary Brasil PCH a) Considerations transferred Brasil PCH Considerations transferred: Cash transferred in cash and cash equivalents directly to shareholders Price adjustment Dividends originally due to the sellers of shares in Brasil PCH Net cash from acquisition 739,943 23,522 (8,559) 754,906 b) Allocation of purchase price The acquisition value paid was allocated to Brasil PCH’s assets and liabilities at fair values, including those intangible assets associated to the right to operate each authorization, which will be amortized over the remaining terms of the authorizations for the PCHs acquired. Consequently, as total amount paid was allocated to identifiable assets and liabilities, no residual value was allocated to goodwill. The purchase price allocation in accordance with the standards applicable to business combinations was made in the fourth quarter of 2014 and was supported by a business appraisal report prepared by an independent firm in conjunction with analyses conducted by the Company’s management. The acquisition of Brasil PCH was initially accounted for as of January 31, 2014, and the fair value of Brasil PCH’s assets and liabilities as of the acquisition date is shown below: Brasil PCH Assets Cash and cash equivalents 131,139 Trade receivables 34,047 Property, plant and equipment 1,593,984 Intangible assets - concession arrangement 1,785,877 Other assets 118,517 Total assets 3,663,564 16 Liabilities and equity Trade payables Borrowings and financing Deferred taxes Other liabilities 11.017 1,327,522 687,101 157,716 Equity 1,480,208 Total liabilities and equity 3,663,564 1.3 Commercial operation of wind farms under LER 2010 and LEN 2011 (A-3) The Reserve Power Agreements sets forth that the wind farms under LER 2010 shall start commercial operations on September 1, 2013. However, ANEEL Decision 1317, of April 28, 2014, changed this date so that it could coincide with the date on which Igaporã II Substation, under the responsibility of Companhia Hidro Elétrica do São Francisco (“Chesf”), starts commercial operations, granted an additional term of 30 days for the wind farms to start commercial operations, as from the date Igaporã II Substation starts commercial operations, and maintained the original date for ending the supply period under the agreement. In March 2014, the Company reversed the provisions previously recognized to meet the reimbursement amount due by the SPEs (clause 11 of the Reserve Power Agreement), in the amount of R$7,399, recorded in balance sheet line item Trade payables – CCEE/Eletrobras, R$4,645 out of which relating to the year ended December 31, 2014 (see note 23). For the New Power Agreements under LEN 2011 (A-3), ANEEL Decision 571, of March 11, 2014, changed the starting supply date of CCEARs so that it could coincide with the date on which the transmission facilities under Concession Arrangement 19/2012 start commercial operations, granted an additional term of 30 days for starting commercial activities, as from the date the transmission facilities are made available, and maintained the supply period of 19 years and 10 months under the agreement. The wind farms under LER 2010 started commercial operations on October 11, 2014, under ANEEL Decision 4108. On March 4, 2015, four, out of the nine, farms which traded power under LEN 2011 (A-3) started commercial operations connected to the same transmission line as that which serves the farms under LER 2009 and LER 2010 (Igaporã II). The other five farms will be connected to Igaporã III line, which, according to the Transmission Projects Schedule (SIGET/ANEEL), is scheduled to be delivered on September 30, 2015. 1.4 Impact of new laws 1.4.1 Provisional Act 627/2013 (“MP 627”) – Law 12973/2014 On November 11, 2013, MP 627 was enacted and significantly changed the income tax and social contribution rules, among others. The provisions set forth in MP 627 will become mandatory beginning calendar year 2015, with early adoption beginning 2014 being allowed. Management analyzed the tax effects of new provisions and concluded that the distributions of dividends and/or interest on capital were not greater than those recorded in accordance with accounting methods and criteria effective as at December 31, 2007. Accordingly, according to Management, no additional tax charges will be recorded in addition to the profit sharing over the last five years. Management elected to early adopt such rules beginning calendar year 2014. 17 MP 627 was converted into Law 12973, of May 13, 2014. 1.5 Net working capital On September 30, 2014, the consolidated current liabilities of the Company is R$1,787,590, while the current assets is R$1,734,469. The negative working capital is due mainly to the bridge loan signed with BNDES of R$418,000. The bridge loan matures on June 15, 2016 or in long-term financing agreement for the disbursement date to be signed between BNDES and the Company, whichever comes first. The Company's management has been conducting actions in order to improve its financial structure and working capital that include structuring loans with longer appropriate to the current needs and deadlines. The Company is in final arrangements for framing next to the stretching BNDES of its debt through long-term financing contract, which will replace the bridge loans taken from BNDES. In addition, the Company also announced the approval of the transaction with Global Terraform, divided into two phases (Phase I and Phase II). In Phase I, approved the entering into purchase and sale agreements amounting to R$587,000 and stock exchange agreement in the amount of R$1,026,000. In Phase II, it approved the entering into swap agreements in the amount of R$13,400,000 (notes 29, 33.1 and 33.2). 2. Basis of preparation 2.1 Statement of compliance The individual financial statements have been prepared in accordance with accounting practices adopted in Brazil (“BR GAAP”), according to guidelines issued by the Accounting Pronouncements Committee (“CPC”) (especially CPC 21 (R1) – Interim Financial Statements) and the standards set forth by the Brazilian Securities and Exchange Commission (“CVM”). The consolidated financial statements have been prepared in accordance with accounting practices adopted in Brazil (“BR GAAP”) and with the International Financial Reporting Standards ("IFRS") issued by the International Accounting Standards Board (IASB). They were prepared and are presented in accordance with CPC 21 (R1) and IAS 34 and the standards set forth by the Brazilian Securities and Exchange Commission (CVM). The Company also follows the guidance in the Accounting Manual for the Brazilian Electricity Industry and standards established by ANEEL. The accounting practices and criteria adopted in the preparation of these interim financial statements are consistent with those adopted in preparing the financial statements of December 31, 2014. The issue of individual and consolidated interim financial information, expressed in thousands of reais and rounded to the nearest thousand, unless other stated, were approved for issuance, filing with CVM and submittal to the Annual Shareholders Meeting, as authorized by the Board of Directors, on August 4, 2015. 18 2.2 Basis of preparation, basis for measurement and significant accounting practices The remaining information related to the basis for preparation, presentation of the Interim Financial Information and summary of significant accounting practices have not suffered relevant alterations in relation to those disclosed in note 2 to the annual financial statements for the year ended December 31, 2014, published on March 5, 2015 in the newspapers Valor Econômico, Diário Oficial de São Paulo and made available by means of the following electronic sites: www.cvm.gov.br, www.bmfbovespa.com.br, www.renovaenergia.com.br/ri . For the Accounting Pronouncements and Interpretation that were prevailing as at December 31, 2014, there were no significant alterations for these interim financial statements in relation to those disclosed in Note 2 to the financial statements as at December 31, 2014. For accounting Pronouncements and Interpretations that prevail as of January 1, 2015, as disclosed in note 2 to the financial statements for the year ended December 31, 2014, there are not relevant impacts for the Company, subsidiaries or jointly-owned subsidiaries. 3. Basis of consolidation The financial statements of the subsidiaries referred to in note 1 were consolidated. The main consolidation procedures are as follows: • elimination of intercompany asset and liability balances between consolidated companies; • elimination of the Parent’s interests in the equity of its subsidiaries, directly and indirectly; • elimination of revenues and expenses and finance costs between the consolidated companies. 19 4. Authorizations 4.1. Regulated market (ACR) Ref. Contract ANEEL Resolution Resolution date Authorized period Installed production capacity* PROINFA PROINFA PROINFA 697 695 703 12/24/2003 12/24/2003 12/24/2003 30 years 30 years 30 years 14.80 MW 16.00 MW 11.00 MW Wind Farms Ref. Contract MME Ordinance Ordinance date Authorized period Installed production capacity* Centrais Eólicas Alvorada S.A. Centrais Eólicas Candiba S.A. Centrais Eólicas Guanambi S.A. Centrais Eólicas Guirapá S.A. Centrais Eólicas Igaporã S.A. Centrais Eólicas Ilhéus S.A. Centrais Eólicas Licínio de Almeida S.A. Centrais Eólicas Nossa Senhora Conceição S.A. Centrais Eólicas Pajeú do Vento S.A. Centrais Eólicas Pindaí S.A. Centrais Eólicas Planaltina S.A. Centrais Eólicas Porto Seguro S.A. Centrais Eólicas Rio Verde S.A. Centrais Eólicas Serra do Salto S.A. Centrais Eólicas Morrão S.A. Centrais Eólicas da Prata S.A. Centrais Eólicas dos Araçás S.A. Centrais Eólicas Seraíma S.A. Centrais Eólicas Tanque S.A. Centrais Eólicas Ventos do Nordeste S.A. Centrais Eólicas Ametista S.A. Centrais Eólicas Borgo S.A. Centrais Eólicas Caetité S.A. Centrais Eólicas Dourados S.A. Centrais Eólicas Espigão S.A. Centrais Eólicas Maron S.A. Centrais Eólicas Pelourinho S.A. Centrais Eólicas Pilões S.A. Centrais Eólicas Serra do Espinhaço S.A. Centrais Eólicas São Salvador S.A. Centrais Eólicas Abil S.A. Centrais Eólicas Acácia S.A. Centrais Eólicas Angico S.A. Centrais Eólicas Folha de Serra S.A. Centrais Eólicas Jabuticaba S.A. Centrais Eólicas Jacaranda do Cerrado S.A. Centrais Eólicas Taboquinha S.A. Centrais Eólicas Tabua S.A. Centrais Eólicas Vaqueta S.A. Centrais Eólicas Umburanas 1 S.A. (Umburanas 1) Centrais Eólicas Umburanas 1 S.A. (Umburanas 2) Centrais Eólicas Umburanas 1 S.A. (Umburanas 3) Centrais Eólicas Umburanas 2 S.A. (Umburanas 4) Centrais Eólicas Umburanas 2 S.A. (Umburanas 5) Centrais Eólicas Umburanas 2 S.A. (Umburanas 6) Centrais Eólicas Umburanas 3 S.A. (Umburanas 7) Centrais Eólicas Umburanas 3 S.A. (Umburanas 8) Centrais Eólicas Umburanas 3 S.A. (Umburanas 9) LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 05/2010 LER 05/2010 LER 05/2010 LER 05/2010 LER 05/2010 LER 05/2010 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 06/2012 LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 695 691 700 743 696 690 692 693 694 699 697 698 742 689 268 177 241 332 330 161 135 222 167 130 172 107 168 128 171 162 109 123 111 115 113 116 114 110 132 390 397 398 388 389 415 550 551 400 08/05/2010 08/05/2010 08/06/2010 08/19/2010 08/05/2010 08/05/2010 08/05/2010 08/05/2010 08/05/2010 08/05/2010 08/05/2010 08/05/2010 08/19/2010 08/05/2010 04/20/2011 03/25/2011 04/07/2011 05/27/2011 05/26/2011 03/18/2011 03/14/2012 04/13/2012 03/21/2012 03/13/2012 03/22/2012 03/08/2012 03/21/2012 03/13/2012 03/22/2012 05/22/2013 03/19/2014 03/24/2014 03/19/2014 03/19/2014 03/19/2014 03/19/2014 03/19/2014 03/19/2014 03/28/2014 08/01/2014 08/04/2014 08/04/2014 08/01/2014 08/04/2014 08/12/2014 11/27/2013 11/27/2013 08/04/2014 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 8.00 MW 9.60 MW 20.80 MW 28.80 MW 30.40 MW 11.20 MW 24.00 MW 28.80 MW 25.60 MW 24.00 MW 27.20 MW 6.40 MW 30.40 MW 19.20 MW 30.24 MW 21.84 MW 31.86 MW 30.24 MW 30.00 MW 23.52 MW 28.56 MW 20.16 MW 30.24 MW 28.56 MW 10.08 MW 30.24 MW 21.84 MW 30.24 MW 18.48 MW 22.40 MW 23.70 MW 16.20 MW 8.10 MW 21.00 MW 9.00 MW 21.00 MW 21.60 MW 15.00 MW 23.40 MW 27.00 MW 27.00 MW 18.90 MW 18.90 MW 18.90 MW 21.60 MW 24.30 MW 24.30 MW 18.00 MW PCH Cachoeira da Lixa Colino 2 Colino 1 20 - CONTINUED - CONTINUATION – Wind Farms Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Umburanas 4 S.A. (Umburanas 10) Umburanas 4 S.A. (Umburanas 11) Umburanas 4 S.A. (Umburanas 12) Umburanas 5 S.A. (Umburanas 13) Umburanas 5 S.A. (Umburanas 14) Umburanas 5 S.A. (Umburanas 15) Umburanas 6 S.A. (Umburanas 16) Umburanas 6 S.A. (Umburanas 18) Itapuã VII Ltda. (EOL Mulungu) Itapuã VII Ltda. (EOL Quina) Itapuã VII Ltda. (EOL Pau Santo) UFV (Usina Fotovoltaica) Centrais Eólicas Itapuã IV Ltda. (UFV Caetité I) Centrais Eólicas Itapuã IV Ltda. (UFV Caetité II) Centrais Eólicas Itapuã V Ltda. (UFV Caetité IV) Centrais Eólicas Itapuã V Ltda. (UFV Caetité V) Ref. Contract MME Ordinance Ordinance date Authorized period Installed production capacity* LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LER 2014 LER 2014 LER 2014 399 407 433 434 435 436 437 438 241 242 285 08/04/2014 08/08/2014 08/21/2014 08/21/2014 08/21/2014 08/21/2014 08/21/2014 08/21/2014 06/01/2015 06/01/2015 06/26/2015 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 21.00 MW 15.00 MW 22.80 MW 18.90 MW 24.90 MW 18.90 MW 27.00 MW 8.10 MW 14.7 MW 10.80 MW 18.00 MW Ref. Contract LER 2014 (Leilão 08/2014) LER 2014 (Leilão 08/2014) LER 2014 (Leilão 08/2014) LER 2014 (Leilão 08/2014) MME Ordinance 246 245 244 243 Ordinance date 06/01/2015 06/01/2015 06/01/2015 06/01/2015 Authorized period 35 years 35 years 35 years 35 years Installed production capacity* 29.75 MW 29.75 MW 29.75 MW 10.5 MW Ref. Contract MME Ordinance Ordinance date Authorized period Installed production capacity* ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL ACL 5099 5092 5093 5098 5085 5081 5088 5084 5091 5096 5087 5124 5128 5125 5126 5094 5090 5101 5086 5089 5102 5170 5097 5100 5083 5095 5082 03/26/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 04/01/2015 04/01/2015 04/01/2015 04/01/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 04/27/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 03/26/2015 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 13.5 MW 21.6 MW 16.2 MW 16.5 MW 16.2 MW 16.2 MW 18.9 MW 13.5 MW 21.6 MW 13.5 MW 21.9 MW 8.1 MW 13.5 MW 14.4 MW 18 MW 13.5 MW 5.7 MW 21.6 MW 6 MW 18.9 MW 24.3 MW 19.2 MW 18 MW 8.1 MW 21.6 MW 27 MW 18.9 MW 4.2. Free-trading market (ACL) Wind Farms Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Eólicas Amescla S.A. Eólicas Angelim S.A. Eólicas Barbatimão S.A. Eólicas Facheio S.A. Eólicas Imburana Macho S.A. Eólicas Jataí S.A. Eólicas Juazeiro S.A. Eólicas Sabiu S.A. Eólicas Umbuzeiro S.A. Eólicas Unha d'Anta S.A. Eólicas Vellozia S.A. Elétricas Itaparica S.A. Elétricas Itaparica S.A. Eólicas Manineiro S.A. Eólicas Pau D'Água S.A. Eólicas Arapuã Ltda. Eólicas Bela Vista I Ltda. Eólicas Botuquara Ltda. Eólicas Canjoão S.A. Eólicas Carrancudo S.A. Eólicas Conquista Ltda. Eólicas Coxilha Alta Ltda. Eólicas Ipê Amarelo S.A. Eólicas Jequitibá S.A Eólicas Macambira S.A. Eólicas Tamboril S.A. Eólicas Tingui S.A. - CONTINUED - 21 -CONTINUATIONWind Farms Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Ref. Contract MME Ordinance Ordinance date Authorized period Installed production capacity* ACL ACL ACL ACL ACL ACL ACL ACL 5118 5119 5121 5122 5123 5171 5127 5120 04/01/2015 04/01/2015 04/01/2015 04/01/2015 04/01/2015 04/27/2015 04/01/2015 04/01/2015 35 years 35 years 35 years 35 years 35 years 35 years 35 years 35 years 18.9 MW 5.4 MW 6 MW 10.8 MW 20.1 MW 10.8 MW 14.7 MW 14.7 MW Alcaçuz S.A. Caliandra S.A. Embiruçu S.A. Ico S.A. Imburana de Cabão S.A. Lençóis Ltda. Putumuju S.A. Recôncavo I Ltda. (*) Information not reviewed by independent auditors 5. Power sale 5.1. Regulated market (ACR) Group company Ref. Contract S mall hydroelectric plants: Caxoeira da Lixa Colino1 Colino2 PROINFA PROINFA PROINFA Wind power generation Centrais Eólicas Alvorada S.A. Centrais Eólicas Candiba S.A. Centrais Eólicas Guanambi S.A. Centrais Eólicas Guirapá S.A. Centrais Eólicas Igaporã S.A. Centrais Eólicas Ilhéus S.A. Centrais Eólicas Licínio de Almeida S.A. Centrais Eólicas NS Sr. Conceição S.A. Centrais Eólicas Pajeú do Vento S.A. Centrais Eólicas Pindaí S.A. Centrais Eólicas Planaltina S.A. Centrais Eólicas Porto Seguro S.A. Centrais Eólicas Rio Verde S.A. Centrais Eólicas Serra do Salto S.A. Buyer Amounts Annual p ower Original contract contracted amount (MWh) Historical price M Wh (R$) Adjusted price M Wh (R$) Effective Term Inflation Tariff adjustment adjustment Final index month Initial Eletrobras Eletrobras Eletrobras 172,450 153,243 219,008 65,349 87,337 61,057 121.35 121.35 121.35 217.41 217.41 217.41 M ay 2008 Sep 2008 July 2008 April 2028 Aug 2028 June 2008 IGP-M IGP-M IGP-M June June June LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 LER 03/2009 CCEE CCEE CCEE CCEE CCEE CCEE CCEE CCEE CCEE CCEE CCEE CCEE CCEE CCEE 76,233 101,644 203,287 330,341 334,900 128,808 254,109 309,138 283,377 279,520 309,138 51,523 406,574 177,876 26,280 35,040 70,080 113,880 113,880 43,800 87,600 105,120 96,360 96,360 105,120 17,520 140,160 61,320 144.94 144.94 144.94 144.94 146.94 146.94 144.94 146.94 146.94 144.94 146.94 146.94 144.94 144.94 190.12 190.12 190.12 190.12 192.75 192.75 190.12 192.75 192.75 190.12 192.75 192.75 190.12 190.12 July July July July July July July July July July July July July July June 2032 June 2032 June 2032 June 2032 June 2032 June 2032 June 2032 June 2032 June 2032 June 2032 June 2032 June 2032 June 2032 June 2032 IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA July July July July July July July July July July July July July July LER 05/2010 LER 05/2010 LER 05/2010 LER 05/2010 LER 05/2010 LER 05/2010 CCEE CCEE 214,701 295,480 88,476 121,764 121.25 121.25 154.69 154.69 Aug 2033 Aug 2033 IPCA IPCA September September CCEE 312,486 128,772 121.25 154.69 Nov 2014 Nov 2014(**) Aug 2033 IPCA September CCEE 325,241 134,028 121.25 154.69 Nov 2014(**) Aug 2033 IPCA September CCEE 295,480 121,764 121.25 154.69 Nov 2014(**) Aug 2033 IPCA September CCEE 214,701 88,476 121.25 154.69 Nov 2014(**) Aug 2033 IPCA September Distributors 238,148 121,764 101.53 109.61 Feb 15 (**) April 2035 IPCA January Distributors 166,189 84,972 100.73 108.74 July 15 (**) April 2035 IPCA January Distributors 245,001 125,268 100.90 108.92 July 15 (**) April 2035 IPCA January Distributors 226,155 115,632 100.87 108.89 Feb 15 (**) April 2035 IPCA January Distributors 83,951 42,924 102.07 110.19 July 15 (**) April 2035 IPCA January Distributors Distributors 236,434 202,168 120,888 103,368 101.32 101.23 109.37 109.28 Feb 15 (**) IPCA IPCA January January Distributors 224,441 114,756 100.09 108.05 July 15 Feb 15 (**) April 2035 April 2035 April 2035 IPCA January Centrais Eólicas Serra do Espinhaço S.A.(*) LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 LEN 02/2011 Distributors 152,483 77,964 99.69 107.62 Jul 15 (**) April 2035 IPCA January Centrais Eólicas São Salvador S.A. LEN 06/2012 Distributors 158,583 89,352 88.68 90.07 Jan 2017 Dec 2036 IPCA January Centrais Eólicas da Prata S.A. Centrais Eólicas dos Araçás S.A. Centrais Eólicas M orrão S.A. Centrais Eólicas Seraíma S.A. Centrais Eólicas Tanque S.A. Centrais Eólicas Ventos do Nordeste S.A. Centrais Eólicas Ametista S.A.(*) Centrais Eólicas Borgo S.A.(*) Centrais Eólicas Caetité S.A.(*) Centrais Eólicas Dourados S.A.(*) Centrais Eólicas Espigão S.A.(*) Centrais Eólicas M aron S.A.(*) Centrais Eólicas Pelourinho S.A.(*) Centrais Eólicas Pilões S.A.(*) 2012 2012 2012 2012 2012 2012 2012 2012 2012 2012 2012 2012 2012 2012 Nov 2014 (**) (**) (**) - CONTINUED - 22 - CONTINUATION – Group company Centrais Eólicas Centrais Eólicas Centrais Eólicas Centrais Eólicas Centrais Eólicas Centrais Eólicas Centrais Eólicas Centrais Eólicas Centrais Eólicas Abil S.A. Acácia S.A. Angico S.A. Folha de Serra S.A. Jabuticaba S.A. Jacaranda do Cerrado S.A. Taboquinha S.A. Tabua S.A. Vaqueta S.A. CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas CRNV&M (Umburanas 1) (*) 2) (*) 3) (*) 4) (*) 5) (*) 6) (*) 7) (*) 8) (*) 9) (*) 10) (*) 11) (*) 12) (*) 13) (*) 14) (*) 15) (*) 16) (*) 18) (*) Amounts Annual p ower Original contract contracted amount (MWh) Ref. Contract Buyer LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 LER 05/2013 CCEE CCEE CCEE CCEE CCEE CCEE CCEE CCEE CCEE 202,880 136,979 75,789 175,459 82,011 172,488 186,909 135,406 197,191 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 LEN 10/2013 Distributors Distributors Distributors Distributors Distributors Distributors Distributors Distributors Distributors Distributors Distributors Distributors Distributors Distributors Distributors Distributors Distributors 98,245 99,774 83,590 82,621 81,692 71,979 28,764 28,169 72,059 82,967 67,410 92,611 81,843 108,051 81,086 97,626 35,807 96,360 60,444 34,164 84,972 39,420 83,220 88,476 64,824 93,732 123,516 121,764 85,848 84,972 81,468 98,988 98,988 109,500 75,336 91,104 63,072 102,492 87,600 104,244 82,344 111,252 36,792 Effective Term Inflation Tariff adjustment adjustment Final index month Historical price M Wh (R$) Adjusted price M Wh (R$) 105.20 113.70 111.30 103.60 104.38 103.99 105.99 104.80 105.55 112.05 121.11 118.55 110.35 111.18 110.76 112.89 111.63 112.42 Sep Sep Sep Sep Sep Sep Sep Sep Sep 2015 2015 2015 2015 2015 2015 2015 2015 2015 Aug 2035 Aug 2035 Aug 2035 Aug 2035 Aug 2035 Aug 2035 Aug 2035 Aug 2035 Aug 2035 IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA September September September September September September September September September 119.83 119.80 120.92 121.46 121.60 120.27 121.52 119.43 121.95 119.87 120.85 120.15 119.93 121.30 121.41 121.60 120.64 119.83 119.80 120.92 121.46 121.60 120.27 121.52 119.43 121.95 119.87 120.85 120.15 119.93 121.30 121.41 121.60 120.64 M ay M ay M ay M ay M ay M ay M ay M ay M ay M ay M ay M ay M ay M ay M ay M ay M ay 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 2018 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 Dec 2037 IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA IPCA January January January January January January January January January January January January January January January January January Initial * The p rice includes ICB (Benefit Cost Index) and CEC (Short-term Economic Cost). ** Original date pursuant to Decision 1317, dated April 28, 2014, and Decision 571, dated M arch 11, 2014. 5.2. Free-trading market (ACL) The Company is currently a party to various free trading market agreements totaling 901.8 MW(*) of installed capacity. In August 2011, the Company entered into a power purchase and sale commitment with Light Energia, whereby Renova will deliver average 200.4 MW(*) of wind power, corresponding to 403.5 MW(*) of installed capacity; wind farms will begin to generate power between 2015 and 2016. Out of the total amount of 200.4 MW(*), 1/3 of the power was traded with LIGHTCOM Comercializadora de Energia S.A. and 2/3 with CEMIG GT. Other agreements were negotiated in the free market, whereby Renova will deliver average 77.0 MW(*) of wind and solar power, corresponding to 160.2 MW of installed capacity. The wind farms that will satisfy these agreements will start to operate in 2015, 2016 and 2017. Additionally, in March 2014, Renova Comercializadora traded average 308.0 MW with CEMIG GT, corresponding to 676.2 MW(*) of installed capacity. On July 17, 2014, a Share Purchase and Sale Investment Agreement was entered into among the Company and Companhia Energética de Minas Gerais (“CEMIG”), which will hold a 50% stake in the project. The wind farms that will satisfy this agreement will start to generate power in 2018. On October 22, 2014, the Administrative Council of Economic Defense (CADE) approved the execution of such Investment Agreement. 23 Pursuant to the Investment Agreement, the transaction will be carried out upon the acquisition by CEMIG of 50% of the voting and total capital of a publicly-held company (SPE) to be established by the Company, in which all agreements relating to the Wind Project will be paid in. The acquisition price will correspond to up to R$113,450 relating to 50% of the amounts of advances relating to agreements already entered into by the Company, adjusted by the fluctuation of the interbank deposit rate (“CDI”) from effective disbursement by the Company up to the date of payment by CEMIG. After the acquisition, CEMIG and Renova will share the future investment of the Wind Project proportionally to their share in the SPE’s capital. (*) Information not reviewed by independent auditors. 6. Segment reporting The Company has four reportable segments representing its strategic business units, besides the performance of its administrative activities. Such strategic business units offer different renewable power sources and are administered separately as they require different technologies, developments and operating characteristics. The operations on each one of the Company´s reportable segments can be summarized as follows: a) PCH – This segment is responsible for the development, implementation and operation of water source power generation projects. This segment includes the development of studies on inventories and basic projects and power generation. The PCHs are under operation stage for comparison between the periods ended June 30, 2015 and 2014. b) Wind – This segment is responsible for the development, implementation and operation of wind source power generation projects. It includes wind measurement, leased land, implementation and power generation. The plants which won LER 2009 became able to operate in the second half of 2012. The plants which won LER 2010 started commercial operations on October 11, 2014. Four plants which traded power under LEN 2011 (A-3) started commercial operations on March 4, 2015 and other five plants are ready to operate and await the transmission line (see note 1.3). c) Solar – This segment is responsible for the development, implementation and operation of the solar source power generation projects. It includes measurements, development of solar projects for generation in high scale and distributed generation, as well as the sale of goods and services. d) Sale – This segment is responsible for the power sale of all types. As at June 30, 2015 and 2014, segment reporting for result, and as at June 30, 2015 and December 31, 2014, segment reporting for profit or loss and total assets and liabilities are broken down as follows: 24 06/30/2015 Net revenue Non-manageable costs Gross margin Manageable costs Share of profit (loss) of subsidiaries Depreciation Finance income Finance costs Income tax and social contribution (Loss) profit PCH 11,752 (215) 11,537 (4,496) (20,917) (1,857) 3,411 (3,746) (1,335) (17,403) Wind 205,693 (11,705) 193,988 (33,234) (48,758) 11,355 (76,568) (12,141) 34,642 Solar 223 223 (299) (76) Total assets Total liabilities 926,986 117,860 3,989,084 2,694,103 410 - Sale 4,909 (2) 4,907 (5,525) 114 (7) (511) Admin. (43,386) (3,587) 4,024 (30,111) (73,060) Consolidated 222,577 (11,922) 210,655 (86,940) (20,917) (54,202) 18,904 (110,432) (13,476) (56,408) 3,848 2,008 869,240 521,701 5,789,568 3,335,672 5,423 5,423 (5,451) (28) Admin (23,850) (727) 16,610 (12,082) (20,049) Consolidated 110,696 (4,975) 105,721 (39,935) (6,211) (35,595) 26,155 (49,810) (6,391) (6,066) 6,323 3,700 531,896 364,486 4,457,054 2,652,374 06/30/2014 Net revenue Non-manageable costs Gross margin Manageable costs Share of profit (loss) of subsidiaries Depreciation Finance income Finance costs Income tax and social contribution Profit (loss) Total assets Total liaibilities PCH 8,943 (312) 8,631 (3,280) (6,211) (2,784) 1,982 (4,055) (1,139) (6,856) Wind 96,229 (4,663) 91,566 (7,285) (32,084) 7,563 (33,673) (5,252) 20,835 Solar 101 101 (69) 32 271,219 125,378 3,647,071 2,158,810 545 - Sale 25 7. Cash and cash equivalents and short-term investments Note Cash Banks checking account Short-term investments Transfer to assets held for sale: Cach and cash equivalents Short-term investments Consolidated 06/30/2015 12/31/2014 71 44,033 53,272 97,376 29.2 29.2 Stated as: Cach and cash equivalents Short-term investments Total Parent 06/30/2015 12/31/2014 22 56,898 538,697 595,617 (23,562) (35,644) 38 669 4,219 4,926 - - 9 785 198,831 199,625 38,170 595,617 4,926 199,625 26,336 11,834 38,170 86,599 509,018 595,617 1,391 3,535 4,926 28,598 171,027 199,625 Short-term and highly liquid investments which can be immediately converted into a known cash amount and are subject to an insignificant risk of change in value were classified as cash equivalents. These financial investments refer to fixed-income instruments under repurchase agreements yielding rates ranging from 100.5% to 102.37% of CDI. Those financial investments corresponding to investment funds which do not have characteristics of cash and cash equivalents were classified in line item short-term investments. The Company’s exposure to interest rate risks and a sensitivity analysis of its financial assets and financial liabilities are disclosed in note 27. 8. Trade receivables Consolidated Note Eletrobras Câmara de Comercialização de Energia Elétrica - CCEE Others Transfer to assets held for sale Total Parent Trade accounts receivable falling due Over due by 90 days 06/30/2015 12/31/2014 06/30/2015 2,634 1,931 979 5,544 4,744 - 26,221 - - 26,221 60,957 - 9,708 - 12/31/2014 - 9,708 2,926 85 38,563 1,931 979 41,473 68,627 85 (20,365) (1,931) (979) (23,275) 18,198 - - 18,198 29.2 - - 68,627 85 As of June 30, 2015, balances are comprised of receivables and over due, with average collection period of 24 days (Espra and the farms under LER 2009 and LER 2010) and 60 days (the farms under LEN 2011) for which losses on performance are not expected. 26 9. Recoverable taxes Note Consolidated 06/30/2015 12/31/2014 Withholding Income Tax IRPJ Corporate Income Tax (IRPJ) COFINS (tax on revenue) IRRF on short-term investments Social Contribution on Net Profit (CSLL) PIS (tax on revenue) Other recoverble taxes Total Transfer to assets held for sale 29.2 Total Parent 06/30/2015 12/31/2014 4,226 10,483 9 338 370 3 25 15,454 3,610 9,534 615 582 552 134 37 15,064 1,023 8,134 31 12 3 8 7 9,218 8,138 31 289 3 8 7 8,476 (2,396) - - - 9,218 8,476 13,058 15,064 10. Advances to suppliers Note Advances to suppliers Transfer to assets held for sale Total Consolidated 06/30/2015 12/31/2014 13,474 29.2 Parent 06/30/2015 12/31/2014 8,575 10,945 6,033 8,575 10,945 6,033 (1,317) 12,157 These advances relate to anticipation for legal services and others to the Company as well as the maintenance of its subsidiaries’ farms. 27 11. Collaterals and restricted deposits Note Consolidated 06/30/2015 12/31/2014 173,764 Collaterals and restricted deposits Transfer to assets held for sale 29.2 Parent 06/30/2015 12/31/2014 160,527 (171,926) - 1,835 40 - - Total 1,838 160,527 1,835 40 Stated as: Current Noncurrent Total 1,835 3 1,838 40 160,487 160,527 1,835 1,835 40 40 As at June 30, 2015, collaterals and restricted deposits including the balance classified as held for sale are broken down as shown below: Consolidated Company Collateral Contractual Subject 06/30/2015 12/31/2014 Renova Other Property lease/Other items 1,835 40 Total current 1,835 40 Company LER 2009 LER 2009 LER 2009 Espra Renova Eólica Collateral Special reserve O&M reserve SD reserve Guarantee Guarantee (c) Institution (a) (b) Rate Contractual Subject Consolidated 06/30/2015 12/31/2014 109,505 101,111 Citibank 98.70% CDI BNDES Financing Citibank 98.70% CDI BNDES Financing 4,760 4,536 Citibank BNB Itaú 98.70% CDI 98.70% CDI - BNDES Financing BNB Financing Debentures Total noncurrent 43,979 13,682 3 171,929 41,908 12,932 160,487 The balances refer to short-term fixed-income instruments linked to financing agreements with BNDES and Banco do Nordeste do Brasil (“BNB”). The Company can solely manage these short-term investments upon express authorization of BNDES and BNB. (a) Refers to collateral “Special reserve” under the BNDES agreement transferred by the SPEs’ mandatory bank to its direct parent companies. This reserve is entitled to receive the total exceeding resources from the central accounts maintained with the bank and not managed by the subsidiary in order to ensure the full payment of the installments for payment of principal and debt accessories. These collaterals may solely be managed by the subsidiary upon BNDES’ express authorization. (b) A reserve that the subsidiaries must maintain over the agreement to ensure the payments of the operation and maintenance agreement obligations (O&M). 28 (c) A reserve that the subsidiaries must maintain over the agreement to ensure the payments of the financing agreement obligations. 12. Deferred taxes Consolidated Assets Note PIS deferred COFINS deferred IRPJ deferred CSLL deferred Total Transfer to assets held for sale or liabilities directly related to assets held for sale 29.2 Liabilities 06/30/2015 12/31/2014 06/30/2015 12/31/2014 220 1,016 649 289 2,174 251 1,158 669 417 2,495 159 736 490 263 1,648 41 189 126 68 424 (2,043) - (1,499) - 131 2,495 149 424 Deferred taxes were recorded based on the differences between generated and effectively invoiced power (note 18). These deferred taxes were calculated using the rates based on the deemed income. 12.1. Changes, net (assets and liabilities) in deferred IRPJ and CSLL Consolidated Balance at December 31, 2013 Changes, net Balance at June 30, 2014 374 331 705 Balance at December 31, 2014 Changes, net Transfer to assets held for sale Balance at June 30, 2015 892 (707) (193) (8) 29 13. Investments 13.1 Breakdown of investments Investments in subsidiaries and jointly controlled entities are as follows: Company PCH Enerbras Centrais Elétricas S.A. (Holding) Renova PCH LTDA. Chipley SP Participações S.A. (Holding) Brasil PCH S.A. Consolidated 06/30/2015 12/31/2014 692,395 713,312 Parent 06/30/2015 12/31/2014 2,671 243 694,200 - 110,866 3 709,949 - Wind farms Nova Renova Energia S.A. Alto Sertão Participações S.A. (Holding) Centrais Eólicas Carrancudo S.A. Centrais Elétricas Botuquara S.A. Centrais Eólicas Alcacuz S.A. Centrais Eólicas Tamboril S.A. Centrais Eólicas Conquista S.A. Centrais Eólicas Coxilha Alta S.A. Centrais Eólicas Tingui S.A. Centrais Eólicas Cansanção S.A. Centrais Eólicas Macambira S.A. Centrais Eólicas Imburana de Cabão S.A. Centrais Eólicas Ipê Amarelo S.A. Centrais Eólicas Putumuju S.A. Centrais Eólicas Lençóis S.A. Centrais Eólicas Anísio Teixeira S.A. Centrais Eólicas Ico S.A. Centrais Eólicas Jequitiba S.A. Centrais Eólicas Caliandra S.A. Centrais Eólicas Canjoão S.A. Centrais Eólicas Cabeça de Frade S.A. Centrais Eólicas Embiruçu S.A. Centrais Eólicas Itapuã V LTDA. Centrais Eólicas Bela Vista XIV LTDA. Centrais Eólicas Umburanas 3 S.A. Centrais Elétricas Itaparica S.A. Outras participações (*) Renovapar S.A. - - 582,930 68,458 6,439 6,506 6,576 7,304 6,354 5,579 5,120 3,776 5,722 5,370 4,669 3,842 3,428 3,572 3,324 2,208 1,737 1,491 1,504 1,855 269 406 141 6,793 780 - 1,071,110 46,968 2,955 2,728 2,682 2,415 2,326 2,085 2,007 1,358 1,958 1,933 1,594 1,350 1,310 1,218 1,185 807 606 595 548 538 190 95 97 (323) 3 - Power sale Renova Comercializadora de Energia S.A. - - 1,865 2,351 1,445,132 1,973,507 Total 692,395 713,312 30 13.2 Information on investees The main information on subsidiaries and jointly controlled entities is broken down as follows: 06/30/2015 Company PCH Enerbras Centrais Elétricas S.A. (Holding) Renova PCH LTDA. Chipley SP Particip ações S.A. (Holding) Wind farms Nova Renova Energia S.A. Alto Sertão Particip ações S.A. (Holding) Centrais Eólicas Itap uã V LTDA. Centrais Eólicas Bela Vista XIV LTDA. Centrais Eólicas Umburanas 3 S.A. Centrais Elétricas Itaparica S.A. Outras particip ações (*) Renovapar S.A. Centrais Eólicas Carrancudo S.A. Centrais Elétricas Botuquara S.A. Centrais Eólicas Alcacuz S.A. Centrais Eólicas Tamboril S.A. Centrais Eólicas Conquista S.A. Centrais Eólicas Coxilha Alta S.A. Centrais Eólicas Tingui S.A. Centrais Eólicas Cansanção S.A. Centrais Eólicas M acambira S.A. Centrais Eólicas Imburana de Cabão S.A. Centrais Eólicas Ipê Amarelo S.A. Centrais Eólicas Putumuju S.A. Centrais Eólicas Lençóis S.A. Total number of shares Equity interest Renova (%) Capital 12/31/2014 Equity Profit (loss) for the year** Total number of shares Equity interest Renova (%) Capital Equity (equity deficiency) Proposed dividends Profit (loss) for the year 5,170,101 31,875 1,200 100.00 99.00 100.00 101,955 32 739,944 2,671 243 694,200 3,280 (7) (20,676) 5,170,101 31,875 1,200 100.00 99.00 100.00 101,955 32 1 110,866 3 709,949 15,966 - 2,697 (6) (24,736) 870,083,000 12,163,808 100 10,000 51,130 100 100 21,197 100 100 100 100 100 100 10,000 100 100 10,000 100 99.99 100.00 99.00 99.00 99.00 99.00 100.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 870,083 12,164 10 51 21 10 10 - 1,128,662 68,458 269 406 141 6,793 780 6,439 6,506 6,576 7,304 6,354 5,579 5,120 3,776 5,722 5,370 4,669 3,842 3,428 36,464 (2,213) (9) (40) (35) (38) (513) (15) (1) (7) (7) (5) (4) (9) (5) (55) (44) (57) (8) (4) 870,083,000 12,163,808 100 10,000 51,130 100 100 21,197 100 100 100 100 100 100 10,000 100 100 10,000 100 99.99 100.00 99.00 99.00 99.00 99.00 100.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 99.00 870,083 12,164 10 51 100 21 10 10 - 1,071,110 46,968 190 95 97 (323) 3 2,955 2,728 2,682 2,415 2,326 2,085 2,007 1,358 1,958 1,933 1,594 1,350 1,310 - 70,011 (1,598) (7) 1 5 (323) (65) (4) (23) (6) (33) (47) (6) (8) (207) (10) (26) (188) (26) (16) (6) - CONTINUED – 31 06/30/2015 Company Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Centrais Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Eólicas Anísio Teixeira S.A. Ico S.A. Jequitiba S.A. Caliandra S.A. Canjoão S.A. Cabeça de Frade S.A. Embiruçu S.A. São Salvador S.A. Abil S.A. Acácia S.A. Angico S.A. Folha da Serra S.A. Jabuticaba S.A. Jacarandá do Serrado S.A. Taboquinha S.A. Tabua S.A. Vaqueta S.A. Unha d'Anta S.A. Cedro S.A. Vellozia S.A. Angelim S.A. Facheio S.A. Sabiu S.A. Barbatimão S.A. Juazeiro S.A. Jataí S.A. Imburana M acho S.A. Amescla S.A. Umbuzeiro S.A. Pau d'Água S.A. M anineiro S.A. S ale Renova Comercializadora de Energia S.A. Total number of shares 100 10,000 100 10,000 100 100 100 - Equity interest Renova (%) 99.00 100.00 99.00 100.00 99.00 99.00 99.00 - 58,377 100.00 Capital 12/31/2014 3,572 3,324 2,208 1,737 1,491 1,504 1,855 - (21) (7) (14) (57) (8) (5) (9) - Total number of shares 100 10,000 100 10,000 100 100 100 - 1,840 (511) 58,377 Equity 10 10 - 58 1,990,839 Profit (loss) for the year** 15,360 Equity interest Renova (%) 99.00 100.00 99.00 100.00 99.00 99.00 99.00 - 100.00 Capital 10 10 10 - 58 Equity (equity deficiency) Proposed dividends Profit (loss) for the year 1,218 1,185 807 606 595 548 538 - - (19) (13) (60) (43) (15) (8) (145) (17) (140) (34) (29) (158) (47) (100) (29) (160) (126) (75) (117) (109) 1 (8) (32) 2 2 (8) 1 2 (19) (10) (30) 2,351 - (1,542) 1,973,507 15,966 42,288 (*) Other comp anies listed in Note 1. (**) Considering the Comp any ´s equity interest. 32 13.3 Changes in investments Changes in investments in subsidiaries and jointly controlled entities are as follows: 13.3.1 Consolidated Company 12/31/2013 Share of profit (loss) of Brasil Chipley Jan - Sep (*) AFCI Consolidated elimination Loss on gain of equity interest Assgnment of receivables Share of profit (loss) of Brasil PCH Oct - Dec (*) Amortization of appreciation (*) Dividends 12/31/2014 (5,259) 754,907 (7,787) (9,168) (11,494) 713,312 PCH Chipley / Brasil PCH S.A. - Company 739,943 12/31/2014 (7,887) (739,943) Share of profit (loss) Amortization of appreciation (*) Brasil PCH 06/30/2015 PCH Chipley / Brasil PCH S.A. 713,312 (2,765) (18,152) 692,395 13.3.1.1 Changes in equity interests Through September 30, 2014, the Company had the shared control of Chipley, with a 60% equity interest. Beginning October 2014, CEMIG GT completed the transaction mentioned in note 1.1., and Renova became the holder of 100% of the shares. The effects of changes in Chipley’s equity interest are shown as follows: Loss on gain of equity interest in Chipley Equity interest through September 30, 2014 Equity interest after September 30, 2014 Equity interest acquired Chipley's equity as of September 30, 2014 Loss on gain of equity interest 60% 100% 40% (13,145) (5,259) 33 13.3.1.2 Shared control investment – Brasil PCH S.A. The Company measures its investments in equity interests in joint ventures using the equity method of accounting. On February 14, 2014, Chipley acquired a 51% equity interest in Brasil PCH S.A. and, as a result of the new Shareholders Agreement, obtained the shared control of this venture. Brasil PCH holds 13 small hydroelectric plants (PCHs), with an installed capacity of 291 MW and average guaranteed power of 194 MW. All PCHs have long-term agreements (20 years) for the sale of electric power in the context of PROINFA (physical information and information relating to power capacity measures not reviewed by the independent auditors). Because the company control is shared, Chipley’s equity interest in Brasil PCH is recorded under the equity method, as required by IFRS 11 / CPC 19 (R2) – Joint Arrangements. As required by CPC 45 (IFRS 12), the financial statements of Brasil PCH (jointly controlled entity) are as follows: BALANCE SHEET AS OF JUNE 30, 2015 ASSETS 06/30/2015 12/31/2014 CURRENT ASSETS EQUITY AND LIABILITIES 06/30/2015 12/31/2014 CURRENT LIABILITIES Cash and cash equivalents 97,061 85,855 Borrowings and financing 180,692 170,098 Other 35,558 49,340 Other 148,965 128,154 132,619 135,195 Total current liabilities 329,657 298,252 877,624 950,957 60,839 60,310 938,463 1,011,267 95,402 97,025 1,363,522 1,406,544 Total current assets NONCURRENT LIABILITIES NONCURRENT ASSETS Property, plant and equipment Other Total noncurrent assets 1,161,653 1,171,028 69,250 100,321 1,230,903 1,271,349 Borrowings and financing Other Total noncurrent liabilities EQUITY TOTAL ASSETS 1,363,522 1,406,544 TOTAL LIABILITIES AND EQUITY 34 INCOME STATEMENT FOR THE PERIOD ENDED JUNE 30, 2015 06/30/2105 02/01/2014 to 06/30/2014 98,443 107,087 Depreciation (17,767) (14,879) Cost of operations (12,806) (14,995) (2,715) (2,177) (33,288) (32,051) 65,155 75,036 (6,300) (6,273) NET REVENUE COSTS OF SALES Charges on use of distribution system Total GROSS PROFIT INCOME (EXPENSES) General and administrative Depreciation and amortization (3,873) (3,227) (10,173) (9,500) 54,982 65,536 (56,378) (53,192) PROFIT BEFORE INCOME TAX AND SOCIAL CONTRIBUTION (1,396) 12,344 Income tax and social contribution (4,028) (4,274) PROFIT FOR THE PERIOD (5,424) 8,070 Total PROFIT BEFORE FINANCE INCOME (COSTS) AND INCOME TAXES FINANCE INCOME (COSTS) 35 13.3.2 Parent Company PCH Enerbras Centrais Elétricas S.A. (Holding) Renova PCH LTDA. Chipley SP Participações S.A. (Holding) 12/31/2013 Transfers Additions AFCI - Loss on gain of equity interest Proposed dividends Share of profit (loss) of subsidiarie 12/31/2014 Additions 4,927 124,135 - - 5 1 4 739,943 (5,259) (15,966) - 2,697 (6) (24,736) 110,866 3 709,949 858,291 266 10 10 10 10 10 10 10 10 1 1 1 1 (2) (1) 1 (1) (2) (2) - 12,164 (801) (677) (533) (286) (644) (337) (646) (693) (370) - 72,908 552 807 557 305 792 374 736 712 520 - 69,900 36,402 2,977 2,733 2,714 2,461 2,334 2,094 2,213 1,369 1,984 2,121 1,620 1,366 1,318 1,239 1,198 - - 70,011 (1,598) (17) (140) (34) (29) (158) (47) (100) (29) (160) (23) (6) (33) (47) (6) (8) (207) (10) (26) (188) (26) (16) (6) (19) (13) 1,071,110 46,968 2,955 2,728 2,682 2,415 2,326 2,085 2,007 1,358 1,958 1,933 1,594 1,350 1,310 1,218 1,185 AFCI 247 - Proposed dividends Share of profit (loss) of subsidiaries Transfer to assets held for sale 06/30/2015 (2,022) - 3,280 (7) (20,676) (109,453) - 2,671 243 694,200 - 37,758 (2,213) (15) (1) (7) (7) (5) (4) (9) (5) (55) (44) (57) (8) (4) (21) (7) (545,732) - 582,930 68,458 6,439 6,506 6,576 7,304 6,354 5,579 5,120 3,776 5,722 5,370 4,669 3,842 3,428 3,572 3,324 Wind farms Nova Renova Energia S.A. Alto Sertão Participações S.A. (Holding) Centrais Eólicas São Salvador S.A. Centrais Eólicas Abil S.A. Centrais Eólicas Acácia S.A. Centrais Eólicas Angico S.A. Centrais Eólicas Folha da Serra S.A. Centrais Eólicas Jabuticaba S.A. Centrais Eólicas Jacarandá do Serrado S.A. Centrais Eólicas Taboquinha S.A. Centrais Eólicas Tabua S.A. Centrais Eólicas Carrancudo S.A. Centrais Elétricas Botuquara S.A. Centrais Eólicas Alcacuz S.A. Centrais Eólicas Tamboril S.A. Centrais Eólicas Conquista S.A. Centrais Eólicas Coxilha Alta S.A. Centrais Eólicas Tingui S.A. Centrais Eólicas Cansanção S.A. Centrais Eólicas Macambira S.A. Centrais Eólicas Imburana de Cabão S.A. Centrais Eólicas Ipê Amarelo S.A. Centrais Eólicas Putumuju S.A. Centrais Eólicas Lençóis S.A. Centrais Eólicas Anísio Teixeira S.A. Centrais Eólicas Ico S.A. - 19,794 23,703 3,499 3,779 3,901 4,896 4,033 3,498 3,122 2,423 3,819 3,481 3,132 2,500 2,122 2,375 2,146 - Continued - 36 - Continuation - Company Centrais Eólicas Jequitiba S.A. Centrais Eólicas Caliandra S.A. Centrais Eólicas Canjoão S.A. Centrais Eólicas Cabeça de Frade S.A. Centrais Eólicas Embiruçu S.A. Centrais Eólicas Itapuã V LTDA. Centrais Eólicas Bela Vista XIV LTDA. Centrais Eólicas Umburanas 3 S.A. Centrais Eólicas Vaqueta S.A. Centrais Eólicas Unha d'Anta S.A. Centrais Eólicas Cedro S.A. Centrais Eólicas Vellozia S.A. Centrais Eólicas Angelim S.A. Centrais Eólicas Facheio S.A. Centrais Eólicas Sabiu S.A. Centrais Eólicas Barbatimão S.A. Centrais Eólicas Juazeiro S.A. Centrais Eólicas Jataí S.A. Centrais Eólicas Imburana Macho S.A. Centrais Eólicas Amescla S.A. Centrais Eólicas Umbuzeiro S.A. Centrais Eólicas Pau d'Água S.A. Centrais Eólicas Manineiro S.A. Centrais Elétricas Itaparica S.A. Outras participações (*) Renovapar S.A. Power sale Renova Comercializadora de Energia S.A. Total 12/31/2013 1 (2) 29 1 (1) (1) 1 (1) 1 (1) (2) (16) AFCI Loss on gain of equity interest Proposed dividends Share of profit (loss) of subsidiarie 12/31/2014 Transfer to assets held for sale Additions (660) (342) (246) (544) (616) (467) (378) (460) (540) (465) (464) (386) (611) (494) (504) - 757 416 364 653 615 475 411 458 538 472 463 384 630 505 533 - 867 649 609 558 683 197 94 92 1 70 20 - - (60) (43) (15) (8) (145) (7) 1 5 (126) (75) (117) (109) 1 (8) (32) 2 2 (8) 1 2 (19) (10) (30) (323) (65) (4) 807 606 595 548 538 190 95 97 (323) 3 - - 1,415 1,188 904 961 1,326 88 351 79 7,154 1,290 - - (14) (57) (8) (5) (9) (9) (40) (35) (38) (513) - - 2,208 1,737 1,491 1,504 1,855 269 406 141 6,793 780 - - - (1,542) 2,351 - - - (511) - 1,840 (5,259) (15,966) 42,288 1,973,507 - 19 3,873 982,779 - 85,962 883,703 4,927 AFCI Proposed dividends Transfers 1 Additions Share of profit (loss) of subsidiaries 107,226 (2,022) 16,654 (655,185) 06/30/2015 1,445,107 (*) Other companies listed in Note 1 37 13.4 Changes in dividends receivable Balance as of December 31, 2013 Proposed dividends Dividends received Balance as of December 31, 2014 Proposed dividends Balance as of June 30, 2015 Consolidated 11,494 (11,494) - Parent 20,452 15,966 (35,879) 539 2,022 2,561 As of June 30, 2015, subsidiary Enerbras had dividends payable in the amount of R$2.561 (December 31, 2014, R$ 539). These amounts were recorded as dividends receivable in the Parent’s current assets. 38 13.5 Changes in investments in subsidiary Nova Renova The investments made in subholding Nova Renova, which controls Renova Eólica, Salvador Eólica and Bahia Eólica, are broken down as follows: Company Nova Renova Energia S.A. 12/31/2014 477 Additions - AFCI 108 Proposed dividends Share of profit (loss) of subsdiaries (106) 9 Transfer to assets held for sale - Renova Eólica Participações S.A. Centrais Eólicas da Prata S.A. Centrais Eólicas dos Araçás S.A. Centrais Eólicas Morrão S.A. Centrais Eólicas Seraíma S.A. Centrais Eólicas Tanque S.A. Centrais Eólicas Ventos do Nordeste S.A. Centrais Eólicas Ametista S.A. Centrais Eólicas Borgo S.A. Centrais Eólicas Caetité S.A. Centrais Eólicas Dourados S.A. Centrais Eólicas Espigão S.A. Centrais Eólicas Maron S.A. Centrais Eólicas Pelourinho S.A. Centrais Eólicas Pilões S.A. Centrais Eólicas Serra do Espinhaço S.A. (2,536) 37,836 64,532 47,777 52,044 54,025 42,068 34,200 22,719 39,570 35,924 15,283 39,097 24,443 44,578 21,672 - (106) 2,139 2,410 1,870 1,804 677 1,565 4,623 3,071 1,633 - (38,859) 3,110 3,382 3,813 3,986 3,412 3,455 1,541 (215) (475) 1,235 (216) 3,541 (491) 2,529 (215) Bahia Eólica Participações S.A. Centrais Eólicas Candiba S.A. Centrais Eólicas Igaporã S.A. Centrais Eólicas Ilhéus S.A. Centrais Eólicas Licínio de Almeida S.A. Centrais Eólicas Pindaí S.A. 9,248 21,023 53,389 23,302 42,701 43,776 - - 6,657 (2,307) (1,469) (2,881) 4,714 725 621 2,652 1,643 2,761 (20,619) (21,748) (51,703) (25,969) (42,860) (43,656) 31,785 12,214 27,110 40,269 36,732 32,582 36,119 12,229 48,000 26,922 1,071,110 - 19,130 (705) (928) (3,422) (3,863) (1,842) (2,296) (5,276) (798) - 9,433 437 696 1,026 3,690 6,340 6,267 871 3,847 2,608 37,758 (60,348) (11,946) (26,878) (37,873) (36,559) (37,080) (40,090) (13,100) (46,571) (28,732) (545,732) Salvador Eólica Participações S.A. Centrais Eólicas Alvorada S.A. Centrais Eólicas Guanambi S.A. Centrais Eólicas Guirapá S.A. Centrais Eólicas N. S. Conceição S.A. Centrais Eólicas Pajeú do Vento S.A. Centrais Eólicas Planaltina S.A. Centrais Eólicas Porto Seguro S.A. Centrais Eólicas Rio Verde S.A. Centrais Eólicas Serra do Salto S.A. TOTAL 19,794 (9) - 06/30/2015 479 (41,492) 40,946 67,914 51,590 56,030 57,428 45,523 37,880 24,914 40,965 38,963 15,744 44,203 28,575 50,178 23,090 582,930 39 13.6 Transfer of control On November 10, 2014, the Company increased the capital of subsidiary Alto Sertão Participações S.A. (“Alto Sertão”) from R$100 to R$12,164, which, in turn, increased the capital of its direct subsidiary Diamantina Eólica Participações S.A. (“Diamantina”) from R$100 to R$12,164, all at the carrying amounts of the investments through the transfer of 100% of the registered common shares, without par value, of its subsidiaries Centrais Eólicas Manineiro, Centrais Eólicas Pau d’Água, Centrais Eólicas São Salvador, Centrais Eólicas Abil, Centrais Eólicas Tabua, Centrais Eólicas Jabuticaba, Centrais Eólicas Vaqueta, Centrais Eólicas Jacarandá do Serrado, Centrais Eólicas Taboquinha, Centrais Eólicas Acácia, Centrais Eólicas Folha da Serra, Centrais Eólicas Angico, Centrais Eólicas Jataí, Centrais Eólicas Amescla, Centrais Eólicas Imburana Macho, Centrais Eólicas Juazeiro, Centrais Eólicas Facheio, Centrais Eólicas Sabiu, Centrais Eólicas Umbuzeiro, Centrais Eólicas Unha d'Anta, Centrais Eólicas Vellozia, Centrais Eólicas Cedro, Centrais Eólicas Angelim, Centrais Eólicas Barbatimão, as supported by appraisal reports, through the issuance of 12,163,708 new registered common shares without par value. As a result, Diamantina obtained the direct control of said subsidiaries, and Alto Sertão obtained the indirect control of them. This change was necessary due to the financing structure of its wind farms related to LEN 2012 (A-5), LER 2013 and free trading market. The investments made in subholding Alto Sertão, which controls Diamantina, are broken down as follows: 40 Company 12/31/2013 Transfer of control AFCI Share of profit (loss) of subsidiaries - AFCI 59 (59) 23,644 (1,111) 22,540 06/30/2015 Alto Sertão Participações S.A. (Holding) - - - Diamantina Eólica Participações S.A. (Holding) - - - Centrais Eólicas M anineiro S.A. - 504 1,523 (106) 1,921 - (36) 1,885 Centrais Eólicas Pau d'Água S.A. - 494 1,674 (42) 2,126 - (26) 2,100 Centrais Eólicas São Salvador S.A. - 801 1,359 (47) 2,113 - (21) 2,092 Centrais Eólicas Abil S.A. - 677 2,172 (184) 2,665 - (67) 2,598 Centrais Eólicas Tabua S.A. - 370 1,337 (48) 1,659 - (59) 1,600 Centrais Eólicas Jabuticaba S.A. - 337 786 (95) 1,028 - (66) 962 Centrais Eólicas Vaqueta S.A. - 660 2,099 (78) 2,681 - (137) 2,544 Centrais Eólicas Jacarandá do Serrado S.A. - 646 1,445 (36) 2,055 - (35) 2,020 Centrais Eólicas Taboquinha S.A. - 693 1,168 (63) 1,798 - (28) 1,770 Centrais Eólicas Acácia S.A. - 533 2,236 (68) 2,701 - (22) 2,679 Centrais Eólicas Folha da Serra S.A. - 644 1,480 (37) 2,087 - (73) 2,014 Centrais Eólicas Angico S.A. - 286 670 (144) 812 - (35) 777 Centrais Eólicas Jataí S.A. - 465 1,017 (32) 1,450 - (80) 1,370 Centrais Eólicas Amescla S.A. - 386 1,199 (6) 1,579 - (55) 1,524 Centrais Eólicas Imburana M acho S.A. - 464 1,262 (52) 1,674 - (21) 1,653 Centrais Eólicas Juazeiro S.A. - 540 1,387 (60) 1,867 - (20) 1,847 Centrais Eólicas Facheio S.A. - 467 1,246 (64) 1,649 - (21) 1,628 Centrais Eólicas Sabiu S.A. - 378 1,142 (62) 1,458 - (13) 1,445 Centrais Eólicas Umbuzeiro S.A. - 611 1,479 (65) 2,025 - (25) 2,000 Centrais Eólicas Unha d'Anta S.A. - 342 2,931 (90) 3,183 - (40) 3,143 Centrais Eólicas Vellozia S.A. - 544 2,192 (51) 2,685 - (44) 2,641 Centrais Eólicas Cedro S.A. - 246 1,220 (49) 1,417 - (28) 1,389 Centrais Eólicas Angelim S.A. - 616 2,236 (88) 2,764 - (33) 2,731 Centrais Eólicas Barbatimão S.A. - 460 1,142 (38) 1,564 - (58) 1,506 - 12,164 36,402 (1,598) 46,968 (2,213) 68,458 TOTAL - 12/31/2014 Share of profit (loss) of subsidiaries 7 7 23,703 - 41 14. Property, plant and equipment 14.1 Consolidated 06/30/2015 Annual de pre ciation rates % Historical cost Accumulated depre ciation 12/31/2014 Ne t value Historical cost Accumulate d de pre ciation Ne t value Property, plant and equipment Generation Land 595 95,797 (15,212) 595 595 80,585 95,797 (14,467) 595 Reservoirs, dams and watermains 3% Buildings, civil works and improvements 3% 192,502 (19,344) 173,158 136,763 (16,428) 120,335 Machinery and equipment 4% 2,247,638 (197,533) 2,050,105 1,825,932 (154,822) 1,671,110 Vehicles 20% 202 (41) 161 202 (32) 170 Furniture and fixtures 10% 142 (77) 65 120 (74) 46 IT equipment 20% 245 (222) 23 245 (209) 36 Measurement towers 20% 23,042 (8,129) 14,913 19,489 (6,141) 13,348 Measurement equipment 20% 2,875 (112) 2,763 367 (3) 364 T ower equipment 20% 2,318 (200) 2,118 951 - Other 20% 6,773 (680) 6,093 6,768 (679) 81,330 951 6,089 T ransmission and connection system Buildings, civil works and improvements 3% 5,385 (245) 5,140 5,385 (174) 5,211 Machinery and equipment 4% 267,544 (13,395) 254,149 268,947 (9,259) 259,688 2,845,058 (255,190) 2,589,868 2,361,561 (202,288) 2,159,273 Administration Machinery and equipment 10% 5,199 (645) 4,554 3,958 (394) 3,564 Improvements 10% 2,036 (245) 1,791 1,949 (206) 1,743 Furniture and fixtures 10% 7,605 (1,454) 6,151 7,492 (1,080) 6,412 Software 20% 3,637 (1,598) 2,039 3,480 (1,325) 2,155 IT equipment 20% 3,630 (1,360) 2,270 2,980 (997) 1,983 22,107 (5,302) 16,805 19,859 (4,002) 15,857 - - - T ransfer to assets held for sale (Note 29.2) T otal construction in progress (1,572,983) 208,818 (1,364,165) 1,294,182 (51,674) 1,242,508 2,381,420 (206,290) 2,175,130 Construction in progress Generation Unapportioned 400,931 - 400,931 348,769 - 348,769 Studies and projects 23,785 - 23,785 23,757 - 23,757 Land 16,900 - 16,900 11,325 - 11,325 149,389 - 149,389 115,470 - 115,470 Buildings, civil works and improvements Measurement towers 10,527 - 10,527 3,285 - 3,285 Wind generators 426,061 - 426,061 549,307 - 549,307 Substation equipment 136,215 - 136,215 87,804 - 87,804 Advances to suppliers 953,432 - 953,432 652,196 - 652,196 493 - T otal construction in progress Social projects- BNDES 2,117,733 493 - - 2,117,733 1,791,913 T otal property, plant and equipment 3,411,915 (51,674) 3,360,241 4,173,333 (206,290) 1,791,913 3,967,043 42 14.2 Changes in property, plant and equipment (consolidated) 12/31/2014 Property, plant and equipment Cost Generation Plant Land Reservoirs, dams and watermains Buildings, civil works and improvements Machinery and equipment Vehicles Furniture and fixtures IT equipment Measurement towers Measurement equipment T ower equipment Other T ransmission and connection system Buildings, civil works and improvements Machinery and equipment Administration Machinery and equipment Improvements Furniture and fixtures Software IT equipment T otal property, plant and equipment - cost (-) Depreciation Generation Plant Reservoirs, dams and watermains Buildings, civil works and improvements Machinery and equipment Vehicles Furniture and fixtures IT equipment Measurement towers Measurement equipment T ower equipment Other T ransmission and connection system Buildings, civil works and improvements Machinery and equipment Administration Machinery and equipment Improvements Furniture and fixtures Software IT equipment T otal property, plant and equipment - depreciation T otal property, plant and equipment Transfe r to asse ts held for sale Additions Write -offs Reclassifications 03/31/2015 595 95,797 136,763 1,825,932 202 120 245 19,489 367 951 6,768 201 1,731 22 3,154 2,508 892 5 - 55,538 419,975 399 475 - (595) (95,797) (127,734) (1,252,957) (202) (142) (245) (6,773) 64,768 994,681 23,042 2,875 2,318 - 5,385 268,947 2,361,561 8,513 (1,403) (1,403) 476,387 (1,668) (86,503) (1,572,616) 3,717 181,041 1,272,442 3,958 1,949 7,492 3,480 2,980 19,859 2,381,420 1,241 87 113 157 650 2,248 10,761 (1,403) 476,387 (139) (210) (18) (367) (1,572,983) 5,060 2,036 7,395 3,637 3,612 21,740 1,294,182 (14,467) (16,428) (154,822) (32) (74) (209) (6,141) (3) (679) (745) (2,916) (42,711) (9) (3) (13) (1,988) (109) (200) (1) - - 15,212 17,517 166,408 41 77 222 680 (1,827) (31,125) (8,129) (112) (200) - (174) (9,259) (202,288) (71) (4,136) (52,902) - - 146 8,454 208,757 (99) (4,941) (46,433) (394) (206) (1,080) (1,325) (997) (4,002) (206,290) 2,175,130 (251) (39) (374) (273) (363) (1,300) (54,202) (43,441) 4 (641) (245) (1,415) (1,598) (1,342) (5,241) (51,674) 1,242,508 - (1,403) 476,387 39 18 61 208,818 (1,364,165) - CONTINUED - 43 - CONTINUATION 12/31/2014 Construction in progress Generation Unapportioned Studies and projects Land Buildings, civil works and improvements Measurement towers Wind generators Substation equipment Advances to suppliers Social Pojects- BNDES Additions 348,769 23,757 11,325 115,470 3,285 549,307 87,804 652,196 - 128,710 31 8,191 89,457 8,663 169,534 95,018 302,110 493 T otal construction in progress 1,791,913 802,207 T otal property, plant and equipment 3,967,043 758,766 Write -offs - Reclassifications (76,548) (3) (2,616) (55,538) (1,421) (292,780) (46,607) (874) - (1,403) (476,387) - Transfe r to asse ts held for sale 06/30/2015 - 400,931 23,785 16,900 149,389 10,527 426,061 136,215 953,432 493 - (1,364,165) 2,117,733 3,360,241 44 12/31/2013 Property, plant and equipment Cost Generation Plant Land Reservoirs, dams and watermains Buildings, civil works and improvements Machinery and equipment Vehicles Furniture and fixtures IT equipment Measurement towers Measurement equipment T ower equipment Other T ransmission and connection system Buildings, civil works and improvements Machinery and equipment Administration Machinery and equipment Improvements Furniture and fixtures Software IT equipment Total property, plant and equipment - cost (-) Depreciation Generation Plant Reservoirs, dams and watermains Buildings, civil works and improvements Machinery and equipment Vehicles Furniture and fixtures IT equipment Measurement towers Measurement equipment Other T ransmission and connection system Buildings, civil works and improvements Machinery and equipment Administration Machinery and equipment Improvements Furniture and fixtures Software IT equipment Total property, plant and equipment - depreciation Total property, plant and equipment Additions Write -offs Re classifications 12/31/2014 595 95,797 127,732 1,242,337 202 119 245 9,086 6,768 7,790 1 10,403 367 951 - - 9,031 575,805 - 595 95,797 136,763 1,825,932 202 120 245 19,489 367 951 6,768 1,668 87,594 1,572,143 710 20,222 - 3,717 180,643 769,196 5,385 268,947 2,361,561 2,167 2,304 3,223 2,472 1,650 11,816 1,583,959 1,393 16 4,269 1,008 1,330 8,016 28,238 398 398 769,594 3,958 1,949 7,492 3,480 2,980 19,859 2,381,420 (371) (371) (371) (12,232) (10,990) (89,799) (2) (62) (170) (3,839) (356) (2,235) (5,438) (65,023) (30) (12) (39) (2,302) (3) (323) - - - - (14,467) (16,428) (154,822) (32) (74) (209) (6,141) (3) (679) (80) (4,378) (121,908) (94) (4,881) (80,380) - - (174) (9,259) (202,288) (91) (243) (680) (776) (599) (2,389) (124,297) 1,459,662 (303) (158) (400) (549) (398) (1,808) (82,188) (53,950) 195 195 195 (176) 769,594 (394) (206) (1,080) (1,325) (997) (4,002) (206,290) 2,175,130 CONTINUED - 45 - CONTINUATION 12/31/2013 Construction in progress Generation Unapportioned Studies and projects Land Buildings, civil works and improvements Measurement towers Wind generators Substation equipment Advances to suppliers T otal construction in progress T otal property, plant and equipment 237,438 27,102 12,462 183,853 4,105 895,864 113,417 171,582 1,645,823 3,105,485 Additions Write-offs 258,319 3,293 4,049 31,507 405 110,529 33,389 478,025 919,516 865,566 Reclassifications (3,832) (3,832) (4,008) 12/31/2014 (146,988) (2,806) (5,186) (99,890) (1,225) (457,086) (59,002) 2,589 (769,594) - 348,769 23,757 11,325 115,470 3,285 549,307 87,804 652,196 1,791,913 3,967,043 14.3 Parent 06/30/2015 Annual depreciation rates % Historical cost Accumulated depreciation 12/31/2014 Net value Historical cost Accumulated depreciation Net value 13,348 Property, plant and equipment Generation Measurement towers 20% 23,042 (8,129) 14,913 19,489 (6,141) Measurement equipment 20% 2,875 (112) 2,763 367 (3) 364 Tower equipment 20% 2,318 (200) 2,118 951 - 951 28,235 (8,441) 19,794 20,807 (6,144) 14,663 Administration Machinery and equipment 10% 5,060 (641) 4,419 3,890 (392) 3,498 Improvements 10% 2,036 (245) 1,791 1,949 (206) 1,743 Furniture and fixtures 10% 7,395 (1,415) 5,980 7,291 (1,048) 6,243 Software 20% 3,586 (1,598) 1,988 3,480 (1,325) 2,155 IT equipment 20% Total property, plant and equipment 3,612 (1,342) 2,270 2,963 (980) 1,983 21,689 (5,241) 16,448 19,573 (3,951) 15,622 49,924 (13,682) 36,242 40,380 (10,095) 30,285 203,747 - 203,747 160,277 - 160,277 23,785 - 23,785 23,757 - 23,757 2,612 - 2,612 2,612 - 2,612 571,908 Construction in progress Generation Unapportioned Studies and projects Land 571,214 - 571,214 571,908 - Total consctruction in progress 801,358 - 801,358 758,554 - 758,554 Total property, plant and equipment 851,282 (13,682) 837,600 798,934 (10,095) 788,839 Advances to suppliers 46 14.4 Changes in property, plant and equipment (parent) 12/31/2014 Additions Reclassifications 19,489 367 951 20,807 3,154 2,508 892 6,554 399 475 874 23,042 2,875 2,318 28,235 3,890 1,949 7,291 3,480 2,963 19,573 40,380 1,170 87 104 106 649 2,116 8,670 874 5,060 2,036 7,395 3,586 3,612 21,689 49,924 (6,141) (3) (6,144) (1,988) (109) (200) (2,297) - (8,129) (112) (200) (8,441) (392) (206) (1,048) (1,325) (980) (3,951) (249) (39) (367) (273) (362) (1,290) - (641) (245) (1,415) (1,598) (1,342) (5,241) (10,095) (3,587) - (13,682) Total property, plant and equipment 30,285 5,083 874 36,242 Construction in progress Generation Unapportioned Studies and projects Land Advances to suppliers Total construction in progress Total property, plant and equipment 160,277 23,757 2,612 571,908 758,554 788,839 43,467 31 180 43,678 48,761 3 (3) (874) (874) - 203,747 23,785 2,612 571,214 801,358 837,600 Property, plant and equipment Generation Measurement towers Measurement equipment Tower equipment Administration Machinery and equipment Improvements Furniture and fixtures Software IT equipment Total property, plant and equipment - cost (-) Depreciation Generation Measurement towers Measurement equipment Tower equipment Administration Machinery and equipment Improvements Furniture and fixtures Software IT equipment Total property, plant and equipment - depreciation - 06/30/2015 47 12/31/2013 Additions Writeoffs Capital payment - Wind power SPEs Reclassifications 12/31/2014 19,489 Property, plant and equipment Generation M easurement towers 9,086 10,403 - - - M easurement equipment - 367 - - - 367 Tower equipment - 951 - - - 951 9,086 11,721 - - - 20,807 M achinery and equipment 2,138 1,752 Improvements 2,304 16 Administration (371) - - 3,890 - - 1,949 Furniture and fixtures 3,171 4,120 - - - 7,291 Software 2,472 1,008 - - - 3,480 - IT equipment Total property, plant and equipment - cost 1,632 1,331 - - 2,963 11,717 8,227 (371) - - 19,573 20,803 19,948 (371) - - 40,380 (3,839) (2,302) - - - (6,141) (3) - - - (3) (2,305) - - - (6,144) (-) Depreciation Generation M easurement towers M easurement equipment (3,839) Administration M achinery and equipment (90) (302) - - - (392) Improvements (243) (158) 195 - - (206) Furniture and fixtures (658) (390) - - - (1,048) Software (776) (549) - - - (1,325) (583) (397) - - - (980) Total property, plant and equipment - depreciation IT equipment (6,189) (4,101) 195 - - (10,095) Total property, plant and equipment 14,614 15,847 (176) 123,354 86,921 27,102 3,293 2,612 - - - - 2,612 Advances to suppliers 40,018 528,163 - - 3,727 571,908 Total construction in progress 193,086 618,377 (3,832) (49,077) Total property, plant and equipment 207,700 634,224 (4,008) (49,077) - - 30,285 Construction in progress Generation Unapportioned Studies and projects Land (3,832) (49,077) - (921) 160,277 (2,806) 23,757 - 758,554 788,839 48 14.5 Property, plant and equipment The Company and its subsidiaries did not identify evidence of impairment of property, plant and equipment. ANEEL, in accordance with the Brazilian regulatory framework, defines the economic useful lives of the power generation assets, with periodical reviews on the estimates. The rates established by ANEEL are recognized as a reasonable estimate of the useful life of the assets. Accordingly, these rates were used as the basis for depreciation of property, plant and equipment. According to articles 63 and 64 of Decree 41019/1957, those assets and facilities used in the power generation, transmission, distribution and sale are linked to these services and cannot be removed, sold, assigned or provided as pledge without the prior and express authorization of the regulatory body. ANEEL, through SFF/ANEEL Letter 459/2001, authorized the assignment of the emerging rights, assets and facilities for the concession of Serra da Prata Hydroelectric Complex, pledged as collateral for the obligations assumed by the Company in the context of the direct financing. 14.6 Construction in progress Property, plant and equipment in progress include investments in water projects, divided into inventories and basic projects already authorized by ANEEL. They also include investments in the wind projects which won LEN 2011 (A-3), five plants which did not start commercial operations, LEN 2012 (A-5), LER 2013 and projects traded in the free market which are under construction through the Company’s subsidiaries. The investments include amounts to purchase wind power generators, civil works, substations and sundry costs. As at June 30, 2015, the consolidated balance of advances to suppliers amounts to R$953,432 (December 31, 2014, R$652,196), comprised of the following: an advance to purchase measurement towers with IEM, in the amount of R$466, an advance under a substation equipment supply agreement entered into with ABB Ltda., Metalurgica Santa Rita and Sadesul, in the amount of R$114,075, an advance to purchase wind power generators, in the amount of R$672,729, with GE, Alstom and others, an advance to assemble wind generators, in the amount of R$77, with Mammoet, an advance for civil works, in the amount of R$115,214, with Consórcio MGT and others, an advance for solar equipments in the amount of R$6,427, an advance for sundry services related to the compliance with environmental requirements by wind plant facilities and other, in the amount of R$4,044, and an advance to acquire a project in the amount of R$40,000. Amounts to be apportioned refer mainly to project costs, with the implementation of plants and capitalized interest. As of June 30, 2015 and 2014, capitalized interest in the period amounts to R$33,019 and R$27,272, respectably. 14.7 Project breakdown As of June 30, 2015, property, plant and equipment in progress totals R$2,117,733, broken down as follows: 49 Projects Consolidated LEN 2011 (A-3) LEN 2012 (A-5) LER 2013 LEN 2013 (A-5) Subtotal - Regulated market 474,157 32,420 399,069 42,668 948,314 Subtotal - Free trading market Other construction in progress 969,515 199,904 Total construction in progress 2,117,733 14.8 Write-off of projects The Company reviews its portfolio of basic projects and inventories on a quarterly basis. After reviewing its portfolio of development of small hydroelectric plant projects, the Company verified there is no inventory projects to be discontinue. As at December 31, 2014, the total amount R$3,832 was elected to discontinue the inventory projects. 15. Trade payables Note Trade payables Transfer to liabilities directly related to assets held for sale Consolidated 06/30/2015 12/31/2014 290,159 29.2 (11,840) 278,319 100,200 100,200 Parent 06/30/2015 12/31/2014 11,532 10,989 - - 11,532 10,989 As of June 30, 2015, the consolidated balance of trade payables mainly includes the amounts relating to the agreements for supply of equipment and materials contracted for the construction of plants under LEN 2011 (A3), LER 2013, LEN 2012 (A-5), free trading market, among others, relating to wind power generators, substations and civil construction. 50 16. Borrowings, financing and debentures 16.1 Consolidated Consolidated 06/30/2015 Current Debt cost Finance charges 12/31/2014 Noncurrent Principal Total Finance charges Principal Current Grand total Total Finance charges Noncurrent Principal Total Finance charges Principal Grand total Total Local currency BNDES - LER 2009 (a) T JLP + 1.92% p.a. 1,827 40,675 42,502 - 520,020 520,020 562,522 1,730 40,682 42,412 - 540,733 540,733 583,145 BNDES - LER 2009 (a) T JLP + 2.18% p.a. 955 19,955 20,910 - 254,316 254,316 275,226 878 19,959 20,837 - 264,394 264,394 285,231 2,699 BNDES - LER 2009 (T ranche "C")(a) T JLP - 529 529 - 1,959 1,959 2,488 5 531 536 - 2,163 2,163 BNDES - LER 2009 (T ranche "D")(a) T JLP - 995 995 - 3,094 3,094 4,089 10 995 1,005 - 3,253 3,253 4,258 5,712 5,735 - 88,044 88,044 93,779 - 5,896 5,896 - 90,739 90,739 96,635 - - - - - - 5,398 251,200 256,598 - - - 256,598 - 6,346 6,346 6,355 - - - - 6,356 6,356 6,356 FNE - Banco do Nordeste do Brasil S.A. - Espra (b) 9.5% p.a. (8.08% p.a.)* Promissory Notes - LEN 2011 (e) 100% CDI + 0.98% p.a. BNDES - Renova Eólica - 3.5% p.a. Finep - CEOL Itaparica (f) BNDES - Renova Eólica 23 9 - 9 (a) T JLP + 2.45% 8,122 31,284 39,406 13,963 623,266 637,229 676,635 1,097 21,449 22,546 1,047 650,417 651,464 674,010 (a) T JLP + 2.60% 3,697 11,515 15,212 4,701 1,855 4,464 6,319 2,177 150,575 152,752 159,071 - - - 3 1,320 1,323 1,323 140,000 140,000 140,061 T JLP BNDES - Renova Eólica (T ranche "P")(a) BNDES - Ponte I Diamantina Eólica (T ranche "A") (d) T JLP + 3.55% BNDES - Ponte I Diamantina Eólica (T ranche "B") (d) T JLP + 2.5% Subtotal borrowings Borrowing costs 41 - 244,741 249,442 264,654 41 - 1,320 1,320 1,361 - - - 1,697 144,768 146,465 2,714 280,733 283,447 - 19,085 536,166 555,251 18,664 - (1,181) Transfer to liabilities directly related to assets held for sale (Note 29.2) (2,805) (67,249) TO TAL BO RRO WINGS AND FINANCING 16,280 467,736 (1,181) 1,743,106 1,761,770 - (10,742) (10,742) (70,054) - (859,518) (859,518) 484,016 18,664 872,846 891,510 61 146,465 283,447 33 2,317,021 11,067 (11,923) (929,572) 1,375,526 11,067 - 61 345,176 (801) 344,375 33 356,243 (801) 355,442 3,227 3,227 75,000 75,000 75,033 1,924,950 1,928,177 2,284,420 (11,126) - (11,126) (11,927) - 1,913,824 1,917,051 2,272,493 500,269 *15% timely payment bonus Debentures - 3rd issuance - Renova Energia S.A. (c) Debentures - 1st issuance - Renova Eólica Participações S.A. (g) Subtotal debentures Borrowing costs TO TAL DEBENTURES 123.45% CDI IPCA + 7.6054% p.a. 3,458 - 3,458 - 500,000 500,000 503,458 269 - 269 - 500,000 500,000 532 4,593 5,125 - 158,521 158,521 163,646 667 - 667 - 73,676 73,676 74,343 3,990 4,593 8,583 - 658,521 658,521 667,104 936 - 936 - 573,676 573,676 574,612 - (1,007) (1,007) - (10,077) - (52) (52) - 3,990 3,586 7,576 - 657,027 936 (52) 884 - (9,070) 649,451 (9,070) 649,451 (1,361) 572,315 (1,361) 572,315 (1,413) 573,199 51 16.2 Parent Pare nt 06/30/2015 C urre nt Finance charge s Local curre ncy Debentures - 3rd issuance - Renova Energia S.A.(c) Borrowing costs TO TAL DEBENTURES Principal 12/31/2013 Noncurre nt Total Principal Curre nt Grand Total total 500,000 503,458 Finance charge s Principal Noncurre nt Total Principal Grand Total total 500,000 500,269 Debt cost 123.45% CDI 3,458 - - (904) 3,458 (904) 3,458 (904) 2,554 500,000 (8,237) 491,763 (8,237) 491,763 (9,141) 494,317 269 - 269 - (52) (52) 269 (52) 217 500,000 (1,361) 498,639 (1,361) 498,639 (1,413) 498,856 52 16.3 Collaterals As at June 30, 2015, the balance payable of borrowings and financing is collateralized as follows: Receivables Pledge of shares Mortgage/Sale of assets Surety - money Total BNDES (a) 7,748,008 1,129,952 2,394,338 158,247 11,430,545 BNB (b) 483,052 112,123 169,394 13,682 778,251 Debentures (c) 1,242,075 1,242,075 Total 8,231,060 2,484,150 2,563,732 171,929 13,450,871 16.4 Changes Changes in borrowings, financing and debentures are as follows: Consolidated Principal Finance charges Parent Total Principal Finance charges Total Balances as of December 31, 2013 2,320,045 70,211 2,390,256 300,064 36,203 336,267 Borrowings and financing Accrued finance charges Finance charges paid Finance charges capitalized Finance charges added to the principal Financing and debentures repayment 2,006,419 23,972 (1,517,912) 110,012 (240,518) 99,497 (23,972) - 2,006,419 110,012 (240,518) 99,497 (1,517,912) 500,000 (301,883) 27,314 (81,183) 17,935 - 500,000 27,314 (81,183) 17,935 (301,883) Borrowing costs Recognition of borrowing costs Borrowing costs capitalized Balances as of December 31, 2014 Borrowings and financing Accrued finance charges Finance charges paid Finance charges capitalized Financing and debentures repayment Finance charges added to the principal Borrowing costs Recognition of borrowing costs Transferência para passivos diretamente associados a ativos mantidos para venda Balances as of June 30, 2015 (3,149) 1,061 26 2,830,462 383,958 (307,138) 21,791 (9,838) 1,151 (926,767) 1,993,619 15,230 101,752 (86,473) 33,021 (21,791) (2,805) 38,934 (3,149) 1,061 26 2,845,692 383,958 101,752 (86,473) 33,021 (307,138) - (9,838) 1,151 (929,572) 2,032,553 406 498,587 - 269 406 498,856 - 29,031 (33,359) 7,517 - 29,031 (33,359) 7,517 - (8,254) 526 - (8,254) 526 - - - 490,859 3,458 494,317 53 16.5 Maturity of non-current amounts (principal and finance charges) Maturities of the amounts classified in noncurrent liabilities (consolidated) are as follows: Maturity year 2016 2017 2018 2019 2020 2021 to 2025 2026 to 2030 + 2030 Total 06/30/2015 Consolidated Parent 66,653 136,004 207,877 71,450 206,159 71,450 229,207 71,450 1,042,039 285,650 501,463 30,889 2,420,291 (*) 500,000 (*) (*) This amount does not include borrowings costs 16.6 Summary of agreements (a) BNDES agreements (long term) LER 2009 Subsidiaries Pajeú do Vento, Planaltina, Porto Seguro, Nossa Senhora da Conceição, Guirapá, Serra do Salto, Guanambi, Alvorada and Rio Verde, with the intermediation of subsidiary Salvador Eólica, entered into a financing agreement with BNDES in the total amount of R$586,677. Financing is subject to interest rates of 1.92% p.a. + Long-term Interest Rate (TJLP), payable in 16 years. The first installment fell due on May 15, 2013 and the last will mature on April 15, 2029. The nine plants total 195.2MW of installed capacity and average 84 MW of contracted firm power. In April 2014, the last installment of the financing agreement, in the amount of R$4,370, was released. The total amount financed for Porto Seguro and Serra do Salto plants includes subloan “D”, which is designed for social investments, in the total amount R$6,400. The financing is subject to TJLP rate, with a two-year grace period for interest payment and a six-year grace period for principal repayment. The first installment fell due on May 15, 2013 and the last will mature on May 15, 2019. In April 2014, the last installment of the financing agreement, in the amount of R$2,500, was released Subsidiaries Candiba, Igaporã, Ilhéus, Licínio de Almeida and Pindaí, with the intermediation of subsidiary Bahia Eólica, entered into a financing agreement with BNDES, in the total amount of R$297,380. Financing is subject to interest rates of 2.18% p.a. + TJLP (Long-Term Interest Rate) and 16 years for principal repayment. The first installment fell due on April 15, 2013 and the last will mature on March 15, 2029. The five plants total an installed capacity of 99.2 MW and average contracted firm power of 43 MW. In April 2014, the last installment of the financing agreement, in the amount of R$192, was released. The total amount financed for Candiba and Ilhéus includes subloan “C”, which is designed for social investments, in the total amount R$3,000. The financing is subject to TJLP rate, with a two-year grace period for interest payment and a six-year grace period for principal amortization. The first installment fell due on January 15, 2014 54 and the last will mature on December 15, 2029. In April 2014, the last installment of the financing agreement, in the amount of R$248, was released All BNDES contracts are collateralized by pledged shares, collateral assignment of credit and emerging rights, financed assets, bank guarantee letter during the construction and first year of commercial operations and reserve accounts equivalent to three months of debt service and three months of operation and maintenance. Under this operation, the Debt Service Coverage Ratio (ICSD) = [(activity cash generation + closing cash balance from prior year)/debt service] must be greater than or equivalent to 1.3. As of June 30, 2015, this ratio was met. LER 2010 and LEN 2011 (A-3) Subsidiary Renova Eólica, with the intermediation of subsidiaries Ametista, Araças, Borgo, Caetité, Dourados, Espigão, Maron, Morrão, Pelourinho, Pilões, Da Prata, Seraíma, Serra do Espinhaço, Tanque, Ventos do Nordeste, its direct subsidiary Nova Renova and the Company obtained a financing in the amount of R$1,044,100 (a direct agreement executed on June 4, 2014, in the amount of R$734,020, and a transfer agreement entered into with Banco do Brasil, in the amount of R$310,080). As of June 30, 2015, the amount released was R$910,077, which was used to settle the bridge loan obtained from BNDES, in the amount of R$647,894 and the remainder part of promissory notes, in the amount of R$251,200. The direct BNDES financing will be divided into 16 tranches, from “A” to “P”, having the followings features: (a) tranches A, C, D, E, F, G, I, J, M and P will have a use and grace period through December 15, 2015, with a repayment term of 192, in monthly consecutive installments, each one in the amount of the debt principal falling due, divided by the number of installments yet to fall due. The first installment will mature on January 15, 2016 and the last, on December 15, 2031; and (b) tranches B, H, K, L, N and O have a use and grace period through December 15, 2014, with a repayment term of 192, in monthly consecutive installments, each one in the amount of the debt principal falling due, divided by the number of installments yet to fall due. The first installment fell due on January 15, 2015 and the last will mature on December 15, 2030. Tranches A, B, C, D, E, F, G, H, I, J, K, L, M, N and O are subject to interest rates of 2.45% p.a.+ TJLP where Tranche P is subject to TJLP. The transfer agreement with Banco do Brasil is subject to a rate of 2.60% p.a. + TJLP. All agreements entered into with BNDES are collateralized by pledged shares, collateral assignment of receivables and emerging rights, financed assets, bank guarantee letter and reserve accounts equivalent to three months of debt service and three months of operation and maintenance. Under this transaction, the Debt Service Coverage Ratio (ICSD) = [(activity cash generation + closing cash balance from prior year)/debt service] must be greater than or equivalent to 1.3 calculated at the end of the year. As of June 30, 2015, this ratio was met. (b) BNB agreement Subsidiary Espra, with the intermediation of subsidiary Enerbras, obtained a financing with BNB on June 30, 2006, in the total amount of R$120,096. The agreements are subject to an interest rate of 9.5% p.a. (which can be reduced to 8.08% due to the 15% timely payment bonus) payable monthly on the 30th of each month. The agreement matures on June 30, 2026. The contracted amount was fully released. 55 This financing is collateralized by property mortgage of Serra da Prata Complex, pledged shares, pledged emerging rights of Authorization Resolutions, right to receive any and all amounts that, actually or potentially, are or may become payable by the Concession Grantor to Espra, all other tangible or intangible rights of the respective Authorization Resolutions and liquidity fund in reserve account (note 11). The financing agreement with BNB does not include covenants requiring compliance with financial ratios subject to accelerated payment of the debt. (c) Simple, nonconvertible debentures On December 15, 2014, a new debenture (3rd issuance) was issued in the amount of R$500,000. The proceeds from this debenture were used to prepay the already existing debenture (2nd issuance) in the amount of R$370,754, generating an additional cash for the Company in the amount of R$129,246. The 3rd issuance debenture yields the same as the 2nd issuance one (123.45% of CDI), with a grace period of four years as from the agreement signature date. The amortization will begin on December 15, 2018 with annual consecutive installments through December 15, 2024. Interest will be paid in semi-annual installments, with no grace period, in June and December of each year, with the first payment falling due on June 15, 2015. The 3rd issuance of debentures was made in accordance with CVM Instruction 476, as resolved by the Company’s Board of Directors’ meeting of December 17, 2014 (“RCA”). Debentures have no restructuring clause. The debentures are collateralized by the pledge of 100% of the Enerbras’ shares owned by the Company and collateral assignment of assets and rights deposited in restricted account with Banco do Brasil from the dividends distributed by subsidiaries Enerbras and Nova Renova. This transaction sets forth that the ICSD (Debt Service Coverage Ratio = dividends received/debt service) must be greater than or equivalent to 1.0. The debt service is represented by the payment of principal and interest of the falling due series in each year of verification. As of June 30, 2015, this ratio was met. (d) BNDES (short-term) On December 19, 2014, a short-term financing agreement was entered into between BNDES and Diamantina, in the total amount of R$700,000, divided into two tranches: tranche “A”, in the amount of R$140,000, and tranche “B”, in the amount of R$560,000, for wind farms under LEN 2012 (A-5), LER 2013 and free trading market. As at June 30, 2015, the amount of R$418,000 had been released. The bridge loans will be settled on June 15, 2016 or on the date the long-term financing with BNDES is released. The principal of tranche A will be subject to interest of 3.55% p.a. above TJLP. The principal of tranche B will be subject to interest of 2.50% p.a. above TJLP. The loans are collateralized by the shares issued by Diamantina and the SPEs in which Diamantina holds shares. This agreement does not include covenants requiring compliance with financial ratios subject to accelerated payment of the debt. (e) Promissory notes On November 05, 2013, the indirect subsidiaries which are part of the wind farms under LER 2010 and LEN 2011 (A-3) issued commercial promissory notes, for public distribution with restrict placement efforts, in the amount of 56 up to R$400,000 and pursuant to CVM Instruction 476. The distribution is financially settled through CETIP and the commercial bills were deposited in the name of the respective holder as registered with CETIP’s Electronic Custody System. The promissory notes will be subject to compensatory interest calculated based on the accumulated variation of 100% of the daily average interbank deposit (DI) rate, “over extra group”, plus a surcharge of 0.98% per year. On April 30, 2014, these indirect subsidiaries settled the commercial promissory notes, in the amount of R$400,000 (principal) plus interest for the period and renegotiated the issuance of new promissory notes for an additional period of 6 months as from April 30, 2014, in the amount of R$400,000, under the same financial conditions as those of the first issuance. On August 29, 2014, when the second tranche of the agreement with BNDES was released, part of the promissory notes was settled, thus remaining a balance of the principal in the amount of R$251,200. On February 02, 2015, promissory notes issued against eight companies under LEN 2011 (A-3) were settled, in the total amount of R$259,316, out of which R$251,200 relating to the principal and R$8,116 relating to interest. (f) FINEP On December 19, 2013, subsidiary Centrais Elétricas Itaparica S.A. entered into a financing agreement with Financiadora de Estudos e Projetos - FINEP, in the amount of R$107,960. The funds from this financing will be used to implement a hybrid and wind power generation and distribution plant. The financing is subject to interest of 3.5% p.a., with a grace period of 36 months, which covers the period from the agreement signature date and to the date of maturity of the amortization installment, payable in 85 installments, with the first one falling due on January 15, 2017 and the last on January 15, 2024. Through June 30, 2015, the amount of R$6,346 had been released. This financing is collateralized by bank letters of guarantee in an amount equivalent to 50% of each release, plus finance charges, and the finance assets (equipment). (g) Infrastructure debentures On November 15, 2014, the 1st issuance of simple, non-convertible debentures, occurred, subject to collateral and an additional unsecured guarantee, in two series (“Debentures”), for public distribution, with restrict placement efforts, of the Company´s indirect subsidiary, Renova Eólica, in the total amount of R$146,000. The 1st series debentures are subject to IPCA + prefixed interest of 7.6054% p.a. where those of the 2nd series are subject to IPCA + prefixed interest of 7.8707% p.a. Debentures were issued as infrastructure debentures, considering the classification of the ventures as priority projects, under the ordinances issued by the Ministry of Mines and Energy (MME). The proceeds from these debentures will be allocated to LER 2010 and LEN 2011 (A-3) in order to supplement the BNDES financing for acquisition of new assets. The first series in the amount of R$73,000 was settled in December 2014 and the second series, also in the amount of R$73,000, was settled in January 2015. The amortization began on June 15, 2016 with semi-annual, consecutive installments through December 15, 2025. The interest is payable in semi-annual installments, with no grace period, in June and December of each year. 57 Under this transaction, the Debt Service Coverage Ratio (ICSD) = [(activity cash generation + closing cash balance from prior year)/debt service] must be greater than or equivalent to 1.3 calculated at the end of the year. As of June 30, 2015, this ratio was met. On January 21, 2015, the 2nd series of debentures of the indirect subsidiary Renova Eólica, in the amount of R$73,000, was settled. The amount was inflation adjusted based on IPCA + prefixed interest of 7.8707% p.a., from the issuance date, November 15, 2014 to the settlement date, of R$75,106. 17. Taxes payable Note IRPJ COFINS CSLL INSS (third parties) INSS IRRF (payroll) FGTS ISS PIS PIS, COFINS and CSLL IRRF Other TOTAL Transfer to assets held for sale or liabilities directly related to assets held for sale TOTAL Consolidated 06/30/2015 12/31/2014 6,191 1,881 3,522 1,175 1,535 672 414 3,064 447 880 2,176 137 22,094 29.2 (6,267) 15,827 4,214 3,636 2,426 1,641 1,315 1,267 430 874 789 557 300 112 17,561 17,561 Parent 06/30/2015 12/31/2014 24 36 1,532 972 414 110 5 391 129 114 3,727 3,727 6 45 1,315 883 430 48 1 145 57 72 3,002 3,002 58 18. Accounts payable / receivable - CCEE/Eletrobras Consolidated Assets Note Current Eletrobras CCEE 06/30/2015 12/31/2014 Liabilitties 06/30/2015 12/31/2014 1,294 1,294 199 199 21,559 21,559 21,174 1,165 22,339 22,092 6,100 7,777 15,627 (1,294) - (21,559) - - (19,878) - (5,849) - Total 2,214 6,299 1,928 37,966 Stated as: Current Noncurrent 2,214 199 6,100 1,928 22,339 15,627 Noncurrent CCEE Transfer to assets held for sale or liabilities directly related to assets held for sale: Current Eletrobras CCEE Noncurrent CCEE 29.2 Eletrobras The Power Purchase and Sale Agreement, entered into the indirect subsidiary Espra and Eletrobras, sets forth that the sales revenues in the context of the CCEE is determined each year (from January to December). The financial adjustment portion resulting from this calculation will be offset in the monthly invoices of the next year. In the period ended June 30, 2015, the generated power volume (58,362 MWh) was lower than the invoice power volume (82,080 MWh), which resulted after accounting of the Power Relocation Mechanism (MRE) in the context of the CCEE – system for sharing the hydrological risks of the generators – in a negative financial adjustment in the amount of R$3,160 (December 31, 2014, R$21,174). These provisions were transferred to the item "liabilities directly associated with assets held for sale". CCEE The Reserve Power Agreements entered into the indirect subsidiaries under LER 2009, LER 2010 and CCEE set forth that the differences between the power generated by plants and contracted power are calculated in each contractual year. The reimbursement for negative deviations (below the tolerance level – 10%) of generation will be paid in 12 equal monthly installments over the next agreement, at 115% of the current sales price, as set forth in subclause 11.3 of such agreement. The returns within the tolerance level – 10% of generation will be reimbursed in 12 installments after possible offset against the positive deviations as from the end of the first four-year period, counted from the startup in commercial operation. 59 The reimbursement for positive deviations (above the tolerance level – 30%) of generation will be paid in 12 equal monthly installments over the next agreement, at 70% of the current sales price, as set forth in subclause 8.11 of such agreement. The returns within the tolerance level – 30% of generation will be reimbursed in 12 installments after possible offset against the negative deviations as from the end of the first four-year period, counted from the startup in commercial operation. As of March 31, 2014, the Company reversed the provision for fines relating to the reimbursement of LER 2010 (see note 1.3). (*) Information not reviewed by independent auditors. 18.1 Changes Changes in the period are as follows: Changes in assets 12/31/2013 CCEE Total assets - Additions 6,299 6,299 Receipts - 12/31/2014 Additions 6,299 6,299 17,087 17,087 Receipts - Transfer to assets held for sale (21,172) (21,172) 06/30/2015 2,214 2,214 Changes in liabilities 12/31/2013 Provision Amortization 12/31/2014 Eletrobras CCEE Total liabilities 2,060 18,546 21,174 337 (2,060) (2,091) 20,606 21,511 Tota, net 20,606 15,212 Transfer to assets held for sale Provision Amortization 06/30/2015 21,174 16,792 6,103 (9,015) (5,718) - (21,559) (5,849) 1,928 (4,151) 37,966 (2,912) (5,718) (27,408) 1,928 (4,151) 31,667 (19,999) (5,718) (6,236) (286) 19. Provision for civil, tax and labor risks As of June 30, 2015, the individual and consolidated provision for civil, tax and labor risks amounted to R$88 (December 31, 2014, R$79). The change of R$9 basically refers to monetary correction of Company’s contingencies. The Company’s and its subsidiaries’ management, based on the opinion of their legal advisors with respect to the likelihood of favorable outcome from several claims, considers that the provisions recorded in the balance sheet are sufficient to cover probable losses. The Company and its subsidiaries are parties to several contingencies amounting to approximately R$12,371 (December 31, 2014, R$7,346), out of which civil claims in the amount of R$7,790 (December 31, 2014, R$3, 855), and labor claims in the amount of R$4,525 (December 31, 2014, R$3,491), which Management, based on 60 the opinion of its legal counsel, assessed as possible loss and did not record any provisions for the period ended June 30, 2015. The main lawsuits refer to pain and suffering and termination of lease and rental agreements. Power Grid Charges - National Energy Policy Council Resolution CNPE Resolution 3, of March 6, 2013, defined new criteria for apportionment of the additional commissioning cost of thermal power plants. According to the new criteria, the Power Grid Charges (ESS), for purposes of power security, which was fully apportioned amongst free consumers and distributors, would be apportioned amongst all members of the National Interconnected System (SIN), including generators and sellers. The Brazilian Association of Independent Power Producers (APINE), of which the Company is a member, obtained the preliminary injunction to suspend the effects of article 2 and 3 of CNPE Resolution 3, which exempted the generators from the ESS payment in accordance with such Resolution. The risk involved approximately R$1,420. Based on Management’s understanding and on the legal counsel’s opinion, this risk was classified as possible loss and did not recognize a provision for the period ended June 30, 2015. 20. Provision for environmental costs Note Current Consolidated 06/30/2015 12/31/2014 11,130 6,686 6,562 9,940 Current Noncurrent (4,654) (1,606) - Total 11,432 16,626 6,476 4,956 11,432 6,686 9,940 16,626 Noncurrent Transfer to liabilities directly related to assets held for sale Apresentados como: Current Noncurrent 29.2 Considering that: (a) before the PCHs and the wind power plants are placed into service, the Company obtains all the environmental permits and, consequently, has a present obligation to comply with all the obligations set out in such permits to be able to operate; (b) such obligation arises from past events (power plant construction); and (c) it is expected that there will be cash outflows capable of generating future economic benefits, the Company provides for socio-environmental costs in current and noncurrent liabilities, and capitalizes such costs in fixed assets over the projects’ construction periods. After plant startup, such costs are recognized directly in profit or loss. 61 The provision is initially measured at fair value and, subsequently, adjusted to present value and upon change in the value or timeliness of the estimated cash flows, which are considered sufficient for the subsidiaries’ future disbursements during the phase of construction and the operation of wind farms in operation. 21. Equity and shareholders’ compensation a) Authorized capital As prescribed by article 8 of the Bylaws, the Company is authorized to increase its capital, as approved by the Board of Directors, regardless of any amendment to the bylaws, through the issuance of common or preferred shares, up to the limit of R$5,002,000. b) Capital On September 29, 2014, CEMIG GT subscribed and paid in 87,186,035 common shares issued by Renova, in the total amount of R$1,550,072, through the capitalization of an advance for future capital increase, in the amount of R$810,129, made on March 31, 2014 and through the assignment to Renova of the amount relating to the advance for future capital increase in Chipley on February 14, 2014, in the amount of R$739,943. The capital increase was authorized by the Company’s Board of Directors on October 27, 2014. In addition to CEMIG GT, preemptive rights relating to 10,866 common shares were exercised by the Company’s other shareholders, totaling 87,196,901 subscribed and paid-in common shares, in the total amount of R$1,550,265. On October 30, 2014, a capital increase was made through the stock option plan whereby eligible employees subscribed and paid in 50,165 common shares in the amount of R$18. A summary of the capital increases made in 2014, plus the R$17 paid during the first quarter, is shown in the table below: Date 09/29/2014 09/29/2014 10/30/2014 Total Common 87,186,035 10,866 Number Preferred Total Value - 87,186,035 1,550,072 - 10,866 193 18 1,550,283 50,165 100,330 150,495 87,247,066 100,330 87,347,396 On May 6, 2015, the Board of Directors approved the capital increase on the basis of the stock option plan. The eligible employees subscribed 39,169 common shares and 78,338 preferred shares, of which 33,669 common shares and 37,338 preferred shares were paid. The shares were effectively issued by the custodian bank in July 2015. As of June 30, 2015, the Company’s subscribed and paid-in totaled R$2,568,006 (2014, R$2,567,997), distributed as follows: 62 RENOVA ENERGIA Common Preferred Total shares Number % Number % Controlling block 188,309,629 79.6% 0.0% RR Participações 50,561,797 21.4% 0.0% Light Energia 50,561,797 21.4% 0.0% Cemig GT 87,186,035 36.8% 0.0% Other shareholders 48,534,657 20.4% 81,811,136 100.0% RR Participações* 8,260,093 3.5% 1,300,000 1.6% BNDESPAR 9,311,425 3.9% 18,622,850 22.8% InfraBrasil 11,651,467 4.9% 23,302,933 28.5% FIP Caixa Ambiental 5,470,293 2.3% 10,940,586 13.4% Other 13,841,379 5.8% 27,644,767 33.7% 236,844,286 100.0% 81,811,136 100.0% Total * Shares not included in the controlling block Note: The controlling block considers shares subject to the Shareholders Agreement Number 188,309,629 50,561,797 50,561,797 87,186,035 130,345,793 9,560,093 27,934,275 34,954,400 16,410,879 41,486,146 318,655,422 % of total capital % 59.1% 15.9% 15.9% 27.3% 40.9% 3.0% 8.8% 11.0% 5.1% 13.0% 100.0% In the period 1,106 common shares were converted into preferred shares. c) Share issuance costs Parent 06/30/2015 12/31/2014 Costs on issuance of shares (41,757) (41,757) The Company records all share issuance costs in a specific line item. These amounts refer to consulting and financial advisory fees relating to the capital increase operations, as shown below: Event Initial Pulic Offering (IPO) Date Costs on issuance of shares July 2010 13,686 New investor: Light Energia September 2011 20,555 New investor: BNDESPAR September 2012 1,871 New investor: CEMIG GT September 2014 5,645 Total d) 41,757 Reserves Capital reserve The Company recorded in the capital reserve the effect of costs on share-based payment relating to its plants under LER 2009, LER 2010 and LEN 2011 (A-3) and other projects, as well as the awards paid relating to the successful 63 IPO and also agreements entered into with its executive officers. These records both reflect the shares granted and the shares to be granted in the medium and short term. These accounting records are detailed in note 26.4. e) Dividends Accumulated losses, if any, and provision for income tax and social contribution will be deducted from profit (loss) for the period before profit sharing. Net profit recorded will be allocated successively in the order below, as set forth in Chapter XVI of the Brazilian Corporate Law: (i) 5% will be directed, prior to any other allocation, to the legal reserve, which cannot exceed 20% of capital; (ii) a portion, as proposed by the management bodies and approved at the General Meeting, may be allocated to the provision for risks, as prescribed by article 195 of the Brazilian Corporate Law; (iii) a portion will be allocated to the payment of mandatory dividends to shareholders. The shareholders are entitled to receive as mandatory dividends, in each year, 25% on net profit for the year, less or plus the following: (i) amount allocated to legal reserve; and (ii) amount allocated to reserve for contingencies and reversal of this reserve from prior years. 22. Net revenue 06/30/2015 MWh* Power generation/supply Electric power supply - PCHs - Eletrobras Wind power supply - CCEE Difference in generation - Eletrobras/CCEE agreement Total revenue 82,081 967,324 95,918 Consolidated 06/30/2014 06/30/2015 MWh* 106,872 556,640 (44,353) (-) Deductions from revenue COFINS PIS Total deductions Other revenues Operations - solar and sale of electric power (-) Deductions from revenue COFINS PIS Total 1,145,322 619,159 17,967 187,514 19,999 225,480 06/30/2014 Parent 06/30/2015 06/30/2014 21,829 99,874 (12,580) 109,123 - - (6,649) (1,386) (8,035) (3,247) (704) (3,951) - - 5,834 6,092 244 116 (463) (101) 5,524 110,696 (14) (4) 223 223 (9) (2) 101 101 (574) (125) 5,132 222,577 (*) Information not revised by independent auditors. 64 23. Costs and expenses Consolidated Cost of services (1) 06/30/2015 Operating expenses Cost of services Total 06/30/2014 Operating expenses Total Tusd/Tust Inspection fee 11,386 536 11,922 - 11,386 536 11,922 4,935 40 4,975 - 4,935 40 4,975 Personnel and management Outside services Rentals and leases Travels Depreciation Discontinued projects Insurance Telephony and IT Materials and consumables 19,662 2,468 184 52,902 312 117 1,741 17,954 24,910 1,328 3,941 1,300 491 1,632 1,064 17,954 44,572 3,796 4,125 54,202 803 1,749 2,805 4,321 2,603 34,861 1,028 271 8,769 17,075 444 1,516 734 1,343 146 1,141 420 8,769 21,396 3,047 1,516 35,595 1,343 1,174 1,141 691 (149) 5,161 798 83,196 95,118 5,326 57,946 57,946 5,161 6,124 141,291 153,213 (4,645) 3,393 40 41,872 46,847 2,070 33,658 33,658 (4,645) 3,393 2,110 75,530 80,505 Fine on reimbursement Power for resale Other (2) Total (1) Tusd - distribution system use tariff and Tust - transmission system use tariff (2) As mentioned in note 1.2, the Company reversed the fine balance, for wind farms under LER 2010 having not being placed into operation and recorded this reversal in the same line item as that which triggered the operation cost. Parent Personnel and management Outside services Rentals and leases Travels Depreciation Discontinued projects Insurance Telephony and IT Materials and consumables Other Total Cost of services 06/30/2015 Operating expenses 2,297 299 2,596 17,954 16,277 978 3,564 1,290 54 1,470 1,007 2,083 44,677 Total 17,954 16,277 978 3,564 3,587 54 1,470 1,007 2,382 47,273 Cost of services 12/31/2014 Operating expenses 833 40 873 8,769 9,135 444 1,462 727 1,343 146 1,081 344 1,196 24,647 Total 8,769 9,135 444 1,462 1,560 1,343 146 1,081 344 1,236 25,520 65 24. Finance income (costs) Consolidated 06/30/2015 06/30/2014 Parent 06/30/2015 06/30/2014 Finance income Income from short-term investments Interest income - intragroup loans Discounts obtained Other finance income Total finance income 18,270 6 628 18,904 25,982 7 166 26,155 4,024 75 4,099 16,460 637 7 143 17,247 Finance costs Debt charges Interest Interest - intragroup loan Tax on Financial Transactions (IOF) Banking fees Other finance costs Total finance costs Total finance income (costs) (101,752) (222) (1,506) (297) (6,655) (110,432) (91,528) (46,758) (315) (460) (57) (2,220) (49,810) (23,655) (29,031) (58) (356) (96) (570) (30,111) (26,012) (11,651) (28) (295) (126) (23) (254) (12,377) 4,870 66 25. Income tax and social contribution Consolidated Parent 06/30/2015 06/30/2014 06/30/2015 06/30/2014 (42,932) 325 (56,408) (6,066) 34% 34% 34% 34% 14,597 (111) 19,179 2,062 (281) (810) (281) (810) (7,112) (2,112) 5,662 4,924 3,880 2,818 - - Temporary provisions (1,486) 1,124 (1,486) 1,124 Tax loss carryforwards (23,074) (7,300) (23,074) (7,300) (13,476) (6,391) - - (Loss) earnings before income tax and social contribution Combined income tax and social contribution rate Income tax and social contribution at statutory rates Permanent deductions (additions) Nondeductible expenses Share of profit (loss) of subsidiaries Effect on subsidiaries taxed under the deemed income Effect of unrecognized deferred tax assets on: Income tax and social contribution in profit or loss The Company did not record taxable income for the period. As of June 30, 2015, the Company had tax loss carryforwards to offset, for which deferred taxes were not recorded, in the following amounts: Parent 06/30/2015 06/30/2014 Tax loss for the year Prior years' tax loss carryforwards Total tax loss carryforwards (67,865) (188,828) (256,693) (21,470) (125,723) (147,193) The consolidated tax refers to subsidiaries Espra (deemed income regime), 14 wind farms under operation (deemed income regime), subholdings Bahia Eólica and Salvador Eólica (actual income regime) and 15 plants under construction (actual income regime). Income tax and social contribution are calculated at the rate of 15%, plus a 10% surtax on taxable income exceeding R$240 for income tax and 9% on taxable income for social contribution, and take into consideration the offset of tax loss carryforwards, limited to 30% of taxable income. The income tax and social contribution under the deemed income regime are paid on gross revenues on a quarterly basis, based on the estimated percentage, according to the conditions and rates set forth in applicable legislation (estimated bases of 8% and 12% on sales, income tax and social contribution, respectively, plus other finance income). Deferred taxes on tax loss carryforwards were not recognized as future taxable income is not expected. 67 26. Related-party transactions Parent Effective term Start End Intragroup loans Espra Salvador Eólica Bahia Eólica CE Itaparica Total 07/10/2009 05/27/2011 10/17/2011 01/01/2014 12/31/2014 12/31/2015 12/31/2015 06/30/2014 Assets 06/30/2015 12/31/2014 Finance income (costs) 06/30/2015 06/30/2014 2,184 910 1,106 578 51 24 (295) 416 219 3,094 1,684 75 2 342 - 38,452 - - - 14,927 - - 3,094 55,063 75 342 Redeemable shares (*) Nova Renova Advance for future capital increase Chipley (**) (*) Redeemable shares issued by the subsidiary Nova Renova S.A. in accordance with its bylaws. (**) The advance for future capital increase agreement does not meet the criteria to characterize it as an investment. The main balances of assets and liabilities as of June 30, 2015, as well as the transactions that impact the profit or loss for the period, relating to the related-party transactions, resulted from the Company’s transactions with its subsidiaries. Despite of the short-term maturities, the Company expects that these amounts will be performed in the long term. 26.1 Trade receivables Trade receivables – loans entered into with the subsidiaries described in the table. These loans were performed to meet these companies’ cash needs. For the balances (receivable and payable), the amount payable is subject to TJPL rate, plus interest varying between 0.25% and 0.5% p.a. 68 26.2 Sales In August 2011, the Company entered into a power purchase and sale commitment with Light Energia, whereby Renova will deliver average 200.4 MW(*) of wind power, corresponding to 403.5 MW(*) of installed capacity; wind farms will begin to generate power between 2015 and 2016. Out of the total amount of 200.4 MW(*), 1/3 of the power was traded with LIGHTCOM Comercializadora de Energia S.A. and 2/3 with CEMIG GT. In March 2014, Renova Comercializadora traded average 308.0 MW with CEMIG GT, corresponding to 676.2 MW of installed capacity. On June 17, 2014, a Share Purchase and Sale Commitment Investment Agreement was entered into among the Company and Companhia Energética de Minas Gerais (“CEMIG”), which will hold a 50% stake in the project. The wind farms that will satisfy this agreement will start to operate in 2018. Pursuant to the Investment Agreement, the transaction will be carried out upon the acquisition by CEMIG of 50% of the voting and total capital of a publicly-held company (SPE) to be established by the Company, in which all agreements relating to the Wind Project will be paid in. The acquisition price will correspond to up to R$113,450 relating to 50% of the amounts of advances relating to agreements already entered into by the Company, adjusted by the fluctuation of the interbank deposit rate (“CDI”) from effective disbursement by the Company up to the date of payment by CEMIG. After the acquisition, CEMIG and Renova will share the future investment of the Wind Project proportionally to their share in the SPE’s capital. (*) Information not reviewed by independent auditors. 26.3 Compensation of key management personnel Compensation of key management personnel for the periods ended June 30, 2015 and 2014, as set forth in CVM Resolution 560, of December 11, 2008, amounted to R$7,516 and R$3,083, respectively, including short-term benefits only. Compensation of the Statutory Board paid by the Company in the period 06/30/2015 Statutory Board (*) 06/30/2014 Non-statutory Board (*) Total Statutory Board (*) 4.00 4.16 8.16 6 1,037 951 1,022 934 2,059 1,885 1,255 1,109 Direct and fringe benefits 86 88 174 146 Compensation due to participation in committee n/a n/a n/a n/a Variable compensation 3,693 1,122 4,815 1551 Bonus 3,693 1,122 4,815 1551 Charge s 246 396 642 277 Post-employme nt bene fits n/a n/a n/a n/a 4,976 2,540 7,516 3,083 Number of me mbe rs Accrued fixed compe nsation Salary or fees T otal compensation by management body 69 Monthly average compensation of the Statutory Board 06/30/2014 06/30/2015 Statutory Board (*) Non-statutory Board (*) Statutory Board Number of members 4.00 4.16 6.00 Highest individual compensation amount Lowest individual compensation amount Average individual compensation amount 343 30 184 51 33 42 240 150 195 26.4 Stock option plan The Company’s Stock Option Plan, created under the terms of article 168, § 3, of Law 6404/76, and approved at the Extraordinary General Meeting, held on January 18, 2010, sets forth the general grant conditions for the Company’s stock options. The Plan’s main purpose is to retain qualified professional and improves the expansion and performance of the Company’s goals, aligned with its shareholders’ and management’s interests. The Stock Option Plan (“Plan’) established that beneficiaries eligible under the Plan include the Company’s directors, executive officers and employees, as well as individuals providing services to the Company or other companies under its control. The options are granted within the maximum limit of 5% of the total shares representing the Company’s capital, on a diluted basis, including in the calculation all options already granted under the plan. Once the option is exercised, the shares subject to this option will be issued through the Company’s capital increase, to be approved under the terms of applicable legislation and the Company’s Bylaws. Plan 2011 Plan 2011 was designed to ensure the high performance of the wind projects, the grants and vesting are simultaneous and fully related to goals achieved in each project, subject to the percent of 3% of the project’s net present value calculated on the following dates: 10% on the execution of the power sale agreement; 20% on the execution of the financing for project construction; 20% on the date the project is placed into operation; and 50% after one year of start-up of operations of the project. The options granted entitle beneficiaries to acquire shares at the price of R$0.34 per unit (corresponding to a one common and two preferred shares). The services provided by project paid through shares/units are as follows: 70 10% 20% 20% 50% 10% 20% 20% 50% upon execution of the power sale agreement upon execution of the project construction financing agreement on the date the project is placed into operation one year after the project is placed into operation upon execution of the power sale agreement upon execution of the project construction financing agreement on the date the project is placed into operation one year after the project is placed into operation LER 2009 Total amount R$/thousand Number of units Unit value - R$ 53,385 26.86 1,434 106,771 26.86 2,868 127,319 29.16 3,713 344,006 30.97 10,654 631,481 18,669 Grant and vesting date 2011 2011 2012 2013 LER 2010 Total amount R$/thousand Number of units Unit value - R$ 27,272 26.86 733 72,772 29.40 2,139 78,693 29.40 2,314 215,340 29.40 6,331 394,077 11,517 Grant and vesting date 2011 2014 2015 scheduled for 2016 LEN 2011 10% 20% 20% 50% upon execution of the power sale agreement upon execution of the project construction financing agreement on the date the project is placed into operation one year after the project is placed into operation Number of units Unit value - R$ 10,498 31.76 34,106 29.40 37,841 29.40 101,468 29.40 183,913 Total amount R$/thousand 333 1,003 1,113 2,983 5,432 Grant and vesting date 2012 2014 scheduled for 2015 scheduled for 2016 In addition, the Company distributed the following shares in connection with the Initial Public Offering (IPO) and key management agreements: Parent Initial Public Offer (IPO) Success Initial Public Offer (IPO) Success Key executive agreement Key executive agreement Key executive agreement Number of units Unit value - R$ 360,051 24.78 125,000 32.96 48,000 33.15 22,890 25.35 54,000 26.76 609,941 Total amount R$/thousand 8,922 4,120 1,591 580 1,445 16,658 Grant and vesting date 2011 2011 2011 2012 2012 For beneficiaries terminated during 2013, options were granted under the new projects (free trading market) as part of existing contractual conditions, as shown below: 71 The grant date 18/03/13 19/09/13 20/12/13 Number of units granted 11,573 47,288 4,547 Fair value of the grant 32.32 46.55 47.00 Exercise price 0.34 0.34 0.34 Others Fair value in the grant date 370 2,185 212 25 2,792 In 2013, the fair value of the grants was recorded in the reverse for employee’s benefits in the amount of R$2,792. On June 26, 2013, the Company’s Board of Directors resolved to suspend Plan 2011 and did not allow the admission of new participants and limited to the projects traded between December 2009 and June 2013. The eligible beneficiaries will continue to participate in the Plan until all goals of these projects are met. In 2014, for the goals of projects traded by the Company after November 2011, the amount of R$3,432, including charges, was paid via payroll. These amounts were recorded in property, plant and equipment in progress of the respective project. The other grants in 2014 refer to the share-based payment plan of former projects already recorded. Plan 2013 Also on June 26, 2013, another program was approved (“Plan 2013”). The grants are exercisable in up to 6 years, with a vesting period of four years (25% per year) subsequently to the grant date. The share exercise price is determined by the average weighted by the volume of the 30 trading sessions prior to the reference date. The first grant was approved by the Company’s Board of Directors on December 19, 2014, in the total volume of 444,520 shares, corresponding to 148,173 units. The exercise price of each option is R$38.42 per unit. As of June 30, 2015, the Company recorded the amount of R$654 directly in equity and profit (loss) for the period. 27. Financial instruments and risk management The Company and its subsidiaries conduct transactions with financial instruments. These financial instruments are managed through operating strategies and internal controls that aim at liquidity, profitability and security. Gains and losses on these transactions are consistent with the policies set by Company’s management. The risks associated with these operations are managed according to the practices defined by Management, including the monitoring of the levels of exposure of each market risk and estimated future cash flow. These practices also determine that the information is updated in the operating systems, as well as the information and operation of the transactions with counterparties. a. Fair value of financial instruments Fair value is the amount for which an asset could be exchanged or a liability could be settled, between parties aware of and interested in the business, through a transaction without beneficiaries. The definition of fair value covers several variations on the metrics adopted to measure an amount at reliable value. 72 The calculation of the fair value was determined based on the available market information and methodologies adopted in the evaluation. However, significant judgment is necessary to understand the market information and estimate the fair value. Some line items have accounting balance equivalent to the fair value. This results from the fact that these financial instruments have characteristics similar to those that would be obtained had these financial instruments been traded in the market. The use of different market methodologies may have a material effect on the estimated realizable values. The transactions with financial instruments are recorded in the Company’s balance sheet at their carrying amount, which is equivalent to their fair value in cash and cash equivalents, trade receivables, related parties, collaterals and restricted deposits and trade payables. The accounting balances of borrowings, financing and debt charges differ from fair value. C onsolidated Fair value Financial assets 06/30/2015 Carrying amount 12/31/2014 06/30/2015 12/31/2014 Curre nt asse ts Short-term investments 53,272 538,697 53,272 538,697 T rade receivables 41,473 68,627 41,473 68,627 1,835 40 1,835 40 171,929 160,487 171,929 160,487 290,159 100,200 290,159 100,200 8,583 936 7,576 884 555,251 356,243 554,071 355,442 658,521 573,676 649,451 572,315 1,761,769 1,928,177 1,751,027 1,917,051 Collaterals and restricted deposits Noncurre nt asse ts Collaterals and restricted deposits Financial liabilities Curre nt liabilitie s T rade payables Debentures Borrowings and financing Noncurre nt liabilitie s Debentures Borrowings and financing 73 Parent Fair value Financial assets 06/30/2015 Carrying amount 12/31/2014 06/30/2015 12/31/2014 Curre nt asse ts Short-term investments 4,219 198,831 4,219 198,831 T rade receivables 85 - 85 - Collaterals and restricted deposits 40 40 40 40 3,094 55,063 3,094 55,063 11,532 10,989 11,532 10,989 3,458 269 2,554 217 500,000 500,000 491,763 498,639 Noncurre nt asse ts Related parties Financial liabilities Curre nt liabilitie s T rade payables Debentures Noncurre nt liabilitie s Debentures b. Categories of financial instruments The classification of financial instruments and their accounting balances are broken down below: Consolidated 06/30/2015 Financial assets Loans and re ceivables Fair value through profit or loss 12/31/2014 O ther at amortized cost Loans and receivables Total Fair value through profit or loss O ther at amortized cost Total Current assets Short-term investments T rade receivables Collateral and restricted deposits - 53,272 - 53,272 - 538,697 - 538,697 41,473 - - 41,473 68,627 - - 68,627 1,835 - - 1,835 40 - - 40 171,929 - - 171,929 160,487 - - 160,487 Noncurre nt assets Collateral and restricted deposits Financial liabilities Current liabilities T rade payables - - 290,159 290,159 - - 100,200 100,200 Borrowings and financing - - 554,070 554,070 - - 355,442 355,442 Debentures - - 7,576 7,576 - - 884 884 Noncurre nt liabilities Borrowings and financing - - 1,751,027 1,751,027 - - 1,917,051 1,917,051 Debentures - - 649,451 649,451 - - 572,315 572,315 74 Pare nt 06/30/2015 Financial assets Fair value through profit or loss Loans and re ceivable s 12/31/2014 O the r at amortiz e d cost Total Fair value through profit or loss Loans and re ceivable s O the r at amortiz e d cost Total Curre nt asse ts Short-term investments - 4,219 - 4,219 - 198,831 - 85 - - 85 - - - - 1,835 - - 1,835 40 - - 40 3,094 - - 3,094 55,063 - - 55,063 T rade payables - - 11,532 11,532 - - 10,989 10,989 Debentures - - 2,554 2,554 - - 217 217 - - 491,763 491,763 - - 498,639 498,639 T rade receivables Collateral and restricted deposits 198,831 Noncurrent asse ts Related parties Financial liabilities Curre nt liabilitie s Noncurrent liabilities Debentures c. Fair value measurement The Company adopts the measurement at fair value of its financial assets and financial liabilities. Fair value is measured at market value based on the assumptions that the market players are able to measure an asset or liability. For purposes of consistency and comparison, the fair value hierarchy prioritizes the inputs adopted in the measurement of the three main levels, as follows: Level 1. Active market: Price - a financial instrument is considered as quoted in an active market if the quoted prices are immediately and regularly available in stock exchange or organized over-the-counter market, by operators, brokers or market association, by entities whose purpose is to disclose the prices by regulatory agencies, and if these prices represent market transactions regularly carried out between independent parties, without beneficiaries. Level 2. Without active market: Valuation method – In relation to financial instruments not traded in an active market, the fair value must be determined based on the valuation/pricing methodology. Criteria used include current fair value of another financial instrument significantly similar, analysis of discounted cash flow and option pricing models. The purpose of the evaluation method is to determine the transaction price on the measurement date through a commercial exchange not subject to personal interests. Level 3. Without active market: Inputs for an asset or liability not based on observable market variations (nonobservable inputs) as at June 30, 2015 – the Company did not have any financial instrument classified in this category. The instruments stated at fair value are broken down as follows: 75 Description Assets Short-term investments Description Assets Short-term investments Balance at 03/31/2015 53,272 Balance at 12/31/2014 538,697 Active market - quoted price (level 1) - Fair value as of June 30, 2015 No active market No active market valuation technique nonobservable inputs (level 2) (level 3) 53,272 - Fair value as of December 31, 2014 Active market No active market No active market - quoted price valuation technique nonobservable inputs (level 1) (level 2) (level 3) - 538,697 - Short-term investments: prepared taking into consideration the security market quotation or market information used in such calculation, based on future interest and exchange rates of similar instruments. The fair value of a security corresponds to its value at the maturity date, discounted to present value using a discount obtained using the market interest curve, in Brazilian reais. In the period ended June 30, 2015, there were no transfers between fair value measurements of level 1 and level 2 or between level 3 and level 2. d. Market risk The market risk reflects the possibility of monetary losses due to the changes in variables that impact the prices and rates traded in the market. These fluctuations basically impact all sectors and, therefore, represent financial risk factors. The Company’s and its subsidiaries’ borrowings and financing, as described in Note 16, were entered into with BNB, BNDES and the Debentureholders. The contractual rules applicable to financial liabilities represent risks related to these exposures. As at June 30, 2015, the Company and its subsidiaries are exposed to market risk associated to the CDI, TJLP and fixed rates. e. Sensitivity analysis (consolidated) The Company and its subsidiaries present below the additional disclosures on their financial instruments required by CVM Instruction 475/08, specifically on the sensitivity analysis in addition to the sensitivity analysis required by IFRSs and accounting practices adopted in Brazil. The Company adopted the assumptions below, defined in CVM Instruction 475/08, to conduct this sensitivity analysis: • definition of a probable scenario for risk behavior that, if materialized, can generate adverse results for the Company, and which is benchmarked by an independent external source (Scenario I); • definition of two additional scenarios with stresses of at least 25% and 50% in the risk variable considered (Scenario II and Scenario III, respectively); and 76 • presentation of the impact of the defined scenarios on the fair values of the financial instruments operated by the Company and its subsidiaries. Transaction as of June 30, 2015 Rate effective at June 30, 2015 Short-term investments: Annual estimated CDI rate for 2016 Annual effect on short-term investments: Loss Transaction Rate effective at June 30, 2015 Borrowings: DEBENTURES - RENOVA Annual estimated CDI rate for 2016 Annual effect on borrowings: Gain Loss Transaction Rate effective at June 30, 2015 Borrowings: BNDES - LP - LER 2009 BNDES - LP - Renova Eólica BNDES - CP - Diamantina Eólica Annual estimated TJLP rate for 2016 Reduction Loss Risk CDI decrease Risk CDI increase Risk TJLP increase TJLP increase TJLP increase Scenario I Probable scenario Scenario II 25% decrease Scenario III 50% decrease 13.64% 53,272 11.66% 13.64% 53,272 8.75% 13.64% 53,272 5.83% (1,069) (2,642) (4,215) Scenario II 25% decrease Scenario III 50% decrease 13.64% 13.64% 13.64% 503,458 11.66% 503,458 14.58% 503,458 17.49% (12,306) - 5,811 23,928 Scenario II 25% decrease Scenario III 50% decrease 6.00% 6.00% 6.00% 844,325 942,650 429,912 6.00% 844,325 942,650 429,912 7.50% 844,325 942,650 429,912 9.00% - 33,253 66,507 Scenario I Probable scenario Scenario I Probable scenario For short-term investments, the probable scenario considers SELIC future rates, used as the basis for calculation of the CDI rate, based on the Central Bank of Brazil’s expectations, over a year, at 11.66%. Scenarios II and III consider a reduction of this rate by 25% (8.75% p.a.) and 50% (5.83% p.a.), respectively. These projections are also applicable to debentures and promissory notes subject to the CDI rate, considering scenarios II and III, based on an increase of 25% (14.58%) and 50% (17.49%), respectively. For borrowings and financing subject to the TJLP rate, the Company and its subsidiaries considered a probable scenario according to the rate for the third quarter of 2015 provided by BNDES, which rate is expected to be maintained over a year, at 6%. Scenarios II and III consider a reduction of this rate by 25% (7.50% p.a.) and 50% (9.00% p.a.), respectively. The weighted average spread in the short-term investments and loans is: (i) 101.31% of 77 CDI rate on short-term investments; (ii) 2.42% + TJLP on BNDES loans; and (iii) 123.45% of CDI rate on debentures. The effects (increase/decrease) included in this sensitivity analysis refer to interest rate changes considered in scenarios I, II and III based on the interest rate in effect as at June 30,2015. These sensitivity analyses have been prepared in accordance with CVM Instruction 475/2008, whose purpose is to measure the effects from the changes in market variables on each financial instrument of the Company and its subsidiaries. However, the actual settled amounts could differ from these estimates due to the subjectivity inherent in the process used in preparing the analyses. f. Liquidity risk The liquidity risk determines the parent’s and subsidiary’s ability to settle the obligations assumed. In order to determine the subsidiary’s financial capacity to properly comply with the commitments assumed, the maturity flows of the funds raised and other obligations are included in the disclosure. For further information on the Company’s borrowings, see note 16. The Company’s management solely enters into with credit lines to leverage its operating capacity. This assumption is confirmed based on the characteristics of the Company’s borrowings. f.1. Liquidity and interest rate risk tables The tables below detail the remaining contractual maturity of the Company’s and its subsidiaries’ non-derivative financial liabilities and the contractual repayment periods. These tables were prepared using the undiscounted cash flows of the financial liabilities based on the nearest date on which the Company and its subsidiaries should settle the related obligations. The tables include interest and principal cash flows. As interest flows are based on floating rates, the undiscounted amount was based on the interest curves at period end. The contractual maturity is based on the most recent date on which Renova Group should settle its respective obligations. Consolidated Intruments at interest rate 1 to 3 months 3 months to 1 year 1 year to 5 years Over 5 years Total Fixed Borrowings and financing - principal and finance charge Debentures - principal and finance charge 24,859 - 520,117 9,155 524,397 208,894 1,247,715 449,055 2,317,088 667,104 Total 24,859 529,272 733,291 1,696,770 2,984,192 Parent Intruments at interest rate 1 to 3 months 3 months to 1 year 1 year to 5 years Over 5 years Total Fixed Debentures - principal and finance charge - - 143,845 359,612 503,457 Total - - 143,845 359,612 503,457 78 g. Credit risk The credit risk reflects the possibility that the Company may not exercise its rights. This description is directly related to line item Trade receivables. Carrying amount Consolidated Financial assets Note Parent 06/30/2015 12/31/2014 06/30/2015 12/31/2014 41,473 68,627 85 - Current Trade receivables 8 In the power sector, the operations carried out are directed to the regulatory agency that maintains the active information on the positions of produced and consumed power. Based on structure, planning is made to operate the system without interferences or interruptions. Power is sold through auctions, agreements, among others. This system is reliable and controls the payments by the players in the market. The Company does not carry out transactions for speculative purposes. The Company manages its risks on a continuous basis, evaluating whether the practices adopted in the performance of its activities are aligned with Management’s policies. The Company does not carry out transactions with financial instruments for equity hedge purposes as it believes that the risks to which its assets and liabilities are exposed can be compensated between each other over the normal course of its activities. These financial instruments are managed using operating strategies that seek to obtain liquidity, profitability, and security. The control policy consists of a permanent monitoring of contracted terms and conditions compared to market terms and conditions. As at June 30, 2015, the Company did not make speculative investments in derivatives or any other risk assets. h. Derivative transactions No transactions with derivative financial instruments were conducted in the periods reported. i. Capital management Consolidated 06/30/2015 12/31/2014 Borrowings and financing debt (-) Cash and cash equivalents and short-term investments 2,962,125 97,376 2,845,692 595,617 Net debt 2,864,749 2,250,075 Equity Financial leverage ratio - % 2,453,896 117% 2,509,641 90% The objectives of the Company in managing its capital are to ensure that the Company is always capable of providing return to its shareholders and benefits to other stakeholders, and maintain an ideal capital structure to reduce this cost. In order to maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to stockholders, return capital to stockholders or, also, issue new shares or sell assets to reduce, for example, indebtedness. 79 j. Risk of shortage of wind This risk results from the shortage of wind due to natural factors, which is reduced because the “wind deposits” in Brazil are one of the best in the world, as in addition to high speed, wind is considered stable, different from certain regions in Asia and the United States, which are subject to cyclones, typhoons and other natural factors. k. Risk of shortage of water Indirect subsidiary Energética Serra da Prata S.A. and the jointly controlled entity Brasil PCH generate power through small hydroelectric plants (PCHs). A long period of shortage of rain, during the humid season, will reduce the water volume of the plants’ reservoirs. An extreme condition would imply decrease in revenues. The occurrence of unfavorable hydrologic conditions, and the obligation to deliver the contracted energy, may result in the Company’s exposure to the long-term energy market, which would affect its future financial results. However, except for one PCH, 100% of the hydroelectric generation capacity of the other PCHs is part of the Power Relocation Mechanism (“MRE”), which mitigates part of the hydrologic risk, through the allocation between all plants linked to the MRE. 28. Earnings per share Basic earnings (loss) per share are calculated by dividing profit (loss) for the period attributable to the holders of common and preferred shares of the Parent by the weighted average number of common and preferred shares outstanding during the period. Diluted earnings (loss) per share is calculated by dividing profit (loss) for the year attributable to the holders of the Parent’s common and preferred shares by the weighted average number of common and preferred shares available during the year, plus the weighted average number of common shares issued on the assumption of exercise of stock options with strike price lower than fair value. According to the Company’s bylaws, preferred shares are entitled to the same conditions of the common shares in profit sharing. The table below shows the data and number of shares used to calculate basic and diluted earnings (loss) per share for the periods indicated in the statement of operations. 80 Parent 06/30/2015 Loss for the year 06/30/2014 (56,408) (6,066) 318,691 231,308 (0.177) (0.026) 318,691 231,308 (Loss) basic earnings per share: Weighted average of outstanding common shares (in thousands) (Loss) basic earnings per share (in R$) Diluted earnings per share: Weighted average of outstanding common shares (in thousands) Dilutive effect of stock options (in thousands) Total shares applicable to dilution (in thousands) Loss diluted earnings per share (in R$) 478 - 319,136 231,308 (0.177) (0.026) 29. Assets classified as held for sale 29.1 Parent Changes in Parent’s investments: Assets Bahia Eólica Participações S.A. Salvador Eólica Participações S.A. Energética Serra da Prata S.A. Total assets classified as held for sale 06/30/2015 206,555 339,177 109,453 655,185 81 29.2 Consolidated Balance sheets as of June 30, 2015 ASSETS CURRENTS Cash and cash equivalents Short-term investments Trade receivables Accounts receivable - CCEE Recoverable taxes Prepaid expenses Advances to suppliers Other receivables Total current assets Bahia 06/30/2015 Salvador Espra Combined 7,690 390 6,002 647 449 15,178 10,751 818 11,729 1,294 1,642 661 284 27,179 5,121 34,436 5,544 107 64 207 20 45,499 23,562 35,644 23,275 1,294 2,396 64 1,317 304 87,856 NONCURRENTS Accounts receivable - CCEE Collaterals and restricted deposits Deferred taxes Other receivables Property, plant and equipment Total noncurrent assets 31 49,864 31 425,467 475,393 19,847 108,380 130 768,377 896,734 13,682 1,882 35 170,321 185,920 19,878 171,926 2,043 35 1,364,165 1,558,047 TOTAL ASSETS 490,571 923,913 231,419 1,645,903 82 EQUITY AND LIABILITIES CURRENTS Trade payables Borrowings and financing Taxes payable Accounts payable - CCEE/Eletrobras Provision for social and environmental costs Dividends payable Other payables Total current liabilities Bahia 06/30/2015 Salvador Espra Combinado 3,648 21,044 1,809 1,399 2 27,902 6,261 43,276 4,081 3,255 456 57,329 1,931 5,735 377 21,559 4,313 7 33,922 11,840 70,055 6,267 21,559 4,654 4,769 9 119,153 NONCURRENTS Borrowings and financing Deferred taxes Accounts payable - CCEE/Eletrobras Provision for social and environmental costs Related parties Total noncurrent liabilities 251,904 77 2,740 483 910 256,114 519,569 1,422 3,109 1,123 2,184 527,407 88,044 88,044 859,517 1,499 5,849 1,606 3,094 871,565 EQUITY 206,555 339,177 109,453 655,185 TOTAL LIABILITIES AND EQUITY 490,571 923,913 231,419 1,645,903 Classified as: Assets classified as held for sale Liabilities directly related to assets held for sale 1,645,903 982,855 83 Income and cash flow statements as of June 30, 2015 06/30/2015 Bahia Salvador Espra Combined Profit of assets classified as held for sale Revenue Costs and expenses Profit before taxes Income tax and social contribution Profit of period 40,479 (28,883) 11,596 (2,177) 9,419 88,767 (55,538) 33,229 (4,705) 28,524 11,752 (7,540) 4,212 (1,229) 2,983 140,998 (91,961) 49,037 (8,111) 40,926 Cash flow of assets classified as held for sale Net cash of operating activities Net cash provided of investing activities Net cash of financing activities (Redução) aumento no saldo de caixa e equivalentes de caixa 12,046 (967) (10,252) 827 15,986 1,522 (19,502) (1,994) 3,494 (10,015) (2,859) (9,380) 31,526 (9,460) (32,613) (10,547) 6,863 7,690 12,745 10,751 14,501 5,121 34,109 23,562 827 (1,994) (9,380) (10,547) Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period (Decrease) Inrease in Cash and Cash Equivalents On May 8, 2015 the Board of Directors approved the conclusion of an agreement of contribution of securities between Renova, the SE Emerging Markets Yield, Inc. ("Global terraform") and SunEdison Inc. ("SunEdison" ) through which the Company agrees to contribute the operating assets related to the projects of Espra (three small hydropower plants), Salvador wind (nine wind farms sold in LER 2009) and Bahia wind (5 wind farms sold in LER 2009) to R$1,613,000 subject to adjustments contemplated in the agreement. The consummation of the agreement is subject to a number of conditions precedent, including the completion of the TerraForm Global IPO, obtaining third-party consent and regulatory approvals, including CADE, ANEEL and Eletrobrás. 30. Insurance coverage The Company and its subsidiaries contracted insurance for certain property, plant and equipment items, civil liability and other contractual guarantees. As at June 30, 2015, current policies are summarized as follows: Risks of generation, construction and transmission: 84 Operation Insured item Coverage Civil liability – LER 2009 Effective term Start End Insured R$ 10,000 06/28/2013 10/10/2015 Renova Energia R$ 1,287,348 07/11/2014 07/11/2015 Renova Energia R$ 183 09/08/2014 09/08/2015 COELBA Operating risks R$ 233,591 09/25/2014 09/25/2015 ESPRA Civil liability R$ 233,591 09/25/2014 09/25/2015 ESPRA Operating risks (LER 2010) R$ 872,116 10/10/2014 10/10/2015 Renova Energia Civil liability – LER 2010 R$ 671,452 10/10/2014 10/10/2015 Renova Energia Operating risks (LER 2009) Surety - Contractual obligations Construction Insured item Coverage Effective term Start End Insured Performance bond for implementation of LEN 2011 R$ 41,193 12/05/2011 08/21/2015 Transportation / Delay Start Up (Project LER 2010 / LEN 2011) R$ 801,500 11/30/2012 08/01/2015 Renova Energia Performance Bond (LEN 2012) R$ 3,144 04/02/2013 04/01/2017 ANEEL Performance Bond (LER 2013) R$ 31,750 12/05/2013 12/01/2015 ANEEL Performance Bond (A-5 2013) R$ 64,715 04/28/2014 08/01/2018 ANEEL Performance Bond (ACL) R$ 40,140 09/19/2014 10/01/2015 ANEEL Performance Bond (ACL) R$ 40,560 09/19/2014 10/01/2016 ANEEL Performance Bond (ACL) R$ 19,520 09/19/2014 01/31/2017 ANEEL Performance Bond (ACL) R$ 4,320 09/19/2014 01/31/2016 ANEEL Performance Bond (ACL) R$ 6,480 09/19/2014 01/10/2015 ANEEL Civil liability (ACL) ANEEL R$ 2,229,363 12/01/2014 01/01/2017 Renova Energia Civil liability (LEN 2012 (A-5)) R$ 77,645 12/01/2014 01/01/2017 Renova Energia Civil liability/ Transportation/Enginnering Risk (LER 2013) R$ 654,103 12/01/2014 01/01/2017 Renova Energia Cosntruction Bond (A-5 2014) R$ 20,633 04/01/2015 07/01/2019 ANEEL Cosntruction Bond (A-5 2014) R$ 20,633 04/01/2015 07/01/2019 ANEEL Performance bond for implementation (LER 2014) R$ 33,903 03/04/2015 04/01/2018 ANEEL Engineering risks /Transportation (LEN 2012) R$ 77,645 12/01/2014 01/01/2017 Renova Energia Engineering risks (ACL) R$ 112,615 11/14/2014 01/01/2017 Renova Energia Engineering risks/ Transportation (ACL) R$ 417,050 12/01/2014 01/01/2017 Renova Energia Engineering risks/ Transportation (ACL) R$ 825,864 12/01/2014 01/01/2017 Renova Energia Engineering risks/ Transportation (ACL) R$ 834,099 12/01/2014 01/01/2017 Renova Energia Engineering risks/ Transportation (ACL) R$ 132,350 12/01/2014 01/01/2017 Renova Energia Administration and Portfolio Insured item Coverage Effective term Start End Insured Civil liability – D&O R$ 30,000 01/31/2015 01/31/2016 Renova Energia Civil liability - Initial Public Offering – POSI R$ 25,000 07/07/2014 07/07/2015 Renova Energia R$ 593 09/12/2014 09/12/2015 Rd Equipment (Wind measurer - Lidar) LIDAR 85 31. Commitments The Company and its subsidiaries have contractual obligations and commitments assumed in connection with the construction and maintenance of their wind farms, including purchases of machinery and equipment, in the amount of R$4,303,569, civil construction, in the amount of R$438,507 and acquisition of projects, in the amount of R$93,212. 32. Non-cash transactions As of June 30, 2015, the Company conducted the following noncash transactions; therefore, these transactions are not reflected in the statement of cash flows: Note Finance charges capitalized Finance income capitalized Payment of capital in subsidiaries through property, plant and equipment Acquisition of property, plant and equipment - Trade payables Proposed dividends of parents Payment of borrowings and promissory notes through a new financing Payment of interest on borrowings through a new financing 14.2, 14.4 14.2 14.4 14.2 13.4 16 16 Consolidated 06/30/2015 06/30/2014 33,021 (3,915) (267,297) - 55,578 (5,787) (165,211) 1,000,000 47,894 Parent 06/30/2015 06/30/2014 7,517 2,022 - 9,209 46,611 15,427 - 33. Subsequent events 33.1 Sale of assets On July 15, 2015, the Company entered into definitive agreements with TerraForm Global, Inc., ("TerraForm Global"), TerraForm Global, LLC and SunEdison, Inc. ("SunEdison") divided into two phases: The first phase of the operation, announced on May 7, 2015, included the signing of the following agreements: (i) The contract of purchase and sale of shares for the sale of the assets of Espra project for R$136,000, through payment in cash; (ii) purchase agreement and sale of shares for the sale of the assets of the Bahia project, the value (equity value) of R$451,000, through payment in cash; and (iii) the stock exchange contract for the exchange of the shares of the Company's subsidiaries which hold the assets of Salvador project, for R$1,026,000, by TerraForm Global shares based on the price per share to be paid in the tender offer (IPO) of TerraForm Global in progress. The above amounts are subject to adjustments included in their contracts. The second phase of the operation, approved and celebrated on July 15, 2015, includes other assets that have longterm power sales contracts, operational and non-operational ("Backlog") and projects under development and to be developed by the Company that may sell power under long-term contracts (Pipeline), and included the signing of the following agreements: 86 (i) The contract of exchange of shares for the exchange of the shares of the Company's subsidiaries which hold the assets of each Backlog the project, as listed below, for the total value of the company (enterprise value, which considers the debt in the value of assets) of R$13.4 billion. The values will be adjusted on the exchange date as the applicable contractual provisions. The assets, with 2204.2 MW of installed capacity, will be exchanged after their respective entries into commercial operation and according to the schedule below negotiated by the parties and Renova will receive the corresponding value in TerraForm Global shares based on the average of the last 30 quotations trading days prior to closing. Asset Light I Light II LEN A-5 2012 LER 2010 LEN A-3 2011 LER 2014 - wind LER 2014 - solar LER 2013 PPA Cemig LEN A-5 2013 LEN A-5 2014 Installed capacity (MW) 200.7 202.8 18.9 167.7 218.4 43.5 53.5 159.0 676.2 355.5 108.0 Year exchange 2017 2017 2017 2018 2018 2018 2018 2019 2019 2020 2020 (ii) option contract through which the TerraForm Global will have until December 31, 2016, a call option and preference in the acquisition of renewable energy projects under development and to be developed by the Company that may sell energy contracts long term. The amount of TerraForm Global shares to be received by Renova will be determined based on a multiple of cash available for distribution of their project in the years following transfer, according to the methodology agreed by the parties. After this period, the parties will negotiate new mechanics of the purchase option and first refusal to acquire the projects, aiming to reflect market conditions and the Company's competitiveness. 33.2 Entry of SunEdison in the Company's Controlling Block On July 15, 2015, the contract of purchase and sale of shares for the sale of the Company's shares held by Light Energia S.A. for SunEdison was concluded. The closing of this transaction is still subject to conditions precedent, among which: regulatory approvals and manifestation as the transfer restrictions of shares and rights of first refusal and tag-along, provided for in the existing shareholder agreements. Upon closing of this transaction, SunEdison will adhere to existing shareholders agreements of the Company and will be part of the Renova controlling block, as follows: 87 RENOVA ENERGIA Controlling block RR Participações SunEdison Cemig GT Other shareholders RR Participações* BNDESPAR InfraBrasil FIP Caixa Ambiental Other Total Common Number 188.309.629 50.561.797 50.561.797 87.186.035 48.534.657 8.250.393 9.311.425 11.651.467 5.470.293 13.851.079 236.844.286 Preferred % 79,6% 21,4% 21,4% 36,8% 20,4% 3,5% 3,9% 4,9% 2,3% 5,8% 100,0% Number 81.811.136 1.280.600 18.622.850 23.302.933 10.940.586 27.664.167 81.811.136 * * % 0,0% 0,0% 0,0% 0,0% 100,0% 1,6% 22,8% 28,5% 13,4% 33,7% 100,0% Total shares Number 188.309.629 50.561.797 50.561.797 87.186.035 130.345.793 9.530.993 27.934.275 34.954.400 16.410.879 41.515.246 318.655.422 % of total capital % 59,1% 15,9% 15,9% 27,3% 40,9% 3,0% 8,8% 11,0% 5,1% 13,0% 100,0% * Carlos Mathias Aloysius Becker Neto Chief Executive Officer Pedro V.B. Pileggi Vice-President for Finance, Business Development and Investors Relations Officer Ricardo de Lima Assaf Vice-President for Legal Affairs, Regulation and Institutional Relations Officer Ney Maron de Freitas Vice-President for Environment and Sustainability Reinaldo Cardoso da Silveira Accountant CRC 014311-0/0-S- SP 88 (Convenience Translation into English from the Original Previously Issued in Portuguese) Renova Energia S.A. and Subsidiares Individual and Consolidated Interim Financial Information for the Quarter Ended June 30, 2015 and Report on Review of Interim Financial Information Deloitte Touche Tohmatsu Auditores Independentes Deloitte Touche Tohmatsu Auditores Independentes Avenida Tancredo Neves 450 Edf. Suarez Trade – 29º andar 41.820-020 – Salvador - BA Tel: + 55 (71) 2103-9400 Fax:+ 55 (71) 2103-9440 www.deloitte.com.br (Convenience Translation into English from the Original Previously Issued in Portuguese) REPORT ON REVIEW OF INTERIM FINANCIAL INFORMATION To the Shareholders, Directors and Management of Renova Energia S.A. São Paulo - SP Introduction We have reviewed the accompanying individual and consolidated interim financial information of Renova Energia S.A. (“Company”), identified as Parent and Consolidated, respectively, included in the Interim Financial Information Form (ITR), for the quarter ended June 30, 2015 and which comprise the balance sheet as of June 30, 2015, and the related income statement and the statement of comprehensive income for the three-month and for the six-month then ended, and statement of changes in equity and statement of cash flows for the six-month then ended, including a summary of significant accounting policies and other explanatory notes. Management is responsible for the preparation and fair presentation of the individual and consolidated interim financial information in accordance with technical pronouncement CPC 21 (R1) – Interim Financial Reporting and IAS 34 – Interim Financial Reporting, issued by the International Accounting Standard Board - IASB, as well as for the presentation of such information in accordance with the standards issued by the Brazilian Securities Commission (CVM), applicable to the preparation of Interim Financial Information (ITR). Our responsibility is to express a conclusion on this interim financial information based on our review. Scope of Review We conducted our review in accordance with Brazilian and International Standards on Review Engagements (NBC TR 2410 and ISRE 2410 - Review of Interim Financial Information Performed by the Auditor of the Entity). A review of interim financial information consists of making inquiries, primarily of persons responsible for financial matters and accounting, and applying analytical and other review procedures. The scope of a review is substantially less than an audit conducted in accordance with International Standards on Auditing and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Therefore, we do not express an audit opinion. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. Please see www.deloitte.com/about for a more detailed description of DTTL and its member firms. Renova Energia S.A. and Subsidiaries Conclusion on the individual interim financial information Based on our review, nothing has come to our attention that causes us to believe that the accompanying individual interim financial information included in the ITR referred to above was not prepared, in all material respects, in accordance with technical pronouncement CPC 21 (R1), applicable to the preparation of Interim Financial Information (ITR), and presented in accordance with the standards issued by CVM. Conclusion on the consolidated interim financial information Based on our review, nothing has come to our attention that causes us to believe that the accompanying consolidated interim financial information included in the ITR referred to above was not prepared, in all material respects, in accordance with technical pronouncement CPC 21 (R1) and international standard IAS 34, applicable to the preparation of Interim Financial Information (ITR), and presented in accordance with the standards issued by CVM. Emphasis As described in Note 14, the fixed assets used in the power generation activity under the independent production regime are depreciated over their estimated useful lives, considering the facts and circumstances that are mentioned in said Note. As new information or decisions by the regulatory agency or concession grantor are published, the current depreciation period for such assets may or may not be changed. Our conclusion does not contain qualification related to this issue. Other matters Statement of value added We have also reviewed the individual and consolidated statements of value added (“DVA”) for the six-month period ended June 30, 2015, prepared under the responsibility of the Company's management, the presentation of which is required by standards issued by CVM applicable to preparation of Interim Financial Information (ITR) and consider as supplemental information under International Financial Reporting Standards - IFRS, which do not require the presentation of these statement. These statements were submitted to the same review procedures described above and, based on our review, nothing has come to our attention that causes us to believe that they were not prepared, in all material respects, in relation to the individual and consolidated interim financial information taken as a whole. The accompanying interim financial information has been translated into English for the convenience of readers outside Brazil. São Paulo, August 4, 2015 DELOITTE TOUCHE TOHMATSU Auditores Independentes © 2015 Deloitte Touche Tohmatsu. All rights reserved. José Luiz Santos Vaz Sampaio Engagement Partner 2