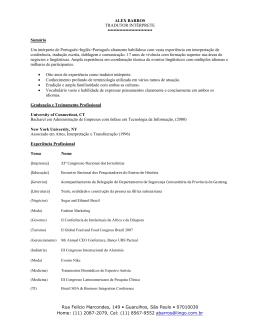

GRI SHOPPING 2015 Quando e onde será? When and where? 16 e 17 de junho – Hotel Pullman Ibirapuera, São Paulo. 16 and 17 June – Pullman Ibirapuera Hotel, Sao Paulo. Quem participa? Who participates? Tomadores de decisão: desenvolvedores/ proprietários, investidores, grandes varejistas (internacionais e nacionais) e os mais respeitados especialistas do setor. Decision makers: developers, owners, investors, major retailers (national and international) and industry experts. Como funciona? How does it work? São 4 sessões simultâneas, com 30-40 executivos em cada sala. Cada participante decide em qual delas quer fazer parte. Um evento de dois dias, com toda a Indústria de Shopping no mesmo local: GRI meetings are different from traditional conferences. There are no presentations, no speakers, and no panels. Instead you have a selection of closed-door discussions where everyone can participate and interact. We have on average 4 rooms with 30-40 executives taking place simultaneously. Each attendee can walk in and out at their own convenience and attend as many sessions as they want. A two days event , with the entire Shopping Mall Industry under the same roof. • 20+ salas de discussão; • 20+ discussions; • Abertura com Keynote speaker no primeiro dia; • Conference Opening with Keynote speaker on the first day; • Talk Show no segundo dia; • Talk Show on the second day; • Mais de 10 horas de momentos de networking. • Over 10 hours of networking time. O encontro do GRI foge do formato tradicional. Não existem apresentações ou palestras expositivas, e sim dezenas de salas de discussões informais, em que todos participam e interagem. GRI Shopping 2015 Será um prazer recebê-los no encontro dos principais players da indústria de Shoppings It will be a pleasure to welcome you in the most senior Malls industry meeting É com grande satisfação que realizamos o encontro mais solicitado pelos membros do GRI Club Brazil, e com grande audiência confirmada já nos primeiros dias de lançamento. Due to a high demand, Brazil GRI Club is pleased to be launching its first ever meeting dedicated to Shopping Malls which will take place this June in Sao Paulo. Nos dias 16 e 17 de junho, o GRI receberá seus membros e convidados para debater desafios e soluções para o setor de Shopping. O programa foi criado pelos nossos membros, seja por meio do compartilhamento de experiências, conhecimentos, opiniões, ideias e indicação de participantes. On 16 and 17 June, GRI’s members and guests will discuss challenges, solutions and opportunities relating to Shopping. The program was created by GRI’s Members and guests through sharing of experiences, knowledge, opinions & ideas. O GRI Shopping reunirá toda a cadeia em uma série de discussões e momentos de networking. Terá um diferencial dos demais encontros: a participação dos varejistas. Entendemos a sinergia do varejo com Shopping, e por essa razão abrimos o encontro a esse setor, ainda pouco explorado pelo nosso Clube. The GRI Shopping will bring together the entire shopping chain in a series of discussions and networking opportunities. It will be different from any other meetings the Brazil GRI Club has run to date: the participation of retailers. We understand the synergy with retail and Shopping, and due to high demand, we creating a meeting dedicated to this sector. Se você acredita que negócios são feitos de relacionamentos, nos vemos em São Paulo nos dias 16 e 17 de Junho. If you believe that business are made through relationships, I look forward to welcoming you in Sao Paulo next 16 and 17 June. Forte abraço. Best Regards, Giane Faccin Director – Americas GRI Club Brazil Henri Alster Chairman GRI GRI Shopping 2015 The GRI Experience GRI began its activities in Brazil in 2010, with annual meetings involving all Real Estate Market. Check some participants experience through those years, regarding GRI Conferences in the Shopping sector. “The selectivity is quite important. When you participate at most other Congress, there is lack of time for the debate - which to me is the most enriching part of an event”. “At GRI, we meet all the partners and we continue discussing business throughout the year”. Marcio Ventura da Silva Manager PREVI “The main difference that I like best about the GRI format is the fact that it bring together all parties involved in business -namely, money, capital, funding, real estate developers, partnerships. The meetings are set in a informal and relaxed environment where it is possible to discuss and understand where the market is going in a short amount of time. The GRI provides more business than other events, in which a speaker talks and people watch. The main quality is that”. Nuno Coelho Partner VCG Empreendimentos “It is an exponential opportunity for a selected audience that understand and participates actively in the market and know its dynamics. Because of this select audience, and also the possibility of interaction, we leave GRI meetings normally with a partnership and develop some business”. Carla Safady Meireles Executive Manager VALIA “I see with very good eyes GRI’s initiative. It is very valid to gather the leaders, decision makers in the industry to talk often and propose innovations and debate”. Claudio Tavares de Alencar Professor e Pesquisador USP “The Market elected GRI as the event that is worth doing. We learn a lot, exchange informations, ideas. GRI is above my expectations, certainlly”. Daniel Citron CEO Related Brasil GRI Shopping 2015 5 razões para participar do GRI Shopping 2015 5 reasons to attend GRI Shopping 2015 1ª Público | Key People O GRI reúne decisores, como Diretores Executivos, CEOs, Presidentes e Chairmen de empresas. Logo, você estará ao lado dos principais players que atuam na indústria de Shopping Centers no Brasil. The GRI brings together decision-makers, such as Executive Directors, CEOs, Presidents and Chairmen of companies. Plenty of opportunities to network with main players of the Shopping Center industry in Brazil. 2ª Formato | Format Devido a senioridade dos participantes, o GRI Shopping não possui palestras ou apresentações expositivas. O que teremos são executivos-chave debatendo temas relevantes ao setor, de forma informal e espontânea. Due to seniority of the participants, GRI has no lectures or expository presentations. What we have are the key executives debating topics relevant to the sector, informally and spontaneously. 3ª Conteúdo | Content Ambiente interativo de troca de experiências. Gera resultados concretos em termos de conhecimento, facilitando tomada de decisões. Interactive environment for Exchange of experiences. Generates concrete results in terms of knowledge, helping decision-making. ADRIANA DE ALCANTARA Senior Director, Strategic Joint Ventures TIAA-CREF ALESSANDRO VERONEZI CEO GENERAL SHOPPING ANDRE FREITAS Managing Director CREDIT SUISSE HEDGING-GRIFFO CARLA SAFADY MEIRELLES Executive Manager, Real Estate Investment VALIA - PENSION FUND CARLOS FELIPE FULCHER CEO 5R CARMINE ROTONDARO Worldwide Real Estate Director KERING 4ª Networking Utilize o encontro como plataforma de negócios. Conecte-se com os principais investidores, desenvolvedores e varejistas nacionais e internacionais. Use the meeting as a business platform. Connect with the main investors, developers and retailers nationally and internationally. 5ª Geração de Valor | Create Value Antecipe tendências do setor, conheça soluções e casos de sucesso de seus colegas. Prepare-se com a inteligência de mercado e troca de experiência entre executivos líderes. Anticipate industry trends, meet solutions and hear success stories of your colleagues. Prepare yourself with market intelligence and exchange of experiences between leading executives. Gráfico de Audiência do GRI Shopping CEO38% Executive Director 24% Business Director 17% Head of Real Estate 5% Superintendent5% Commercial Director 4% Others (VP, Investiments, Financial) 7% 4% 7% 5% 5% 38% 17% 24% CHRISTIAN VASCONCELLOS DA CUNHA CEO Shoppings JHSF CLAUDIO DALL’ACQUA JR New Business Director IGUATEMI SHOPPING CENTERS DORIVAL REGINI CEO LANDIS FOREST CITY EDUARDO GRIBEL President TENCO SHOPPING CENTERS EDUARDO PRADO Superintendent, Investors Relationship ALIANSCE SHOPPING CENTERS FABIO ALOI Business Development Director INBRANDS GRI Shopping 2015 GRI SHOPPING 2015 – Um conteúdo feito pelo mercado e para o mercado GRI SHOPPING 2015 – A content made by the market and to the market Investidores • Fundos de pensão, fundos soberanos: qual o interesse no setor? • Vale a pena investir nesse momento? • Qual modelo de Shopping faz mais sentido? Desenvolvedores • Quais regiões são mais resilientes? • Como melhorar o relacionamento com o varejista em termos de gestão, e custos de ocupação? • Qual o Mix mais adequado? Varejistas • Que experiências podem compartilhar entre si para aprender com os demais? • Qual o perfil do mercado consumidor brasileiro? Como atrair os consumidores físicos e digitais? • Como a interação entre o desenvolvedor e o varejista pode somar para benefício mútuo? Investors • Pension funds, sovereign wealth funds: what’s the point in the sector? • Worth investing right now? • What Mall model makes more sense? Developers • Which regions are more resilient? • How to improve the relationship with the retailer in terms of managemente, and occupancy costs? • What’s the most appropriate Mix? Retailers • Witch experiences can you share with each other to learn more? • What is the profile of the Brazilian consumer market? How to attract consumers - digital and physical? • How the interaction between the developer and the retailer can be add to mutual benefit? GRI Shopping 2015 was created by GRI’s Club members and guests. On February 2015, we held a meeting to plan the large event on details. FAUZE BARRETO ANTUN Partner - Real Estate PATRIA INVESTIMENTOS FRANCISCO DE AUGUSTINIS Real Estate Investment Manager FUNCESP GASTON WAINSTEIN VP Development WALMART LEANDRO BOUSQUET VIANA Head of Real Estate VINCI PARTNERS MARCELO CARPEGIANI Business Development Director SONAE SIERRA MAXIMO LIMA Partner Director HSI - HEMISFÉRIO SUL INVESTIMENTOS GRI Shopping 2015 – Programação | Timetable Keynote Speaker Mailson da Nóbrega Economista, foi ministro da Fazenda de 1988 a 1990. Presidiu o Conselho Monetário e o Confaz e integrou os boards do FMI, do Banco Mundial e do BID. Participa de conselhos de administração de empresas e é colunista da revista Veja. Economist, former Finance Minister from 1988 to 1990. Chaired the Monetary Council and the Confaz and integrated the boards of IMF, the World Bank and the IDB. He is on the board of directors of several companies in Brazil and abroad. He is a columnist for Veja magazine. 16 de Junho | Terça-feira June 16th | Tuesday 13h45 – 14h30 Credenciamento 14h30 – 15h30 Abertura – Keynote Speaker 16h00 – 18h30 Discussões 18h30 – 19h30 Coquetel 19h30 VIP Board Dinner* 1:45 pm – 2:30 pm 2:30 pm – 3:30 pm 4:00 pm – 6:30 pm 6:30 pm – 7:30 pm 7:30 pm onwards 17 de Junho | Quarta-feira June 17th | Wednesday 08h00 – 09h00 09h00 – 10h00 10h30 – 12h45 12h45 – 14h00 14h00 – 16h30 08:00 am – 09:00 am 09:00 am – 10:00 am 10:30 am – 12:45 pm 12:45 pm – 2:00 pm 2:00 pm – 4:30 pm Credenciamento Talk Show Discussões Almoço Discussões * Apenas sob convite, reservado para membros do GRI Club Brazil e para co-chairs. NESSIM DANIEL SARFATI Founder BARZEL PROPERTIES OTAVIO CAETANO Director SAVOY PAULO GOMES Portfolio Manager ADIA Check-in Opening – Keynote Speaker Discussions Cocktail VIP Board Dinner* Check-in Talk Show Discussions Lunch Discussions * By Invitation Only, reserved for members of the GRI Club Brazil and co-chairs RAFAEL PINHO Executive Director MORGAN STANLEY SÔNIA REGINA HESS CEO DUDALINA THIAGO LIMA CEO REP Discussões FUNDOS DE PENSÃO E FUNDOS SOBERANOS - Até onde vai o apetite para Shoppings? PENSION FUNDS AND SOVEREIGN WEALTH FUNDS - How far goes the appetite for shopping malls? ADRIANA DE ALCANTARA Senior Director, Strategic Joint Ventures TIAA-CREF USA PAULO GOMES Portfolio Manager ADIA UAE CARLA SAFADY MEIRELLES Executive Manager, Real Estate Investment VALIA - PENSION FUND Brazil RICARDO JAIME BEHAR Managing Director BRADESCO BBI Brazil GASTÃO VALENTE Senior Vice President GIC Brazil WALTER CARDOSO CEO CBRE Brazil LUIS CARLOS FERNANDES Core Manager PREVI Brazil Adriana de Alcantara Carla Safady Meirelles Gastão Valente Luis Carlos Fernandes Paulo Gomes Ricardo Jaime Behar Walter Cardoso SHOPPINGS - O que esperar dos próximos 24 meses? SHOPPINGS – What to expect in the next 24 months? ANDRE FREITAS Managing Director CREDIT SUISSE HEDGING-GRIFFO Brazil FAUZE BARRETO ANTUN Partner - Real Estate PATRIA INVESTIMENTOS Brazil ARMANDO MESQUITA NETTO Business Development Director MÉTODO ENGENHARIA Brazil LEANDRO BOUSQUET VIANA Head of Real Estate VINCI PARTNERS Brazil EDUARDO GRIBEL President TENCO SHOPPING CENTERS Brazil MAXIMO LIMA Partner Director HSI - HEMISFÉRIO SUL INVESTIMENTOS Brazil EDUARDO PEREIRA GUILHERME CHRISTIANO Manager CBRE Brazil OTAVIO CAETANO Director SAVOY Brazil Andre Freitas Eduardo Pereira Christiano Armando Mesquita Netto Eduardo Gribel Fauze Barreto Antun Leandro Bousquet Viana Maximo Lima Otavio Caetano • Grupos de discussão acontecem simultaneamente em salas separadas • • Discussion groups happen simultaneously in separate rooms • GRI Shopping 2015 CHEGUEI, ENTREI E AQUI ESTOU - Lições e aprendizados dos varejistas internacionais HERE I AM – Lessons and learnings from international retailers ALEXANDRE DOMINGUEZ Director South America TOPSHOP Brazil MARCEL GHOLMIEH CEO INFINITY Brazil CARMINE ROTONDARO Worldwide Real Estate Director KERING FRANCE PAULO MATOS Director Tommy Hilfiger TOMMY HILFIGER Brazil JATIN MALHOTRA Director Real Estate and Business Development FOREVER 21 USA RENATA PAGLIARUSSI Director LUSH FRESH HANDMADE COSMETICS Brazil Alexandre Dominguez Carmine Rotondaro Jatin Malhotra Luiz Henrique Trevisan Marcel Gholmieh Paulo Matos LUIZ HENRIQUE TREVISAN Country Manager PRETTY BALLERINAS BRASIL Brazil Renata Pagliarussi SHOPPINGS, OUTLETS, STRIP MALLS, OPEN MALLS, LIFESTYLE CENTER - De onde podemos esperar crescimento real? SHOPPINGS, OUTLETS, STRIP MALLS, OPEN MALLS, LIFESTYLE CENTER –Where can we expect real growth? ALEXANDRE CAIADO CEO GOLD SEA PARTICIPAÇÕES Brazil MARCO AURELIO MENDONÇA New Business Director GWI REAL STATE Brazil CHRISTIAN VASCONCELLOS DA CUNHA CEO Shoppings JHSF Brazil PAULO STEWART CEO SAPHYR Brazil Alexandre Caiado Christian Vasconcellos Filipe Vasconcelos Marco Aurelio Mendonça Paulo Stewart FILIPE VASCONCELOS CEO BROOKFIELD GESTÃO DE EMPREENDIMENTOS Brazil O conteúdo desta brochure pode sofrer alteração sem notícia prévia. All material throughout this brochure is subject to change without notice. Discussions JUROS EM ALTA, CONSUMO ESTAGNADO - O que faz com que Shopping ainda seja um investimento inteligente? HIGH INTEREST RATES, STAGNANT CONSUMPTION - What makes shopping still a smart investment? ALEXANDRE MACHADO Director, Real State CREDIT SUISSE HEDGING-GRIFFO Brazil MARCELO REZENDE RAINHO Partner Director VISTA REAL STATE Brazil FELIPE RODRIGUES CEO USINA INVEST MALLS Brazil NESSIM DANIEL SARFATI Founder BARZEL PROPERTIES Brazil FRANCISCO DE AUGUSTINIS Real Estate Investment Manager FUNCESP Brazil ROSSANO NONINO Director, Real State GÁVEA INVESTIMENTOS Brazil FREDERICO PORTO Senior Managing Director BRAZILIAN SECURITIES - GRUPO PAN Brazil SILVIO LEAL Partner BRC GROUP Brazil MARCELO MICHALUA Partner Director RB CAPITAL Brazil VITOR GUIMARÃES BIDETTI CEO BREI – BRAZILIAN REAL ESTATE INVESTMENTS Brazil Alexandre Machado Felipe Rodrigues Francisco de Augustinis Frederico Porto Marcelo Michalua Marcelo Rezende Rainho Nessim Daniel Sarfati Rossano Nonino Silvio Leal Vitor Guimarães Bidetti Claudio Dall’acqua Jr Dorival Regini Eduardo Prado Marcelo Costa Santos Marcia Sola Rodrigo Abbud MACROECONOMIA E SHOPPINGS - Qual região será mais resiliente após o grande ciclo de entregas? MACROECONOMICS AND MALLS - Which region will be more resilient after the great cycle of deliveries? CLAUDIO DALL’ACQUA JR New Business Director IGUATEMI SHOPPING CENTERS Brazil MARCELO COSTA SANTOS Sócio-diretor ENGEBANC REAL ESTATE Brazil DORIVAL REGINI CEO LANDIS FOREST CITY Brazil MARCIA SOLA Business Director IBOPE Brazil EDUARDO PRADO Superintendent, Investors Relationship ALIANSCE SHOPPING CENTERS Brazil RODRIGO ABBUD Fouding Partner VBI REAL ESTATE Brazil • Grupos de discussão acontecem simultaneamente em salas separadas • • Discussion groups happen simultaneously in separate rooms • GRI Shopping 2015 EXPANSÃO DO VAREJO - O que esperam os principais varejistas nos próximos 24 meses? RETAIL EXPANSION – What are the major retailers expectation over the next 24 months? ALEXANDRE LOPES DIAS Retail Relationship Director GENERAL SHOPPING Brazil FRANCISCO OLIVEIRA Business Development Director GRUPO SBF Brazil ANDRE PEZETA Business Development Director BIO RITMO Brazil MARCOS TADEU DE PAULA MARQUES Business Development Director RIACHUELO Brazil CARLOS SIMÕES Business Development Director C&A MODAS Brazil RUFINO PIZARRO NETO Director SENDAS Brazil EDSON NOGUEIRA Business Development Director MAGAZINE LUIZA Brazil SYLVANA GOUVEIA Head of Real Estate STARBUCKS COFFEE BRASIL Brazil Alexandre Lopes Dias Andre Pezeta Carlos Simões Edson Nogueira Fabio Aloi Francisco Oliveira Marcos Tadeu Marques Rufino Pizarro Neto Sylvana Gouveia FABIO ALOI Business Development Director INBRANDS Brazil 2015-2016 - Construir ou expandir? 2015-2016 - Build or expand? ALEXANDRE PARANHOS Business Development Director BUENO NETTO Brazil SERGIO BRANDÃO MARINS CEO TACTIS GESTÃO IMOBILIÁRIA Brazil CESAR MELO Owner RENTA ENGENHARIA Brazil VICENTE PIEROTTI Director ABL SHOPPING Brazil NUNO COELHO Partner, Director VCG EMPREENDIMENTOS Brazil Alexandre Paranhos Cesar Melo Sergio Brandão Marins Nuno Coelho Vicente Pierotti O conteúdo desta brochure pode sofrer alteração sem notícia prévia. All material throughout this brochure is subject to change without notice. Discussões GREENFIELDS - Até que ponto faz sentido? GREENFIELDS – Does it still makes sense? CARLOS FELIPE FULCHER CEO 5R Brazil MARCELO CARPEGIANI Business Development Director SONAE SIERRA Brazil EDISON REZENDE CEO ENASHOPP Brazil PAULO CARNEIRO Owner PCA PAULO CARNEIRO ASSOCIADOS Brazil LEONARDO BORDEAUX Director ABL SHOPPING Brazil PAULO QUEIROZ Partner PORTFOLIO CAPITAL Brazil Carlos Felipe Fulcher Edison Rezende Leonardo Bordeaux Marcelo Carpegiani Paulo Carneiro Paulo Queiroz Amandus Zibell Neto Gustavo Nicolau Margarida de Ordaz Paulo Liberatore MIXED USE - Solução ou saída arriscada? MIXED USE - Solution or risky exit? AMANDUS ZIBELL NETO Commercial Director BSP PROPRIEDADES Brazil MARGARIDA DE ORDAZ CALDEIRA Main Board Director BROADWAY MALYAN Brazil GUSTAVO NICOLAU Director AKYLAS PATRIMONIAL Brazil PAULO LIBERATORE Manager Director LIBERCON ENGENHARIA Brazil • Grupos de discussão acontecem simultaneamente em salas separadas • • Discussion groups happen simultaneously in separate rooms • GRI Shopping 2015 MERCADO CONSUMIDOR BRASILEIRO - De cisne branco a patinho feio? BRAZILIAN CONSUMER MARKET - From white swan to ugly ducking? CLAUS REINHARDT CEO ETIQUETA NEGRA Brazil RAFAEL PINHO Executive Director MORGAN STANLEY Brazil FABIO GIANNI General Director SALVATORE FERRRAGAMO Brazil RICARDO CAMARGO Executive Director ABF- ASSOCIAÇÃO BRASILEIRA DE FRANQUIAS Brazil FERNANDO AUGUSTO LUSTOSA NOGUEIRA Real Estate and Development Director JBS BRASIL Brazil SÔNIA REGINA HESS CEO DUDALINA Brazil GASTON WAINSTEIN VP Development WALMART Brazil VINICIUS MONTEIRO LUPI Business Development Director LOJAS VARANDA Brazil Claus Reinhardt Fabio Gianni Fernando Augusto Lustosa Gaston Wainstein Ilia Riaskoff Rafael Pinho Ricardo Camargo Sônia Regina Hess Vinicius Monteiro Lupi Alessandro Veronezi Carlos Tadeu Ferraz Ricardo Nunes ILIA RIASKOFF Commercial Developer TUDOSHOPPING Brazil MOBILIDADE URBANA SOB TRILHOS E SHOPPING CENTERS - Demanda garantida vs desafios institucionais URBAN MOBILITY UNDER RAILS AND SHOPPING – Guaranteed demand vs institutional challenges ALESSANDRO VERONEZI CEO GENERAL SHOPPING Brazil RICARDO NUNES Commercial Director METRORIO Brazil CARLOS TADEU FERRAZ Consultor OM (Odebrecht Mobilidade) FERRAZ & ASSOCIADOS Brazil O conteúdo desta brochure pode sofrer alteração sem notícia prévia. All material throughout this brochure is subject to change without notice. Discussions CUSTO DE OCUPAÇÃO - Há espaço para se rediscutir o modelo de relacionamento Varejo x Shopping? OCCUPANCY COST – Is There Room For Rediscussing The Retail Relationship Model X Mall? ANTONIO MOREIRA LEITE President, Trigo Franchising GRUPO TRIGO Brazil JOÃO MARCOS CURVELLO Business Development Director RAIA DROGASIL Brazil EDILSON OLIVEIRA Managing Director GLOBAL MALLS Brazil SIDNEY ISIDRO Business Development Director VIA VAREJO Brazil GUILHERME VILAZANTE Head of Research MERRILL LYNCH Brazil THIAGO BORGES CFO AREZZO Brazil Antonio Moreira Leite Edilson Oliveira Guilherme Vilazante Hans Peter Scholl João Marcos Curvello Sidney Isidro HANS PETER SCHOLL Partner METROFIT Brazil Thiago Borges MIX DE SHOPPINGS - Pensando for a da caixa para atender os consumidores SHOPPING MIX - Thinking outside the box to meet consumers LUIS FELIPE SALLES Commercial Director MIX DE SHOPPING Brazil RODRIGO SELLES CO-CEO ABL SHOPPING Brazil Luis Felipe Salles Marcia Saad Rodrigo Selles Daniel Casañas Boscolo Rodrigo Senna Thiago Lima MARCIA SAAD Commercial Director SHOPPING PATIO HIGIENOPOLIS Brazil STRIP MALLS - Basta importar o modelo? STRIP MALLS – Is it simply import the template? DANIEL CASAÑAS BOSCOLO Development Director RODOBENS MALLS Brazil THIAGO LIMA CEO REP Brazil RODRIGO SENNA Partner RS PARTNERS Brazil • Grupos de discussão acontecem simultaneamente em salas separadas • • Discussion groups happen simultaneously in separate rooms • GRI Shopping 2015 O CONSUMIDOR DIGITAL - Como atrai-los? THE DIGITAL CONSUMER - How to attract them? ALESSANDRO LEAL Business Director GOOGLE Brazil MARCELO LOBIANCO Head of Sales Retail & E-commerce FACEBOOK Brazil Alessandro Leal Marcelo Lobianco André Cruz Fernando de Melo Franco Ana Cristina da Costa Mordejai Goldenberg PLANO DIRETOR SP - Gargalos x oportunidades PLANO DIRETOR SP – Bottlenecks vs opportunities ANDRÉ CRUZ Business Development Director GRUPO PÃO DE AÇÚCAR Brazil FERNANDO DE MELO FRANCO Urban Development Secretary São Paulo City Hall PREFEITURA DE SÃO PAULO Brazil NOVO CENÁRIO DE CRÉDITO AO VAREJO - Como impacta o setor? NEW RETAIL CREDIT SCENARIO - How does it impact the industry? ANA CRISTINA DA COSTA Head Consumer goods, trade and services BNDES Brazil MORDEJAI GOLDENBERG Partner PROINVEST FINANCE Brazil O conteúdo desta brochure pode sofrer alteração sem notícia prévia. All material throughout this brochure is subject to change without notice. Discussões MODELO DE GESTÃO - Quais inovações fortalecem a relação com varejistas? MANAGEMENT - Which innovations strengthen the relationship with retailers? LORIVAL RODRIGUES Owner M.GRUPO Brazil SANDRO MALIMPENSA Business Development Director L’OCCITANE Brazil MARCO AURELIO VIDAL Business Development Director AREZZO Brazil SERGIO IUNIS Business Development Director BFFC - BRAZIL FAST FOOD CORPORATION Brazil Lorival Rodrigues RICARDO RIBEIRO Business Development Director CHILLI BEANS Brazil Marco Aurelio Vidal Ricardo Ribeiro Sandro Malimpensa Sergio Iunis Cyro Santiago Rodrigues Dirceu O. Pastre SUL - Tradicionalismo vs. mercado aberto a novos players? SOUTH -Traditionalism vs. The market opened to new players? ALFREDO KHOURI JUNIOR CEO GRUPO CATUAI Brazil Alfredo Khouri Junior CYRO SANTIAGO RODRIGUES Director M.GRUPO Brazil DIRCEU O. PASTRE General Director GRUPO DMF Brazil • Grupos de discussão acontecem simultaneamente em salas separadas • • Discussion groups happen simultaneously in separate rooms • GRI Shopping 2015 SUDESTE - Mercado saturado ou ainda há oportunidades? SOUTHEAST - Saturated market or are there still opportunities? EDUARDO CRUZ Head of Real Estate GRUPO CARIOCA Brazil PAULO HENRIQUE PINTO CEO MENDES PINTO EMPREENDIMENTOS Brazil GUILHERME PAIVA Superintendent SHOPPING PRAIA DA COSTA Brazil RAPHAEL BROTTO Superintendent SHOPPING VITORIA Brazil HENRIQUE COSTA CEO COSTA HIROTA Brazil Eduardo Cruz Guilherme Paiva Henrique Costa Paulo Henrique Pinto Raphael Brotto André Siniscalchi Daniel Lucilius João Graciliano Luiz Augusto Duarte Leite NORTE/NORDESTE - Caminho natural para quem quer crescer? NORTH/NORTHEAST - Natural way to grow? ANDRE SINISCALCHI VP Shopping MB CAPITAL Brazil JOÃO GRACILIANO CEO IMALLS Brazil DANIEL LUCILIUS Commercial Director MM SHOPPING Brazil LUIZ AUGUSTO DUARTE LEITE Superintendent SHOPPING PREMIO Brazil O conteúdo desta brochure pode sofrer alteração sem notícia prévia. All material throughout this brochure is subject to change without notice. SILVER SP ON SOR Patrocinadores | Sponsors Reconhecida mundialmente como a melhor e maior consultoria imobiliária, a CBRE estabeleceu-se no Brasil em 1979 e constituiu uma das maiores plataformas de negócio do país e da América Latina. A empresa atua em todo território nacional através de departamentos especializados e equipados para proporcionar o melhor atendimento a todos os seus clientes. Dentro de uma política internacional agressiva, através de aquisições de várias empresas ao redor do mundo, a empresa expandiu extraordinariamente sua atuação para ocupantes e usuários de escritórios e de indústrias, tanto no Brasil como no exterior. A abrangência dos serviços oferecidos, o crescente volume de transações realizadas e a expertise adquirida durante seus 238 anos de existência no mundo proporcionam à CBRE um conhecimento diferenciado do mercado, permitindo identificar as melhores oportunidades e aconselhar seus clientes com excelência, sejam eles investidores, incorporadores, construtoras, ocupantes ou proprietários. CBRE was established in 1979 in Brazil, being proud of establishing one of the largest business platforms in the country and Latin America. Our company operates with specialized departments which are equipped to provide the best services to all our clients throughout the National Territory. With an aggressive international policy, through the acquisition of several other companies around the world, the company has significantly widened its field of activity for occupier and users of office and industrial properties, both in Brazil and abroad. Likewise, national and international investors have found in the company a “safe haven” to conduct acquisitions and to analyze investments from the most different segments. With a vast experience of its 12 departments, CBRE is ready to take in investors, developers and construction companies, as well as occupiers and landlords in general at all stages of work, including the real estate appraisals, through which we accomplished today, the greatest degree of reliability on the market. I N D U S TRY PAR T NER Walter Cardoso Presidente [email protected] www.cbre.com.br A ENGEBANC REAL ESTATE atua junto a proprietários, investidores e ocupantes de imóveis comerciais, industriais, logísticos e terrenos, oferecendo um portfólio completo de serviços imobiliários, tais como a intermediação de compra e venda, locação, avaliação, estudos de mercado, obtenção de capitais, gerenciamento de propriedades, entre outros. Com uma equipe sinérgica, constantemente capacitada e com profundo conhecimento do mercado local, a ENGEBANC REAL ESTATE oferece a seus clientes uma combinação única de expertise imobiliário e financeiro, proporcionando a construção de soluções integradas, ágeis e criativas. A ENGEBANC REAL ESTATE é parte do Grupo ENGEBANC, fundado como uma empresa de engenharia consultiva em 1992 e que atualmente conta com 25 escritórios em 16 estados brasileiros. ENGEBANC REAL ESTATE provides advisory and valuation services to owners, occupiers and investors of commercial real estate, including office, retail, industrial and logistics. Among the services offered are leasing (Landlord and Tenant Representation), sale and acquisition representation, market research, equity and debt raising, valuation & advisory as well as facilities management. With fully integrated and complementary teams as well as a deep knowledge of local markets, ENGEBANC REAL ESTATE offers its clients a unique combination of financial and real estate expertise that yields creative, nimble and integrated solutions. ENGEBANC REAL ESTATE is part of the ENGEBANC Group, founded as a consulting engineering company in 1992 and currently present in 16 Brazilian states through 25 local branches. Marcelo Costa Santos Sócio-diretor Tel (11) 3039-3615 | [email protected] www.engebanc.com.br Associação Brasileira de Franchising é uma entidade sem fins lucrativos, criada há 27 anos para fomentar e contribuir com o desenvolvimento técnico e institucional do Franchising no Brasil. A entidade possui em seu quadro associativo mais de 1200 associados divididos entre franqueadores, franqueados, consultores e prestadores de serviços comum só ideal: disseminação de um franchising forte, prospero e ético. A ABF orienta como pesquisar corretamente uma franquia e fornece dados, através de seu site, sobre as empresas franqueadoras associadas. Para as empresas interessadas em expandir seus negócios através do sistema de franquia, a ABF, relaciona profissionais de consultoria em Franchising para assessorarem o processo e ações necessárias para formatar o negócio. Brazilian Franchising Association is a non-profit organization, created 27 years ago to promote and contribute to the technical and institutional development of Franchising in Brazil. The organization has in its membership over 1200 members divided by franchisors, franchisees, consultants and service providers with only one common ideal: dissemination of a strong, prosperous and ethical franchising. ABF guides how to properly research a franchise and provides data through our website on the franchisors that are members of the entity. For companies interested in expanding their business through the franchise system, ABF has a list of Franchising consulting professionals to advise the process and actions needed to format the business. Fone: (11) 3020-8800www.portaldofranchising.com.br OPORTUNIDADES DE PATROCÍNIO O GRI possui oportunidades limitadas de participação com networking e posicionamento de marca diferenciados, voltadas aos prestadores de serviços que entendem nosso público seleto como peça-chave para seu relacionamento e negócios. Entre em contato conosco para entender como sua empresa pode se beneficiar com esse encontro ímpar da industria de Shopping Centers. Entre em contato: Diego Tavares | Director – Americas BR Tel: +55 19 3203 0647 | [email protected] GRIClub Brazil CONHEÇA O GRI (Global Real State Institute) O GRI CLUB no Brasil • • • • • • • • MEET THE GRI THE GRI IN BRAZIL Clube fechado e restrito By invitation only Club Reúne os principais líderes do Mercado Imobiliário Bring together key leaders of the real estate market Fundado em 1997 em Londres Founded in 1997 in London Presente em 18 regiões do mundo Present in 18 regions of the world A ESTRUTURA DO CLUB Iniciou suas atividades em 2010 Began its activities in 2010 Possui mais de 150 membros Over 150 members 20+ encontros fechados por ano (jantares, cafés-da-manhã) 20+ closed doors meetings per year (dinner, breakfast) 8 Conferências Internacionais anuais no pais 8 International Conferences in the country Club Structure O Club é composto por: The Club is formed by: Board Members | Senior Members | Members | Company Members BOARD MEMBERS Adam Gallistel GIC USA Luiz Amaral TRX BRAZIL Adriana de Alcantara TIAA-CREF USA Marcelo Santos ENGEBANC REAL ESTATE BRAZIL Christopher Moad CANADA PENSION PLAN INVESTMENT BOARD (CPPIB) CANADA Martin Jaco BR PROPERTIES BRAZIL Claudio Bernardes SECOVI - SP BRAZIL Maximo Lima HSI - HEMISFÉRIO SUL INVESTIMENTOS BRAZIL Conselho do Clube Daniel Cherman TISHMAN SPEYER BRAZIL Nessim Sarfati CYRELA COMMERCIAL PROPERTIES BRAZIL Daniel Citron RELATED BRASIL BRAZIL Tom Alan Heneghan EQUITY INTERNATIONAL USA Fauze Antun PÁTRIA INVESTIMENTOS BRAZIL Paulo Gomes ADIA ABU DHABI Joshua Pristaw Leandro Bousquet Rafael Birmann Walter Cardoso GTIS PARTNERS USA BIRMANN S/A BRAZIL VINCI PARTNERS BRAZIL CBRE BRAZIL Para fazer parte do GRI Club Brazil é necessário indicação de algum membro. Entrada sujeita a aprovação de Comitê Especial. GRI Membership is by invitation only. Application must be submitted to its Special Committee. www.griclub.org GRIClub Brazil Os encontros do GRI proporcionam um fórum para os líderes da indústria imobiliária global desenvolverem relações valiosas, identificarem novas oportunidades de negócios e fortalecerem suas conexões globais. GRI meetings provide a forum for the world’s leading real estate players to develop valuable relationships, find new business partners, and strengthen their global networks. Próximos encontros do GRI em todo o mundo Next GRI Meetings in 2015 all over the world ASIA GRI2015 TÜRKİYE TURKEY GRI2015 TURKEY GRI 2015 20 - 21 April AFRICA GRI 2015 21 - 22 April ASIA GRI 2015 22 - 23 April CEE GRI2015 BRITISH GRI2015 BRITISH GRI 2015 28 - 29 April CHINA Global Real Estate Institute AFRICA GRI2015 GRI2015 DEUTSCHE GRI2015 DEUTSCHE GRI 2015 06 - 07 May GRI EUROPE SUMMIT 2015 CEE GRI 2015 01 - 02 June RUSSIA GRI2015 @RealEstateGRI www.facebook.com/griclubbrazil BR Tel: +55 (19) 3203 0645 UK Tel: +44 (20) 7121 5060 Fax: +44 (20) 7388 8740 [email protected] www.griclub.org www.globalrealestate.org CHINA GRI 2015 03 - 04 September GRI EUROPE SUMMIT 2015 Paris, 10 - 11 September ITALIA GRI 2015 LATIN AMERICA GRI 2015 30 Set - 01 October 2015 CHAIRMEN’S RETREAT THE GRI INDIA GRI2015 INDIA GRI 2015 18 - 11 November ITALIA GRI 2015 Milan, 26 - 27 November EUROPE RETREAT 2016 21 - 24 January SAVE THE DATE W W W. G R I C LU B. O R G/M E M B E R S Próximos encontros do GRI Club Brazil em 2015 Next GRI Club Brazil Meetings in 2015 GRI Residential - 28, 29 April GRI Land Development and Planned Communities - 19, 20 May GRI Shopping - 16, 17 June GRI Hotels - 24, 25 June GRI Real Estate Marketing - 11 August Industrial & Warehouses GRI Forum 10 September GRI Infraestructure - 20, 21 October Offices GRI Forum - 27 October Brazil GRI - 17, 18 November Exclusive Meetings all long the year +20 Exclusive meetings for members only

Download