Electronics Industry Trends THE TRUTH BEHIND THE BARCODE THE TRUTH BEHIND THE BARCODE: Electronics Industry Trends 19th May 2014 Authors: Gershon Nimbalker, Claire Cremen, Yolande Kyngdon & Haley Wrinkle Design: Elin Eriksson, Dwight Gilberg, Tim Park, Fiona Russell & Haley Wrinkle Organizations: Not For Sale & Baptist World Aid Australia Produced with Support From: International Labor Rights Forum Electronics Industry Trends report was funded in part by a grant from the United States Department of State. The opinions, findings, and conclusions stated herein are those of the author and do not necessarily reflect those of the United States Department of State. International Labor Rights Forum advises the Free2Work program. We would like to thank ILRF for its contributions to this report. Research contained in this report was completed over a period of eighteen months to February 2014. Published 19th May 2014 www.notforsalecampaign.org/australia Visit www.behindthebarcode.org.au to find out more. Introduction | Exploitation and Slavery in Electronics More than ever before, the world is asking questions about the people making our electronics and the conditions under which they work. Interest has been spurred on by the ascendency of global brands like Apple, Microsoft and Samsung, combined with growing public concern about exploitation and child labor in Chinese electronics factories, as well as fears about the use of conflict minerals sourced from the Democratic Republic of Congo (DRC). This report seeks to shed light on these concerns by examining the efforts of thirty-nine widely-recognised electronics brands to address exploitation and forced labor within their supply chains. It is the second in a series of industry-focused reports; the first focused on the apparel industry. Product supply chains are particularly susceptible to the presence of slavery and exploitation when little or no responsibility is taken by companies to protect worker rights upstream in the supply chain. On these grounds, this report grades companies across four categories of their Corporate Social Responsibility (CSR) practices: policies; traceability and transparency; monitoring and training, and worker rights. Our research finds that the electronics industry has substantial room for improvement as the highest grade awarded was B+ and the median received was C-. The sector’s greatest strength is the early steps it has taken toward knowing who makes its products (traceability). Almost half of all the companies we assessed have traced the majority of suppliers responsible for their final stage of manufacturing, and a quarter have done the same for their components manufacturing. Many brands have also begun to locate their smelters to ensure the minerals they use have not originated from the civil war-ravaged Democratic Republic of the Congo. However, the research shows a clear trend that insufficient efforts have been undertaken to uphold worker rights, and in particular to ensure workers are paid a living wage. Of the companies assessed, only Nokia was able to provide sufficient evidence that its worker rights policies had translated into increased wages. This is of particular concern given that payment of a living wage is among the most persistent issues raised by workers in developing countries and one of the most dependable measures of improved worker well-being. We encourage electronics companies to take further steps to trace their supply chains, monitor them effectively against the use of child and forced labour and, most importantly, begin publicly reporting the impact of their CSR policies, in particular, the wage gains of their workers. Further, we urge the industry to solidify these commitments by creating legally binding and enforceable agreements with workers. Examples from the apparel industry include the Accord on Fire and Building Safety in Bangladesh and the Freedom of Association Protocol in Indonesia. Electronics companies have great potential to bring substantial benefits to the countries in which they operate. For developing countries, the investment, technology, job opportunities, skills and tax revenues that accompany their operations can be critical in helping their citizens overcome poverty. However, without adequate safeguards many of these benefits will not fully materialise and workers may be exploited or even enslaved. This report provides an overview of key labour rights issues affecting the electronics sector, alongside in-depth company profiles and snapshots of good company practices. The report is a tool for consumers who may wish to ‘vote with their wallets’ and advocate for better business practices. It is a tool for companies to assess their performance and compare their strengths and weaknesses with those of their peers. It is also a tool for policy makers to understand where greater governmental oversight is needed. 1 2 Introduction | Exploitation and Slavery in Electronics Company Performance While no company earned an A grade in this report, B+ grades were awarded to Nokia, LG, Microsoft and Apple. Apple’s inclusion in the top tier may come as a surprise given the public attention it has received for poor working conditions and child labour at Chinese suppliers like Foxconn and Pegatron. In fact, Apple itself reported finding eight facilities using child labour in 2014. This context should provide the reader with some understanding of the degree to which we graded companies on a curve. A number of large companies were in the B category, not because their supply chains are free of abuse, but because they were doing relatively more to proactively address these issues. These companies trace and effectively monitor a good portion of their supply chain, with a few going further to implement grievance mechanisms and policies to remediate child labour. B Nokia Acer Apple Dell Hewlett-Packard Intel LG Electronics Microsoft Motorola Mobility Motorola Solutions Panasonic Samsung Toshiba Blackberry Garmin Hitachi IBM Olympus Philips SanDisk Sharp Sony TomTom Woolworths Australia C Overall company grades are listed to the right. D F Amazon Kindle Asus Canon Dick Smith Electronics Fujitsu HTC Huawei Hisense Palsonic Kogan Lenovo Nintendo Oracle Soniq TEAC Compare Grades to Wage Impact: Companies that guarantee above local minimum wage ONE PARTIAL 3 Introduction | Living Wage & Collective Bargaining Living Wage Partial Payment of a living wage Nokia receives partial credit for demonstrating that some suppliers at the final assembly stage pay workers a living wage Naturally, wages are one of the chief concerns of workers. Although our research grades companies on their overall labour rights management systems, it is worth specifically highlighting their wage practices. Almost every company with an ethical sourcing policy requires the payment of either a legal minimum wage or an industry standard wage, which often amounts to the same thing. However, the legal minimum wage in many developing countries is not sufficient for a worker and their dependents to meet their basic living needs. Legal minimum wages may keep workers and their families in poverty or force them into working excessive overtime to make ends meet. We believe that one of the most demonstrable differences a company can make to the welfare of their workers is through the payment of a ‘living wage’. This is a wage high enough to ensure that workers can meet basic needs (food, water, shelter, clothing, energy, transport, education and health care) for themselves and their families, with a small amount left over for discretionary spending or savings in case of an emergency. Of the 39 companies analysed only Nokia was able to provide sufficient evidence to demonstrate that workers were receiving amounts above the legal minimum. It is worth noting that both Microsoft and Samsung also claim to pay above minimum wages, however at the time of publishing we had not received sufficient documentary evidence to verify this. This wage deprivation is compounded by the fact that only 31% of companies uphold the right of supply chain workers to engage in collective bargaining. Worse still, Nokia was the only company able to sufficiently identify factories where collective bargaining arrangements existed. The International Labour Organization has found that in countries with high rates of collective action in the workplace (>30%), wage increases correlate more closely with economic growth compared to countries with low levels of collective action.[1] In other words, workers on the aggregate earn more when they are unified and thus structurally capable of engaging in collective bargaining. It is important that collective bargaining is recognised as a distinctly protected right. Our research indicates that, with perhaps the single exception of Nokia, few brands are taking sufficient action towards recognising workers rights to freedom of association and collective bargaining. Finally, we accept that it is extremely difficult to directly measure the extent of child or forced labour in a supply chain as it is so often hidden. However, we do know that where workers are treated fairly (where they can speak out about their conditions and receive adequate pay) modern Introduction | Living Wage & Collective Bargaining slavery is far less likely to occur. Advocating for living wages within the supply chain and promoting the rights of workers to engage in collective action, while beneficial in their own right, are also significant measures to reduce the risk of slavery. 1 Methodology Sources: [1] International Labour Organization, Global Wage Report 2008-09 p.41, http://www.ilo.org/wcmsp5/ groups/public/---dgreports/---dcomm/documents/publication wcms_100786.pdf This chapter provides an overview of how we graded companies. 5 Methodology | How We Grade Companies Our assessment system gives companies and supply chains A to F grades on their efforts to guard against the use of child and forced labour and worker exploitation in production. Assessments are based on publicly available information and data self-reported by the company. Companies that did not respond substantively to our enquiries and have not provided data are marked with an asterisk (*). We contacted each company multiple times before recording a non-substantive response. A few companies responded but chose not to disclose any additional data. These are also marked with an asterisk. The supply chain of an average electronic product has many different stages. At the raw materials level, electronics contain dozens of minerals that have been extracted from the ground in every continent except Antarctica. These minerals are traded several times before being smelted and refined, a process that amalgamates minerals from a multiple of different locations. Next, the refined minerals enter the global market where they are typically traded again, and then purchased by component manufacturers. These manufacturers number in the tens of thousands, and predominantly operate in Asia; particularly in China, Japan, South Korea, Taiwan, Thailand, the Philippines and Singapore. Then, the components are incorporated into a myriad of different branded products which are finally sold to consumers across the globe. In this study we focused on companies’ interaction with three key stages: raw materials (mineral extraction), inputs (smelting and refining and/or component manufacturing), and final manufacturing. This is a simplified supply chain that generally reflects the complicated supply chain dynamics of the brands analysed. There can, for example, be considerable overlap between the stages. We give companies A-F grades for efforts to address slavery. We evaluated 39 major electronics brands. We looked at three key electronics supply chain production phases: EXTRACTION SMELTING & REFINING and/or COMPONENTS MANUFACTURING FINAL MANUFACTURING 6 Methodology | How We Grade Companies To evaluate a company, we asked a set of 61 questions about its production policies and practices. The questions addressed the company’s management of mineral extraction, smelting and refining, and final manufacturing, and fall into four categories: At each supply chain level, we assessed the companies’ management systems in four categories: Policies Traceability & Transparency We evaluated the brand’s code of conduct, sourcing and subcontracting policies, and involvement with other organisations working to combat child and forced labour. We looked at how thoroughly the brand understands its own supply chain, and whether it discloses critical information to the public. Monitoring & Training Worker Rights We measured the adequacy of the brand’s monitoring program to address the specific issues of child and forced labour. We assessed the degree to which the brand supports worker well-being by ensuring that workers are able to claim their rights at work through collective bargaining or worker owned cooperatives, and whether workers earn a living wage. When conducting a brand evaluation, our research team first assessed a brand’s own publications alongside relevant independent reports and data such as third party audit findings and non-governmental organisation (NGO) publications. Next, we sent our questionnaire for information and comment directly to the company. Where they responded, we reviewed the evaluation again. We allot six to eight weeks for this process. Our grades take into account the prevalence of child and forced labour in the countries where the selected companies operate. Where companies source from suppliers in low risk areas, they are graded on a softer curve because it is expected that less stringent management systems are necessary to combat abuse in these regions, particularly where a strong national rule of law exists. It is important to note that due to the lack of access to on-the-ground information, we have gathered data on CSR systems and not on the actual working conditions they are designed to ameliorate. High grades do not necessarily represent supply chains free of child and forced labour or worker exploitation, but instead represent those that are better managed on a relative basis. Our grades are only an indication of the extent to which companies have developed a set of management systems that theoretically prevent abuses. As the Clean Clothes Campaign has stressed, the components of a CSR system will likely only create positive impact if used in conjunction with one another.[1] For example, a company can have strong written policies against modern slavery and gather information about supplier working conditions through in-depth monitoring, but unless it uses these standards and information to correct grievances, we would not expect it to create much impact on actual working conditions. The category grades represent the health of sections of a system rather than the system as a whole, and should be evaluated within this broader context. Methodology | How We Grade Companies Our assessments rank companies for their relative efforts. It is our hope that in the future, better standard practices will enable us to grade companies on a more rigorous curve. For more information on our risk assessments and broader methodology, see www.free2work.org Sources: [1] Clean Clothes Campaign, Looking for a Quick Fix: How Weak Social Auditing is Keeping Workers in Sweatshops, p.77, 1 November 2005 http://archive.cleanclothes.org/ documents/05-quick_fix.pdf Electronics Industry 2 The Problem: Child & Forced Labour This chapter provides a geographical overview of where child and forced labour are used in electronics production today. We use this information to understand companies’ specific supply chain risks. 8 Child & Forced Labour in Electronics Supply Chains | Overview Children and forced labourers can be found working at multiple stages of today’s electronics supply chains. In this section (pages 8-11), we explore specific instances of modern slavery in the manufacturing and extractives sectors. We give an overall picture of the documented cases of child and forced labour through a series of maps, and provide country spotlights for a specific look at selected issues. Child and Forced Labour in Electronics and Component Manufacturing Child and slave labour is not limited to the extractive stage of the electronics supply chain. The component and final production stages are also home to these abuses. Components manufacturing is the point at which the parts for electronics products are created. This includes items such as cables, hard disk drives and circuit boards. Components consist of various materials, including minerals, plastics and a variety of petroleum-based substances. The final production stage is manufacturing where electronic goods are assembled and finished prior to sale. In recent years, these stages of the electronics supply chain have received media attention due to the discovery of child and slave labour practices by various manufacturing suppliers. The following pages highlight a few key examples. Child and Forced Labour in Minerals Extraction The use of modern slavery is particularly prevalent in the extractives sector. Minerals that are often present in electronics such as gold, bauxite, halite, tin, tantalum, tungsten and lithium have been mined by either large mining companies exclusively, or by a combination of large mining companies and small independent producers known as Artisanal and Small-scale Miners (ASM). The ASM sector employs between 13-20 million people worldwide, predominantly in developing states, and is known to be highly vulnerable to the presence of child and forced labour as well as other forms of worker exploitation.[1] The poverty and informal work status common to ASM workers leave many susceptible to enslavement. Impoverished, illegal miners are unattractive formal loan candidates. These miners regularly borrow money from local loan sharks or ‘sponsors’ who oversee their mining operations and take a percentage of their income. As a direct result of these agreements, workers in the ASM sector can end up in indebted servitude, or ‘debt bondage’, a form of modern slavery. Research shows the ASM sector is also the most likely group of producers in the extractives industry to contain child labour. Children working in ASM suffer long-term physical and mental harm on account of their consequent exclusion from school, the arduous nature of the jobs they perform, and the dangerous substances they are regularly exposed to in the mining environment.[2] After minerals are extracted from the ground, they are traded and then smelted and refined. In the smelting and refining process minerals are isolated from their ores and purified. The smelting and refining process is particularly significant to the tracing or tracking of electronics supply chains. Smelting and refining amalgamates minerals from many different sources, and often combines minerals produced with child and slave labour with those that do not possess such a history. The ability to definitively trace the origins of minerals and determine the manner in which they were produced is, as a result, greatly complicated. This stage of the supply chain is also crucial for tracing the origin of minerals, and so the electronics industry’s efforts towards tracing the source of minerals by tracing smelters is encouraging. In the Traceability and Transparency section of this report (page 18) we look at initiatives that aim to increase the transparency surrounding smelters and refiners and preserve the origins of certain minerals. Sources: [1] Abbi Buxton, Responding to the challenge of artisanal and small-scale mining. How can knowledge networks help? p.1, 2013, IIED http://pubs.iied.org/pdfs/16532IIED.pdf? [2] Mining, Minerals and Sustainable Development, Global Report on Artisanal & Small Scale Mining p.24, 2002 http://pubs.iied.org/pdfs/G00723.pdf 9 Child & Forced Labour | in Electronics & Component Manufacturing China is the global leader in electronics manufacturing. Under-age children and forced labourers continue to be found working in export factories in China today, according to the US Department of State. Spotlight: China China’s electronics manufacturing sector is home to both child and forced labour. A number of NGOs and even the companies themselves have documented cases of abuse. For example, in 2012 China Labor Watch, a human rights advocacy NGO, released a report on the labour practices of HEG Electronics Co. Ltd., an electronics processing company and major Samsung supplier. They found that HEG regularly employed children under the age of 14 in its factories. Where is Child and Forced Labour Used? CHINA KEY: Countries known to use child and/or forced labour in electronics manufacturing (Source: DOL List of Goods Produced by Child Labor or Forced Labor, 2011) While most electronics companies do not report specific statistics on the existence of modern slavery in manufacturing facilities, Apple made a move toward transparency in this area in 2012 following press attention decrying its supply chain conditions. The company’s findings reveal something about the extent of the problem in the industry as a whole: in 2014 Apple reported that of the 451 facilities it audited, a total of eight supplier facilities used bonded labour and 11 facilities used child labour. Sources: China Labor Watch: Samsung Factory Exploiting Child Labor - Investigative Report on HEG Electronics (Huizhou) Co., Ltd Samsung Supplier, 2012 http://chinalaborwatch.files.wordpress.com/2012/08/samsung8-271.pdf Apple Supplier Responsibility 2014 Progress Report http://images.apple.com/ supplier-responsibility/pdf/Apple_SR_2014_Progress_Report.pdf 10 Child & Forced Labour | in Minerals Extraction Many of the devices we buy contain minerals extracted by people held in modern slavery. Below is a map of the top countries that extract seven main minerals (see key) found in electronics. The map on the next page shows where child and forced labour is used to extract these minerals. DR CONGO RUSSIA SWITZERLAND USA Coloured triangles represent countries that lead the world in the extraction of specific minerals (Source: FAOSTAT, 2011; British Geological Survey: World Mineral Production, 2007-2011) Where does mineral extraction take place? CANADA KEY: Gold Tungsten Tin Copper Cobalt Tantalum KAZAKHSTAN SPAIN MEXICO UKRAINE Iron MOROCCO Spotlight: Mali BRAZIL INDONESIA CHINA IRAN VIETNAM INDIA CUBA PERU GHANA SOUTH AFRICA ARGENTINA BOLIVIA MALAYSIA CÔTE D’IVOIRE ZAMBIA RWANDA MADAGASCAR ETHIOPIA AUSTRALIA NEW CALEDONIA Every country in Africa with an ASM sector is home to child labour as the two practices go virtually hand in hand. Gold mining regularly exposes ASM workers, including child labourers, to the elements arsenic and mercury. These chemicals can cause serious harm and can be fatal in high doses. In the gold mines of Mali up to 40,000 children mined this metal during 2011. It was regularly purchased by large trading firms residing in Switzerland and Dubai. 11 Child & Forced Labour | in Minerals Extraction Spotlight: Democratic Republic of the Congo Where is child and forced labour used in mineral extraction? SENEGAL MONGOLIA GUINEA INDONESIA MALI NORTH KOREA COLOMBIA These examples illustrate the extreme hardships endured by child labourers in the ASM sector. They also show the ease with which minerals mined by children can enter the market, and the supply chains of some of the electronics brands analysed in this report. BOLIVIA SURINAME NICARAGUA ECUADOR In 2008, a Bloomberg investigative report examined the prevalence of child labour within copper and cobalt mines in the Katanga province of the DRC. Copper is commonly used in the manufacture of electronic components, while cobalt is a key element of electrical devices. The reporter discovered that thousands of children worked in the mines, often in structurally dangerous conditions. Some children have died as a result of the work they were performing. The copper and cobalt mined by child labourers was purchased by nearby foreign-owned smelting plants, before being sold on to the world market. These refined minerals were eventually traced to the suppliers of some of the world’s largest electronics brands. BURKINA FASO PERU GHANA ETHIOPIA NIGER KEY: Red represents countries known to use child and/or forced labour in the extraction of one or more minerals (Source: DOL List of Goods Produced by Child Labor or Forced Labor, 2011) Sources: TANZANIA D R CONGO PHILIPPINES Human Rights Watch, A Poisonous Mix: Child Labour, Mercury and Artisanal Gold Mining in Mali, December 2011 http://www.hrw.org/reports/2011/12/06/poisonous-mix Simon Clark, Michael Smith and Franz Wild, ‘Child Workers Die Digging in Congo Mines for Copper’ Bloomberg, 22 July 2008 http://www. bloomberg.com/apps/news?pid=newsarchive&sid=aW8xVLQ4Xhr8 Electronics Industry Company Performance: Overview 3 A Motorola Solutions Woolworths Australia B Acer Apple Dick Smith Electronics* Hewlett Packard LG Electronics Motorola Mobility C Blackberry Dell Fujitsu Hitachi Ltd HTC* IBM* Intel* Lenovo* Oracle* Philips Toshiba D Amazon Kindle* Asus* Canon* Garmin Huawei* Nintendo Panasonic SanDisk* Sharp* TEAC* F Hisense* Kogan* Palsonic* Soniq* Microsoft Nokia Olympus Samsung Sony TomTom Company Performance: Overview 13 Company Performance | Visual Overview Performance on Key Indicators Policies See Policies section of report for details on indicators Performance on Key Indicators Traceability, Monitoring, Worker Rights See Traceability, Monitoring, and Worker Rights sections of report for details on indicators Final Manufacturing Smelting/ Components Extraction partial Toshiba Soniq* D- Tomtom Sharp* C TEAC* SanDisk* C- C D- C B- C+ Sony Samsung B C+ B Philips F Panasonic Palsonic* D B+ C- D Olympus B- Nokia Oracle* * = non responsive companies Woolworths Australia no Nintendo D- D- B+ B+ B yes KEY: Motorola Solutions Motorola Mobility Microsoft D- C- B LG Electronics D Lenovo* Huawei* C Kogan* HTC* F Intel* Hitachi Ltd B IBM* Hisense* Garmin D+ C Hewlett-Packard D B+ D- C- D- B- D Fujitsu Dick Smith Electronics* Dell Canon* Blackberry* Asus* B- Apple Grade Amazon Kindle* Company Acer The remaining sections of this report look at companies’ efforts in specific evaluation categories. The infographic below provides a visual overview of company performance - each column represents one company, and each small coloured bar corresponds to one indicator. “YES” (positive) answers are in green, and “NO” (negative) answers are in red. The rest of this report will go into detail on these indicators. Note that companies with higher grades are doing more to manage their supply chains at multiple levels. Electronics Industry Company Performance: Policies A 4 Motorola Solutions Woolworths Australia B Acer Apple Dick Smith Electronics* Hewlett-Packard LG Electronics Motorola Mobility C Blackberry Dell Fujitsu Hitachi Ltd HTC* IBM* Intel* Lenovo* Oracle* Philips Toshiba D Amazon Kindle* Asus* Canon* Garmin Huawei* Nintendo Panasonic SanDisk* Sharp* TEAC* F Hisense* Kogan* Palsonic* Soniq Microsoft Nokia Olympus Samsung Sony TomTom Company Performance: Policies This chapter focuses on companies’ policies to address child and forced labour in their supply chains. While good policies do not necessarily mean good practices, they are a critical starting point. They form the backbone of management systems that uphold worker rights and protect against abuses. We use a set of indicators to assess each company’s code of conduct, sourcing and subcontracting policies, and involvement with other organisations working to combat modern slavery. Policies | Industry Overview Of the 39 electronics companies assessed: 15% Partial 82% have a code of conduct that covers core ILO principles and Rights at Work 10% Partial 20% 3% Partial have a policy addressing subcontracting and homework Codes of Conduct A Code of Conduct lays out minimum social requirements suppliers must follow. Good codes are based on internationally agreed upon standards. The International Labour Organization’s (ILO) Four Fundamental Principles and Rights at Work define clear principles for prohibitions against child labour, forced labour and discrimination, and guarantees for worker rights to freedom of association and collective bargaining. Among the companies we assessed, it was encouraging to see that a majority - two thirds - have Codes of Conduct that align at minimum with these basic principles. 44% of the companies assessed had adopted the Electronics Industry Citizenship Coalition (EICC) Code of Conduct, which prohibits the use of child and forced labour and addresses the common roots of human trafficking. However, it fails to include the right to collective bargaining. Responsible Purchasing have taken steps to use responsible purchasing practices 41% The following statistics provide a snapshot overview of the existence of policies in the electronics industry to protect against exploitation, child labour and forced labour. They are based on the scorecards of the 39 companies we assessed, which can be viewed in more detail on the next page. The way a company purchases from its subcontracted factories and suppliers affects those businesses’ ability to provide decent and safe conditions for workers. When brands deliberately foster intense competition, workers may suffer as suppliers seek to win contracts by depressing labour costs, such as wages and overtime payments. Only 10% of the companies assessed Samsung, LG, Motorola and Microsoft - guarantee a decent price or alternatively take measures to financially enable their suppliers to ensure decent working conditions. Subcontracting Policies It is common practice for suppliers to subcontract out parts of companies’ orders to unauthorised, unmonitored facilities where workers may be left without any redress in the event of abuse. These workers are some of the most vulnerable within the electronics industry. 41% of companies assessed say they are taking some steps to ensure the code of conduct standards are implemented in subcontracting arrangements. 15 16 Policies | Company Performance Scorecard Here is a more detailed look at our policies questionnaire. See how companies performed on specific indicators. KEY: yes partial no Code of Conduct Q1 Each coloured bar represents one indicator. Not all indicators in the Free2Work questionnaire are depicted in this graphic. Does the brand have a code that addresses labour standards? Q2 Does the code include elimination of child labour? Q3 Does the code include abolition of forced or compulsory labour? * = non responsive companies Q4 Does the code include freedom of association? Q5 Does the code include rights to collective bargaining? Q6 Does the code prohibit discrimination on the basis of personal attributes or affiliations? Q7 Does the code prohibit use of regular and excessive overtime? Are suppliers required to ensure freedom of movement for Q8 employees and their right to leave and enter work voluntarily? Q9 Are suppliers prohibited from using recruitment fees? Q10 Does the code apply to multiple levels of the supply chain? Q11 Is the code included in supplier contracts? Policies Q1 Does the brand have a policy of non-interference toward trade unions and worker organising? Q2 Does the brand participate in any multi-stakeholder initiatives? Has the brand taken steps to use responsible purchasing Q3 practices? Acer *Amazon Kindle Apple *Asus *Blackberry *Canon Dell *Dick Smith Electronics Fujitsu Garmin Hewlett-Packard *Hisense Hitachi Ltd *HTC *Huawei *IBM *Intel *Kogan *Lenovo LG Electronics Microsoft Motorola Mobility Motorola Solutions Nintendo Nokia Olympus *Oracle *Palsonic Panasonic Philips Samsung *SanDisk *Sharp *Soniq Sony *TEAC TomTom Toshiba Woolworths Australia Does brand have a policy that addresses subcontracting in Q4 the supply chain (including homework)? Policies Grade: B D B D C D C B C D B F C C D C C F C B B B A D B B C F D C B D D F B D B C A Policies | Good Practice Highlights Winners & Losers The following are more detailed snapshots of two companies’ good practices in the Policies category. Company Performance: Policies Collective Bargaining: Nokia Recruitment Fees: Apple Of all companies assessed, only Nokia provided evidence of factories that have collective bargaining agreements in place. History has demonstrated that collective bargaining and freedom of association are essential methods for workers to balance bargaining power in employment relations and negotiate for improved pay and working conditions. This is particularly important for workers in developing countries who undertake low-skilled work in regions where there is frequently a surplus of labour. These conditions dramatically weaken their negotiating power and make them vulnerable to exploitation and modern forms of slavery. Workplaces where employees are empowered through processes like collective bargaining will significantly mitigate these risks. Apple requires suppliers to reimburse excessive recruitment fees charged to contract workers found working on Apple products.[1] In exchange for employment, labour brokers often charge potential contract workers recruitment fees. Where these recruitment fees are excessive, prospective employees may find themselves with large debts before they start work. These debts, compounded by high interest rates, can leave workers paying a high proportion of their income in an attempt to pay these debts. Workers are often not allowed to leave until the debts are paid off, and this can result in situations of bonded labour. The EICC Code of Conduct prohibits charging workers excessive recruitment fees. Apple defines excessive recruitment fees as amounts in excess of one month’s wages.[2] In 2014, they reported that $US3.9 million was paid by their suppliers to workers who were charged excessive recruitment fees and since 2008, their suppliers have reimbursed contract workers $16.9 million.[3] Beyond this, collective bargaining is also one of the ILO’s Four Fundamental Principles and Rights at Work. It is concerning that only one third of companies had policies that included the right to collective bargaining, and only one company provided evidence that collective bargaining was occurring. Without the presence of worker representative organisations, rights to freedom of association and collective bargaining risk becoming rights in theory only. We encourage the electronics industry to embrace policies that promote collective bargaining and ensure that organisations allowing this to occur are in place. A Next, we encourage Apple to ensure that reimbursements are made available to more workers within its supply chain as there continue to be reports of workers who have not had recruitment fees returned to them.[4] It could also take further steps to entirely ban suppliers and labour brokers from charging recruitment fees to workers. Sources: [1] Apple Supplier Responsibility Progress Report 2014 p.15. [2] Apple Supplier Responsibility Standards, Version 4.0 [3] Apple Supplier Responsibility Progress Report 2014 p.15 [4] China Labor Watch, Apple’s Unkept Promises, July 2013. https://www.chinalaborwatch.org/pro/proshow-181.html 17 Motorola Solutions Woolworths Australia B Acer Apple Dick Smith Electronics* Hewlett-Packard LG Electronics Motorola Mobility C Blackberry Dell Fujitsu Hitachi Ltd HTC* IBM* Intel* Lenovo* Oracle* Philips Toshiba D Amazon Kindle* Asus* Canon* Garmin Huawei* Nintendo Panasonic SanDisk* Sharp* TEAC* F Hisense* Kogan* Palsonic* Soniq Compare to Wage Impact: Companies that guarantee above local minimum wage Microsoft Nokia Olympus Samsung Sony TomTom ONE Electronics Industry Traceability & Transparency Scores: A Apple Dell Hewlett-Packard Intel* LG Electronics Microsoft B Acer Motorola Solutions Philips Samsung Sharp* Toshiba C Blackberry Garmin Hitachi Ltd IBM* Olympus D Amazon Kindle* Asus* Canon* Dick Smith Electronics* Fujitsu HTC* F Hisense* Palsonic* TEAC* Motorola Mobility Nokia Panasonic 5 Company Performance: Traceability & Transparency SanDisk* Sony TomTom Woolworths Australia Huawei* Kogan* Lenovo* Nintendo Oracle* Soniq* This chapter focuses on electronics companies’ supply chain traceability and transparency. It looks at how 39 companies perform in this category and highlights specific good practices. Traceability & Transparency | Industry Overview Of the 39 electronics companies assessed Percentage of companies that have fully traced their suppliers for final stage and components manufacturing, and percentage of suppliers that have partially traced their suppliers for minerals extraction: Final Stage Production - 49% Components Manufactoring - 26% Partial Tracing for Minerals Extraction - 18% Surprisingly, many companies do not know exactly who produces their goods. Since child labour, forced labour and exploitation are used in electronics manufacturing, components manufacturing, smelting and mineral extraction globally, it is critical that companies know the actors in each stage of their supply chain to guard against such abuses. Public transparency is also important because it shows a company’s willingness to be held accountable to both workers and consumers. We define traceability as the extent to which a company understands its supply chain, and transparency as the extent to which it makes information publicly available. The statistics below reveal how the 39 companies assessed perform in three key traceability and transparency areas. Known Suppliers We believe it is the responsibility of companies to know the identity of their suppliers. Without this knowledge, it is impossible for brands to ensure the labour rights of the people who make their products. While there is still much work to be done, traceability is one of the electronics industry’s areas of strongest performance. Almost half (49%) of all companies assessed have traced all or almost all of their suppliers responsible for the final stage of manufacturing; 26% have done the same for their components manufacturing; and, while none have completely traced their mineral extraction, 59% of companies are involved in tracing projects to better understand their mineral suppliers in order to avoid sourcing conflict minerals from the DRC. With respect to minerals tracing, there is room for improvement. Most of these traceability efforts are model projects that focus on a select few suppliers. Only 18% of companies directly traced some suppliers in the extractive stage through these pilot projects, including ‘Solutions for Hope’ which is a closed-pipe tantalum supply chain project and the ‘Conflict Free Tin Initiative’. Public Supplier Lists 28% of companies assessed publish at least some supplier names In the fight against child labor, forced labor and exploitation, it is vital that companies produce public supplier lists. Such lists increase the transparency surrounding industries, and enable companies to be held accountable to workers in their supply chains. Transparency also enables independent groups to shed light on working conditions, which can in turn facilitate better public understanding of the issues and consumer demand for change. Only 28% of brands we assessed provide public supplier lists, and of those, only Apple and Hewlett-Packard provide a comprehensive public list of suppliers at the final manufacturing stage with both names and addresses. Dell also has a comprehensive public list of 95% of its suppliers including links to their websites and sustainability programs where they exist. 19 20 Traceability & Transparency | Industry Overview Tracing Projects Of the 39 electronics companies assessed 59% are involved in a project to trace minerals suppliers The majority of companies we assessed are working to trace their supply chains, in most cases to prevent the sourcing of conflict minerals. Conflict minerals are those that emanate from places where an internationallyrecognised conflict is occurring. The Democratic Republic of the Congo, where an ongoing civil war has claimed 5 million lives [1] is the leading source of the world’s conflict minerals: tin, tungsten, tantalum and gold (known collectively as 3TG). Many conflict mines use child and forced labourers, and also host other forms of modern slavery such as sexual slavery and forced marriage. Children work in particularly hazardous conditions as diggers, porters, and mineral extractors. Many are forced to work in narrow mine shafts where their small bodies fit better than adult ones. The 2010 Dodd-Frank Reform Act (US) requires companies that use any of these four minerals to learn more about their supply chains and report to the Securities and Exchange Commission. In order to comply with this new law, companies must prove that they have taken reasonable precautions to avoid these four minerals originating in the DRC and surrounding countries. The majority of these are engaged with the anti-conflict mineral partnership of the EICC and the Global e-Sustainability Initiative (GeSI). The EICC and GeSI have established two tools that companies can use to check the conflict-free status of their supply chains: the Conflict Minerals Reporting Template and the Conflict-Free Smelter (CFS) Program. The Reporting Template is a survey that companies can ask their suppliers to complete. Suppliers fill in information related to the minerals they use, the products they create, and the smelters from which they source. If accurately completed, the surveys can provide valuable information about the firms from which they directly and indirectly source. The CFS Program, on the other hand, audits smelters and refiners who elect to participate; firms are evaluated on the steps they take to avoid purchasing and/or processing conflict minerals. Those that participate are publicly classified as ‘conflict-free’. Sources: [1] International Rescue Committee, Mortality in the Democratic Republic of the Congo: An Ongoing Crisis 2006-2007. http://www.rescue.org/sites/default files/resource-file/2006-7_congoMortalitySurvey.pdf 21 Traceability & Transparency | Company Performance Scorecard KEY: Here is a more detailed look at our Traceability & Transparency questionnaire. See how companies performed on specific indicators. yes partial no Each coloured bar represents one indicator. Not all indicators in the Free2Work questionairre are depicted in this graphic. * = non responsive companies Q1 Is there a public list of countries in which suppliers are located? Q2 Is there a public list of suppliers? Final Manufacturing Smelting/ Components Q3 Does the brand have a system to make sure subcontractors are known? Q4 Does the brand track suppliers’ use of temporary or contract workers? Q1 Has the brand traced all or almost all of its smelters or components manufacturers? (partial = some directly traced) Q2 If not fully traced, is the brand involved in a tracing project to locate unknown suppliers? Q3 Is there a public list of countries in which suppliers are located? Q4 Is there a public list of suppliers? Q1 If not fully traced, is brand involved in a tracing project to Q2 locate unknown suppliers? Q3 Is there a public list of countries in which suppliers are located? Q4 Is there a public list of suppliers? Acer *Amazon Kindle Apple *Asus *Blackberry *Canon Dell *Dick Smith Electronics Fujitsu Garmin Hewlett-Packard *Hisense HitachiLtd *HTC *Huawei *IBM *Intel *Kogan *Lenovo LG Electronics Microsoft Motorola Mobility Motorola Solutions Nintendo Nokia Olympus *Oracle *Palsonic Panasonic Philips Samsung *SanDisk *Sharp *Soniq Sony *TEAC TomTom Toshiba Woolworths Australia Extraction Has the brand traced all or almost all of its suppliers at one raw materials level? (partial = some directly traced) Traceability & Transparency Grade: B D A D C D D A D D C A F C D D C A D D A A A B D A C D F A B B C B D C F C B C Traceability & Transparency | Good Practice Highlights Winners & Losers The following are more detailed snapshots of two companies’ good practices in traceability and transparency. Traceability is the extent to which a company knows its supply chain. Transparency is the extent to which it makes information publicly available. Traceability & Transparency Scores: Mineral Tracking Initiative: Motorola Solutions Transparency: Philips, Hewlett-Packard, SanDisk and Apple In 2011, Motorola Solutions, in partnership with AVX Corporation, established ‘Solutions for Hope’, an initiative that sources conflict-free tantalum from the DRC. In establishing this project, Motorola has recognised that not all minerals sourced from the DRC or adjoining countries are actually fuelling the conflict. In many parts of the DRC, minerals are mined by members of the ASM sector who are not associated with the fighting, and depend on these natural resources for their livelihoods. In 2012, it was estimated that 20% of the population of the DRC was either working in the ASM sector, or living off ASM generated income.[1] A blanket boycott of all DRC minerals therefore has the capacity to seriously harm the livelihoods of a large number of people. Solutions for Hope has established a ‘closed-pipe supply line,’ in which carefully selected conflictfree tantalum miners in the DRC supply the mineral to participating firms. This enables these miners to operate free of the general constraint imposed by the U.S. Securities Exchange Commission’s anti-conflict mineral regulations, while also providing them with a regular, reliable income. So far, Solutions for Hope has resulted in 145 metric tonnes of conflict-free tantalum from the DRC entering the market[2]. This mineral tracking scheme provides cooperating companies with an unparalleled ability to trace the origins of at least a portion of the tantalum they use. Philips, Hewlett-Packard and SanDisk have been industry leaders in the area of transparency by making public their full list of smelters, which are crucial in tracing the origin of minerals. In 2014 Apple joined the initiative. These companies are now better able to manage the risks of child and forced labour in the portion of their supply chain they have traced. These companies publish the identity of their suppliers, which is critical as it enables independent groups investigating working conditions to highlight any concerns found in the supply chain. This level of transparency was unheard of in the electronics industry only three years ago. Beyond business interests, companies may fear that furnishing public supplier lists could expose them to criticism if a supplier is discovered violating labour rights. However, disclosure of suppliers this deep into the supply chain reflects the commitment of these companies to being genuinely open and transparent. In addition to Motorola Solutions, other companies in this report involved in this initiative include: Motorola Mobility, Nokia, Intel, Hewlett-Packard and Blackberry. A Apple Dell Hewlett-Packard Intel* LG Electronics Microsoft B Acer Motorola Solutions Philips Samsung Sharp* Toshiba C Blackberry* Garmin Hitachi Ltd IBM* Olympus D Amazon Kindle* Asus* Canon* Dick Smith Electronics* Fujitsu HTC* F 22 Motorola Mobility Nokia Panasonic SanDisk* Sony TomTom Woolworths Australia Huawei* Kogan* Lenovo* Nintendo Oracle* Soniq Hisense* Palsonic* TEAC* Sources: [1] G. Franken ‘Certified Trading Chains in Mineral Production: A Way to Improve Responsibility in Mining’ in Non-Renewable Resource Issues: 213 Geoscientific and Societal Challenges, p.215 http://web.mit.edu/12.000/www/ m2016/pdf/certifiedtradingminerals.pdf [2] Solutions For Hope Website/ Results http://solutions-network.org/sitesolutionsforhope/results/ Compare to Wage Impact: Companies that guarantee above local minimum wage Only NOKIA Electronics Industry Monitoring Scores: Motorola Mobility Samsung Toshiba A Acer Apple LG Electronics Microsoft B Dell Hewlett-Packard Intel* Motorola Solutions C Blackberry* Garmin Hitachi Ltd IBM* SanDisk* D Amazon Kindle* Asus* Canon* Dick Smith Electronics* Fujitsu HTC* F Hisense* Kogan* Palsonic* Soniq* TEAC* Nokia Panasonic Philips 6 Company Performance: Monitoring Sharp* Sony TomTom Woolworths Australia Huawei* Lenovo* Nintendo Olympus* Oracle* This chapter focuses on electronics companies’ monitoring and training programs, which can be important parts of preventative systems. It looks at how 39 companies perform in this category and highlights specific good practices. 24 Monitoring & Training | Industry Overview Audits are tools companies can use to gain snapshots of suppliers’ working conditions and to identify major abuses including the use of modern-day slavery. Workers themselves are among the best monitors, since they are present when auditors cannot be. Accurate information can often only be gathered by interviewing workers off-site and away from management, where workers feel comfortable to express concerns. The most replicable model (one that is under-utilised) is one where workers are organised into a functioning union with access to a safe and effective grievance process. While audits can be a key element for ensuring compliance, they are by nature only effective when the information gathered is used to improve working conditions. Audits can form the basis for corrective action plans which suppliers can use to correct issues. Many suppliers lack the capacity or knowledge to provide certain protections to workers, which is why training programs can be an important tool. % of all companies assessed that use auditing # of companies that use internal monitoring, broken down by % of suppliers monitored by supply chain level’ 4 0% 4 1-25% 62% 26-50% Twenty four (62%) of the brands we assessed use their own internally developed monitoring systems to investigate suppliers to some extent. These internal systems vary in quality and are not necessarily better or worse than third party audits. 2 12 51-75% 17 76-100% Internal Systems Of the 39 electronics companies assessed % of companies that use third party monitoring (FM) Auditing Suppliers % of companies that monitor more than 75% of suppliers annually, by supply chain level Minerals - 0% 12 1-25% 56% 5 26-50% 51-75% Third Party Systems Twenty-two companies use a third party auditor to monitor at least a portion of their supply chains. Many of these brands also use internal systems. Third party monitoring systems, like internal ones, differ significantly in quality. 17 0% 1 4 76-100% Final Manufacturing (FM)- 15% Smelting/ Components - 3% # of companies that use third party monitoring, broken down by % of suppliers monitored with this system Quality of Audit % of companies that audit suppliers unannounced or with off-site worker interviews (FM) % of companies that monitor more than 75% of suppliers annually, by supply chain level 77 0% 20 1-25% 24% 26-50% 0 51-75% 3 76-99% 0 0 100% Unannounced audits can provide a more accurate picture of day-to-day operations because abuses cannot be as easily hidden without advanced warning. Workers are best able to express concerns when interviewed offsite, away from management. Only 24% of the assessed brands report using unannounced visits and/or off-site interviews to conduct at least a portion of their audits, with Samsung being significantly more rigorous in its use of these measures than others (see ‘good practice highlight’ below). Given that more than three quarters of the electronics companies we assessed aren’t engaging in these practices, improving the quality of auditing practices is an area in need of significant attention by the industry. 25 Monitoring & Training | Company Performance Scorecard KEY: Here is a more detailed look at our Monitoring and Training questionnaire. See how companies performed on specific indicators. yes partial no Each coloured bar represents one indicator. Not all indicators in the Free2Work questionairre are depicted in this graphic. * = non responsive companies Q1 Does the brand monitor at least 75% of its suppliers annually? (Partial = some monitored) Does the brand monitor at least 75% of its suppliers with Q2 unannounced visits or off-site worker interviews? (Partial = some) Final Manufacturing Q3 Does the brand share audit reports and corrective action plans publicly? (Partial = some) Q4 Are both auditors and factory managers trained to identify human trafficking, child labour and forced labour? Q5 Does the brand invest in supplier compliance implementation through training and other financial support? Q1 Does the brand monitor at least 75% of its suppliers annually? (Partial = some monitored) Does the brand monitor at least 75% of its suppliers with Q2 unannounced visits or off-site worker interviews? (Partial = some) Smelting/ Components Q3 Does the brand share audit reports and corrective action plans publicly? (Partial = some) Q4 Does the brand invest in supplier compliance implementation through training and other financial support? Q1 Does the brand monitor at least 75% of its suppliers annually? (Partial = some monitored) Does the brand monitor at least 75% of its suppliers with Q2 unannounced visits or off-site worker interviews? (Partial = some) Q3 Does the brand share audit reports and corrective action plans publicly? (Partial = some) Q4 Does the brand invest in supplier compliance implementation through training and other financial support? Acer *Amazon Kindle Apple *Asus *Blackberry *Canon Dell *Dick Smith Electronics Fujitsu Garmin Hewlett-Packard *Hisense HitachiLtd *HTC *Huawei *IBM *Intel *Kogan *Lenovo LG Electronics Microsoft Motorola Mobility Motorola Solutions Nintendo Nokia Olympus *Oracle *Palsonic Panasonic Philips Samsung *SanDisk *Sharp *Soniq Sony *TEAC TomTom Toshiba Woolworths Australia Extraction Monitoring & Training Grade: A D A D C D D B D D C B F C D D C B F D A A A B D B D D F B B A C C F C F C A C Monitoring & Training | Good Practice Highlights Winners & Losers The following are more detailed snapshots of two companies’ good practices in monitoring and training. Monitoring Scores: Monitoring: Samsung Training: Hewlett-Packard Samsung conducts on-site internal audits for 100% of its factories responsible for the final assembly of its products each year, with up to a quarter of those factories also being audited by a third party through the EICC. Furthermore, Samsung claims to audit between half and three quarters of their suppliers with either unannounced audits or with off-site worker interviews. From research into the impact of auditing in other industries, we know that the quality of social audits is crucial to their effectiveness at detecting incidences of modern slavery and worker exploitation.[1] Unannounced audits and off site worker interviews are one of the most effective measures to get a genuine picture of what is happening at the factory level. Only 24% of companies were using these measures in their auditing, and with the exception of Samsung, they were only using them to audit a quarter of their supply chain or less. Samsung could further improve on the good work it is already doing by extending the use of these measures to its components suppliers and by making audit reports and corrective action plans public. Hewlett-Packard is the first electronics company to introduce specific supplier guidelines for the use of student and dispatch workers. These workers are highly vulnerable to exploitation. There are a number of reports arising out of electronics factories of their use of child labour. Workers with temporary employment arrangements are similarly more vulnerable to exploitation, and are less likely to raise complaints about working conditions since their employment is easier to terminate. The training that Hewlett-Packard provides, aids suppliers at both the final manufacturing and components manufacturing stages in understanding the issues faced by dispatch and migrant workers. In its 2011 Global Citizenship Report, HewlettPackard attributed improvements in suppliers’ audit performances to the training programs it had undertaken. These efforts are to be applauded and highlight the ways in which a company may engage with suppliers to deal with working conditions beyond the standard cycle of social audits and corrective action plans. Providing suppliers with training is one way to encourage deeper understanding of workers’ rights and to equip factories to identify the challenges faced by known vulnerable groups. Source: [1] Clean Clothes Campaign, How Weak Social Auditing is Keeping Workers in Sweatshops http://www.cleanclothes.org/resources/publications/05-quick-fix pdf/view A Acer Apple LG Electronics Microsoft Motorola Mobility Samsung Toshiba B Dell Hewlett-Packard Intel* Motorola Solutions C Blackberry* Garmin Hitachi Ltd IBM* SanDisk* D Amazon Kindle* Asus* Canon* Dick Smith Electronics* Fujitsu HTC* F Hisense* Kogan* Palsonic* Soniq* TEAC* Compare to Wage Impact: 26 Nokia Panasonic Philips Sharp* Sony TomTom Woolworths Australia Companies that guarantee above local minimum wage Huawei* Lenovo* Nintendo Olympus* Oracle* ONE Electronics Industry Worker Rights Scores: A B Garmin Nokia C Apple LG Electronics Panasonic Samsung D Acer Dell Fujitsu Hewlett-Packard Hitachi Ltd Intel* Microsoft Motorola Mobility Motorola Solutions F 7 ------------------ Company Performance: Worker Rights Olympus Oracle* Philips SanDisk* Sony TomTom Toshiba Woolworths Australia Amazon Kindle* Asus* Blackberry* Canon* Dick Smith Electronics* Hisense* HTC* Huawei* IBM* Kogan* Lenovo* Nintendo Palsonic* Sharp* Soniq* TEAC* This chapter focuses on the degree to which companies support worker rights. It looks at how 39 companies perform in this category and highlights specific good practices. Worker Rights | Industry Overview Of the 39 electronics companies assessed Risks of modern-day slavery are far less in workplaces where individuals are able to claim their rights at work through organising, and where workers do not suffer from poverty wages. Most workers in electronics supply chains toil under poor conditions and are paid extremely low wages. We look at whether companies are actively addressing worker well-being. The statistics below reveal how the 39 electronics companies we assessed perform in two key Worker Rights areas. 5% Partial Preferred Supplier Programs 33% base sourcing decisions on supplier labour conditions (FM level) Companies may possess policies and codes of conduct, but they will have little genuine impact if there is no incentive for suppliers to adhere to them. Companies have the financial leverage to demand and ensure decent working conditions including living wages, particularly by concentrating their order volumes with a sufficiently narrow set of suppliers in order to command a significant portion of a supplier’s product capacity. All of the brands in this report have codes of conduct that espouse the protection of worker rights. However we found that only 38% of sourcing decisions at the final manufacturing stage were based on supplier maintenance of such standards. Such systems should provide incentives to suppliers to continue improving labour standards. 13% Partial Grievance Mechanisms 31% have at least a pilot grievance mechanism project (FM level) Grievance mechanisms are systems through which workers can anonymously submit complaints of violations of their rights and seek relief. While some companies ask their suppliers to establish internal grievance mechanisms, it is important that workers are given an avenue through which they can communicate to an external party, since the supplier may be directly responsible for the abuse. Among the companies assessed, 31% reported having a formal grievance mechanism available to some portion of their supply chain. 28 29 Worker Rights | Company Performance Scorecard KEY: yes Here is a more detailed look at our Worker Rights questionnaire. See how companies performed on specific indicators. Q1 Q3 Q4 Are collective bargaining agreements in place? Q5 Q6 Q7 Q8 Q1 Q2 Q3 Smelting/ Components Extraction Does the brand have a functioning grievance mechanism (may be a pilot project)? Does the brand have any systems or policies in place to rehabilitate child or forced labourers if discovered? When child or forced labour is removed from the workplace, is it later verified by unannounced monitoring? If child labour is discovered, does the brand find a way to provide for the child’s education and replace the lost income to the family? Does the brand guarantee that workers make a living wage? Does the brand have a system for basing sourcing decisions on supplier labour conditions? Has the company identified independent, democratically elected unions in at least 50% of suppliers? (partial=some) Q4 Are collective bargaining agreements in place? Q5 Does the brand have a functioning grievance mechanism (may be a pilot project)? Does the brand have any systems or policies in place to rehabilitate child or forced labourers if discovered? Q6 Each coloured bar represents one indicator. Not all indicators in the Free2Work questionairre are depicted in this graphic. Q1 Does the brand guarantee that workers make a living wage? Q2 Does the brand have a system for basing sourcing decisions on supplier labour conditions? Q3 Are collective bargaining agreements in place? Q4 Does the brand have a functioning grievance mechanism (may be a pilot project)? Q5 Does the brand have any systems or policies in place to rehabilitate child or forced labourers if discovered? Acer *Amazon Kindle Apple *Asus *Blackberry *Canon Dell *Dick Smith Electronics Fujitsu Garmin Hewlett-Packard *Hisense HitachiLtd *HTC *Huawei *IBM *Intel *Kogan *Lenovo LG ELectronics Microsoft Motorola Mobility Motorola Solutions Nintendo Nokia Olympus *Oracle *Palsonic Panasonic Philips Samsung *SanDisk *Sharp *Soniq Sony *TEAC TomTom Toshiba Woolworths Australia Final Manufacturing Worker Rights & Remidiation Grade: no * = non responsive companies Does the brand guarantee that workers make a living wage? Does the brand have a system for basing sourcing decisions on supplier labour conditions? Has the company identified independent, democratically elected unions in at least 50% of suppliers? (partial=some) Q2 partial D F C F F F D F D B D F D F F F D F F C D D D F B D D F C D C D F F D F D D D Worker Rights | Good Practice Highlights Winners & Losers The following are more detailed snapshots of three companies’ good practices in the worker rights category. Worker Rights Scores: Living Wage: Nokia Fair Pricing (Non-Implemented): FairPhone Nokia was the only brand we examined which demonstrated that any of their workers are paid a living wage. As discussed previously on page 5, wages are a crucial concern for workers, and one of the most significant indicators of worker well-being. Nokia provided us with a third party audit report demonstrating the steps they undertook to conduct a basic needs analysis on the living costs of employees. They also provided a comparison that looked at the wages workers receive, the legal minimum wage, and living wage calculations of local NGOs and trade unions. Nokia has undertaken this analysis for a number of their factories, but not all; and, accordingly, have been awarded partial credit. This is one of the most significant initiatives we have seen amongst electronics companies, and one that would be well worth replicating across the sector. FairPhone is a social business that is in the early phases of building what the organisation calls a “fair(er)” smartphone. At the time of publishing FairPhone had only just released their first batch of phones, and as this initiative is still in its infancy we have not yet evaluated their operations. We do, however, look forward to seeing its progress. FairPhone will face an uphill battle in creating a decent supply chain because of its size. An employee notes, “We know we can’t change the system overnight as a small player with little leverage, but we think we have to make it tangible by raising awareness and making step-by-step interventions.” We applaud FairPhone’s examination of supply chain issues like fair pricing for Cobalt - something the industry as a whole, which collectively has far greater leverage, should tackle. We will watch with interest as this small company attempts to progressively take these steps - steps that will only be possible if consumers provide the demand for the company to grow and gain greater leverage over its developing supply chains. Grievance Mechanism: Microsoft In 2011, Microsoft, the world’s largest software corporation, initiated a new grievance mechanism - a hotline that workers can access 24 hours a day, seven days a week to voice concerns. It is the only system of its kind in the electronics industry. The hotline came out of Microsoft’s collaboration with the Fair Labor Association and the Clear Voice Hotline, organisations that seek to improve conditions for workers by increasing, respectively, supply chain transparency and channels of communication available to workers. It is unclear to what extent Microsoft has informed its supply chain workers about the hotline or how the company will follow up in the event of a grievance. These actions will be critical to the hotline’s effectiveness. A ------------------ B Garmin Nokia C Apple LG Electronics Panasonic Samsung D Fairphone: About http://www.fairphone.com/about/ F Compare to Wage Impact: Acer Dell Fujitsu Hewlett-Packard Hitachi Ltd Intel* Microsoft Motorola Mobility Motorola Solutions Amazon Kindle* Asus* Blackberry* Canon* Dick Smith Electronics* Hisense* HTC* Huawei* Companies that guarantee above local minimum wage 30 Olympus Oracle* Philips SanDisk* Sony TomTom Toshiba Woolworths Australia IBM* Kogan* Lenovo* Nintendo Palsonic* Sharp* Soniq* TEAC* ONE 31 Index | Brand List Company Name Brand Grade Living Wage Company Name Brand Grade Living Wage AcerAcer B- NO Motorola Mobility Motorola Mobility B Apple B+ NO Motorola Solutions Motorola Solutions B-NO Asus*Asus* D- NO NintendoNintendoDNO Research in Motion* Blackberry* C- NO Nokia Research in Motion* Research in Motion* C- NO OlympusOlympusB- CanonCanon* D- NO Oracle D NO Dell Dell B- NO PalsonicPalsonic* F NO Dell Alienware B- NO PanasonicPanasonicB NO Dick Smith Electronics Dick Smith Electronics* D NO PanasonicSanyo B NO Fujitsu Fujitsu D+ NO PhilipsPhilipsC+ GarminGarmin C NO Samsung Hewlett-Packard B NO SanDiskSanDisk* C- NO HisenseHisense* F NO SharpSharp* C NO Hitachi Hitachi C NO SoniqSoniq* D- NO HTC HTC* D NO Sony Huawei Huawei * D- NO TEACTEAC* D- NO IBM IBM* C- NO TomTomTomTomC NO Intel Intel* B NO ToshibaToshibaB- NO Amazon Amazon Kindle* D NO Woolworths Australia AWA C+ NO Kogan Kogan* D- NO Woolworths Australia Essentials C+ NO LenovoLenovo* D- NO Woolworths Australia Abode C+ NO LG Electronics LG Electronics B+ NO Woolworths Australia Woolworths C+ NO Microsoft Microsoft B+ NO Apple Hewlett-Packard Nokia Oracle* Samsung Sony B+ B C NO PARTIAL NO NO NO NO 32 Index | Brands By Grade Company Name Brand Grade Living Wage Nokia Nokia B+ Apple Apple B+ LG Electronics LG Electronics Microsoft Company Name Brand Grade Living Wage SharpSharp* C NO NO Sony C NO B+ NO TomTomTomTom C NO Microsoft B+ NO IBM IBM* C- NO Intel Intel* B NO Research in Motion* Blackberry* C- NO Hewlett-Packard Hewlett-Packard B NO Research in Motion* Research in Motion* C- NO Motorola Mobility Motorola Mobility B NO SanDiskSanDisk* C- NO PanasonicPanasonicB NO Fujitsu Fujitsu D+ NO PanasonicSanyo B NO Amazon Amazon Kindle* D NO Samsung B NO Dick Smith Electronics Dick Smith Electronics* D NO AcerAcerB- NO HTC HTC* D NO Samsung PARTIAL Sony Dell Dell B- NO NintendoNintendo DNO Dell Alienware B- NO Oracle D NO Motorola Solutions Motorola Solutions B-NO Asus*Asus* D- NO Oracle* OlympusOlympusB- NO CanonCanon* D- NO ToshibaToshibaB- NO Huawei Huawei * D- NO PhilipsPhilipsC+ NO Kogan Kogan* D- NO Woolworths Australia AWA C+ NO LenovoLenovo* D- NO Woolworths Australia Essentials C+ NO SoniqSoniq* D- NO Woolworths Australia Abode C+ NO TEACTEAC* D- NO Woolworths Australia Woolworths C+ NO HisenseHisense* F NO GarminGarminC NO PalsonicPalsonic* F NO C NO Hitachi Hitachi Thank You | Our Team Of Volunteers We would like to thank our team of volunteers who contributed many hours of research for this report over the past two years: · Abigail Blenkin · Alison McGill · Andrew Miller · Andrew Roberts · Eliza Whalley · Emily Saunders · Hugh Morgan · Jasmin Howorth · Jay Boolkin · Jill Wardrop · Julie Seymour · Lenny Elario · Liesje Barratt · Marianne Ibrahim · Mark Kelen · Melinda Woodhouse · Michael Williams · Minusha Balacharige · Naomi Fraser · Nicky Mathieson · Paul Atkinson · Sarah Hando · Sarah Martin · Tanya Fenwick · Teresa Leone · Una McGeehan · Yolande Kyngdon Thank you! 33

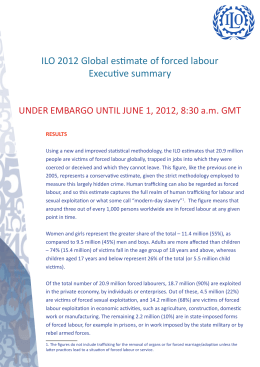

Download