November 2006

“We Always Want More”

OVERVIEW OF LOJAS AMERICANAS

US$ 1.5 billion (R$ 3.6 billion) Consolidated Gross Revenue in 2005

Market Cap of US$ 3.4 billion (R$ 7.0 billion) – November/2006

EBITDA Margin 12.0% (2005)

Net Income 2005 US$ 73.4 million (R$ 176.1 million)

Brazilian leader in sales : CDs, DVDs, cookies, chocolates, candies, toys, lingerie

Prominent position in Brazil’s retail sector

Leading position in LATAM Internet (Americanas.com/Shoptime)

Personal loans and consumer credit offering

3 Distribution Centers

9.7 thousand employees

Awards:

Agência Estado Destaque Empresas 2005

(The Best performance for the shareholders)

Folha de São Paulo “Top of Mind 2005”

Revista Exame - “Melhores e Maiores”

Forbes Brasil - “Platinum List 200”

iBest “Best Ecommerce Site” – Popular Jury

“We Always Want More”

TIME LINE

77 years old

1929

’40

Lojas

Americanas

Foundation

Lojas

Americanas

goes public

(IPO)

’82

Garantia’s

Bank

partners

’98 ’99

2001

Focus in

the core

business

(IT/Logistics)

Lojas

Americanas

Turnaround

Americanas.com

Creation

’03

’05

Americanas

Express

Project

Organic Growth

Record:

37 new stores

The number of stores

doubled in the last 5

years!

Shoptime

Acquisition

Americanas Taií

Creation

“We Always Want More”

FIVE MAIN FRONTS OF GROWTH

Multi-Channel Retailing

DC PE

35 stores

22,900 m²

DC RJ

72 stores

DC SP

35,500 m²

111 stores

53,000 m²

“We Always Want More”

FIVE MAIN FRONTS OF GROWTH

Multi-Channel Retailing

Bricks-and-mortar Business

219 stores (nov/06)

Nort

h

DC PE

35 stores

2

Northeas

t

33

MidWest

21

191 traditional - avg. 1,500 m2

28 express - avg. 500 m2

22,900 m²

Average Ticket: R$ 24

Customer Profile:

Southeas

t

133

South

30

DC RJ

72 stores

DC SP

35,500 m²

112 stores

53,000 m²

1.8MM customers/day in events

77% women - Middle class

“We Always Want More”

Store Lay-Out: The WORLDS’ Concept

leisure

household

cookies, chocolates & candies

Easter & Christmas

CDs & DVDs

stationer’s

birthday accessories

bed&bath

decoration/presents

electric appliance

kitchen

sports

beauty

lingerie

cosmetics

fragrances

socks&kerchiefs

make-up

food(convenience)

snack bar

bakery

grocery

greengrocers

OUR

WORLDS

The assortment

is grouped

according to its

final use

children

toys

children’s clothing

babies clothing

baby accessories

diapers

clothing

shoes & luggage

clothes complement

adult clothing

jeans

“We Always Want More”

FIVE MAIN FRONTS OF GROWTH

Multi-Channel Retailing

6 MILLION

CUSTOMERS

E-Commerce and TV Channel

Business

2 websites, telephone sales,

Catalogue and TV channel

DC SP

(19MM antennas)

Brazil - 1st in on-line sales -

6 MM Customers

+ 200 countries

around the world

Average Ticket R$ 300

Complementary Assortment

Exclusive and differenciated

products

“We Always Want More”

FIVE MAIN FRONTS OF GROWTH

Multi-Channel Retailing

Nort

h

2

Northeas

t

33

MidWest

21

Southeas

t

+ 16 own

stores

133

South

Financial Business

Joint-venture w/Banco Itaú

30

Products:

Personal Loans

Private Label (Consumer Credit)

Co-branded cards

“We Always Want More”

FIVE MAIN FRONTS OF GROWTH

“We Always Want More”

OPERATING HIGHLIGHTS – 1H06

Better Operating Efficiency (vs. 3Q05)

Consolidated EBITDA (R$93.1 million) grew by 50.2%

Operating Income (R$71.2 million) 52.2% increase

0.2 p.p. increase in SG&A expenses, as % of NR

SSS growth (Net Revenue) + 10.7% in 3T06 vs. 3T05

Gross revenue per associate grew by 20.9%

86% increase in consolidated gross revenue of A.com and Shoptime

“We Always Want More”

Better Operating Efficiency (vs. 3Q05)

Consolidated Gross Revenue of R$ 1,124.3 million – an increase of 41%

Net Revenue – “Same Store Sales” growth of +10.7%

Gross Margin of 30.7% - 110 basis points higher

Operating Income (R$71.2 milhões) – up on 52.2%

Consolidated EBITDA of R$93.1 million – up on 50.2%

EBITDA margin of 11.0%, 80 basis points superior

Gross Revenue per associate grew 20.9%

Increase of 86% in Americanas.com/Shoptime Gross Revenue

“We Always Want More”

LOJAS AMERICANAS IN FIGURES

Gross Revenue (R$ MM)

3,640

2,949

2,325

1,918

1,693

SSS growth (NR)

10.7%

1,765

1,510

Growth

41.0%

1,124.3

797.6

1999 2000 2001 2002 2003 2004 2005

3Q05 3Q06

“We Always Want More”

LOJAS AMERICANAS IN FIGURES

Gross Margin (%NR)

30.9

30.2

30.7

30.3

29.5

29.6

28.1

25.2

2000 2001 2002 2003 2004 2005

3Q05 3Q06

“We Always Want More”

LOJAS AMERICANAS IN FIGURES

SG&A (%NR)

25.9

22.5

20.8

19.0

18.9

19.5

19.7

18.4

2000 2001 2002 2003 2004 2005

3Q05 3Q06

“We Always Want More”

LOJAS AMERICANAS IN FIGURES

Consolidated EBITDA (R$ MM)

12.0%NR

330.9

274.7

217.6

Growth

50.2%

142.8

11.0%NR

90.1

10.2%NR

93.1

62.0

0.6%NR

8.0

2000 2001 2002 2003 2004 2005

3Q05 3Q06

“We Always Want More”

LOJAS AMERICANAS IN FIGURES

Gross Revenue per Associate

(R$ thousand)

344

Growth

20.9%

309

287.2

266

237.6

229

170

2001

2002

2003

2004

2005

3Q05

3Q06

“We Always Want More”

BUSINESS STRATEGY

Brazil in figures

Over 5,500

Brazilian cities

•Population: over 180 million

•Number of mobile phones: 90 million

•Credit cards: over 50 million

•Internet users: over 20 million

“We Always Want More”

BUSINESS STRATEGY

Potential Growth

190

90

Cities with

Less 100,000

opportunity of

inhabitants

opening one

Over 100,000

store

inhabitants

Cities with

Citiesstores

with

LASA

LASA stores

5,500 5,220

options via Internet, telesales, catalogs and TV

to a potential public of 43 million Brazilians.

“We Always Want More”

BUSINESS STRATEGY

Bricks and Mortar Business

Expansion

Pillars

Stores opened

Stores programmed

Number of inhabitants

35

Consumer Profile

37

18

16

4

7

27

2001 2002 2003 2004 2005 2006

Presence of other

players

Integration of

locations and logistics

“We Always Want More”

BUSINESS STRATEGY

Bricks and Mortar Business

Expansion 2006

Northeast Region

North Region

27 stores

opened

Belém - PA

+

18 stores

schedule

d

1

10

Middle-West Region

Recife-PE 1 Traditional + 1 Express

Natal - RN

Vitória da Conquista - BA

Feira de Santana - BA

São Luis - MA 2 Traditional

Fortaleza - CE

Maracanaú - CE

Joazeiro do Norte - CE

Southeast Region

Niterói - RJ - Estrada de Itaipú Express

Rio de Janeiro - RJ 5 Express

3

Três Rios - RJ

Campinas - SP Express

Dourados - MS

Cuiabá - MT

Goiânia - GO

25

São Paulo – SP 1 Traditional + 4 Express

Limeira - SP

Mauá - SP

South Region

Criciúma - SC

Curitiba - PR 2 Traditional

Londrina - PR

Tubarão - SC

Porto Alegre - RS

Osasco - SP Express

6

Ribeirão Preto - SP

São José do Rio Preto – SP 2 Traditional

Suzano - SP

Taubaté - SP

Divinópolis - MG

Ipatinga - MG

Barreiro - MG

Uberaba - MG

“We Always Want More”

Piratininga – Niterói/RJ

Marechal Floriano – Curitiba/PR

Av. Sr. dos Passos – Feira de Santana/BA

Shc Três Américas – Cuiabá/MT

“We Always Want More”

BUSINESS STRATEGY

Captured

synergies

R$ 160MM

(DCF)

Latin America’s #1 E-retailer - Multi Channel

230.000 SKUs for 6 million customers

TV channel that reaches 19 million antennas and growing

E-commerce represents 32% of LASA consolidated sales (1H06)

Shoptime’s acquisition R$ 117.8 million (3.5x EBITDA projected for 2006)

Around 80 special stores. Some examples:

“We Always Want More”

BUSINESS STRATEGY

E-commerce Gross Revenue (R$ MM)

864.8

434.0

Growth

86.0%

385.8

267.6

166.4

207.5

80.8

25.2

2000 2001 2002 2003 2004 2005*

3Q05* 3Q06

* Shoptime´s acquisition occurred in September, 2005

“We Always Want More”

BUSINESS STRATEGY

Americanas.com / Shoptime - EBITDA

(R$ MM)

Growth

116%

35.8

16.6

3Q05*

3Q06

* Shoptime´s acquisition occurred in September, 2005

“We Always Want More”

BUSINESS STRATEGY

Joint Venture LASA - BANCO ITAU

JV will enable credit access for over 40 million brazilians

without bank accounts

Personal Loans, Consumer Credit, Private Label and Co-

branded Cards

300,000 Private Label cards and 160,000 Personal Loan cards.

Represents about 3.0% of total parent company sales

Co-Branded International

Card (Visa/ MC)

September, 2006

Co-Branded Card

(Visa/ MC)

September, 2006

Personal Loan Card

May,2006

First private label card accepted on the Internet.

Benefits

Selling Expenses reduction (fees)

Improvement in consolidated Working Capital

LASA´s Capital Gain: R$ 200 million (50% of JV)

Forms of Payment (9M06)

Lojas Americanas

Americanas.com

2% Checks

Private Label Card

May,2006

41%

57%

Credit Card

81%

Credit Card

Cash

19% Other “We Always Want More”

PRIORITIES OF CASH

Expansion Program and Investments

Technology

and Operations

Store openings and remodeling

People - capacitating the associates

CAPEX budget for 2006: R$ 158.1 MM

Share Buy-Back and Dividends Program

EVA

Total

2001-2006:

R$ 515.3 MM

® Oriented

39.5% EBITDA

Dividends Payment and Share Buy-back

Program (R$ million)

Store Opening Evolution

Share Buy-back

Stores opened

Stores programmed

Dividends Payment

35

35.3

18.1

37

28.5

31.1

18

11.1

16

89.2

7

27

4

0.4

86.5

87.2

57.0

56.3

14.6

2001

2002

2003

2004

2005

2006

2001

2002

2003

2004

2005

2006

* 2005 - Shoptime Acquisition R$ 117 million

“We Always Want More”

LOJAS AMERICANAS IN FIGURES

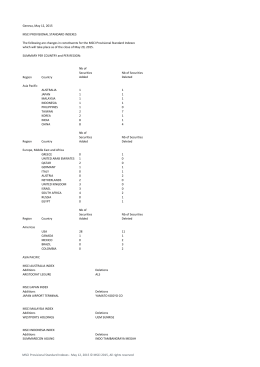

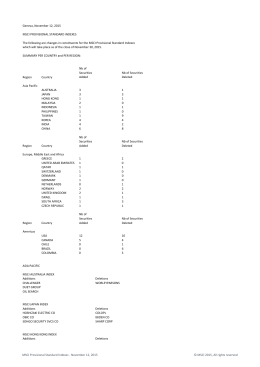

Shareholders Capital Structure

Position at August, 2006

Common

Shares

51.9%

45.7%

4.8%

Foreign

Investors

Total

Shares

40.1%

25.6%

2.4%

Controlling

Shareholders

CBV

Foreign

Investors

Treasury

Preferred

38.0%

Shares

57.2%

2.7%

Free Float

Foreign

Investors

33.1%

Tag Along of 100%

for ON and PN Shares

2.9%

64.0%

“We Always Want More”

“We will continue to pursue our learning path and to overcome obstacles,

and this makes us enthusiastic since it will enable us to achieve

new levels of results, always seeking to better meet our customer’s needs”.

“WE ALWAYS WANT MORE”

This presentation contains forward-looking statements. Such statements

are not statements of historical fact, and reflect the beliefs and expectations

of the Lojas Americanas’management. The words "anticipates", “wishes”,

“expects”, "estimates", “intends", "forecasts", "plans", "predicts", "projects",

"targets" and similar words are intended to identify these statements, which

necessarily involve known and unknown risks and uncertainties. Known

risks and uncertainties include, but are not limited to, the impact of

competitive products and pricing, market acceptance of products,

regulatory environment, currency fluctuations, supply difficulties, changes in

product sales mix, and other risks. Forward-looking statements speak only

as of the date they are made, and the Company does not undertake any

obligation to update them in light of new information or future

developments.

MSCI Logo:

The use of Morgan Stanley Capital International Inc.´s ("MSCI") trademarks

and index names does not constitute a sponsorship, endorsement or

promotion by MSCI, any of its affiliates, any of its information providers or

any other third party involved in, or related to, compiling, computing or

creating any MSCI index. The MSCI indexes are trademarks of MSCI or its

affliates and have been lincensed for use for certain purposes by Lojas

Americanas S.A.

“We Always Want More”

Download