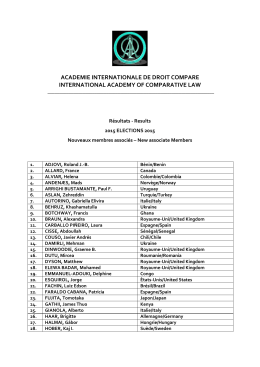

2011 FMA European Conference 8 - 10 June 2011 Porto, Portugal Bem vindo ao Porto Dear Colleagues: Welcome to the 2011 FMA European Meeting in beautiful Porto, Portugal! You will find a wide array of sessions to attend, each of which offers a unique opportunity for the discussion of timely academic and practical issues in finance. There are many outstanding papers being presented on this year's program – and many outstanding panel discussions as well as a number of opportunities for socializing. We express a very special thank you to the members of this year's Program Committee who evaluated the academic paper submissions. We would also like to extend our appreciation to all of the participants on the program — Dr. René Stulz, our Keynote Speaker, Dr. Miguel Ferreira, Doctoral Student Consortium Coordinator, the paper presenters, session chairpersons, discussants, panel session organizers and panelists, and attendees. Each of you makes a vital contribution to the program's success, and we are most appreciative. Finally, we offer our most sincere thanks to this year's conference partners and sponsors: Partners Universidade do Porto EGP-UPBS, University of Porto Business School Faculdade de Economia da Universidade do Porto (FEP) CEF.UP Keynote Address Sponsor Associação Portuguesa de Bancos (APB) Sponsors Associação Portuguesa de Analistas Financeiros (APAF) Luso-American Development Foundation (FLAD) Banco de Portugal Comissão do Mercado de Valores Mobiliários (CMVM) NYSE Euronext Ordem dos Técnicos Oficiais de Contas (OTOC) The support provided by these partners and sponsors makes this a truly special event for all of us. Thank you for joining us. We know you will enjoy this year’s program and social activities. Sincerely, Hendrik (Hank) Bessembinder University of Utah Jorge Farinha Universidade do Porto Ana Paula Serra Universidade do Porto 2011 FMA EUROPEAN CONFERENCE 8 - 10 JUNE 2010 — PORTO, PORTUGAL TABLE OF CONTENTS Welcome ......................................................................................................................................... Inside Front Cover Dr. Hendrik (Hank) Bessembinder, University of Utah Dr. Jorge Farinha, Universidade do Porto Dr. Ana Paula Serra, Universidade do Porto Table of Contents ............................................................................................................................ 1 Doctoral Student Consortium .......................................................................................................... 2 Keynote Address, Dr. René Stulz, The Ohio State University ........................................................ 3 Special Panel Sessions ................................................................................................................... 4 2011 European Conference Program Committee ........................................................................... 6 Partners and Sponsors.................................................................................................................... 8 Conference Program ....................................................................................................................... 11 At-a-Glance Program Schedule ...................................................................................................... 27 Roster of Attendees......................................................................................................................... 29 Index of Participants ........................................................................................................................ 33 Porto Palácio Hotel Map.................................................................................................................. 35 Routledge Taylor & Francis Group .................................................................................................. 36 Oxford University Press................................................................................................................... 37 Upcoming FMA Conferences .......................................................................................................... 38 2012 FMA European Conference - Istanbul, Turkey ....................................................................... Inside Back Cover Conference Exhibitor Capital IQ Partners Sponsors Porto cover photo: Jordi Ramisa - Istanbul cover photo: Ilker Canikligil 2011 FMA European Conference Program - 1 2011 FMA EUROPEAN CONFERENCE DOCTORAL STUDENT CONSORTIUM COORDINATOR Dr. Miguel Ferreira, Universidade Nova de Lisboa Associate Professor of Finance PANELISTS & WORKSHOP LEADERS Dr. Craig Lewis, Vanderbilt University and US SEC Madison S. Wigginton Professor of Management in Finance Dr. Gordon Roberts, York University Professor of Finance and CIBC Professor of Financial Services Dr. Pedro Santa-Clara, Universidade Nova de Lisboa Millennium bcp and Professor of Finance Dr. João Santos, Federal Reserve Bank of New York Assistant Vice President, Financial Intermediation Function Dr. Laura Starks, University of Texas Chair, Finance Department, Charles E and Sarah M Seay Regents Chair, and Director, AIM Investment Center STUDENT PARTICIPANTS Iness Aguir .......................................................... University of Texas San Antonio Gino Cenedese ................................................... University of Warwick Burcin Col ........................................................... McGill University Catarina Alexandra Alves Fernandes ................. Universidade do Porto KiHoon Jimmy Hong ........................................... University of Cambridge Pearpilai Jutasompakorn .................................... Monash University Olga Lebedeva.................................................... University of Mannheim Yuenjung Park .................................................... Korea Advanced Institute of Science & Technology (KAIST) Joao Filipe Monteiro Pinto .................................. Universidade do Porto Manuel Teixeira de Vasconcelos ........................ Erasmus University Alminas Zaldokas................................................ INSEAD 2011 FMA European Conference Program - 2 Keynote Address Sponsored By KEYNOTE ADDRESS Dr. René M Stulz, The Ohio State University Thursday, 9 June, 17:15 (5:15) pm Sala Porto (Floor 1) René M. Stulz is the Everett D. Reese Chair of Banking and Monetary Economics and the Director of the Dice Center for Research in Financial Economics at the Ohio State University. He has also taught at the Massachusetts Institute of Technology, the University of Chicago, and the University of Rochester. He received his Ph.D. from the Massachusetts Institute of Technology. He was awarded a Marvin Bower Fellowship from the Harvard Business School, a Doctorat Honoris Causa from the University of Neuchâtel, and the 1999 Eastern Finance Association Distinguished Scholar Award. In 2004, the magazine Treasury and Risk Management named him one of the 100 most influential people in finance. A recent study found that he was the sixth most often cited contributor to the top journals in financial economics from 2003 to 2008. He is a past president of the American Finance Association, a past president of the Western Finance Association, and a fellow of the Financial Management Association. René M. Stulz was the editor of the Journal of Finance, a leading academic publication in the field of finance, for twelve years. He is on the editorial board of more than ten academic and practitioner journals. Further, he is a member of the Asset Pricing and Corporate Finance Programs of the National Bureau of Economic Research. He has published more than sixty papers in finance and economics journals, including the Journal of Political Economy, Journal of Financial Economics, Journal of Finance, and Review of Financial Studies. His published research deals with topics such as the valuation discount of conglomerates, the benefits and costs of leverage, spinoffs and asset sales, the determinants of liquid asset holdings of firms, secured debt, bank loans, the pricing of exotic options, credit risks, the cost of capital, managerial ownership, the market for corporate control, corporate governance, the performance of firms issuing debt and equity, the determinants of firm capital structures and liquid asset holdings, the use of derivatives in risk management, capital flows, and financial globalization. He is the author of a textbook titled Risk Management and Derivatives and a co-author of the Squam Lake Report: Fixing the Financial System, and has edited several books, including the Handbook of the Economics of Finance. René M. Stulz has taught in executive development programs in the US, Europe, and Asia. He has consulted for major corporations, the New York Stock Exchange, and the World Bank. He is a director of several companies, the president of the Gamma Foundation, and a trustee of the Global Association of Risk Professionals. Finally, he has worked with some of the country’s most prominent law firms on issues such as the Procter and Gamble derivatives losses, internet IPOs, and the bankruptcy of Enron. OPENING RECEPTION Círculo Universitário do Porto (Rua do Campo Alegre, 877) 18:30 (6:30) pm Advance registration required 2011 FMA European Conference Program - 3 2011 FMA EUROPEAN CONFERENCE SPECIAL PANEL SESSIONS THURSDAY, 9 JUNE Session 06 Special Session Sponsor Borrowing and Lending: Banks and Firms Revisited Thursday, 9 June, 8:30 am – 10:00 am, Sala Tâmega (Floor 2) Presentations Did the Rise of CLOs Lead to Riskier Lending? João Santos, Federal Reserve Bank of New York Lending Relationships and the Effect of Bank Distress: Evidence from the 2007-2008 Financial Crisis Miguel Ferreira, Universidade Nova de Lisboa Daniel Carvalho, University of Southern California Pedro Matos, University of Southern California Borrowing Patterns, Bankruptcy, and Voluntary Liquidation José Mata, Universidade Nova de Lisboa António Antunes, Banco de Portugal Pedro Portugal, Banco de Portugal Special Session Sponsor Session 16 Financial Regulation after the International Financial Crisis: What really will change? Thursday, 9 June, 10:30 am - 12:00 noon, Sala Tâmega (Floor 2) Panelists Elisa Ferreira Member, Economic and Monetary Affairs Committee European Parliament Maureen O'Hara Robert W Purcell Professor of Finance Cornell University Carlos Tavares Vice Chairman, European Securities and Markets Authority (ESMA) Chair, Portuguese Securities Market Commission (CMVM) Session 26 Special Session Sponsor Financial Markets and Public Finance in Portugal Thursday, 9 June, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Tâmega (Floor 2) Panelists Raúl Manuel Simões Marques Chairman, APAF (Portuguese Association of Financial Analysts) Executive Vice-President of the Board of Directors and Executive Committee, Banif Gestão de Activos and Banif Açor Pensões Manuel Puerta da Costa Member of the Board, BPI Gestão de Activos and APAF João Cantiga Esteves, Member of the Board, APAF 2011 FMA European Conference Program - 4 FRIDAY, 10 JUNE Session 56 The Shadow Financial Regulatory Committee: Dissecting the Financial Crisis and Financial Reform Friday, 10 June, 10:30 am - 12:00 noon, Sala Tâmega (Floor 2) Moderator George Kaufman, John F Smith, Jr Professor of Finance & Economics Loyola University Chicago Panelists Franklin Edwards, Arthur F Burns Chair of Free and Competitive Enterprise Columbia University Richard Herring, Jacob Safra Professor of International Banking, Professor of Finance & Co-Director, Wharton Financial Institutions Center University of Pennsylvania Kenneth Scott, Ralph M Parsons Professor of Law and Business, Emeritus Stanford University Session 66 Research Opportunities in Corporate Governance Friday, 10 June, 13:30 (1:30) pm - 15:00 (3:00 pm), Sala Tâmega (Floor 2) Moderator Ralph A Walkling, Stratakis Chair in Corporate Governance and Executive Director of the Center for Corporate Governance Drexel University Panelists Marco Bigelli, Professor of Finance University of Bologna, Johns Hopkins University, and Université de Paris XII Charles Elson, Edgar S. Woolard, Jr., Chair in Corporate Governance & Director, John L. Weinberg Center for Corporate Governance University of Delaware Ajay Patel, Professor and GMAC Chair in Finance Wake Forest University Laura Starks, Chair, Finance Department, Charles E. & Sara M. Seay Regents’ Chair, and Director, AIM Investment Center University of Texas Austin René Stulz, Everett D. Reese Chair of Banking and Monetary Economics & Director, Dice Center for Research in Financial Economics The Ohio State University 2011 FMA European Conference Program - 5 2011 FMA EUROPEAN CONFERENCE PROGRAM COMMITTEE NAME AFFILIATION COUNTRY Margarida Abreu Vikas Agarwal Rui AP Albuquerque Gordon J Alexander Alvaro Santos Almeida Carlos Francisco Alves Mario Daniele Amore Alexandre Miguel Baptista Faten Ben Slimane Wolfgang Bessler Keith C Brown Maria Carapeto Lal C Chugh Joao Cocco Costanza Consolandi Asher Curtis Qinglei Dai Nandita Das Gang (Nathan) Dong Mário Coutinho dos dos Santos João Duque Gary W Emery Vihang Errunza Javier Estrada Shuang Feng Miguel Almeida Ferreira Francisco Gomes Laura Gonzalez Mamiza Haq Huong N Higgins Delroy M Hunter Amrit Paul Judge Aneel Keswani Lawrence Kryzanowski Asjeet S Lamba Thorsten Lehnert Abraham Lioui Igor Loncarski Qingzhong Ma Carmen Pilar Martí-Ballester Cesario Mateus Pedro Matos Victor Mendes Usha R Mittoo Rajesh Mohnot José António Moreira ISEG-UTL Georgia State University Boston University University of Minnesota Universidade do Porto Universidade do Porto Copenhagen Business School The George Washington University Champagne Management School University of Giessen University of Texas Cass Business School University of Massachusetts Boston London Business School University of Siena University of Utah Universidade Nova de Lisboa Delaware State University Rutgers University Portuguese Catholic University ISEG - UTL University of Oklahoma McGill University IESE Business School University of Massachusetts Amherst Universidade Nova de Lisboa London Business School Fordham University University of Queensland Worcester Polytechnic Institute University of South Florida Middlesex University Business School Cass Business School Concordia University University of Melbourne University of Luxembourg EDHEC Business School University of Ljubljana Cornell University Universitat Autònoma de Barcelona University of Greenwich University of Southern California CMVM University of Manitoba Middlesex University Dubai Universidade do Portto Portugal US US US Portugal Portugal Denmark US France Germany US UK US UK Italy US Portugal US US Portugal Portugal US Canada Spain US Portugal UK US Australia US US UK UK Canada Australia Luxembourg France Slovenia US Spain UK US Portugal Canada Dubai Portugal 2011 FMA European Conference Program - 6 Narayan Naik Mervi M Niskanen João Pedro Vidal Nunes José Renato Haas Ornelas Shams Pathan João Pedro Pereira José Manuel Peres Jorge Petya Platikanova Peter F Pope Peter N Posch Marcel Prokopczuk Sofia Brito Ramos Clara Raposo Raghavendra Rau Luc Renneboog Cláudia Alexandra Ribeiro Lalith Samarakoon Leire San-Jose Pedro Santa-Clara João Santos Nicos A Scordis Henri Servaes Mark B Shackleton Andre C Silva Pierre Six Sotiris K Staikouras Carmen Stefanescu Duane R Stock David Stolin Janikan Supanvanij Kazunori Suzuki Erik Theissen Radu Sebastian Tunaru Pedro Luiz Valls Pereira Manuel Vasconcelos João Paulo Vieito Milos Vulanovic Jean-Philippe Weisskopf Sabine Wende Lan Xu Maxim Zagonov Ania Zalewska London Business School University of Eastern Finland ISCTE-IUL Business School Central Bank of Brazil The University of Queensland ISCTE-IUL Business School Universidade Porto ESADE Business School Lancaster University University of Ulm ICMA Centre, University of Reading ISCTE Lisbon University Institute ISEG-UTL University of Cambridge Tilburg University Universidade do Porto University of St Thomas University of Huddersfield & Universidad del País Vasco Universidade Nova de Lisboa Federal Reserve Bank New York St John's University London Business School Lancaster University Management School Universidade Nova de Lisboa Rouen Business School Cass Business School ESSEC University of Oklahoma Toulouse Business School St Cloud State University Chuo University University of Mannheim University of Kent at Canterbury São Paulo School of Economics Erasmus University Polytechnic Institute of Viana do Castelo Western New England College University of Fribourg University of Cologne Washington University in St. Louis Toulouse Business School University of Bath 2011 FMA European Conference Program - 7 UK Finland Portugal Brazil Australia Portugal Portugal Spain UK Germany UK Portugal Portugal UK Netherlands Portugal US UK & Spain Portugal US US UK UK Portugal France UK France US France US Japan Germany UK Brazil Netherlands Portugal US Switzerland Germany US France UK 2011 FMA EUROPEAN CONFERENCE —PARTNERS UNIVERSIDADE DO PORTO About Universidade do Porto With origins dating back to the eighteenth century, the Universidade do Porto is currently the largest institution of teaching and scientific research in Portugal. Nearly 31,000 students, 2,300 teachers and researchers, and 1,700 non-teaching staff are in its 15 schools and 69 research units, spread across three campuses located in the city of Porto. With 14 faculties and a business school, the Universidade do Porto offers a wide range of courses covering all levels of higher education and all major areas of knowledge. The qualifications of faculty make it the most sought after institution of higher learning by most Portuguese university applicants. Every year, more than 2,000 international students also choose the Universidade do Porto to complete their higher education. The Universidade do Porto is responsible for more than 20% of the Portuguese scientific articles indexed annually in ISI Web of Science, making it the largest producer of science in Portugal. More than half of those research units were rated "Excellent" or "Very Good" in the latest international independent rankings. In fact, the Universidade do Porto has some of the most productive and internationally recognized centers of Portuguese research and development. In recent years, the Universidade do Porto has focused on economic value of research activities and recent partnerships with some of the largest companies have resulted in several innovations with proven success in national and international markets. EGP-UNIVERSITY OF PORTO BUSINESS SCHOOL (EGP-UPBS) EGP-UPBS is the Business School of the University of Porto. Its mission is the teaching of graduate courses and advanced executive management training programmes, as well as complementary activities in the fields of applied research and business services. Founded in 1988, the School’s special governance structure is jointly assured by the University of Porto and a set of more than 20 large corporations and other private entities. This provides the school with a very effective blend of scientific and pedagogical rigor coupled with a special concern for the practical needs of the business world. School Faculty members are recruited from the University of Porto’s different departments but also from both the professional world as well as from a large number of renowned international business schools. EGP-UPBS offers one of the oldest full time MBAs in Portugal, as well as the largest Executive MBA program in the country, both of which enjoy a double accreditation by AMBA-Association of MBAs and EPAS (EFMD). The full-time Magellan MBA is an international programme that currently has the largest percentage of international students of any internationally accredited MBA programme in Portugal. Students from both MBA programmes have been consistently recording relevant professional achievements, with a substantial number of these currently leading some of the most important private corporations in Portugal (Sonae, EDP Renewables, Cerealis, ColepCCL, Bial, etc.). The School has also one of the largest portfolios in Portugal of one-year Post-Graduate programmes (over 15) in all fields of Management, as well as a vast array of shorter duration open-enrollment courses for executives. In 2011, the quality of EGP-UPBS’s in-company training programmes was internationally acknowledged as EGP-UPBS entered the top-100 Financial Times Woldwide Ranking of Customised Executive Education (at number 65). FEP-FACULDADE DE ECONOMIA DA UNIVERSIDADE DO PORTO Founded in 1953, the University of Porto School of Economics and Business (FEP - Faculdade de Economia da Universidade do Porto) awards academic degrees in the fields of economics and business. FEP is renowned for its high educational standards and scientific research, and for the academic merit, wide practical experience, and teaching ability of its faculty. Currently FEP has more than three thousand students enrolled in 20 programmes of Economics and Business, more than two hundred of which are foreign students. The school offers 2 undergraduate degrees in Economics and Business Administration, 16 MSc degrees and 2 PhD courses in Economics, Business and Management Studies. FEP has two Research Centres classified as “Very Good” by FCT, the National Foundation for Science and Technology. Its scientific production contributes to the University of Porto being in the top 200 European Universities in International Academic Rankings and being also recognised as the most prestigious teaching and research institution in the country, producing 22,5% of the scientific articles produced in Portugal. A highly qualified faculty, 77% of whom hold a PhD, good facilities and equipment, plus good relations with the business world are the basis for the first-rate training that FEP provides its students, which is fully recognized and appreciated in today’s business and labour marketplace. 2011 FMA European Conference Program - 8 CEF.UP CEF.UP is a research center in Economics and Finance hosted by the Faculdade de Economia (FEP), Universidade do Porto. It was created in 2009 following the merger of CEMPRE and CETE, also hosted by FEP and established in 1993 and 1991, respectively. CEF.UP conducts theoretical and applied research in Economics and Finance. It aims at producing high quality scientific research and contributing to the dissemination of economic knowledge and informing the public policy debate. CEF.UP organizes three seminar series, publishes a working papers series, manages a data center, and organizes scientific events. Jointly with NIPE, the Center develops and maintains a ranking of academic research performance website. The center regularly hosts visitors who cooperate with researchers on individual projects, participate in the seminars series, and teach in the PhD program in Economics. KEYNOTE ADDRESS SPONSOR ASSOCIAÇÃO PORTUGUESA DE BANCOS The Portuguese Banking Association (APB) is the main entity that represents the Portuguese banking sector. It was created in 1984 to strengthen the financial system, as well as its relationship with society and contribute to the development of a stronger banking sector and is especially attentive to the problems and needs of the country. Its purpose is to represent members with the authorities responsible for setting the regulatory framework that develops banking and economic policy in order to help improve the regulatory system, the service quality of banks, and reduce the levels of risk. CONFERENCE SPONSORS ASSOCIAÇÃO PORTUGUESA DE ANALISTAS FINANCEIROS (APAF) The Portuguese Association of Financial Analysts (APAF) was established in 1984 to transfer financial information and expertise between analysts and investment managers in Portugal with other countries through the European Federation. In order to attain its objectives, APAF also promotes several initiatives aiming to strengthen the professional qualifications of its members through close relations with the most prestige institutions of higher education. On an international level, APAF is a member of The European Federation of Financial Analysts' Societies (EFFAS), and participates in several initiatives and on specialised commissions that focus on the fields of financial analysis. BANCO DE PORTUGAL Banco de Portugal is the central bank of the Republic of Portugal. Established by royal charter on 19 November 1846 to act as a commercial bank and issuing bank, it came about as the result of a merger of the Banco de Lisboa and the Companhia de Confiança Nacional, an investment company specialising in the financing of public debt. The bank issues legal tender that is designated as the national currency – the real until 1911, the escudo from 1911 until 1998, and the euro since 1999. Following its nationalisation in September 1974 and its new Organic Law (1975), the Banco de Portugal was, for the first time, responsible for the supervision of the banking system. It is an integral part of the European System of Central Banks, which was founded in June 1998. 2011 FMA European Conference Program - 9 COMISSÃO DO MERCADO DE VALORES MOBILIÁRIOS (CMVM) The Portuguese Securities Market Commission (CMVM) was established in April 1991 with the task of supervising and regulating securities and other financial instruments markets (traditionally known as stock markets), as well as the activity of all those who operate within said markets. The CMVM regulates the functioning of the securities markets, public offerings, actions of all the market operators and, in general, all matters pertaining to this area of activity. The CMVM is an independent public institution, with administrative and financial autonomy. LUSO-AMERICAN DEVELOPMENT FOUNDATION (FLAD) The Luso-American Development Foundation (FLAD) is a private, financially independent Portuguese institution. Its main goal is to contribute towards Portugal's development by providing financial and strategic support for innovative projects by fostering cooperation between Portuguese and American civil society. FLAD's support is channeled in different ways. It awards scholarships and sponsors institutional projects, training programs and exchanges, for example (programs and scholarships). A substantial part of the Foundation's activity consists of launching its own projects, which it manages alone or in partnership with other institutions. The Foundation is an active member of the main international foundations networks. It belongs to the Board of the European Foundation Centre (EFC) in Brussels and is represented on its Legal Committee. The Foundation is a member of the Council on Foundations, which gathers US foundations or foundations operating in the US. It is associated with the Bellagio Forum for Sustainable Development, which is a group of US and European grant making foundations in the environmental area and which promote initiatives designed for supporting sustainable governance. NYSE EURONEXT NYSE Euronext is a leading global operator of financial markets and provider of innovative trading technologies. The company's exchanges in Europe and the United States trade equities, futures, options, fixed-income, and exchangetraded products. With approximately 8,000 listed issues (excluding European Structured Products), NYSE Euronext's equities markets - the New York Stock Exchange, NYSE Euronext, NYSE Amex, NYSE Alternext, and NYSE Arca - represent one-third of the world's equities trading, the most liquidity of any global exchange group. NYSE Euronext also operates NYSE Liffe, one of the leading European derivatives businesses and the world's second-largest derivatives business by value of trading. The company offers comprehensive commercial technology, connectivity and market data products and services through NYSE Technologies. NYSE Euronext is in the S&P 500 index, and is the only exchange operator in the Fortune 500. For more information, please visit www.nyx.com. ORDEM DOS TÉCNICOS OFICIAIS DE CONTAS (OTOC) Ordem dos Técnicos Oficiais de Contas (OTOC) is a professional organization responsible for regulating the accountancy practice in Portugal. OTOC administers an admittance examination every four months. Successful candidates earn the designation of Técnico Oficial de Contas (TOC), the authorized tax and accountancy practitioner in Portugal. OTOC, which is the largest Portuguese professional body with more than 75,000 affiliates, offers a broad range of training programs to its members, and is an active member in the public discussion of accounting and finance issues. 2011 FMA European Conference Program - 10 2011 FMA EUROPEAN CONFERENCE PROGRAM THURSDAY, 8:30 AM - 10:00 AM Session 01 Corporate Finance Thursday, June 9, 8:30 am - 10:00 am, Sala Douro Norte (Floor 1) Chairperson: Yaxuan Qi, Concordia University Impact of Pecking Order Preferences on Firm Individual Political Contributions and Firm Success in Real Business Cycles Performance Andreas Mueller, RWTH Aachen University Alexei V Ovtchinnikov, Vanderbilt University Malte Brettel, RWTH Aachen University Eva Pantaleoni, Vanderbilt University Self-Expropriation versus Self-Interest in Dual-Class Voting: The Pirelli Case Study Marco Bigelli, Univ of Bologna Stefano Mengoli, Univ of Bologna Presenter: Andreas Mueller Discussant: Charles Reuter, ESCP Europe, LSF & Paris Ouest Presenter: Marco Bigelli Discussant: Markus Schmid, Univ of Mannheim Presenter: Alexei Ovtchinnikov Discussant: Yaxuan Qi, Concordia University Session 02 Family Firms and Entrepeneurial Finance Thursday, June 9, 8:30 am - 10:00 am, Sala Douro Sul (Floor 1) Chairperson: Katrin Baedorf, WHU, Otto Beisheim Sch of Mgmt Financing and Managerial Support With (Some) Do Not Wake Sleeping Dogs: Payout Policies in Optimistic Entrepreneurs Founding Family Firms Laurent Vilanova, Univ of Lyon – Coactis Jean-Philippe Weisskopf, Univ of Fribourg Presenter: Laurent Vilanova Discussant: Wei-Peng Chen, Shih Hsin University Presenter: Jean-Philippe Weisskopf Discussant: Katrin Baedorf, WHU, Otto Beisheim Sch of Mgmt Ownership Structure, Family Control, and Acquisition Decisions Lorenzo Caprio, Università Cattolica del Sacro Cuore – Milano Ettore Croci, Università degli Studi di Milano - Bicocca Alfonso Del Giudice, Universita Cattolica - Milan Presenter: Ettore Croci Discussant: Dorra Najar, University Paris Dauphine Session 03 Managerial Incentives and Mergers Thursday, June 9, 8:30 am - 10:00 am, Sala Minho (Floor 1) Chairperson: George Alexandridis, ICMA Centre, University of Reading Cultural Values, CEO Risk Aversion and Corporate Cash versus Stocks for M&A Payments: Takeovers Determinants and Shareholder Valuation Bart Frijns, Auckland Univ of Tech Isabel Feito-Ruiz, Univ of Oviedo Aaron Gilbert, Auckland Univ of Tech Susana Menéndez-Requejo, Univ of Oviedo Thorsten Lehnert, Luxembourg Sch of Finance Alireza Tourani-Rad, Auckland Univ of Tech Presenter: Thorsten Lehnert Presenter: Isabel Feito-Ruiz Discussant: Discussant: Mieszko Mazur, IESEG George Alexandridis, ICMA Centre, Univ of Reading Internal Capital Markets, Non-Cash Divestitures and Managerial Incentives Mieszko Mazur, IESEG Presenter: Mieszko Mazur Discussant: Isabel Feito-Ruiz, Univ of Oviedo Session 04 Credit Markets Thursday, June 9, 8:30 am - 10:00 am, Sala Lima (Floor 1) Chairperson: Gordon Roberts, York University Savior or Sinner? Credit Defaults Swaps and the Cross-Listed Bonds and Rating Conservatism Market For Sovereign Debt Yiğit Atilgan, Sabanci University Iuliana Ismailescu, Pace University Aloke Ghosh, Baruch College Blake Phillips, Univ of Waterloo Jieying Zhang, Univ of Southern California Liquidity and Credit Risk Premia in the Pfandbrief Market Jan Bernd Siewert, Universität Mannheim Volker Vonhoff, Universität Mannheim Presenter: Blake Phillips Discussant: Yalin Gündüz, Deutsche Bundesbank Presenter: Volker Vonhoff Discussant: Mary Pieterse-Bloem, Tilburg University Presenter: Yiğit Atilgan Discussant: Gordon Roberts, York University Session 05 Portfolio Management and Performance Thursday, June 9, 8:30 am - 10:00 am, Sala Cávado (Floor 1) Chairperson: F Douglas Foster, Australian National University Portfolio Matching by Multi-Fund Managers: Effects Investment Style Volatility and Mutual Fund on Fund Performance and Flows Performance Vijay Yadav, INSEAD Keith C Brown, Univ of Texas WV Harlow, Putnam Investments Hanjiang Zhang, Nanyang Technological Univ Presenter: Vijay Yadav Discussant: Tim A Kroencke, Ctr for European Econ Res (ZEW) Presenter: Keith C Brown Discussant: F Douglas Foster, Australian National University 2011 FMA European Conference Program - 11 International Diversification Benefits with Foreign Exchange Investment Styles Tim A Kroencke, Centre for European Economic Research (ZEW) Felix Schindler, Centre for European Economic Research (ZEW) Andreas Schrimpf, Aarhus Univ & CREATES Presenter: Tim A Kroencke Discussant: Keith C Brown, Univ of Texas Session 06 Borrowing and Lending: Banks and Firms Revisited Special Session Sponsor Thursday, June 9, 8:30 am – 10:00 am, Sala Tâmega (Floor 2) PRESENTATIONS Did the Rise of CLOs Lead to Riskier Lending? João Santos, Federal Reserve Bank of New York Lending Relationships and the Effect of Bank Distress: Evidence from the 2007-2008 Financial Crisis Miguel Ferreira, Universidade Nova de Lisboa, Daniel Carvalho, University of Southern California Pedro Matos, University of Southern California Borrowing Patterns, Bankruptcy, and Voluntary Liquidation José Mata, Universidade Nova de Lisboa António Antunes, Banco de Portugal Pedro Portugal, Banco de Portugal Session 07 Management Compensation Thursday, June 9, 8:30 am - 10:00 am, Sala Corgo (Floor 2) Chairperson: Christopher W Anderson, University of Kansas Urban Agglomeration and CEO Compensation What Is the Most Effective Executive Compensation Bill B Francis, Rensselaer Plan? Polytechnic Institute Helena Pinto, Univ of Strathclyde Iftekhar Hasan, Rensselaer Martin Widdicks, Lancaster University Polytechnic Institute Kose John, New York University Maya Waisman, Fordham University Gender, Top Management Compensation Gap and Firm Performances: Tournament versus Behavioral Theory João Paulo Torre Vieito, Polythechnic Institute of Viana do Castelo Presenter: Bill B Francis Discussant: Christopher W Anderson, Univ of Kansas Presenter: João Paulo Vieito Discussant: Helena Pinto, University of Strathclyde Presenter: Helena Pinto Discussant: João Paulo Vieito, Polytechnic Instititue of Viana do Castelo Session 08 Derivatives Modeling Thursday, June 9, 8:30 am - 10:00 am, Sala Tua (Floor 2) Chairperson: Jr-Yan Wang, National Taiwan University Contingent Claims Valuation and Calibration with The Valuation of Forward-Start Rainbow Options Parameter Uncertainty for Low Frequency Data Chun-Ying Chen, National Taiwan University Radu Tunaru, Univ of Kent at Canterbury Jr-Yan Wang, National Taiwan University Presenter: Radu Tunaru Discussant: Jaqueson K Galimberti, Univ Federal de Santa Catarina Presenter: Jr-Yan Wang Discussant: Cláudia Ribeiro, FEP, University of Porto and CEF.UP Does Modeling Framework Matter? A Comparative Study of Structural and Reduced-Form Models Yalin Gündüz, Deutsche Bundesbank Marliese Uhrig-Homburg, Karlsruhe Inst of Tech Presenter: Yalin Gündüz Discussant: Jr-Yan Wang, National Taiwan University Session 09 Bank Risk Thursday, June 9, 8:30 am - 10:00 am, Sala Sousa (Floor 2) Chairperson: Julapa Jagtiani, Federal Reserve Bank Philadelphia, Risk Management, Corporate Governance, and Risk and Stability in Islamic Banking Bank Performance During the Financial Crisis Pejman Abedifar, Université de Limoges Vincent Aebi, Univ of St Gallen Amine Tarazi, Université de Limoges Gabriele Sabato, Royal Bank of Scotland Philip Molyneux, Univ of Wales Markus Schmid, Univ of Mannheim Presenter: Markus Schmid Discussant: Julapa Jagtiani, Fed Res Bank Philadelphia Presenter: Pejman Abedifar Discussant: Milagros Vivel, Univ of Santiago de Compostela Bank Risk and Analyst Forecasts Mario Anolli, Univ del Cattolica Sacro Cuore Elena Beccalli, Univ Cattolica Sacro Cuore & London School of Economics Presenter: Mario Anolli Discussant: Oliver Pucker, Univ of Cologne Session 10 International Finance 1 Thursday, June 9, 8:30 am - 10:00 am, Sala Sabor (Floor 2) Chairperson: Iraj Fooladi, Dalhousie University Stock Exchange Consolidation and Financial Risk Sovereign Wealth Funds: An Exploratory Study of Faten Ben Slimane, Champagne Sch of Mgmt their Behavior Ali Fatemi, DePaul University Iraj Fooladi, Dalhousie University Nargess Kayhani, Mt Saint Vincent University Presenter: Faten Ben Slimane Presenter: Iraj Fooladi Discussant: Discussant: Ulf Nielsson, Copenhagen Business School Aditya Kaul, Univ of Alberta 2011 FMA European Conference Program - 12 Privatization and Fiscal Deficits in European Emerging Markets Christina Hunt, Bank of America Merrill Lynch David A Walker, Georgetown University Presenter: David A Walker Discussant: Iraj Fooladi, Dalhousie University COFFEE BREAK, 10:00 am - 10:30 am Foyer, Floor 1 & Foyer, Floor 2 THURSDAY, 10:30 AM - 12:00 NOON Session 11 Agency and Financial Contracting Thursday, June 9, 10:30 am - 12:00 noon, Sala Douro Norte (Floor 1) Chairperson: Bill Francis, Rensselaer Polytechnic Institute Investor Objective and Financial Contracting: Do Agency Relations Mediate the Interaction Evidence from the PIPE Market Between Firms’ Financial Policies and Business Christopher W Anderson, Univ of Kansas Cycles? Na Dai, University at Albany SUNY Charles HJ Reuter, ESCP Europe, LSF & Paris Ouest Presenter: Christopher W Anderson Presenter: Charles Reuter Discussant: Discussant: Ma Camino Ramón-Llorens, Bill Francis, Rensselaer Polytechnic Institute Universidad Politécnica de Cartagena Effort, Risk Sharing, and Syndication in Venture Capital András Danis, Vienna Grad Sch of Finance Presenter: Andras Danis Discussant: Alexander Guembel, Univ of Toulouse Session 12 Governance and Corporate Decisions Thursday, June 9, 10:30 am - 12:00 noon, Sala Douro Sul (Floor 1) Chairperson: Narayanan Jayaraman, Georgia Tech Why do Firms Adopting more Antitakeover Does Director Liability Protection Matter? Provisions have Lower Valuation? Iness Aguir, Univ of Texas San Antonio Te-Feng Chen, National Taiwan University Natasha Burns, Univ of Texas San Antonio Huimin Chung, National Chiao Tung University Sattar A Mansi, Virginia Tech Ming-Ying Lin, National Chiao Tung University John K Wald, Univ of Texas San Antonio Ji-Chai Lin, Louisiana State University Presenter: Ming-Ying Lin Presenter: Sattar A Mansi Discussant: Discussant: Narayanan Jayaraman, Georgia Tech Alexander Molchanov, Massey University Overconfidence, Corporate Governance, and Global CEO Turnover Hyung-Suk Choi, Hongik University Steven P Ferris, Univ of Missouri Narayanan Jayaraman, Georgia Tech Sanjiv Sabherwal, Univ of Texas Arlington Presenter: Narayanan Jayaraman Discussant: Jean-Philippe Weisskopf, Université de Fribourg Session 13 Mergers Thursday, June 9, 10:30 am - 12:00 noon, Sala Minho (Floor 1) Chairperson: Alan Gregory, University of Exteter How have M&As Changed? Evidence from the Sixth Assessing Market Attractiveness for Mergers and Merger Wave Acquisitions: The MARC M&A Maturity Index George Alexandridis, ICMA Centre, Maria Carapeto, Cass Business School Univ of Reading, Scott Moeller, Cass Business School Christos F Mavrovitis, ICMA Centre, Anna Faelten, Cass Business School Univ of Reading Alexandra Smolikova, Cass Business School Nickolaos G Travlos, ALBA Grad Bus School Presenter: George Alexandridis Discussant: Ching-chieh Chang, Univ of Washington Presenter: Anna Faelten Discussant: Alan Gregory, Univ of Exeter Managerial Discretion and the Value of Cash Proceeds From Asset Sales Petya Platikanova, ESADE Presenter: Petya Platikanova Discussant: Martin Bugeja, Univ of Technology Sydney Session 14 Credit Thursday, June 9, 10:30 am - 12:00 noon, Sala Lima (Floor 1) Chairperson: John V Duca, Federal Reserve Bank Dallas A Short-Term View of Cash Holding, Trade Credit Shifting Credit Standards and the Boom and Bust in and Access to Short-Term Bank Finance US House Prices Gerhard Kling, Univ of Southampton John V Duca, Federal Reserve Bank of Dallas Salima Paul, Univ of West of England Bristol John Muellbauer, Oxford University Eleimon Gonis, Univ of West of England Bristol Anthony Murphy, Fed Res Bank of Dallas Does Loan Renegotiation Differ by Securitization Status? Yan Zhang, US OCC Presenter: Gerhard Kling Discussant: Diana Bonfim, Banco de Portugal & ISEG-UTL Presenter: Yan Zhang Discussant: John V Duca, Fed Res Bank Dallas Presenter: John V Duca Discussant: David A Walker, Georgetown University 2011 FMA European Conference Program - 13 Session 15 Portfolio Decisions and Investor Choices Thursday, June 9, 10:30 am - 12:00 noon, Sala Cávado (Floor 1) Chairperson: David Rakowski, SIU Carbondale Investors’ Distraction and Strategic Re-Pricing The Wisdom of Crowds: Mutual Fund Investors' Decisions Aggregate Asset Allocation Decisions Marco Navone, Università Bocconi John Chalmers, Univ of Oregon Aditya Kaul, Univ of Alberta Blake Phillips, Univeristy of Waterloo Presenter: Marco Navone Presenter: Aditya Kaul Discussant: Discussant: Blake Phillips, Univ of Waterloo David Rakowski, SIU Carbondale Session 16 Financial Regulation after the International Financial Crisis: What will really change? Thursday, June 9, 10:30 am - 12:00 noon, Sala Tâmega (Floor 2) Why Might Investors Choose Active Management? F Douglas Foster, Australian National University Geoffrey J Warren, Australian National University Presenter: F Douglas Foster Discussant: Juan Sotes-Paladino, Univ of Southern California Special Session Sponsor PANELISTS Elisa Ferreira, Member, Economic and Monetary Affairs Committee European Parliament Maureen O'Hara, Robert W Purcell Professor of Finance Cornell University Carlos Tavares, Vice Chairman, European Securities and Markets Authority (ESMA) Chair, Portuguese Securities Market Commission (CMVM) Session 17 Modeling Risk and Performance Thursday, June 9, 10:30 am - 12:00 noon, Sala Corgo (Floor 2) Chairperson: Nicos Scordis, St John's University Key Investment Criteria used by Venture Capitalists The Efficiency of Ratio Models in Performance For Evaluating Entrepreneurs’ Business Proposals: Measurement - The Case of Private Banking a Cluster Analysis Portfolios Mª Camino Ramón-Llorens, Universidad Katrin Baedorf, WHU - Otto Politécnica de Cartagena Beisheim Sch of Mgmt Ginés Hernández-Cánovas, Universidad Politécnica de Cartagena Presenter: Mª Camino Ramón-Llorens Presenter: Katrin Baedorf Discussant: Discussant: Andreas Mueller, RWTH Aachen Nicos Scordis, St John's University Prudence and the Modeling of Risk Nicos A Scordis, St John's University Presenter: Nicos Scordis Discussant: Gerhard Winkler, Oesterreichische Nationalbank Session 18 Options Pricing and Strategies Thursday, June 9, 10:30 am - 12:00 noon, Sala Tua (Floor 2) Chairperson: Craig Lewis, Vanderbilt University An Empirical Model Comparison for Valuing Crack Options on Troubled Stock Spread Options Ana Câmara, Oklahoma State University Steffen Mahringer, Goldman Sachs António Câmara, Oklahoma State University Marcel Prokopczuk, ICMA Centre, Univ of Reading Ivilina Popova, Texas State University Betty Simkins, Oklahoma State University Presenter: Marcel Prokopczuk Presenter: Betty Simkins Discussant: Discussant: Panos K Pouliasis, Cass Business School Craig Lewis, Vanderbilt University Persistence of Derivative Returns through the Financial Crisis: Directional Bets and Market Neutral Strategies Loke Seng Onn, Monash University Jothee Sinnakkannu, Monash University Presenter: Loke Seng Onn Discussant: Guido Baltussen, Erasmus University Rotterdam Session 19 Contagion and Systemic Risk Thursday, June 9, 10:30 am - 12:00 noon, Sala Sousa (Floor 2) Chairperson: Raquel Gaspar, ISEG, Technical University of Lisbon Liquidity, Contagion and Financial Crisis Measuring International Systemic Risk: An Alexander Guembel, Univ of Toulouse Application of CoVaR To the Global Banking Oren Sussman, Univ of Oxford Industry Germán López-Espinosa, Univ of Navarra Antonio Moreno, Univ of Navarra Antonio Rubia, Univ of Alicante Laura Valderrama, IMF The Real Effects of Banking Crises: Finance or Asset Allocation Effects? Some International Evidence Ana I Fernández, Univ of Oviedo Francisco González, Univ of Oviedo Nuria Suárez, Univ of Oviedo Presenter: Alexander Guembel Discussant: Raquel Gaspar, ISEG, Technical Univ of Lisbon Presenter: Nuria Suárez Discussant: Antonio Rubia, Univ of Alicante Presenter: Antonio Rubia, Univ of Alicante Discussant: Francesco Vallascas, Univ of Leeds & Univ of Cagliari 2011 FMA European Conference Program - 14 Session 20 International Finance 2 Thursday, June 9, 10:30 am - 12:00 noon, Sala Sabor (Floor 2) Chairperson: Delroy Hunter, Univ of South Florida Taylor Rules and Exchange Rate Predictability in Empirical Investigation of Covered Interest Rate Emerging Economies Parity in Developed and Emerging Markets Jaqueson K Galimberti, Emrah Sener, Ozyegin University Universidade Federal de Santa Catarina Sait Satiroglu, Ozyegin University Marcelo L Moura, Insper – Yildiray Yildirim, Syracuse University Institute of Education and Research Do Implicit Barriers Matter for Globalization? Ines Chaieb, Univ of Geneva Francesca Carrieri, McGill University Vihang Errunza, McGill University Presenter: Jaqueson Galimberti Discussant: Abu Jalal, Suffolk University Presenter: Ines Chaieb Discussant: Delroy Hunter, Univ of South Florida Presenter: Emrah Sener Discussant: Voker Vonhoff, Universität Mannheim LUNCHEON, 12:00 noon - 13:30 (1:30) pm Madruga Restaurant (Floor -1) THURSDAY, 13:30 (1:30) PM - 15:00 (3:00) PM Session 21 Financing Thursday, June 9, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Douro Norte (Floor 1) Chairperson: Nizar Atrissi, Université Saint-Joseph Product Market Concentration, Financing Optimal Leverage, its Benefits, and the Business Constraints, and Firms’ Business Cycle Sensitivity Cycle Peter Pontuch, Université Paris Dauphine Dieter Hess, Univ of Cologne Philipp Immenkötter, Univ of Cologne Presenter: Peter Pontuch Discussant: Murillo Campello, Univ of Illinois Urbana-Champaign & NBER Presenter: Philipp Immenkötter Discussant: Gerhard Kling, Univ of Southhampton Capital Structure and the Redeployability of Tangible Assets Murillo Campello, Univ of Illinois Urbana -Champaign & NBER Erasmo Giambona, Univ of Amsterdam Presenter: Murillo Campello Discussant: Petya Platikanova, ESADE Session 22 International Corporate Governance Thursday, June 9, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Douro Sul (Floor 1) Chairperson: Lawrence Kryzanowski, Concordia University Canadian Financial Restatements and Corporate Foreign Institutional Investment: Is Governance Governance Quality at Home Important? Lawrence Kryzanowski, Concordia University Nida Abdioglu, Manchester Business School Ying Zhang, Concordia University Arif Khurshed, Manchester Business School Konstantinos Stathopoulos, Manchester Business School Presenter: Lawrence Kryzanowski Presenter: Nida Abdioglu Discussant: Discussant: Brandon Chen, Univ of New South Wales Ines Chaieb, Univ of Geneva The Impact of Foreign Government Investments on Corporate Performance: Evidence From the US Elvira Sojli, Erasmus University Wing Wah Tham, Erasmus University Presenter: Elvira Sojli Discussant: Lawrence Kryzanowski, Concordia University Session 23 Buyouts and Acquisitions Thursday, June 9, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Minho (Floor 1) Chairperson: Sung Bae, Bowling Green State University Incidence and Structure of Buyout Syndicates: The An Investment-Based Explanation for the PostEffects of Target and Lead-Investor Characteristics Merger Underperformance Puzzle Nancy Huyghebaert, KU Leuven Ching-chieh Chang, Univ of Washington Randy Priem, KU Leuven Linda Van de Gucht, KU Leuven Presenter: Randy Priem Discussant: Ruediger Stucke, Univ of Oxford Presenter: Ching-chieh Chang Discussant: Sung Bae, Bowling Green State University 2011 FMA European Conference Program - 15 Determinants of Target Selection and Acquirer Returns: Evidence from Cross-Border Acquisitions Sung C Bae, Bowling Green State University Kiyoung Chang, Univ of South Florida-SarasotaManatee Doseong Kim, Sogang University Presenter: Sung C Bae Discussant: François Belot, University Paris Dauphine Session 24 Borrowing Costs and Risk Thursday, June 9, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Lima (Floor 1) Chairperson: John Finnerty, Fordham University Convertibles and Hedge Funds as Distributors of How Does Sovereign Debt Affect Corporate Equity Exposure Borrowing Costs in Emerging Markets? Stephen J Brown, New York University Şenay Ağca, George Washington University Bruce D Grundy, Univ of Melbourne Oya Celasun, International Monetary Fund Craig M Lewis, Vanderbilt University & US SEC Patrick Verwijmeren, VU University Amsterdam Presenter: Craig Lewis Discussant: John Finnerty, Fordham University Presenter: Şenay Ağca Discussant: Zuzana Fungáčová, Bank of Finland Performance Pricing Covenants and Corporate Loan Spreads Kamphol Panyagometh, NIDA Business School Gordon S Roberts, York University Aron A Gottesman, Pace University Presenter: Gordon Roberts Discussant: Andy Naranjo, Univ of Florida Session 25 Fund Management Thursday, June 9, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Cávado (Floor 1) Chairperson: Thorsten Lehnert, University of Luxembourg Do Regulated Mutual Fund Fees Affect Know When To Hold ‘Em, and Know When To Fold Competition, Fund Flows and Performance? ‘Em: The Success of Frequent Hedge Fund Evidence from US Equity Funds Activists Natalie Y Oh, Univ of New South Wales Nicole M Boyson, Northeastern University Jerry T Parwada, Univ of New South Wales Robert Mooradian, Northeastern University Kian Ming (Eric) Tan, Univ of New South Wales Presenter: Eric Tan Discussant: Thorsten Lehnert, Univ of Luxembourg Presenter: Robert Mooradian Discussant: Ettore Croci, Università degli Studi di Milano - Bicocca Session 26 Financial Markets and Public Finance in Portugal Thursday, June 9, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Tâmega (Floor 2) Why Closed-End Funds Make Open Market Repurchases? Susanne Espenlaub, Manchester Bus School Arif Khurshed, Manchester Business School Tianna Yang, Manchester Business School Presenter: Susanne Espenlaub Discussant: Eric Tan, Univ of New South Wales Special Session Sponsor PANELISTS Raul Marques, Chairman, APAF (Portuguese Association of Financial Analysts) and, Executive Vice-President of the Board of Directors and Executive Committee at Banif Gestão de Activos and Banif Açor Pensões Manuel Puerta da Costa, Member of the Board , BPI Gestão de Activos and APAF João Cantiga Esteves, XXX Session 27 Forecasting and Market Efficiency Thursday, June 9, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Corgo (Floor 2) Chairperson: Christian Dick, ZEW Mannheim How Serious is the Anchoring Bias in US Are Analysts Misleading Investors? The Case of Macroeconomic Consensus Forecasts? Going-Concern Opinions Dieter Hess, Univ of Cologne Rúben M T Peixinho, Univ of Algarve & CEFAGESebastian Orbe, Univ of Cologne UE Richard J Taffler, Manchester Business School Presenter: Sebastian Orbe Presenter: Rúben Peixinho Discussant: Discussant: Christian Dick, Danielle Lyssimachou, Manchester Bus School Centre for European Economic Research (ZEW) Mannheim Crash Worries and Stock Returns Guido Baltussen, Erasmus University Rotterdam Presenter: Guido Baltussen Discussant: Loke Seng Onn, Monash University Session 28 Measuring and Managing Risk Thursday, June 9, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Tua (Floor 2) Chairperson: Radu Tunaru, University of Kent at Canterbury Pitfalls and Remedies in Testing the Calibration The Information Content of the S&P 500 Index and Quality of Rating Systems VIX Options on the Dynamics of the S&P 500 Index Wolfgang Aussenegg, Vienna Univ of Tech San-Lin Chung, National Taiwan University Florian Resch, Oesterreichische Nationalbank Wei-Che Tsai, National Taiwan University Gerhard Winkler, Oesterreichische Nationalbank & Yaw-Huei Wang, National Taiwan University WU Wien Pei-Shih Weng, National Central University Presenter: Gerhard Winkler Discussant: Yaw-Huei Wang, National Taiwan University Presenter: Yaw-Huei Wang Discussant: Andreas Kaeck, ICMA Centre, Univ of Reading 2011 FMA European Conference Program - 16 VIX Dynamics With Stochastic Volatility of Volatility Andreas Kaeck, ICMA Centre, Univ of Reading Carol Alexander, ICMA Centre, Univ of Reading Presenter: Andreas Kaeck Discussant: Radu Tunaru, Univ of Kent at Canterbury Session 29 Default, Securitization, and Banking Thursday, June 9, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Sousa (Floor 2) Chairperson: Duane Stock, University of Oklahoma Consumer Strategic Default Bahavior: The Case of Share Price Response to Credit Risk Securitization Mortgage and Home Equity Loan Defaults in European Banking Julapa Jagtiani, Fed Res Bank of Philadelphia Christian Farruggio, Univ of Bochum William W Lang, Fed Res Bank of Philadelphia Tobias C Michalak, Univ of Bochum André Uhde, Univ of Bochum Presenter: Julapa Jagtiani Presenter: Tobias Michalak Discussant: Discussant: Yan (Jenny) Zhang, US OCC Jens Hagendorff, Univ of Edinburgh CEO Remuneration and Bank Default Risk: Evidence from the US and Europe Francesco Vallascas, Univ of Leeds & Univ of Cagliari Jens Hagendorff, Univ of Edinburgh Presenter: Jens Hagendorff Discussant: Duane Stock, Univ of Oklahoma Session 30 International Cross Listings Thursday, June 9, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Sabor (Floor 2) Chairperson: Qian Sun, Fudan University Development of Emerging Stock Markets and the One Security, Four Markets: Canada-US CrossDemand for Cross-Listing Listed Options and Underlying Equities Adriana Korczak, Univ of Bristol Michal Czerwonko, McGill University Piotr Korczak, Univ of Bristol Nabil Khoury, Univ of Quebec in Montreal Stylianos Perrakis, Concordia University Marko Savor, Univ of Quebec in Montreal Presenter: Adriana Korczak Presenter: Marko Savor Discussant: Discussant: Qian Sun, Fudan University Yiğit Atilgan, Sabanci University How Cross-Listings from an Emerging Economy Affect the Host Market Qian Sun, Fudan University Wilson HS Tong, Hong Kong Poly University Xin Zhang, Queen's University Presenter: Qian Sun Discussant: Marko Savor, Univ of Quebec in Montreal COFFEE BREAK, 15:00 (3:00) PM - 15:30 (3:30) PM Foyer, Floor 1 & Foyer, Floor 2 THURSDAY, 15:30 (3:30) PM - 17:00 (5:00) PM Session 31 Debt Thursday, June 9, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Douro Norte (Floor 1) Chairperson: Thomas O'Brien, University of Connecticut Analysis of Debt Capacity as a Tax Incentive to Collateral and its Determinants: Evidence from Currency Hedging Vietnam Luis Otero Gonzalez, Univ of Thanh Dinh, Maastricht University Santiago de Compostela Christa Hainz, ifo Inst for Economic Research Milagros Vivel, Univ of Santiago Stefanie Kleimeier, Maastricht University de Compostela Sara Fernandez Lopez, Univ of Santiago de Compostela Pablo Durán, Univ of Santiago de Compostela Presenter: Luis Otero Presenter: Stefanie Kleimeier Discussant: Discussant: Thomas O'Brien, Univ of Connecticut Günseli Tümer-Alkan, VU University Amsterdam Borrowing Beyond Borders: The Geography and Pricing of Syndicated Bank Loans Joel Houston, Univ of Florida Jennifer Itzkowitz, Seton Hall University Andy Naranjo, Univ of Florida Presenter: Andy Naranjo Discussant: Randy Priem, KU Leuven Session 32 Thursday, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Douro Sul, Floor 1, No Session Session 33 Corporate Acquisitions Thursday, June 9, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Minho (Floor 1) Chairperson: Fernando Anjos, University of Texas Excess Control Rights and Corporate Acquisitions Client Performance, Choice of Investment Bank François Belot, Université Paris-Dauphine Advisors in Corporate Takeovers, and Investment Bank Market Share Valeriy Sibilkov, Univ of Wisconsin - Milwaukee Presenter: François Belot Presenter: Valeriy Sibilkov Discussant: Discussant: Fernando Anjos, Univ of Texas Alexei Ovtchinnikov, Vanderbilt University 2011 FMA European Conference Program - 17 Takeovers and Target Firm Financial Distress Martin Bugeja, Univ of Technology, Sydney Presenter: Martin Bugeja Discussant: Mariela Borell, Centre for European Economic Research (ZEW) Session 34 CDS Thursday, June 9, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Lima (Floor 1) Chairperson: João Pedro Pereira, ISCTE-IUL Business School Lisbon The Impact of Credit Rating Announcements on The Complete Picture of Credit Default Swap Credit Default Swap Spreads Spreads - A Quantile Regression Approach John D Finnerty, Fordham University Pedro Pires, ISCTE-IUL Business School Lisbon Cameron Miller, Standard & Poor's João Pedro Pereira, ISCTE-IUL Business Ren-Raw Chen, Fordham University School Lisbon Luís Filipe Martins, ISCTE-IUL Business School Lisbon Presenter: John D Finnerty Presenter: João Pedro Pereira Discussant: Discussant: Kam Fong Chan, Univ of Queensland Lidija Lovreta, CUNEF Structural Imbalances in the Credit Default Swap Market: Empirical Evidence Lidija Lovreta, CUNEF Presenter: Lidija Lovreta Discussant: João Pedro Pereira, ISCTE-IUL Business School Lisbon Session 35 Fund Performance and Management Thursday, June 9, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Cávado (Floor 1) Chairperson to be announced What Explains Mutual Fund Performance Geography and Local (Dis)Advantage: Evidence Persistence? International Evidence from Muni Bond Funds Miguel A Ferreira, Universidade Nova de Lisboa David Rakowski, SIU Carbondale Aneel Keswani, Cass Business School Saiying Deng, SIU Carbondale Antonio F Miguel, ISCTE- Lisbon University Institute Sofia B Ramos, ISCTE- Lisbon University Institute Presenter: Antonio F Miguel Discussant: Benilde Oliveira, Univ of Minho Presenter: David Rakowski Discussant: Antonio Miguel, ISCTE- Lisbon University Institute Factor Decomposition and Diversification in European Corporate Bond Markets Mary Pieterse-Bloem, Tilburg University Ronald J Mahieu, Tilburg University Presenter: Mary Pieterse-Bloem Discussant: Alfonso Del Giudice, Universita Cattolica - Milano Session 36 Financial Modeling Thursday, June 9, 15:30 (3:30) pm – 17:00 (5:00) pm, Sala Tâmega (Floor 2) Chairperson: Matti Suominen, Aalto University Ambiguity Aversion, Strategic Trading and Funding A Stuctural Model of Short-term Reversals Liquidity Matti Suominen, Aalto University Ji Yeol Jimmy Oh, Univ of Cambridge Kalle Rinne, Aalto University Presenter: Ji Yeol Jimmy Oh Discussant: Matti Suominen, Aalto University Presenter: Matti Suominen Discussant: Alexei Orlov, Radford University The Price of Macroeconomic Announcement News Peter C de Goeij, Tilburg University Jiehui Hu, Tilburg University Bas J M Werker, Tilburg University Presenter: Jiehui Hu Discussant: Sebastian Orbe, Univ of Cologne Session 37 Events and Market Efficiency Thursday, June 9, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Corgo (Floor 2) Chairperson: Marc Umber, Frankfurt School of Finance & Management Deal Spreads in European Cross-Border M&A: Do The Price of Growth: Evidence of the Pedestrian Deal Spreads Adequately Reflect the Risk in Merger Nature of Post-Merger Returns Arbitrage? Sandra Mortal, Univ of Memphis Marc P Umber, Frankfurt School of Finance & Michael J Schill, Univ of Virginia Management Differential Interpretation of Information and the PostAnnouncement Drift: A Story of Consensus Learning António Barbosa, ISCTE Business SchoolLisbon Presenter: Marc Umber Discussant: Anna Faelten, Cass Business School Presenter: António Barbosa Discussant: Steffen Hitzemann, Karlsruhe Institute of Technology Presenter: Sandra Mortal Discussant: Marc Umber, Frankfurt School of Finance & Mgmt Session 38 Capital Structure Thursday, June 9, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Tua (Floor 2) Chairperson: Philipp Immenkötter, Univ of Cologne Why are US Firms Using More Short-Term Debt? Claudia Custódio, Arizona State University Miguel Ferreira, Universidade Nova de Lisboa Luis Laureano, ISCTE-IUL Presenter: Miguel Ferreira Discussant: Gary W Emery, Univ of Oklahoma Testing Dynamic Tradeoff Theory: Profitability and Leverage András Danis, Vienna Grad Sch of Finance Daniel Rettl, Vienna Grad Sch of Finance Presenter: András Danis Discussant: Philipp Immenkötter, Univ of Cologne 2011 FMA European Conference Program - 18 Session 39 Bank Governance Thursday, June 9, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Sousa (Floor 2) Chairperson: Amama Shaukat, Univ of Exeter Which Cross-Border Mergers and Acquisitions Risky Lending: Does Bank Corporate Governance Create Value to Listed Acquirer's Bank? The Role Matter? of Differences in Regulatory Arbitrage, Governance Olubunmi Faleye, Northeastern University and Institution between Acquirers and Targets Karthik Krishnan, Northeastern University Sheng-Hung Chen, Nanhua University Mei-Hsin Hsiao, Nanhua University Did Bank Executive Compensation Structure Lead to Excessive Risk Taking and the Current Financial Crisis? Lin Guo, Suffolk University Abu Jalal, Suffolk University Shahriar Khaksari, Suffolk University Presenter: Sheng-Hung Chen Discussant: Amama Shaukat, Univ of Exeter Presenter: Abu Jalal Discussant: Şenay Ağca, George Washington University Presenter: Olubunmi Faleye Discussant: Sheng-Hung Chen, Nanhua University Session 40 - Sala Sabor (Floor 2), 15:30 (3:30) pm - 17:00 (5:00 pm) No session scheduled KEYNOTE ADDRESS SPONSORED BY René M. Stulz, Everett D. Reese Chair of Banking and Monetary Economics Director of the Dice Center for Research in Financial Economics The Ohio State University Thursday, June 9, 17:15 (5:15) pm - Sala Porto (Floor 1) René M. Stulz is the Everett D. Reese Chair of Banking and Monetary Economics and the Director of the Dice Center for Research in Financial Economics at the Ohio State University. He has also taught at the Massachusetts Institute of Technology, the University of Chicago, and the University of Rochester. He received his Ph.D. from the Massachusetts Institute of Technology. He was awarded a Marvin Bower Fellowship from the Harvard Business School, a Doctorat Honoris Causa from the University of Neuchâtel, and the 1999 Eastern Finance Association Distinguished Scholar Award. In 2004, the magazine Treasury and Risk Management named him one of the 100 most influential people in finance. He is a past president of the American Finance Association and of the Western Finance Association, and a fellow of the American Finance Association, of the Financial Management Association, and of the European Corporate Governance Institute. OPENING RECEPTION Círculo Universitário do Porto (walking directions available at the Conference Registration Desk) 18:30 (6:30) pm SPONSORED BY Advance reservations required FRIDAY, 8:30 AM - 10:00 AM Session 41 - Sala Douro Norte (Floor 1), 8:30 am - 10:00 am No session scheduled Session 42 Financial Strength and Distress Friday, June 10, 8:30 am - 10:00 am, Sala Douro Sul (Floor 1) Chairperson: Bo Zhao, George Washington University Cash Holdings within Subsidiaries: The Impact of Financial Distress, Corporate Investment and the Group Health Chill Effect Nico Dewaelheyns, KU Leuven Lan Xu, Washington University in St Louis Rosy Locorotondo, KU Leuven Cynthia Van Hulle, KU Leuven Ultimate Controllers, Ownership and the Probability of Insolvency in Financially Distressed Firms Jannine Poletti-Hughes, Univ of Liverpool Presenter: Rosy Locorotondo Discussant: Pedro J Garcia-Teruel, University of Murcia Presenter: Jannine Poletti-Hughes Discussant: Rosy Locorotondo, KU Leuven Presenter: Lan Xu Discussant: Bo Zhao, George Washington University Session 43 LBOs and Delistings Friday, June 10, 8:30 am -10:00 am, Sala Minho (Floor 1) Chairperson: Sandra Mortal, University of Memphis The Delisting Decision: The Case of Buyout Offers Delistings, Controlling Shareholders, and Firm with Squeeze-Out (BOSO) Performance in Europe Isabelle Martinez, Univ of Toulouse Ettore Croci, Università degli Studi Stéphanie Serve, Univ of Cergy Pontoise di Milano - Bicocca Alfonso Del Giudice, Universita Cattolica - Milan Presenters: Stéphanie Serve & Isabelle Martinez Presenter: Alfonso Del Giudice Discussant: Discussant: Marco Bigelli, Univ of Bologna Melissa Toffanin, Concordia University 2011 FMA European Conference Program - 19 Who Benefits from the Leverage in LBOs? Rüdiger Stucke, Oxford University Tim Jenkinson, Oxford University & CEPR Presenter: Rüdiger Stucke Discussant: Sandra Mortal, University of Memphis Session 44 - Sala Lima (Floor 1), 8:30 am - 10:00 am No session scheduled Session 45 Institutional Investors and Return Predictability Friday, June 10, 8:30 am - 10:00 am, Sala Cávado (Floor 1) Chairperson: Laurent Barras, McGill University Hedge Fund Predictability Under the Magnifying Predicting Defined Benefit Pension Returns: The Glass: The Economic Value of Forecasting Impact of SFAS 132 Required Disclosure of Asset Individual Fund Returns Allocation Information Doron Avramov, Hebrew Univ of Jerusalem Joanne Doyle, James Madison University Laurent Barras, McGill University Kenneth Eades, Univ of Virginia Robert Kosowski, Imperial College Bus School Brooks Marshall, James Madison University Does Institutional Ownership Matter for International Stock Return Comovement? José Afonso Faias, Univ Católica Portuguesa Miguel A Ferreira, Univ Nova de Lisboa Pedro Santa-Clara, Univ Nova de Lisboa Pedro Matos, Univ of Southern California Presenter: Laurent Barras Discussant: José Afonso Faias, Universidade Catolica Portuguesa Presenter: José Afonso Faias Discussant: Erkin Diyarbakirlioglu, Sorbonne Business School Presenter: Kenneth Eades Discussant: Laurent Barras, McGill University Session 46 - Sala Tâmega (Floor 2), 8:30 am - 10:00 am No session scheduled Session 47 Analysts, Accuracy, and Announcements Friday, June 10, 8:30 am - 10:00 am, Sala Corgo (Floor 2) Chairperson: Adriana Korczak, University of Bristol The Determinants of Target Price Accuracy: The Projected Earnings Accuracy and the Profitability International Evidence of Stock Recommendations Pawel Bilinski, Manchester Business School Dieter Hess, Univ of Cologne Danielle Lyssimachou, Manchester Bus School Daniel Kreutzmann, Univ of Cologne Oliver Pucker, Univ of Cologne Presenter: Danielle Lyssimachou Discussant: Michael Liebmann, University of Freiburg Presenter: Oliver Pucker Discussant: Adriana Korczak, Univ of Bristol Effects Behind Words: Quantifying Qualitative Information in Corporate Announcements Michael Liebmann, Univ of Freiburg Michael Hagenau, Univ of Freiburg Matthias Häussler, WHU - Otto Beisheim School of Management Dirk Neumann, Univ of Freiburg Presenter: Michael Liebmann Discussant: António Barbosa, ISCTE Bus School - Lisbon Session 48 Issues in Risk Management Friday, June 10, 8:30 am - 10:00 am, Sala Tua (Floor 2) Chairperson: Ricardo Correia, Universidad Carlos III de Madrid Dealing with Recession: A Real Option Approach Patent Now or Later? Corporate Financing Into Project Evaluation of SMEs Decisions, Agency Costs and Social Benefits Farrah Merlinda Muharam, Ricardo Correia, Universidad Carlos III de Madrid Universidad Autonoma de Barcelona Sydney Howell, Manchester Bus School Maria-Antonia Tarrazon, Peter Duck, Manchester Bus School Universidad Autonoma de Barcelona Presenter: Farrah Merlinda Muharam Discussant: Ricardo Correia, Universidad Carlos III de Madrid Presenter: Ricardo Correia Discussant: Farrah Merlinda Muharam, Universidad Autonoma de Barcelona Macro Expectations, Aggregate Uncertainty, and Expected Term Premia Christian D Dick, Centre for European Economic Research (ZEW) Mannheim Maik Schmeling, Universität of Hannover Andreas Schrimpf, Aarhus University & CREATES Presenter: Christian D Dick Discussant: Jiehui Hu, Tilburg University Session 49 Cost of Bank Financing Friday, June 10, 8:30 am - 10:00 am, Sala Sousa (Floor 2) Chairperson: Tobias Michalak, University of Bochum International Return and Volatility Spillovers among Banks and Insurers: A VAR-BEKK Approach Elyas Elyasiani, Temple University Elena Kalotychou, Cass Business School Sotiris K Staikouras, Cass Business School Presenter: Sotiris Staikouras Discussant: Ken-ichi Tatsumi, Gakushuin University Impact of the TARP Financing Choice on Existing Preferred Stock Dong H Kim, Univ of Oklahoma Duane Stock, Univ of Oklahoma Presenter: Duane Stock Discussant: Tobias Michalak, University of Bochum Session 50 Trading and Behavioral Finance Friday, June 10, 8:30 am - 10:00 am, Sabor (Floor 2) Chairperson: Grant McQueen, Brigham Young University Positive Mood, Risk Attitudes, and Investment Does Systematic Trading Behaviour in Different Decisions: Field Evidence from Comedy Movie Investor Categories Impact upon Future Stock Attendance in the US Returns? A Study of Investors in the Finnish Market Gabriele M Lepori, Copenhagen Bus School Henry Leung, Univ of Sydney Annica Rose, Univ of Sydney Joakim Westerholm, Univ of Sydney Presenter: Gabriele Lepori Presenter: Annica Rose Discussant: Discussant: Laurent Vilanova, Univ of Lyon - Coactis Grant McQueen, Brigham Young University 2011 FMA European Conference Program - 20 Advertising, Visibility, and Stock Turnover Grant McQueen, Brigham Young University Keith Vorkink, Brigham Young University Eric DeRosia, Brigham Young University Glenn L Christensen, Brigham Young University Presenter: Grant McQueen Discussant: Annica Rose, Univ of Sydney COFFEE BREAK, 10:00 am - 10:30 am Foyer, Floor 1 & Foyer, Floor 2 FRIDAY, 10:30 AM - 12:00 NOON Session 51 Borrowing Friday, June 10, 10:30 am - 12:00 noon, Sala Douro Norte (Floor 1) Chairperson: Kenneth Eades, University of Virginia What Happens after Default? Stylized Facts on Conditional Conservatism, Agency Costs, and the Access to Credit Contractual Features of Debt Diana Bonfim, Banco de Portugal & ISEG-UTL Hye Seung (Grace) Lee, Lehigh University Daniel A Dias, Univ of Illinois Urbana-Champaign & CEMAPRE Christine Richmond, IMF Presenter: Diana Bonfim Discussant: Peter Pontuch, Université Paris Dauphine Presenter: Hye Seung Lee Discussant: Jiri Novak, Charles University Bond Covenants, Bankruptcy Risk, and Issuance Costs Sattar A Mansi, Virginia Tech Yaxuan Qi, Concordia University John K Wald, Univ of Texas San Antonio Presenter: Yaxuan Qi Discussant: Kenneth Eades, Univ of Virginia Session 52 Boards Friday, June 10, 10:30 am - 12:00 noon, Sala Douro Sul (Floor 1) Chairperson: Dusan Isakov, University of Fribourg Are all Non-Independent Non-Executives Board Monitoring and the Wall Street Rule Undesirable? Directors’ Independence and Firm Brandon Chen, Univ of New South Wales Value in UK Amama Shaukat, Univ of Exeter Paper Tiger? An Empirical Analysis of Majority Voting Jay Cai, Drexel University Jacqueline Garner, Drexel University Ralph Walkling, Drexel University Presenter: Amama Shaukat Discussant: Nida Abdioglu, Manchester Business School Presenter: Ralph Walkling Discussant: Jannine Poletti-Hughes, Univ of Liverpool Presenter: Brandon Chen Discussant: Ralph Walkling, Drexel University Session 53 Financial Policies and Value Friday, June 10, 10:30 am - 12:00 noon, Sala Minho (Floor 1) Chairperson: Valeriy Sibilkov, University of Wisconsin Milwaukee The Relative Importance of Financial and NonShopping for Information? Diversification and the Financial Analysis in Project Evaluation - Evidence Network of Industries From Portuguese Firms Fernando Anjos, Univ of Texas Austin Nuno Moutinho, Polytechnic Inst of Braganca Cesare Fracassi, Univ of Texas Austin MDS Lopes, Univ of Porto Presenter: Nuno Moutinho Discussant: Rúben Peixinho, Univ of Algarve & CEFAGE-UE Presenter: Fernando Anjos Discussant: Valeriy Sibilkov, Univ of Wisconsin Milwaukee Trade Credit Policy and Firm Value Cristina Martínez-Sola, Univ of Jaén Pedro J García-Teruel, Univ of Murcia Pedro Martinez-Solano, Univ of Murcia Presenter: Cristina Martínez-Sola Discussant: Andrea Signori, Univ of Bergamo Session 54 Regulation and Markets Friday, June 10, 10:30 am - 12:00 noon, Sala Lima (Floor 1) Chairperson: Elvira Sojili, Erasmus University Differential Access to Price Information in Financial Short Selling: The Impact of SEC Rule 201 of 2010 Markets Chinmay Jain, Univ of Memphis David Easley, Cornell University Pankaj K Jain, Univ of Memphis Maureen O'Hara, Cornell University Thomas H McInish, Univ of Memphis Liyan Yang, Univ of Toronto Do Less Regulated Markets Attract Lower Quality Firms? Evidence from the London AIM Market Ulf Nielsson, Copenhagen Business School Presenter: Maureen O'Hara Discussant: Ji Yeol Jimmy Oh, Univ of Cambridge Presenter: Ulf Nielsson Discussant: Faten Ben Slimane, Groupe ESC Troyes Presenter: Thomas H McInish Discussant: Elvira Sojli, Erasmus University 2011 FMA European Conference Program - 21 Session 55 Portfolio Choice Friday, June 10, 10:30 am - 12:00 noon, Sala Cávado (Floor 1) Chairperson: Vijay Yadav, INSEAD The Value of Cross-Trading to Mutual Fund Portfolio Selection with Spectral Risk Measures Families in Illiquid Markets: A Portfolio Choice A Really Good Choice? Approach Mario Brandtner, Friedrich Schiller Univ of Jena Luis Goncalves-Pinto, Univ of Southern California Juan Sotes-Paladino, Univ of Southern California The Determinants of International Equity Holdings: Information versus Culture Erkin Diyarbakirlioglu, Sorbonne Business School Presenter: Juan Sotes-Paladino Discussant: Marco Navone, Universitá Bocconi Presenter: Erkin Diyarbakirlioglu Discussant: Vijay Yadav, INSEAD Presenter: Mario Brandtner Discussant to be announced Session 56 The Shadow Financial Regulatory Committee: Dissecting the Financial Crisis and Financial Reform Friday, June 10, 10:30 am - 12:00 noon, Sala Tâmega (Floor 1) The Shadow Financial Regulatory Committee works to identify and analyze developing trends and ongoing events that promise to affect the efficiency and safe operation of sectors of the financial services industry; explore the spectrum of short- and long-term implications of emerging problems and policy changes; help develop private, regulatory and legislative responses to such problems that promote efficiency and safety and further the public interest; and to assess and respond to proposed and actual public policy initiatives with respect to the impact on the public interest. Moderator George Kaufman, John F Smith, Jr Professor of Finance and Economics Loyola University Chicago Panelists Franklin Edwards, Arthur F Burns Chair of Free and Competitive Enterprise Columbia University Richard Herring, Jacob Safra Professor of International Banking, Professor of Finance, and Co-Director, Wharton Financial Institutions Center University of Pennsylvania Kenneth Scott, Ralph M Parsons Professor of Law and Business, Emeritus Stanford University Session 57 Risk and Return 1 Friday, June 10, 10:30 am - 12:00 noon, Sala Corgo (Floor 2) Chairperson: Javier Estrada, IESE Business School Black Swans, Beta, Risk, and Return Local Sports Sentiment and the Returns and Javier Estrada, IESE Business School Trading Behavior of Locally Headquartered Stocks: María Vargas, Univ of Zaragoza A Firm-Level Analysis Shao-Chi Chang, National Cheng Kung Univ Sheng-Syan Chen, National Taiwan University Robin K Chou, Chengchi University Yueh-Hsiang Lin, National Taipei College of Bus Presenter: Javier Estrada Presenter: Yueh-Hsiang Lin Discussant: Discussant: Yueh-hsiang Lin, National Taipei University Gabriele Lepori, Copenhagen Business School The Impact of Stock Market Volatility Expectations on Investor Behavior: Evidence from Aggregate Mutual Fund Flows Louis Ederington, Univ of Oklahoma Evgenia (Janya) Golubeva, Univ of Oklahoma Presenter: Louis Ederington Discussant: Javier Estrada, IESE Business School Session 58 Risk Friday, June 10, 10:30 am - 12:00 noon, Sala Tua (Floor 2) Chairperson: Betty Simkins, Oklahoma State University The Value Effects of Foreign Currency and Interest Exposure, Hedging, and Value: New Evidence From Rate Derivatives Use: Evidence From Italy, Spain the US Airline Industry and Portugal Stephen David Treanor, Cal State Chico Florbela Galvão da Cunha, ISCTE Bus School Daniel A Rogers, Portland State University José Dias Curto, ISCTE Business School David A Carter, Oklahoma State University Amrit Judge, Middlesex University Betty J Simkins, Oklahoma State University Presenter: Florbela Galvão da Cunha Presenter: Betty Simkins Discussant: Discussant: Betty Simkins, Marcel Prokopczuk, Oklahoma State University ICMA Centre, Univ of Reading Session 59 - Sala Sousa, Floor 2, 10:30 am - 12:00 noon No session scheduled 2011 FMA European Conference Program - 22 Nonlinear Foreign Exchange Exposure: Evidence from Brazilian Companies José Luiz Rossi, Insper Inst of Educ & Research Presenter: José Luiz Rossi Discussant: Delroy Hunter, Univ of South Florida Session 60 Money and Capital Flows Friday, June 10, 10:30 am - 12:00 noon, Sala Sabor (Floor 2) Chairperson: Stefanie Kleimeier, Maastricht University Payment Systems in the Accession Countries Common Information Asymmetry Factors in Francisco José Callado Muñoz, Universitat de Syndicated Loan Structures: Evidence From Girona Syndications and Privately Placed Deals Jana Hromcová , Universitat Autonoma de Claudia Champagne, Université de Sherbrooke Barcelona Frank Coggins, Université de Sherbrooke Natalia Utrero González, Universitat de Girona Presenter: Francisco José Callado Muñoz Discussant: Olubunmi Faleye, Northeastern University Presenter: Claudia Champagne Discussant: Stefanie Kleimeier, Maastricht University Political Risk, Trade, and Capital Allocation Art Durnev, McGill University Alexander Molchanov, Massey University Presenter: Alexander Molchanov Discussant: Francisco Jose Callado Muñoz, Universitat de Girona LUNCHEON, 12:00 noon - 13:30 (1:30) pm Madruga Restaurant (Floor -1) FRIDAY, 13:30 (1:30) PM - 15:00 (3:00) PM Session 61 Taxes and Leverage Friday, June 10, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Douro Norte (Floor 1) Chairperson: Nandu Nayar, Lehigh University Do Equity Tax Shields Reduce Leverage? The LYON Taming by the IRS: Evidence on the Tax Austrian Case Advantage of Debt Manfred Frühwirth, WU Wien Nandu Nayar, Lehigh University Marek Kobialka, WU Wien Presenter: Manfred Frühwirth Discussant: Nandu Nayar, Lehigh University Presenter: Nandu Nayar Discussant: Manfred Frühwirth, WU Wein The Zero-Leverage Phenomenon: International Evidence Wolfgang Bessler, Univ of Giessen Wolfgang Drobetz, Univ of Hamburg Rebekka Haller, Univ of Hamburg Iwan Meier, HEC Montréal Presenter: Wolfgang Drobetz Discussant: András Danis, Vienna Graduate School of Finance Session 62 - Sala Douro Sul, Floor 1, 13:30 (1:30) pm - 15:00 (3:00) pm No session scheduled Session 63 Private Equity Friday, June 10, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Minho (Floor 1) Chairperson: Donia Trabelsi, University Paris I Panthéon - Sorbonne Do Private Equity Investors Help Distressed Why do Private Equity Firms Sell to Each Other? Companies to Become Healthy or do they Trigger Miguel Sousa, University of Oxford & Faculdade de Financial Distress? Economia do Porto Mariela Borell, Centre for European Economic Research (ZEW) Tereza Tykvová, Centre for European Economic Research (ZEW) Presenter: Mariela Borell Discussant: Miguel Sousa, University of Oxford & Faculdade de Economia do Porto Presenter: Miguel Sousa Discussant: Donia Trabelsi, Univ Paris I Panthéon - Sorbonne Venture Capital and the Financing of Innovation Donia Trabelsi, Univ Paris 1 Panthéon - Sorbonne Ghasem Shiri, Univ Paris 1 Panthéon - Sorbonne Presenter: Donia Trabelsi Discussant: Nuno Moutinho, Polytechnic Inst of Braganca Session 64 Information and Market Prices Friday, June 10, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Lima (Floor 1) Chairperson: Richard Payne, Cass Business School Does Order Flow in the European Carbon Measuring the Information Content of Limit Order Allowances Market Reveal Information? Flows Iordanis Kalaitzoglou, Heriot-Watt University Torben Latza, Univ of Bristol Boulis Maher Ibrahim, Heriot-Watt University Richard Payne, Cass Business School Does the Introduction of S&P 500 ETF Options Improve Price Discovery of the S&P 500 ETF? Wei-Peng Chen, Shih Hsin University Huimin Chung, National Chiao Tung University Presenter: Iordanis Kalaitzoglou Discussant: Richard Payne, Cass Business School Presenter: Wei-Peng Chen Discussant: Thomas McInish, University of Memphis Presenter: Richard Payne Discussant: Emrah Sener, Ozyegin University 2011 FMA European Conference Program - 23 Session 65 Risk and Performance Measurement Friday, June 10, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Cávado (Floor 1) Chairperson: Michael Wolf, University of Zurich Does the Use of Downside Risk-Adjusted Measures Which Hedge Fund Managers Deliver Alpha? Impact the Performance of UK Investment Trusts? Assessing Performance when Returns are Skewed Chris Adcock, Univ of Sheffield Andrea Heuson, Univ of Miami Nelson Areal, Univ of Minho Mark Hutchinson, University College Cork Manuel Armada, Univ of Minho Maria Ceu Cortez, Univ of Minho Florinda Silva, Univ of MInho Belilde Oliveira, Univ of Minho Presenter: Benilde Oliveira Presenter: Andrea J Heuson Discussant: Discussant: Mario Brandtner, Friedrich Schiller Univ of Jena Michael Wolf, Univ of Zurich Robust Performance Hypothesis Testing with the Variance Olivier Ledoit, Univ of Zurich Michael Wolf, Univ of Zurich Presenter: Michael Wolf Discussant: Mark Hutchinson, University College Cork Session 66 Research Opportunities in Corporate Governance Special Session Sponsor Friday, June 10, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Tâmega (Floor 2) This panel will explore research topics in corporate governance including the current research the panel is pursuing. Also, what can we learn from international corporate governance? For example, the panel will discuss that, while the US is just enacting Say on Pay, it already exists in at least five other countries. Norway’s experiment in mandating a fixed percentage of females on boards is another example. The panelists will offer their thoughts on the best and worst aspects of the governance structures of their country and others where their research was applicable. Moderator Ralph A Walkling, Stratakis Chair in Corporate Governance & Executive Director, Center for Corporate Governance Drexel University Panelists Marco Bigelli, Professor of Finance University of Bologna, Johns Hopkins University, and Université de Paris XII Charles Elson, Edgar S. Woolard, Jr., Chair in Corporate Governance and the Director of the John L. Weinberg Center for Corporate Governance University of Delaware Ajay Patel, Professor and GMAC Chair in Finance Wake Forest University Laura Starks, Chair - Finance Department, Charles E. & Sara M. Seay Regents’ Chair, and Director, AIM Investment Center University of Texas Austin René Stulz, Everett D. Reese Chair of Banking and Monetary Economics and the Director of the Dice Center for Research in Financial Economics The Ohio State University Session 67 Risk and Return 2 Friday, June 10, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Corgo (Floor 2) Chairperson: Valeri Zakamouline, University of Agder Leverage, Beta Estimation, and the Size Effect Idiosyncratic Volatility Premium: Dividend Matters Jörg Seidel, Univ of Hamburg Bo Zhao, George Washington University Wolfgang Drobetz, Univ of Hamburg Robert Savickas, George Washington University Why Does Higher Variability of Trading Activity Predict Lower Expected Returns? Alexander Barinov, Univ of Georgia Presenter: Wolfgang Drobetz Discussant: Valeri Zakamouline, Univ of Agder Presenter: Alexander Barinov Discussant: Sotiris Staikouras, Cass Business School Presenter: Bo Zhao Discussant: Hye Seung (Grace) Lee, Lehigh University Session 68 Price Dynamics Friday, June 10, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Tua (Floor 2) Chairperson: Louis Ederington, University of Oklahoma Understanding the Price Dynamics of Emission Jumps and Trading Activities in Interest Rate Permits: A Model for Multiple Trading Periods Futures Markets: The Response To Macroeconomic Steffen Hitzemann, Karlsruhe Institute of Announcements Technology (KIT) Johan Bjursell, Ronin Capital LLC Marliese Uhrig-Homburg, Karlsruhe Institute of George HK Wang, George Mason University Technology (KIT) Robert I Webb, Univ of Virginia Forecasting Petroleum Futures Markets Volatility: The Role of Regimes & Market Conditions Nikos K Nomikos, Cass Business School Panos K Pouliasis, Cass Business School Presenter: Steffen Hitzemann Discussant: Paulo Pereira, Universidad do Porto & CEF.UP Presenter: Panos K Pouliasis Discussant: Iordanis (Jordan) Kalaitzoglou, Heriot-Watt University Presenter: Robert I Webb Discussant: Louis Ederington, Univ of Oklahoma 2011 FMA European Conference Program - 24 Session 69 Bank Regulation Friday, June 10, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Sousa (Floor 2) Chairperson: Nuria Suárez, Univ of Oviedo Bank Capital Regulation - A Double-Edged Sword? Does Deposit Insurance Retard the Development of Minimum Capital Norms Promote Safety but Lower Financial Markets? Efficiency Kaysia T Campbell, Eastern Carolina University Vinod S Changarath, Univ of Cincinnati Delroy M Hunter, Univ of South Florida Michael F Ferguson, Univ of Cincinnati James E Owers, Georgia State University Bank Capital, Liquidity Creation and Deposit Insurance Zuzana Fungáčová, Bank of Finland Laurent Weill, Univ of Strasbourg Mingming Zhou, Univ of Colorado Col Springs Presenter: Vinod S Changarath Discussant: Pejman Abedifar, Université de Limoges Presenter: Zuzana Fungáčová Discussant: Florbela Galvao da Cunha, ISCTE Business School Presenter: Delroy Hunter Discussant: Nuria Suárez, Univ of Oviedo Session 70 Insurance Friday, June 10, 13:30 (1:30) pm - 15:00 (3:00) pm, Sala Sabor (Floor 2) Chairperson: Mario Anolli, Universita Cattolica Sacro Cuore & London School of Economics How Have Acquirers Fared in Bank-Insurance Liquidity Risk and Solvency II Takeovers? A Risk Decomposition Approach Raquel M Gaspar, ISEG, Tech Univ of Lisbon Barbara Casu, Cass Business School Hugo Sousa, Instituto de Seguros de Portugal Panagiotis Dontis-Charitos, Univ of Westminster Sotiris Staikouras, Cass Business School Jonathan Williams, Bangor University Presenter: Panagiotis Dontis-Charitos Discussant: Bjoern Hagendorff, University of Leeds Presenter: Raquel M Gaspar Discussant: Mario Anolli, Universita Cattolica Sacro Cuore & London School of Economics The Shareholder Wealth Effects of Insurance Securitization: The Case of Catastrophe Bonds Bjoern Hagendorff, Univ of Leeds Jens Hagendorff, Univ of Edinburgh Kevin Keasey, Univ of Leeds Presenter: Bjoern Hagendorff Discussant: Panagiotis Donis-Charitos, Univ of Westminster COFFEE BREAK, 15:00 (3:00) pm - 15:30 (3:30) pm Foyer, Floor 1 & Foyer, Floor 2 FRIDAY, 15:30 (3:30) PM - 17:00 (5:00) PM Session 71 - Sala Douro Norte, Floor 1, 15:30 (3:30) pm - 17:00 (5:00) pm No session scheduled Session 72 - Sala Douro Sud, Floor 1, 15:30 (3:30) pm - 17:00 (5:00) pm No session scheduled Session 73 Initial Public Offerings Friday, June 10, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Minho (Floor 1) Chairperson: Andrea Heuson, University of Miami Motives and Valuation Effects of Share Repurchase The Effect of a Firm's IPO on its IOU - An Announcements in Germany: A Comparison of Examination of Changes in Bank Loan Covenants Established Firms and Initial Public Offerings and Yields Wolfgang Bessler, Justus-Liebig-Univ Giessen Melissa Toffanin, Concordia University Wolfgang Drobetz, Hamburg University Martin Seim, Justus-Liebig-University Giessen What are IPO Underwriters Paid for? Michele Meoli, Univ of Bergamo Andrea Signori, Univ of Bergamo Silvio Vismara, Univ of Bergamo Presenter: Wolfgang Bessler Discussant: Andrea Heuson, Univ of Miami Presenter: Andrea Signori Discussant: Wolfgang Bessler, Univ of Giessen Presenter: Melissa Toffanin Discussant: Vinod Changarath, Univ of Cincinnati Session 74 - Sala Lima, Floor 1, 15:30 (3:30) pm - 17:00 (5:00) pm No session scheduled Session 75 Ethics, Law, and Social Responsibility Friday, June 10, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Cávado (Floor 1) Chairperson: Robert Webb, University of Virginia Ethical vs Non-Ethical - Is There a Difference? The Role of Law, Corruption and Culture in Analyzing the Performance of Ethical and NonInvestment Fund Manager Fees Ethical Investment Funds Sofia A Johan, Tilburg Law & Economics Center Linnéa Lundberg, Stockholm University Dorra Najar, University Paris-Dauphine Maria Vikman, Stockholm University Jiri Novak, Charles University Presenter: Jiri Novak Presenter: Dorra Najar 2011 FMA European Conference Program - 25 Stock Market Valuation of Corporate Social Responsibility Indicators Alan Gregory, Univ of Exeter Julie Whittaker, Univ of Exeter Xiaojuan Yan, Univ of Exeter Presenter: Alan Gregory Discussant: Robert Webb, Univ of Virginia Discussant: Julie Whittaker, University of Exeter Discussant: Sattar Mansi, Virginia Tech Session 76 - Sala Tâmega, Floor 2, 15:30 (3:30) - 17:00 (5:00) pm No session scheduled Session 77 International Equity Risk Friday, June 10, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Corgo (Floor 2) Chairperson: Alexander Barinov, University of Georgia Estimating Cost of Equity using the International The Variance Risk Premium Around the World CAPM: Are Two Factors Better than One? Juan-Miguel Londono, Tilburg University Walter Dolde, Univ of Connecticut Carmelo Giaccotto, Univ of Connecticut Dev R Mishra, Univ of Saskatchewan Thomas J O'Brien, Univ of Connecticut Spatial Modeling of Stock Market Comovements Gema Fernández-Avilés, Univ of Castilla Jose-María Montero, Univ of Castilla Alexei G Orlov, Radford University Presenter: Thomas O'Brien Discussant: Dusan Isakov, University of Fribourg Presenter: Alexei G Orlov Discussant: Juan-Miguel Londono, Tilburg University Presenter: Juan-Miguel Londono Discussant: Alexander Barinov, University of Georgia Session 78 - Sala Tua, Floor 2, 15:30 (3:30) - 17:00 (5:00) pm No session scheduled Session 79 Bank Liquidity and Risk Friday, June 10, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Sousa (Floor 2) Chairperson: Claudia Champagne, Université de Sherbrooke Transmission of Bank Liquidity Shocks in Loan and The Nexus between Monetary Policy, Banking Deposit Markets: The Role of Interbank Borrowing Market Structure and Bank Risk Taking: An and Market Monitoring Empirical Assessment of the Risk Taking Channel Franklin Allen, Univ of Pennsylvania of Monetary Policy Aneta Hryckiewicz, Univ of Frankfurt & Kozminski Tobias C Michalak, Univ of Bochum University Oskar Kowalewski, Warsaw School of Economics (SGH) Günseli Tümer-Alkan, VU Univ Amsterdam Presenter: Günseli Tümer-Alkan Discussant: María Rodríquez Moreno, Univ Carlos III de Madrid Presenter: Tobias Michalak Discussant: Jose Luis Rossi, Insper Inst of Educ & Research Systemic Risk Measures: The Simpler the Better? María Rodríquez Moreno, Univ Carlos III de Madrid Juan Ignacio Peña, Univ Carlos III de Madrid Presenter: Maria Rodriguez-Moreno Discussant: Claudia Champagne, Université de Sherbrooke Session 80 Stock Market Risk and Dynamics Friday, June 10, 15:30 (3:30) pm - 17:00 (5:00) pm, Sala Sabor (Floor 2) Chairperson: José Dias, ISCTE-Lisbon University Institute Regime-Switching and Long Memory in Systematic Explaining the Dynamics of the Size Premium Risk: Evidence from Realized Betas of Industry Valeriy Zakamulin, Univ of Agder Portfolios Kam Fong Chan, Univ of Queensland Bowman Robert, Univ of Queensland Lawrence Gillian, Res Bank of New Zealand Presenter: Kam Fong Chan Discussant: José Dias, ISCTE-Lisbon University Institute Presenter: Valeriy Zakamulin Discussant: Lan Xu, Washington University in St Louis The Dynamics of Stock Market Cycles in the Euro Zone José G Dias, ISCTE-Lisbon Univ Institute Sofia Brito Ramos, ISCTE-Lisbon Univ Institute Presenter: José G Dias Discussant: Joana Franco Rocha, FEP, Universidade do Porto & CEF.UP WINE CELLAR TOUR AND TASTING AND GALA DINNER Yeatman Hotel Buses will depart Porto Palácio Hotel at 18:00 (6:00) pm and 18:30 (6:30) pm Advance Reservations Required 2011 FMA European Conference Program - 26 AT-A-GLANCE CONFERENCE PROGRAM THURSDAY, 9 JUNE - 8:30 am -10:00 am SALA DOURO NORTE 01 Corporate Finance SALA TÂMEGA 06 SPECIAL SESSION Borrowing and Lending: Banks and Firms Revisited FLOOR 1 SALA MINHO 03 Managerial Incentives and Mergers SALA DOURO SUL 02 Family Firms and Entrepeneurial Finance FLOOR 2 SALA TUA 08 Derivatives Modeling SALA CORGO 07 Management Compensation SALA LIMA 04 Credit Markets SALA CÁVADO 05 Portfolio Management and Performance SALA SOUSA 09 Bank Risk SALA SABOR 10 International Finance 1 10:00 am - 10:30 am - Foyer, Floor 1 and Foyer, Floor 2 COFFEE BREAK THURSDAY, 9 JUNE - 10:30 am - 12:00 noon SALA DOURO NORTE 11 Agency and Financial Contracting SALA TÂMEGA 16 SPECIAL SESSION Financial Regulation after the International Financial Crisis SALA DOURO SUL 12 Governance and Corporate Decisions SALA CORGO 17 Modeling Risk and Performance FLOOR 1 SALA MINHO 13 Mergers SALA LIMA 14 Credit SALA CÁVADO 15 Portfolio Decisions and Investor Choices FLOOR 2 SALA TUA 18 Options Pricing and Strategies SALA SOUSA 19 Contagion and Systemic Risk SALA SABOR 20 International Finance 2 Noon - 13:30 (1:30 pm) - Madruga Restaurant (Floor -1) LUNCHEON THURSDAY, 9 JUNE - 13:30 (1:30) pm - 15:00 (3:00) pm SALA DOURO NORTE 21 Financing SALA TÂMEGA 26 SPECIAL SESSION Financial Markets and Public Finance in Portugal SALA DOURO SUL 22 International Corporate Governance SALA CORGO 27 Forecasting and Market Efficiency FLOOR 1 SALA MINHO 23 Buyouts and Acquisitions SALA LIMA 24 Borrowing Costs and Risk SALA CÁVADO 25 Fund Management FLOOR 2 SALA TUA 28 Measuring and Managing Risk SALA SOUSA 29 Default, Securitization, and Banking SALA SABOR 30 International Cross Listings 15:00 (3:00) pm - 15:30 (3:30) pm - Foyer, Floor 1 and Foyer, Floor 2 COFFEE BREAK THURSDAY, 9 JUNE - 15:30 (3:30) pm - 17:00 (5:00) pm SALA DOURO NORTE 31 Debt SALA TÂMEGA 36 Financial Modeling SALA DOURO SUL FLOOR 1 SALA MINHO 33 Corporate Acquisitions SALA CORGO FLOOR 2 SALA TUA 37 Events and Market Efficiency 38 Capital Structure SALA LIMA 34 CDS SALA SOUSA 39 Bank Governance 17:15 (5:15) pm KEYNOTE ADDRESS Sala Porto, Floor 1 18:30 (6:30) pm RECEPTION Círculo Universitário do Porto (Rua do Campo Alegre, 877) 2011 FMA European Conference Program - 27 SALA CÁVADO 35 Fund Performance and Management SALA SABOR FRIDAY, 10 JUNE- 8:30 am - 10:00 am FLOOR 1 SALA MINHO SALA DOURO NORTE SALA DOURO SUL 42 Financial Strength and Distress SALA TÂMEGA SALA CORGO FLOOR 2 SALA TUA 47 Analysts, Accuracy, and Announcements SALA LIMA 43 LBOs and Delistings 48 Issues in Risk Management SALA SOUSA 49 Cost of Bank Financing SALA CÁVADO 45 Institutional Investors and Return Predictability SALA SABOR 50 Trading and Behavioral Finance 10:00 AM - 10:30 AM - Foyer, Floor 1 and Foyer, Floor 2 COFFEE BREAK FRIDAY, 10 JUNE- 10:30 am - 12:00 noon SALA DOURO NORTE 51 Borrowing 52 Boards SALA TÂMEGA 56 SPECIAL SESSION Shadow Financial Regulatory Committee: Dissecting the Financial Crisis and Financial Reform FLOOR 1 SALA MINHO SALA DOURO SUL 53 Financial Policies and Value SALA LIMA 54 Regulation and Markets SALA CÁVADO 55 Portfolio Choice SALA SOUSA SALA SABOR 60 Money and Capital Flows FLOOR 2 SALA TUA SALA CORGO 57 Risk and Return 1 58 Risk Noon - 13:30 (1:30) pm - Madruga Restaurant - Floor -1 LUNCHEON FRIDAY, 10 JUNE- 13:30 (1:30) pm - 15:00 (3:00) pm SALA DOURO NORTE 61 Taxes and Leverage SALA TÂMEGA 66 SPECIAL SESSION Research Opportunities in Corporate Governance SALA DOURO SUL FLOOR 1 SALA MINHO 63 Private Equity FLOOR 2 SALA TUA SALA CORGO 67 Risk and Return 2 68 Price Dynamics SALA LIMA 64 Information and Market Prices SALA SOUSA 69 Bank Regulation SALA CÁVADO 65 Risk and Performance Measurement SALA SABOR 70 Insurance 15:00 (3:00) PM - 15:30 (3:30 PM) - Foyer, Floor 1 and Foyer, Floor 2 COFFEE BREAK FRIDAY, 10 JUNE- 15:30 (3:30) pm - 17:00 (5:00) pm SALA DOURO NORTE SALA DOURO SUL SALA TÂMEGA SALA CORGO 77 International Equity Risk FLOOR 1 SALA MINHO SALA LIMA 73 Initial Public Offerings FLOOR 2 SALA TUA SALA SOUSA 79 Bank Liquidity and Risk 18:00 (6:00) pm and 18:30 (6:30) pm BUS DEPARTURES FROM HOTEL FOR WINE TOUR AND GALA DINNER (Advance Registration Required) 2011 FMA European Conference Program - 28 SALA CÁVADO 75 Ethics, Law, and Social Responsibiiity SALA SABOR 80 Stock Market Risk and Dynamics 2011 FMA EUROPEAN CONFERENCE – ROSTER OF ATTENDEES NAME Abdioglu, Nida Abedifar, Pejman Agca, Senay Aguir, Iness Aiguzhinov, Artur Alexandridis, George Almeida, Álvaro Anderson, Christopher Anjos, Fernando Anolli, Mario Atilgan, Yigit Atrissi, Nizar AFFILIATION Manchester Business School Universite de Limoges George Washington University University of Texas San Antonio Universidade do Porto ICMA Centre, University of Reading Universidade do Porto University of Kansas University of Texas Università Cattolica del Sacro Cuore Sabanci University Université Saint-Joseph HOTEL Porto Palácio ARRIVAL 6/8/2011 DEPARTURE Porto Palácio 6/7/2011 6/11/2011 Porto Palácio Porto Palácio 6/8/2011 6/8/2011 6/15/2011 6/11/2011 Bae, Sung Baedorf, Katrin Baltussen, Guido Barbosa, António Barinov, Alexander Barras, Laurent Belot, Francois Ben Slimane, Faten Benzinho, Jose Bessembinder, Hank Bessler, Wolfgang Bigelli, Marco Bonfim, Diana Borell, Mariela Brandtner, Mario Brown, Keith Bugeja, Martin Bowling Green State University WHU - Otto Beisheim School of Management Erasmus University Rotterdam ISCTE Business School University of Georgia McGill University Université Paris-Dauphine Champagne School of Management IP Coimbra/ISCAC University of Utah University of Giessen University of Bologna Banco de Portugal and ISEG-UTL Centre for European Economic Research (ZEW), Mannheim Friedrich Schiller University of Jena University of Texas University of Technology, Sydney Porto Palácio 6/8/2011 6/12/2011 Porto Palácio Porto Palácio 6/6/2011 6/8/2011 6/11/2011 6/11/2011 Porto Palácio Porto Palácio 6/8/2011 6/12/2011 Porto Palácio 6/9/2011 6/7/2011 6/11/2011 6/11/2011 Callado-Muñoz, Francisco José Campello, Murillo Cenedese, Gino Chaieb, Ines Chamberlain, Trevor Champagne, Claudia Chan, Andrew Chan, Kam Fong Chang, Ching-chieh Changarath, Vinod Chen, Brandon Chen, Sheng-Hung Chen, Wei-Peng Col, Burcin Cooley, Philip Correia, Ricardo Croci, Ettore Girona University University of Illinois University of Warwick University of Geneva & Swiss Finance Institute McMaster University Université de Sherbrooke Capital IQ University of Queensland University of Washington University of Cincinnati University of New South Wales Nanhua University Shih Hsin University McGill University Trinity University Universidad Carlos III University of Milan - Bicocca Porto Palácio 6/8/2011 6/10/2011 Porto Palácio Porto Palácio Porto Palácio Porto Palácio 6/8/2011 6/14/2011 6/7/2011 6/8/2011 6/11/2011 6/10/2011 Porto Palácio Porto Palácio 6/8/2011 6/8/2011 6/11/2011 6/12/2011 da Cunha, Florbela Dabo, Moriba Danielova, Anna Danis, Andras ISCTE Business School Cairo University McMaster University Vienna Graduate School of Finance Porto Palácio 6/9/2011 6/10/2011 Porto Palácio Del Giudice, Alfonso Dias, José Dick, Christian Diyarbakirlioglu, Erkin Dontis-Charitos, Panagiotis Draper, Paul Drobetz, Wolfgang Duca, John Universita Cattolica - Milan ISCTE - IUL Centre for European Economic Research (ZEW) Mannheim Sorbonne Business School University of Westminster University of Leeds University of Hamburg Federal Reserve Bank of Dallas Porto Palácio 12:00:00 AM ?? 8/6/2011 12:00:00 AM ?? 12/6/2011 Porto Palácio Porto Palácio Porto Palácio 6/8/2011 6/7/2011 6/8/2011 6/11/2011 6/12/2011 6/11/2011 Eades, Ken Easley, David Ederington, Louis Elson, Charles University of Virginia Cornell University University of Oklahoma University of Delaware Porto Palácio 6/8/2011 6/9/2011 6/11/2011 6/11/2011 2011 FMA European Conference Program - 29 Porto Palácio Porto Palácio Porto Palácio Porto Palácio Emery, Gary Espenlaub, Susanne Estrada, Javier University of Oklahoma Manchester Business School IESE Business School Porto Palácio 6/8/2011 6/11/2011 Porto Palácio 6/8/2011 6/11/2011 Faelten, Anna Faias, Jose Faleye, Olubunmi Farinha, Jorge Fatemi, Ali Feito-Ruiz, Isabel Fernandes, Catarina Ferreira, Miguel Finnerty, John Fooladi, Iraj Foster, Douglas Francis, Bill Fruehwirth, Manfred Fungacova, Zuzana Cass Business School Catolica Lisbon Northeastern University Universidad do Porto DePaul University University of Oviedo University of Porto & Polytechnic Institute of Bragança Nova School of Business and Economics Fordham University Dalhousie University Australian National University Rensselaer Polytechnic Institute WU Wien Bank of Finland Porto Palácio Porto Palácio 6/7/2011 6/11/2011 Porto Palácio 6/7/2011 6/11/2011 Porto Palácio Porto Palácio Porto Palácio Porto Palácio 6/8/2011 6/7/2001 6/7/2011 6/8/2011 6/12/2011 6/13/2011 6/12/2011 6/11/2011 Galimberti, Jaqueson Garcia-Teruel, Pedro Gaspar, Raquel Goncalves-Pinto, Luis Gregory, Alan Guembel, Alexander Gunduz, Yalin Manchester Business School University of Murcia ISEG - Technical University of Lisbon USC Marshall School of Business University of Exeter University of Toulouse Deutsche Bundesbank Porto Palácio Porto Palácio Porto Palácio 6/8/2011 6/8/2011 6/8/2011 6/11/2011 6/11/2011 6/11/2011 Hagenau, Michael Hagendorff, Bjoern Hagendorff, Jens Harlow, Van Harris, Robert Herring, Richard Heuson, Andrea Hitzemann, Steffen Hong, KiHoon Jimmy Hu, Jiehui Hunter, Delroy Hutchinson, Mark Immenkötter, Philipp University of Freiburg University of Leeds University of Edinburgh Putnam Investments University of Virginia University of Pennsylvania University of Miami Karlsruhe Institute of Technology University of Cambridge Tilburg University University of South Florida University College Cork University of Cologne Porto Palácio Porto Palácio 6/7/2011 6/11/2011 6/8/2011 6/7/2011 6/11/2011 6/11/2011 6/9/2011 6/12/2011 Porto Palácio HF Tuela Porto Porto Palácio Porto Palácio Porto Palácio 6/8/2011 6/12/2011 6/8/2011 6/10/2011 Irek, Fabian Isakov, Dusan Itzkowitz, Jennifer Luxembourg School of Finance University of Fribourg University of Florida Jagtiani, Julapa Jalal, Abu Jayaraman, Narayanan Jorge, Jose Joy, Michael Jutasompakorn, Pearpilai Federal Reserve Bank of Philadelphia Suffolk University Georgia Institute of Technology CEF.UP, Universidade do Porto Irish Public Bodies Mutal Insurance Ltd Monash University Porto Palácio Porto Palácio Porto Palácio 6/7/2011 6/8/2011 6/8/2011 6/12/2011 6/12/2011 6/12/2011 Porto Palácio 6/8/2011 6/10/2011 Kaeck, Andreas Kalaitzoglou, Iordanis Kalotychou, Elena Kaufman, George Kaul, Aditya Khoury, Nabil Kleimeier, Stefanie Kling, Gerhard Korczak, Adriana Kroencke, Tim Kryzanowski, Lawrence ICMA Centre, University of Reading Heriot Watt University Cass Business School Loyola University Chicago University of Alberta Universite du Quebec a Montreal Maastricht University University of Southampton University of Bristol Centre for European Economic Research (ZEW) Concordia University Porto Palácio Porto Palácio Porto Palácio 6/9/2011 6/13/2011 Porto Palácio Porto Palácio Porto Palácio Porto Palácio 6/6/2011 6/11/2011 6/7/2011 6/8/2011 6/11/2011 6/11/2011 Porto Palácio 6/8/2011 6/11/2011 Lebedeva, Olga Lee, Hye Seung Lehnert, Thorsten Lepori, Gabriele Lewis, Craig Liebmann, Michael University of Mannheim Lehigh University Luxembourg School of Finance Copenhagen Business School Vanderbilt University & US SEC University of Freiburg Porto Palácio Porto Palácio 6/7/2011 6/11/2011 Porto Palácio 6/7/2011 6/11/2011 6/8/2011 6/10/2011 2011 FMA European Conference Program - 30 Porto Trinidade Hotel Porto Palácio Porto Palácio Porto Palácio Lin, Ming-Ying Lin, Yueh-Hsiang Locorotondo, Rosy Londono Yarce, Juan Miguel Lovreta, Lidija Lyssimachou, Danielle National Chiao Tung University National Taipei College of Business Katholieke Universiteit Leuven & Research Foundation Flanders Tilburg University CUNEF Manchester Business School Porto Palácio 6/8/2011 Porto Palácio Porto Palácio Porto Palácio Porto Palácio 6/8/2011 6/8/2011 6/12/2011 6/11/2011 6/8/2011 6/12/2011 Mansi, Sattar Martí, Carmen Martinez, Isabelle Martinez-Sola, Cristina Mavrovitis, Christos Mazur, Mieszko McInish, Thomas McQueen, Grant Michalak, Tobias Miguel, Antonio Molchanov, Alexander Mooradian, Robert Mortal, Sandra Moutinho, Nuno Mueller, Andreas Muharam, Farrah Merlinda Muscarella, Chris Virginia Tech Universitat Autònoma de Barcelona University of Toulouse Paul Sabatier University of Jaen ICMA Centre, Henley Business School IESEG University of Memphis Brigham Young University University of Bochum Instituto Universitario de Lisboa (ISCTE-IUL) Massey University Northeastern University University of Memphis / SEC Instituto Politecnico de Braganca RWTH Aachen University Universitat Autonoma de Barcelona Penn State University Porto Palácio 6/7/2011 6/10/2011 6/6/2011 6/12/2011 6/7/2011 6/11/2011 6/8/2011 6/10/2011 Porto Palácio 6/7/2011 6/11/2011 Najar, Dorra Naranjo, Andy Navone, Marco Nayar, Nandkumar Nielsson, Ulf Novak, Jiri Université Paris Dauphine University of Florida Università Bocconi Lehigh University Copenhagen Business School Charles University in Prague Porto Palácio Porto Palácio Porto Palácio Porto Palácio Porto Palácio 6/8/2011 6/6/2011 6/14/2011 12/6/2011 O'Brien, Thomas Oh, Ji Yeol O'Hara, Maureen Oliveira, Benilde Onn, Loke Orbe, Sebastian Orlov, Alexei Ovtchinnikov, Alexei University of Connecticut University of Cambridge Cornell University University of Minho Monash University University of Cologne Radford University Vanderbilt University Porto Palácio 6/8/2011 6/12/2011 Porto Palácio 6/7/2011 6/11/2011 Porto Palácio Porto Palácio Porto Palácio 6/8/2011 6/10/2011 6/7/2011 6/11/2011 Palma, Pedro Panyagometh, Kamphol Park, Yuenjung Patel, Ajay Payne, Richard Peixinho, Ruben Pereira, Joao Pedro Phillips, Blake Pieterse-Bloem, Mary Pinto, Helena Pinto, João Platikanova, Petya Poletti Hughes, Jannine Pontuch, Peter Pouliasis, Panagiotis Priem, Randy Universidade do Porto NIDA Business School KAIST Wake Forest University Cass Business School University of the Algarve and CEFAGE-UE ISCTE-IUL University of Waterloo Tilburg University University of Strathclyde Universidad do Porto ESADE Business School University of Liverpool Universite Paris Dauphine Cass Business School Katholieke Universiteit Leuven Porto Palácio Porto Palácio 6/7/2011 6/7/2011 6/10/2011 6/10/2011 6/8/2011 6/11/2011 6/8/2011 6/8/2011 6/8/2011 6/8/2011 6/10/2011 6/11/2011 6/12/2011 6/12/2011 Prokopczuk, Marcel Pucker, Oliver ICMA Centre - Henley Business School University of Cologne Porto Palácio Porto Palácio Porto Palácio Porto Palácio Hotel Quality Inn Portus Cale Porto Palácio Porto Palácio 6/8/2011 6/10/2011 Qi, Yaxuan Concordia University Porto Palácio 6/8/2011 6/11/2011 Rader, Jack Rakowski, David Ramón-Llorens, Ma Camino Reuter, Charles Roberts, Gordon Rodriguez-Moreno, Maria FMA SIU Carbondale Universidad Politenica de Cartagena ESCP Europe, L.S.F., Université de Paris Ouest York University Universidad Carlos III 6/7/2011 6/7/2011 6/11/2011 6/11/2011 2011 FMA European Conference Program - 31 Porto Palácio Porto Palácio Porto Palácio Porto Palácio Porto Palácio Porto Palácio Porto Palácio Porto Palácio Porto Palácio Porto Palácio Hotel Quality Inn Portus Caleþ Rosa, Mark Rose, Annica Rossi, José Santa Clara, Pedro Santos, Joao Savor, Marko Schallheim, James Schmid, Markus Scordis, Nicos Scott, Ken Sener, Emrah Serra, Ana Paula Serve, Stephanie Shaukat, Amama Sianab, Alex Sibilkov, Valeriy Signori, Andrea Simkins, Betty Soares Lopes, Maria Sojli, Elvira Sousa, Miguel University of Sydney Insper Institute of Education and Research Porto Palácio Porto Palácio 6/9/2011 6/10/2011 6/6/2011 6/8/2011 6/11/2011 6/11/2011 6/8/2011 6/12/2011 Porto Palácio Porto Palácio 6/7/2011 6/8/2011 6/12/2011 6/11/2011 Porto Palácio Porto Palácio 6/7/2011 6/11/2011 Porto Palácio Porto Palácio Porto Palácio Porto Palácio 6/7/2011 6/7/2011 6/8/2011 6/12/2011 6/15/2011 6/11/2011 Porto Palácio Porto Palácio 6/8/2011 6/9/2011 6/10/2011 6/11/2011 Porto Palácio 6/8/2011 6/11/2011 6/8/2011 6/11/2011 Porto Palácio 6/7/2011 6/10/2011 Porto Palácio 6/8/2011 6/12/2011 Springauf, Eva-Maria Staikouras, Sotirs Starks, Laura Stock, Duane Strong, Robert Stucke, Ruediger Stulz, Rene Suarez Suarez, Nuria Sun, Qian Suominen, Matti Universidad Nova de Lisboa Federal Reserve Bank New York University of Quebec in Montreal University of Utah University of Mannheim St. John's University Stanford University Ozyegin University Universidad do Porto University of Cergy-Pontoise University of Exeter Capital IQ University of Wisconsin - Milwaukee University of Bergamo Oklahoma State University University of Porto Erasmus University Rotterdam Universidade do Porto & Oxford Private Equity Institute, Saïd Business School Oesterreichische National Bank Cass Business School University of Texas University of Oklahoma University of Maine Oxford University The Ohio State University University of Oviedo Fudan University Aalto University Tan, Kian Tastan, Mesut Toffanin, Melissa Trabelsi, Donia Tümer Alkan, Günseli Tunaru, Radu University of New South Wales University of Texas Dallas Concordia University University Paris 1 Pantheon - Sorbonne VU University Amsterdam University of Kent at Canterbury Umber, Marc Frankfurt School of Finance & Management Valderrama, Laura Vallascas, Francesco Vasconcelos, Manuel Vieito, João Paulo Vilanova, Laurent Vivel, Milagros Vonhoff, Volker IMF University of Leeds Erasmus University Polytechnic Institute of Viana do Castelo University Lyon 2 - Coactis University of Santiago de Compostela University of Mannheim Walker, David Walkling, Ralph Wang, Jr-Yan Wang, Yaw-Huei Webb, Robert Weisskopf, Jean-Philippe Westerholm, Joakim Whittaker, Julie Winkler, Gerhard Wolf, Michael Georgetown University Drexel University National Taiwan University National Taiwan University University of Virginia & KAIST Business School University of Fribourg University of Sydney University of Exeter Oesterreichische Nationalbank University of Zurich Porto Palácio Porto Palácio 6/8/2011 6/7/2011 6/10/2011 6/12/2011 Porto Palácio Porto Palácio 6/8/2011 6/8/2011 6/10/2011 6/13/2011 Xu, Lan Yadav, Vijay Zakamulin, Valeriy Zaldokas, Alminas Zeitun, Rami Zhang, Yan Zhao, Bo Washington University in St Louis INSEAD University of Agder INSEAD University of Queensland US OCC The George Washington University Porto Palácio 6/8/2011 6/11/2011 2011 FMA European Conference Program - 32 Porto Palácio Porto Palácio Porto Palácio Porto Palácio Porto Palácio Porto Palácio PRESENTERS - DISCUSSANTS - CHAIRPERSONS SPECIAL SESSION PARTICIPANTS - DOCTORAL STUDENT CONSORTIUM PARTICIPANTS NAME Nida Pejman Senay Iness George Christopher Álvaro Kalaitzoglou Fernando Mario Antonio Yigit Nizar Iordanis Sung Katrin Guido António Alexander Laurent François Wolfgang Marco Diana Mariela Mario Keith Martin Francisco Murillo Daniel Gino Ines Claudia Kam Ching-chieh Vinod Brandon Sheng-Hung Wei-Peng Burcin Ricardo Ettore Manuel Florbela Andras Manuel Teixeira Alfonso Jose Christian Erkin Panagiotis Wolfgang John Kenneth Louis Franklin Charles Gary Jose Fong S. Puerta Galvao G. V. Abdioglu Abedifar Agca Aguir Alexandridis Anderson Almeida Angelos Anjos Anolli Antunes Atilgan Atrissi SESSION(S) 22 52 09 69 24 39 DSC 03 13 07 11 55 64 33 53 09 70 06 04 30 21 Bae Baedorf Baltussen Barbosa Barinov Barras Belot Bessler Bigelli Bonfim Borell Brandtner Brown Bugeja 23 02 17 18 27 37 47 67 77 45 23 33 73 01 43 66 14 51 33 63 55 65 05 13 33 Callado Munoz Campello Carvalho Cenedesde Chaieb Champagne Chan Chang Changarath Chen Chen Chen Col Correia Croci 60 21 06 DSC 20 22 60 79 34 80 13 23 69 73 22 52 39 02 64 DSC 48 02 25 da Costa da Cunha Danis de Vasconcelos Del Giudice Dias Dick Diyarbakirlioglu Dontis-Charitos Drobetz Duca 26 58 69 11 36 61 DSC 35 43 80 27 48 45 55 70 61 67 14 Eades Ederington Edwards Elson Emery 45 51 57 68 56 66 36 Susanne Javier Espenlaub Estrada 25 57 Anna José Olubunmi Isabel Catarina Alexandra Elisa Miguel John Iraj F Bill Manfred Zuzana Faelten Faias Faleye Feito-Ruiz Fernandes Ferreira Ferreira Finnerty Fooladi Foster Francis Frühwirth Fungacova 13 37 45 39 60 03 DSC 16 DSC 06 38 24 34 10 05 15 07 11 61 24 69 Galimberti Galvao da Cunha Garcia-Teruel Gaspar Gregory Guembel Gunduz 08 20 69 42 19 70 13 75 11 19 04 08 Hagendorff Hagendorff Herring Heuson Hitzemann Hong Hu Hunter Hutchinson Immenkötter 70 29 56 65 73 37 68 DSC 36 48 20 58 69 65 21 36 Dusan Isakov 52 77 Julapa Abu Narayanan Jose Pearpilai Jagtiani Jalal Jayaraman Jorge Jutasompakorn 09 29 20 39 12 80 DSC Kaeck Kalaitzoglou Kaufman Kaul Khoury Kleimeier Kling Korczak Kroencke Kryzanowski 28 64 68 56 10 15 30 31 60 14 21 30 47 05 22 Lebedeva Lee Lehnert Lepori Lewis Liebmann Lin Lin DSC 51 67 03 25 50 57 DSC 18 24 47 12 36 57 Jaqueson Florbela Pedro Raquel Alan Alexander Yalin Bjoern Jens Richard Andrea Steffen KiHoon Jiehui Delroy Mark Philipp Andreas Iordanis George Aditya Nabil Stefanie Gerhard Adriana Tim Lawrence Olga Hye Thorsten Gabriele Craig Michael Ming-Ying Yueh-hsiang 2011 FMA European Conference Program - 33 Alves Douglas B. J J. Jimmy P (Jordan) Alexander Seung Rosy Juan-Miguel Lidija Danielle Locorotondo Londono Lovreta Lyssimachou 42 77 34 27 47 Claudia Gordon Annica José Mansi Marques Martinez Martinez-Sola Mata Matos Mazur McInish McQueen Michalak Miguel Molchanov Monteiro Mooradian Moreno Mortal Moutinho Mueller Muharm 12 75 26 43 53 06 06 03 54 64 50 29 49 79 35 12 60 26 25 55 79 37 43 53 63 01 17 48 Najar Naranjo Navone Nayar Nielsson Novak 02 75 24 31 15 55 61 10 54 51 75 Pedro Joao Marko Markus Nicos Kenneth Emrah Stéphanie Amama Valeriy Andrea Betty Faten Elvira Juan Miguel Sotiris Laura Duane Ruediger Rene Nuria Qian Matti O'Brien Oh O'Hara Oliveira Onn Orbe Orlov Otero Ovtchinnikov 31 77 36 54 16 54 35 65 18 27 27 36 36 77 31 01 33 Park Payne Peixinho Pereira Pereira Phillips Pieterse-Bloem Pinto Pinto Platikanova Poletti-Hughes Pontuch Portugal Pouliasis Priem Prokopczuk Pucker DSC 64 27 53 34 68 04 15 04 35 07 DSC 13 21 42 52 21 51 06 18 68 23 31 18 58 09 47 Yaxuan Qi 01 51 David Ma Charles Rakowski Ramón-Llorens Reuter 15 35 11 17 01 11 Sattar Raul Manuel Isabelle Cristina Jose Pedro Mieszko Thomas Grant Tobias Antonio Alexander Manuel Robert Maria Sandra Nuno Andreas Farrah Simoes H Alves Rodriquez Merlinda Dorra Andy Marco Nandu Ulf Jiri Thomas Ji Yeol Maureen Benilde Loke Sebastian Alexei Luis Alexei Yuenjung Richard Ruben Joao Paulo Blake Mary Helena Joao Filipe Petya Jannine Peter Pedro Panos Randy Marcel Oliver Jimmy Seng Pedro Monteiro K Camino Ribeiro Roberts Rose Rossi 08 DSC 04 24 50 58 79 Santa-Clara Santos Savor Schmid Scordis Scott Sener Serve Shaukat Sibilkov Signori Simkins Slimane Sojli Sotes-Paladino Sousa Staikouras Starks Stock Stucke Stulz Suarez Sun Suominen DSC DSC 06 30 01 09 17 56 20 64 43 39 52 33 53 53 73 18 58 10 54 22 54 15 55 63 49 67 DSC 66 29 49 23 43 Keynote 19 69 30 36 Eric Ken-ichi Carlos Melissa Donia Günseli Radu Tan Tatsumi Tavares Toffanin Trabelsi Tümer-Alkan Tunaru 25 49 16 43 73 63 31 79 08 28 Marc Umber 37 Laura Francesco Joao Laurent Milagros Volker Valderrama Vallascas Vieito Vilanova Vivel Vonhoff 19 19 07 02 50 09 04 20 Walker Walkling Wang Wang Webb Weisskopf Whittaker Winkler Wolf 10 14 52 66 08 28 68 75 02 12 75 17 28 65 Lan Xu 42 80 Vijay Yadav 05 55 Valeri Valeriy Alminas Yan Bo Zakamouline Zakamulin Zaldokas Zhang Zhao 67 80 DSC 14 29 42 67 David Ralph Jr-Yan Yaw-Huei Robert Jean-Philippe Julie Gerhard Michael 2011 FMA European Conference Program - 34 Luiz Ben Paulo A. I. (Jenny) PORTO PALÁCIO HOTEL FLOOR ONE Stairs up to Floor Two Sala Douro Norte Sessions Foyer Sala Porto Conference Registration Keynote Address Thursday, 17:15 (5:15) pm Salas Minho Cávado Lima Sessions Coffee Breaks Sala Douro Sul Sessions FLOOR TWO Stairs up from Floor One Sala Corgo Sessions Sala Sousa Sala Tua Sala Sabor Sessions Sessions Sessions Sala Tâmega Sessions Foyer Coffee Breaks Diagram for informational purposes only. Not to scale. 2011 FMA European Conference Program - 35 Financial Management Association Survey and Synthesis Series... Survey Research in Corporate Finance Bridging the Gap between Theory and Practice H. Kent Baker, J. Clay Singleton, and E. Theodore Veit Provides a unique summary of the state-of-the-art of survey research in finance. Hardback | 464 pages 978-0-19-534037-2 | February 2011 | $69.95 $45.47 Asset Pricing and Portfolio Choice Theory Kerry Back Truth in Lending Theory, History, and a Way Forward Thomas A. Durkin and Gregory Elliehausen This book concerns an ongoing public policy debate about the efficacy of financial disclosures as consumer protections. Hardback | 368 pages 978-0-19-517295-9 | March 2011 | $74.00 $48.10 Real Options in Theory and Practice Graeme Guthrie Back covers the classical results on single-period, discrete-time, and continuous-time models of portfolio choice and asset pricing. Includes extensive exercises and solutions. Hardback | 464 pages 978-0-19-538061-3 | September 2010 | $89.95 $58.47 Develops the building blocks of real options analysis and shows readers how to apply them to a wide variety of problems in business and economics. Includes CD. Hardback | 432 pages 978-0-19-538063-7 | July 2009 | $89.95 $58.47 )0$PHPEHUVFDQUHFHLYHDQH[FOXVLYHGLVFRXQWRQDOOWLWOHVLQWKHVHULHV 9LVLWZZZRXSFRPXVIPDWRRUGHUQRZ Give your work the visibility it deserves Introducing 2 brand new top-level journals of the Society for Financial Studies RAPS Executive Editor: Wayne Ferson Editors: Maureen O’Hara Jeffrey Pontiff Amir Yaron RCFS Executive Editor: Paolo Fulghieri New in 2012 New in 2011 Submit online Editors: Christopher Hennessy Joshua Rauh Michael Roberts UPCOMING CONFERENCES 2011 CONFERENCES 2011 FMA ANNUAL MEETING October 19 - 22, 2011 Sheraton Denver Hotel Denver, Colorado www.fma.org/Denver/ 2012 CONFERENCES 2012 FMA ASIAN CONFERENCE 11 - 13 July 2012 Phuket, Thailand SUBMISSION DEADLINE: DECEMBER 15, 2011 www.fma.org/Thailand / 2012 FMA EUROPEAN CONFERENCE 6 - 8 June 2012 Istanbul, Turkey SUBMISSION DEADLINE: DECEMBER 1, 2011 www.fma.org/Istanbul/ 2012 FMA ANNUAL MEETING 17 - 20 October 2012 Atlanta, Georgia SUBMISSION DEADLINE: JANUARY 13, 2012 Financial Management Association International First Call for Papers and Participation 2012 FMA European Conference 6 - 8 June 2012 Istanbul, Turkey Recep Bildik, Istanbul Stock Exchange and Koç University William L. Megginson, University of Oklahoma 2012 FMA European Conference Program Chairs DEADLINE SUMMARY Program Committee Member Application November 11, 2011 Completed Papers and Abstracts December 1, 2011 Panel Discussion Proposals December 1, 2011 Requests to serve as session chairperson or paper discussant February 10, 2012 Doctoral Student Consortium Applications February 18, 2012 The Sixteenth Annual European Conference of the Financial Management Association International (FMA) will be held June 6 through June 8 at the Point Hotel Barbaros in breathtaking Istanbul, Turkey. FMA’s European Conference brings together academicians and practitioners with interests in financial decision-making and provides a forum for presenting new research and discussing current issues in financial management and related topics. Presentations of research papers, panel discussions, and tutorials will begin either Wednesday afternoon or Thursday morning and end Friday afternoon. The Doctoral Student Consortium will be held on Wednesday. Submission Fee: US$25/ US $35 for non-members For information on submission procedures, go to www.fma.org/Istanbul / 2012 Yılında Istanbul'da Görüşürüz! www.fma.org/Istanbul/