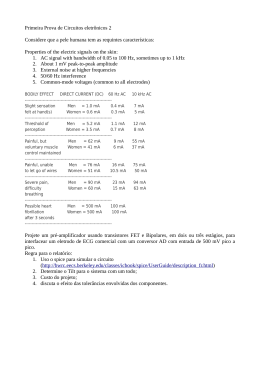

Business Advisory Working Group Mozambique MEETING MINUTES 1 2 3 4 5 6 7 8 9 10 Page 1 of 2 Date of Meeting: 12 September 2014 Place of Meeting: Maputo, Indy Village Time: Agenda From 8h30 to 13h. 1. Welcome and Introduction - Cooperation Framework to Support the New Alliance for Food Security & Nutrition in Mozambique and the BAWG Concept Note By: USAID/SPEED 2. Results of the Survey conducted amongst companies: challenges and constrains By: BAWG Secretariat 3. Results of the Analysis of Proposed Regulation on “Cessão de Exploração” By: USAID/SPEED 4. Next Steps for BAWG operationalization a. Appointment of Group Chair b. BAWG Results Based Work Plan c. Date and Place of Meeting 2-2014 A initiative under: With the support of: & Support Documents The following documentation was made available to all participants, prior and during the meeting: 1. Cooperation Framework to Support the New Alliance for Food Security & Nutrition in Mozambique 2. Survey Report 3. Analysis of Proposed Regulation on “Cessão de Exploração” 4. BAWG Concept Note 5. BAWG Results Based Work Plan Participants A total of 18 companies have attended the meeting. In addition, representatives from CTA, USAID, SPEED, Grow Africa, CEPAGRI and other institutions have also attended the meeting. List of Participants in Annex I. Working Language: The meeting was held in English as this was the preferred working language informed by participants. Minutes1 The meeting was moderated by Mariam Umarji (MBU), which started by welcoming and thanking everyone for the presence and participation in the meeting. She presented herself, invited each participant to introduce himself to the group (name, company and area of activity) and concluded by presenting the agenda. No Any Other Business (AOB) has been added to the agenda. 1. Welcome and Introduction - Cooperation Framework to Support the New Alliance for Food Security & Nutrition in Mozambique and the BAWG Concept Note By: USAID/SPEED The representatives of the Speed Programme (Birgit Helms and Rosário Marapusse) welcomed all participants to the meeting and explained the context under which the group was being established. Reference was made to the New Alliance Framework for Mozambique (NA) and the 15 areas of action that Government of Mozambique (GoM) committed to improve in order to facilitate the doing business in the country by the companies / investments who have signed a Letter of Intention (LOI) under the framework. They further explained that the delays observed in scheduling this first meeting was related to the many changes in context namely the one related with the appointment of a new board for CTA. Initially it was proposed that this group would closely work alongside the CTA Agribusiness group but no agreement was reached and SPEED decided to move forward and schedule this first meeting. Rosario Marapusse presented the BAWG Concept Note and with the support from the facilitator the following objectives where agreed to as being the core objectives of the BAWG: (i) Be available at least bi-monthly to discuss relevant policy issues pertaining to NA and affecting business; (ii) Provide policy comments and recommendations based on its experience and in line with NA goals and objectives; (iii) Provide comments and opinions by electronic or telephonic means, or through meetings, outside the regular bi-monthly meetings, as requested; (iv) Represent the opinions of business in the agriculture, agro- 1 These minutes are a summary of the key aspects discussed and key interventions. More interventions than reported have occurred during the meting but are presented in a summary format. Page 2 of 8 processing and related sectors as relevant and in line with their own specialist knowledge and experience; (v) Represent the opinions of the Group and seek to ensure that the general views agreed by the Group are heard outside the Group, using any means at their disposal, such as their own representative organizations, contacts with government or donor organizations, or the media with a view to ensuring wider, informed debate about the issues in question; (vi) Contribute to, and seek to motivate broad debate on policy related matters as related to agricultural, food security, nutrition and business environment development; (vii) Act in their individual capacity, in their capacity as members of the Group and as representatives of their companies as ambassadors for the NA and for increased private sector investment in the agriculture sector, and as ambassadors for policy change where the Group deems this is required. No changes to the Concept Note have been recorded in the meeting and all participants consequently endorsed it. The Concept Note can be fond in Annex II to these meeting minutes. 2. Results of the Survey conducted amongst companies: challenges and constrains By: BAWG Secretariat The facilitator presented the results of the survey conducted amongst the companies / investments with signed LOIs. The Survey Report can be found in Annex III. The main conclusions of the survey were that: (i) Companies / Investments have difficult understanding and complying with all applicable regulations and procedures in all of the areas listed in the survey namely on the field related to Land, Licensing and Export; It is not clear who is the official and reliable source of information in each area; (ii) Companies / Investment have access to information on a certain issue from different sources and depending on the source of information the details on the issue are different; (iii) Companies / Investments have difficult in coordinating with local authorities and also to identify themselves to such authorities as being LOI companies under the NA; (iv) Companies / Investments also found that it is difficult to have access to finance, that local banks and SMEs are unprepared for the level of relationship they require. (v) The survey also concluded that most companies rated their perception of GoM action in relation to the 15 agreed commitments as “very slow or no developments”. Page 3 of 8 The facilitator also explained that only a small % of the LOI companies responded to the survey and that certain questions where not answered in detail. To support prioritization of the areas of action for the BAWG the facilitator conducted a exercise to summarize the key constrains felt by companies. Each participant was called to present (in order of importance) 3 areas that where impeding their development in the country. This exercise conducted in the room resulted on the following: (i) Access to timely and complete and reliable information is the key constrain for the LOI companies: in the areas of land, licensing, taxes, exports, banking system, among others; Information received at central level varies from the information received on the same issue at provincial and district level; Penalties are being frequently applied to companies for non compliance and there is no credible source of information to use to be compliant from the beginning; (ii) Access to Land: availability of information on land, DUAT holders information, coordination with local authorities and communities and other issues pertaining to land where the high Page 4 of 8 (iii) (iv) (v) priority set of issues identified by the group; All issues related to funding was identified next: all issues pertaining to access to finance and functioning of the banking system are also critical to these companies; Detail information on procedures to be followed in import and export of good, services and capital where also listed as critical; More access to information on labor legislation, tax legislation and licensing was listed last. The group agreed that the survey should be left on line for another week and that companies should talk and incentivize other companies to respond. After the exercise was concluded, Carlos Henriques in representation of CTA informed the group about the recent developments in CTA namely that a new board had took office and was trying to organize itself to work and take this and other issues forward in their dialogue with Government. He also took opportunity to inform that in ACIS website there is a great deal of information available on most of the issues raised by the group and that are also a concern to other private sector companies. He also stressed that the existence of the BAWG would also create opportunity for a higher level dialogue with GoM and that the group should take advantage that a new Government will take office and that usually has a reform window of opportunity at the beginning of the term that both *CTA and this group should pursue. MIC is the focal point for CTA to dialogue with GoM but he explained that this is not ideal and the dialogue needs to be elevated and also to start including other ministries. Some of the participant companies took also this opportunity to demonstrate their insatisfaction towards the role played by CTA so far. 3. Results of the Analysis of Proposed Regulation on “Cessão de Page 5 of 8 Exploração” By: USAID/SPEED Ian Rose, a consultant hired by Speed to analyze the draft regulation on “Cessão de Exploração” presented the findings of it analysis. According to him, the pre-existing legal framework arguably inhibits investment and development because transferability of rural land, and of vacant urban land, is subject to a government approval process that contains a high degree of discretion. In the absence of being able to transfer one’s land use rights “automatically” (i.e. without discretionary government approval) the ability to temporarily assign or cede land use rights to a willing outside investor could – in principle – provide an alternate pathway for capital. However, a close reading of the proposed regulations lead to the following conclusions: The proposed regulations represent a positive, though somewhat modest, step in facilitating investment in land currently held by private DUAT holders because it clarifies the procedures to give investors a mechanism to formally register their rights (and thus subsequently assert the land use rights). • Notwithstanding the above, the proposed regulations in their current form are not likely to significantly facilitate investment in land held by private DUAT-holders because the degree and levels of government approvals (and corresponding inherent discretion) do not differ greatly from the government approvals that would be required for a DUAT transfer itself or for new DUAT applications. • With respect to community land, the proposed regulations have the potential for increasing investment by giving both communities and third-party investors greater clarity as to the required procedures. However, the draft declines to fill an important gap in the framework concerning what constitutes community consent, a key issue in terms of meeting international standards. Overall, the proposed regulations represent a positive step toward encouraging transactions that could result in bringing investments to underdeveloped land. However, with respect to privately-held DUATs, the current draft contains an excess of required approvals and paperwork that is, to some extent, duplicative of steps already taken by the title holder. Much of the state’s interest can be protected by a strengthened regime of monitoring rather than ex-ante approvals that delay transactions. With respect to community land, the state’s oversight role as envisioned in the proposed regulations is arguably more justified than in the realm of a transaction between a private DUAT holder and investor, and the draft provides needed clarity on the procedures of formal registration and government approvals. Nevertheless, the draft could go further and fill a still-remaining gap by addressing issues of local community governance and representation. The following issues and concerns were articulated by the participants during the meeting: • • Although the proposed regulation has the potential to facilitate land leasing transactions for land which is already formalized (i.e. land for which a DUAT title has already been issued), the impact of this regulation will be limited unless the procedures for initial DUAT issuance (by application) are simplified and unless efforts at systematic formalization throughout the continued are continued and strengthened. This is because Issuance of a DUAT is a Page 6 of 8 prerequisite for execution of the cessão de exploração in most relevant instances under the regulation. • The need for a publicly accessible and up to date cadastre (or land register) was emphasized, as part of a broader urge for more transparency generally in land administration. • Long prazos, or time durations for leases and DUATs, were urged (significantly longer than those envisioned in the draft regulation). • Too much land is being tied up by DUATs on land that is being underutilized. While some urged that these DUATs should be revoked, others urged that steps to free up leasing and transferability were a better mechanism to get this land into the hands of more productive users. • If government revokes a DUAT for land on which improvements have been made, the government should pay compensation for such improvements (contrary to what law currently states). • Private applicants should not be forced to pay expenses (such as transportation or per diems) in order to get government officials to go to parcel locations and perform registration work. This is part of government’s responsibility (and thus the resources allocated to such local government offices should be increased). • The community consultation process is cumbersome and delays are often caused through no fault of the private applicant (such as delays caused by community leaders failing to participate or show up at meetings). • Lack of formal tenure security (e.g., issuance of DUAT title) does indeed inhibit local businesses and investors. There is concern that government will take such land and give it to larger foreign investors. • Expansion and creation of new municipalities creates ambiguity and conflicts over who has rights to land newly included in the municipalities (and removed from district jurisdiction). • Lack of consistent procedures between different districts, regions and provinces creates confusion and inhibits investment. • Rent seeing and corruption does occur in land administration and must be confronted. The lack of transparency in land administration benefits the political elite who tend to restrict access to land to themselves. 4. Next Steps for BAWG operationalization a. Appointment of Group Chair A chair has been appointed to represent the group, he is Shaun Cawood from CB Farm Fresi. With the support of Grow Africa for administrative and travelling logistics the chair, which is based in Tete, will take the lead in the group coordination. The discussions for the decision on who to chair the group where very dynamic. It was also suggested that a government institutions should also co chair the group to ensure dialogue and communication with government. CEPAGRI (Honorata Sulica) agreed to take this proposal back to her Director for discussion. b. BAWG Results Based Work Plan The proposed template for a Results Based Work Plan was presented but no comments where received expect that a draft should be circulated for analysis and detailed comments. Page 7 of 8 c. Date and Place of Meeting 2-2014 The group agreed that the next meeting will be held in November, date, time and place to be circulated in due time. Annexes: ANNEX I: List of Participants ANEXO II: BAWG Concept Note ANEXO III: BAWG Preliminary Results of Survey 1 - 2014 ANNEX IV: Presentation of GoM Regulation on “Cessão de Exploração” ANNEX V: Template for Result Based Work Plan Page 8 of 8 Página 1 de 3 Página 2 de 3 SPEED Concept Note January 22nd 2014 Business Advisory Group on New Alliance Framework 1. INTRODUCTION As part of its commitment to the New Alliance framework Mozambique has committed to “pursue the policy goals [of the New Alliance company] in order to build domestic and international private sector confidence to increase agricultural investment significantly” (New Alliance Key Policy Commitments). The policy commitments go on to indicate “The Government of Mozambique intends to focus its efforts, in particular, on increasing stability and transparency in trade policy; improving incentives for the private sector…” and “The Government of Mozambique reaffirms its intention to provide the human and financial resources and the mechanisms for dialogue with the private sector…” In addition the Private Sector Engagement section of the New Alliance (NA) document for Mozambique indicates that among other things “Private sector representatives…intend to advise, shape, and participate in broad, inclusive and sustained private sector consultative mechanisms with the host government”. Currently there are a number of consultative mechanisms which potentially feed into the discussions around NA. These include the CTA agriculture working group (pelouro), the Land Forum and other mechanisms within MINAG, and the working relationship between the NA partner companies and CEPAGRI. However none of these mechanisms is designed specifically to input the private sector’s views into discussion and legislative development within the NA framework. For example the CTA agriculture pelouro has its own work plan and agenda which in some instances overlaps with NA matters, while the MINAG forums deal with specific issues such as land. Through CEPAGRI the NA partners have a support mechanism for their investments but this does not overlap with or lead to dialogue among others interested in the overall developments in agriculture envisaged by NA. Recent analysis of legislation developed or under development within the NA framework indicates that much of this would benefit from additional private sector input in order to comply with the policy objectives discussed above. Analysis of the difficulties faced by a number of the NA partner companies in realizing their planned investments further indicates the need for structured dialogue to resolve the issues arising, not only for the partner companies but also for the private sector as a whole. In addition, while much of the NA process is led by MINAG there are significant overlaps with other authorities such as the Tax Authority (AT) which suggest that the private sector’s voice needs to be heard in a wider context on matters related to the NA framework. Over the coming period the SPEED program is expected to ramp up its activities in relation to the achievement of the NA goals. This requires a detailed understanding of the issues faced by business where these overlap with the NA policy commitments. This note therefore proposes the creation of a Business Advisory Group on the New Alliance which would seek to address the issues outlined above. 2. PROPOSED TERMS OF REFERENCE FOR THE GROUP It is envisaged that the group will advise the SPEED Program, through CTA, as well as MINAG, CEPAGRI, and other government partners in NA as well as donor partners supporting NA. It is further envisaged that the Group would met in Maputo which may present some constraints to participation. However this could potentially be overcome by electronic communication with anyone outside Maputo who wanted to participate. The Group would be expected to: • Be available at least bi-‐monthly to discuss relevant policy issues pertaining to NA and affecting business; • Provide policy comments and recommendations based on its experience and in line with NA goals and objectives; • Provide comments and opinions by electronic or telephonic means, or through meetings, outside the regular bi-‐monthly meetings, as requested; • Represent the opinions of business in the agriculture, agro-‐processing and related sectors as relevant and in line with their own specialist knowledge and experience; • Represent the opinions of the Group and seek to ensure that the general views agreed by the Group are heard outside the Group, using any means at their disposal, such as their own representative organizations, contacts with government or donor organizations, or the media with a view to ensuring wider, informed debate about the issues in question; • Contribute to, and seek to motivate broad debate on policy related matters as related to agricultural, food security, nutrition and business environment development; • Act in their individual capacity, in their capacity as members of the Group and as representatives of their companies as ambassadors for the NA and for increased private sector investment in the agriculture sector, and as ambassadors for policy change where this is deemed by the Group required. 3. PROPOSED COMPOSITION OF THE GROUP The Group should be sufficiently large to be representative, but sufficiently small to enable it to work effectively. Group members should include a variety of sectors and experiences, including agriculture, agro-‐processing and other related industries. It should also draw on experience from existing investments and potential new investments under the NA compacts. Group members should have sufficient standing in the business community to ensure that their voices are heard and their inputs respected. Where possible, to ensure continuity in the workings of the Group, the commitment of a specific representative of an organization to participate should be guaranteed. It is proposed that the Group comprises a balance of: members of the CTA agriculture pelouro; representatives of other relevant sectoral organizations; representatives of some of the NA compact partners receiving assistance from CEPAGRI; any other interested party who fulfills the criteria outlined above. Potential members include: Name João Jeque Organization Comments APAMO (Executive Director) / Sugar industry – large scale CTA pelouro chair commercial agriculture, exports, and agro-‐processing, plus representing CTA Arnaldo Ribeiro / Carlos MozFoods / MozSeeds / CTA Large scale commercial Henriques pelouro agriculture, exports, seed production, CTA pelouro member Paulo Negrão / José Alcobias Associação de Fruticultores do Fruit and nut production and Sul de Moçambique (FRUTISUL) / processing and export, CTA CTA pelouro pelouro Sr. Mahmood Africom Agro-‐processing -‐ flour Cargill NA compact partner Other NA compact partners – CEPAGRI to indicate Sr. Ujjwal OLAM Large scale commodities trading, agricultural production, export, other ag sectors (forestry for example) Plexus Large scale commodities trading, agricultural production, export, other ag sectors Sybrand Niekerk CIM Maize milling, flour production, food and animal rations production Export Marketing Large scale commodities trading, export Alfredo Chambule Mozambique Leaf Tobacco Constraint – outside Maputo Fertilizer company Due to focus of NA on fertilizer it would be important to have someone from this sector included 4. RESOURCE REQUIREMENTS In order to be able to function effectively the Group would require a secretariat responsible for passing relevant communications on NA related issues to Group members from a variety of sources including government, donors, CTA, and SPEED. The secretariat would also need to compile answers received and assist in channeling these to the relevant people or organizations. In addition the Group would require a meeting space in which to conduct its bi-‐monthly meetings and any ad hoc meetings. 5. WORK PLAN Initially the Group would need to be constituted as an informal working group. At the first meeting it would be necessary to provide detailed input and information to the Group abut NA, its aims and objectives, as well as the status of the framework, and related legislation and actions. Based on this it is envisaged that the Group would begin to develop its own working agenda alongside that of CTA’s pelouro and SPEED. Business Advisory Working Group Mozambique Short Survey: 1 2 3 4 5 6 7 8 9 10 Issues affecting New Alliance Private Sector Partners in Mozambique Page 1 of 2 September, 2014 FINAL DRAFT A initiative under: With the support of: & Table of Contents Table of Contents ...................................................................................................... 2 1. Introduction ......................................................................................................... 3 2. Background and Context ................................................................................... 3 3. Survey Results .................................................................................................... 4 4. Annexes ............................................................................................................... 6 Annex I – Survey Questionnaire .............................................................................. 6 Annex II – 15 Policy Action by GoM and Status of Progress @ June 2014 .. Error! Bookmark not defined. Page 2 of 6 1. Introduction A survey aiming at identifying any patterns emerging from issues (challenges and constrains) affecting the private sector partners within the New Alliance Framework in Mozambique has been conducted between 25 August and 5 September 2014, i.e., during a period of 10 days. Under the New Alliance in Mozambique many companies have committed, trough the signature of compacts, to undertake investment projects that will assist the country to achieve the goals of promoting food security and improved nutrition. The road from compact signature to implementation is not all smooth and straight. In the process of seeking to undertake these investments some of the partner companies have experienced several types of difficulties. Despite the first attempt, done by CEPAGRI, to identify these constrains and challenges the recently established Business Advisory Working Group (BAWG) decided to take the initiative to repeat and expand on the initially performed exercise. This survey has been conducted by the Secretariat to the BAWG as to form the basis of the relevant analysis and dialogue that the group needs to engage in the months to come. A copy of the questionnaire used can be found in Annex 1 to this report. The survey was conducted only and using SurveyMonkey.com a well-accepted web based software and more details can be found at www.surveymonkey.com 2. Background and Context In January 2014 CEPAGRI developed a brief analysis trying to identify patterns arising from the issues affecting the private sector partners within the New Alliance Framework. A total of 17 status reports were analysed by CEPAGRI and the following list of issues was identified: (1) Land Selection and Approval (2) Procedures for company registration, land application, seed registration, licensing and export (3) Access to relevant information such as legislation and agricultural statistics (4) Access to information pertaining decentralization (what is to be done at provincial level as opposed to central level) (5) Identification of potential partners, access to finance and market research In the 17 companies status report these issues have been listed in different degrees of impact without going into further details. Under the New Alliance Framework a total of 15 Actions has been agreed by Government of Mozambique (GoM) to support the investments being made by these companies. The 2014 New Alliance Progress Report, June 2014, by Speed / USAID reports that out of the 15 agreed Policy Actions “4 of the policies have been completed while 10 are in progress and 1 records no progress.” The private sector partner continues to report the existence of several bottlenecks to get their operations fully established in Mozambique and there needs to identify the issues that continue to exist in detail. This short survey is another attempt to identify such details. Page 3 of 6 3. Survey Results Out of a total of 17 responses a subtotal of 11 institutions have responded to the survey in a complete and eligible manner. In these 11 companies responding there is need to contact the companies and double check some of the information provided. A total of approximately 40 companies have signed Letters of Intent with Government of Mozambique. So the level of responses obtained is considerably low and there is need to understand why the companies / investments are not responding to the BAWG calls for participation. Main Area Country of Origin Location within Mozambique Nova Terra Agriculture South Africa Zambezia (Gurue, Sabir) Optima Industrial Lda Food Processing Mozambique Manica (Gondola) Chicoa Fish Farm Aquaculture Mauritius Tete (Cahora Bassa) Nippon Biodieselfuel. CO. Ltd Research Japan Cabo Delgado (Pemba) Corvus Investments International Agriculture South Africa Maputo (Sabie, Boane) Poultry Mauritius Nampula Enica SA Agriculture Mozambique Maputo CB Farm Fresh Agriculture Mozambique Tete Mobily Money Mozambique Maputo Agriculture Mozambique Gaza (Guija) Protein Supplements Mozambique Manica (Gondola) Company Frango King Lda Vodafone M-Pesa SA The African Company Food Optima Industrial Lda Here are the key survey results: (i) English (86%) is the preferred working language for this group of companies; approximately 29% of the respondents are not yet based in Mozambique while remaining ones are based in the country for at least 3 years (there are some exceptions where the companies are based in Mozambique for more than 5 years); (ii) The number of employees (Mozambican staff) hired by the companies already located in Mozambique varies from 5 to more than 20. The average number of staff employed in the country is 5; (iii) Investment reported by the companies in Mozambique range from 150.000 USD to 58.000.000 USD; Page 4 of 6 (iv) The following are the key constrains listed by the companies: Area Issues Reported 1. Land Selection and Approval 2. Company establishment licencing 3. Access to information and relevant (i) Length of time to obtain DUAT (land license) (ii) Cumbersome procedures (iii) Negotiation with local population / communities (iv) Mistrust based on failed projects that were not delivered (v) Cost of Environment Impact Assessment (vi) Costs “to clear” land from population / communities (vii) Identification and coordination of Stakeholders (viii) Lack of cooperation from Provincial Government (i) (ii) (iii) (iv) Number of licences required Time required and delays in the different timings involved Processes are not properly streamlined Absence of one-stop shop in certain regions; inefficient onestop shop (v) The existences of quotas for foreigners (i) (ii) (iii) (iv) VAT information is difficult to obtain Lack of know how Lack of information; inconsistent information Different version of the same information depending on contact used (v) Time required to obtain information (i) 4. Export Procedures Different understanding of the applicable regulations by the agents involved (ii) Trade partners restrictions (iii) Less transparent practices by some (iv) 90 day period to import / repatriate sales revenue (v) Central bank regulation to match export currency with loan currency (i) 5. Identification of local (ii) partners and sources (iii) of finance (iv) (v) Finance is difficult to obtain Time of processes Banks unprofessional and slow DFIs target only / mostly apply to large projects Local partners lack business understanding (v) On the perception of progress from GoM in implementing the policy commitments agreed to under the New Alliance Framework, companies reported that there is either very weak progress or no progress at all in the key policy commitments by GoM. Page 5 of 6 4. Annexes Annex I – Survey Questionnaire Consult PDF file issued as a separate document. Annex II – New Alliance Annual Report 2014 Consult in http://speed-program.com/new-alliance/downloads/ Page 6 of 6 08/10/14 Será que CE e uma ferramenta adequada para aumentar o invesFmento e desenvolvimento de terrenos subuFlizados? Cessão de Exploração (CE): Análise da Proposta de Regulamento Sim ! Mas somente, se for elaborado no sentido de reduzir o numero de aprovacoes Governamentais e eliminar subjectividade destes procedimentos Maputo, 11 Setembro 2014 Apresentado por: Ian M. Rose, USAID/SPEED Consultant Contexto no actual quadro jurídico Análise Econômica do Regime Jurídico • A terra em Moçambique e propriedade do Estado; • Os cidadãos, os estrangeiros, as comunidades e as pessoas jurídicas podem adquirir o direito de uso e aproveitamento da terra (DUAT) para diferentes períodos (Prazos); • A transmissão de DUAT é: automáFco para “prédios úrbanos”, mas requer autorização prévia do governo para “prédios rúsFcos”; Modelo Economico Clássico: • A transferência irrestrita acabará por colocar a terra sob o controle do usuário melhor posicionada para desenvolver a terra para o uso, assim permiLndo mais produLvidade. • "A mão invisível do mercado" mais eficiente do que um regulamento super-‐imposta de cima (pelo estado). Modelo Orientada pelo Estado Mocambicano • A Confianca que o Governo da na alocacao da terra ao Cessionario, trata-‐se em parte da origem subjacente em recurso a Lei de Terras de Moçambique, tais como: transferência de acesso restrito, Plano de Exploração, etc • O Governo exigê um Plano de Exploração (poucas excepções) • Aproximadamente menos de 5% das parcelas estão registadas formalmente com Ftulos de DUAT; • O direito consuetudinário (normas costumeiras) é reconhecido pela Lei de Terras Terra como propriedade do Estado Não representa impedimento mas sim a Restricao de Transmissibilidade de Direitos Exemplo: O "Dono" da terra nos EUA é que deve pagar impostos sobre a propriedade so eh expropriado a terrao por razoes de uLlidade pública (Ex: divida de imposto, construcao de estradas, etc). 3 4 1 08/10/14 O que é “Cessão de Exploração? E uma transferencia temporária de DUAT (de “Cedente” ao “Cessionario”/invesJdor) “Apresentação do Problema” • O grau discricionario do Governo no processo de aprovação de transferência (de terra rural) representa um factor importante no impedimento do invesFmento; • O Ftular deve estar em conformidade com o “plano de exploracão”, a menos que haja uma jusFficação, contudo não estao estabelecidos ou descritos os seus criterios de validacao da jusFficacao; • Se a transferência não for aprovada, o Ftular pode perder o seu invesFmento, uma vez que a Lei não permite a transmissibilidade automaFca do direito da terra; • São as restrições na transmissibilidade do direito da terra, combinado com a exigência do plano de exploração, que impede invesFmento. • O regime de aprovaçao prévia apresenta riscos, não apenas por causa de oportunidades de criacao de rendas economicas (rent-‐ seeking), mas também, de certa forma, por causa da falta de capacidade e recursos humanos das ReparFcoes Governamentais. 5 Será que as restrições de transmissão de terra provocam situações de subdesenvolvimento Sem estudos e análise muito mais detalhados, só podemos dizer talvez.. Não devemos sobresLmar o obstáculo, porque: a) InvesLdores experientes e sofisLcados podem adquirir terra através de uma enLdade corporaLva e efeLvamente podem transferir os direitos de terceiros, por via da venda das acções da empresa; b) InvesLdores experientes podem criar Planos de Exploração com menos detalhes, ao em vez de mais detalhes, permiLndo flexibilidade, mais tarde; c) Fatores completamente independentes de transmissibilidade podem explicar os tracos subdesenvolvidos de terra, tais como: (i) A falta de infra-‐estrutura para transportar mercadorias para o mercado; (ii) Adequação de terras (qualidade e localização) para uso produLvo em relação à concorrência; (ii) falta de confiança no sistema judicial para resolver disputas; etc. 7 Obje8vo de um regulamento de Cessão de Exploração bem elaborado do ponto de vista econômico: 1. Baixar os custos de transferência de direitos de uso da terra (mesmo se for apenas temporário); 2. Criar um ambiente propício para invesLmentos; EfecLvamente isto cria um mercado de arrendamento de terras, que é cada vez mais visto como um instrumento que permite a melhor alocação atraves de um mercado livre ( sem distorções) como faria um mercado de propriedade da terra. A Proposta de Regulamento de Cessão de Exploração: Principais Categorias de Parcelas Tratadas nesta Proposta: 1. “Prédios rúsJcos” de detentores privados do Ttulo de DUAT em áreas rurais 2. Terras de comunides locais em áreas rurais 3. Terras de titulares de DUATs individuais através de ocupação de boa-‐fé ou segundo normas costumeiras (rural) [4. Lotes Urbanos] O Cedente (Ltular DUAT original e cedente dos direitos) O Cessionário (cessionário de direitos, invesLdor) 6 8 2 08/10/14 Detentores privados do Otulo de DUAT de prédios rús8cos Sera que número de aprovações (e correspondente subje8vidade) reduziu na regulação de Cessão de Exploração, em comparação com uma aplicação de DUAT original ou com pedidos de transferências? Requisitos processuais para Cessão De E. Autorização do Governador, Sim Ministro de Agr ou CM (de acordo com a dimensão das parcelas) Sim • Em Marco de 2014 foi lançado pela DNTF um draj dos documentos para comentários: Observação-‐ não de forma significaLva.. Título provisório ou definiLvo Só definiLvo DefiniLvo ou DefiniLvo ou provisório provisório Parcel Demarcada Sim Sim Re-‐Submissao do Plano de Exploração Sim Só se mudou Só se mudou Parecer Técnico muitos menos Minimal Novo Edital Sim Não Não • Em Julho de 2014, o draj, que o consultor da FAO apresentou após a consulta de GRFCT em 20 de junho de 2014: Observação-‐sim. 9 Requisitos processuais para Março Documento Recomendar Cessão de Exploraçao 2014 Revisto em Julho Sim Não Não C de E celebrados por escritura publica Sim Sim Sim Prazo máximo de 10 anos, a renováveis 3 vezes (30 anos) ou 1 ano Prazo renováveis 10 vezes (10 anos) mesma mesma alongar Não permiLdo nos 3 anos finais de prazo de DUAT Mesma mesma Eliminar a restrição Documento Recomendar Revisto em Julho SPGC (Serviços Províncias de Geografia e Cadastro) Sim 10 Impacto esperado pelos Cessionarios Privados dos DUATs (ao invez de comunidade) Privados detentores do Otulo de DUAT de prédios rús8cos Prévio registro com o Registo Predial Março 2014 11 • Pequeno – a não ser que os procedimentos tornam-‐se simplificados como na revisão pendente. • Maior -‐ nos casos em que o Ltular do direito não deseja transferir o DUAT (mesmo se pudesse), mas precisa de parceiro / invesLdor, sem dar a ele/ela o controle permanente. Parceiro / invesLdor tem a segurança de que seus interesses serão registrados em cadastro no SPGC e registo predial. NOTA: • Pequenos proprietários também podem se beneficiar sendo eles mais propensos a ter ptulos de propriedade em seu nome pessoal, e não através de pessoa jurídica. • No projecto de revisão, para os detentores de DUAT informais: só precisam de ter o DUAT formalizado, nao todos os outros requístos 12 3 08/10/14 Lotes Urbanos previsto para o Desenvolvimento Residencial Comunidades Locais • ConsenFmento (o FPIC -‐ livre, prévio e consenFmento informado) • Monitoria de Cumprimento (após a transacao) • Pedaço de terra desocupada dentro de uma jurisdição municipal seria um predio rusLco, e estão sujeitos as mesmas restrições de transmissibilidade. v RLT é explícito que CE "... Depende de consenLmento dos SEUS Membros" [art. 15 (4)]; • Projecto original de Cessão de Exploração teria incluído parcelas vagas desLnadas para o desenvolvimento residencial (tais como prédios de apartamentos), mas exclui-‐projecto de revisão (e nota que sao tratados separadamente) v Projecto de Março: incluir uma referência ao "consenLmento da respecLva Comunidade“; v Enquanto aguarda projecto: nenhuma referência ao consenLmento da comunidade; • Incluindo desenvolvimento habitacional seria úLl, pois reduz o risco para o colaborador, dando-‐lhe uma atribuição temporária registada de DUAT. • E também seria importante clarificar o tratamento para projectos turisLcos (para que sejam incluidos) 13 Considerações especiais: • Tanto “Prédios rúsLcos" e "Predios Urbanos" pode ocorrer em terra fora das jurisdições municipais, e ambas as categorias podem ocorrer em terras localizadas dentro das jurisdições municipais; 14 Comunidades Locais DUAT dos membros da comunidade, em princípio, são muito fortes: os direitos de co-‐ptulo. Procedimento aplicavel para pedidos de DUATs de terceiros (que pode afectar terra de comunidade local): RLT originalmente especificado 3-‐9 membros da comunidade, além de ocupantes / Ltulares de vizinhos, assinaria minutos de consulta • 2010 Decreto e 2011 Diploma Ministerial: assinatura de consulta pelo Conselho ConsulLvo, em duas fases Anéxo Técnico de RLT – Delimitaçao de Terra de Comunidade Local: Acta de consulta assinado por 3-‐9 membros da comunidade "escolhida em reuniões públicas“ Lei de Terras do arLgo 30: "os mecanismos de representação" das comunidades locais seriam estabelecidas em lei futuro 15 Recomendações – Terra de Comunidades Locais • As consultas comunitárias – esclarecer o processo; • Membros/Representantes de Comunidade (e não apenas membros de Conselhos ConsulLvos) deve assinar a documentação; • Padrões mínimos para a representação da Comunidade • Delimitação de toda area da comunidade é suficiente, mas a área afetada por C de E deve ser demarcada • Regime fortalecido de monitoramento 16 4 08/10/14 Recomendações para Cessão de Exploração: DUATs privados Recomendações para o Regime Jurídico Relacionado • Aprovação de Cessão de Exploração a nível SPGC • Não devia haver a necessidade de resubmissao do Plano de Exploração, se o mesmo não foi substancialmente alterado • PermiLdo nos casos em que cedente tem um DUAT provisório ou definiLvo • Alterar RLT 15 (4) para permiLr C d E para ser aprovado somente ao nível SPGC • Divulgar requisitos para o plano de exploração (pode exigir a alteração do Art LT. 19). Conte com instrumentos de zoneamento • Homologação concedida sem a aprovação explícita do governo em determinado período de tempo (projecto pendente incorpora este conceito para o Parecer técnico). 2012 Comunicado sobre para transferências de DUATs em parcelas < 10 ha chamadas para linha do tempo total de 75 dias, mas sem consequências para o não cumprimento prazo • Harmonizar procedimentos das consultas comunitarias • Orientações técnicas sobre as normas de demarcação (padrões diferentes para as áreas rurais e urbanas) • Coordenação de DNTF / SPGC cadastros com registo predial (criar "Cadastro Nacional de Terras" referenciados no LT art. 5. • Alongar prazo inicial (i.e. mais de 10 anos) • Não devia haver novo “edital” • Nenhuma reserva prévia exigida com registo predial (mas necessário depois) • PermiLdo durante os ulLmos 3 anos 17 18 Obrigado! Thank you! 5 Activity Business Advisory Working Group DRAFT Template N.º 01/BAWG RESULT WORK PLAN Support Who When How Document Objective | Performance Indicator

Baixar