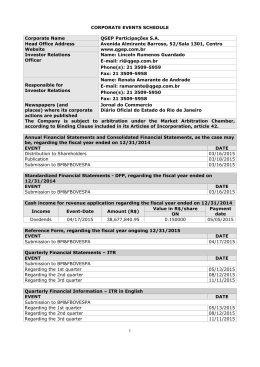

TOTVS S.A.

Publicly-Held Company

Corporate Taxpayer’s Identification (CNPJ) No. 53.113.791/0001-22

Company Registry (NIRE) No. 35.300.153.171

NOTICE TO THE MARKET

São Paulo, December 4, 2013

TOTVS S.A. (BM&FBOVESPA: TOTS3) (“Company”) informs that it has received

the official letter GAE/CREM/OFFICIAL LETTER NO. 4372/13, of December 3,

2013, sent by BM&FBOVESPA S.A. – Bolsa de Valores, Mercadorias e Futuros

(“BM&FBOVESPA”), requesting further clarification on the dissenting shareholder’s

right to withdraw in connection with the acquisition by the Company of the control of

Ciashop - Soluções para Comércio Eletrônico S/A ("Ciashop"). The request is part of

the Cooperation Agreement, entered into by and between Comissão de Valores

Mobiliários (“CVM”) and BM&FBOVESPA on December 13, 2011.

Below are the transcriptions of the official letter GAE/CREM/OFFICIAL LETTER NO.

4372/13 and the clarifications provided by the Company.

I. GAE/CREM/OFFICIAL LETTER NO. 4372/13:

GAE/CREM 4372-13

December 3, 2013

Totvs S/A

Department of Investor Relations

Mr. Alexandre Fonseca Dinkelmann

Dear Sirs:

Considering the terms of the material fact of December 2, 2013, which informs the

purchase of 68.5% of the capital of Ciashop – Soluções para Comércio Eletrônico S.A.,

by Totvs Brasil Sales Ltda. (wholly-owned subsidiary of said company) and that the

Company’s shareholders will be granted the right to withdraw, in compliance with

article 256 of Law No. 6,404/76, as amended by Law No. 10,303/01, we hereby request

the provision of the following information, by December 4, 2013:

● Shareholders enrolled on which date on the Company’s records will be entitled

to the right to dissent;

● The amount of refund (reembolso) in R$ per share;

We hereby inform you this request is part of the Cooperation Agreement, entered into

by and between CVM and BM&FBOVESPA on December 13, 2011, and that failure to

fulfill such request may subject the company to the application of fine by CVM’s

Corporate Relations Office (Superintendência de Relações com Empresas – SEP), in

compliance with the provisions of CVM Instruction No. 452/07.

Best regards,

Ana Lúcia Costa Pereira

Office of Corporate Relations (Coordenadoria de Relações com Empresas)

BM&FBOVESPA S.A. Bolsa de Valores, Mercadorias e Futuros

with copy to CVM – Brazilian Securities and Exchange Commission

Mr. Fernando Soares Vieira – Director of Corporate Relations

Mr. Waldir de Jesus Nobre – Director of Trading and Markets Supervision

II. CLARIFICATIONS TO THE REQUEST FOR INFORMATION

São Paulo, December 4, 2013

To Ms.

ANA LÚCIA COSTA PEREIRA

Office of Corporate Relations

BM&FBOVESPA S.A. Bolsa de Valores, Mercadorias e Futuros

with copy to CVM – Brazilian Securities and Exchange Commission

Mr. Fernando Soares Vieira – Director of Corporate Relations

Mr. Waldir de Jesus Nobre – Director of Trading and Markets Supervision

RE: Reply to Official Letter GAE/CREM/OFFICIAL LETTER NO. 4372/13

TOTVS S.A.

CNPJ No. 53.113.791/0001-22

TOTVS S.A. (“Company”), acting in response to Official Letter

GAE/CREM/OFFICIAL LETTER NO. 4372/13, received on December 3, 2013, hereby

provides the following clarifications on the dissenting shareholder’s right to withdraw in

connection with the acquisition of the control of Ciashop - Soluções para Comércio

Eletrônico S/A ("Ciashop"):

(i) Shareholders that are entitled to the right to withdraw:

Pursuant to Article 137, paragraph 1 of the Brazilian Corporate Law (Law No.

6,404/76), the following shareholders are entitled to the right to withdraw: the

dissenting shareholders that held shares issued by the Company on December, 2, 2013,

(including those shareholders that purchased shares on December 2, 2013) date on

which the Material Fact was disclosed, in connection with the acquisition of the control

of Ciashop.

Shareholders that already held Company shares on December 2, 2013 and that purchase

new shares issued by the Company following said date shall not be entitled to the right

to dissent on the new purchased shares.

(ii) Amount of refund:

The amount of the refund the dissenting shareholder shall receive from the Company, in

the event of exercise of the right to withdraw, shall be of five reais and sixty centavos

(R$ 5.60) per share issued by the Company, which represents the Equity Book Value set

out in the last balance sheet, based on the Company’s financial statements as of

December 31, 2012, approved at the Annual Shareholders’ Meeting held on March 5,

2013, divided by the total number of shares issued by the Company.

It is nevertheless worth mentioning that the foregoing amount of refund may be

updated, in the event the Extraordinary Shareholders’ Meeting to be called to ratify the

acquisition of Ciashop takes place after the approval, by the Annual Shareholders’

Meeting, of the Company’s financial statements as of December 31, 2013. In said event,

the amount of refund per share to be received by dissenting shareholders in connection

with the right of withdraw shall be calculated based on the Company’s financial

statements as of December 31, 2013, and not on the Company’s financial statements as

of December 31, 2012.

Finally, it is also important to clarify that the shareholders and the market in general

shall be informed by means of the Company’s Material Fact related to the closing of the

Transaction, as well as upon the call of the Extraordinary Shareholders’ Meeting to

resolve on the ratification of the Transaction.

This is a free translation of the original Notice to the Market in Portuguese

São Paulo, December 4, 2013

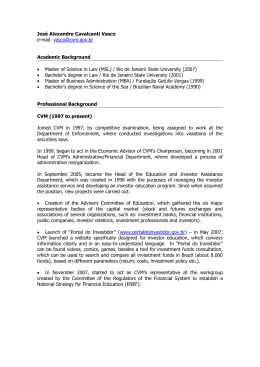

Alexandre Dinkelmann

Investor Relations Officer

Download