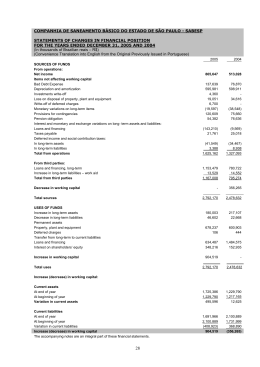

Key Indicators - US GAAP Financial data (US$ million) 3T99 1T00 2T00 3T00 Net sales (Consol.) Globo Cabo Net Sul Corporate Network EBITDA (Consol.) Globo Cabo 123.1 94.6 23.6 4.9 34.9 25.9 136.5 104.4 26.1 6.0 24.3 23.5 140.1 104.3 29.0 6.9 31.9 23.2 153.8 114.6 32.3 6.9 37.4 27.5 Net Sul Corporate Network 7.5 1.5 1.6 (0.8) 6.3 2.4 7.7 2.1 EBITDA Margin (Consol.) 28.4% 17.8% 22.8% 24.3% Globo Cabo 27.4% 22.6% 22.2% 24.0% Net Sul Corporate Network 31.9% 30.4% 6.1% -14.0% 21.7% 35.4% 23.8% 30.8% Subscribers Growth Globo Cabo Subscribers 4Q99 1Q00 2Q00 3Q00 936.1 949.1 965.6 1,008.7 4.9% 5.7% 7.1% 19.1% 1,332.1 1,348.1 -1.0% 4.9% (excluding Net Sul and Unicabo) Annualized Organic Growth (excluding Net Sul and Unicabo) Globo Cabo Subscribers 1,416.1 1,467.9 (including Net Sul and Unicabo) Annualized Overall Growth (including Net Sul and Unicabo) * Londrina and Blumenau acquisitions 21.7%* 15.5% Subscribers Mix and ARPU 33,03 29,60 30,01 29,21 33,46 33,87 34,76 2.6 2.5 0.6 0.6 0.6 0.6 0.4 17.3 17.1 17.4 17.6 19.9 46.3 44.3 41.0 34.3 35.7 38.0 41.0 1Q99 2Q99 3Q99 Advanced Plus 0.7 3.0 20.4 21.5 30.4 27.0 24.3 47.6 49.3 49.3 48.7 4Q99 1Q00 2Q00 3Q00 Master Standard Others Vírtua - Evolution 1,113 14,792 8,929 568 280 1,068 1Q00 2Q00 3Q00 Two Way Homes Passed (in thousands) 1Q00 2Q00 Subscribers 3Q00 Churn Rate vs. Bad Debt 31.5% 27.1% 17.2% 16.6% 12.2% 2.97% 15.4% 15.3% 2.87% 1.83% 1.64% 1.65% 1Q00 2Q00 0.82% -0.10% 1Q99 2Q99 3Q99 4Q99 % Bad Debt Churn Rate (Quarterly Annualized) 2Q00 EBITDA Composition US GAAP 3Q99 1Q00 2Q00 3Q00 100% 100% 100% 100% 48.7% Direct Operating Programmers and royalties. . . . . .28.7% Network expenses . . . . . . . . . . . . . 5.2% Customers relations. . . . . . . . . . . . 2.3% Payroll and benefits . . . . . . . . . . . . 6.1% Other costs (third parties). . . . . . . 6.4% 48.6% 49.5% 48.7% 28.4% 4.1% 2.3% 6.3% 7.5% 30.6% 4.4% 2.6% 6.5% 5.4% 28.6% 4.9% 2.6% 6.4% 6.2% 22,9% Selling/ Administrative Selling . . . . . . . . . . . . . . . . . . . . . . . 4.3% General & Administrative . . . . . . .16.6% Bad debt expense. . . . . . . . . . . . . . 0.8% Other . . . . . . . . . . . . . . . . . . . . . . . . 1.2% 33.5% 5.5% 21.1% 1.6% 5.4% 27.7% 7.6% 16.0% 1.6% 2.5% 27.0% 8.7% 17.0% 1.8% -0.5% EBITDA 17.8% 22.8% 24.3% Net Revenue 28.4% Amortization Schedule* Pro-forma Notes Convertible debentures FRNs-Net Sul 185 32 95 2000 123 2001 74 2002 64 4 10 8 64 2003 * Includes Vicom and Net Sul 85 2004 2005 2006 Total debt: US$ 784 MM

Baixar