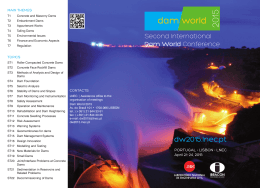

MINING MARKET CYCLES AND TAILINGS DAM INCIDENTS Michael Davies1 and Todd Martin2 Vice-President, AMEC Earth & Environmental 2 Principal, AMEC Earth & Environmental Vancouver, British Columbia 1 ABSTRACT Tailings dam incidents, namely physical failures and major operational upsets, have been described in literature for over 30 years. These accounts typically address the contributing physical attributes and/or design/operational deficiencies that led in whole, or in part, to the recorded incident. One aspect of tailings dam stewardship not typically noted let alone evaluated in terms of contribution to incidents of record are the prevailing economic conditions during a key period of dam design, construction and/or operation. An evaluation of the temporal trends in tailings dam incidents relative to the cyclical nature of the economic realities of the mining industry is examined. Although clearly no perfect correlation exists, there appears some validity to the hypothesis that the frequency of tailings dam incidents can be expected to increase some relatively short period after a cyclical “boom” in the mining industry. INTRODUCTION The Mining Industry is driven by cyclical global economic conditions. The demand for the commodities produced by the industry, though certainly having trends that for individual metal and non-metal commodities can differ from overall global industry trends, is an excellent barometer of global economic health. The end to the most recent high in the economic cycle hit the commodity prices for most mined materials severely. Though there have been exceptions such as gold, most commodities are, in mid 2009, trading at levels at or below the beginning of the most recent boom. This most recent boom cycle started gathering some modest signs of life in 2003 through 2005 but took off in early 2006 to what eventually became many unprecedented highs in commodity prices. Though this most recent 2006-2008 boom was exceptional in terms of its height and the rapid and severe nature of its contraction, it is far from the first such cycle the mining industry has seen. Using data from indicator commodities such as copper and gold, a comparison of tailings dam incidents with mining cycles over the past few cycles (up to about 30 years) is explored. Both the nature and frequency of tailings dam incidents is noted in the comparison. Incident records are from both published and less available sources. From the comparisons made, trends appear that should reinforce high prioritization within the Mining Industry for enhanced tailings dam stewardship in the near future. The paper includes some anecdotes from projects completed in this most recent boom to illustrate some of the reasons why the trends noted may exist. Further, the paper will provide some thoughts on how to prevent this trend reappearing during the inevitable next cycle in the Mining Industry. TAILINGS DAM INCIDENT RECORDS Though no single comprehensive public database of mine tailings dam incidents exists, there are numerous sources of information including: • • • • • • USCOLD (1994) UNEP (1996) U.S. EPA (1997) Vick (1997) Davies et al. (2000) WISE (wise-uranium.org). In addition, through incident review assignments and other similar sources the authors have been able to augment the published information with approximately 20 additional incidents beyond the published accounts. In total, from December 1968 through to August 2009, there were 143 tailings dam incidents that were available to evaluate in terms of their trends. These 143 events occurred over the nearly 42 years of record used in the database. Figure 1 presents a summary of the incidents from all available sources over the nearly 42 years. Figure 1 depicts the total number of “incidents” (defined as physical failure of some or all of a given tailings dam and/or a significant operational issue leading to disruption of the associated mining operation for a period of greater than one month) and plots these incidents on a per two year basis. The data used to develop Figure 1 are considered more thorough post approximately 1992 as since that time, it is more difficult to have incidents that go unreported. The two year basis was selected to provide a better sampling of the information and due to how it “worked” with trends presented later in this paper. In each case, the date provided is the end of the given two year period for which the data is provided. For the last data point, which is August 2009, the period of record is only 20 months versus 24 for all other periods noted. Number of incidents (per preceding 2-year period) 20 18 16 ? 16 14 12 12 12 12 10 8 9 9 7 6 0 1970 7 6 6 5 4 2 9 8 4 4 4 4 3 3 2 1975 1980 1985 1990 1995 2000 2005 2010 Year Figure 1 - Tailings Dam Failure Incidents – 1968 to 2009 From Figure 1, which makes no attempt to regionalize or discretize the data by failure mode for the purposes of this paper, “peaks and valleys” in the temporal distribution of failure events certainly appear to exist with several cycles of increased incident frequency apparent, raising the question as to the drivers behind these cycles. MINING MARKET CONDITIONS The global mining market constitutes a diverse number of commodities mined and marketed across all regions of the world. The historic global market conditions and trends for each of these commodities are individually complex and worthy of extensive evaluation in their own right (which they do, and will continue to receive). Perhaps the most predictable aspect of these conditions is their unpredictability. For example, while there are no shortage of supposedly prescient “experts” now assuring the industry they had the dramatic Q3-Q4 2008 fall in mined commodity prices “fully predicted and accounted for”, the reality is this most recent decline was seemingly just as surprising to an industry that has experienced these cycles many times before as all the other declines have been over the decades. To quote George Bernard Shaw, “We learn from history that we learn nothing from history.” While the 2005-2008 rally in most mined commodity prices may have been unprecedented in terms of the market capitalization values reached by mining companies, and the commodity prices realized, in many ways it was simply just another cycle in a cyclical industry that very much mirrors the global economic situation. To mirror the industry, copper is an excellent bellwether commodity. In many ways, it is the engine that powers the mining industry and its “health” dictates global mining (and overall economic) conditions like no other commodity. Figure 2 shows the price of copper, in period pricing, from January 1968 to present. In addition to copper, and to have another comparative commodity for evaluative purposes, gold was selected as an additional commodity of interest for this paper. Though in terms of commodity tonnage gold is far from the second most prevalent mined material, there are an abundance of gold mines and gold mine tailings dams that have contributed a significant portion of the tailings dam incident record; in fact providing more dam failures than any other single commodity. Figure 2 therefore also provides the historic gold price from January 1968 to present, and it is apparent that the cycles in both copper and gold prices are largely similar. As such, for the purposes of this paper, copper price is taken as a proxy for mining commodity cycles. An alternative means of plotting commodity price is in terms of the inflation-adjusted value. This in effect “normalizes” the commodity price over time, and, as illustrated in Figure 3 for copper, provides a means of amplifying the price cycles. The inflation-adjusted copper price plotted in Figure 3 is based on an average annual inflation rate (for the United States) of 4.1% from 1946 through 2008. 1000 Prices not adjusted for inflation. 3.6 800 3.2 700 2.8 600 2.4 500 2 400 1.6 300 1.2 200 0.8 100 0.4 0 1968 0 1972 1976 1980 1984 1988 1992 1996 2000 2004 2008 Year Figure 2 - Copper & Gold Price – 1968 to 2009 4.5 4 Copper price ($US/lb): unadjusted Copper price ($US/lb): inflation-adjusted Copper price from LME data. Inflation-adjusted price based on average annual inflation rate of 4.1% (1946 through 2008). Copper price ($US/lb) 3.5 3 2.5 2 1.5 1 0.5 0 1968 1972 1976 1980 1984 1988 1992 1996 2000 2004 Year Figure 3 - Copper Price (inflation-adjusted) - 1968 to 2009 2008 Copper Price ($US/lb) Gold Price ($US/oz) 900 4 Gold price ($US/oz) Copper price ($US/lb) TAILINGS DAM INCIDENTS MINING ECONOMIC CYCLES AND Whenever data involving two or more variables is compared, the questions of relevancy and causation must be raised, for correlation alone cannot in isolation infer a causal relationship. There is no question in the thesis of this paper there are lots of “darts” that can be thrown at any relationship derived between commodity prices for copper and gold and tailings dam incidents, given the many variables contributing to the latter. As an example of one such objection, commodity prices are a reflection on overall economic activity and when more mines are operating, the likelihood of incidents will be higher even if the rate of incident per operating mine remains the same. Another legitimate objection would the reliability of the incidents database, given the increased likelihood of such incidents being reported, and documented, in recent years than would have been the case decades ago. However, the concept that there may be a relationship of some manner between the booms in the mining cycle and the damage to the overall mining industry created by tailings dam incidents seemed worthy of examination. In evaluating the tailings dam incident database, a database that includes 143 incidents, a few trends were apparent: • • • over the nearly 42 years of record, the 143 incidents leads to an average rate of incidents of about 6 to 7 per any average two year period. there were very distinct variations to any average trend with a range of between 2 and 16 incidents per any two year period (starting January 1968 and every two years afterwards) there were sub-trends or two-year windows outside of ones starting in January that included one two-year period (September 1980 to August 1982, inclusive) with 17 incidents. From Figure 1, five periods of peak incident frequency (the starting date for a higher than average period of tailings dam incidents) can be identified. The fifth period includes the present which is not a complete record. It may be that the present time constitutes a lead up period versus a peak depending upon whether the trends of the previous four peaks sustain through to 2010-2011 as will be discussed later herein. Table 1 provides a summary of the two-year periods from 1968 to present where higher than average tailings dam incidents were recorded. Table 1 – Tailings Dam Incidents – Periods of Higher than Average Occurrence Start of Two Year Period of Increased Tailings Dam Incidents January 1976 January 1984 Peak of Copper Price Peak of Gold Price January 1974 September 1980 January 1974 September 1980 December 1987 March 1990 June 1989 February 1998 September 1995 January 1996 Q1-Q2 2009 (?) February 2008 February 2008 Table 2 provides a summary of the peaks of the gold and copper prices over the past 42 years. Ironically, there have essentially been five peaks in each of these, in comparison to the peak periods in tailings dam incidents noted in Table 1. Table 2 – Periods of Peak Copper and Gold Prices Compared to Periods of Peak Tailings Dam Incidents Start of Two-Year Period January 1976 January 1984 March 1990 February 1998 Early to Mid 2009 (?) Number of Tailings Dam Incidents 8 12 16 12 >12 Using the first four peak periods, the time lag between the peak of the copper price and the start of the next two-year period of increased frequency of tailings dam incidents was: • • • • 24 months 39 months 9 months 28 months The average lag from peak of copper price to period of increased frequency of tailings dam incidents from these four event windows is 25 months. For the gold price peak data, the corresponding time lags from peak price to increased incidence frequency for the first four incidents peaks were: 24 months 39 months 27 months 25 months The average lag in the gold peak price to start of increased incidence period was 29 months. For the most recent boom there is insufficient information to know if a peak in incidents has occurred or there is a ramping up of activity towards one. From the available information, there appears to be a lag of between 2 and 2.5 years from the end of a mining boom to the start of a two-year period Looking at the data in some more depth, the two-year incident window could not be improved upon much though the number may be a range of between 18 and 36 months post peak price versus a set period as implied by the simplistic average used above. It is undoubtedly the case that the lag is driven by many factors, including for example the duration of the upswing in terms of commodity prices, as a longer such period would likely result in more projects being developed. Tailings dam incidents/preceding 2-year period 18 4.40 Tailings dam incidents Inflation-adjusted copper price 16 4.00 14 3.60 12 3.20 10 2.80 8 2.40 6 2.00 4 1.60 2 1.20 0 1965 1970 1975 1980 1985 1990 1995 2000 2005 Year Figure 4 – Adjusted copper price and tailings dam incidents 2010 0.80 2015 Inflation-adjusted copper price ($US/lb) • • • • of increased frequency of tailings dam incidents. This is illustrated in Figure 4, which plots both the tailings dam incidents (per two year period), and the inflation-adjusted copper price. While the time lag between the peak in the adjusted copper price and the peak of the tailings dam incidents varies for each cycle, it is very clear that each commodity price cycle peak, as represented by the copper price, can be correlated to a subsequent peak in the number of tailings dam incidents. ANECDOTES BOOM FROM THE RECENT There is a common discussion question amongst long-term designers of tailings dams during mining booms – who is doing all that extra work? The reputable design houses and their senior resources are typically fully-occupied during average economic conditions and can quickly become stretched during peak periods. When a prolonged peak of an unprecedented nature occurs as did recently between 2005 and 2008, it is difficult indeed to imagine where all that additional capacity came into the industry in terms of design, operating and regulatory experience. The complexity of a tailings dam, in comparison to many engineered structures including conventional water retention dams, cannot be overstated. These structures are never at steady-state conditions during operations and are often constructed over decades where the initial portion of the dam may include design criteria and construction practices long out of date. However, what really does occur during boom times that could represent the causal link between the trends noted in this paper? One window into a portion of the reasoning is offered through a few select anecdotes from the recent boom. 1. Following the OMS Manual? At one mine, the Operating, Maintenance and Surveillance (OMS) Manual for the tailings area included a stipulation that the tailings dam and impoundment be visually inspected daily or whenever “was convenient” (the latter portion was handwritten, word for word, in the OMS manual). Apparently the daily requirement for this dam and impoundment, which was more than five km from the main operations, was onerous so a somewhat lesser frequency was adopted. When the long overdue viewing did take place it was discovered that the tailings line had cracked at a valve on the crest of the dam, eroding a significant portion of the earthfill and allowing tailings to find their way into a stream bed for about two km downstream. During the incident review, it was determined that the “job” of the daily (or “convenient”) was formerly done by someone who had left the mine for another opportunity and they were awaiting some new hire to fill the position but were having problems getting someone. That problem had gone on for 14 months – clearly the period between inspections as well – so instead of daily, “convenient” turned out to be about every 400 days. The owners of the mine were “impressed” with how much damage a cracked line could do when left alone for about 400 days. 2. Interesting Design At one mine, space was at a premium. There simply was very little room for all of the infrastructure and the desired tailings impoundment directly adjacent to the mill. However, an enterprising designer came up with a solution by simply (seemingly) ignoring upstream failure modes. The rock shell was impressive and steep getting to more than 40 m in height at about 1.5H:1V. The dam was being constructed in an upstream manner with tailings and supernatant “supporting” the rock shell (this was the part the designer did not seem to include in their assessment). When the tailings in the impoundment simply could not take the loading of the rock shell any longer, and it is incredible failure did not occur prior to the rockfill reaching 40 m in height above the tailings, it failed into the tailings beach effectively shutting the mine down for a prolonged period of repair. A post-incident review confirmed no consideration of the upstream support requirement of the beach to the rock shell had ever been considered by the designers who, by their own admission, had “only started” designing tailings dams. 3. Drainage, Drainage, Drainage! A review of a proposed tailings dam included a very insightful view to an interesting approach to dam design. Beached hydraulic tailings tend to create quite a high level of anisotropy in terms of their hydraulic conductivities (the horizontal value tends to be many times the vertical value – typically in the order of two orders of magnitude greater). As such, basal drains can have some impact for the first number of metres of a tailings impoundment but at some point, the influence of basal drains on the beached tailings becomes quite negligible. This was apparently lost on the design for this particular facility that was to be up to 150 m in height behind a fully drained and competent rock shell. There were no fewer than 300 separate drains in the basin design, totalling more than 20 km in length, consisting of very expensive and totally unnecessary pipe that some supplier was very anxious to provide to the mine. Not all design errors lead to failures – some are simply huge added expenses based upon nothing more than a lack of experience. 4. We Have a Permit! The current regulatory climate around the world can only be termed “challenging” by those who work in the mining industry. There are a series of permits required with nearly every one offering a unique opportunity to create a design problem by getting caught up with the myopic drive to obtain the permit – fast, and at any cost. Getting a new tailings facility permitted can be one of the greatest of those challenges. However, meeting that challenge via a design for a facility that is either economically, technically, and/or operationally infeasible, but that expedites the granting of a permit, is not the answer. On one particular project, the use of paste tailings technology was nominated as the panacea for the project. Some small bench scale laboratory testing showed that if the paste was thick enough (low water content) and had sufficient cement and other agents added, a 30 mm high pile could be repeatedly created at about a 10% slope. From this, it was extrapolated that such a result could be recreated at full field scale! Moreover, no bleed water emanated from the uniform hardening slope so no dam of any sort (starter or otherwise) would ever be required. Designs and extensive documentation with stunning three-dimensional pictures were developed showing uniform 10% slopes up to 50 metres in height without any need for anything more than the 5% by weight cement addition plus many other useful additives. No other works, particularly earthworks, would be required. The regulators were enthusiastic over the concept and a permit was obtained “much quicker than we thought” for the no dam, no seepage and no worries uniform sloped tailings pile. Mission accomplished! However, in the course of a subsequent review, once having convinced the owner that there may be a flaw, a somewhat larger scale trial was commissioned whereby it was shown that the laboratory slope could not be maintained over a few metres, let alone 500 metre long beaches. It was also eye-opening for the owner to see the calculation of how much money per tonne these tailings needed in terms of the paste additives (including the cement). However, the worst news (at that time it seemed) was the need for earthworks, which would mean a totally different impact situation and essentially restart the permitting process. While no other facility had ever been designed or constructed in any form similar to the conceptualized facility, none of the owner, the regulator, or the designer let that lack of precedent impede the single-minded task of getting this project its permit by writing promissory notes that physical reality, and project economics, could not honour. REASONS FOR THE TRENDS? Taking the trends in peak incident events relative to periods of commodity price peaks as valid indicators of a causal relationship, and then using the above and many, many similar anecdotes from the recent and previous booms, perhaps some “whys?” begin to emerge. The authors suggest the following are only a handful from a wide assortment of “whys?” but ones that would seemingly be avoidable with some better judgment from the key parties involved. In other words, it should not be inevitable that more tailings dam failure incidents are recorded just because there is commensurately more activity brought about by more robust commodity prices. Some potential reasons for the trends that have been readily observable from the past few boom cycles include: • • • • • • • Permit haste: o use of fashionable but projectinappropriate tailings technologies o unprecedented design/operation to satisfy non-realistic regulatory or third party stakeholders preference o defaulting to flooding for potential ARD despite dam safety risks o acceptance of sites that are pleasing to regulators but not to geotechnical reality o over-taxed regulatory capacity. Fast tracking of investigation, design and construction to take advantage of the price cycle Inadequate appreciation of capital and operating costs associated with designs based more on rapid permit procurement than technical and economic realities Rapid cost escalation during project construction due to boom times, necessitating cost cutting Inexperienced (but overconfident) designers Experienced (but overly-subscribed) designers Lack of independent, third party review • • • • • Rapid turnover of key mine management and operating personnel as new opportunities abound during the boom times Disconnect between design expectations and operational realities Development of long-known deposits that have been left undeveloped for good reasons Pressures to cut costs for once mines constructed on the basis of rising commodity prices are forced to operate with the reality of lower commodity prices “Cookie cutter” designs having attributes well and good in, for example, South Africa, but being used for a project in a high rainfall, high seismic environment. The list above is far from exhaustive. However, there is not a single item in that list that would qualify as a justification for the postulated relationship between commodity price booms and tailings dam incidents, and as such merely points to a lack of discipline in sticking with well-established design and stewardship practices. A lack of discipline brought about by the need to make hay while that economic sun shines, even when it leads to another case history in the growing catalogue of tailings dam incidents, is understandable but is not acceptable. SUMMARY THOUGHTS The evaluation of tailings dam incidents versus the price of commonly mined commodities is admittedly not a scientific endeavour, per se, and certainly was not given extensive rigor in terms of statistical evaluation, assessment of other underlying causes in the data trends, etc. However, there appears to be some correlation between a mining boom cycle and an increased number of tailings dam incidents approximately 24 to 36 months after the end of the boom, in the manner of a hangover after a good party. Another way to look at it, as most booms are several years in length, the increased number of incidents appears to occur within four or five years of there being more market capital and, commensurately, more project construction following ore definition, engineering, permitting and construction. The lag appears somewhat more quickly than a typical timeframe to get a mine from concept to operation but there are perhaps many projects just waiting the improved financial condition to finally be constructed, or restarted etc. The correlation may also imply that facilities that are constructed or restarted during a boom are seemingly more susceptible to having failure incident early on in their initial or restarted operating period. Is there really a correlation between tailings dam incidents and mining cycle booms? If the trends suggested by the data over the booms of the period since 1968 provide some guide to the future, the implications to the mining industry in 2009, on the heels of an extraordinary boom, are clear and perhaps daunting. The recent boom that ended so abruptly in 2008 was unprecedented in terms of copper price. The apparent building up of tailings dam incidents of the past year or so may only be background level activity to a peak in incidents coming in the next 12 to 30 months. Such a pessimistic viewpoint is perhaps an unlikely version of the future that unfolds. There are very sound guidance documents, corporate standards and increased awareness in design houses to avoid the failures of past periods. Major mining companies in particular have for over a decade now been implanting increasingly stringent controls, and applying consistently improved stewardship practices (e.g. the Mining Association of Canada guidelines) pertaining to tailings management facilities. At the same time, some of the anecdotes offered in this paper lead one to a perhaps tempered optimism and a more of a “wait and see” approach. What is clear, the exercise of evaluating the incident database in a few years time will be very illustrative in light of the trends suggested by the data presented in this paper. Perhaps the trends of the past 40ish years will not be repeated; for the mining industry this is most certainly the desired outcome. REFERENCES/BIBLIOGRAPHY AGRICOLA, G., 1556. De Re Metallica. 1st Edition. DAVIES, M.P., 2001. Impounded mine tailings: What are the failures telling us? Distinguished Lecturer Series. CIM Bulletin. July, p. 53-59. DAVIES, M.P. and MARTIN, T.E., 2000. Upstream Constructed Tailings Dams — A Review of the Basics. Proceedings, Tailings and Mine Waste’00. A.A. Balkema Publishers, Rotterdam, p.3-15. DAVIES, M.P., DAWSON, B.B. and CHIN, B.G., 1998. Static liquefaction slump of mine tailings — st Canadian A case history. Proceeding, 51 Geotechnical Conference. DAVIES, M.P., MARTIN, T.E., and LIGHTHALL, P.C., 2000. Tailing Dam Stability: Essential Ingredients for Success. Chapter 40. Slope stability in surface mining. Edited by Hustrulic McCarter and Van Zyl. Society for Mining, Metallurgy and Exploration Inc., p. 365-377. DUNNE, B., 1997. Managing Design and Construction of Tailings Dams. Proceedings of the International Workshop on Managing the Risks of Tailing Disposal. ICME-UNEP, p. 77-88. INTERNATIONAL COUNCIL ON METALS AND THE ENVIRONMENT (ICME) and UNITED NATIONS ENVIRONMENT PROGRAMME (UNEP), 1997. Proceedings of the International Workshop on Managing the Risks of Tailings Disposal. INTERNATIONAL COUNCIL ON METALS AND THE ENVIRONMENT (ICME) and UNITED NATIONS ENVIRONMENT PROGRAMME (UNEP), 1998. Case studies in Tailings Management. MARTIN, T.E. and DAVIES, M.P., 2000. Trends in the stewardship of tailings dams. Proceedings, Tailings and Mine Waste ’00. A.A. Balkema Publishers, Rotterdam, p. 393- 407. MORGENSTERN, N.R., 1998. Geotechnics and Mine Waste Management — An Update. Proceedings, ICME/UNEP Workshop on Risk Assessment and Contingency Planning in the Management of Mine Tailings, p. 172-175. SIWIK, R., 1997. Tailings Management: Roles and Responsibilities. Proceedings of the International Workshop on Managing the Risks of Tailings Disposal, ICME-UNEP, Stockholm, p.143-158. UNITED NATIONS ENVIRONMENT PROGRAMME, 1996. Environmental and Safety Incidents Concerning Tailings Dams at Mines: Results of a Survey for the Years 1980-1996. Industry and Environment, 129 p. U.S. ENVIRONMENTAL PROTECTION AGENCY, 1997. Damage Cases and Environmental Releases from Mines and Mineral Processing Sites. Office of Solid Waste, 231 p. USCOLD, 1994. Tailings Dam Incidents. A report prepared by the USCOLD Committee on Tailings Dams. VICK, S.G., 1997. Tailings dam failures: Effects and consequences. Presented at the Canadian Institute of Mining and Metallurgy Annual General Meeting.

Download