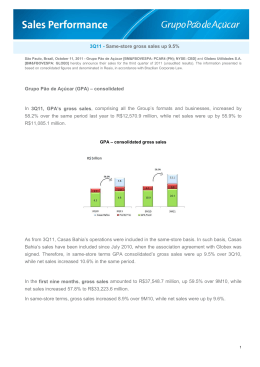

PLASCAR ANNOUNCES MARCH 31, 2012 RESULTS. Quote (3/31/12) PLAS3 - R$ 1.81 Market cap on 3/31/12 R$ 301 million Number of shares Ordinary: 166 MM Campinas, SP, May 3, 2012 – Plascar Participações Industriais S.A. (Bovespa: PLAS3), Brazil’s leading manufacturer of automotive parts for the internal and external finishing of light and heavy vehicles in the Original Equipment Market (OEM), which supplies auto makers in Latin America and Mercosur and exports to Argentina, Mexico, the USA, Australia and Europe, announces its 1Q2012 results. The Company’s operating and financial information, except where otherwise indicated, is consolidated and amounts are stated in Brazilian Reais. 1Q2012 performance highlights: − EBITDA was R$ 3.6 million (1.7% margin). Investor Relations Rua Pierre Simon de Laplace, 965 – Conj. B1,B2,B3,B4,C1,C2 Cond. Unic Sl. 2 Cj. B1 Techno Park – CampinasSP - CEP 13069-320. − Plascar’s net revenue decreased 4.7% in 2012, to R$ 219.1 million. − Gross margin reaches 11.7%, or R$ 25.6 million. Plascar Board of Directors Wilbur L. Ross Jr. André C. do Nascimento Charles D. Popoff Francisco N. Satkunas Edson F. Menezes Supervisory Board Adauto Martins Costa Mauro Cesar Leschziner Alcides Morales Filho Website: www.plascargroup.com IR - Contact Gordiano Pessoa Filho CFO and Investor Relations Officer. [email protected] Phone: (+ 55 19) 3518 8601 (+ 55 19) 3518 8640 Performance in the Period 1Q2012 1Q2011 Change - % Gross sales 272,082 285,194 -4.6% Net revenue 219,090 229,893 -4.7% Gross profit 25,586 49,532 -48.3% Gross margin % 11.7% 21.5% -9.8p,p, EBITDA 3,617 28,971 -87.5% EBITDA margin % 1.7% 12.6% -10.9p,p, Net income (loss) (18,663) 1,289 -1,696.8% 5,231 5,071 (13,432) 6,360 Amounts in R$ thousand Elimination of effect of debentures * • Interest on debentures Adjusted net income (loss) These amounts include net sales of R$ 60,286 (R$ 47,639 in 2011) / EBITDA of R$ 3,473 (R$ 4,510 in 2011)/ net income (loss) of (R$ 1,551), R$ 331 in 2011, reported by Plastal – Argentina (renamed Plascar Argentina S.A. in August 2011). *For analytical purposes only, accrued interest (110% of Interbank Deposit Certificate - CDI) incurred on subscribed debentures is eliminated, as these are “mandatorily convertible into shares”, i.e. their conversion into “Capital” will not result in any cash disbursements. 1 Background The Company started operating in the rubber industry in the city of Jundiaí, São Paulo State in October 1963. In 1973, it began operations in the automotive industry, and in the mid 1980’s, after several corporate mergers and the implementation of a growth and modernization program, the Company substantially improved its subsidiaries, and became second to none in the automotive plastic parts industry. Corporate structure IAC Group Brazil is a joint venture between WL Ross & Co. LLC (“WLR”) and Franklin Mutual Advisers, LLC. On April 12, 2006, Delaware-based company International Automotive Components Group Brazil, LLC (IAC Group Brazil, LLC) acquired control of Permali do Brasil Ind. e Com. Ltda. from Collins & Aikman Europe S.A. Legal structure- IAC Group Brazil Invesco 100% WL Ross & Co. LLC 75.7% IAC – Group International Automotive Components Group Brazil LLC 24.3% Franklin Mutual Advisers, LLC 100% Permali do Brasil Indústria e Comércio Ltda 56,52% 0.11% Plascar Participações Industriais S.A Non-controlling interests 43.48% 99.89% Plascar Ind. de Comp. Plásticos Ltda. 100% Plascar Ind. de Comp. Plásticos S.A. - Argentina 95% 5% * 100% Plascar Argentina S.A Ristolsur S.A – Uruguay (Chery – OEM) 2 Operating performance After the fourth quarter of 2008, as a result of the financial crisis that initially hit the United States, Europe and Asia, the global motor vehicle industry changed dramatically, leading automakers and auto part manufacturers to adopt thorough restructuring and cost-cutting initiatives. In 1Q2012 sales decreased by 0.8% over the same prior year period (source: ANFAVEA) and by 2.5% in Argentina (source: ADEFA). Vehicle production in 1Q2012 dropped 10.9% over the same 2011 period (source: ANFAVEA) and rose 3.1% in Argentina (source: ADEFA). SOURCE: ANFAVEA – BRAZIL Change 1Q11 1Q12 % SOURCE: ADEFA–ARGENTINA Change 1Q11 1Q12 -% VEHICLE PRODUCTION 829 738 -10.92% 159 164 3.14% VEHICLE SALES 825 818 -0.82% 161 157 -2.46% As a result of the decline in vehicle production, Plascar (consolidated) reported a decrease in the Company’s net revenue by 4.7% in 1Q2012 over the same 2011 period, reaching gross margin of 11.7% for the period. Net revenue in 1Q2012 totaled R$ 219.1 million. Brazil • Gross revenue in 1Q2012: R$ 211,270 • Gross revenue in 1Q2011: R$ 236,634 % Change: -10.7% Argentina • Gross revenue in 1Q2012: R$ 60,812 • Gross revenue in 1Q2011: R$ 48,560 % Change: 25.2% Consolidated (Brazil + Argentina) • Gross revenue in 1Q2012: R$ 272,082 • Gross revenue in 1Q2011: R$ 285,194 % Change: -4.6% 3 Net Revenue (in thousands of R$) 12/11 -4.7% * 229,893 219,090* 11/10 55.6% 147,781 1Q10 1Q11 1Q12 *Including R$ 60,286 (R$ 47,639 in 2011) from Plascar Argentina S.A. Composição da Receita Líquida no 1º Trimestre'12 R$ 219.090 mil Composição da Receita Líquida no 1º Trimestre'11 R$ 229.893 mil 45.560 20% 25.136 11% 15.951 7% 30.267 14% 17.215 8% 9.970 5% 77.529 35% 95.497 41% 47.749 21% 84.109 38% 4 Gross profit vs. Gross margin (%) In 1Q2012, gross margin was 11.7%, versus 21.5% in 2011. Gross profit, expressed in reais, amounted to R$ 25.6 million in 1Q2012. Some of the main reasons for this gross margin level were: a) Supply to new customers has started (especially Japanese and French automakers); b) Entry into New Market Niches (truck parts and “non-automotive” segment); c) Renegotiation of old contracts; e) Compliance with clauses involving the automatic pass-through of raw material prices to customers; and finally, the greater dilution of fixed costs, as a natural result from expanded operations, excluding the effects from the market downturn in 1Q2009. Amounts expressed in thousands of Reais R$ 229,893* R$ 219,090* R$ 147,781 R$ 49,532* R$ 31,355 21.2% 1Q10 R$ 25,586* 21.5% 11.7% 1Q11 1Q12 Net revenue Gross profit ............. Gross profit - % *Including net sales of R$ 60,286 (R$ 47,639 in 2011) and gross profit of R$ 5,881 (R$ 7,097 in 2011) from Plascar Argentina S.A. 5 EBITDA (in R$) vs. EBITDA (%) EBITDA totaled R$ 3.6 million in 1Q2012. EBITDA margin was 1.7% in 1Q2012 versus 12.6% in 2011. 11/10 67.8% R$ 28,971* 12/11 -87.5% R$ 17,269 12.6% 11.7% R$ 3,617* R$ 1,289* R$ (13) 1Q10 1Q11 1.7% 1Q12 - R$ 18,663* EBITDA (in R$ thousand) vs. EBITDA margin (%) Net income (loss) (in R$ thousand) *Including EBITDA of R$ 3,473 (R$ 4,510 in 2011), loss of R$ 1,551 (net income R$ 331 in 2011) from Plascar Argentina S.A In 1Q2012, loss totaled R$ 18,663 thousand; in 1Q2011, net income was R$ 1,289. Debentures (amounts in thousands of reais, except where indicated otherwise) As approved by a majority vote at the Special Shareholders’ Meeting held on April 7, 2010, the Company approved the private issuance of forty thousand (40,000) subordinated debentures, mandatorily convertible into Company-issued shares, at a par value of R$ 10.00 each. Debentures mature within two years from the date of issuance, i.e. May 7, 2012. Debentures bear interest equivalent to 110% of the CDI rate. Compensatory interest is mandatorily payable on the maturity date, by means of payment in Company-issued shares. For the quarter ended March 31, 2012, there were no new debenture subscriptions. By March 31, 2012, 14,756 debentures had been subscribed, in a total R$ 183,053 (R$ 177,823 as at December 31, 2011), including compensatory interest, recorded as “Debentures”, in current liabilities. The funds obtained from the transaction were substantially used to amortize existing debts and to acquire entities. As at March 31, 2012, the annualized effective interest rate of debentures is 10.61%. The debenture transaction was formally completed with the notice filed with the Brazilian Securities and Exchange Commission (CVM) on March 28, 2012, in which the Company informed of its decision to withdraw its registration statement for initial public offering of remaining debentures (“Remainder Auction”). 6 Human Resources Headcount in 1Q2012 was 4,788 employees (5,146 in 1Q2011). Main awards received by Plascar in 2010/2011 Public acknowledgment: People Management For the third time, Plascar is one of the “100 best companies to work in Latina America - 2010” For the third consecutive year, Plascar was recognized as one of the “100 best workplaces in Latina America”, according to the list published by HSM Management magazine (May/June issue). Plascar was also a finalist in the “Communication - Telling the Truth” category. The survey that elects the 100 Best Companies to Work For is conducted by the Great Place to Work Institute on an annual basis. This year, 1,400 companies from 12 Latin American countries were surveyed. Overall, 17 Brazilian companies are part of the list. th Plascar is considered the 13 Best Company to Work For in Brazil th For the 4 consecutive year, Plascar ranked among the “100 Best Companies to Work For in Brazil”, according to the ranking published by Época magazine and the Great Place to Work Institute. This year, the survey received a record 770 registrations. Out of that total, 100 companies were classified, representing 11% of the Brazilian GDP. th This time, Plascar ranked 13 . Additionally, Plascar excelled in the following survey categories: • 5 best manufacturing company; and • 15 most sought after company. th th Plascar ranks among the “150 Best Companies to Work for” Once again, Plascar is among the “150 Best Companies to Work for”, a traditional ranking prepared by Exame and Você S.A., two renowned magazines published by Editora Abril, in partnership with Fundação Instituto de Administração (FIA) of São Paulo th University (USP), which had its 14 edition in 2010. th For the 5 consecutive year, Plascar was certified as having one of the best working environments in Brazil among the 541 companies that participated in this year’s survey. Plascar is granted the "Outstanding Performance in Social Responsibility" award Based on the outcome of the survey it conducts annually using the method developed by the Great Place to Work Institute Brasil, specialized magazine “Melhor Gestão de Pessoas” granted Plascar the “Outstanding Performance in Social Responsibility” award. This is the third year Plascar has been acknowledged by the magazine, having received the "Outstanding Performance - Reliability" award in 2008 and 2009. Acknowledgment: Corporate Governance 7 Plascar ranks 1st in Sustainable Growth – Vehicles and Spare Parts – in the Valor 1000 survey st Plascar ranked 1 in the “Sustainable Growth” category among the companies in the vehicles and spare parts sector classified in the Valor 1000 survey, an annual publication of Valor Econômico newspaper that ranks the 1000 largest companies in Brazil. th Plascar ranked 9 in the ranking of the companies in the vehicles and spare parts sector, coming in 467th place in the overall ranking, up 13 positions from 2009 . Plascar is once again recognized as one of the best at “Melhores da Dinheiro” ranking In 2010, Plascar achieved the following rankings on this important list, published annually by “IstoÉ Dinheiro” magazine: - The best company in the auto parts sector in terms of Human Resources; - The third best company in the auto parts sector; - The third best company in the auto parts sector in terms of Financial Sustainability, Innovation and Quality. Plascar goes up 59 positions in the “Maiores e Melhores” raking published by Exame Magazine nd In 2011, Plascar came in 442 place in this select ranking published by Exame magazine, up 59 positions compared to 2010. Plascar among the 200 greatest companies published by Valor magazine th Plascar came in 196 place in this ranking published by Valor Econômico newspaper in December 2011. Acknowledgment: Technological Innovation Plascar is granted the SAE Brasil 2010 Technological Innovation award For the third consecutive year, Plascar received the “Technological Innovation Highlight” award from SAE BRASIL, an international entity that brings together and represents engineers from several transportation sectors. th The award was presented during the 19 International Congress and Exhibition of Mobility Technology organized by SAE BRASIL in São Paulo between October 5 and 7, which received more than 12,000 visitors. At the congress, Plascar presented its “sustainable car,” a project that was fully designed by the Company's engineers and presents several solutions to challenges faced by the automotive industry. The award was rceived by Plascar’s CEO André Nascimento, its Engineering Director José Donizeti da Silva, its Advanced Engineering and Materials Manager Márcio Tiraboschi, and its Product Development Manager Marcos Julio, who represented all Plascar professionals involved in the project. The SAE BRASIL award ceremony was attended by Brazil’s Minister of Development, Industry and Commerce Miguel Jorge, representing president Luís Inácio Lula da Silva. The Minister received the SAE BRASIL 2010 prize, the highest honor granted by the entity. 8 Plastal Argentina Beginning August 2011 Plastal was renamed Plascar Argentina S.A. Shareholders’ compensation - Dividends At the Annual General Meeting held on April 27, 2012 was approved the retention of part of net income for the year ended 2011, recorded under heading Retained Profits Reserve for Expansion in the amount of R$ 7,735, to be used in future investments in expansion projects in accordance with the Company's capital budget. The mandatory minimum dividends amounting to R$ 2,578 recorded as of December 31, 2011 on net income for the year ended on that date shall be paid by June 30, 2012. Subsequent Event At the Ordinary and Extraordinary General Meeting held on April 27, 2012 was approved the Company's capital increase in the amount of R$ 4,068 (from R$ 289,080 to R$ 293,148) as approved by the Board of Directors meeting held on 16 April 2012. 9

Download