01

PROFILE OF THE CRÉDITO AGRÍCOLA

FINANCIAL GROUP

1. CAIXA CENTRAL GOVERNING BODIES

THE BOARD OF THE ANNUAL GENERAL MEETING

Nuno Carlos Ferreira Carrilho

Caixa de Crédito Agrícola Mútuo de Terras de Viriato

Chairman

Carlos Alberto Pereira Martins

Caixa de Crédito Agrícola Mútuo de Cantanhede e Mira

Deputy Chairman

João Batista Moreira Peres

Caixa de Crédito Agrícola Mútuo de Bairrada e Aguieira

Secretary

SENIOR AND SUPERVISORY BOARD

Carlos Alberto Courelas

Caixa de Crédito Agrícola Mútuo de Pombal

Chairman

Francisco Amâncio Oliveira Macedo

Caixa de Crédito Agrícola Mútuo dos Açores

António João Mota Cachulo da Trindade

Caixa de Crédito Agrícola Mútuo de Baixo Mondego

José Artur Palma Estrela

Caixa de Crédito Agrícola Mútuo de Guadiana Interior

Jorge Manuel da Piedade Volante

Caixa de Crédito Agrícola Mútuo de Porto de Mós

João Fernandes Chendo

Caixa de Crédito Agrícola Mútuo de Região do Fundão e Sabugal

António Manuel Nobre Louçã

Caixa de Crédito Agrícola Mútuo de S. Teotónio

João Lázaro da Cruz Barrote

Caixa de Crédito Agrícola Mútuo de Sotavento Algarvio

Henrique Vasconcelos Teixeira

Caixa de Crédito Agrícola Mútuo de Vale do Sousa e Baixo Tâmega

CRÉDITO AGRÍCOLA | ANNUAL REPORT 2011 | CONSOLIDATED

PROFILE OF THE CRÉDITO AGRÍCOLA FINANCIAL GROUP

7

THE EXECUTIVE BOARD

João António Morais da Costa Pinto

Chairman

Licínio Manuel Prata Pina

Member

Renato Manuel Ferreira Feitor

Member

José Fernando Maia Alexandre

Member

Maria Júlia de Almeida Rocha

Member (From January to September 2011)

CHARTERED ACCOUNTANT

Ernst&Young Audit & Associados – S.R.O.C., S.A.

Represented by Ana Rosa Ribeiro Salcedas Montes Pinto

CRÉDITO AGRÍCOLA | ANNUAL REPORT 2011 | CONSOLIDATED

PROFILE OF THE CRÉDITO AGRÍCOLA FINANCIAL GROUP

8

ADVISORY BOARD

José Luís Sereno Gomes Quaresma

Caixa de Crédito Agrícola Mútuo de Baixo Vouga

Chairman

João Manuel Correia da Saúde

Caixa de Crédito Agrícola Mútuo de Albufeira

Hélio José de Lemos Rosa

Caixa de Crédito Agrícola Mútuo de Alenquer

Afonso de Sousa Marto

Caixa de Crédito Agrícola Mútuo de Batalha

Francisco José Salgueiro Correia

Caixa de Crédito Agrícola Mútuo de Beja e Mértola

Alcino Pinto dos Santos Sanfins

Caixa de Crédito Agrícola Mútuo de Douro, Corgo e Tâmega

António Augusto Nascimento Mateus

Caixa de Crédito Agrícola Mútuo de Lourinhã

Arnaldo Filipe Rodrigues Santos

Caixa de Crédito Agrícola Mútuo de Ribatejo Norte

Ângelo de Jesus Antunes

Caixa de Crédito Agrícola Mútuo de Zona do Pinhal

Adriano Augusto Diegues

Co-opted, under the provisions of no. 2 of article 35 of the Caixa Central statutes

CRÉDITO AGRÍCOLA | ANNUAL REPORT 2011 | CONSOLIDATED

PROFILE OF THE CRÉDITO AGRÍCOLA FINANCIAL GROUP

9

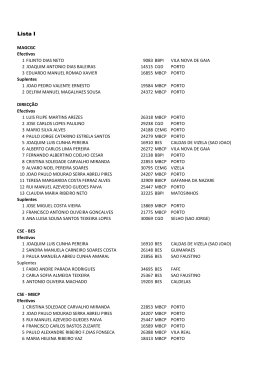

2. ORGANISATION CHART

SICAM

CAIXAS

ASSOCIADAS

1.04%

FENACAM

100.00%

CAIXA CENTRAL

0.10%

32.64%

CA VIDA

57.28%

10.00%

0.68%

CA SEGUROS

96.72%

100.00%

100.00%

CA IMÓVEIS

100.00%

CRÉDITO AGRÍCOLA

S.G.P.S.

100.00%

CA CONSULT

CA GEST

CA INFORMÁTICA

79.20%

20.25%

1.70%

0.57%

CA SERVIÇOS

85.25%

12.47%

100.00%

CCCAM SGPS

UNIPESSOAL LDA.

100.00%

CA FINANCE

RURAL RENT

100.00%

6.71%

66.67%

AGROCAPITAL SCR

28.57%

26.05%

FCR CENTRAL FRIE

27.78%

FCR INOVCAPITAL

GLOBAL 2

3.33%

Full Consolidation

Consolidation by

Asset Equivalence

FCR

AGROCAPITAL 1

68.46%

15.56%

FII CA IMOBILIÁRIO

0.28%

87.58%

3.83%

FII CA PATRIMÓNIO

CRESCENTE

FII CA

ARRENDAMENTO

HABITACIONAL

13.35%

12.42%

1

FENACAM has 98.84% of its own funds > total GCA = 99.98%

As at 31.12.2011

CRÉDITO AGRÍCOLA | ANNUAL REPORT 2011 | CONSOLIDATED

PROFILE OF THE CRÉDITO AGRÍCOLA FINANCIAL GROUP

10

3. SICAM – MAIN INDICATORS

.

SICAM

INDICATORS

2002

Dec.

2003

Dec.

2004

Dec.

2005

Dec.

2006

Dec.

2007

Dec.

2008

Dec.

2009

Dec.

2010

Dec.

2011

Dec.

Customer funds

6,863

7,181

7,599

8,174

8,671

9,158

9,613

10,070

9,989

9,884

Credit to customers

6,387

6,690

6,942

7,290

7,464

7,467

8,373

8,859

8,606

8,587

Net assets

7,946

8,251

8,696

9,319

10,044

10,566

11,447

12,097

13,213

13,030

Operating income

520

570

657

738

828

874

979

1,000

1,026

1,058

Financial margin

307

306

316

326

352

387

403

315

306

343

Net worth

370

376

396

404

424

486

513

424

445

472

Net result

33

81

90

87

96

113

121

42

36

53

Core Tier 1 – Group

a)

8.1%

9.1%

10.4%

10.5%

11.6%

11.6%

12.2%

12.1%

12.7%

12.5%

Tier 1 – Group

a)

8.1%

9.1%

10.4%

10.5%

11.6%

11.5%

12.0%

11.8%

12.5%

12.3%

Solvency Ratio Group

a)

10.5%

11.3%

12.9%

14.0%

14.4%

14.4%

13.3%

12.7%

13.4%

12.7%

General

93.1%

93.2%

91.4%

89.2%

86.1%

81.5%

87.1%

88.0%

86.2%

86.9%

Without Commercial Paper

86.4%

88.5%

86.7%

85.5%

81.5%

79.3%

82.0%

84.0%

86.2%

86.9%

52.5%

52.1%

52.5%

55.2%

58.4%

54.1%

55.5%

69.4%

67.1%

64.6%

ROE

6.4%

14.1%

13.7%

11.8%

11.5%

13.0%

12.4%

4.2%

3.5%

5.0%

ROA

0.4%

1.0%

1.0%

0.9%

1.0%

1.1%

1.1%

0.3%

0.3%

0.4%

15.3

14.5

13.2

12.6

12.1

12.1

11.7

12.1

12.9

12.3

5.3%

5.5%

5.7%

5.9%

4.0%

3.4%

3.8%

4.1%

4.9%

5.8%

73.6%

94.7%

98.4%

126

120

118

111

105

100

92

88

85

84

632

647

670

680

689

686

Transformation Ratio:

Efficiency Ratio (SICAM)

Degree of Leverage

OC Ratio

Cover Ratio

Number of CCAM

105.4% 113.6% 108.9%

Number of branches

(Total in SICAM)

b)

584

598

616

628

Average net

assets per Caixa

c)

61,543

67,026

71,754

81,993

Average number of

branches per Caixa

d)

4.6

5.0

5.2

5.6

136.0% 127.4%

127.8% 119.8%

91,648 102,500 116,924 127,626 132,375 133,162

6.0

6.4

7.2

7.6

8.0

8.0

!"#$%&'!(')!**!+(&'+,'%#$+&

a) Figures for ratios for 2002 to 2006 calculated in line with the former accounting system in Portugal, for the transitional period (2007)

and in preparatory figures for 2008. From March 2008, using the Basel II criteria.

b) Includes Caixa Central branches.

c) In thousands of euros

d) Only CCAM branches

CRÉDITO AGRÍCOLA | ANNUAL REPORT 2011 | CONSOLIDATED

PROFILE OF THE CRÉDITO AGRÍCOLA FINANCIAL GROUP

11

Baixar