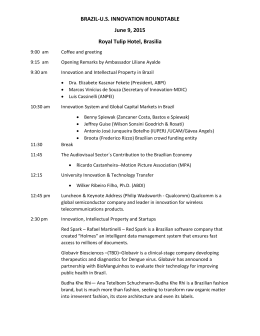

American Chamber of Commerce for Brazil - AMCHAM International Affairs Department Brazil, 2012/2013 ACKNOWLEDGMENTS The American Chamber of Commerce for Brazil, being the largest Amcham outside the United States is constantly serving its members by building bridges for Brazilian businesses worldwide. Our foreign investment attraction efforts have also been a key leading point for Amcham. The How to Series is part of this initiative. With the support of some of our corporate members we are putting together strategic information on the most various aspects of doing business in Brazil. As part of th BRICS (Brazil, Russia, India, China and South Africa) and representing the 6 largest economy of the world, Brazil has clearly demonstrated its importance in the global market. The country’s business environment as well as foreign investment numbers, despite international crisis, continues very positive. Medium and high classes are increasing, which creates a solid internal market and contributes to maintain good results in the economy. The 2014 FIFA World Cup has been estimated in USD 56.8 billions and the 2016 Olympics in USD 19.3 billions in investments. These events have had an impact on direct investments in Brazil and in infrastructure projects needed to hold them in the country. It is now more than ever a strategic time for businesses opportunities in Brazil. We welcome you and hope that the information you are about to read serves you best. Gabriel Rico - CEO, Amcham Brasil Rayes & Fagundes Advogados Associados is a full service law firm recognized for its expertise and experience in representing and advising foreign companies and individuals in Brazil. Over the years, we have learnt that it is important not only to provide specific legal support, but also to help our clients understand the whole environment in which they will make their decisions. The idea underlying this brochure is providing foreign investors and entrepreneurs with an overview of the main legal aspects for establishing a company or simply doing business in Brazil. Our relationship with Amcham is a long-standing one and comes from the great number of US companies and individuals we have been advising since the firm´s inception. João Paulo Fagundes, Founding Partner Rayes & Fagundes Advogados Associados Lia Esposito Roston, Partner Rayes & Fagundes Advogados Associados LAW CONTENT 01 INTRODUCTION 06 02 POSSIBLE BUSINESS STRUCTURES 09 03 THE BRAZILIAN SUBSIDIARY 11 04 THE SOCIEDADE LIMITADA 16 05 THE SOCIEDADE ANÔNIMA 18 06 INVESTING IN BRAZIL 22 07 PRIVATE EQUITY INVESTMENT FUNDS (PE'S) 25 08 VISAS FOR FOREIGN ADMINISTRATORS 29 09 RELATIONSHIP WITH EMPLOYEES AND CONTRACTORS 30 10 TAXATION OF THE BRAZILIAN SUBSIDIARY 33 11 DIVESTMENT AND COMPANY DISPUTES 35 12 ABOUT OUR SPONSOR 37 01. INTRODUCTION Brazil comprises almost half of South America (47.3%) with Brazil achieved one of the major rates of economic growth an area of 8.5 million square kilometers and a multicultural during the Twentieth Century. An economy that had initially population with over 190 million inhabitants. The been rural, has become predominantly industrialized. Federative Republic of Brazil consists of 26 States and its Brazil is member of the World Trade Organization and is capital - the federal district of Brasilia. Initially a Portuguese part of the International Monetary Fund and the World colony, Brazil is currently a nation with a solid democracy Bank. Brazil is the 6th largest economy in the world bearing which adopted the presidential system as its political model. a Gross Domestic Product (GDP) of US$ 2.473 trillion, per data divulged in 2011 by the Brazilian Institute of Geography and Statistics (IBGE). The Brazilian GDP per FEDERAL REPUBLIC OF BRAZIL capita achieved US$ 12,689.00. The major growth observed was obtained both due to the increase in consumption and in investments. In 2011 exports surpassed US$ 256,040 million with annual growth of 26.8% and their main destinations were Asia (US$ 76,697 million), European Union (US$ 52,946 Flag Coat of Arms million), South America and Caribbean (US$ 29,293 LAW million, excluding MERCOSUR), the MERCOSUR (US$ Capital Brasília 27,853 million), the United States (US$ 25,942 million), Most populous city São Paulo Middle East (US$ 12,261 million), Africa (US$ 12,225 Official language Portuguese million), and Eastern Europe (US$ 5,174 million). Government Federal Republic Currency Real Regarding to imports, in 2011 the total amount surpassed 06 US$ 226,243 million, with annual growth of 24.5%, being US$ 70,076 million from Asia, US$ 46,416 million from the European Union, US$ 34,225 million from the United period FDI equal to US$ 33,9 billion and US$ 46,134 States, US$ 19,375 million from South America and billion respectively. In accordance with the survey of Caribbean (excluding MERCOSUR) and US$ 18,435 UNCTAD, Brazil is one of the most attractive economies million from MERCOSUR, US$ 15,436 million from for the direct foreign investments. Also, countless global Africa, US$ 6,141 million from Middle East, and, finally, players entered the Brazilian market where they operate US$ 5,175 million from Eastern Europe. under equitable conditions in relation to their domestic competitors. The Government and the Brazilian business Brazilian exports continue to grow in 2012, reaching a total executives have engaged themselves in the expansion and of US$ 55,080 million in the first quarter of 2012, modernization of the Brazilian economy. This step has representing a growth rate of 7.51% over the same period of encouraged the entrance of bulky foreign investments and 2011, while imports reached US$ 48,087 billion. Thus, the has led to the increment of international trade. trade balance registered a surplus of US$ 2,440 million in the first quarter of 2012. In 2011, the credit rating agency Standard & Poor's raised The volume of Foreign Direct Investment (FDI) destined to Moody's, in 2011, has modified the investment rate of Brazil grew 40% from 2007 to 2010, a rate considerably Brazil from Baa3 to Baa2 with a positive perspective .This favorable when compared to this kind of investment in the boost shows the great maturity of the Brazilian world, which has decreased 36.9% due to the international companies, which has been proven by the improvement of financial crisis, as per report prepared in 2010 by the United the fiscal and foreign debt and by the perspectives of Nations Conference on Trade and Development economic growth. (UNCTAD). As a result, Brazil became the Latin American country which received most of the foreign investments in BM&F BOVESPA is Latin America's largest securities the period, around US$ 48,4 billion. This record in capturing stock exchange market. In 2011, the daily average of foreign resources led Brazil to surpass other emerging Latin BOVESPA market was US$ 3,8 billion. The foreign America economies, such as Chile and Mexico, and Asian investment represents 39% of the total volume traded in economies. Additionally, Brazil has surpassed other BOVESPA. Moreover, BOVESPA is the third largest maturity economies as Germany and France. Indeed, Brazil stock exchange market in the world. The development of received in 2010 US$ 48,4 billion of FDI, while Mexico and the stock exchange clearly shows the evolution that has Chile received US$ 18,7 billion and US$ 15 billion been set forth in the Brazilian capital markets and the huge respectively. France and Germany received during the same attraction of foreign investments. 07 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL the long term rating of Brazil from BBB- to BBB. Among other factors, the elevation of the number of In this sense, the interest of foreign investors in Brazil has investments in Brazil, the systematic drop of real interest grown significantly, and to approach the main legal aspects rates, productivity gains, a permanently low inflation rate, involved in the establishment of a new company in Brazil is and the strengthening of companies have generated an a matter of paramount importance. enormous trading and investment flow in favor of Brazil 08 LAW over the past years. 02. POSSIBLE BUSINESS STRUCTURES First of all, it is important to mention the possible Foreign investors prepared to really increment their business structures that can be adopted in order that the participation in the Brazilian market, yet without foreign investor partakes of the positive results of the establishing a company in Brazil, may opt for the Brazilian economy. appointment of a commercial representative, a distributor The most simple business structure that can be adopted by it is necessary to be cautious, being indispensable to sign the foreign investor is the exportation of products or an agreement which clearly describes the rights and services to Brazil without hiring a representative or setting obligations of each party. In general, the Brazilian up a company in the country. The mentioned structure is legislation protects the commercial representative, the usually used by the investors who intend to try the Brazilian distributor and the franchisor, granting them several legal market prior to making a more firm investment decision. mechanisms for their defense in case any arbitrary There is less commitment of the capital and there are decision from the foreign investor with regard to their certainly fewer risks involved, though it is more difficult to scope of action, exclusivity suppression, the relationship’s approach the clients. abrupt disruption, among others. POSSIBLE BUSINESS STRUCTURES Exportation Commercial Representation Less Commercial Distribution Franchise Liaison Commercial Partnerships With the Consortium Country Acquisition of equity Establishment of Brazilian Subsidiary More 09 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL or a franchisor. To formalize any of the latter employments The foreign investor that is not very familiar with the Brazilian market may also opt for a joint venture, allying its technology, know-how and trademark to the local knowledge and structure of the Brazilian partner. To carry out an undertaking in Brazil, a possible format of a commercial partnership is also the consortium between the foreign investor and the Brazilian partner. The consortium is not equipped with a legal personality and its participants respond only to the obligations they accounted for, without presuming solidarity. The consortium contract must be filed at the Brazilian Authorities (Junta Comercial), and it must envisage the purpose of the partnership, the duration, Another alternative for the association of a foreign investor’s efforts to a Brazilian partner is the acquisition, by the foreign investor, of equity in an already established Brazilian company, considering that the mentioned acquisition is preceded by a proper assessment of the contingencies that the Brazilian company might have and a sound negotiation of the profit and power division between the Brazilian partner and the foreign associate. In a partnership like this, it is essential to sign a quotaholder agreement and/or a shareholder agreement that encompasses the financial contributions promised, voting agreements, preference rights, tag along, drag along, and shares purchase and sales options, among other relevant issues, in order to protect the foreign investor’s interests. address and form of solution of disputes, obligations and responsibilities of each consortium participant, results allocation, accounting norms, representation, management fees and the form of deciding on common interest issues. The consortium format is widely adopted for major undertakings to be contracted by the Brazilian government, 10 LAW through public bids. Finally, the foreign investor may decide to open a Brazilian subsidiary; this alternative has proven to be very advantageous for the investor who really wishes to be established in the local market on a permanent basis and compete on equal conditions with Brazilian business executive peers. It is precisely about the opening of a new Brazilian company that this publication is about. 03. THE BRAZILIAN SUBSIDIARY THE COMPANIES, PERSONALITY AND LIABILITY LIMITS It is important to note that there are norms and judicial decisions that exempt the application of the legal autonomy related to the company, enabling, in some The carrying out of investments for the exploitation of the situations, the pierce of the corporate veil and the economic activity involves several legal forms. The Brazilian liabilities of the partners' for the company's debts. Those law reflects the principle of autonomous assets, separating situations normally involve the abuse of the legal form it. Thus, the integral assets of the commercial establishment belong to the company and not to its partners, and such assets may be used only to cover responsibilities attributable to the company as such company and its partners are considered different entities. “ deviating from the objective or by confusing the assets. As a general rule, the pierce of the corporate veil is most usually verified in circumstances such as failure to pay taxes by the partners in charge of the company's management, the ascertainment of settlement of As a rule, the personality of the company starts with the payments of the company's labor debts, the consumers' registration at the Brazilian Authorities (Junta Comercial), protection and the repression of acts that are harmful to the which makes the formation of a new company entity public and makes it possible to know about its existence among other economic agents. environment. In sum, there is a tendency toward the restriction of the effects of the company's legal autonomy in the relationship with its employees, its consumers and with the government. 11 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL company from the members that personality characterized by In order to make the company regular, it is essential that there is a written agreement between its partners with the adoption of the proper formalities (articles of association and bylaws). The agreement should be registered at the competent commercial board; otherwise the sanction will be the lack of liability limitation by the partners with regard to the companies' debts. “ the rights and obligations of the TYPES OF COMPANIES However, if the company is detained by different groups of partners and/or it has plans to issue debentures, subscription The companies may assume the form of a company warrants, commercial papers and other securities and stock, with a collective name, limited partnership, share then adopting a sociedade anônima is more appropriate. partnership, sociedade limitada or sociedades anônimas. The incorporation of a sociedade anônima is mandatory Notwithstanding that the entrepreneurs can opt for any of depending on the economic activities to be performed. For the latter available types of company, only the sociedade example, financial institutions must necessarily assume limitada and the sociedade anônima have economic that regime. relevance and are worth being analyzed in this publication. The corporate capital of a sociedade limitada is divided in quotas. Each partner's liability is restricted to the value of REGISTRATION OF COMPANIES AT THE BOARD OF TRADE (JUNTA COMERCIAL) his/her quotas, but all of them are jointly liable for the payment of the corporate capital. The sociedade anônima Each State of the Brazilian Federation has a Junta has its corporate capital divided in shares and is Comercial, in charge of enrolling all the companies that characterized by the shareholders' liability limitation to the exercise economic activities which comprehend the value of subscription of their own shares. production or organized circulation of goods and services. The incorporation of companies in Brazil must be registered The sociedade limitada requires at least two partners and the amendments to its articles of association require the approval of at least 75% of its capital. The sociedade anônima, in turn, is operated by the decisions taken by the majority of the votes and may have one sole shareholder, in which it is considered a wholly-owned subsidiary. at the Junta Comercial of the State where their head-office is located, as well as where their branches are installed. Among the formalities enforced by the approval of the Junta Comercial for the filing request of the articles of association of the sociedade limitada (articles of association) and of the sociedade anônima (articles of incorporation and bylaws), 12 LAW we can find the designation by the foreign partner of a legal The sociedade limitada has some practical advantages, such representative resident in Brazil with the power to receive as a more simple and flexible corporate structure, reduced summons and represent the foreign partner before costs, and less formality. It is extremely appropriate for the government authorities. Said legal representative will be the case of foreign partners with one common controller. person who signs, on behalf of the foreign partner, the articles of association/bylaws of the Brazilian company sociedades anônimas are more detailed than those for the and all its amendments, as well as the minutes of the accounting of sociedades limitadas. partners' resolutions. The articles of association or bylaws of the Brazilian COMPANY NAME AND INTELLECTUAL PROPERTY company to be established, duly signed by the partners and two witnesses, must contain the identification of the The corporate name by which the company will be partners, the corporate purpose, the address of the identified must be previously researched at the Junta head-office and of the branches, the subscribed corporate Comercial because it needs to comply with the principle of capital, the corporate bodies, the elected administrators, novelty, as a company cannot use a name previously the decision process and quorums, the obligations and registered. Additionally, the company name must not limitations imposed to the administrators, and the process cause any confusion and it has to be sufficiently for the resolution of disputes, among other information. The distinctive to the others. must be presented at the competent Junta Comercial, The company name is an integral element of the company enclosing the pertinent forms and payment slips of charges establishment and a property of the company's owner, owed to the Junta Comercial. being the exclusiveness of its use protected by the Brazilian law. BOOKKEEPING It is relevant to mention that the foreign investor shall be Companies have the obligation to maintain their concerned with not only the protection of the company bookkeeping records under the responsibility of an name, but with the protection of possible intellectual accounting department with duly certified professionals. property belonging to him/her, and that will be used by the Bookkeeping has several purposes: management future Brazilian company. assessment, support for third parties' information interests and surveillance of compliance with legal obligations, Trademarks, industrial designs, utility models and mainly tax related obligations. patents already registered abroad or already being used by the foreign investor, and which will be exploited Companies also have to compile periodical accounting nationwide, must be registered at the National Institute of reports. The legal requirements for the accounting reports of Industrial Property – INPI – in order to obtain exclusive 13 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL articles of association, the bylaws and their amendments use protection in the Brazilian territory. In this respect, it is There are also more rigid restrictions imposed specifically on important to highlight that such protection in the Brazilian Brazilian companies controlled by foreigners for in activities territory only takes place upon the effective enrollment such as newspapers and radio broadcasting, to purchase rural at INPI. property, and to exploit mining on border zones. CORPORATE PURPOSE Furthermore, the Brazilian environmental legislation interferes and limits activities that are potentially harmful to The correct definition of the purpose of a company is the environment, such as the battery and lightbulb industry, extremely relevant because it is based on the corporate hydroelectric power plants, natural oil and gas industries, purpose that the specific applicable legal rules will be residue processors, among other activities that involve identified in the economic sector where the company acts. manufacturing and/or handling of toxic or hazardous material, deforestation of protected areas or potential risks It is based on the corporate purpose that the company will be to the environment. subject to surveillance, according to what is determined by the Regulatory Agencies and other Government Finally, certain economic activities may take advantage of Administrative entities, such as for example, the ANP – incentives and tax benefits from significant tax reductions. National Oil Agency, the ANTT – National Land Transportation Agency, the ANVISA – National Sanitation Surveillance Agency, the ANS – National ADDRESS Supplement Health Agency, the ANATEL – National Determining the company's address is also an essential Telecommunications Agency, the ANEEL – National provision. Initially, it may be established in a venue for Electric Power Agency, and the BCB – the Central Bank of merely developing its representation functions, though with Brazil. Among the activities with a more accentuated time and due to the type of economic activity developed, the regulation by the Brazilian authorities we could name as need of allocation of a specific infrastructure will certainly examples: the oil and gas industry, the research and mining be raised to better assist the Brazilian market. 14 LAW of mineral resources, the health and general insurances, and the activities of banking institutions, telecommunications It is worth noting that there are regions in Brazil, such as the services, supply of electric power, the pharmaceutical and Region of the city of Manaus, in the state of Amazonas, foodstuffs industry, and the railroad exploitation. which grant tax benefits to companies that are set up there. These benefits vary from significant reduction of taxes to operation permits and additional registrations are required incentives to purchase property and to build industries. It´s by the enforcement authorities. important to analyze the benefits of each state before establishing a company in Brazil. However, in general terms, all companies must consult the municipality (city government) in accordance to the zone REGISTRATIONS, BUSINESS OPERATIONS PERMITS, LICENSES AND RECORDS delimitation of the region where they are located in order to operate pursuant to the law and obtain the respective As it was mentioned above, depending on activity sector and Revenue Service; in order to obtain the CNPJ – National the location of the Brazilian company, certain legal specific Register of Legal Entities at the Ministry of Finance, as rules are applicable, and, consequently, enrollments, well as at State and/or Municipal Revenue Services. 15 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL operation permits. They also need to register at the Federal 04. SOCIEDADE LIMITADA Discussing and determining the type of company of the each partner has the preferential right to purchase quotas legal entity to be established in Brazil is also indispensable proportionally to the number of their existing quotas. for the foreign investor. The reduction of corporate capital can occur only when The sociedade limitada or partnership is the company certain conditions are fulfilled: whose corporate capital is divided in quotas. This a type of company regulated by the Brazilian Civil Code, articles • Occurrence of irreparable losses; or 1052 and 1087, and in a subsidiary manner by Law 6404 (Corporation Law). The company is incorporated through • Excessive capital pursuant to the company's the filing of the articles of association at the Board of Trade corporate object. (Junta Comercial). PARTNERS' RESOLUTIONS CORPORATE CAPITAL The most important resolutions for the destiny of a There is no stipulated minimum corporate capital and the sociedade limitada are taken by the partners representing ¾ increase or reduction of the corporate capital shall be of the corporate capital, such as the approval of the articles performed through an amendment to the articles of association. of association amendments, merger, company dissolution or 16 LAW ceasing of liquidation status. Said quorum is mandatory and An increase of the corporate capital is admitted as soon as all cannot be reduced by the partners' agreement; however, it the subscribed quotas are paid. In order not to cause a can be increased. There are situations whereby only a dilution of the participation of the existing partners in the majority is demanded as quorum, a hypothesis in which the corporate capital, the Brazilian Civil Code provides that articles of association can stipulate a larger quorum. The resolutions are taken during meetings or general MANAGEMENT meetings, pursuant to the articles of association. There is no need to publish the notice call for the meeting or general Sociedades limitadas are managed by one or more senior meeting when all the partners attend or state, in writing, that managers, partners or non-partner managers. The senior they are aware of the place, date, time and agenda. managers are appointed by the partners and can be designated in the articles of association or in another Up to April 30 of every year, the sociedades limitadas must hold a general meeting or a partners' meeting to: separate corporate document. There is no minimum or maximum mandate period for the position of a senior • Approve of accounts, make resolutions about the manager. The partners may, at any time, remove him/her assets balance sheets and the financial results; and from office. 17 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL • Appoint senior managers, if applicable. 05. SOCIEDADE ANÔNIMA The sociedade anônima is a company whose corporate capital is divided into shares and whose discipline is pursuant to Law 6404/76. The sociedade anônima can be publicly or closely held, pursuant to its securities and stocks complying with the right of preference for the already existing shareholders. Just as it happens in the sociedade limitada, in the sociedade anônima a reduction of the capital is admitted in the case of loss or excess of capital. of issuance, being or not being able to negotiate in the stock markets; i.e., the stock exchange or the organized over the SECURITIES counter market. The publicly-held sociedade anônima obtains resources from the public and submits itself to the The sociedade anônima can issue common, preferred or surveillance of the CVM (Brazilian Securities Exchange fruition shares, with or without nominal value. Should the Commission); on the other hand, the closely-held sociedade shares have a nominal value; the price of emission of new anônima obtains its resources from its own shareholders. In shares cannot be less than the referred nominal value, this sense, the closely-held sociedade anônima has more establishing a limit for the dilution of the participation of the freedom to establish its operating rules, whereas the already existing shareholders. publicly-held sociedade anônima has less flexibility. As for the types of shares, this depends on the nature of the 18 LAW CORPORATE CAPITAL As a general rule, no minimum capital is required. However, for establishing a sociedade anônima the shareholders must subscribe and pay at least 10% of the capital prior to filing its bylaws at the competent Board of Trade (Junta Comercial). rights or advantages attributed to the holders. Common shares must always guarantee the holder the right to vote. Preferred shares grant determined preferences or advantages, such as priority in receiving dividends or in receiving the capital repayment. The number of nonvoting preferred shares, or subject to restriction to exercise this right cannot surpass 50% of the total of the shares issued. The fruition shares are those that replace the integrated Usually the capital increase is done via an amendment of the bylaws, convening an Extraordinary General Meeting, shares amortized for. The way of showing proof of holders' shares depends on the should not subject the minority shareholders to the will of type of company, i.e., publicly or closely held. the management bodies or of the majority. In the closely-held company the ownership is certified in the registration of shares book, while in the publicly-held Nevertheless, should the bylaws be omissive or should the company it is certified by the custody agent. general meeting deliberate to alter the bylaws to introduce a norm on the issue, the compulsory dividend cannot be Apart from the aforementioned shares, the sociedade less than 25% of the net profit adjusted, pursuant to law. anônima can issue other securities, such as debentures, subscription warrants, participation certificates and commercial papers. SHAREHOLDERS' RESOLUTIONS As a rule, the resolutions of a sociedade anônima are taken financial investment of Brazilian companies. Thanks to their flexibility they have become the most important instrument of securities investment in “ votes; i.e., votes of stockholders who Unlike the sociedade anônima, there is no demand of compulsory minimum dividends in the sociedade limitada. the sociedades anônimas, both “ perfectly adjust to the needs of the by absolute majority of votes (50% + 1 vote of the valid are present, excluding annulled votes), with the exception of some issues listed in Article 136 of Law 6404, such as the company's bylaws alteration and the reduction of the publicly-held and closely-held, granting the issuer the minimum compulsory dividend, for which it is demanded possibility to determine the amortization flow and their form that at least half of the corporate stock with the right to vote. of compensation. Debentures can eventually be converted into shares of the issuing company, in compliance with the Shareholders' resolutions are carried out at the General Meetings and can be of three types: conditions described in the respective indenture. • Company Incorporation General Meeting; MINIMUM DIVIDENDS • Annual General Meeting; The bylaws can establish the minimum dividends to be paid • Extraordinary General Meeting. to shareholders as a percentage of the profit or the corporate capital, or establish other criteria to determine this. These Up to April 30 of every year, the sociedades anônimas are must be regulated with precision and in detail and they compelled to carry out an Annual General Meeting where 19 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL Debentures are widely used papers in Brazil and they the following issues are voted for: the Executive Office must be elected by the Shareholders' General Meeting. • Approval of the financial statements; • Deliberations regarding the allocation of the annual net profit and the dividend payments; The Board of Directors is a collegiate body, mandatory in the publicly-held sociedades anônimas, and optional in the closely-held sociedades anônimas. It must consist of at least • The election of the administrators and the three participants who must be shareholders, individuals members of the Fiscal Board, when applicable. and resident or non-resident in Brazil. The Extraordinary General Meetings are convened for the The Executive Office is an executive body, who is deliberation of any other purposes not subject to the Annual responsible for representing the company and practicing all General Meeting. the appropriate management acts. It consists of at least two participants, whether shareholders or not, who must reside The shareholders may celebrate agreements regulating the in Brazil. The Executive Office's mandate is of a maximum ways they may exercise their voting rights, as well as for the of three years. purchase and sale of shares, preferred rights in the purchases, tag along and drag along. The Brazilian legislation attributes In the sociedade anônima it is still mandatory to have a specific execution of latter agreements; so, should a Fiscal Board, which is instated via the request of the shareholder exercise the right to vote differently from the shareholders that represent at least 0.1 (one tenth) of the agreement terms previously signed, the meeting chairman voting shares, or 5% (five percent) of the nonvoting shares. 20 LAW must disregard the attendance vote and must input it in the agreement terms. FORMALITIES COMPANY ADMINISTRATIVE BODIES The financial statements of sociedades anônimas must be audited by independent auditors. Moreover, in the The sociedade anônima is managed by a Board of Directors sociedades anônimas, it is mandatory to publish the and an Executive Office, or only by an Executive Office. minutes of the meetings and other corporate documents The Board of Directors is elected by the Shareholders' which resolution contents entail the effects on third parties. General Meeting, and the Executive Office is elected by the The mandatory publications must be done at the State or Board of Directors. Should there be no Board of Directors; Federal District gazettes, according to the location of the company's head-office, and in another widely-circulated Exchange Commission – and, therefore, they must newspaper distributed in the location where the company's comply with additional legal requirements, such as head-office is located. registration at the CVM of all the issuance of securities stock to be carried out, and the remittance of periodical The publicly-held sociedades anônimas are subject to the reports to them. regulatory power of the CVM – Brazilian Securities COMPARISON CHART Sociedade Anônima • General rule of inexistence of the partners' • General rule of inexistence of the partners' liabilities after corporate capital integralization; liabilities after corporate capital integralization; • Partners' solidarity for the amount of capital not • Partners' liability is limited to the amount he/she integralized; was committed to integrate; • Alteration of the Articles of Association demands ¾ • Alteration of Bylaws demands 50% + 1 of the of the corporate capital; voting capital; • Possibility of exclusion of minority partners for a • Exclusion of minority partners for a fair cause is fair cause; controversial; • Less protection for the minority partner; • Possibility to capture resources through the issuance of shares with agio, debentures, among • Easier path for the partner that intends to leave the others; company; • Publishing the corporate bylaws and auditing • Fewer formalities. financial statements is required. 21 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL Sociedade Limitada 06. INVESTING IN BRAZIL FOREIGN CAPITAL REGISTRATION OF FOREIGN INVESTMENT The Brazilian legislation does not attribute different treatment to foreign and domestic investors, with the exception of certain specific cases. Foreign capital is pursuant to Laws 4131/62 and 4390/64 which define foreign capital in the following manner: Entrance of foreign capital, in the form of cash or goods, is subject to registration at the Central Bank of Brazil (Foreign Capital Registration – RDE). Intangible goods, like trademarks and goodwill, may be used for the companies' capitalization provided that they are duly assessed. “foreign capital is considered to be, for the effects of this law, any goods, machinery and equipment that enters Brazil with no initial disbursement of foreign exchange, and are intended for the production of goods and services, as well as any funds, financial resources or cash, brought into the country to be used in economic activities, provided that, in both hypothesis, they belong to individuals or legal entities resident, domiciled or headquartered abroad”. Foreign capital may constitute direct or indirect investment. The Central Bank is the government authority in charge of monitoring the entrance and exit of foreign exchange from Brazil. Capital registration at the Central Bank will grant the foreign investor the right of return on the invested capital and the right of remittances of profit and dividends. This means that the currency remittances abroad can undergo restrictions whenever there is no registration at the Central Bank because the remittances of profit, the repatriation of capital and the registration of reinvestments are all based on the amounts previously registered as foreign investment. Direct investments are carried out through the establishment of new companies or by the acquisition of participation LAW shares/quotas in already existing Brazilian companies. The law does not determine a minimum amount for carrying 22 out a foreign investment. Since September of 2000, the registration of foreign investments has been performed electronically. Such registration is under the responsibility of the investment's receiver company and of the non-resident investor through his/her legal representatives in the country. STEP BY STEP FOR CARRYING OUT A DIRECT INVESTMENT IN THE BRAZILIAN COMPANY TO BE ESTABLISHED BY THE FOREIGN INVESTOR Appointment of a Legal Representative domiciled in Brazil, by the Foreign Partner Power of Attorney notarization and legalization by the Brazilian Consulate abroad Foreign partner's documents notarization and legalization by the Brazilian Consulate abroad Sworn translation of the aforementioned documents and their registration at the Brazilian Notary Public's Office of Documents and Titles Registrations. Choice of company's administrator domiciled in Brazil Establishment of corporate capital and of each partner's participation shares Preparation and Filing of Company's Instatement Acts at the competent Commercial Boards Habilitation of the Brazilian company instated at the system of the Central Bank of Brazil for reception of foreign capital Acquiring of the foreign partners' registration at the taxpayers Brazilian Income Revenue Service Foreign exchange investment contract signing and registration at the Central Bank Acquiring the Brazilian company's registration before the tax authorities, as well as the licenses; operations registration and necessary operations permits. 23 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL Definition of company's corporate purpose, corporate name and address PAYMENT OF DIVIDENDS AND INTEREST ON EQUITY CAPITAL AND REINVESTMENT There is no minimum period by which the registered foreign capital must remain in Brazil; therefore, such capital can be repatriated to its country of origin, disregarding any type of previous authorization. The returns of capital in amounts higher than those registered will be considered as capital gains in benefit of the foreign investor. Thus, they are subject to income tax withholding at a rate of 15% or 25%; the latter is levied on remittances to tax heavens. Thus, the capital gains obtained in the capital repatriation, in the transfer of quotas or shares and in interest payments on the capital 24 LAW belonging to the foreign investor will be taxed by the revenue service in accordance with the aforementioned rates. With regard to taxation levied on the capital returns, the profit can be remitted abroad with no limitation and is not subject to income tax withholding. Reinvestments are profits gained by companies located in Brazil and attributed to individuals or companies residing or domiciled abroad which decide to reinvest such profits in the company that generated them or in another sector of the economy. If the foreign investor opts for reinvesting the profits in lieu of remitting them abroad, they can be registered as foreign capital – in the same manner as the initial investment – thus increasing the basis of calculating future remittances or profit reinvestments for taxation purposes. 07. PRIVATE EQUITY INVESTMENT FUNDS (PE'S) An investor can choose an alternative legal structure to company, including effective influence in defining make the legal entity more efficient and to decrease the tax strategic policies as well as in its management. costs levied on the foreign investment, instead of setting up a sociedade limitada or a sociedade anônima. The PE's are a communion of resources destined towards One of the most commonly adopted alternatives is the bonuses or other bonds and convertible or interchangeable investment in Private Equity Investment Funds (PE's). securities, in publicly-held or closed companies, with Foreign investors are able to indirectly acquire shares of participation in the decision making process of the publicly or closely-held sociedades anônimas through these invested company. It is closed joint property and the name funds. This arrangement is made because foreign investors must include “Private Equity Fund.” Participation in the can benefit from income tax exemptions of the PE's quotas decision making process of the invested company must be on certain withdrawal or bailout, sale and amortization carried out in such a way as to ensure effective influence in operations once the conditions that are foreseen in the law defining its strategic and management policies, especially are fulfilled. by recommending board members. PE's are destined exclusively toward qualified investors The PE's are regulated by CVM Regulation nº 391, dated with a minimum subscription of R$ 100,000.00, they must of July 16, 2003 and amendments. be closed and jointly owned investments. Closed companies that receive PE investments must Their resources are destined toward the acquisition of comply with to the following governance practices: shares, debentures, subscription bonuses and other bonds and convertible or interchangeable securities, in publicly- • Prohibition of the issuance of beneficiaries and held or closed companies. These acquisitions must provide non-existence of these securities in circulation; the Fund with decision making participation in the invested 25 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL the acquisition of shares, debentures, subscription • Establishment of a unified 1 (one) year mandate name an institution authorized by the Central Bank to for the entire board; assume co-responsibility. The aforementioned must be carried out through a formal representation contract which, • Availability of contracts with related parties, in general, is signed with the custodian. stockholder agreements and option programs to acquire shares or other bonds or securities issued It is worth noting that the foreign investor will need a by the company; representative before the CVM as well as a representative before the Internal Revenue Service and the Central Bank. • Choice of arbitration to resolve corporate These functions can be performed by the same person. conflicts; • In case of public offer of its stocks, must INCORPORATION commit to the fund to submit itself to a special segment of the stock exchange or the Organized The operation of the Fund can only be initiated after OTC Market authorized by CVM that ensures approval by the CVM. The following requirements are minimum levels of differentiated corporate necessary for registration: governance practices foreseen in the previous items; and • An annual audit of the accounting statements by independent auditors registered with CVM. The duration of the Fund is foreseen in the Regulation, along with the requirements for any extensions. • Act of Incorporation of the Fund; • Sworn statement from the Fund Manager; • Sworn statement with the name of the independent auditor; • Information regarding the maximum and minimum number of shares to be issued, their APPOINTING A LEGAL REPRESENTATIVE value, all of the costs incurred, and all other information relevant to their distribution; 26 LAW In order to invest in a PE, the foreign investor is obligated to appoint a legal representative that will represent said • The disclosure material to be used in the investor before the CVM. When this representative is an distribution of Fund shares, including the individual or non-financial legal entity, the investor must prospectus, if there is one; available to potential investors; REDEMPTION AND NEGOTIATION OF SHARES • If there is a professional manager, a brief The PE regulation must explain the criteria to amortize its description of the qualifications and professional shares, without the possibility of redemption. The shares experience of the technical administrator and manager. can be the object of private negotiations between qualified • Any other additional information that becomes investors or negotiated in the stock market. In this case, an intermediary is necessary to ensure that who is buying the MANAGEMENT shares is a qualified investor. The Fund manager must be a legal entity authorized by the TAXATION CVM. The Fund Manager and the Portfolio Manager are responsible for losses suffered by the shareholders when Generally speaking, the income and earnings from said managers act with negligence or fraud or if they PE's have their taxes withheld at a percentage rate violate the law or the rules set forth by the CVM and of 15%. the Regulations. However, the foreign investor can take advantage of a PE Funds can only invest their resources in the acquisition of shares, debentures, subscription bonuses or other bonds reduction to zero percent on the rate for income tax for the investment, if the following requirements are met: • The investors, individually or together with 1 other people connected to them , do not hold and convertible or interchangeable securities in company 40% or more of the total number of shares share issuances. It is prohibited to carry out operations issued by the PE Fund and the shares do not involving derivatives, except when such operations are allow for earnings greater than 40% of the total carried out exclusively to protect assets. amount of earnings coming from the Fund; 1. Following are those connected to the private individual: (i) their relatives up to 2nd degree; (ii) company under their control or under control any of their relatives up to the 2nd degree; (iii) partners or the leadership of a company under their control or under the control of the controller, controlled or sister firm. Connections to the legal entity shareholders: its controller, controlled or sister firm. 27 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL FUND ASSETS • The PE Fund does not have debt security at any maximum percentage rate of less than 20% - known as tax time in its portfolio that is greater than 5% of its havens – a 15% withholding tax will be levied on the net assets. The exception of this limit relates to earnings from the Fund or the capital gains resulting from shares in business corporations, debentures that the transaction of shares by the investor. can be converted into shares, subscription bonuses and public bonds; and Clearly, the PE's are more advantageous than the structured investments in the form of holding companies, taking into • The foreign investor is not a resident or is account that the later are subject to taxation just like domiciled in a country that does not tax the ordinary companies, including IRPJ (corporate income tax), earnings or that taxes earnings for a maximum of 20% or less. CSLL (the Social Contribution on Net Profits) and PIS/PASEP and COFINS. In other words, having fulfilled the aforementioned requirements, there will be no income tax levied on earnings It is important to emphasize that all investment portfolios in Brazil. must fulfill specific rules imposed by the CVM for the 28 LAW formation and management of these funds, including the In cases where investors are residents or domiciled in naming of the manager who will be responsible for countries that do not tax earnings or that tax earnings at a collecting the taxes. 08. VISA FOR FOREIGN ADMINISTRATORS Every director of a Brazilian company must reside in Brazil. period of two years; or, otherwise, an investment of Should the foreign investor appoint a trustworthy foreign R$ 600,000.00 exempting the latter employment administrator that intends to move to Brazil, the request for a commitment. The minimum investment is mandatory specific permanent residence visa is mandatory. for each foreign director. If the foreign administrator The issuance of a permanent residence visa must be a permanent visa carrying out a minimum investment in requested by the Brazilian company established by the Brazil of R$ 150,000.00. In this case, he is exempted investor and presupposes carrying out a minimum of the employment commitment, but he needs to present investment in Brazil of R$ 150,000.00, taking into account a business plan to be analyzed by the National a commitment to generate 10 employments during the Immigration Council. 29 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL is one of the shareholders of the company, he may request 09. RELATIONSHIP WITH EMPLOYEES AND CONTRACTORS Once the foreign investor has decided to establish a company in Brazil, the latter will have to employ qualified professionals for the development of their activities. These professionals can be employed by the Brazilian company or work as mere service providers. LABOR RELATIONSHIP “ Labor Relationship Requisites: • onerosity; • individuality; • subordination; • habituality. 30 LAW “ • INSS Contribution (National Institute of Social Secuity) – Employer must pay monthly contributions of 20% of the employees' gross salary. • GILRAT (Labor Accident Insurance) – Social contribution paid to the National Institute of Social Security by the employer. The levy varies between 1 to 3% of the gross salary paid to the employees as an extension of the risk to which the employees are subject to. • Education Salary – Employers must pay the INSS a monthly amount for education salary which corresponds to 2.5% levied on the • Other payments known as “payments to third parties” – Employers must pay contributions to benefit some specific institutions, such as the Social Service of Commerce “SESC” and to the Brazilian Service of Support to Micro and Small Companies “SEBRAE”. • Employers must deposit in a blocked bank LABOR TAXES AND CONTRIBUTIONS In addition to paying the benefits listed in aforementioned item, the employer's liabilities with regard to labor fees/taxes are: account an amount equivalent to 8% of the gross salary paid to each employee, as FGTS (Unemployment Guarantee Fund). The deposits are made monthly to the order of the employee. 31 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL employees' gross salary. The FGTS is paid solely by the employer; there is no deduction on the employee's paycheck. In case the employment bond is terminated without cause, the employer incurs in a fine of 50% of the total existing deposits in the employee's name. Below is a summary chart of the taxes*: TAXES AND CONTRIBUTIONS PAID BY EMPLOYER – IN % INSS, FGTS and related taxes In % 1. INSS 20 2. Third Parties 2.7 to 5.8 3. FGTS 8 4. RAT 1 to 3 *This chart contents an estimative of the taxes, which varies depending on 32 LAW the activities to be performed by the employee. OUTSOURCING Outsourcing is legalized in Brazil; nevertheless, so that there is no configuration of the labor relationship between the service provider and the contracting party, or the employees of the first and second, the service provider must have technical independence and be free of any subordination. There is a risk of recognizing the labor bond when: • The service provided is related directly to the main activity of the contracting party; • There is subordination between the service provider and the contracting party. In case the outsourcing is disregarded by the Labor Courts, the contracting party must pay the service provider all the benefits and contributions that are regularly due to the employees, such as overtime, 13th. salary, vacation, FGTS, among others. 10. TAXATION OF THE BRAZILIAN SUBSIDIARY When planning to establish a company in Brazil, investors recognized by both countries which allows that the must bear in mind the different taxation regimes that exist in income tax withheld by a country be used to deduct the the country, as well as pay attention to the different income tax owed in the other country. accessory tax obligations for each type of activity. Investors will need to pay careful attention to the income tax carried out by the company is under the cumulative or and the social contribution tax levied on the net profit that noncumulative regime of PIS and COFINS (federal taxes must be paid by the company established in Brazil. There are levied on revenue). These regimes will subject the different process of calculating these taxes owed by the company to different tax rates and procedures. The companies, such as the taxable income regime, whereby the noncumulative regime allows taxpayers to obtain credits annual net accounting of the net profit with adjustments to reduce taxes. The cumulative regime does not grant shall be the basis for levying the mentioned taxes at a global credits but its rates are lower. rate of 34%, and the presumed profit regime, whereby the taxation basis is estimated and extracted from the company's The company being established in Brazil has to assess if quarterly income. its products and services will be subject to the ICMS state tax, which is levied on the sales of goods and the provision Brazil has treaties with some countries (France, Spain, of services of communication and transportation, or Holland, among others) to avoid double taxation. As a rule, subject to the ISS municipal tax, which is a tax levied on the income tax withheld on the remittance of income to services provided. countries that are signatory of these treaties allows the foreign beneficiaries to deduct from their foreign total Furthermore, if the company plans on performing foreign income the amount of tax retained in Brazil. trade operations, the investors will need to assess which type of registration regime, a simplified or an ordinary, Even though there is no treaty signed between Brazil and the will be needed to carry out imports and exports. A United States of America, there is a reciprocity rule computerized information system named SISCOMEX 33 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL Moreover, the investors must assess if the activity to be (Foreign Trade Integrated System) was created to facilitate place to settle the company allows greater logistics and import and export operations and is mandatory to all tax savings. traders. Transfer pricing rules also apply to international transactions between related parties or companies Finally, investors must do a complete evaluation of all the domiciled in tax havens. declarations, accounting books and other documents that 34 LAW have to be controlled by a bookkeeper before setting up a Investors must determine the location where the company company in Brazil. This diligence is necessary because the will be established in order to be sure of the incentives and electronic system of financial, commercial and other tax benefits granted by the Brazilian Federal Government, corporate information management have to be completely states and cities, as well as to verify its proximity to the free aligned with the bookkeeping requirements demanded by trade, dry ports, and customs zones. The definition of the the law. 11. DIVESTMENT AND COMPANY DISPUTES In addition to researching the best alternatives for entering • Termination of the duration period; the Brazilian market, it is equally important to analyze how to exit from it. TRANSFER OF SHARES AND QUOTAS' OWNERSHIP • In the cases foreseen in the articles of association and bylaws acts; • In case of lack of plurality among partners; • Pursuant to law enforcement judicial decision In the case of a sociedade limitada, the transfer of quotas when the company's articles of association or must be carried out by signing and registering the articles of bylaws are annulled by admitting that the association at the Brazilian Authorities (Junta Comercial). company is no longer capable of fulfilling its goals; In the case of the closely-held sociedade anônima, the operation in the registration book of nominal shares and by signing the terms of shares transfer in the book of transfer of shares registration. Finally, in the publicly-held sociedades anônimas, the transfer is formalized by means of an electronic (online) registration made by the custody agent. • Pursuant to management's decision. The company personality expires after a dissolution process which can be judicial or extrajudicial. The company's simple inactivity does not generate its extinction as a legal person. The dissolution procedure initiates with a deliberation instated by the partners at the COMPANY OVERALL DISSOLUTION Judicial Courts; it continues with its liquidation for the The overall dissolution of the company can be carried out resolution of the company's business pending issues and according to the following cases: distribution, and with the division of the assets among the partners. For as long as the dissolution does not occur, the • The partners' will; company remains to exist. 35 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL transfer of shares is carried out by writing down this COMPANY DISPUTE SOLUTIONS Judicial lawsuits are also frequent against the company's management due to violation of the countless duties that are The company's disputes usually involve, among other, the imposed upon the managers pursuant to law, such as due following issues: diligence, strict compliance with the legal and statutory • Company's partial or overall dissolution; • Partners' exclusion; dispositions, to inform all the relevant facts to the company, among others. The aforementioned lawsuits can result in high compensation to be paid by the company's administrators to shareholders and to those impaired by the • Misunderstandings regarding the company's management; 36 LAW • Submission of managers' financial statements and accounts. company procedures. 12. ABOUT OUR SPONSOR Rayes & Fagundes Advogados Associados envisages to be sociedades anônimas, Foreign Investments in the most reliable and efficient international corporate law Brazil, Capital Markets, Banking, Investment firm, providing complete and customized solutions, with Funds, Preparation of Contract Managements, sophistication and profitability for its clients, by means of a Bids, Trademarks, Patents, Franchises, highly reliable structure. Distribution and Representation, Copyrights, Software, Real Estate, Insurance, This aim has been pursued with a lot of determination by Administration, Regulatory, Project Financing, the 130 professionals that compose the firm. With head- Environmental, Labor Relations, Benefit Plans office in São Paulo, Rayes & Fagundes Advogados and Collective Negotiations. cities of Rio de Janeiro and Belo Horizonte, besides • In the Litigation sphere it represents its clients counting on a complete network of professionals in the Mediation and Arbitration cases, as well nationwide, always aiming at ensuring agility and security as in judicial and administrative processes in the services provided to its clients. involving Strategic Credit Recovery, defending banks and other financial institutions, Mass Entirely assisting the interests of companies and individuals Consumer Relations, the Internet and with businesses in Brazil, Rayes & Fagundes Advogados E-Commerce, Trademarks disputes, Patents, Associados performance is divided into three great spheres, Software and Copyrights, Company and outlined as follows: Competition litigations, Distribution Contract lawsuits, Franchises, Commercial • In the Corporate sphere, the firm provides all the Representation and Other Sales Agents, Civil legal support for the structure and management of Responsibility, International Disputes, its clients' operations in Brazil, dealing in Mergers Insurance, Management, Regulatory, and Acquisitions, sociedades limitadas, Environmental, lawsuits in relation to Bids, 37 HOW TO ESTABLISH A BUSINESS PRESENCE IN BRAZIL Associados, is also present with its own facilities in the Concession of Public Contracts in general, Counting on solid professional relationships and even Administrative Decisions Impugnation and of having such values as reliability and sophistication on its Regulatory Acts, besides Labor Litigation. services and solutions, Rayes & Fagundes Advogados Associados is currently recognized in the market as a • In the Tax sphere, it deals on behalf of its clients differentiated law firm, of high technical quality and in all the judicial and administrative cases that customized assistance. discusses taxes and contributions, as well as in the defense against tax assessments, apart from For further information, please contact: providing important Consulting Services, Planning, Compliance and Tax Management, Company Reorganization, Tax Due Diligence and Credit Collection; Import and Export Consulting, 38 LAW Tax Benefits and Incentives. With this full service profile, the firm outstands for assisting Rayes & Fagundes Advogados Associados and representing important foreign and multinational Rua Chedid Jafet, 222 - bloco C - 3rd. floor companies, of the most diverse industries, such as São Paulo - SP - Brazil - CEP 04551-065 foodstuffs, energy, oil, telecommunications, electronic Telephone: (55 11) 3050-2150 products, the Internet, pharmaceutical and hygiene Fax: (55 11) 3050-2151 products, service providers, and even financial institutions E-mail: [email protected] and investment funds. Website: www.rfaa.com.br ENDEREÇOS BELO HORIZONTE RECIFE Rua da Paisagem, 220 34000-000 – Nova Lima, MG Tel.: (55 31) 2126-9750 • Fax: (55 31) 2126-9772 [email protected] Rua Gonçalves Maia, 207 – Boa Vista 50070-060 – Recife, PE Tel.: (55 81) 3223-0000 / 3223-2603 Fax: (55 81) 3205-1865 [email protected] BRASÍLIA SHIS QI 5, Comércio Local - Bloco C 1º andar - Lago Sul 71615-530 – Brasília, DF Tel.: (55 61) 3704-8017 • Fax: (55 61) 3704-8037 [email protected] CAMPINAS Rua Dr. José Bonifácio Coutinho Nogueira, 150 Edf. Galleria Plaza – 7º andar, sala 701 13091-611 – Campinas, SP Tel./Fax: (55 19) 2104-1250 / 2104-1275 [email protected] CURITIBA Rua João Marchesini, 139 – Prado Velho 80215-060 – Curitiba, PR Tel.: (55 41) 2104-9350 [email protected] GOIÂNIA Avenida T-63, Qd. 145 – Lt. 08/09 Edf. New World, sala 105 – Setor Bueno 74230-100 – Goiânia, GO Tel.: (55 62) 4006-1150 • Fax: (555 61) 4006-1157 [email protected] PORTO ALEGRE Av. Dom Pedro II, 861 – 8º andar Prédio do CIEE 90550-142 – Porto Alegre, RS Tel.: (55 51) 2118-3700 • Fax: (55 51) 2118-3738 [email protected] RIBEIRÃO PRETO Avenida Wladimir Meirelles Ferreira, 1525 Ufcio Commerciale San Paolo, salas 1 e 2 14021-630 – Ribeirão Preto, SP Tel.: (55 16) 2132-4599 • Fax: (55 16) 2132-4563 [email protected] SALVADOR Avenida Tancredo Neves, 1632 Edf. Salvador Trade Center Torre Norte, sala 1307 – Caminho das Árvores 41820-020 – Salvador, BA Tel.: (55 71) 3480-3481 [email protected] SÃO PAULO Rua da Paz, 1431 – Chácara Santo Antônio 04713-001 – São Paulo, SP Tel.: (55 11) 3324-0194 • Fax: (55 11) 5180-3777 [email protected] UBERLÂNDIA Rua Santos Dumont, 46 – Santa Mônica 38400-060 – Uberlândia, MG Tel.: (55 34) 2101-4100 • Fax: (55 34) 2101-4107 [email protected]

Download